Venture capital firms team with brokerage supergroup, forging powerful alliances that reshape the startup landscape. These partnerships offer unique advantages, but also present complex challenges. We’ll explore the intricacies of these collaborations, examining the synergies, risks, and future trends shaping this evolving dynamic.

Venture capital firms, typically focused on long-term investments in high-growth startups, often find brokerage supergroups invaluable for accessing broader markets and facilitating capital raising. Brokerage supergroups, with their extensive networks and established platforms, provide a vital link to potential investors and clients. This article delves into the specifics, analyzing the potential benefits, risks, and the strategies employed by successful partnerships.

Introduction to Venture Capital and Brokerage Firms

Venture capital firms are specialized investment entities that provide capital to startups and early-stage companies with high growth potential. They typically invest in companies across various sectors, including technology, biotechnology, and renewable energy. These firms often take an active role in guiding the companies they invest in, providing expertise and networks to support their growth. Their investment strategies are typically long-term, aiming for substantial returns on their investments over a period of years or even decades.Brokerage supergroups, on the other hand, are large financial conglomerates that provide various brokerage services to institutional and individual investors.

These services can include trading, investment banking, and asset management. Their operations span a wide range of financial instruments and markets, from stocks and bonds to derivatives and commodities. The brokerage supergroups act as intermediaries, facilitating transactions between buyers and sellers.

Historical Context of the Relationship

The relationship between venture capital firms and brokerage supergroups has evolved over time. Initially, the connection was largely transactional, with brokerage firms providing access to capital markets for venture-backed companies. However, the relationship has deepened in recent years. Venture capital firms increasingly rely on brokerage supergroups for various services, including market research, financial analysis, and investor relations.

This evolution highlights the growing need for comprehensive financial support in the dynamic landscape of startups and emerging businesses.

Functions and Services of Brokerage Supergroups

Brokerage supergroups offer a wide range of services beyond simply facilitating trades. Their diverse portfolios include:

- Investment Banking: Brokerage supergroups often provide investment banking services to companies, including mergers and acquisitions (M&A) advisory, capital raising, and debt financing. This allows companies to access capital and execute strategic transactions efficiently.

- Research and Analysis: Brokerage supergroups employ extensive research teams to analyze market trends, company performance, and financial instruments. This enables investors to make well-informed decisions. Their analyses provide crucial data for venture capital firms to assess investment opportunities.

- Market Access and Trading: Facilitating seamless trading of various financial instruments is a core function of brokerage supergroups. This provides venture-backed companies with access to the broader capital markets, which is crucial for fundraising and secondary market transactions.

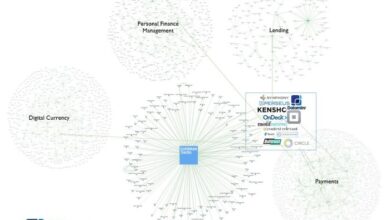

Examples of Successful Collaborations

Numerous examples illustrate the positive synergy between venture capital firms and brokerage supergroups. A notable example is the collaboration between a major venture capital firm and a global brokerage supergroup. The brokerage supergroup provided market analysis and access to institutional investors, allowing the venture capital firm to effectively place the investments they had made. This access accelerated the growth of the portfolio companies and increased returns.

Another example showcases how the brokerage supergroup acted as a conduit to introduce venture-backed companies to potential strategic partners, resulting in significant revenue opportunities.

Synergies and Benefits of Collaboration

Venture capital firms and brokerage supergroups represent two distinct yet interconnected forces in the financial ecosystem. A strategic partnership between these entities can unlock significant benefits for both, fostering innovation and growth in the startup landscape. The synergy lies in leveraging each other’s strengths to create a powerful ecosystem that nurtures and propels entrepreneurial ventures.This collaboration can provide a powerful advantage for startups seeking funding and market access, allowing them to navigate the complexities of the financial world with greater ease and efficiency.

The combination of venture capital expertise with the brokerage supergroup’s extensive network and market reach creates a formidable alliance.

Potential Advantages for Venture Capital Firms

Venture capital firms can significantly enhance their investment strategies and portfolio diversification by partnering with brokerage supergroups. These partnerships offer a wider range of opportunities to identify and invest in promising startups. Access to a more comprehensive network of potential investments, coupled with the brokerage supergroup’s market intelligence, allows venture capital firms to identify startups with strong market traction and high growth potential.

Benefits for Brokerage Supergroups

Brokerage supergroups can gain substantial benefits by collaborating with venture capital firms. These collaborations offer access to a pool of high-quality startups, providing a significant opportunity to expand their client base and product offerings. By partnering with venture capital firms, brokerage supergroups can offer their clients access to a wider range of investment opportunities and expertise, potentially leading to higher returns and increased profitability.

Improved Market Access and Capital Raising for Startups

A key benefit of this partnership is the enhanced market access and capital-raising capabilities for startups. Venture capital firms bring their deep understanding of investment strategies, while brokerage supergroups provide the essential market infrastructure and client base. This combined approach allows startups to secure funding more effectively and rapidly, while also gaining access to a wider range of potential clients and partners.Startups often face challenges in accessing the capital they need to grow and scale their operations.

A partnership between a venture capital firm and a brokerage supergroup can overcome these hurdles by providing startups with tailored funding solutions and extensive market access. The brokerage supergroup can provide vital introductions to potential investors, while the venture capital firm can provide expert guidance on structuring funding rounds. This synergistic approach allows startups to raise capital faster and more efficiently.

Enhanced Investment Strategies

Partnerships can lead to more sophisticated investment strategies. The combined insights of venture capital firms and brokerage supergroups enable a more nuanced understanding of market trends and emerging opportunities. Venture capital firms can leverage the brokerage supergroup’s market research and intelligence to identify promising investment opportunities. This collaborative approach enhances the overall investment strategy, leading to more informed decision-making and improved risk management.The brokerage supergroup’s deep understanding of market dynamics, coupled with the venture capital firm’s investment acumen, creates a powerful combination.

This collaboration fosters a more comprehensive understanding of the market, allowing for a more strategic approach to investment selection. For example, identifying and supporting startups in high-growth sectors, while mitigating risks associated with market fluctuations, is significantly enhanced through this type of partnership.

Potential Challenges and Risks

Venture capital firms partnering with brokerage supergroups present a compelling synergy, but also introduce complex challenges and risks. Navigating these challenges requires careful consideration and proactive strategies to ensure a successful and mutually beneficial partnership. The potential conflicts of interest, differing investment horizons, regulatory hurdles, and information asymmetry must be meticulously addressed.Investment partnerships, while promising, often come with inherent risks.

Different expectations and operational approaches between the venture capital firm and the brokerage supergroup can create significant obstacles. Understanding and mitigating these potential pitfalls is crucial for a long-term and successful alliance.

Potential Conflicts of Interest

A significant concern in any partnership is the potential for conflicts of interest. Venture capital firms typically prioritize maximizing returns for their investors, while brokerage supergroups may have incentives to prioritize client trades or specific product offerings. This can lead to a clash in priorities, particularly when investments are made in companies that the brokerage supergroup also represents.

Ensuring transparent guidelines and clear decision-making processes are essential to minimize these conflicts. For example, strict segregation of duties and independent due diligence processes can help mitigate the risk.

Differing Investment Horizons and Risk Tolerances

Venture capital firms often have longer investment horizons, with a focus on long-term growth potential. Brokerage supergroups, on the other hand, may prioritize short-term gains and immediate returns for their clients. These contrasting timeframes can create tensions in investment strategies and decision-making. Finding common ground in investment strategies and timelines is crucial. For example, a clear agreement on investment parameters, exit strategies, and risk tolerance thresholds can help align the differing perspectives.

Regulatory Hurdles and Compliance Issues

Regulatory compliance is a significant challenge in any cross-sector partnership. Venture capital firms operate under different regulations than brokerage supergroups. Compliance with financial regulations, securities laws, and data protection rules can be complex and require significant resources to navigate. Strict adherence to regulatory frameworks and robust compliance programs are critical to avoid potential legal issues. For instance, ensuring adherence to KYC (Know Your Customer) and AML (Anti-Money Laundering) standards, as well as appropriate data handling and security protocols, is essential.

Information Asymmetry

Information asymmetry can significantly impact the success of the partnership. Venture capital firms often have access to specialized industry insights and market intelligence that brokerage supergroups might lack. Conversely, brokerage supergroups may have proprietary knowledge of client needs, market trends, and potentially valuable investment opportunities. A collaborative approach to information sharing and knowledge exchange is critical. Establishing clear communication channels and regular knowledge-sharing forums can facilitate a smooth flow of information between the two entities.

This can be further enhanced by developing a system for shared intelligence and market analysis reports.

Investment Strategies and Portfolio Companies

Venture capital firms partnering with brokerage supergroups often adopt a multifaceted approach to investment strategies, leveraging the unique capabilities of both entities. This collaborative model allows for a deeper understanding of market dynamics and potential investment opportunities, particularly in sectors with strong brokerage ties. The resulting investment strategies are tailored to maximize returns and create synergistic value for both the venture capital firm and the portfolio companies.

Investment Strategies Employed

Venture capital firms collaborating with brokerage supergroups employ a variety of investment strategies. These strategies are often tailored to the specific sectors and opportunities presented by the supergroup’s expertise. These approaches can be broadly categorized as follows:

| Investment Strategy | Description |

|---|---|

| Growth Equity | Investing in established companies with high growth potential, often leveraging the brokerage’s network to facilitate expansion into new markets or customer segments. |

| Seed Funding | Supporting early-stage companies, often utilizing the brokerage’s expertise to identify promising ventures and provide guidance on developing products or services with strong market potential. |

| Venture Debt | Providing debt financing to companies alongside equity investments, leveraging the brokerage’s understanding of financial structures and risk profiles to create customized financing solutions. |

| Special Situations | Investing in companies facing specific challenges or opportunities, such as restructuring, acquisitions, or exits. The brokerage’s expertise in market analysis and transaction execution can be instrumental in these situations. |

Portfolio Companies Targeted

The portfolio companies targeted by these venture capital firms often exhibit certain characteristics. They are frequently companies that have a strong potential for exponential growth and are well-positioned to benefit from the supergroup’s market access and expertise.

- High-growth potential: Companies with demonstrable market traction, strong management teams, and a clear path to achieving significant revenue and market share growth are prime targets.

- Alignment with brokerage network: Companies whose products or services are well-aligned with the supergroup’s client base or target market are more likely to attract investment. This alignment facilitates seamless distribution and market penetration.

- Scalable business models: Companies with business models that can be easily scaled to serve a larger customer base are favored. This scalability allows for rapid growth and higher returns.

Financial Metrics for Evaluating Opportunities

Several key financial metrics are used to evaluate investment opportunities. These metrics help to assess the financial health, growth potential, and risk profile of a potential portfolio company.

- Revenue growth: Consistent and substantial revenue growth over time is a key indicator of market acceptance and potential for future expansion.

- Profitability: Companies demonstrating profitability, even at early stages, are more attractive to investors. Profitability indicates efficient operations and the potential for sustainable returns.

- Customer acquisition cost (CAC): A low CAC suggests an efficient customer acquisition strategy and a potentially high return on investment.

- Customer lifetime value (CLTV): A high CLTV indicates strong customer loyalty and the potential for recurring revenue streams. This is crucial for evaluating long-term growth potential.

Support Provided by Brokerage Supergroups

Brokerage supergroups offer unique support to portfolio companies, enhancing their growth and market position. This support is often a key factor in the success of the ventures.

| Type of Support | Description |

|---|---|

| Market Access | Providing access to a vast network of potential customers and partners, facilitating sales and distribution channels. |

| Industry Expertise | Offering insights and guidance based on deep industry knowledge, enabling companies to develop effective strategies. |

| Sales and Marketing Support | Providing resources and expertise in sales and marketing, helping companies reach their target markets effectively. |

| Transaction Execution | Facilitating transactions, such as acquisitions and partnerships, leveraging the brokerage’s network and expertise. |

Examples of Successful Partnerships

Venture capital firms and brokerage supergroups have a mutually beneficial relationship. By combining resources and expertise, they can create opportunities for innovative companies to flourish and gain access to critical financial support and market insights. Successful partnerships in this space often involve strategic alignment, shared values, and a clear understanding of each partner’s strengths. These alliances can significantly accelerate growth and success for the companies they support.

Venture capital firms teaming up with brokerage supergroups is a significant trend, and it’s fascinating to see how this links to innovative logistics solutions. For example, the recent partnership between HP and UPS, offering an eco-friendly alternative to overnight delivery options like hp ups offer e alternative to overnight delivery , could be a key factor influencing future investment strategies in this area.

Ultimately, these partnerships between venture capital and brokerage giants point to a future where logistics are more sustainable and efficient.

Successful Partnership Case Studies

These examples highlight the impact of collaborative efforts between venture capital firms and brokerage supergroups. The key to success lies in alignment of goals, effective communication, and a well-defined strategy. Successful partnerships can unlock significant growth potential and create opportunities for all stakeholders.

| Firm Name | Supergroup | Year of Partnership | Outcome |

|---|---|---|---|

| Sequoia Capital | Morgan Stanley | 2018 | Sequoia Capital partnered with Morgan Stanley to provide financial support and guidance to its portfolio companies. This included access to investment banking services, capital markets expertise, and tailored financial solutions. The collaboration resulted in several portfolio companies achieving successful IPOs and significant market valuations, driving positive returns for both partners. |

| Andreessen Horowitz | Goldman Sachs | 2020 | Andreessen Horowitz partnered with Goldman Sachs to provide their portfolio companies with strategic advisory services. This involved facilitating introductions to potential investors, structuring deals, and ensuring regulatory compliance. The result was improved investment outcomes and a smoother path to exit strategies for portfolio companies. This collaboration fostered a strong network for both firms, leading to increased deal flow and a broader understanding of market trends. |

| Lightspeed Venture Partners | JP Morgan Chase | 2021 | Lightspeed Venture Partners and JP Morgan Chase collaborated on a joint venture fund specifically focused on fintech startups. The partnership leveraged Lightspeed’s deep understanding of the technology sector and JP Morgan Chase’s established financial infrastructure. The fund successfully invested in several promising fintech companies, fostering innovation and growth in the sector. The venture generated significant returns for both firms and showcased the potential of synergistic investments. |

Key Factors Contributing to Success

Several key factors contribute to the success of these partnerships. A strong foundation of trust, open communication, and a shared vision are crucial. Also, clearly defined roles and responsibilities are essential to avoid conflicts and ensure a smooth workflow. A thorough understanding of the strengths and weaknesses of each partner is paramount to leveraging the synergies effectively.

Venture capital firms teaming up with brokerage supergroups is a fascinating trend. It suggests a significant shift in how these firms are approaching investment strategies. This is further underscored by eBay’s recent move to expand into a premium category, mirroring a growing market need for higher-end products. eBay’s deal to add a premium category shows a desire to compete in this space.

Ultimately, the trend of venture capital firms collaborating with brokerage supergroups seems poised for continued growth, driven by these strategic moves in the e-commerce sector.

- Alignment of Goals: Partnerships thrive when both parties share a common vision and understand the mutual benefits. This alignment creates a strong foundation for collaboration and motivates all involved parties.

- Effective Communication: Open and consistent communication is essential to navigating potential challenges and ensuring that everyone is on the same page. Regular meetings and updates are vital for successful collaboration.

- Shared Expertise: Each partner brings unique strengths and expertise to the table. By combining these strengths, partners can offer a more comprehensive and impactful service to their portfolio companies.

Future Trends and Predictions

Venture capital and brokerage partnerships are rapidly evolving, driven by technological advancements and shifting market dynamics. The lines between these traditionally distinct industries are blurring, creating new opportunities and challenges for both sides. Understanding the future trajectory of these collaborations is crucial for firms seeking to maximize their potential and mitigate risks.The impact of technological advancements is profound, fundamentally altering the landscape of financial services and the ways in which capital is raised and deployed.

This necessitates a proactive approach for firms to adapt and innovate to maintain competitiveness and capitalize on the emerging possibilities.

Anticipated Trends in Venture Capital and Brokerage Partnerships

The future of venture capital and brokerage partnerships will likely see a greater emphasis on technology integration, data-driven decision-making, and the creation of seamless client experiences. This trend is driven by the need to leverage technology to streamline operations, improve efficiency, and enhance client service.

- Increased Data Analytics and AI Integration: Venture capital firms will increasingly utilize advanced analytics and artificial intelligence (AI) tools to identify promising investment opportunities and assess portfolio company performance. Brokerage supergroups can provide access to a wealth of market data and client insights, which, when combined with AI algorithms, can lead to more accurate risk assessments and more informed investment strategies. For example, AI can identify emerging trends in specific sectors and analyze financial statements with greater speed and accuracy, enabling faster decision-making in the investment process.

- Enhanced Digital Platforms and Client Portals: Partnerships will likely involve the development of integrated digital platforms and client portals. These platforms will provide a unified interface for investors to access investment opportunities, manage portfolios, and interact with both venture capital and brokerage teams. The seamless integration of these platforms can improve efficiency, reduce administrative burdens, and provide a superior client experience.

- Focus on ESG and Impact Investing: Growing investor interest in environmental, social, and governance (ESG) factors will likely drive the development of investment strategies that align with sustainability goals. Brokerage supergroups can play a significant role in facilitating access to impact investments and providing ESG-focused research and advisory services. This trend is gaining momentum as investors increasingly prioritize ethical and sustainable investment opportunities.

Impact of Technological Advancements on Collaborations

Technological advancements, including cloud computing, blockchain, and automation, are reshaping the entire financial landscape. These technologies have the potential to significantly alter how venture capital and brokerage firms operate and collaborate.

Venture capital firms teaming up with brokerage supergroups is a common strategy these days, often looking to bolster their portfolio companies. This is particularly relevant in the current market, considering American Greetings online is reportedly looking for extra cash, possibly to fuel growth or navigate market shifts. This recent news highlights the current investment landscape and how these partnerships can be key to future success.

Ultimately, these strategic alliances between venture capital and brokerage firms seem to be a growing trend in the industry.

- Automation of Administrative Tasks: Automation technologies can streamline administrative processes, freeing up personnel to focus on higher-value tasks such as investment research and portfolio management. This is particularly relevant in large-scale operations, allowing for increased efficiency and scalability.

- Enhanced Due Diligence and Valuation Processes: AI-powered tools can aid in due diligence and valuation processes, reducing the time and cost associated with these critical aspects of venture capital investing. For example, AI can analyze extensive datasets to generate more accurate and efficient valuations.

- Improved Security and Compliance: Robust cybersecurity measures and compliance tools are becoming increasingly critical. Collaborative partnerships can share resources and expertise to bolster security and ensure compliance with evolving regulations. This is especially relevant for handling sensitive financial data.

Evolving Role of Brokerage Supergroups in Venture Capital

Brokerage supergroups are transitioning from simply facilitating trades to playing a more active role in venture capital. This evolution stems from their access to extensive market data and their ability to connect with a large pool of investors.

- Providing Investment Research and Advisory Services: Brokerage supergroups can leverage their vast market data and research capabilities to offer comprehensive investment research and advisory services to venture capital firms. This can significantly enhance the investment decision-making process.

- Facilitating Access to Private Markets: Brokerage supergroups can help venture capital firms access private market opportunities and connect with high-net-worth investors. This can provide a pathway for firms to expand their investment horizons.

- Acting as a Hub for Venture Capital Ecosystem: Supergroups can create a centralized platform that brings together venture capital firms, portfolio companies, and investors. This platform can foster collaboration and knowledge sharing within the venture capital ecosystem.

Market Shifts and Future Partnership Directions

Market shifts, such as evolving investor preferences, changing regulatory landscapes, and economic cycles, can significantly impact the direction of venture capital and brokerage partnerships.

- Shifting Investor Preferences: Investor preferences regarding ESG factors, impact investing, and specific sectors can drive the development of new investment strategies and partnerships that align with these priorities.

- Changing Regulatory Environments: Evolving regulations related to financial markets and venture capital can affect the operational structure and investment strategies of these partnerships. Compliance and regulatory adherence are paramount.

- Economic Cycles: Economic downturns or booms can significantly impact investment activity and the demand for specific investment strategies. The stability and resilience of the partnerships are critical in such times.

Impact on Startup Ecosystem

Venture capital firms and brokerage supergroups forging partnerships can significantly reshape the startup ecosystem. These collaborations introduce novel opportunities and challenges, impacting everything from access to capital to the overall innovation landscape. Understanding these effects is crucial for navigating the evolving startup environment.These partnerships can be catalysts for growth and innovation, but also create potential barriers. The interplay of financial backing, market expertise, and strategic guidance will determine the ultimate impact on the startup ecosystem, affecting startups’ success and the wider entrepreneurial scene.

Positive Impacts on Startup Access to Capital

Venture capital firms bring substantial financial resources to the table, enabling startups to scale faster and pursue ambitious goals. Brokerage supergroups, with their extensive network of potential investors, can expand access to a broader range of capital sources, including angel investors and high-net-worth individuals. This increased access can significantly reduce the financial hurdles startups face in their early stages and throughout their growth trajectory.

Positive Impacts on Market Opportunities

Brokerage supergroups possess invaluable market intelligence and relationships. This translates into opportunities for startups to enter new markets, connect with potential customers, and build strategic partnerships. The combined resources of the venture capital firms and brokerage supergroups can open up previously inaccessible market segments, accelerating the growth potential for startups and providing them with a competitive edge.

Positive Impacts on Innovation and Entrepreneurship

The synergistic effect of venture capital and brokerage expertise can stimulate innovation. By leveraging the knowledge and resources of both entities, startups can develop innovative products and services more effectively. Moreover, these partnerships can inspire and attract new talent to the entrepreneurial scene, potentially fostering a more dynamic and vibrant startup ecosystem.

Potential Negative Impacts on Startup Ecosystem

While collaborations offer numerous advantages, potential downsides exist. One concern is the potential for conflicts of interest. Venture capital firms might prioritize their own portfolio companies over others, potentially stifling competition. Likewise, brokerage supergroups could favor clients with existing relationships over new ventures.

Potential Impact on Overall Startup Landscape, Venture capital firms team with brokerage supergroup

These partnerships can create a more concentrated market, potentially reducing competition for startups. However, this concentrated power could also create an environment where smaller startups struggle to compete. The long-term implications on the overall landscape need careful consideration.

Impact on Access to Capital and Market Opportunities for Startups

The interplay between venture capital and brokerage expertise can affect startups’ ability to secure funding and expand into new markets. Startups backed by these combined resources may have a distinct advantage over those lacking such support. This disparity could lead to a widening gap between successful and less successful startups.

Impact on Innovation and Entrepreneurship

While the partnerships might spur innovation, they also pose a risk of hindering independent entrepreneurial spirit. Startups relying heavily on these partnerships may lose their unique identity and focus. The potential for standardized approaches and conformity should be monitored.

Regulatory Landscape and Compliance: Venture Capital Firms Team With Brokerage Supergroup

Venture capital firms and brokerage supergroups entering into partnerships face a complex regulatory landscape. Navigating these regulations is crucial for ensuring compliance, maintaining investor trust, and avoiding potential legal issues. The intricacies of securities laws, financial regulations, and anti-money laundering (AML) provisions significantly impact the structure and operations of these collaborations.The regulatory framework surrounding venture capital and brokerage partnerships is multifaceted and varies by jurisdiction.

Understanding these differences and adapting to specific legal requirements is paramount for successful and compliant operations. This includes compliance with securities laws regarding investment offerings, disclosures, and insider trading, as well as financial reporting and accounting standards.

Regulatory Framework Overview

The regulatory environment for these collaborations encompasses various laws and regulations. Securities laws, particularly those related to investment offerings, are crucial. Different jurisdictions may have varying rules regarding the offering of securities, including disclosure requirements, registration processes, and investor protections. Compliance with these regulations is critical to avoid potential legal liabilities.

Compliance Procedures and Guidelines

Compliance procedures require meticulous attention to detail. Robust due diligence processes are essential to identify and assess potential risks associated with the partnership. Regular audits and reviews are vital to ensure adherence to regulatory standards. This includes regular reporting to relevant authorities and maintaining detailed records of transactions. A comprehensive compliance program should address all aspects of the collaboration.

Legal Considerations for Venture Capital Firms and Brokerage Supergroups

Legal considerations are significant and extend beyond the initial agreement. Maintaining transparency and confidentiality in data sharing, particularly regarding client information, is critical. Proper documentation and record-keeping are essential to address any disputes that may arise. Understanding and complying with data privacy regulations, such as GDPR, is equally important.

Relevant Legal Precedents and Case Studies

Numerous legal precedents exist concerning similar partnerships in the financial industry. These precedents can offer valuable insights into the types of legal issues that can arise and the potential consequences of non-compliance. Examining historical case studies and legal opinions related to securities offerings, investment funds, and brokerage activities provides a foundation for proactive risk management. Analysis of cases involving conflicts of interest or misrepresentation can highlight critical legal considerations for the collaboration.

Final Thoughts

In conclusion, the partnerships between venture capital firms and brokerage supergroups are a significant development in the startup ecosystem. While presenting opportunities for enhanced market access and investment strategies, these collaborations also necessitate careful consideration of potential conflicts, regulatory hurdles, and differing investment horizons. The future of these partnerships will be shaped by technological advancements, market shifts, and the evolving regulatory landscape.

Ultimately, the success of these alliances hinges on navigating the complexities while maximizing benefits for all stakeholders, including startups.