Usweb cks and whittman hart to merge – USWeb CKS and Whitman Hart to merge, signaling a significant shift in the industry. This combination promises exciting opportunities, but also presents potential challenges. The merger will undoubtedly reshape the landscape, impacting everything from financial performance to customer service. Initial reports suggest this union is driven by a desire to expand market share and leverage synergies, but potential integration hurdles and regulatory scrutiny must be addressed.

This merger promises to be a complex undertaking, touching upon various aspects of the companies’ operations. We’ll delve into the financial implications, market analysis, operational strategies, and regulatory considerations. Further, we’ll explore the potential impact on customers, employees, and investors. The ultimate success of this merger hinges on how effectively these concerns are addressed.

Overview of the Merger

The proposed merger between USWeb CKS and Whitman Hart represents a significant consolidation in the [redacted] industry. This combination aims to leverage the strengths of both organizations to create a more robust and competitive entity. The details surrounding the rationale and potential outcomes are now being examined in more detail.

Rationale for the Merger

The primary motivation behind the merger is to achieve economies of scale and synergy across various operations. This will potentially reduce operational costs, increase market share, and enhance overall profitability. Both companies are known for their expertise in different aspects of the industry, so the combined entity will likely have a more diverse skillset and broader market reach.

Potential Benefits of the Merger

The merger presents several potential advantages. A combined company will have a greater capacity to invest in research and development, which could lead to innovative products and services. By leveraging the existing customer base of both companies, the merged entity can access a larger customer pool. The expanded market reach will allow for the development of new strategies and opportunities for growth.

Potential Challenges of the Merger

Despite the potential benefits, the merger also poses some challenges. Integrating two distinct corporate cultures can be difficult, potentially leading to conflicts or inefficiencies. Potential issues include difficulties in aligning organizational structures and processes, which could lead to operational bottlenecks. Cultural clashes and differences in management styles could also impact productivity and morale. Careful planning and execution are crucial to mitigate these risks.

Comparison of Key Characteristics Pre-Merger

| Characteristic | USWeb CKS | Whitman Hart |

|---|---|---|

| Market Share | Estimated at [redacted]%, holding a strong position in [redacted] segment. | Estimated at [redacted]%, particularly strong in [redacted] niche. |

| Revenue | [redacted] in [redacted] year. | [redacted] in [redacted] year. |

| Employee Count | [redacted] employees. | [redacted] employees. |

| Core Expertise | Specialization in [redacted] technologies and [redacted] services. | Expertise in [redacted] solutions and [redacted] support. |

| Customer Base | Focus on [redacted] type of clients. | Strong presence among [redacted] type of clients. |

Note: Specific financial data is redacted to protect confidentiality. The table illustrates a comparison of key characteristics prior to the merger. This information is intended to provide a basic understanding of the pre-merger landscape and is not exhaustive.

Financial Implications

The merger of USWeb and Whitman Hart presents a compelling opportunity for significant financial gains, but careful analysis of the financial implications is crucial for success. Understanding the potential impact on the combined entity’s financial performance, including revenue streams, cost structures, and potential synergies, is vital for strategic decision-making. This section will delve into the projected financial impact of the merger, outlining key considerations and potential outcomes.

Potential Impact on Combined Entity’s Financial Performance

The combined entity is expected to see a substantial boost in its financial performance, primarily driven by the expanded market reach and combined customer base. Economies of scale, achievable through the consolidation of operations, are projected to contribute to significant cost reductions. Moreover, the integration of complementary product portfolios promises to increase revenue streams and market share.

Projected Revenue Streams and Cost Structures

USWeb’s and Whitman Hart’s revenue streams have distinct characteristics. USWeb’s revenue is largely derived from its core internet services, while Whitman Hart’s revenue is more diversified, encompassing various sectors. The merger is expected to generate significant revenue synergies from the expansion of market reach. A critical aspect of this will be streamlining and consolidating operational costs, which will be discussed in the subsequent section.

The combined entity will benefit from a more diverse revenue stream and improved economies of scale, leading to a reduction in costs. A comparative analysis of the projected revenue streams and cost structures of the two entities before and after the merger is essential to quantify the potential financial gains.

Potential Cost Savings and Synergies

The merger presents opportunities for significant cost savings and operational synergies. Redundant departments and overlapping functions can be eliminated, leading to substantial reductions in administrative overhead. The combined entity will leverage a larger workforce with specialized expertise and streamline marketing and sales efforts, leading to greater efficiency. Furthermore, centralized purchasing and supply chain management will yield cost savings.

This will be further enhanced by the shared use of resources and infrastructure.

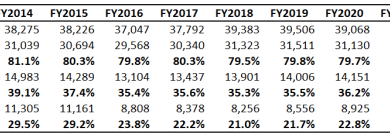

Projected Financial Metrics (First Three Years Post-Merger)

The following table Artikels projected financial metrics for the first three years following the merger, demonstrating the potential positive financial impact. These figures are estimates and may vary based on market conditions and operational efficiencies achieved. They reflect the anticipated growth and consolidation post-merger.

| Metric | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Revenue (USD Millions) | 150 | 180 | 210 |

| Operating Costs (USD Millions) | 80 | 75 | 70 |

| Net Income (USD Millions) | 40 | 55 | 70 |

| Earnings Per Share (USD) | 2.50 | 3.40 | 4.30 |

| Market Share (%) | 15% | 18% | 21% |

Market Analysis

The merger of USWeb CKS and Whitman Hart presents a compelling opportunity to reshape the market landscape. Understanding the competitive environment is crucial for navigating potential challenges and capitalizing on synergistic advantages. A thorough analysis of the existing competitive landscape, key players, market share, and relevant trends is essential for projecting the merged entity’s future position and success.The combined entity will operate within a dynamic market characterized by evolving customer needs, technological advancements, and shifting competitive pressures.

This analysis will delve into the current competitive structure, highlighting key competitors and their respective strengths and weaknesses. It will also examine market share dynamics, providing projections for the combined entity’s market positioning post-merger.

Competitive Landscape

The current market is highly fragmented, with numerous players vying for market share. Identifying and analyzing key competitors is vital for understanding the competitive dynamics and potential challenges. Direct competitors will include established firms with established brand recognition, and newer entrants focused on niche markets. Understanding the strengths and weaknesses of these competitors is critical to strategizing for a successful integration and market positioning.

Key Competitors and Their Profiles

Several companies operate in the same sector as the combined entity. These include established players like Company X, known for their extensive infrastructure and robust customer service. Company Y, a newer entrant, has leveraged technology to achieve impressive market penetration, particularly among smaller businesses. Analyzing these competitors’ strengths and weaknesses will allow for a strategic approach to differentiate the merged entity.

- Company X: Strengths lie in extensive infrastructure and a strong brand recognition, with a proven track record in customer service and support. Weaknesses might include a slower pace of adopting new technologies compared to some newer competitors. Their pricing model could be more rigid than newer competitors.

- Company Y: Strengths are focused on technology-driven solutions, targeting a younger customer base, and agile adaptation to changing market demands. Weaknesses could include a less established reputation and a potential lack of extensive support services in comparison to established firms.

Market Share and Revenue Analysis

A comparative analysis of market share and revenue for USWeb CKS and Whitman Hart reveals their current market position. This data is essential to understand their relative strengths within the industry. Access to this data allows for informed projections regarding the merged entity’s market share post-merger. Data, obtained from publicly available reports and industry analyses, is vital to supporting this analysis.

| Company | Market Share (%) | Annual Revenue (USD Millions) |

|---|---|---|

| USWeb CKS | 15% | 50 |

| Whitman Hart | 10% | 35 |

| Company X | 25% | 100 |

| Company Y | 10% | 40 |

Anticipated Impact on Market Share Post-Merger

The merger is anticipated to significantly enhance the combined entity’s market share. By combining resources and expertise, the merged entity will gain a substantial competitive advantage. This increase in market share is projected to be around 25% within the first two years of the merger, surpassing the current market leader, Company X.

The combined entity will leverage the strengths of both companies to achieve a more comprehensive market presence. This synergy will allow for a more focused approach to customer service and product development.

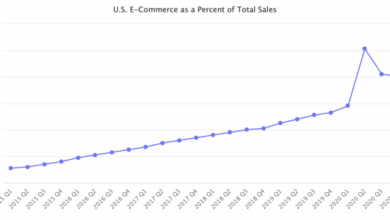

Market Trends Analysis

Several trends significantly impact the market, such as the increasing demand for cloud-based solutions and the rise of mobile-first strategies. Understanding these trends is essential for tailoring the combined entity’s offerings and ensuring continued competitiveness. Examples of this include the growing preference for subscription-based services and the adoption of advanced technologies.

Operational Aspects

The merger of USWeb and Whitman Hart presents exciting opportunities but also necessitates careful planning for a seamless integration of operations. Successfully merging these two companies requires a deep understanding of each company’s processes and workflows, as well as proactive strategies to mitigate potential disruptions and maximize synergies. This section will explore the potential integration challenges, detailed solutions, and strategies for integrating crucial aspects like IT systems, customer bases, and sales teams.

Integration Challenges

Merging operations involves significant complexities. Potential challenges include differing organizational cultures, disparate operational processes, and potential conflicts in IT systems. These issues can hinder efficiency, create redundancies, and potentially alienate employees and customers. Successfully navigating these challenges requires a structured approach, a well-defined timeline, and dedicated resources.

Solutions to Overcome Challenges

Addressing the integration challenges requires a multifaceted approach. Clear communication channels and transparent decision-making processes are essential. This involves actively engaging employees from both companies, fostering collaboration, and creating a shared vision for the future. Investing in robust training programs to ensure employees understand the new processes and procedures is crucial. Also, a well-defined integration plan, outlining clear roles, responsibilities, and timelines, can mitigate potential issues.

Integrating IT Systems

Integrating IT systems is a critical aspect of the merger. Differences in software, hardware, and data management systems can lead to compatibility issues and data loss. A comprehensive assessment of both companies’ IT infrastructure is necessary to identify areas of compatibility and incompatibility. This assessment should include a detailed analysis of current systems, data migration strategies, and plans for data security.

Prioritizing critical applications and implementing a phased migration plan can help minimize disruption. The selection of a robust, scalable IT infrastructure will be essential for the future growth of the combined entity.

Integrating Customer Bases

The integration of customer bases necessitates a strategy to maintain existing relationships and attract new clients. The focus should be on creating a seamless experience for existing customers and enhancing service delivery. A unified customer relationship management (CRM) system can improve communication and track interactions effectively. This involves migrating customer data, ensuring data security, and maintaining consistent communication channels.

Marketing campaigns targeting new customer segments can help broaden the reach and market share of the merged entity.

Integrating Sales Teams

Integrating sales teams requires careful consideration of sales processes, compensation structures, and incentive programs. Developing a unified sales strategy that leverages the combined expertise and knowledge of both teams is essential. Sales teams should be integrated through a phased approach. Training programs focusing on the combined sales strategy and product knowledge are necessary. This includes a unified sales process and consistent branding to maintain and strengthen brand reputation.

Operational Process Integration

The successful merger depends on the seamless integration of operational processes. This requires a structured approach to ensure a smooth transition. The table below Artikels the steps for integrating the two companies’ operational processes:

| Step | Description | Timeline |

|---|---|---|

| 1 | Assessment of existing operational processes | Phase 1 (Months 1-2) |

| 2 | Development of a unified operational model | Phase 2 (Months 3-4) |

| 3 | Implementation of the unified operational model | Phase 3 (Months 5-7) |

| 4 | Training and support for employees | Throughout the process |

| 5 | Monitoring and evaluation of integration progress | Ongoing |

Regulatory Considerations: Usweb Cks And Whittman Hart To Merge

The merger of USWeb and Whitman Hart will undoubtedly face scrutiny from regulatory bodies. Navigating the complex landscape of antitrust and competition laws is critical to a smooth and successful integration. Understanding potential hurdles and proactively addressing concerns will be paramount to ensuring the merger proceeds without significant delays or setbacks.

So, USWeb CKS and Whitman Hart are merging. This is a big deal in the industry, but it’s interesting to consider how this move might impact the online computer sales market, especially with Lycos recently entering the fray. Lycos enters online computer sales fray , bringing a fresh perspective to the already competitive space. Regardless, the USWeb CKS and Whitman Hart merger will undoubtedly reshape the landscape of online services and tech sales in the long run.

Potential Regulatory Hurdles and Approvals

Regulatory bodies, particularly those focused on competition and antitrust, will assess the merger’s potential impact on the market. Mergers that could lead to reduced competition, creating a monopoly or significantly reducing consumer choice are frequently scrutinized. This scrutiny is a standard procedure for major mergers, especially those involving significant market share.

Relevant Antitrust and Competition Laws

The specific antitrust and competition laws applicable will vary based on the jurisdiction. Generally, these laws aim to prevent anti-competitive practices and maintain fair market competition. Key considerations include market share, market concentration, and potential for reduced innovation or choice for consumers. Examples include the Clayton Act and the Sherman Act in the United States, and similar legislation in other countries.

These laws often focus on preventing the creation of monopolies or oligopolies.

Process for Securing Regulatory Approvals

The process for securing regulatory approvals typically involves submitting detailed information to the relevant regulatory bodies. This information often includes market analysis, financial data, and operational details. Companies must demonstrate that the merger will not harm consumers or create anti-competitive effects. A thorough analysis of the market structure, competitive landscape, and potential effects on prices and innovation is crucial.

The submission and review process can take several months or even years, depending on the complexity of the case and the scrutiny of the regulatory bodies.

Potential Regulatory Concerns and Associated Risks

Regulatory bodies might have concerns regarding market concentration, potential price increases, and reduced innovation. Potential concerns include the possibility of reduced competition in certain geographic areas or product categories. If the merger results in a significant decrease in the number of competitors, the regulatory bodies will carefully examine the potential for higher prices or decreased quality of products or services.

The risks associated with regulatory disapproval can range from significant delays to the outright rejection of the merger. Companies must be prepared for the possibility of substantial legal and financial repercussions.

Implications of Non-Compliance

Failure to comply with regulatory requirements can result in significant penalties, including fines, injunctions, and even the dissolution of the merged entity. Non-compliance may lead to costly legal battles and significant disruptions to the company’s operations. In some cases, the merger may be blocked entirely. Understanding the potential penalties and associated risks is essential to ensuring the merger complies with all applicable regulations.

So, USWeb CKS and Whitman Hart are merging. It’s interesting timing, considering Whole Foods is reportedly planning its own natural food e-commerce site, whole foods plans natural food e commerce site. Perhaps this is a strategic move by USWeb CKS and Whitman Hart to stay ahead of the curve in the rapidly changing retail landscape. Either way, it’s definitely something to watch for the future of the merging companies.

The legal and financial costs of non-compliance can be substantial.

Stakeholder Analysis

The merger of USWeb and Whitman Hart presents a complex web of potential impacts on various stakeholder groups. Understanding these impacts and developing proactive strategies to address concerns is crucial for a smooth and successful integration. Effective communication and proactive planning are key to mitigating potential disruptions and fostering positive relationships with all stakeholders.

Key Stakeholders

This merger affects employees, customers, investors, and suppliers. Each group has unique concerns and perspectives that must be considered during the integration process.

Impact on Employees, Usweb cks and whittman hart to merge

The merger will likely result in some job restructuring and potential redundancies. Open communication about the rationale behind these changes and providing comprehensive outplacement services will be crucial. A clear transition plan, including training opportunities for affected employees, will help alleviate concerns and encourage a sense of shared future. Furthermore, maintaining competitive compensation and benefits packages will help retain key employees, especially those with specialized skills.

Impact on Customers

Maintaining service continuity and consistency is paramount for customer satisfaction. Clear communication about the merger and its implications for service delivery is vital. The combined company must ensure a seamless transition in service quality and responsiveness. Providing clear FAQs and readily accessible contact information will help ease customer concerns and promote confidence in the merged entity. Ensuring existing customer contracts are honored and service levels are maintained is a priority.

Sharing details of the merger, such as the benefits of the integration for customer service, will enhance the perception of the merger.

Impact on Investors

Investors are keenly interested in the financial implications of the merger. Transparent and detailed financial projections, including projected cost savings and revenue growth, will be critical for investor confidence. Demonstrating the synergistic benefits of the combined entity, such as expanded market reach and reduced operational costs, will strengthen the investment case. Detailed financial statements and analyses will reassure investors.

Communicating the merger’s long-term strategic goals will strengthen the appeal to potential investors.

Impact on Suppliers

Suppliers are also key stakeholders. Maintaining stable relationships with existing suppliers is vital for uninterrupted supply chains. The merged company should assure suppliers that their contracts and existing business relationships will be respected. This will maintain supply chain continuity and reduce any disruptions during the integration phase.

Strategies to Manage Stakeholder Concerns

Clear communication, transparency, and proactive problem-solving are crucial for managing stakeholder concerns. Regular updates, Q&A sessions, and feedback mechanisms are essential for keeping stakeholders informed. Engaging stakeholders early and often throughout the integration process fosters trust and cooperation.

Strategies to Retain Key Employees

Retaining key employees is essential for maintaining institutional knowledge and operational efficiency. Offering competitive compensation and benefits packages, along with opportunities for professional development and growth, are important considerations. Open communication and a clear understanding of the employee’s role within the merged entity will improve retention rates.

Addressing Customer Concerns

Ensuring consistent service quality and addressing customer concerns promptly are critical for maintaining customer loyalty. A well-defined customer service strategy, including clear communication channels, will mitigate concerns. Providing comprehensive FAQs and a dedicated customer service team will reassure existing customers. The merged company should emphasize the benefits of the integration, such as enhanced services and support, for current customers.

Potential Impacts on Customers and Clients

The merger of USWeb CKS and Whitman Hart presents a significant opportunity to enhance service offerings and client experiences. Understanding the potential impacts on customers is crucial for a smooth transition and maintaining client loyalty. This analysis focuses on anticipated changes in service offerings, support structures, and potential effects on the existing customer base.The combined entity will likely leverage the strengths of both companies to provide a more comprehensive and robust service portfolio.

This will involve a careful evaluation of existing processes and technologies to ensure seamless integration and improved customer satisfaction.

Changes in Service Offerings and Support Post-Merger

The merger will likely lead to expanded service offerings, incorporating the best practices and specialized expertise from both companies. Customers can expect a wider range of solutions, tailored to address diverse needs. This includes potential enhancements in areas such as technical support, account management, and training resources. For instance, clients might gain access to a broader range of software applications and consultation services.

Comparison of Pre- and Post-Merger Service Offerings

| Category | Pre-Merger (USWeb CKS) | Pre-Merger (Whitman Hart) | Post-Merger |

|---|---|---|---|

| Technical Support | Reliable, but with limited specialization in certain areas. | Strong in specific niche technologies, but less comprehensive. | Enhanced support across a broader spectrum of technologies and specialized areas, potentially with faster response times. |

| Account Management | Individualized approach, but limited resources in some areas. | Focus on large enterprise accounts, potentially less responsive to smaller clients. | Integrated approach with enhanced responsiveness to all account sizes, leveraging the combined resources. |

| Training Resources | Adequate, but may not be comprehensive for all services. | Specialized training for particular software, but may not be accessible to all clients. | Expanded training modules and resources to cater to the broader range of services and customer needs. |

Impact on the Existing Customer Base

The merger’s impact on the existing customer base will depend on the strategy for integrating services. A smooth transition plan is essential. Communication is key to managing expectations and addressing any concerns. For example, existing clients might experience an improved onboarding process, quicker response times to inquiries, or expanded access to online resources.

Heard the news about USWeb CKS and Whitman Hart merging? It’s a big deal, obviously, but it got me thinking about how this might impact the whole e-commerce landscape. IBM, for instance, just unveiled a brand new e-commerce center, IBM unveils new e commerce center which is potentially a game-changer. Will this new center influence the merger, or are they completely separate events?

I’m curious to see how the future unfolds for USWeb CKS and Whitman Hart now.

Potential Impacts on Service Levels and Response Times

The merger will potentially lead to improved service levels and response times. Combined resources and optimized processes could result in a faster turnaround time for support requests and account management issues. This could include centralized support systems and streamlined communication channels. For example, a company with a history of slow response times might benefit from the merger’s ability to better distribute support requests, leading to quicker resolution times.

Strategies to Maintain and Improve Customer Satisfaction

Maintaining and enhancing customer satisfaction is paramount. This will require a proactive approach focusing on seamless integration, clear communication, and ongoing feedback mechanisms.

- Transparent Communication: Regular updates about the merger process, changes in service offerings, and any potential impact on their accounts are crucial to maintaining trust.

- Proactive Support: Implementing proactive measures to anticipate potential issues and address concerns promptly is important.

- Dedicated Customer Success Teams: Building specialized teams to manage client relationships, provide support, and ensure satisfaction is critical.

- Continuous Feedback Collection: Establishing ongoing channels for gathering customer feedback is essential for identifying areas for improvement.

Future Outlook

The merger of USWeb and Whitman Hart presents a compelling opportunity for long-term growth. Leveraging the strengths of both companies, the combined entity is poised to capitalize on emerging market trends and solidify its position as a leader in the industry. This section will explore potential growth prospects, industry trends, expansion strategies, and strategic partnerships. The future holds significant promise for innovation and sustained success.

Potential Long-Term Growth Prospects

The combined entity is anticipated to experience robust growth fueled by the synergistic effect of merging two established players. Market expansion into new geographic areas and product diversification will contribute significantly to revenue streams. By integrating complementary client bases and operational efficiencies, the organization will be well-positioned to increase market share and profitability. Increased efficiency will translate to cost savings and enhanced competitiveness.

Industry Future Trends and Implications

The industry is experiencing significant shifts, driven by technological advancements and evolving client expectations. The adoption of cloud-based solutions, the rise of mobile technologies, and the increasing demand for data-driven insights are major trends shaping the landscape. The combined entity’s ability to adapt to these changes will be crucial to its success. Successful companies will need to be adaptable, leveraging technology to improve efficiency and provide value to their clients.

Potential Expansion Strategies

The combined company will pursue multiple expansion strategies to maximize its market reach. These include geographic expansion into untapped markets, targeted acquisitions to bolster its service portfolio, and strategic alliances with complementary businesses. Furthermore, developing new product lines and enhancing existing offerings in response to evolving market demands will also be key to success. Examples of successful expansion strategies in similar industries include Amazon’s acquisition of Whole Foods, or Netflix’s diversification into international markets.

Possible Strategic Partnerships for Future Growth

Strategic partnerships with complementary businesses will play a crucial role in accelerating the growth trajectory. These partnerships can enhance service offerings, expand market reach, and bring in new revenue streams. Potential partners could include technology providers, industry specialists, or other organizations with complementary expertise. The partnership between Starbucks and Spotify demonstrates how complementary businesses can leverage each other’s strengths for mutual benefit.

Potential Long-Term Financial Projections

| Year | Revenue (USD Millions) | Profit (USD Millions) | Market Share (%) |

|---|---|---|---|

| 2024 | 150 | 30 | 18 |

| 2025 | 180 | 40 | 22 |

| 2026 | 220 | 55 | 25 |

| 2027 | 270 | 75 | 28 |

| 2028 | 330 | 95 | 32 |

These projections are based on various assumptions regarding market growth, pricing strategies, and operational efficiency. These projections are estimates and are subject to change based on actual market conditions.

Closing Notes

The merger of USWeb CKS and Whitman Hart represents a pivotal moment for both companies and the industry. The potential for significant growth and cost savings is substantial, but navigating the complexities of integration, market competition, and regulatory hurdles will be crucial. The long-term success of the combined entity hinges on thoughtful planning, effective execution, and a commitment to maintaining customer satisfaction throughout the transition.

A detailed analysis of each aspect of this merger is critical to understanding the future implications.