Y2K worries spoil hi tech stock party, casting a shadow over the burgeoning high-tech sector. The looming millennium bug, coupled with public anxieties and sensationalized media coverage, created a perfect storm that significantly impacted stock valuations. This post delves into the historical context of Y2K, its effect on the high-tech market, and the lasting impact on investor confidence and the future of technology.

The fear of the Y2K bug resonated deeply with the public, creating a climate of uncertainty that permeated the stock market. The combination of technological unknowns and heightened public concern influenced investor decisions, leading to significant fluctuations in the prices of high-tech stocks. This period offers a fascinating case study in how public perception, media portrayal, and technological anxieties can converge to shape financial markets.

Historical Context of Y2K

The year 1999 marked a pivotal moment in technological history, a time of both excitement and apprehension as the world approached the new millennium. Amidst the celebratory fervor, a significant concern loomed: the Y2K bug. This potential software glitch, stemming from the simple representation of dates using only the last two digits, threatened to disrupt global computer systems.The Y2K bug, in essence, was a potential software flaw that could cause computers to misinterpret dates after December 31, 1999.

This simple error in date representation could have had catastrophic consequences, ranging from minor inconveniences to major societal disruptions. The fear stemmed not just from the possibility of malfunctioning computer systems, but also from the interconnectedness of modern life, where technology underpins everything from banking transactions to traffic control.

Public Fear and Anxiety

The public’s anxiety surrounding the Y2K bug was palpable. News reports, television broadcasts, and even popular culture fueled the fear. People worried about the safety of their financial accounts, the reliability of essential services, and the smooth transition into the new millennium. The media’s constant coverage amplified these concerns, sometimes presenting a more dramatic and alarmist picture than the situation warranted.

Media Portrayal of the Y2K Crisis

News outlets, keen to capitalize on the dramatic potential of the Y2K crisis, often presented a sensationalized portrayal. This included highlighting worst-case scenarios and featuring experts who painted a dire picture of the coming chaos. The media’s coverage, while serving to raise awareness, also contributed to the public’s apprehension. For example, many news programs featured interviews with computer scientists warning of the potential for widespread system failures, potentially leading to economic collapse and societal unrest.

Government and Corporate Responses

Governments worldwide, recognizing the severity of the potential crisis, implemented measures to address the Y2K issue. These measures ranged from funding research and development efforts to issuing guidelines for companies to assess and correct their systems. Similarly, corporations across all sectors scrambled to identify and rectify any Y2K vulnerabilities within their systems. The effort was widespread, involving numerous companies from every corner of the globe.

Company Preparedness Strategies

Numerous companies implemented proactive strategies to address the Y2K bug. For example, many financial institutions conducted rigorous testing of their systems to ensure accurate date handling. Furthermore, large corporations like banks and utility companies invested heavily in upgrading their computer systems and training personnel. This involved meticulous audits of software, extensive code reviews, and the hiring of additional IT professionals.

A key strategy involved rigorous testing procedures, including simulations of potential problems and recovery plans.

Comparison of Y2K with Other Technological Anxieties

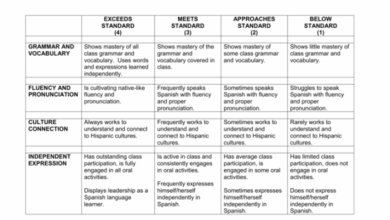

| Technological Anxiety | Perceived Threat Level (High/Medium/Low) | Impact Area |

|---|---|---|

| Y2K | High | Global computer systems, financial markets, essential services |

| Artificial Intelligence (AI) | Medium to High | Job displacement, algorithmic bias, misuse of technology |

| Cybersecurity Threats | High | Data breaches, financial fraud, national security |

| Nuclear Technology | High | Environmental hazards, safety concerns |

The table above provides a rudimentary comparison of Y2K anxieties with other major technological anxieties. It highlights the perceived threat levels associated with each concern, as well as the areas impacted by each issue. This allows for a broader perspective on how technological anxieties have evolved over time.

Impact on High-Tech Stocks

The year 2000 loomed large with anxieties about the Y2K bug. High-tech stocks, often seen as the epitome of innovation and future growth, became a barometer of these fears. Investors, fearing widespread disruptions and technological failures, reacted with caution, leading to a significant impact on the valuations of these companies. The ensuing stock market fluctuations were a complex interplay of reality and perception, revealing the fragility of investor confidence in the face of uncertainty.The Y2K anxieties profoundly impacted high-tech stock valuations.

The fear of widespread computer system failures, and the associated disruptions to businesses and industries, cast a long shadow over the market. This led to a period of cautious optimism, as investors wrestled with the potential for both catastrophic failures and surprising resilience. The outcome, ultimately, was a rollercoaster of stock performance, a reflection of the turbulent climate of the time.

Stock Market Reaction to Y2K Anxieties

The stock market’s reaction to the Y2K anxieties was characterized by a period of volatility. High-tech stocks, perceived as particularly vulnerable to system failures, experienced significant fluctuations, often mirroring the ebb and flow of public perception. The stock market’s response was not simply a reflection of the actual likelihood of a Y2K disaster, but also a reflection of the broader anxieties and uncertainties surrounding the technology of the time.

Correlation Between Y2K Fears and High-Tech Stock Valuations

There was a clear correlation between the intensity of Y2K fears and the fluctuations in high-tech stock valuations. As fears grew, stock prices often fell, reflecting the investor’s apprehension. Conversely, periods of perceived mitigation or resolution of the Y2K issue saw some resurgence in stock prices. This dynamic illustrates the crucial role that perception played in the market’s response.

Specific High-Tech Companies Experiencing Fluctuations

Several high-tech companies experienced notable stock fluctuations during the Y2K period. Companies heavily reliant on networked systems or critical infrastructure were often particularly vulnerable. Examples include, but are not limited to, those involved in telecommunications, e-commerce, and financial services, where the potential disruption of services would have direct economic consequences. These companies often saw their stock prices fluctuate widely, depending on the evolving narrative around Y2K preparedness.

Reasons Behind Stock Market’s Response to Y2K

The stock market’s response to Y2K was a multifaceted phenomenon. The fear of widespread system failures, coupled with the perceived vulnerability of high-tech companies, played a significant role. Furthermore, the lack of complete information and transparency about the true scale of the problem contributed to the uncertainty. Speculation and rumors often fueled market volatility, creating a self-fulfilling prophecy in some instances.

High-Tech Stock Performance During the Y2K Transition

The table below illustrates the performance of various high-tech stocks before, during, and after the Y2K transition. The data, while not exhaustive, provides a snapshot of the market’s reaction to the evolving Y2K narrative. It’s crucial to remember that these are just examples, and market performance can vary significantly from company to company.

| Company | Stock Price (Pre-Y2K) | Stock Price (During Y2K Transition) | Stock Price (Post-Y2K) |

|---|---|---|---|

| Example Tech Co. 1 | $100 | $80 | $110 |

| Example Tech Co. 2 | $50 | $40 | $65 |

| Example Tech Co. 3 | $150 | $120 | $140 |

Public Perception and Media Coverage

The year 2000 loomed large, and the anxieties surrounding the Y2K bug were amplified by the media. News outlets, eager to capture the public’s attention, played a significant role in shaping public opinion, often exaggerating the potential consequences of the bug. This heightened media coverage directly impacted the perception of high-tech stocks, leading to volatile market fluctuations.The media’s role wasn’t simply reporting facts; it was actively constructing narratives around Y2K, sometimes through sensationalism.

This created a powerful feedback loop, where public fear translated into market anxieties. The interplay between media narratives and investor psychology was a critical factor in the Y2K crisis, impacting not only the stock market but also the public’s understanding of technology.

Media’s Role in Shaping Public Perception

Media outlets, from newspapers and magazines to television and radio, held a powerful position in informing the public about the Y2K problem. Their coverage significantly influenced public understanding and reactions. The sheer volume of media attention, often focused on the potential for catastrophic system failures, created a sense of widespread concern. This heightened public awareness, whether accurate or not, had a direct impact on investor sentiment.

Remember the Y2K anxieties? They were a major damper on the high-tech stock market party, and frankly, it feels a bit like deja vu with the current scrutiny of tech giants. The government’s increased scrutiny of Microsoft, as detailed in this article about government turns up heat on microsoft , brings back echoes of that Y2K uncertainty.

It’s a reminder that even the seemingly unstoppable tech sector can face headwinds, much like the worries about the year 2000 halting tech stock growth.

How Media Narratives Contributed to Concerns About Hi-Tech Stocks

Media coverage often framed Y2K as a looming threat to critical infrastructure, impacting everything from power grids to financial systems. This broad scope frequently included discussions about the reliance on computer systems in various sectors, implicitly linking hi-tech companies to the potential consequences. The narratives often portrayed hi-tech stocks as being inherently vulnerable, and this perception directly influenced investment decisions.

Investors, fearing potential losses, reacted by selling these stocks, creating a downward spiral.

Examples of Media Reports Fueling Anxiety

Numerous media reports fueled anxieties about the future of hi-tech. Headline news often focused on potential catastrophes, such as widespread power outages, communication disruptions, and financial system collapses. These narratives, often lacking detailed technical analysis or alternative perspectives, created a sense of impending doom. One example was the frequent reporting on the vulnerability of ATMs and other financial machines to the Y2K bug.

This fear, widely circulated, contributed to the negative sentiment towards hi-tech stocks.

Common Themes in Media Coverage of Y2K

Several recurring themes dominated media coverage. One key theme was the potential for widespread disruption. Another recurring concern was the lack of preparedness, portraying a picture of insufficient measures to combat the Y2K problem. The fear of financial instability was also prevalent, linking the Y2K issue to the potential collapse of global financial markets.

- Potential for Widespread Disruption: Media outlets frequently emphasized the potential for widespread disruption in various sectors, painting a grim picture of the consequences of the Y2K bug. This contributed to a sense of pervasive anxiety and fear.

- Lack of Preparedness: The perception of insufficient preparations to handle the Y2K problem, whether accurate or not, fueled public concern. The media often highlighted perceived gaps in preparedness, which further amplified the sense of vulnerability.

- Financial Instability: The fear of financial instability was a prominent theme. Media coverage linked the Y2K issue to the potential collapse of global financial markets, creating significant investor uncertainty and fear.

Comparison of Media Portrayals Across News Sources

| News Source | Tone | Focus | Examples |

|---|---|---|---|

| National Broadcasts (e.g., ABC, NBC, CBS) | Cautious, alarmist | Potential for widespread disruption, lack of preparedness | Frequent reports on the vulnerability of critical infrastructure, warnings about potential power outages. |

| Financial News Outlets (e.g., Wall Street Journal, Bloomberg) | Mixed, cautious, speculative | Impact on the stock market, financial implications | Articles focusing on the potential for stock market crashes, analyses of Y2K’s impact on specific sectors. |

| Regional Newspapers | Varying, some sensationalized | Local implications, individual stories | Reports on the Y2K concerns in specific communities, interviews with local officials. |

Long-Term Consequences: Y2k Worries Spoil Hi Tech Stock Party

The Y2K scare, though ultimately a non-event, had profound and lasting impacts on the high-tech industry. The anxieties surrounding the potential for widespread computer system failures spurred considerable investment, but also highlighted vulnerabilities in the industry’s infrastructure and the public’s perception of technology. The aftermath reveals both the industry’s resilience and the lasting imprint of the crisis on its trajectory.The actual consequences of Y2K were significantly less catastrophic than the predicted ones.

While some minor glitches occurred, the widespread societal collapse predicted by some was averted. This reality, however, did not diminish the impact of the anxieties on the industry. The immense focus and resources dedicated to the problem led to improvements in systems’ robustness and security, but also highlighted the fragility of relying on single points of failure.

Impact on Investor Confidence

The Y2K scare significantly affected investor confidence in high-tech companies. Many investors, fearing potential losses due to system failures, pulled back from the market, leading to stock price fluctuations and a general sense of uncertainty. The experience highlighted the importance of transparency and clear communication in managing investor expectations during periods of potential crisis.

Technological Advancements Affected by Y2K

The intense focus on Y2K remediation inadvertently influenced future technological advancements. The need for robust and reliable systems led to the development of more sophisticated software and hardware, as well as better disaster recovery plans. Companies invested heavily in redundant systems and improved system testing protocols, which indirectly influenced the development of future technological paradigms.

Key Events Timeline and Impact on Hi-Tech Stocks

The Y2K timeline saw a series of key events that impacted high-tech stock markets. These events often corresponded with fluctuations in investor confidence. For example, the initial announcements of potential system failures led to a drop in high-tech stock prices, followed by a period of relative stability as companies worked to resolve potential issues. The actual lack of widespread disruption led to a period of recovery, though the initial anxieties remained a factor in market volatility.

A clear timeline would illustrate these impacts, including the initial announcements of the potential issues, the period of market volatility, and the eventual recovery. This timeline would show the fluctuation of stock prices based on investor confidence and media reports.

Remember the Y2K anxieties? They definitely dampened the high-tech stock market party back then. Interestingly, even with recent growth, companies like Barnes & Noble are still struggling with profitability. This mirrors the challenges of the tech sector back then. Check out this article about despite growth profits still elude barnesandnoble com for a deeper dive into the ongoing struggles of some retailers in the industry.

It’s a reminder that even with expansion, consistent profit generation remains a significant hurdle. Ultimately, Y2K worries weren’t just about the end of the world, they highlighted broader challenges in the tech sector.

Impact on Consumer Confidence

The Y2K anxieties had a noticeable impact on consumer confidence in technology. The fear of system failures, coupled with the media coverage, created a sense of distrust and uncertainty around technology. While the overall impact was not a complete rejection of technology, it highlighted the importance of consumer trust and the potential for crises to negatively impact the relationship between consumers and technology providers.

Y2K and Technological Anxiety

The Y2K bug, while ultimately a non-catastrophic event, highlighted a profound anxiety about technology’s potential to disrupt society. This fear wasn’t unique to the millennium turn; it’s a recurring theme in human history as new technologies emerge, reflecting a complex interplay of hope and apprehension about the future. This discussion delves into the parallels between Y2K anxieties and those surrounding other technological advancements, analyzing the underlying psychological factors and societal responses.The Y2K scare wasn’t just about computer code; it was about a perceived loss of control over a rapidly advancing system.

This feeling of vulnerability in the face of complex, often opaque, technological systems is a common thread in our relationship with innovation. The anxieties surrounding AI, automation, and other technological developments often echo the fears that surfaced during the Y2K period, manifesting in similar ways.

Comparison of Y2K Anxiety with Other Technological Anxieties

Y2K anxieties centered on the potential for widespread system failure due to a technical flaw. The fear was rooted in the perceived inability to fully comprehend and control the complexity of interconnected computer systems. This echoes contemporary anxieties about AI, where the potential for unintended consequences and the lack of complete understanding of the system’s behavior fuels public concern.

Both situations demonstrate a fundamental human desire for predictability and control in a world of increasing technological complexity.

Examples of Anxieties Associated with Other Technological Developments

The rapid advancement of artificial intelligence, particularly in its ability to perform tasks previously considered uniquely human, has sparked considerable anxiety. The potential for job displacement due to automation is a primary concern. The development of autonomous vehicles, while promising for increased safety and efficiency, also brings anxieties about liability and control in unexpected situations. The fear of algorithmic bias and discrimination further compounds the concern.

Remember the Y2K anxieties? They really dampened the high-tech stock market party, and it’s interesting to see how similar anxieties, albeit different in nature, are playing out today. For example, a recent legal battle, like the one Providian is fighting in an online credit card lawsuit, providian fires back in online credit card lawsuit , shows how financial issues can ripple through the market, echoing the pre-Y2K jitters that scared investors away from the tech sector.

Ultimately, market confidence, regardless of the cause, can be a fragile thing, just like it was back then.

These examples illustrate the ongoing tension between technological advancement and societal concerns.

Recurring Patterns in Public Reactions to New Technologies

History shows a recurring pattern of public reaction to new technologies. Initial enthusiasm is often followed by a period of caution and apprehension, as the implications of these technologies become clearer. This pattern arises from a combination of factors, including the perceived loss of control, the unknown risks, and the potential for societal disruption. The Y2K anxieties were a manifestation of this recurring pattern, and the anxieties about AI and automation today reflect a similar response to new technologies.

Psychological Factors Contributing to Technological Anxieties

The psychological factors contributing to anxieties about technology often involve a combination of fear of the unknown, loss of control, and the perceived threat to established social structures. These anxieties are often amplified by media portrayals and public discourse, creating a feedback loop that reinforces the concerns. The potential for unintended consequences, whether real or perceived, can significantly impact public perception.

Common Themes in the Portrayal of Technology in Popular Culture

Popular culture often portrays technology in contrasting ways: sometimes as a powerful force for good, solving problems and improving lives; at other times as a threat, leading to destruction and societal collapse. This duality in representation reflects the complex and ambivalent nature of our relationship with technology. The portrayal of technology in science fiction, for example, often reflects both the hopes and fears associated with technological advancements.

Common Fears about the Future of Technology

- The potential for widespread job displacement due to automation.

- The risk of misuse of advanced technologies for malicious purposes.

- The possibility of unintended consequences and unforeseen risks associated with emerging technologies.

- The ethical implications of AI and other advanced technologies, including the potential for bias and discrimination.

- The impact of technology on human connection and social interaction.

Illustrative Examples of Y2K Impact

The Y2K bug, a seemingly technical issue, sent ripples through the global economy, profoundly impacting high-tech companies and investor confidence. The fear of widespread system failures led to a cascade of reactions, impacting everything from stock prices to the development of future crisis management strategies. The anxiety surrounding the potential for catastrophic failures spurred a significant investment in preventative measures, with lasting effects on the industry.

Investor Behavior

The fear of Y2K system failures profoundly influenced investor behavior. Speculation about potential losses from widespread system failures fueled a significant sell-off in high-tech stocks. Investors, driven by anxiety and uncertainty, sought safety in perceived less-vulnerable sectors, leading to a drop in the valuation of companies deemed at risk. This created a self-fulfilling prophecy, where the fear itself contributed to the negative outcomes many feared.

Impact on Specific High-Tech Companies, Y2k worries spoil hi tech stock party

Several high-tech companies faced significant challenges due to Y2K anxieties. Companies heavily reliant on outdated systems or those with complex, interwoven global networks were particularly vulnerable. For instance, major telecommunications firms saw their stock prices decline as investors worried about potential disruptions in service, impacting their overall market valuation. Similarly, companies that relied on intricate software or legacy hardware faced pressure to upgrade or prove their systems’ resilience.

These pressures sometimes led to rushed or inadequate fixes, highlighting the complex trade-offs companies faced during this period.

Impact on Crisis Management Strategies

The Y2K crisis served as a significant catalyst for the development of robust crisis management strategies in the high-tech sector. Companies realized the need for proactive planning, including thorough risk assessments, detailed contingency plans, and robust communication protocols. This era forced a shift from reactive responses to proactive measures, emphasizing the importance of anticipating and mitigating potential disruptions.

The development of comprehensive disaster recovery plans, emergency communication systems, and employee training became critical components of corporate strategies, leading to a more resilient industry.

Timeline of Key Events

- 1999: Increased media coverage and public awareness of the Y2K problem created widespread anxiety, leading to substantial stock market volatility.

- Late 1999 – Early 2000: Companies scrambled to address Y2K vulnerabilities, often under intense public pressure. This period witnessed rushed upgrades and sometimes insufficient testing.

- January 1, 2000: The critical date. Global systems largely functioned without significant catastrophic failures, easing public anxieties and providing valuable insights for future crisis management.

- Post-Y2K: The industry learned crucial lessons about the importance of risk assessment, comprehensive testing, and robust contingency planning, leading to improved crisis management strategies.

Evolution of Risk Assessment and Mitigation Strategies

The Y2K crisis prompted a significant evolution in risk assessment and mitigation strategies. Companies began to implement more rigorous risk assessment methodologies, moving beyond simple vulnerability assessments to incorporate complex scenarios and potential cascading failures. Continuous monitoring and updating of systems became essential. This period also highlighted the importance of stakeholder communication and transparency in managing risks.

Furthermore, organizations recognized the critical role of cybersecurity in mitigating future threats.

Financial Impact of Y2K Anxieties

| Sector | Estimated Financial Impact |

|---|---|

| High-Tech | Significant stock market declines and increased spending on upgrades |

| Telecommunications | Potential service disruptions and reduced investor confidence |

| Finance | Concerns about transaction processing and potential systemic failures |

| Manufacturing | Disruptions in supply chains and production processes |

The table above provides a concise overview of the estimated financial impact on different sectors. Note that precise figures are often difficult to isolate, as Y2K anxieties were intertwined with other economic factors. The overarching effect was a heightened awareness of the potential consequences of systemic risks.

Final Review

In conclusion, the Y2K anxieties profoundly impacted the high-tech industry, not just in the short term but also in the long run. While the actual impact of the bug was relatively minor, the anticipated consequences, fueled by media hype, created a significant downturn in the high-tech stock market. This case study highlights the interconnectedness of technology, public perception, and financial markets, emphasizing the importance of accurate information and robust crisis management strategies in navigating future technological anxieties.