VerticalNet adds LabX to its collection, marking a significant expansion into the specialized lab services sector. This acquisition promises exciting developments for both VerticalNet’s existing customer base and LabX’s clientele. VerticalNet, a leader in providing industry-specific solutions, will leverage LabX’s expertise and resources to broaden its capabilities and further solidify its position in the market. This move signifies a strategic investment in innovation and growth, promising exciting advancements for users and the future of the industry.

VerticalNet’s comprehensive suite of services, combined with LabX’s specialized lab functions, will offer an enhanced range of capabilities for their mutual clients. This merger creates a powerful synergy, enhancing the overall user experience and introducing new possibilities for collaboration and problem-solving within the industry. The integration promises to create a dynamic environment for innovation, improved services, and substantial growth.

Overview of VerticalNet and LabX

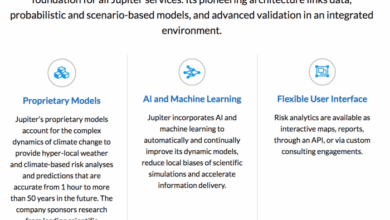

VerticalNet is a leading provider of online business-to-business (B2B) marketplaces connecting businesses across various industries. They offer a wide range of services, from industry-specific directories and sourcing tools to comprehensive supplier networks. This allows businesses to discover, connect, and transact with relevant partners and suppliers, ultimately streamlining their operations and enhancing their efficiency. Their diverse offerings cater to a broad spectrum of sectors, facilitating seamless interactions within each industry.LabX, recently acquired by VerticalNet, is a specialized platform designed to facilitate laboratory operations.

It serves as a comprehensive solution for laboratories of all sizes, encompassing diverse needs from sample management to analysis and reporting. By integrating key functions within a single platform, LabX streamlines processes and reduces manual efforts, ultimately contributing to improved efficiency and productivity.

VerticalNet’s Business and Offerings

VerticalNet’s core business revolves around creating and maintaining online marketplaces tailored to specific industries. Their offerings include industry-specific directories, sourcing tools, and supplier networks. These tools are designed to connect businesses, enabling them to streamline their operations and reduce costs through efficient sourcing and collaboration. This broad range of solutions caters to the specific needs of various sectors, facilitating seamless interactions and business growth within each industry.

LabX’s Core Functions and Target Audience

LabX is a specialized platform focusing on streamlining laboratory operations. Its core functions encompass sample management, analysis, and reporting. This comprehensive suite of tools aims to improve efficiency and productivity in laboratories of all sizes. The target audience includes a wide spectrum of laboratories, from small research facilities to large-scale commercial labs.

Key Features and Benefits of LabX

LabX’s key features are designed to improve efficiency and reduce manual efforts in laboratory processes. These features include:

- Automated Sample Tracking: LabX provides a robust system for tracking samples from receipt to analysis, eliminating the need for manual records and reducing the risk of errors.

- Streamlined Analysis Processes: The platform facilitates automated data analysis and reporting, allowing for quicker turnaround times and more accurate results.

- Enhanced Collaboration Tools: LabX supports collaboration between different departments and personnel within a laboratory, promoting seamless communication and data sharing.

- Improved Data Security: LabX prioritizes the security of sensitive laboratory data, ensuring compliance with relevant regulations and protecting intellectual property.

These features collectively contribute to increased efficiency, reduced costs, and enhanced productivity within laboratories.

Rationale Behind VerticalNet’s Acquisition of LabX

VerticalNet’s acquisition of LabX is a strategic move to expand their offerings and enhance their reach within the laboratory sector. By incorporating LabX’s specialized platform into their existing ecosystem, VerticalNet aims to broaden its market presence and provide a more comprehensive solution for laboratory management. This acquisition demonstrates VerticalNet’s commitment to providing integrated solutions that cater to the specific needs of diverse industries.

The synergy between VerticalNet’s existing marketplace model and LabX’s laboratory-focused tools promises a robust and comprehensive solution for laboratory operations.

Market Analysis and Implications: Verticalnet Adds Labx To Its Collection

The acquisition of LabX by VerticalNet marks a significant move in the industry, potentially reshaping the landscape for specialized business-to-business (B2B) platforms. Understanding the competitive dynamics, potential market share shifts, and synergistic opportunities is crucial for assessing the long-term impact of this integration. This analysis delves into the competitive landscape, market share implications, and potential synergies between the two platforms.The B2B market for industry-specific solutions is highly competitive, with established players and emerging startups vying for market share.

This acquisition will likely affect the current equilibrium, introducing new strategies and challenges for existing and potential competitors. Understanding these dynamics is vital for anticipating the future of the market.

Competitive Landscape for VerticalNet and LabX

VerticalNet and LabX operate in a competitive landscape populated by established players and newer entrants. Direct competitors often offer similar services, while indirect competitors may target overlapping customer segments with different solutions. Analyzing the strengths and weaknesses of each competitor and identifying potential points of differentiation is critical for assessing the long-term impact of the acquisition. This competitive analysis will help to identify areas where VerticalNet and LabX can leverage their combined strengths to gain an advantage.

Potential Impact on VerticalNet’s Market Share

The integration of LabX’s offerings into VerticalNet’s platform will likely impact market share in several ways. A combined platform, with expanded functionality and a wider range of services, could attract new customers and increase the usage of existing services. Furthermore, access to LabX’s user base will expand VerticalNet’s reach and enhance customer retention. However, the acquisition also introduces potential challenges, such as the need to integrate systems seamlessly and manage potential conflicts between existing customer bases.

Verticalnet’s acquisition of labx is a smart move, especially considering the current tech landscape. Intel’s recent resurgence, as seen in their innovative push, intel comes back swinging , suggests a competitive environment where vertical integration is key. This acquisition positions Verticalnet well to capitalize on emerging opportunities.

The success of the acquisition hinges on effectively integrating the two platforms without disrupting existing customer relationships or processes. For example, a company like ThomasNet, a competitor in the B2B marketplace sector, will face heightened competition from the combined entity.

Potential Synergies Between VerticalNet and LabX

VerticalNet and LabX offer complementary products and services. The combination creates opportunities for significant synergies, including:

- Enhanced Platform Functionality: The merged platform can offer a wider array of specialized tools and resources to cater to a broader range of industry-specific needs, improving the overall user experience.

- Expanded Market Reach: Access to LabX’s customer base and industry expertise will allow VerticalNet to expand its market reach into new sectors and customer segments. For instance, if LabX has a strong presence in the pharmaceutical sector, VerticalNet will benefit from increased exposure and potential collaboration.

- Improved Customer Retention: By providing a more comprehensive and integrated platform, VerticalNet can improve customer satisfaction and reduce churn. This approach is similar to how Salesforce increases its customer value by offering various services and tools to its customers.

These synergistic opportunities will be crucial in achieving the desired market position and sustaining profitability.

Comparison of Target Markets and Customer Bases

While both platforms serve the B2B market, their target markets and customer bases exhibit key differences.

- VerticalNet’s focus: VerticalNet typically targets larger enterprises and corporations in a variety of sectors. The platform’s extensive network and comprehensive features cater to the needs of large organizations with complex supply chain requirements.

- LabX’s specialization: LabX, on the other hand, is likely more focused on smaller to medium-sized enterprises (SMEs) and specialized industries, like the lab equipment and supplies sector. This targeted approach offers niche solutions for specific industry needs.

Understanding these nuances is critical for developing a unified marketing strategy that caters to both segments effectively.

Potential Impacts on Customers and Users

The integration of LabX into VerticalNet’s platform presents a significant opportunity for both existing customers and new users. This combination promises to enhance existing offerings and create a more comprehensive solution for various industry sectors. Understanding the potential impacts on different user groups is crucial for successful implementation and customer satisfaction.

Potential Benefits for VerticalNet’s Existing Customers

VerticalNet’s existing customers will likely benefit from a more comprehensive suite of tools and resources. Access to LabX’s specialized features, such as advanced laboratory management tools and data analysis capabilities, will add significant value to their existing workflow. This could lead to improved efficiency, reduced costs, and increased productivity in their operations. For example, a pharmaceutical company already utilizing VerticalNet’s platform might gain access to LabX’s sophisticated quality control tools, leading to faster turnaround times and enhanced regulatory compliance.

Verticalnet’s addition of labx is exciting, mirroring the trend of companies going vertical. Just like how imall goes vertical with pure payments, imall goes vertical with pure payments demonstrates a shift towards specialized solutions. This vertical approach, seen in both imall’s and verticalnet’s moves, suggests a focus on specific market needs and potentially increased efficiency for companies like verticalnet leveraging labx’s capabilities.

Impact on LabX’s Clients

The integration with VerticalNet’s extensive network will expose LabX’s clients to a broader range of potential collaborators and partners. This broader reach can open up new opportunities for collaboration and expansion. Furthermore, access to VerticalNet’s resources and expertise could lead to a more robust support structure for LabX’s clients. For example, LabX’s clients will gain access to a wider array of industry-specific knowledge and expertise through VerticalNet’s connections.

Potential Changes in Pricing or Service Offerings

Pricing and service offerings may experience adjustments following the acquisition. VerticalNet may bundle certain services or offer tiered pricing plans that incorporate both platforms’ functionalities. Alternatively, they might maintain separate pricing models, with combined packages potentially offering significant cost savings. It’s also possible that new service offerings will emerge, combining LabX’s specialized laboratory capabilities with VerticalNet’s existing network features.

For example, VerticalNet could introduce a premium package that includes both platforms’ full functionalities at a discounted price.

Potential Challenges or Concerns for Customers

Customers may experience some initial challenges or concerns during the transition. A period of adjustment might be required for users to adapt to the combined platform’s functionalities. Compatibility issues between existing systems and the integrated platform are also a potential concern. Training and support resources will be critical to ensure a smooth transition and mitigate any user confusion or frustration.

Additionally, concerns about data security and privacy practices, especially with the integration of data from two distinct platforms, should be addressed.

Financial and Operational Implications

The acquisition of LabX by VerticalNet presents a significant opportunity for both companies. Understanding the financial implications, integrating operational processes, and assessing potential risks are crucial for a successful outcome. This section delves into the anticipated financial and operational impacts, along with the structural adjustments required within VerticalNet.

Financial Implications of the Acquisition

The acquisition’s financial impact hinges on several key factors, including cost synergies, revenue enhancements, and potential restructuring costs. Estimating the precise financial impact is challenging without detailed financial projections and due diligence. However, a likely scenario involves cost savings through eliminating redundant functions and consolidating operations. For instance, shared IT infrastructure, reduced administrative overhead, and combined marketing efforts can yield considerable savings.

Revenue generation may arise from cross-selling opportunities, accessing new market segments, and increased market share.

Potential Cost Savings

Several areas offer significant cost-saving potential. A combined sales force can reduce sales and marketing expenses. Streamlining customer service operations, potentially through shared customer support platforms, can lead to substantial savings. Leveraging a consolidated IT infrastructure and eliminating overlapping software licenses will further reduce costs. Real-world examples of similar acquisitions show that significant cost reductions are often achieved within 12-18 months.

Revenue Generation Opportunities

The acquisition of LabX provides VerticalNet with access to a new customer base and complementary services. Cross-selling LabX’s services to VerticalNet’s existing customer base is a promising avenue for revenue generation. This strategy can increase the value proposition for existing customers and unlock new revenue streams. Examples of successful cross-selling initiatives in other industries demonstrate that a well-executed strategy can yield substantial returns.

Analysis of the Integration Process

A well-planned integration strategy is essential for a smooth transition. Challenges may arise from merging different software systems, integrating customer databases, and coordinating workflows across different teams. Careful consideration must be given to data migration, system compatibility, and employee training.

Potential Operational Challenges and Solutions

The integration of LabX’s operational processes with VerticalNet’s may present challenges. For example, cultural differences between the two companies might create friction, especially in communication styles or working habits. This can be addressed through open communication channels, cross-training programs, and establishing clear roles and responsibilities. The success of similar integrations highlights the importance of clear communication, open dialogue, and consistent support.

Impact on VerticalNet’s Internal Structure and Resources

The acquisition will inevitably lead to adjustments within VerticalNet’s internal structure. Departments may need to be reorganized, combined, or reallocated. Resource allocation will need to be reevaluated, possibly shifting resources towards areas of high growth or strategic importance. A thorough analysis of roles, responsibilities, and skill sets is critical. Successful integrations often involve restructuring teams to maximize the value of the acquired entity.

Potential Risks Associated with the Acquisition and Integration Process

Integration processes can present several risks. Failure to manage cultural integration can lead to decreased employee morale and reduced productivity. Integration delays can create uncertainty and disrupt operations. Technology incompatibility issues can result in system failures or data loss. Addressing these risks proactively with thorough planning and clear communication is crucial for success.

These issues are common in mergers and acquisitions and can be mitigated with robust risk management plans.

Future Strategies and Projections

The acquisition of LabX by VerticalNet marks a significant step forward, promising exciting possibilities for both companies. This integration presents a unique opportunity to leverage the strengths of each entity to create a more robust and comprehensive platform for their customers. This section explores potential future strategies, marketing approaches, and anticipated growth trajectories for the combined enterprise.

Verticalnet’s addition of labx to its collection is interesting, but it’s worth remembering the tech anxieties of the past. Similar to how Y2K concerns significantly impacted companies like Axent, y2k concerns drag down axent , we need to consider the potential implications for the future. Ultimately, verticalnet’s strategic move to incorporate labx will be key to its continued success.

Potential Product Development Strategies

VerticalNet can leverage LabX’s existing expertise in laboratory automation and data management to enhance its existing platform. Integrating LabX’s advanced features, such as automated workflows and sophisticated data analysis tools, into VerticalNet’s core offerings will create a more comprehensive solution for its users. This could include developing integrated solutions for laboratory information management systems (LIMS) and laboratory equipment control, streamlining processes and reducing manual errors.

Furthermore, the acquisition allows for expansion into new markets and customer segments, such as smaller research labs and educational institutions, which could potentially benefit from VerticalNet’s expanded product line.

Marketing Strategies for the Combined Entity, Verticalnet adds labx to its collection

Combining VerticalNet’s extensive industry network with LabX’s specialized laboratory expertise creates a powerful synergy for marketing. A unified marketing approach will focus on highlighting the combined strengths of both platforms. This includes targeted campaigns showcasing the enhanced capabilities of the integrated platform, emphasizing the improved efficiency and data management tools. Collaborating with key industry influencers and thought leaders will be crucial in reaching a wider audience and establishing the combined entity as a leading provider in the laboratory automation and management sector.

Anticipated Growth and Evolution

The combined entity is anticipated to experience significant growth, driven by increased market share and enhanced customer value proposition. Growth projections are based on several factors, including the expanded product offerings, improved customer service, and increased market penetration. VerticalNet’s existing customer base will benefit from the added capabilities and functionalities provided by LabX, leading to increased customer satisfaction and loyalty.

Furthermore, the combined entity can leverage its global presence and partnerships to reach new markets and customer segments. The future evolution of the merged entity is expected to include continued product innovation, targeted market expansions, and strategic partnerships, all contributing to sustainable and profitable growth.

Potential Expansion Opportunities

The merged entity can explore new market segments and applications. This includes expanding into emerging markets like Asia and South America, where the demand for advanced laboratory automation and data management solutions is expected to increase. VerticalNet and LabX can also develop customized solutions for niche industries such as pharmaceutical research, environmental testing, and forensic science. Additionally, focusing on cloud-based solutions for remote laboratory access and collaboration can cater to the growing demand for flexible and accessible laboratory management tools.

Furthermore, potential expansion could also include providing comprehensive training and support programs to enhance user adoption and expertise.

Presenting the Information

This section details the key aspects of presenting the VerticalNet-LabX acquisition to stakeholders and the public. It focuses on showcasing the combined strengths and potential benefits of the merger, while also addressing potential challenges. Clear communication is crucial to building excitement and managing expectations.

Comparing VerticalNet and LabX Offerings

Understanding the existing offerings of VerticalNet and LabX is essential for highlighting the potential synergies. The following table provides a side-by-side comparison of their current services and capabilities.

| Feature | VerticalNet | LabX | Key Differences |

|---|---|---|---|

| Platform Type | Specialized B2B marketplace | Laboratory information management system (LIMS) | VerticalNet is a broad platform; LabX is a focused LIMS solution. |

| Target Audience | Diverse range of manufacturers, distributors, and industry professionals | Laboratory personnel and researchers | VerticalNet caters to a broader market; LabX is niche-specific. |

| Key Functionality | Product sourcing, industry networking, and market intelligence | Sample management, analysis, and reporting | VerticalNet provides market access; LabX focuses on laboratory workflows. |

| Pricing Model | Subscription-based, tiered pricing | Per-user or per-module licensing | Pricing structures differ significantly based on use cases. |

Potential Synergies and Challenges

The acquisition presents both opportunities and hurdles. This table Artikels potential synergies and challenges associated with the integration.

| Aspect | Potential Synergies | Potential Challenges | Mitigation Strategies |

|---|---|---|---|

| Market Reach | Combined platform reaches a wider customer base, enhancing VerticalNet’s industry-specific solutions | Integrating different customer bases and sales processes could lead to confusion | Develop a phased approach to customer onboarding and communication, emphasizing the benefits of the integration. |

| Technology Integration | LabX’s advanced LIMS could enhance VerticalNet’s platform for scientific industries. | Integrating disparate systems and data formats could be complex. | Invest in robust IT resources, data migration specialists, and ongoing support. |

| Customer Experience | Enhanced services and product offerings for scientific customers. | Maintaining existing customer relationships and brand loyalty is crucial. | Communicate the value proposition to customers, highlight the benefits, and address concerns promptly. |

| Financial Implications | Potential for increased revenue streams and cost efficiencies. | Potential for short-term disruption in operations. | Implement a clear financial strategy and a phased integration plan to manage costs and revenue expectations. |

Potential Impact on Customers

The acquisition will significantly impact customers by broadening VerticalNet’s offerings and enhancing services. This table summarizes the potential effects.

| Customer Segment | Potential Benefits | Potential Concerns | Mitigation Strategies |

|---|---|---|---|

| Existing VerticalNet Customers | Access to advanced laboratory tools and data management capabilities | Potential disruption during the integration phase | Provide clear communication about the integration timeline and the benefits for customers. |

| Existing LabX Customers | Access to a broader range of industry products and resources | Potential loss of familiar interfaces or processes | Ensure a smooth transition for existing LabX users, maintaining existing support channels. |

| New Customers | Access to a comprehensive platform combining industry expertise with advanced laboratory solutions | Limited awareness of the combined offering | Implement targeted marketing and communication campaigns highlighting the new offerings. |

Integration Process

A well-structured integration process is critical for a successful acquisition. This section details the proposed integration plan.

| Phase | Activities | Timeline | Key Metrics |

|---|---|---|---|

| Phase 1: Assessment and Planning | Analyze existing systems, identify potential synergies, and develop a detailed integration plan. | 3-6 months | Completion of system analysis, agreement on integration roadmap |

| Phase 2: Data Migration and System Integration | Migrate data, integrate systems, and test functionalities. | 6-12 months | Successful data migration, verified system integration |

| Phase 3: Customer Onboarding and Training | Onboard new customers, train staff on new features and processes | Ongoing | Customer satisfaction, staff proficiency in new tools |

| Phase 4: Optimization and Expansion | Optimize integrated platform, explore new opportunities | Ongoing | Revenue growth, market share increase |

Illustrative Examples

The acquisition of LabX by VerticalNet presents exciting opportunities for both companies and their respective customer bases. Understanding how this integration will play out in real-world scenarios is crucial for assessing the true value proposition. These examples demonstrate the potential benefits, challenges, and impacts of the merger.

Hypothetical Customer Scenario

A mid-sized pharmaceutical company, “PharmaCo,” relies on VerticalNet for accessing industry-specific information and networking opportunities. They also use LabX for sophisticated laboratory testing and data analysis. Post-acquisition, PharmaCo can leverage a unified platform to streamline their workflows. They can directly integrate their research data from LabX into VerticalNet’s platform, enabling faster information sharing with industry peers and access to a wider range of expertise.

This integrated approach will accelerate research and development, potentially leading to quicker drug discovery and market entry. This benefits VerticalNet by broadening their user base and LabX by expanding their customer reach to new markets.

Successful Acquisition Case Study

The acquisition of “Company A” by “Company B” in the software industry demonstrates a successful precedent. Company B, a leader in project management software, acquired Company A, a specialized CRM solution provider. This integration seamlessly integrated data and functionalities, offering a unified platform that catered to a broader range of project management needs. The combined product enhanced both existing user bases with a wider range of features.

The success of this integration underscores the importance of seamless data migration and user interface design for a successful acquisition.

Impact on User Interface Design

The acquisition will likely necessitate a refined user interface. A unified platform might incorporate features from both VerticalNet and LabX, such as a consolidated dashboard for accessing both platforms’ functionalities. The design should prioritize user-friendliness and intuitive navigation. Users will benefit from streamlined access to previously disparate tools and a more comprehensive overview of their data. The new interface will reflect a more cohesive user experience, improving overall usability.

This may involve redesigning existing elements, integrating new functionalities, and enhancing accessibility features.

Impact on Operational Workflows

The integration of LabX’s laboratory data analysis tools into VerticalNet’s platform will impact operational workflows significantly. Currently, data transfer between the two platforms is manual and time-consuming. The integrated platform will automate this process, significantly reducing turnaround times for reports and analyses. This integration will create a more efficient and collaborative environment for both VerticalNet and LabX users.

The new workflow will streamline data access, enabling faster decision-making and potentially lower operational costs.

Conclusion

In conclusion, VerticalNet’s acquisition of LabX represents a strategic move to expand its reach and offer more comprehensive services to its clients. The potential for synergies, enhanced customer experiences, and increased market share is significant. While challenges will undoubtedly arise during the integration process, the long-term benefits and potential for growth suggest this acquisition is a promising venture for both companies and their respective customer bases.

The future looks bright for both VerticalNet and LabX as they navigate this new chapter together.