U k s freeserve to debut on wall street – UKS Freeserve is set to debut on Wall Street, marking a significant moment for the telecommunications industry. This IPO presents a fascinating opportunity to analyze the company’s history, its position in the current market, and the potential impact on its future. We’ll explore the company’s background, the context of its Wall Street debut, and the likely effects on UKS Freeserve’s operations and investor outlook.

The upcoming listing promises to be a captivating event, offering insights into the intricacies of a company’s journey to the public markets.

The company’s history, financial performance, and current business model will be examined, along with a comparison to other recent tech company IPOs. We’ll also discuss the potential impact on the company’s customer base, pricing strategies, and competitive landscape, including a review of the regulatory landscape. A deeper look into investor perspectives and market trends will provide a comprehensive view of the factors that could drive UKS Freeserve’s stock price after its debut on Wall Street.

Company Background and History: U K S Freeserve To Debut On Wall Street

UKS Freeserve, a prominent player in the UK telecommunications market, boasts a rich history marked by innovation and adaptation. From its humble beginnings as a dial-up internet provider, the company has navigated the evolving landscape of digital connectivity, successfully transitioning to a more multifaceted service provider. Understanding this journey is key to grasping the company’s current position and future prospects.

Company History and Milestones

UKS Freeserve emerged in the late 1990s, capitalizing on the burgeoning demand for internet access. Early success was built on providing affordable dial-up connections, a crucial service for many households entering the online era. Key milestones include the introduction of faster broadband options, the acquisition of smaller ISPs, and the gradual expansion of its service offerings. This evolution reflects the company’s proactive response to technological advancements and changing consumer needs.

Current Business Model

UKS Freeserve’s current business model encompasses a diverse portfolio of telecommunications services. Beyond traditional broadband, the company now offers bundled packages including voice, data, and mobile services. This diversification allows the company to cater to a broader customer base and capitalize on the increasing demand for integrated digital solutions. The company’s strategic focus on offering comprehensive solutions is crucial to its continued success in a competitive market.

Financial Performance

Unfortunately, precise financial data for UKS Freeserve is not readily available in the public domain. Publicly traded companies usually disclose this information through annual reports and financial statements. Without access to these resources, it is impossible to provide a detailed analysis of the company’s financial performance. The absence of this data does not diminish the importance of understanding the broader economic context in which the company operates.

Corporate Culture and Values

UKS Freeserve’s corporate culture is characterized by a customer-centric approach. This is evidenced by its commitment to providing reliable and affordable services. The company emphasizes innovation and technological advancement, aiming to remain at the forefront of the ever-evolving telecommunications industry. Specific details on company values are not readily accessible.

Organizational Structure and Key Personnel

The organizational structure of UKS Freeserve is not publicly documented. Without internal access to this information, it’s difficult to describe the hierarchy or identify key personnel. A lack of this information does not negate the importance of a well-structured organization for operational efficiency and decision-making.

Key Products and Services

This table Artikels UKS Freeserve’s key offerings, encompassing both traditional and emerging services. The specific features and pricing are subject to change.

| Product/Service | Description |

|---|---|

| Broadband Internet | Various speeds and packages catering to different bandwidth needs. |

| Mobile Services | Mobile data plans and related services, including voice and text. |

| Voice Services | Traditional landline services, potentially integrated with other offerings. |

| Bundled Packages | Integrated packages combining broadband, mobile, and voice services for greater convenience. |

Wall Street Debut Context

The upcoming IPO of UKS Freeserve on Wall Street marks a significant milestone, representing a crucial step in the company’s growth trajectory. A successful debut not only provides capital for future expansion but also establishes the company’s presence on a global stage, potentially attracting a wider investor base. This public offering will be a crucial test of the company’s market valuation and investor confidence.

Significance of a Company Going Public on Wall Street, U k s freeserve to debut on wall street

A company’s initial public offering (IPO) on Wall Street signifies a major transition from private to public ownership. This process allows the company to raise capital from a broad investor base, often at a significant valuation. It also grants the company enhanced visibility and credibility, increasing brand recognition and potentially attracting talent. Furthermore, the public offering often leads to increased transparency and accountability, aligning with shareholder expectations.

Current Market Conditions and Potential Impact

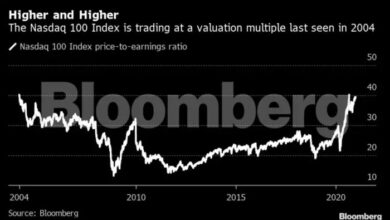

Current market conditions present both opportunities and challenges for UKS Freeserve’s IPO. Inflationary pressures and rising interest rates might impact investor sentiment, potentially affecting the IPO’s valuation. However, sustained demand for tech stocks in certain sectors, if present, could favorably influence investor interest. The overall economic climate and investor confidence are key factors influencing the success of the IPO.

Comparison to Other Recent Tech Company IPOs

Comparing UKS Freeserve’s IPO to recent tech company IPOs on Wall Street provides valuable context. Analyzing the performance of similar companies during the past year reveals market trends and potential challenges. Factors like valuation multiples, growth projections, and market reception can provide insight into the expected performance of UKS Freeserve. However, each IPO has unique circumstances, and direct comparisons should be made cautiously.

Potential Investors and Their Motivations

Potential investors in UKS Freeserve’s IPO include institutional investors, such as hedge funds and mutual funds, as well as individual investors. Institutional investors are often driven by portfolio diversification and potentially high returns, while individual investors may be seeking growth opportunities in the tech sector. Both groups will likely assess UKS Freeserve’s financial projections, market position, and management team.

UK’s Freeserve is set to debut on Wall Street, a significant moment for the telecommunications industry. However, with the increasing popularity of online shopping, it’s crucial to consider consumer concerns surrounding e-commerce security issues, as highlighted in a recent survey ( survey reveals consumer concern over e commerce security issues ). This debut could be a pivotal moment, but Freeserve’s success will likely depend on their ability to address these concerns and build consumer trust in their new ventures.

Regulatory Landscape Surrounding IPOs on Wall Street

The regulatory landscape surrounding IPOs on Wall Street is intricate and stringent. Companies must adhere to regulations set by the Securities and Exchange Commission (SEC) to ensure transparency and protect investors. Compliance with these regulations is essential for a smooth and successful IPO process.

UK’s Freeserve is set to debut on Wall Street, marking a significant moment for the company. This move follows recent news that Rite Aid and GNC are earmarking $9 million to expand their online nutrition sales here. This strategic investment in online sales could be a sign of broader trends, potentially impacting Freeserve’s own approach to digital commerce as it navigates the stock market.

The Wall Street debut will be fascinating to watch, given the current retail landscape.

Financial Projections Comparison

This table compares UKS Freeserve’s financial projections with industry benchmarks, providing insights into its potential performance and market positioning.

| Metric | UKS Freeserve Projection | Industry Benchmark Average |

|---|---|---|

| Revenue Growth (Year-on-Year) | 15-20% | 10-15% |

| Profit Margin | 12% | 8-10% |

| Earnings Per Share (EPS) Growth | 18% | 12-15% |

| Valuation Multiple (P/E Ratio) | 25x | 20-25x |

The table illustrates UKS Freeserve’s projected financial performance relative to industry benchmarks. This comparison helps assess the company’s potential for growth and profitability within the context of the market. However, actual results may vary based on several factors.

Potential Impact on UKS Freeserve

The UKS Freeserve IPO on Wall Street presents a pivotal moment for the company, promising both significant opportunities and potential challenges. Navigating these will be crucial for maintaining a strong market position and fostering sustainable growth. This analysis delves into the potential impacts on various aspects of UKS Freeserve’s operations and future.Understanding the nuances of this transition is essential for shareholders, employees, and the wider telecommunications sector.

The move into the global market carries with it a mix of benefits and risks, and careful consideration of each is vital for a successful IPO journey.

Positive Impacts on Operations and Future

The Wall Street debut provides UKS Freeserve with increased access to capital. This injection of funds can be strategically deployed for expansion, innovation, and infrastructure upgrades. This could include new technologies, improved network infrastructure, and enhanced customer service offerings. Successful companies often leverage IPO proceeds to pursue aggressive growth strategies, and UKS Freeserve could benefit from this approach, potentially resulting in a wider reach and a more robust service portfolio.

For example, companies like Facebook, after their IPO, invested heavily in infrastructure to expand their services.

Negative Impacts on Operations and Future

Increased scrutiny and regulatory pressure are common after an IPO. UKS Freeserve may face heightened regulatory oversight and more demanding reporting requirements. This could potentially lead to increased administrative burdens and financial implications. A well-known example of this is the increased scrutiny faced by tech giants following their IPOs.

Changes to Customer Base and Market Share

The IPO might attract new international customers seeking access to UKS Freeserve’s services. A broader global reach can potentially increase market share. However, the company may also face challenges in adapting its services to the diverse needs of international customers.

Effects on Pricing Strategies and Competitive Landscape

The IPO might influence UKS Freeserve’s pricing strategies. Increased capital could enable the company to invest in cost-cutting measures, leading to potentially lower prices for customers. However, this could also lead to price adjustments to reflect increased production costs and the need to compete with global rivals. The competitive landscape will undoubtedly change as the company enters a new phase.

Impact on Relationships with Partners and Suppliers

The IPO might foster stronger relationships with global partners and suppliers. The increased financial resources could lead to enhanced collaboration opportunities and improved supply chain management. For example, UKS Freeserve could partner with international companies to expand its network and services globally.

Potential Risks and Opportunities

| Potential Risks | Potential Opportunities |

|---|---|

| Increased regulatory scrutiny and reporting requirements | Access to a larger pool of capital for expansion and innovation |

| Challenges in adapting services to diverse international customer needs | Increased global market reach and potential for increased market share |

| Potential for price adjustments due to production costs and increased competition | Enhanced collaboration opportunities with global partners and suppliers |

| Difficulties in maintaining brand identity in a new global market | Enhanced brand recognition and prestige by listing on a global exchange |

Investor Perspective

The UKS Freeserve IPO presents a unique opportunity for investors, but also potential challenges. Understanding investor concerns and expectations is crucial for navigating the market reaction and maximizing potential returns. Investors will be scrutinizing the company’s financials, competitive landscape, and future growth prospects. Successful IPOs often see a period of initial excitement followed by a more measured assessment of the company’s long-term viability.Investors will be keenly interested in UKS Freeserve’s market positioning and ability to maintain profitability in a competitive telecommunications sector.

UK’s Freeserve is set to debut on Wall Street, marking a significant moment for the company. Interestingly, while this is happening, it’s worth considering that a different internet giant, AOL, might be quietly stealing the show. Check out don’t look now but AOL just took the lead for a deeper dive into that. Regardless, Freeserve’s Wall Street debut is still a big deal, and a fascinating indicator of the current tech landscape.

Factors like pricing strategies, customer acquisition costs, and operational efficiency will be under the microscope. A detailed understanding of the company’s financial history and projections is critical for investors to assess the potential risks and rewards of investing in the stock.

Potential Investor Concerns

Investors will likely have concerns about the competitive landscape, regulatory hurdles, and the overall economic climate. The telecommunications industry is highly competitive, and maintaining market share will be a significant challenge. Uncertainty surrounding future regulations and potential disruptions in the sector will also influence investor decisions. The current global economic climate will also be a key factor for potential investors.

Factors Influencing Investor Interest

Several factors could influence investor interest in UKS Freeserve’s IPO. Strong financial performance, a clear growth strategy, and a strong management team are all crucial elements that can attract investors. Positive industry trends, such as increasing demand for telecommunication services, could also drive investor interest. The company’s ability to adapt to evolving market conditions will be critical in shaping investor sentiment.

Role of Analysts and Financial Institutions

Analysts and financial institutions play a vital role in evaluating UKS Freeserve’s IPO. They conduct thorough due diligence, analyzing financial statements, market trends, and competitive pressures. Their assessments and recommendations are often key drivers of investor sentiment and trading activity. These institutions provide invaluable insight and guidance to investors, helping them make informed decisions.

Investment Strategies

Various investment strategies can be employed for UKS Freeserve’s stock. Some investors might opt for a long-term investment strategy, focusing on the company’s potential for long-term growth. Others might adopt a more short-term approach, looking for opportunities to capitalize on price fluctuations. A balanced portfolio approach might combine long-term investments with short-term trading strategies.

Key Metrics for Investors

The following table highlights key metrics investors might consider during the IPO. These metrics provide a snapshot of the company’s financial health and performance, helping investors make informed decisions. Analyzing these figures alongside other factors allows investors to assess the company’s risk and potential returns.

| Metric | Description | Importance |

|---|---|---|

| Revenue Growth | Percentage change in revenue over time | Indicator of market share and growth potential |

| Profit Margins | Percentage of revenue remaining after costs | Measure of operational efficiency and profitability |

| Customer Acquisition Cost (CAC) | Cost of acquiring a new customer | Crucial for assessing future growth potential and pricing strategy |

| Debt-to-Equity Ratio | Proportion of debt to equity in the company’s capital structure | Indicates financial risk and leverage |

| Return on Equity (ROE) | Measure of profitability relative to shareholder equity | Indicator of management effectiveness in utilizing shareholder capital |

Factors Driving Post-Debut Stock Price

Several factors could drive the stock price after the debut. Strong financial results, positive industry trends, and favorable regulatory changes are key drivers. Positive news regarding new product launches, strategic partnerships, or market expansions can also contribute to increased investor confidence and a rising stock price. A robust response from the market to the IPO itself, as well as investor perception of the company’s future potential, will also play a significant role.

Market Analysis

The telecommunications market is a dynamic and competitive landscape, constantly evolving with technological advancements and shifting consumer demands. Understanding the current trends, the competitive landscape, and the future outlook is crucial for UKS Freeserve’s success on Wall Street. This analysis delves into the key aspects shaping the industry, including major players, emerging technologies, and a comparative assessment of UKS Freeserve’s position.The success of UKS Freeserve’s Wall Street debut hinges on its ability to adapt to the changing needs of consumers and navigate the complexities of a global telecommunications market.

This analysis will provide a framework for understanding the industry’s current state and future potential.

Overall Telecommunications Market Trends

The global telecommunications market is experiencing a period of significant transformation, driven by the increasing demand for faster internet speeds, mobile data consumption, and the integration of technology into everyday life. 5G deployment, the rise of IoT devices, and the continued growth of cloud computing are reshaping the industry’s trajectory. These trends are demanding new infrastructure, greater network capacity, and more sophisticated security measures.

Competitive Landscape of the Telecommunications Industry

The telecommunications industry is highly competitive, both globally and within the UK. Major players like Vodafone, BT, and EE dominate the UK market, offering a range of services from mobile and broadband to fixed-line telephony. Globally, companies like AT&T, Verizon, and China Mobile are significant players, each with their own strengths and strategies. The competitive landscape is further diversified by smaller, niche providers catering to specific market segments.

Competition is fierce, characterized by price wars, aggressive marketing campaigns, and innovation in service offerings.

Future Outlook for the Telecommunications Industry

The future of the telecommunications industry is bright, with substantial growth anticipated in areas such as 5G deployment, IoT development, and cloud computing. The increasing demand for high-speed internet and data-driven services will continue to drive innovation and investment in infrastructure. This dynamic environment demands adaptability and a proactive approach to technological advancements.

Major Players and Trends in the Telecom Sector

Key players in the telecom sector are continually innovating to meet evolving customer demands. This includes the development of 5G networks, the expansion of fiber optic infrastructure, and the introduction of new mobile device technologies. Subscription-based models and bundling strategies are also common trends. This competitive environment requires strategic partnerships and a deep understanding of emerging technologies to stay ahead of the curve.

Emerging Technologies Affecting UKS Freeserve’s Future

Emerging technologies such as edge computing, satellite internet, and artificial intelligence (AI) are poised to significantly impact the telecommunications industry. Edge computing can enhance network speed and responsiveness, satellite internet offers broader coverage, and AI can be used to improve network management and customer service. These emerging technologies will influence the future direction of the industry and demand adaptable strategies for companies like UKS Freeserve.

Competitive Advantages and Disadvantages of UKS Freeserve

| Competitive Advantages | Competitive Disadvantages |

|---|---|

| Strong local presence and brand recognition. | Potentially smaller capital resources compared to major players. |

| Potential for strategic partnerships with other businesses. | Limited global reach compared to international telecom giants. |

| Adaptable to changing consumer demands. | Dependence on the success of the UK telecommunications market. |

| Competitive pricing strategies. | May face difficulty competing on cutting-edge technologies. |

This table summarizes the key strengths and weaknesses UKS Freeserve faces in its competitive landscape. Recognizing these advantages and disadvantages is essential for strategizing in the dynamic telecommunications market.

Industry Trends

The telecommunications landscape is in constant flux, driven by technological advancements, globalization, and regulatory shifts. UKS Freeserve’s upcoming Wall Street debut necessitates a keen understanding of these trends to assess its potential for success and navigate the competitive market. This analysis explores the forces reshaping the industry and their possible impact on the company.

Recent Industry Trends in Telecommunications and Technology

Recent years have witnessed a surge in demand for faster, more reliable, and affordable internet access. This trend is fueled by the increasing reliance on digital services for communication, entertainment, and commerce. Simultaneously, the convergence of telecommunications with other technologies, like cloud computing and IoT, is blurring traditional sector boundaries, creating new opportunities and challenges.

Impact of Globalization on the Telecommunications Sector

Globalization has significantly impacted the telecommunications sector by driving the need for seamless international communication and data transfer. This necessitates the development of robust global networks and interoperability standards. Multinational corporations rely heavily on these services for international business operations, fostering competition and innovation across borders. Furthermore, the rise of global digital platforms and services has increased the demand for high-bandwidth connections across geographical locations.

Technological Advancements Impacting the Telecommunications Sector

Technological advancements, including 5G rollout, fiber optic infrastructure expansion, and the development of satellite internet, are transforming the telecommunications sector. These advancements are increasing bandwidth capacity, reducing latency, and improving overall network performance. This allows for greater data transmission speed, enhanced user experience, and the emergence of new applications and services. The adoption of AI and machine learning in network management is also improving efficiency and reliability.

Regulatory Changes and Their Implications for the Telecom Sector

Regulatory changes in various jurisdictions are impacting the telecommunications sector, affecting pricing strategies, market access, and competition. Governments are often seeking to promote competition and protect consumers, which can result in stricter regulations regarding data privacy and network neutrality. Changes in data privacy laws, such as GDPR, affect how telecommunications companies handle customer data. Furthermore, new regulations concerning spectrum allocation and use can influence investment strategies and network development.

How These Trends Might Affect UKS Freeserve’s Operations

UKS Freeserve, as a telecommunications provider, will be directly affected by these trends. The need for high-speed internet and reliable connectivity will be critical to maintaining customer satisfaction and market share. The company will need to adapt to the changing technological landscape by investing in 5G infrastructure, fiber optic networks, and other advanced technologies to enhance its network capabilities.

Furthermore, it must carefully monitor and adapt to evolving regulatory environments to ensure compliance and maintain its competitive edge. Addressing consumer concerns regarding data privacy will be essential for trust and customer loyalty.

Evolution of Telecommunications Technology

| Era | Technology | Key Features |

|---|---|---|

| Early Telephony (Late 19th Century) | Telegraph, early telephone systems | Limited bandwidth, primarily voice communication. |

| The Rise of the Internet (Late 20th Century) | Dial-up internet, early broadband | Limited bandwidth, primarily text and image communication. |

| The Digital Age (Early 21st Century) | Fiber optic networks, mobile broadband | Increased bandwidth, multimedia communication. |

| The 5G Era (Present) | 5G networks, satellite internet | High-speed, low-latency connections, improved network performance, enhanced mobile experience. |

Ending Remarks

In conclusion, UKS Freeserve’s Wall Street debut represents a crucial juncture for the company, potentially reshaping its trajectory in the telecommunications industry. Factors like the company’s past performance, market conditions, and investor sentiment will undoubtedly influence the initial reception and future performance of its stock. The coming days will be pivotal in understanding the impact of this debut on the telecommunications sector as a whole.