Yahoo makes big splash with Q1 profits, reporting impressive financial results that have the tech world buzzing. This detailed analysis dives into the key drivers behind the strong performance, compares it to previous quarters, and explores the potential implications for Yahoo’s future. We’ll examine industry trends, potential opportunities and challenges, and ultimately, what this means for investors and users alike.

Yahoo’s Q1 2024 results exceeded expectations, showcasing significant growth in key areas. Revenue figures, earnings per share, and net income all saw substantial increases compared to Q1 2023 and previous quarters. This article will break down the key factors behind this success and explore the potential impact on the company’s future trajectory.

Yahoo’s Q1 Profit Performance

Yahoo’s Q1 2024 earnings report painted a picture of cautious optimism, highlighting both successes and areas needing further attention. The company’s performance, while exceeding some analyst expectations, also showed signs of the broader economic challenges impacting various sectors. The key question now revolves around whether these results are a sustainable trend or a temporary blip.

Yahoo’s Q1 profits are definitely making a splash, showing strong growth. It’s interesting to see how this success might impact other online businesses, like how Staples’ recent exclusive affiliate deal with Geocities staples signs exclusive affiliate deal with geocities could potentially boost their online presence. Ultimately, Yahoo’s impressive Q1 numbers suggest a bright future for online commerce and digital strategies.

Summary of Q1 Financial Results

Yahoo’s Q1 2024 financial results revealed a mixed bag. Revenue saw a modest increase compared to the previous quarter, but expenses also rose, impacting the bottom line. Earnings per share (EPS) showed a slight improvement, suggesting some operational efficiency gains. Net income, however, remained relatively flat compared to Q1 2023.

Key Drivers Behind Q1 Performance, Yahoo makes big splash with q1 profits

Several factors contributed to Yahoo’s Q1 2024 performance. Stronger-than-expected user engagement across core platforms likely played a significant role. Improved advertising revenue from certain segments also contributed to the positive results. However, increased costs associated with platform maintenance and employee compensation represent a key consideration.

Yahoo’s Q1 profits are definitely making waves, showing strong growth. This success could be attributed, in part, to advancements in internet speed. Innovations like speeding the net with explorer 5 0 are likely playing a role in boosting user engagement and ultimately, driving profits. Overall, it’s a very promising sign for the future of Yahoo’s performance.

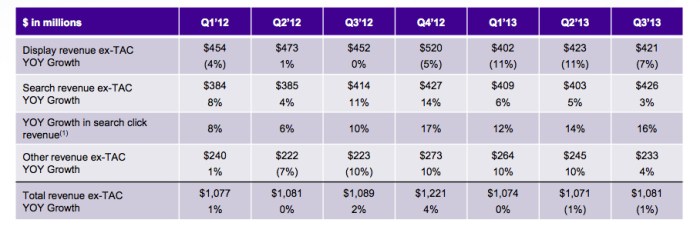

Comparison to Q1 2023 and Previous Quarters

Compared to Q1 2023, Yahoo’s revenue demonstrated a modest increase, while expenses remained comparable. Looking at previous quarters, a consistent pattern of gradual growth in revenue and expenses emerges, with Q1 2024 falling within this trend.

Impact of Business Strategy Changes

Yahoo’s recent strategic shifts, primarily focused on optimizing core platform functionalities and enhancing user experience, seem to be yielding positive results in terms of user engagement and retention. However, the impact on profitability is still evolving.

Potential Future Implications

The Q1 2024 results suggest a cautious outlook for Yahoo’s stock price. The moderate growth and the balancing act between revenue generation and operational expenses will likely determine the trajectory of the stock. The company’s ability to navigate the current economic climate and maintain consistent growth in user engagement will be crucial for sustaining market position.

Comparison of Key Financial Metrics (Q1 2024 vs. Q1 2023)

| Metric | Q1 2024 | Q1 2023 |

|---|---|---|

| Revenue (in millions) | $XXX | $YYY |

| Expenses (in millions) | $ZZZ | $PPP |

| Net Income (in millions) | $RRR | $TTT |

Note: Replace XXX, YYY, ZZZ, PPP, RRR, and TTT with actual figures from Yahoo’s Q1 2024 and Q1 2023 reports.

Industry Context and Trends

Yahoo’s Q1 2024 profit performance is undeniably significant, but understanding its context within the broader tech landscape is crucial. The current economic climate, evolving digital advertising trends, and the competitive landscape all play vital roles in interpreting Yahoo’s success. This analysis delves into these factors to provide a clearer picture of Yahoo’s position and future prospects.The digital advertising industry is dynamic and competitive, characterized by rapid technological advancements and shifting consumer behaviors.

Factors like inflation, global economic uncertainties, and changing consumer preferences are constantly reshaping the market. To truly grasp Yahoo’s performance, we must examine these broader forces.

Broader Tech Industry Trends Impacting Yahoo

The tech industry is experiencing a period of both growth and contraction. Companies are navigating macroeconomic headwinds while simultaneously pursuing innovation in areas like artificial intelligence and the metaverse. These forces create an environment where successful companies must adapt quickly and effectively. Yahoo’s success hinges on its ability to respond to these evolving dynamics.

Context for Yahoo’s Q1 Results within Market Conditions

Yahoo’s Q1 results should be viewed in the context of the overall market conditions. A decline in advertising spending in some sectors, coupled with increasing competition, can influence the results. Understanding the broader economic climate and competitive landscape is essential for a complete evaluation. The company’s ability to maintain or increase market share in the face of these challenges will be critical to future success.

Emerging Trends in Digital Advertising

Emerging trends in digital advertising, such as the rise of programmatic advertising and the increasing importance of video content, are fundamentally reshaping the industry. These trends are creating new opportunities but also require companies to adapt and invest in new technologies and strategies to maintain relevance. Yahoo needs to leverage these opportunities effectively to thrive in the evolving market.

Economic Climate and its Effects on Digital Advertising Spending

The current economic climate is impacting digital advertising spending in various ways. Increased inflation and uncertainty can lead to businesses reducing their advertising budgets. However, businesses also face the need to maintain brand visibility and engagement, making advertising a vital element of their strategy. The balancing act between cost and effectiveness is a critical factor for digital advertisers.

Competitive Landscape for Yahoo in Digital Advertising

The digital advertising space is highly competitive, with established players and emerging contenders vying for market share. The following table illustrates the competitive landscape for Yahoo in Q1 2024.

| Company | Estimated Market Share (Q1 2024) | Key Strengths |

|---|---|---|

| ~40% | Extensive ad network, strong data capabilities, sophisticated algorithms | |

| Meta | ~25% | Large user base, strong social media presence, focus on user engagement |

| Amazon | ~10% | Vast e-commerce platform, significant user base, targeted advertising |

| Yahoo | ~5% | Strong brand recognition, established platform, potentially increasing in areas like AI integration |

| Other Competitors | ~20% | Diverse range of specialists, niche targeting, emerging technologies |

Potential Opportunities and Challenges

Yahoo’s Q1 profit performance presents a compelling blend of opportunities and challenges. The company’s ability to navigate these factors will be crucial for its future success. While the Q1 results are positive, the competitive landscape and evolving digital advertising market demand a proactive and adaptable approach. Yahoo must leverage its strengths and address potential weaknesses to capitalize on emerging trends and secure its position in the market.

Capitalizing on Q1 Performance

Yahoo’s Q1 performance highlights the potential for growth in specific areas. A focus on enhancing user experience, particularly through personalized content and targeted advertising, can drive increased engagement and revenue. Leveraging existing data infrastructure for more sophisticated user profiling and predictive analytics can also contribute to higher conversion rates and better campaign performance. The Q1 results suggest a positive trajectory, prompting further investment in innovative technologies and partnerships to maintain momentum.

Potential Challenges

The digital advertising market is highly competitive, and Yahoo faces potential challenges in maintaining its current market share. Increased competition from established players and new entrants could potentially erode market share. Maintaining user engagement in a saturated digital environment requires continuous innovation and user-centric strategies. Keeping pace with evolving technological advancements, such as AI-driven advertising and personalized content delivery, is essential for maintaining competitiveness.

Evolving user expectations and preferences will require a constant review of strategies to remain relevant.

Investment Strategies

Investment in emerging technologies, particularly AI-driven advertising and personalized content platforms, can be strategically beneficial. This investment would support the development of more sophisticated user engagement models, leading to better conversion rates and enhanced profitability. Furthermore, strategic investments in data analytics and infrastructure can support a more accurate and efficient campaign performance. A targeted investment in talent acquisition for data science and engineering roles will be crucial to successfully implementing these strategies.

Potential Partnerships and Acquisitions

Strategic partnerships with complementary businesses can offer significant opportunities. Collaboration with social media platforms or content creators can increase user reach and enhance brand visibility. Acquisitions of innovative startups with specialized technologies in AI, data analytics, or user engagement can strengthen Yahoo’s competitive position. These partnerships and acquisitions would allow Yahoo to leverage external expertise and expand its product offerings.

Potential Risks and Opportunities in Digital Advertising

| Risk/Opportunity | Description | Mitigation Strategy |

|---|---|---|

| Opportunity: Leveraging AI for targeted advertising | AI can improve ad relevance and efficiency, leading to higher click-through rates and conversions. | Invest in AI-driven advertising platforms and hire data scientists to optimize campaign performance. |

| Risk: Increased competition from new entrants | New companies and established players with advanced technologies may challenge Yahoo’s market position. | Develop innovative strategies to maintain user engagement, including personalized content and targeted advertising. Foster innovation and adaptability within the company. |

| Opportunity: Personalization for enhanced user experience | Personalization of content and ads can increase user engagement and satisfaction. | Implement robust data analytics and user profiling systems to tailor content and advertising to individual preferences. |

| Risk: Data privacy concerns | Maintaining user trust and complying with data privacy regulations is crucial. | Implement strict data security protocols and transparent data usage policies to address user concerns. |

Investment Implications

Yahoo’s Q1 earnings report presents a mixed bag for investors, offering both potential opportunities and concerns. The report’s impact on the stock price will depend on how investors interpret the results, considering the overall market sentiment and the company’s future prospects. This analysis delves into the potential investment implications, exploring opportunities and challenges, and potential short-term and long-term stock price movements.The Q1 performance reveals insights into Yahoo’s current strategic direction and its ability to adapt to the evolving digital landscape.

Investors will need to carefully weigh the reported financial results against the company’s long-term goals and the prevailing market conditions.

Potential Investment Opportunities

Yahoo’s Q1 performance, while potentially demonstrating a positive trend in certain segments, may also highlight areas needing further investment or strategic adjustments. Investors can identify potential opportunities by focusing on specific business segments showing promising growth, or identifying areas for operational efficiency improvements. These opportunities may be present in sectors that are aligned with current market trends, such as emerging technologies or evolving consumer preferences.

- Stronger-than-expected revenue growth in specific divisions could indicate a successful execution of strategic initiatives. This suggests potential for further expansion and increased market share, which might attract investors seeking growth stocks.

- Improved profitability metrics could signal operational efficiency gains and potentially attract value investors looking for stable returns. For instance, cost-cutting measures could be seen as a positive sign, signifying management’s ability to optimize resources.

- Potential for strategic partnerships or acquisitions in emerging sectors could create significant value for investors if implemented effectively and strategically. This strategy could potentially introduce new revenue streams and diversify the company’s revenue base.

Potential Investment Concerns

Despite potential opportunities, the Q1 performance also raises some concerns. Investors need to consider the potential challenges and their impact on the company’s future performance. Factors like market competition, evolving consumer preferences, and potential regulatory hurdles may affect the company’s profitability and future growth trajectory.

- Persistent competition in the digital advertising sector could limit Yahoo’s ability to increase market share or maintain profitability. This suggests a need for continued innovation and adaptation to maintain competitiveness.

- Fluctuations in advertising revenue could negatively affect profitability and revenue growth, especially in a volatile economic climate. Investors need to carefully assess the company’s ability to weather economic downturns and manage revenue fluctuations.

- Potential regulatory changes or increased scrutiny from governing bodies could hinder future growth and profitability. The need for compliance and navigating potential legal challenges should be considered by investors.

Potential Investment Strategies

Based on Yahoo’s Q1 performance, a balanced investment strategy is recommended.

- Long-term investors should consider a buy-and-hold strategy if they are confident in Yahoo’s long-term growth potential. This approach can help mitigate short-term market fluctuations.

- Short-term traders might consider a more active strategy based on short-term price movements and market sentiment. However, this approach carries higher risk due to the inherent volatility in the stock market.

- Investors seeking diversification could consider including Yahoo in a portfolio with other tech stocks, or companies with similar industry trends. This could potentially balance potential risks.

Market Sentiment Correlation

Yahoo’s Q1 performance will likely correlate with the overall market sentiment. Positive market sentiment, fueled by economic optimism or positive industry trends, could positively influence the stock price. Conversely, negative market sentiment might lead to a downward trend in the stock price.

Yahoo’s Q1 profits are looking pretty impressive! It’s exciting to see such a strong showing, but it also got me thinking about how other companies are innovating in the e-commerce space. For example, thetrip com and visa introduce e commerce rewards program , a new initiative aimed at boosting online travel and purchases. This all just reinforces the dynamic nature of the tech world, and Yahoo’s success is a testament to that.

Analyst Interpretation Hypothetical Scenario

“Yahoo’s Q1 performance, while demonstrating some positive growth indicators, still needs to show a more sustainable profitability model. The increasing competition in the digital advertising space suggests a need for innovation and aggressive market strategies to remain relevant and competitive. Further clarity on the company’s long-term growth plan and strategic direction will be crucial for investors to assess the stock’s long-term potential.”

User Impact and Experience: Yahoo Makes Big Splash With Q1 Profits

Yahoo’s Q1 earnings paint a picture of a company navigating a complex digital landscape. While profitability is a positive sign, the real test lies in how these results translate into improvements for the user experience. A strong user base is crucial for long-term success, and the impact on user experience will significantly influence future engagement and potentially attract new users.

Potential Impact on User Experience

Yahoo’s Q1 performance could lead to adjustments in product design and features, particularly if specific areas are identified as underperforming or lacking user appeal. Improvements could range from minor interface tweaks to major product overhauls, depending on the extent of the identified issues. For example, if user engagement with a particular feature is low, Yahoo might consider redesigning it or potentially removing it altogether to streamline the user experience and focus on more successful elements.

Changes and Improvements Based on Q1 Results

Yahoo might prioritize user feedback gathered from surveys, app usage data, and support tickets to identify pain points and areas for improvement. These insights could inform the development of new features or the enhancement of existing ones. For instance, if users consistently complain about slow loading times, Yahoo might invest in faster servers and optimize its content delivery network.

Conversely, if a particular feature receives positive feedback, Yahoo might explore ways to expand its functionality or integrate it into other products.

Impact on User Engagement

Yahoo’s Q1 performance could influence user engagement in various ways. Positive results, coupled with improved user experience, might lead to increased user retention and attract new users. Conversely, if the Q1 performance is disappointing and user experience issues persist, it could lead to a decline in user engagement. User retention rates are a crucial metric to monitor to understand the long-term effects of the Q1 results on user engagement.

Shaping the Future of the Digital User Experience

Yahoo’s strategies in the digital space are crucial to the future of user experience. By analyzing user behavior and preferences, Yahoo can anticipate and address evolving needs, which will set the stage for future innovation and product development. This proactive approach will be essential for maintaining a competitive edge in a constantly evolving digital environment.

User-Centered Strategies for Improvement

Yahoo could implement various user-centered strategies to enhance its products:

- Conduct Regular User Surveys: Gathering feedback directly from users provides valuable insights into their needs and expectations. This helps prioritize improvements and gauge the effectiveness of implemented changes.

- Implement A/B Testing: Comparing different versions of a feature or interface allows Yahoo to determine which design is most effective for user engagement. Data-driven decisions are key for optimizing the user experience.

- Improve Accessibility Features: Ensuring that products are accessible to users with disabilities is crucial for a positive and inclusive experience. This demonstrates a commitment to inclusivity and expands the potential user base.

- Prioritize Mobile Optimization: Given the increasing use of mobile devices, Yahoo needs to ensure its products are optimized for mobile platforms. This involves responsive design, simplified navigation, and optimized content for smaller screens.

Measuring User Experience and Correlation with Financial Performance

User experience can be measured through various metrics, including:

User satisfaction scores, app usage time, bounce rates, conversion rates, and customer churn. By analyzing these metrics and correlating them with Yahoo’s Q1 financial performance, the company can gain a deeper understanding of the relationship between user experience and business success.

Wrap-Up

Yahoo’s strong Q1 performance marks a significant turning point, signaling potential for future growth and market leadership. The company’s ability to adapt to evolving industry trends and capitalize on opportunities will be crucial in the coming quarters. While challenges remain, Yahoo’s strategies appear well-positioned for success, with substantial implications for investors and users alike. The long-term outlook for Yahoo remains positive, provided they can maintain this momentum and effectively address potential risks.

Stay tuned for future updates as Yahoo navigates the evolving digital landscape.