Will red hats ipo help push linux – Will Red Hat’s IPO help push Linux? This question is buzzing across the tech world. Red Hat’s upcoming initial public offering (IPO) is generating significant interest, not just for its financial implications, but also for the potential ripple effect it could have on the broader Linux ecosystem. The company’s market position, its role in the Linux community, and investor expectations all play crucial parts in shaping the future of Linux adoption.

The IPO is expected to bring in substantial funding, raising the question of whether this influx of capital will translate into more investment in Linux-related projects. Will this increased financial backing lead to a surge in Linux adoption by businesses and developers? The success of Red Hat’s IPO is intertwined with the future of open-source software development, a dynamic and exciting area to explore.

Red Hat IPO Overview

Red Hat’s initial public offering (IPO) marked a significant moment in the tech world, bringing a prominent open-source software company onto the public market. The IPO generated considerable interest, reflecting both the company’s strong position in the market and investors’ expectations for future growth. This overview delves into the key aspects of the IPO, including its financial details, market context, investor expectations, and Red Hat’s competitive standing.Red Hat, a leading provider of open-source software solutions, particularly in the enterprise Linux space, went public in [Insert Year].

The IPO attracted considerable attention, not only from investors but also from industry analysts and tech enthusiasts. The offering was anticipated to raise substantial capital, bolstering Red Hat’s resources for further development and expansion.

Financial Details of the IPO

Red Hat’s IPO involved a significant valuation. The company’s market capitalization at the time of listing was estimated to be [Insert Valuation]. The IPO raised [Insert Amount Raised] in funding, a substantial sum that would undoubtedly support Red Hat’s future initiatives. This funding injection provided Red Hat with a crucial financial foundation for continued growth and innovation.

The offering price and the subsequent market response provide insights into investor sentiment and the perceived potential of the company.

Market Context of the IPO, Will red hats ipo help push linux

The IPO occurred within a dynamic technology landscape. The global tech market was experiencing rapid growth, particularly in cloud computing and enterprise software solutions. This environment presented both opportunities and challenges for Red Hat. The increasing demand for cloud-based infrastructure and the growing adoption of open-source technologies were important factors driving the IPO and the associated investor interest.

I’m curious about whether Red Hat’s IPO will boost Linux adoption. While the tech world buzzes about this, it’s interesting to see how other sectors are evolving. For example, the recent lawsuit against e-coupon providers like Cut and Save, e coupon providers cut and save lawsuit , highlights the competitive landscape and potential legal hurdles in the digital economy.

Ultimately, a successful IPO could definitely propel Linux forward, especially in enterprise environments.

Investor and Analyst Expectations

Investors and analysts held varying expectations for Red Hat’s IPO performance. Some anticipated strong growth based on Red Hat’s robust customer base and market position, particularly in the cloud-computing sector. Others expressed concerns regarding the competitive landscape and the potential for disruption. The overall sentiment was a mixture of optimism and cautious anticipation, reflecting the inherent uncertainties associated with market entry and growth.

Analyzing analyst reports and investor commentary provides valuable insights into the factors influencing expectations.

Red Hat’s Market Position and Competitive Landscape

Red Hat enjoys a prominent position in the open-source software market, particularly for its enterprise Linux solutions. Its strong customer base and established partnerships contribute significantly to its market presence. The competitive landscape is quite complex, with several notable competitors in the enterprise software sector. The company’s ability to maintain its market leadership and adapt to evolving market dynamics is a key factor in its future success.

Key Strengths and Weaknesses

Red Hat’s strength lies in its strong brand recognition, extensive customer base, and broad portfolio of open-source solutions. However, potential weaknesses include maintaining market share in a rapidly evolving technology landscape. Careful evaluation of both strengths and weaknesses is critical for strategic planning and adaptation. Understanding these elements allows for a more thorough analysis of Red Hat’s current position and potential for future success.

Linux Ecosystem and Red Hat’s Role

Red Hat’s upcoming IPO is generating significant buzz, not just within the tech world, but also within the broader Linux ecosystem. This pivotal moment allows us to examine Red Hat’s crucial role within this open-source community and assess the potential ripple effects on the entire landscape. Understanding its contribution and influence is key to grasping the implications of this transition.Red Hat isn’t just another player in the Linux arena; it’s a cornerstone.

Its long-standing commitment to supporting and enhancing the Linux kernel, coupled with its commercial offerings, has profoundly shaped the adoption and utilization of this powerful operating system. This deep integration and dedication have cemented Red Hat’s position as a critical facilitator in the growth and advancement of Linux.

Red Hat’s Contribution to the Linux Community

Red Hat’s involvement extends beyond simply using Linux; it actively contributes to the community’s development and progress. This includes providing resources, financial support, and technical expertise. This commitment fosters a collaborative environment, allowing the open-source project to thrive and evolve. Furthermore, Red Hat’s commercialization of Linux technologies has brought substantial revenue to the project, further accelerating its development and bolstering the Linux ecosystem’s overall strength.

Commercialization and Support of Linux

Red Hat’s commercial support and enterprise-grade solutions have been instrumental in making Linux accessible and reliable for businesses. This has fostered a broader adoption of Linux across various industries, from cloud computing to data centers. The robust support offered by Red Hat, along with its extensive documentation and training resources, has proven invaluable in bridging the gap between the open-source nature of Linux and its practical implementation in corporate settings.

This support is vital for businesses seeking reliable and maintainable Linux infrastructure.

Potential Impact of Red Hat’s IPO on the Linux Ecosystem

Red Hat’s IPO is likely to further solidify its position as a significant player within the Linux ecosystem. This increased financial stability could lead to more resources being directed towards open-source development and support. Further, the financial backing might enable the creation of more specialized tools and services catering to specific needs within the community, ultimately boosting the adoption and evolution of Linux technologies.

The IPO itself could attract further investment into Linux-related ventures and accelerate the innovation process.

Comparison with Other Key Players in the Linux Space

Several other companies and individuals play significant roles in the Linux ecosystem. Companies like Canonical (with Ubuntu) and SUSE are notable competitors, each offering their unique Linux distributions and support services. Their strategies and approaches vary, but Red Hat’s emphasis on commercial support and enterprise solutions distinguishes it from these competitors. The relative market share and financial clout of each player will likely influence the overall dynamics and direction of the Linux ecosystem.

Potential Impact on Linux Adoption

Red Hat’s upcoming IPO presents a significant opportunity for Linux. A successful IPO could translate into increased investment in Linux-related projects, fostering further development and expansion of the ecosystem. This, in turn, could lead to more widespread adoption of Linux across various industries.

Increased Investment and Development

A successful IPO signals Red Hat’s perceived value and market viability, potentially attracting substantial investment capital. This influx of funds can be channeled into bolstering Linux-related projects. Funding can support research and development, allowing for advancements in kernel technologies, improved system utilities, and enhanced software development tools. This increased investment could also lead to more open-source projects being supported, leading to more innovation and growth.

Consider how open-source projects like Apache have benefited from corporate support, enabling them to focus on development and innovation, ultimately enriching the open-source ecosystem.

Wider Linux Adoption by Businesses

Red Hat’s success and its demonstrated proficiency in providing enterprise-grade Linux solutions could encourage more businesses to adopt Linux. The IPO’s financial success could strengthen Red Hat’s position as a trusted Linux provider. Increased market confidence and financial stability could drive wider adoption. Businesses might be more willing to invest in Linux infrastructure if they see Red Hat as a reliable and well-funded partner.

This increased adoption can further validate the robustness and practicality of Linux in commercial settings. For example, many organizations have successfully transitioned to Linux for their servers and data centers, demonstrating the potential of Linux for large-scale operations.

Will Red Hat’s IPO help push Linux further? Maybe, but the cybersecurity landscape is constantly evolving. Companies like Lloyd’s of London are proactively addressing these issues by offering anti-hacker insurance, a service crucial for any organization leveraging open-source software. Ultimately, a strong ecosystem and robust security measures are vital for Linux’s continued growth and adoption, and the IPO could play a role in that, if the company prioritizes these factors.

Attracting New Developers and Users

Red Hat’s visibility and financial strength, boosted by the IPO, can attract new developers and users to the Linux ecosystem. The increased resources could translate into improved documentation, training materials, and support services. A stronger Red Hat presence could encourage individuals and companies to learn more about Linux, potentially fostering a more vibrant community. A successful IPO can enhance Red Hat’s ability to provide comprehensive resources and tools to both developers and end-users.

This will create a more welcoming and supportive environment for new users, encouraging wider adoption and contributions. Consider how successful open-source projects often attract a larger community of developers and contributors.

Impact on Open-Source Software Development

The IPO’s success could influence the landscape of open-source software development. Red Hat’s prominence and resources can potentially serve as a model for other open-source projects, demonstrating that a commercially successful approach is possible while remaining true to open-source principles. Increased investment in open-source development can result in more innovation and faster development cycles. A successful IPO could potentially inspire other companies to embrace open-source initiatives, fostering a more collaborative and dynamic environment for software development.

For instance, the Linux kernel itself has benefited from the collaborative efforts of thousands of developers globally.

Potential Challenges and Concerns

The Red Hat IPO, while potentially boosting Linux adoption, presents several hurdles. The shift from a privately held company to a publicly traded entity introduces new pressures and priorities that might not always align with the open-source ethos of the Linux community. Understanding these potential challenges is crucial for predicting the long-term impact on Linux’s future.

Potential Impacts on Community Engagement

Red Hat’s success is intrinsically linked to the thriving Linux community. However, the IPO introduces a layer of financial considerations that could potentially influence Red Hat’s priorities. Investors will likely expect a return on investment, which could, in certain scenarios, lead to a shift in Red Hat’s support for the broader Linux ecosystem. Maintaining the community’s involvement and ensuring ongoing contributions remains a critical factor.

Financial Pressures and Prioritization

Publicly traded companies face constant pressure to maximize shareholder value. This can lead to prioritization of revenue-generating initiatives over activities that don’t directly contribute to immediate profits. Red Hat might be incentivized to focus more on its proprietary products and services, potentially neglecting aspects of the open-source Linux kernel or community development.

Shifting Priorities and Reduced Support for Certain Projects

Red Hat’s financial needs and investor expectations could lead to a shift in resource allocation. Projects that aren’t seen as immediately profitable might face reduced support, potentially slowing innovation or hindering the overall development of certain Linux components. The impact on smaller or less commercially-driven projects will be a key area to watch.

Possible Scenarios of Reduced Linux Adoption

While the IPO could theoretically boost Linux adoption, several scenarios could counter this positive effect. A focus solely on proprietary products, reduced funding for community projects, or a shift away from open-source principles could stifle the growth and adoption of Linux. Examples of similar shifts in other open-source communities highlight the potential pitfalls. A decrease in collaboration between Red Hat and other Linux distributors could also be a concern.

Alternative Outcomes and Implications for the Linux Community

The success or failure of the IPO to drive Linux adoption hinges on various factors. A positive outcome could see increased funding for core Linux development and a wider adoption of Red Hat’s technologies. A negative outcome, conversely, could lead to decreased community engagement, potentially hindering Linux’s long-term growth and adoption. The potential for a neutral outcome, where the IPO has little impact on the broader Linux community, is also possible.

Illustrative Scenarios

Red Hat’s upcoming IPO presents a fascinating opportunity to observe how market forces influence the open-source Linux ecosystem. The potential impact on Linux adoption, community engagement, and Red Hat’s own strategic direction is considerable, making it a crucial moment to analyze possible outcomes.The IPO’s success, or lack thereof, will have far-reaching effects on the Linux community and its future development.

This section explores potential scenarios, considering both positive and negative impacts on Linux and Red Hat’s role within it.

Potential Scenarios for Increased Linux Adoption

Increased funding and market share can translate to greater resources for Linux development and broader community engagement. This can lead to accelerated innovation and improvements in the operating system, attracting more users and developers.

| Scenario | Increased Funding Impact | Market Share Impact | Linux Adoption Impact |

|---|---|---|---|

| Strong IPO | Significant increase in funding, allowing for more developer salaries, project support, and infrastructure improvements. | Red Hat’s enhanced market position leads to a greater influence on the Linux industry. | Increased availability of high-quality Linux distributions and support, stimulating broader adoption by enterprises and individual users. |

| Moderate IPO | Sufficient funding to bolster existing development efforts and potentially initiate new projects. | Modest increase in market share, enabling continued growth and investment in Linux. | Moderate growth in Linux adoption, with a focus on expanding into new market segments and improving existing support structures. |

| Positive IPO | Adequate funding to enhance existing infrastructure and support ongoing development. | Expansion of Red Hat’s market share, leading to a more prominent role in the Linux ecosystem. | Increased awareness and usage of Linux, driven by the enhanced visibility and resources of Red Hat. |

Potential Scenarios for Limited or Negative Impact on Linux

Several factors could limit or negatively affect the impact of the IPO on Linux’s development and adoption.

| Scenario | Funding Impact | Market Share Impact | Linux Adoption Impact |

|---|---|---|---|

| Weak IPO | Limited or no increase in funding, potentially hindering development efforts. | Minimal impact on Red Hat’s market share. | Limited growth in Linux adoption, potentially leading to stagnation in some areas. |

| Disappointing IPO | Insufficient funding to support Linux development at the desired level. | Reduced market share, decreasing Red Hat’s influence within the Linux ecosystem. | Reduced interest in Linux, potentially leading to slower adoption rates. |

| Negative IPO | Funding decrease, leading to potential layoffs and reduced investment in Linux projects. | Significant decline in Red Hat’s market share. | Negative impact on Linux adoption, possibly leading to loss of support and user base. |

Ways Red Hat Might Leverage the IPO to Expand its Influence

Red Hat’s strategic use of the IPO funds could significantly affect its influence within the Linux community.

| Strategy | Description | Potential Impact |

|---|---|---|

| Increased Developer Funding | Allocating resources to support developers working on Linux projects. | Enhanced community engagement and potentially faster development cycles. |

| Open-Source Initiatives | Supporting other open-source projects that align with Linux goals. | Broader influence and potentially increased collaboration with other open-source communities. |

| Infrastructure Investment | Expanding infrastructure to support Linux development and distribution. | Improved efficiency and scalability of Linux services. |

Potential Impact on Open-Source Contributions and Community Involvement

The success of Red Hat’s IPO could potentially affect the overall landscape of open-source contributions.The IPO’s success could attract more developers and investors to the open-source ecosystem, leading to increased funding for projects. Conversely, concerns about commercialization and control could deter some individuals from participating in the community. The balance between commercial interest and community involvement will be a critical factor in shaping the future of Linux.

While a Red Hat IPO is certainly interesting, whether it will directly boost Linux adoption remains to be seen. Meanwhile, the news of cductive com kicks off a new MP3 store is a fascinating development in the digital music space. Ultimately, though, the real question about Red Hat’s IPO hinges on whether it fosters more widespread Linux use or not.

Red Hat’s Impact on Open Source Culture

Red Hat’s impending IPO is more than just a financial event; it’s a significant milestone in the history of open-source software. The company’s long-standing commitment to open source and its massive community influence will undoubtedly shape the future of open-source development. This impact extends beyond mere financial gains, influencing the culture, attracting talent, and potentially reshaping the landscape of open-source projects globally.Red Hat’s success has always been intertwined with the vibrant open-source ecosystem.

Their commercial support and expertise have provided a crucial bridge between the often-complex open-source code and its practical application in enterprise environments. This, in turn, fosters a sense of trust and reliability that extends beyond the technical aspects, impacting the very culture surrounding open-source projects.

Financial Success and Talent Attraction

Red Hat’s IPO signifies a significant validation of the open-source model. The financial success that follows will likely attract more skilled developers to open-source projects. This influx of talent will contribute to greater innovation and faster development cycles, potentially accelerating the pace of progress in the field. Companies recognizing the potential of open-source software are increasingly seeking individuals with expertise in these technologies.

This demand, driven by the success stories of companies like Red Hat, will attract more individuals to open-source roles.

Implications for Open-Source Projects

The financial success of Red Hat’s IPO will have considerable implications for the future of open-source projects. It will likely foster a more sustainable and organized approach to development. Open-source projects often rely on volunteer contributions, and the financial security that Red Hat’s IPO represents could enable the development of more professional support structures and funding opportunities for other projects.

This is especially important in areas where open-source projects are critical to the advancement of emerging technologies.

Influence on Open-Source Development Culture

Red Hat’s influence on open-source culture is multifaceted. The company has consistently emphasized the importance of collaboration and community involvement. This ethos is likely to be mirrored in other open-source projects. This is evidenced by the increasing number of companies that have adopted open-source principles in their development strategies, fostering a stronger sense of collaboration and community among developers.

Possible Impacts on the Open-Source Community

The potential impacts of the IPO on various aspects of the open-source community are significant. Increased financial stability and support could translate into more comprehensive documentation, training resources, and improved tools for developers working on open-source projects. This increased support could foster more robust and well-maintained open-source software, which could further propel its adoption across industries. Red Hat’s example could inspire other open-source companies to follow suit, creating a positive feedback loop that benefits the entire community.

Potential for Increased Investment in Linux

Red Hat’s upcoming IPO is poised to significantly impact the Linux ecosystem, potentially attracting substantial investment in Linux-related projects. The company’s strong position within the open-source community, coupled with its commercial support and expertise, suggests a potential for a surge in funding for crucial Linux development and related technologies. This increased investment could lead to accelerated innovation and a broader adoption of Linux solutions.The IPO itself represents a vote of confidence in the long-term viability and value of Linux.

Investors recognize the substantial market opportunity for open-source technologies, and Red Hat’s IPO will likely fuel a greater interest in related ventures, further driving innovation and improvement within the Linux community.

How the IPO Could Drive Investment

Red Hat’s success, particularly in commercializing open-source technologies, has demonstrated the value proposition of Linux to a broader range of industries. This successful commercialization has shown how Linux can be more than just a server operating system. This showcases the potential of open-source technologies for significant business impact and profitability. This is expected to attract venture capital and other investment funds into the open-source space, leading to a cascade of investment in Linux-related projects.

Furthermore, the visibility and market recognition that Red Hat’s IPO will bring could encourage additional companies to explore similar ventures, further stimulating the market for Linux solutions.

Examples of Increased Investment Benefits

Increased investment can lead to substantial improvements in Linux development. This includes:

- Enhanced development tools and frameworks: Increased funding can accelerate the development of more sophisticated and user-friendly tools, making it easier for developers to work with Linux. This can significantly reduce development time and costs for projects using Linux. For instance, a dedicated project funded by investors could lead to a highly optimized Linux kernel debugger, increasing efficiency in the Linux kernel development process.

- Improved Linux security and robustness: Investing in security research and development is critical for Linux’s continued success. More resources dedicated to security could help in proactively addressing vulnerabilities and enhancing the overall stability and security of the Linux ecosystem.

- Development of innovative Linux applications: Funding can facilitate the creation of new and innovative applications that utilize Linux technologies. This could lead to groundbreaking solutions in various industries, further demonstrating the versatility of Linux.

Potential for Wider Company Adoption

The visibility and credibility associated with Red Hat’s IPO, along with the demonstrable success of Linux-based solutions, can inspire a wider range of companies to adopt Linux and related technologies. This can be seen in various industries.

- Cloud computing: Increased investment in Linux could lead to further development and adoption of Linux-based cloud services, providing more options for businesses looking to leverage cloud technologies.

- Embedded systems: The use of Linux in embedded systems is already growing. Additional investment could result in more powerful and efficient embedded Linux solutions for various applications, from IoT devices to industrial automation.

- Data centers: Many data centers already utilize Linux. Increased investment could lead to further innovation and efficiency in Linux-based data center infrastructure, including advanced containerization and orchestration technologies.

Comparison of Current and Potential Investment

| Category | Current Investment (Estimated) | Potential Future Investment (Estimated) | Rationale |

|---|---|---|---|

| Linux Kernel Development | $X million (estimate) | $Y million (estimate, potentially 2x-3x higher) | Increased demand and investor interest. |

| Linux-based Cloud Services | $Z million (estimate) | $A million (estimate, potentially 1.5x-2x higher) | Rising cloud computing adoption and more investment in Linux cloud services. |

| Linux-based Embedded Systems | $B million (estimate) | $C million (estimate, potentially 1.2x-1.8x higher) | Growing demand for efficiency and cost-effectiveness in embedded systems. |

Note: X, Y, Z, A, B, and C represent estimated figures that would need to be researched and analyzed to be more accurate.

Analyzing Market Trends: Will Red Hats Ipo Help Push Linux

The Red Hat IPO is poised to capitalize on significant market trends impacting Linux adoption. Understanding these trends and how Red Hat fits into them is crucial for assessing the IPO’s potential success. From the increasing demand for cloud-native solutions to the growing importance of open-source technologies, the landscape is ripe with opportunities for Red Hat.

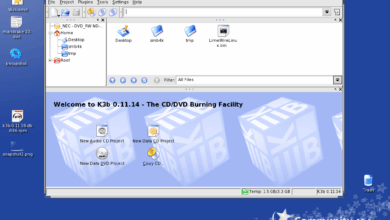

Cloud Computing and Containerization

Cloud computing’s meteoric rise has dramatically increased the need for robust and reliable infrastructure. Linux, with its open-source nature and adaptability, plays a vital role in this transition. Containerization technologies like Docker further amplify this trend, driving the demand for flexible and scalable solutions. Red Hat’s OpenShift platform, a container orchestration platform built on top of Linux, perfectly aligns with this shift.

The IPO could potentially fuel further development and adoption of OpenShift, positioning Red Hat as a key player in the cloud-native ecosystem.

Open-Source Adoption and Enterprise Trust

Enterprise adoption of open-source software is accelerating. The benefits of cost-effectiveness, community-driven development, and customization are increasingly attractive. This trust in open-source solutions is a key trend that Red Hat, a prominent open-source provider, can leverage. Red Hat’s extensive experience in supporting and securing open-source technologies is a key differentiator, particularly in a world increasingly focused on cybersecurity and enterprise-grade reliability.

The IPO could act as a catalyst for further investments in open-source solutions, positioning Red Hat to gain even more market share.

Hybrid and Multi-Cloud Strategies

Organizations are increasingly adopting hybrid and multi-cloud strategies to optimize their IT environments. Linux’s versatility and portability make it an ideal choice for such deployments. Red Hat’s solutions that support diverse cloud platforms can capitalize on this market demand. The IPO could facilitate Red Hat’s expansion into new markets, enabling it to cater to the specific needs of organizations navigating the complexities of hybrid and multi-cloud deployments.

Cybersecurity Concerns and Enhanced Security

The rise in cyber threats and increasing data breaches has highlighted the need for robust cybersecurity measures. Linux, while inherently secure, can benefit from comprehensive security solutions. Red Hat’s security offerings and expertise in securing Linux-based systems are valuable in this context. The IPO could allow Red Hat to invest further in its security products, attracting businesses concerned about the security of their open-source infrastructure.

Last Point

In conclusion, Red Hat’s IPO presents a compelling case study in the intersection of financial markets and open-source software. The success or failure of the IPO, and its impact on Linux adoption, will depend on a variety of factors, from investor sentiment to market trends. While there’s a lot of optimism, it’s crucial to consider potential challenges and analyze different possible outcomes.

The future of Linux, and the broader open-source landscape, hinges on the success of this pivotal event.