Victorias secret invites investors to get intimate – Victoria’s Secret invites investors to get intimate, prompting a flurry of questions about the strategy behind this unusual approach. This move raises several key issues, including potential motivations, marketing implications, financial projections, public perception, and the possibility of strategic partnerships. The unconventional nature of the invitation demands a thorough examination of its various facets.

The company’s current investor relations strategy will be examined, along with potential motivations behind this unique approach. Similar strategies employed by other retail companies will be contrasted to provide a broader context. The potential benefits and risks associated with this investor engagement will be discussed, and how this differs from traditional communication methods. The impact on investor sentiment and stock price will be analyzed.

Investor Relations Strategy: Victorias Secret Invites Investors To Get Intimate

Victoria’s Secret’s recent invitation for investors to “get intimate” signals a shift in their investor relations strategy, moving beyond traditional communication methods. This approach suggests a desire to foster closer relationships and potentially build a stronger connection with investors. The move likely stems from a need to enhance transparency and communication, particularly in light of recent performance challenges.

Current Investor Relations Strategy Summary

Victoria’s Secret’s current investor relations strategy appears to be transitioning from a more detached, traditional approach towards a more intimate and direct engagement. This includes a willingness to interact more personally with investors. The company aims to build trust and understanding by providing deeper insight into its operations and future plans. This departure from the norm suggests a proactive attempt to improve investor perception and address any concerns.

Potential Motivations Behind the “Get Intimate” Invitation

The invitation to “get intimate” with investors likely stems from a desire to counteract negative investor sentiment and potentially boost stock performance. Recent financial results and market perception have possibly influenced this strategy. The company may feel that direct communication and transparency can foster a more positive investor outlook and build trust. The “get intimate” phrase is likely chosen for its emotional impact and emphasis on personal connection, which could enhance engagement and understanding.

Historical Investor Relations Strategies in Retail

Historical investor relations strategies in the retail sector have often revolved around quarterly earnings calls, press releases, and investor presentations. These methods generally provide updates on financial performance and strategic direction. However, the increasing popularity of more interactive and engaging methods suggests a broader trend toward building stronger relationships with investors. This shift is seen in other industries, where companies seek to proactively address concerns and foster better understanding.

Benefits and Risks of Intimate Investor Engagement

This more intimate approach to investor engagement offers the potential for stronger investor relationships and improved transparency. It can foster a better understanding of the company’s challenges and opportunities. However, there’s also the risk of misinterpretation or miscommunication, potentially leading to investor dissatisfaction or negative sentiment. The risk of misrepresenting the company’s position also exists. The effectiveness of this approach depends heavily on the execution and transparency of the communication.

Comparison with Traditional Investor Communication Methods

Traditional investor communication methods, such as press releases and earnings calls, offer a standardized, impersonal approach. In contrast, the “get intimate” approach aims for a more personalized interaction. This difference is likely driven by a need for greater engagement and understanding in today’s investor landscape. The shift from a formal to a more personal approach is noteworthy.

Potential Impact on Investor Sentiment and Stock Price

The impact on investor sentiment and stock price is uncertain and depends heavily on the execution of the strategy. Successful implementation could lead to improved investor perception and a positive impact on the stock price. Conversely, a poorly executed strategy could have the opposite effect. A successful example of a company that used similar engagement strategies might provide valuable insight into its outcomes.

Victoria’s Secret’s invitation to investors to get intimate feels a bit… unexpected. While their lingerie line is certainly a hot topic, perhaps this move is a way to streamline their finances, mirroring the efficiency of online payment services like the online payment service aiming to streamline bill paying process. Ultimately, this strategy could help them navigate the complexities of the market, potentially paving the way for a more profitable future.

The effectiveness of this approach is likely to vary based on the company’s specific situation and market conditions.

Comparison of Investor Relations Strategies

| Strategy | Benefits | Risks | Examples |

|---|---|---|---|

| Traditional (Press Releases, Earnings Calls) | Standardized, well-defined communication channels | Potentially impersonal, limited interaction | Many publicly traded companies |

| Intimate Engagement (Events, Direct Communication) | Stronger investor relationships, greater transparency | Risk of miscommunication, misinterpretation | Companies seeking to foster closer ties with investors |

Marketing and Branding Implications

Victoria’s Secret’s invitation to investors to “get intimate” carries significant marketing and branding implications. This approach, while potentially intriguing, demands careful consideration of target audience, message delivery, and the potential impact on the brand’s image. The “intimate” concept, if executed effectively, could resonate with a specific segment, but a misstep could damage the brand’s reputation.The invitation, in its core, is a deliberate attempt to redefine Victoria’s Secret’s image.

This redefinition hinges on communicating a more personal and exclusive connection with investors. The key is in how this “intimacy” is portrayed and to whom it is addressed. A clear marketing strategy is essential to translate this concept into tangible results.

Marketing Objectives

The primary marketing objectives behind the “intimate” invitation likely include fostering closer relationships with investors, increasing investor confidence, and potentially attracting new investment. The objective is to shift the perception of the brand from a purely retail-focused company to one that values long-term partnerships and strategic collaborations.

Strategies for Communicating Intimacy

Communicating the “intimate” aspect effectively requires a nuanced approach. For investors, the focus should be on transparency, strategic partnerships, and exclusive insights into the brand’s future. Visuals could feature behind-the-scenes glimpses into the brand’s operations, highlighting innovative approaches and exclusive collaborations. For broader audiences, the focus might be on highlighting the brand’s unique values and its ability to foster personal connections.

This approach could take the form of emotionally-charged advertisements or social media campaigns, but this must be done with extreme caution to avoid alienating certain segments.

Potential Impact on Brand Perception

This approach could significantly alter Victoria’s Secret’s brand perception. If executed well, the brand could appear more sophisticated, strategic, and focused on long-term value creation. Conversely, a poorly executed campaign could negatively impact the brand image, particularly if it is perceived as inappropriate or overly suggestive. It is critical that the tone and messaging maintain a professional and respectful atmosphere, avoiding any hint of exploitation or inappropriateness.

Table: Emphasizing Intimacy in Marketing Materials

| Approach | Target Audience | Message | Visuals |

|---|---|---|---|

| Exclusive Investor Events | High-Net-Worth Investors | “Exclusive insights into Victoria’s Secret’s future” | Elegant, intimate settings with a focus on sophistication and exclusivity |

| Social Media Engagement | Broader Consumer Base | “Victoria’s Secret’s commitment to innovation and partnership” | Images and videos highlighting the brand’s history and evolution in a sophisticated way |

| Investor Reports | Investors | “Transparent and detailed financial performance and strategic direction” | Data visualizations and infographics that clearly display key financial information |

Examples of Successful Campaigns

Many luxury brands successfully utilize exclusivity and intimacy to engage their target audience. Think of high-end fashion brands that host exclusive events, or tech companies that build a community around their products. The key lies in aligning the messaging with the brand’s values and maintaining a consistent tone across all platforms.

Negative Impacts of Ineffective Execution

A poorly executed “intimate” campaign could damage Victoria’s Secret’s reputation. Misinterpretation of the message could lead to investor skepticism or even negative publicity. The brand’s perceived values could be tarnished if the campaign is perceived as overly suggestive, inappropriate, or exploitative. Maintaining a professional and respectful tone throughout all interactions is paramount.

Financial Performance and Projections

Victoria’s Secret’s new investor outreach strategy, “Get Intimate,” aims to foster a deeper connection with investors, potentially boosting confidence and future investment. This strategy, focusing on transparency and relatability, could significantly impact financial performance and market perception. Understanding the potential financial implications, both positive and negative, is crucial for investors and stakeholders.

Potential Financial Implications

The “Get Intimate” initiative, aiming to cultivate a more personal relationship with investors, could have a positive ripple effect on financial performance. Increased investor confidence, leading to higher investment, is a key potential outcome. This strategy contrasts with past approaches, which might have been perceived as overly corporate or distant. Building a more personal brand perception could attract investors who value authenticity and engagement.

Improvements in Investor Confidence

The “Get Intimate” approach directly targets improving investor confidence. A stronger connection with investors can foster trust and understanding, potentially leading to a more favorable investment outlook. This could manifest in higher stock prices, increased investment in future initiatives, and potentially more favorable market valuations. Consider the impact of a similar strategy employed by other companies; a more accessible, personal approach has been shown to generate positive investor sentiment in the past.

Projections of Investor Interest Impact

Investor interest, driven by the “Get Intimate” initiative, is projected to positively impact financial performance. Higher investment capital could lead to expanded product lines, improved marketing campaigns, and enhanced store operations. Successful implementation could see an increase in revenue and profitability. For example, increased investor interest in Tesla following Elon Musk’s engagement strategy has historically correlated with stock price growth and market capitalization increase.

Victoria’s Secret’s invitation to investors to get intimate feels a bit… bold, right? It’s a fascinating move, especially considering UK S Freeserve is set to debut on Wall Street. This new company’s entry into the market, as detailed in u k s freeserve to debut on wall street , might just be a sign of broader shifts in the industry, potentially affecting how Victoria’s Secret positions itself going forward.

All in all, it’s a lot to unpack for a lingerie brand.

Comparison with Past Financial Performance Data

Comparing past financial performance with the projected impact of “Get Intimate” is essential. Previous strategies and their resulting financial outcomes will serve as a benchmark. Analysis of past stock prices, revenue figures, and investor sentiment during similar periods will help in assessing the potential impact of this new strategy.

Potential Financial Risks and Challenges

While the “Get Intimate” strategy holds promise, potential risks exist. A misinterpretation of investor feedback or a lack of clear communication could damage investor confidence. Competition and economic factors can also affect financial performance, regardless of the outreach strategy.

Impact on Future Stock Price and Market Valuation

The “Get Intimate” strategy’s impact on future stock price and market valuation hinges on its effectiveness in attracting and retaining investors. A successful strategy will likely lead to a higher stock price and a more positive market valuation. Conversely, a mismanaged strategy could have the opposite effect.

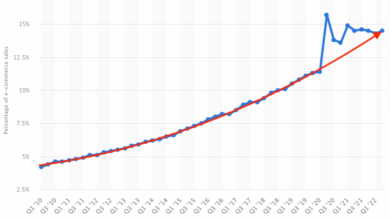

Victoria’s Secret’s invitation to investors to get intimate feels a bit like planning a wedding, doesn’t it? Just like meticulously crafting every detail of a nuptial affair, special report internet commerce is like planning a wedding emphasizes the intricate nature of the business decisions involved. Ultimately, both endeavors require careful consideration and strategic planning to ensure a successful outcome.

So, Victoria’s Secret’s move signals a significant moment in their business strategy.

Potential Financial Outcomes Under Different Scenarios

| Scenario | Stock Price Impact | Investor Sentiment | Revenue Impact |

|---|---|---|---|

| High Investor Engagement | Significant Increase | Extremely Positive | 10-15% Increase |

| Moderate Investor Engagement | Moderate Increase | Positive | 5-10% Increase |

| Low Investor Engagement | Slight Increase or No Change | Neutral | Minimal to No Change |

The table illustrates potential financial outcomes based on varying levels of investor engagement with the “Get Intimate” strategy.

Potential Public Perception and Criticism

Victoria’s Secret’s move to an intimate investor relations strategy presents a complex landscape of potential public reaction. The approach, while potentially effective in fostering closer bonds with investors, could also invite significant criticism, particularly if not handled with meticulous care and transparency. Understanding the potential for both positive and negative public perception is crucial for successful implementation.

Potential Public Reactions

The public’s reaction to Victoria’s Secret’s intimate investor relations strategy will likely vary widely. Some may view the initiative as a refreshing approach to transparency, fostering trust and understanding of the company’s financial health. Others might perceive it as overly familiar or even intrusive, raising concerns about the company’s motives and potentially impacting investor confidence. The overall public response will depend heavily on how the company communicates and manages the strategy.

Examples of Successful and Unsuccessful Attempts

Numerous companies have attempted to cultivate closer relationships with investors, with varying degrees of success. Examples of successful strategies often highlight transparency and a genuine commitment to investor engagement. Conversely, attempts that failed often stemmed from a perceived lack of sincerity, misleading information, or a perceived attempt to manipulate investor sentiment. Past instances of successful engagement often included regular, detailed financial reports and open Q&A sessions with executives.

Potential Criticisms and Negative Perceptions

Potential criticisms of the strategy may include concerns about manipulation of investor sentiment, the perceived prioritization of investors over other stakeholders, or the impression of a lack of genuine transparency. Negative perceptions might also arise if the strategy is perceived as a publicity stunt or if the company’s actions don’t align with its public statements. A significant concern lies in the perception of prioritizing investor relations over consumer interests.

Transparency and Ethical Communication

Maintaining transparency and ethical communication in investor relations is paramount. This involves providing clear, accurate, and timely information to investors, responding to their inquiries with professionalism and honesty, and consistently demonstrating a commitment to ethical practices. Furthermore, consistent communication is vital to manage investor expectations and build trust. Transparency is critical to fostering long-term investor relationships.

Handling Potential Criticism

Several approaches can be employed to mitigate potential criticism. A proactive and open communication strategy, including regular updates and engaging with investor concerns, can help build trust and manage negative perceptions. The company can also highlight the benefits of this strategy for all stakeholders, including customers and employees, to demonstrate a broader commitment. Demonstrating a genuine interest in investor feedback and acting on it will build confidence.

Table: Potential Criticism and Corresponding Responses

| Criticism | Potential Response | Stakeholder Impact |

|---|---|---|

| Manipulation of investor sentiment | Maintain consistent, transparent financial reporting and avoid misleading information. | Builds trust with investors; maintains credibility. |

| Prioritization of investors over other stakeholders | Emphasize the positive impact of investor confidence on overall company performance, including job security and product development. | Demonstrates consideration for all stakeholders; potentially increases investor confidence. |

| Lack of genuine transparency | Establish clear communication channels, hold regular investor Q&A sessions, and provide comprehensive financial reports. | Enhances investor trust; fosters understanding of the company’s financial position. |

Potential for Strategic Partnerships

Victoria’s Secret’s investor outreach presents a unique opportunity for forging strategic partnerships that can revitalize the brand and unlock new revenue streams. This move signals a commitment to growth and innovation, opening doors to collaborations that can leverage the brand’s existing strengths and tap into new market segments. The key is to identify partners whose values align with Victoria’s Secret’s evolving vision, fostering mutually beneficial relationships.

Potential Product Lines and Collaborations

Victoria’s Secret can explore collaborations across diverse sectors to expand its product offerings and appeal to a broader customer base. This includes partnerships with lifestyle brands, wellness companies, and tech ventures. For instance, a partnership with a sustainable fashion brand could introduce eco-conscious clothing lines, appealing to a growing segment of environmentally aware consumers. Similarly, collaborations with fitness apparel companies could broaden Victoria’s Secret’s reach into the activewear market, while collaborations with tech companies could lead to innovative and interactive experiences for customers in stores or online.

Examples of Successful Strategic Partnerships

Several successful partnerships in the fashion industry demonstrate the potential of strategic alliances. Nike’s collaborations with artists and designers have consistently generated significant buzz and boosted sales. Similarly, collaborations between luxury brands and emerging artists often result in unique and highly sought-after products. These examples illustrate the positive impact that carefully selected partnerships can have on brand image and market share.

Potential Partners

Several companies could benefit from and contribute to a successful partnership with Victoria’s Secret. These include sustainable lifestyle brands, tech companies focused on immersive retail experiences, and wellness brands that align with the brand’s existing aesthetic.

- Sustainable fashion brands committed to ethical sourcing and production practices.

- Tech companies specializing in augmented reality or virtual reality experiences for retail environments.

- Wellness brands that focus on body positivity and self-care, complementing Victoria’s Secret’s existing focus on beauty and confidence.

Long-Term Impact of Partnerships

Strategic partnerships can significantly impact Victoria’s Secret’s long-term success by fostering innovation, increasing brand awareness, and expanding market reach. By collaborating with complementary brands, Victoria’s Secret can introduce fresh product lines, new customer segments, and new revenue streams, enhancing brand longevity and resilience.

SWOT Analysis of Potential Partners

A thorough SWOT analysis of potential partners is crucial before committing to a collaboration. This analysis should consider each partner’s strengths, weaknesses, opportunities, and threats in relation to Victoria’s Secret’s strategic goals. For example, a sustainable fashion brand might have strong brand recognition and loyal customer base but may lack experience in luxury retail, necessitating careful consideration of the potential partnership.

| Potential Partner | Strengths | Weaknesses | Opportunities | Threats |

|---|---|---|---|---|

| Sustainable Fashion Brand A | Strong brand recognition, loyal customer base, focus on ethical sourcing | Limited experience in luxury retail, potentially smaller production capacity | Expanding market for sustainable luxury products, tapping into Victoria’s Secret’s customer base | Competition from other sustainable brands, potential supply chain disruptions |

| Tech Company B | Innovative technologies, strong online presence | Limited retail experience, potential for technology disruptions | Developing new retail experiences, enhancing customer engagement | Competition from other tech companies, potential for rapid technological advancements |

Illustrative Content

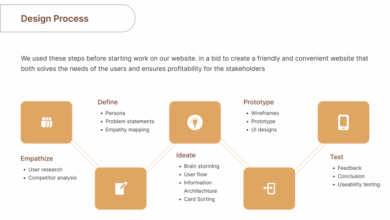

Victoria’s Secret’s journey to reconnect with investors necessitates a compelling narrative that goes beyond the numbers. This section delves into illustrative content designed to showcase the brand’s unique position, emphasizing the “intimacy” aspect and highlighting future potential. A strong investor relations strategy requires not just financial projections, but also a compelling story that resonates with the audience.

Investor Relations Presentation

This presentation will open with a nostalgic, yet modern, visual journey through Victoria’s Secret’s history, showcasing the evolution of its brand identity and the emotional connection it has fostered with its customers. It will then transition to a frank discussion of the current market landscape, recognizing the challenges and opportunities. The presentation will highlight recent strategic shifts, emphasizing the brand’s reinvention and renewed focus on intimacy.

Crucially, data-driven insights into customer preferences and market trends will demonstrate the validity of the new direction. Financial projections, supported by meticulous analysis, will be presented, incorporating a clear roadmap for future growth and profitability.

Promotional Video

The promotional video will begin with a captivating montage of Victoria’s Secret’s past campaigns, juxtaposing them with modern visuals emphasizing the brand’s evolution. This will be followed by a series of interviews with key stakeholders, including designers, marketers, and executives, who articulate the brand’s renewed focus on intimacy and its unique approach to the market. The video will also feature testimonials from customers, highlighting the emotional connection they feel with the brand.

Ultimately, the video aims to create a sense of shared vision and future potential for investors, while showcasing the brand’s emotional appeal and cultural relevance.

Financial Projections Infographic

The infographic will present a visually engaging depiction of the brand’s financial projections over the next five years. It will use a combination of charts and graphs, with clear and concise labels, to illustrate key metrics such as revenue growth, profit margins, and market share. The infographic will highlight the anticipated impact of the brand’s strategic initiatives on its financial performance.

A section will showcase the potential for cost reduction through streamlined operations, and another will emphasize the expected return on investment for investors. The infographic will use color-coded data points to represent key milestones, emphasizing the brand’s trajectory toward profitability.

Fictional News Article

A fictional news article will cover Victoria’s Secret’s investor outreach, highlighting the potential impact of the brand’s rebranding strategy on its financial performance. The article will quote industry experts, highlighting the brand’s unique approach to appealing to a younger demographic, and emphasizing the brand’s focus on intimate customer experiences. It will include an interview with a company executive, discussing the rationale behind the shift and the expected impact on investor confidence.

The article will also include analysis from financial analysts, who will discuss the potential for Victoria’s Secret to achieve sustainable growth.

Visual Content Importance

Visual content plays a critical role in investor relations. High-quality visuals, including presentations, videos, and infographics, enhance engagement and comprehension of complex information. Visuals effectively communicate the brand’s story, showcasing its evolution, emotional appeal, and future prospects. Images, videos, and infographics will convey the essence of the brand, making a more memorable impression on the investors.

Table of Content Types and Importance, Victorias secret invites investors to get intimate

| Content Type | Description | Importance | Example |

|---|---|---|---|

| Investor Presentation | Comprehensive overview of the brand’s strategy, financial performance, and future projections. | Provides a clear and concise understanding of the brand’s value proposition and investment potential. | A detailed PowerPoint presentation showcasing the brand’s evolution, strategic shifts, and financial forecasts. |

| Promotional Video | Visually engaging narrative of the brand’s history, values, and customer connections. | Captivates investors and creates an emotional connection to the brand. | A short, compelling video showcasing the brand’s history, recent campaigns, and future prospects. |

| Financial Infographic | Visual representation of key financial metrics and projections, showcasing potential growth and profitability. | Conveys complex financial data in a digestible and engaging manner. | An infographic presenting revenue growth, profit margins, and market share forecasts for the next 5 years. |

| News Article | Third-party coverage of the investor outreach, showcasing the brand’s repositioning and anticipated impact. | Demonstrates the brand’s relevance and market perception to potential investors. | A fictional article featuring quotes from industry experts and financial analysts regarding the brand’s strategic shifts. |

Conclusion

Victoria’s Secret’s unconventional investor invitation sparks a comprehensive examination of potential motivations, marketing implications, and financial projections. The public perception and potential criticisms of this strategy will be explored, alongside the importance of transparency and ethical communication. The possibility of strategic partnerships and the long-term impact of these collaborations will also be analyzed. The ultimate success of this approach will depend on careful execution and effective communication.