Will softbanks investments start asian stampede – Will SoftBank’s investments start an Asian stampede? This question explores SoftBank’s history of investment, their current focus, and the potential impact on the Asian tech sector. The analysis delves into the current Asian tech landscape, examining growth potential, competitive dynamics, and the possibility of a significant investment surge, often referred to as an “Asian stampede.” We’ll examine SoftBank’s role in driving this potential surge, considering their strategies and comparing them to other prominent Asian investors.

SoftBank’s past investments offer insights into their approach and decision-making processes. Analyzing their successes and failures provides a valuable context for understanding the potential impact of future investments. The current economic climate in key Asian markets is crucial to understanding the potential for investment opportunities and growth. We’ll also look at potential risks and challenges, and the ripple effect this investment surge could have across various sectors.

Introduction to SoftBank’s Investments

SoftBank, a global conglomerate, has carved a significant niche in the investment landscape, particularly in technology and innovation. Its investment strategy, however, has been a rollercoaster ride, marked by both spectacular successes and notable setbacks. Understanding SoftBank’s journey is crucial to evaluating its current approach and future prospects.SoftBank’s history is intertwined with the rise and fall of tech startups, reflecting both the dynamism and volatility of the sector.

Their ambitions often transcend traditional venture capital, encompassing larger acquisitions and strategic partnerships that have shaped the global tech ecosystem.

Will SoftBank’s investments trigger an Asian investment stampede? It’s a hot topic, but the recent summer sports frenzy and the revamp of the Nike website summer sports frenzy brings revamped nike com site might offer some clues. Perhaps the surge in sports-related investment activity is a sign of broader economic trends that could influence SoftBank’s decisions and, in turn, spark a similar investment wave across Asia.

So, will SoftBank’s investments start an Asian stampede? The question remains.

SoftBank’s Investment Strategy: A Historical Overview

SoftBank’s investment journey began with a focus on telecommunications. Over the years, it has evolved into a multi-faceted investment entity, increasingly prioritizing technology, innovation, and emerging markets. Their early success was built on shrewd investments in the telecom sector, laying the groundwork for future ventures.

SoftBank’s Current Investment Portfolio

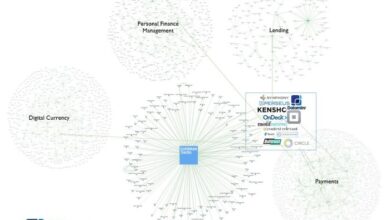

SoftBank’s current portfolio spans a broad range of sectors, but technology and innovation remain central themes. Significant investments in sectors like artificial intelligence, robotics, fintech, and e-commerce are visible. Their investment activities often focus on companies poised for substantial growth and disruptive innovation, aiming for returns that exceed market expectations.

Key Sectors Targeted by SoftBank, Will softbanks investments start asian stampede

SoftBank actively targets companies exhibiting high growth potential and transformative technologies. Their strategy leans heavily on early-stage investments and strategic acquisitions to capitalize on emerging trends. The conglomerate’s investments are often underpinned by long-term vision and a willingness to take calculated risks. Key sectors include:

- Artificial Intelligence (AI): SoftBank has invested in numerous AI startups, recognizing the transformative potential of this technology. Examples include ventures focused on AI-powered healthcare solutions and autonomous vehicle development.

- Robotics: SoftBank’s investments in robotics companies are indicative of their commitment to automation and industrial transformation. This sector is considered critical for future productivity and efficiency.

- Fintech: SoftBank has a notable presence in the financial technology sector, backing companies revolutionizing financial services. Their focus on this sector is driven by the need for innovative and efficient financial solutions.

- E-commerce: SoftBank’s investments in e-commerce ventures underscore their understanding of the evolving retail landscape and the potential for disruptive business models.

SoftBank’s Investment Approach

SoftBank’s investment approach is characterized by a blend of strategic vision and calculated risk-taking. They often seek companies that possess strong intellectual property, experienced management teams, and a clear path to market leadership.

Typical Investment Criteria and Decision-Making Process

SoftBank’s investment decisions are guided by rigorous criteria and a structured process. Key factors include:

- Market Potential: SoftBank analyzes the potential of the market in which a company operates, considering market size, growth rate, and competition.

- Team Expertise: The team’s capabilities and experience are scrutinized, looking for leadership with proven track records and industry knowledge.

- Innovation and Technology: The core technology and its potential to disrupt existing markets are critical considerations.

- Financial Projections: Realistic and well-supported financial projections are a prerequisite for investment.

SoftBank’s Investment Timeline

| Year | Event | Description |

|---|---|---|

| 2010 | SoftBank Vision Fund I launched | The first significant fund, marking SoftBank’s entry into large-scale venture capital. |

| 2018 | SoftBank Vision Fund II established | Further expansion of the investment strategy, with a greater focus on technology and innovation. |

| 2023 | SoftBank’s continued investments | The fund continues to invest in emerging technologies, adapting to market dynamics. |

Asian Tech Landscape

The Asian tech sector is experiencing explosive growth, driven by a confluence of factors including a young and tech-savvy population, robust investment capital, and rapidly developing infrastructure. This burgeoning sector is poised to reshape global technological landscapes, and understanding its dynamics is crucial for investors and industry players alike. SoftBank’s investments in this area are likely to be heavily influenced by this dynamic environment.This section will explore the key aspects of the Asian tech landscape, focusing on prominent companies, economic climates, growth potential, competitive landscapes, and comparisons with other global regions.

Analyzing these facets provides a more complete picture of the opportunities and challenges inherent in this rapidly evolving sector.

Prominent Asian Tech Companies and Market Positions

Several Asian tech companies have achieved significant market presence and are recognized globally. These include names like Tencent, Alibaba, and Samsung, each possessing strong foundations in their respective markets. Tencent’s dominance in China’s gaming and social media sectors, Alibaba’s e-commerce behemoth, and Samsung’s technological prowess in electronics and mobile devices exemplify the range of capabilities and market penetration these companies have achieved.

Other prominent players include ByteDance (TikTok) and Coupang (e-commerce). Understanding their current market positions, strengths, and weaknesses is critical for gauging the overall competitive landscape.

Economic Climate and Investment Opportunities

The economic climate in key Asian markets is diverse. China, with its vast consumer base and substantial investment, remains a significant player. India’s rapidly growing middle class and burgeoning startup scene present compelling opportunities for tech ventures. Other markets, like South Korea, Taiwan, and Singapore, boast established technological ecosystems and a strong focus on innovation. Investment opportunities vary across these markets, influenced by factors such as regulatory environments, infrastructure development, and market maturity.

Will SoftBank’s investments spark an Asian investment stampede? It’s a fascinating question, and a lot hinges on recent moves. For instance, the recent link-up between eBay and Kinkos, detailed in this insightful article on ebay and kinkos link up , suggests a potential shift in the retail landscape. However, will this domino effect translate into a broader Asian investment boom?

Only time will tell, but the potential is certainly there.

Growth Potential and Key Drivers

The Asian tech sector’s growth potential is substantial. This is fueled by factors like increasing internet penetration, a young and digitally savvy population, and the ongoing development of robust digital infrastructure. Mobile-first adoption, for instance, is driving the demand for innovative mobile applications and services. This trend is particularly pronounced in emerging markets where smartphones have become the primary access point to the internet.

Competitive Landscape in Asian Tech Sectors

Competition is fierce within various Asian tech sectors. For example, in the e-commerce sector, players like Alibaba and Coupang face intense competition from regional and international rivals. In the fintech space, the presence of established financial institutions and new digital players create a complex landscape. Understanding these competitive dynamics is crucial for assessing the potential for success in any given market.

Key players often utilize strategic partnerships, acquisitions, and innovative business models to maintain their competitive edge.

Comparison of Asian Tech Ecosystems with Other Global Regions

Asian tech ecosystems differ from those in other global regions in several aspects. For instance, China’s ecosystem, driven by government support and massive capital infusion, often contrasts with the more organically developed startup ecosystems in regions like the United States. Cultural nuances, regulatory environments, and the specific needs of different markets shape the distinct characteristics of each ecosystem.

While the US tech scene often focuses on disruptive innovation and global expansion, Asian tech ecosystems may emphasize regional dominance and local market penetration. This comparison provides valuable insights into the unique challenges and opportunities presented by each region.

Potential for an “Asian Stampede”

The concept of an “Asian stampede” in investment circles refers to a rapid and significant surge in capital flowing into Asian tech companies. This phenomenon is often driven by a confluence of factors, including burgeoning economies, increasing venture capital availability, and the emergence of innovative startups. Such a surge can have substantial implications for the region’s economic development and the broader global tech landscape.This potential “stampede” isn’t simply about the quantity of investment; it’s about the qualitative shift in the Asian tech landscape.

It signals a belief in the region’s long-term potential, driving innovation and potentially reshaping global technology markets. The impact of SoftBank’s investments, as a key player, is undeniable, and understanding the potential catalysts and consequences is crucial.

Factors Triggering an Investment Surge

The rapid development of digital infrastructure and the growing middle class in several Asian countries, especially in Southeast Asia, are significant catalysts. Increased access to capital through venture capital firms and private equity is another key driver. Furthermore, government initiatives promoting innovation and technology adoption, combined with a vibrant startup ecosystem, are all contributing factors.

Impact of SoftBank’s Investments

SoftBank’s substantial investments in Asian tech companies have played a crucial role in shaping the region’s technology landscape. Their backing of various startups has not only provided capital but also mentorship and industry connections. This strategic approach has helped accelerate the growth of companies and foster a more competitive market. Examples include SoftBank’s investments in ride-hailing services, e-commerce platforms, and fintech companies, which have significantly impacted the development of these sectors in various Asian countries.

Potential Risks and Challenges

While an investment surge can be beneficial, it also carries risks. Overvaluation of companies, leading to potential bubbles, is a critical concern. Regulatory hurdles and inconsistencies across different Asian markets can also pose challenges. Furthermore, the potential for a rapid cooling of the investment climate, as seen in other global markets, must be considered. It’s important to balance the optimism with a realistic assessment of the potential obstacles.

Will SoftBank’s investments trigger an Asian investment stampede? It’s a fascinating question, and the answer likely hinges on several factors. Interestingly, the recent expansion of iVillage, a platform focused on supporting expectant mothers, ivillage expansion caters to expectant mothers , suggests a broader trend of increased investment in the Asian market. Ultimately, whether SoftBank’s moves spark a full-blown stampede remains to be seen.

Ripple Effect Across Sectors

An investment boom in the Asian tech sector can have a profound ripple effect across various industries. For example, increased investment in e-commerce can stimulate demand for logistics and delivery services. Growth in fintech can revolutionize financial services, potentially impacting traditional banking models. The development of artificial intelligence and other technologies can also transform industries such as manufacturing and healthcare.

In essence, a robust investment environment can lead to a wide-ranging transformation of the Asian economy.

SoftBank’s Role in Driving the “Stampede”

SoftBank’s massive investment portfolio, particularly in Asian tech, has sparked considerable interest and discussion. Their strategies and influence on the region’s burgeoning startup ecosystems are a key factor in evaluating the potential for an “Asian stampede” in venture capital. Understanding their approach, compared to others, provides insight into the potential impact on the Asian market.SoftBank’s investment approach has been a significant force in the Asian tech landscape.

Their vast resources and aggressive strategies have attracted both praise and criticism. This section examines SoftBank’s current investment strategies in Asia, comparing them to other prominent investors, and analyzes the potential ripple effects of their decisions on the region’s entrepreneurial environment.

SoftBank’s Current Investment Strategies in Asia

SoftBank’s current strategy in Asia prioritizes large-scale investments in established and emerging tech companies. They often target sectors like e-commerce, fintech, and cloud computing. This focus reflects a belief in the long-term potential of these industries in the region. Their investment style leans towards substantial financial backing, sometimes enabling companies to rapidly scale and compete in a crowded market.

This contrasts with some other investors who favor smaller, more diversified portfolios.

Comparison with Other Prominent Investors in Asia

Other prominent investors, such as Sequoia Capital and Tiger Global, often adopt a different approach. Sequoia Capital, for example, typically focuses on seed and early-stage investments, fostering long-term partnerships with founders. Tiger Global, on the other hand, often prioritizes investments in established companies with proven business models. SoftBank’s approach, with its substantial backing of later-stage companies, differs considerably from these models.

These variations influence the pace and nature of investment activity across the region.

Potential Influence on Asian Markets

SoftBank’s investments can significantly influence Asian markets by driving competition, fostering innovation, and shaping the direction of specific industries. Their investments can lead to rapid expansion of businesses and infrastructure, creating jobs and opportunities. However, the large-scale nature of some SoftBank investments can also raise concerns about market dominance and potential disruption of existing ecosystems. The potential influence hinges on the successful implementation of SoftBank’s strategies and the response from the market.

SoftBank’s Potential Role as a Catalyst for Further Investment

SoftBank’s large-scale investments can act as a catalyst, attracting further investment into Asian tech. Their high-profile deals and endorsements can boost investor confidence in the region’s potential, leading to a cascade of similar investments from other players. Their demonstrated success in certain sectors can also create a trend, encouraging other investors to follow suit. This domino effect can accelerate the growth of Asian tech startups and ecosystems.

SoftBank’s Influence on Startup Ecosystems in Asian Countries

SoftBank’s investments have demonstrably impacted startup ecosystems across various Asian countries. In China, for instance, their investments in e-commerce platforms have significantly contributed to the country’s rapid digital transformation. Their presence in India has fostered a more competitive environment in sectors like fintech and cloud computing. Their involvement has, in some cases, led to the development of local talent and infrastructure to support these ventures.

Their influence on specific markets varies based on the country’s regulatory environment, entrepreneurial culture, and existing ecosystem.

Potential Outcomes and Implications

SoftBank’s significant investments in Asian tech could trigger a cascade effect, potentially propelling a surge in venture capital activity across the region. This “Asian stampede” could reshape the tech landscape, impacting investors, startups, governments, and global markets in profound ways. Understanding the potential outcomes and implications is crucial for navigating this evolving dynamic.

Possible Outcomes of an Asian Tech Investment “Stampede”

The surge in investment could lead to rapid growth in startups, creating new jobs and fostering innovation. However, a lack of regulatory oversight or a poorly managed influx of capital could lead to asset bubbles, misallocation of resources, and unsustainable growth. The stampede might also bring about a disproportionate concentration of wealth and power in the hands of a few influential players.

Impacts on Stakeholders

A significant influx of capital can drastically alter the landscape for various stakeholders.

| Stakeholder | Potential Positive Impacts | Potential Negative Impacts |

|---|---|---|

| Investors | Increased returns, diversification of portfolios, access to promising new markets | Higher risk of losses due to speculative investments, potential asset bubbles, and increased competition |

| Companies | Access to funding for expansion, technological advancements, and market penetration | Pressure to meet unrealistic expectations, potential dilution of ownership, and difficulty maintaining profitability during rapid growth |

| Governments | Economic growth, job creation, enhanced international competitiveness | Potential for regulatory challenges, pressure to accommodate rapid growth, and concerns over the sustainability of the boom |

Global Market and Investment Trend Implications

This Asian tech investment surge could significantly influence global markets and investment trends. The increased activity could attract global investors to the Asian tech sector, potentially leading to a shift in capital allocation towards emerging markets. The stampede could also lead to a re-evaluation of risk assessments for Asian markets, potentially altering investment strategies worldwide. For example, the rise of Chinese tech giants like Tencent and Alibaba demonstrated the transformative potential of a region with significant investment.

Long-Term Consequences of Investment Surge

The long-term consequences of this surge in investment in Asia’s tech sector could be substantial and multifaceted. It could lead to the creation of global tech leaders and accelerate the technological advancements in the region, impacting various industries. However, it also poses risks of overvaluation, unsustainable growth, and an eventual correction. The dot-com bubble serves as a cautionary tale.

Framework for Analyzing Economic Effects

To analyze the potential economic effects of this investment boom, a comprehensive framework encompassing several key indicators is necessary. This framework should include:

- Market Valuation Metrics: Tracking valuations of startups and established companies to identify potential bubbles and unsustainable growth. Analyzing P/E ratios and other valuation metrics will be critical. A surge in valuations without corresponding increases in revenue or profitability should raise red flags.

- Employment Trends: Monitoring job creation and job losses in the tech sector to assess the overall impact on the labor market. This involves examining the growth of high-skilled positions and the potential displacement of certain roles. Historical examples of technology-driven job creation and displacement provide valuable insights.

- Innovation Metrics: Evaluating the pace of innovation and the development of disruptive technologies. Analyzing patent filings, research collaborations, and the creation of new business models will give a clear picture of the long-term impact on the global economy.

Illustrative Examples

SoftBank’s investments, particularly in Asia, are often framed as a potential “stampede,” echoing past investment booms in other regions. Understanding the dynamics of these surges, and the companies that have benefited, is crucial to gauging the potential impact of this activity on the Asian tech landscape. Examining similar investment patterns in other markets provides valuable context for evaluating the potential outcomes in Asia.Past investment surges, while often fueled by similar narratives of unprecedented growth potential, haven’t always yielded uniformly positive results.

Success hinges on factors like the quality of the investments, the regulatory environment, and the broader economic conditions. However, analyzing these historical examples can help us anticipate the potential benefits and pitfalls of a similar investment surge in Asia.

Past Investment Surges in Other Regions

Significant investment surges have occurred in various regions throughout history, often driven by technological advancements and market expectations. The dot-com boom of the late 1990s and early 2000s in the US and the subsequent rise of tech giants, while not a direct comparison, highlight the dynamics of capital influx and the impact on markets. The emergence of Chinese tech giants like Alibaba and Tencent, which benefited from earlier investment surges in the country, also demonstrate a parallel, although distinct, trajectory.

The rise of e-commerce in China is a notable example of how investment booms can drive substantial economic changes in a specific region.

Case Studies of Successful Asian Tech Companies

Several Asian tech companies backed by SoftBank have achieved remarkable success. Examples include companies like Meituan-Dianping, a Chinese food delivery and services platform, and others. Their rise, and the subsequent impact on the Asian economy, are prime examples of the potential of well-placed investments in the region. Analyzing these success stories can offer insights into the factors that contribute to growth.

The specific characteristics of these companies, such as their business models, market positions, and management teams, provide clues to understanding the broader investment landscape.

Impact on Economies of Other Regions

Investment surges, when successful, can lead to job creation, increased innovation, and broader economic growth. The dot-com boom in the US, for instance, created many new jobs and spurred innovation in various sectors. The influence of successful tech companies on the economies of the regions they operate in is significant. This influence includes not only job creation but also the development of supporting industries, which can have a ripple effect throughout the economy.

Potential for Similar Growth Patterns in Asia

The potential for similar growth patterns in Asia is substantial. The region boasts a large and growing consumer base, a burgeoning entrepreneurial ecosystem, and an increasing focus on technology adoption. Several factors, including a strong consumer base, burgeoning entrepreneurial ecosystems, and the increasing adoption of technology, contribute to this potential. However, the success of such a surge depends on various factors.

The quality of investments, the regulatory environment, and broader economic conditions remain crucial determinants.

Historical Comparison of Asian Investment Markets with Global Markets

Comparing Asian investment markets with global markets reveals interesting similarities and differences. Asian markets, while exhibiting unique characteristics, often follow similar trends to global markets. However, the regulatory landscape and cultural nuances in Asian markets add a layer of complexity to investment strategies. Historical data can provide insights into investment patterns and market dynamics, but the nuances of each region need to be considered.

Factors like regional regulatory frameworks and cultural contexts play a significant role in the success of investment strategies in Asian markets.

Conclusive Thoughts: Will Softbanks Investments Start Asian Stampede

Ultimately, the question of whether SoftBank’s investments will trigger an Asian tech investment “stampede” remains uncertain. The potential outcomes, positive and negative, are significant for both Asian markets and global investment trends. This analysis provides a framework for understanding the factors at play, the potential impacts on various stakeholders, and the long-term consequences of this investment surge. While the future is unpredictable, the potential for a substantial impact on the Asian tech sector is undeniable.