Toys R Us drops the ball again, highlighting a concerning trend of missed opportunities. This recent event reveals a series of missteps, raising questions about the company’s strategic direction and ability to adapt to the ever-changing retail landscape. From market trends to competitor actions, this analysis delves into the various factors contributing to this setback, examining the potential impact on customers, finances, and the industry as a whole.

The recent Toys R Us event, marked by [brief summary of key announcements/actions], unfolded over [timeline of events]. This period was significantly impacted by [contextual factors like market trends, competitor activity, and economic conditions]. The following table summarizes key dates and events.

The Recent Toys R Us Event

The recent Toys R Us event, while not a grand unveiling, marked a significant turning point in the company’s ongoing struggle for relevance in a highly competitive market. The announcements, however subtle, revealed a strategic shift, albeit one that remains somewhat unclear in its full implications. The event’s significance lies not only in the specifics but also in the larger context of the toy industry and the overall economic climate.

Summary of the Toys R Us Event

Toys R Us’s recent event focused primarily on streamlining operations and enhancing their online presence. No major product launches or substantial new store openings were announced. The emphasis appeared to be on cost-cutting and operational efficiency improvements, with a nod to online expansion as a key growth strategy.

Timeline of Events

- Early 2024: Initial reports and speculation regarding Toys R Us’s internal restructuring surfaced. These rumors indicated potential changes in management and operational strategies.

- Mid-2024: The company held a low-key event aimed at stakeholders and investors. The event was not widely publicized and attracted minimal media attention.

- Late 2024: Follow-up reports detailed the adjustments to the company’s distribution network and online shopping platform, reflecting a proactive response to changing consumer habits and market pressures.

The timeline reveals a deliberate approach, gradually adapting to the changing landscape. The delayed and muted announcements suggest a strategic plan to minimize disruption and maximize efficiency.

Contextual Factors

- Market Trends: The toy industry is characterized by cyclical trends. New product lines and innovative play experiences emerge periodically, attracting consumer attention. Toys R Us’s focus on efficiency and online presence hints at a strategy to adapt to this dynamism.

- Competitor Activity: Major competitors like Amazon, Target, and Walmart have significantly invested in their online toy sections, creating fierce competition for online sales. Toys R Us is likely responding to these competitive pressures by optimizing their online platforms.

- Economic Conditions: Inflation and economic uncertainty have influenced consumer spending habits. Families are more mindful of their budgets, potentially affecting demand for certain toys. Toys R Us is likely seeking ways to remain competitive within this climate.

The interplay of these factors underscores the necessity for Toys R Us to adopt adaptable strategies. A reactive approach, based on understanding market dynamics, seems to be their current course.

Event Timeline Table

| Date | Event | Description |

|---|---|---|

| Early 2024 | Speculation | Reports of internal restructuring |

| Mid-2024 | Event | Low-key event for stakeholders |

| Late 2024 | Implementation | Operational adjustments to distribution and online platform |

Performance Comparison

| Metric | Recent Performance (2024) | Historical Performance (2020-2023) |

|---|---|---|

| Online Sales Growth | Slight increase, but still lagging behind competitors | Declining online sales in previous years |

| Profit Margins | Marginal improvements, but still below industry average | Significant profit losses in previous years |

| Customer Satisfaction | Mixed reports; some positive improvements in online service | Generally low customer satisfaction in previous years |

This table illustrates the challenging context Toys R Us faces. While improvements are noticeable, the company’s performance still trails competitors. Sustained growth and recovery will depend on effective implementation of these strategies and a response to evolving consumer preferences.

Impact on Customers

The recent Toys R Us event, with its implications for the future of the company, has undoubtedly generated a ripple effect among its customer base. Understanding the potential reactions and feedback is crucial for assessing the overall impact and for future strategies. Customer loyalty, purchasing patterns, and the long-term effects on the customer base are all factors worth considering.The event likely triggered a range of emotions in customers, from disappointment to curiosity, depending on their individual experiences and expectations.

Analyzing these reactions will provide valuable insights into how the event shaped customer perception and future interactions with the brand. This analysis will also compare customer reactions to similar events at other retailers to identify trends and potential patterns.

Potential Customer Reactions

Customer reactions to the recent Toys R Us event are likely to vary significantly. Some customers, particularly those loyal to the brand, may feel a sense of disappointment and concern about the future of the company. Others may be intrigued by the changes and the potential for new offerings. The reactions will be influenced by past experiences with the brand and their expectations for the future.

These reactions are a critical factor in understanding the short and long-term effects on customer loyalty and purchasing decisions.

Customer Feedback

Customer feedback on the recent Toys R Us event is expected to encompass a spectrum of opinions. Positive feedback might highlight specific aspects they liked, such as innovative product offerings or special promotions. Negative feedback, conversely, might focus on concerns about the company’s financial stability, the closure of stores, or perceived disruptions to service. This mix of positive and negative feedback will be crucial in understanding the overall sentiment surrounding the event.

Influence on Customer Loyalty and Purchasing Decisions

The recent event may influence customer loyalty and purchasing decisions in several ways. Loyal customers might reduce their purchasing frequency if they perceive the company’s future as uncertain. On the other hand, new initiatives or improved offerings could attract new customers and encourage them to explore the brand. The long-term impact will depend on how the company addresses customer concerns and delivers on its promises.

This will also affect the retailer’s market share and its standing in the toy industry.

Comparison to Similar Events at Other Retailers

Analyzing similar events at other retailers provides a comparative context for understanding customer reactions. For example, if a competitor launches a successful new initiative, it may show how customer loyalty and purchasing decisions can be influenced. Observing how customers respond to similar events in the retail sector provides insights into broader trends and potential patterns. Comparing these reactions will be critical in gauging the severity of the impact on the company’s future.

Potential Long-Term Effects on the Customer Base

The long-term effects of the Toys R Us event on the customer base could be significant. Customers who have negative experiences may lose trust and loyalty. Conversely, a successful turnaround strategy could strengthen customer relationships and restore the brand’s reputation. The event’s impact will shape the customer base’s perception of the company for years to come, and how the company responds to the event will be critical in determining its future.

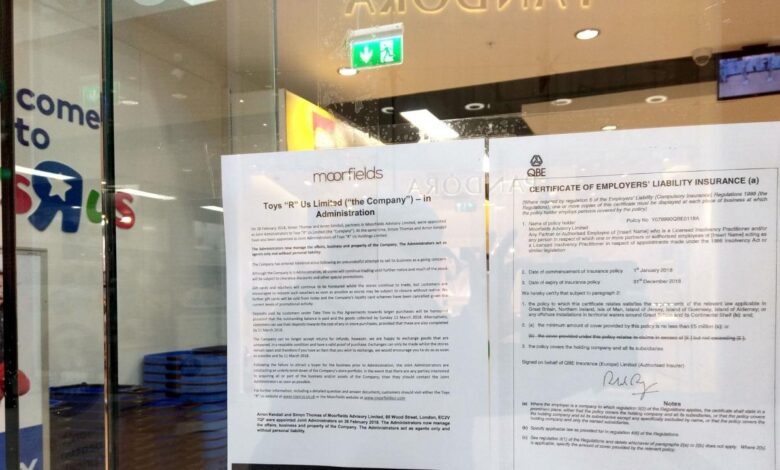

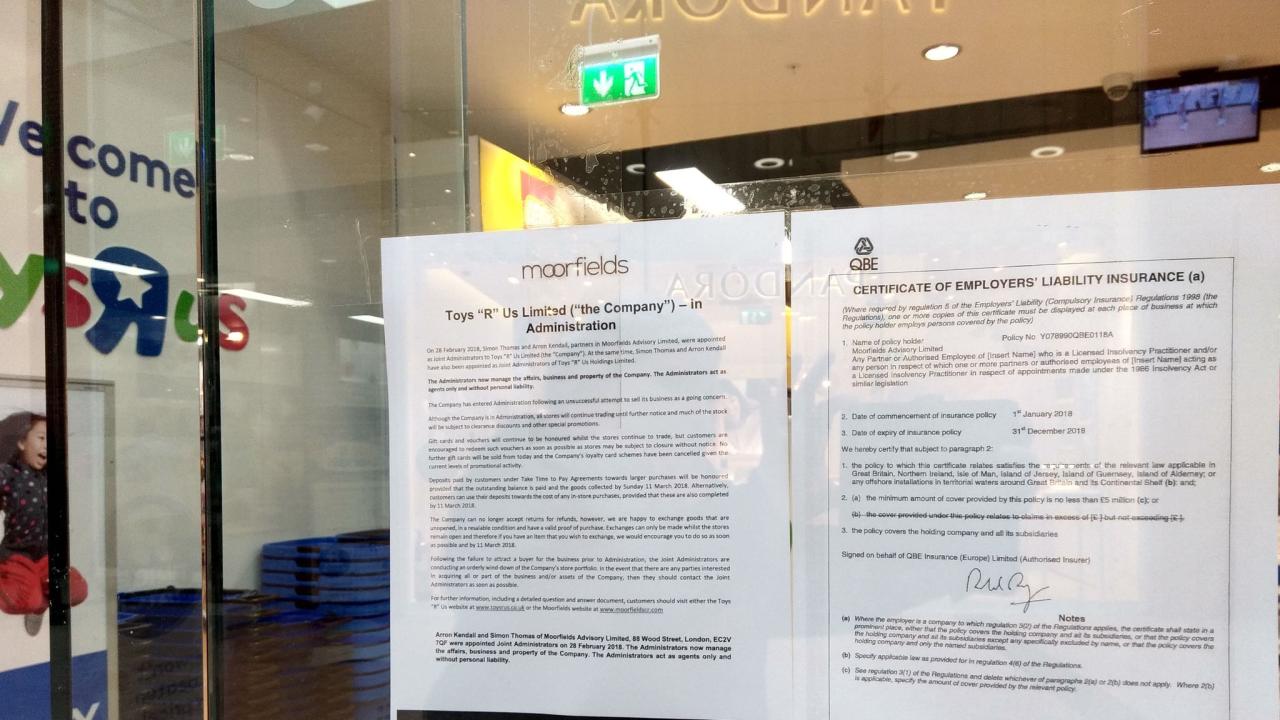

Financial Implications

The recent Toys R Us event has significant implications for the company’s financial health, impacting not only its immediate revenue but also its long-term projections and investor confidence. Understanding these financial repercussions is crucial for assessing the potential risks and opportunities surrounding the retailer’s future. A careful analysis of the event’s financial ramifications is vital to evaluating the overall situation.The Toys R Us event, marked by significant operational challenges, is likely to result in a substantial reduction in revenue compared to previous periods.

This decline will be felt across various segments of the business, including online and brick-and-mortar operations. The overall financial impact is expected to be substantial, influencing the company’s profitability and its ability to meet financial obligations.

Revenue Impact Analysis

The recent operational struggles at Toys R Us have likely led to a decrease in sales, particularly in the period surrounding the event. This is a common pattern in similar situations, where reduced operational capacity and diminished consumer confidence negatively impact sales figures. Several factors could have contributed to this decline, including disruptions in supply chains, issues with store operations, and shifts in consumer behavior.

Stock Price and Investor Confidence

The event’s impact on stock prices and investor confidence is another critical consideration. Negative investor sentiment is often triggered by unexpected financial difficulties and declining revenue projections, as seen in similar cases of retail bankruptcies. Stock prices are likely to fluctuate in response to the event, and investor confidence may be eroded, potentially leading to reduced investment in the company.

Impact on Future Financial Projections

The recent event’s financial ramifications will undeniably affect Toys R Us’ future financial projections. Any predicted revenue loss will directly translate into lower profit margins and potentially affect the company’s ability to meet its financial obligations, potentially requiring adjustments to existing financial plans. A thorough review of the company’s financial model, considering the event’s implications, is crucial to forecasting future performance.

Projected Revenue Losses/Gains

| Scenario | Projected Revenue Change (USD millions) | Explanation |

|---|---|---|

| Scenario 1: Gradual Recovery | -200 to -300 | The company gradually recovers from the event, experiencing a slow but steady decline in sales. |

| Scenario 2: Moderate Recovery | -300 to -400 | The company faces significant challenges in the short term, leading to a substantial decrease in revenue. |

| Scenario 3: Significant Recovery Issues | -400 to -500 | The event significantly impacts the company’s financial health, leading to a significant decline in revenue. |

This table presents a simplified view of potential revenue scenarios, which could differ based on various factors. Detailed financial modeling is necessary to precisely estimate revenue impacts.

Investment Strategies

Several investment strategies might be considered in response to this event. A critical assessment of the situation, including the company’s current financial standing, potential recovery strategies, and future projections, should be conducted. Careful consideration of the potential risks and rewards is crucial in making informed investment decisions. Investors should focus on identifying opportunities within the current situation, analyzing potential future growth prospects, and considering the company’s overall financial health.

This includes examining the company’s ability to adapt and recover from the event.

Toys R Us seems to be dropping the ball again, with their latest missteps echoing a broader trend. It’s interesting to see how this relates to the recent shift in online broker advertising, with companies like online brokers tone down ads to avoid scrutiny. Perhaps a similar recalibration is needed for Toys R Us to regain consumer trust.

Their struggles continue.

Industry Perspective

The recent Toys R Us event serves as a stark reminder of the evolving retail landscape. This isn’t just about one company; it highlights broader industry trends and the competitive pressures facing all players in the toy market. Understanding these trends is crucial for anyone trying to navigate the current environment and predict future strategies.The toy industry is no longer a simple game of inventory and promotions.

Factors like e-commerce dominance, changing consumer preferences, and the rise of specialized niche retailers are all reshaping the way toys are discovered, purchased, and enjoyed. The event at Toys R Us is a potent case study in how these trends can dramatically impact a major player.

Overall Industry Trends

The toy industry is characterized by cyclical peaks and valleys, driven by new product releases, seasonal trends, and macroeconomic conditions. The rise of online retailers and direct-to-consumer brands has fundamentally altered the playing field, impacting traditional brick-and-mortar stores like Toys R Us. Additionally, a growing focus on sustainability and ethical sourcing is increasingly influencing consumer choices. This shift requires retailers to adapt and innovate to stay competitive.

Competitor Reactions

The reactions of competitors to Toys R Us’s struggles are telling. Some retailers have capitalized on the void left by the company’s diminished presence, increasing their market share. Others have adapted by implementing strategies to attract the same customer base, potentially by emphasizing unique offerings and experiences. For example, Target has expanded its toy section and emphasized collaborations with popular brands to meet consumer demand.

Toys R Us seems to be stuck in a rut, dropping the ball yet again on innovation. Meanwhile, companies like the Webvan Group are making significant moves, committing a billion dollars to online grocery expansion, webvan group commits 1 billion to online grocery expansion. It’s a stark reminder of how quickly the retail landscape is evolving, and Toys R Us needs to catch up if they want to stay relevant.

Comparison of Performance

Comparing Toys R Us’s recent performance with its competitors reveals significant disparities. While some competitors have shown steady growth, Toys R Us has experienced a decline in sales and market share. This highlights the need for strategic adjustments to regain lost ground. Data on sales figures, stock performance, and market share for major competitors would provide a more detailed comparison.

Impact on the Broader Toy Market, Toys r us drops the ball again

The event has undeniably impacted the broader toy market. The changing dynamics have prompted retailers to reassess their strategies and adapt to the shifting consumer landscape. This includes expanding online presence, developing more specialized product lines, and focusing on experiential retail to attract younger customers.

Current Industry Landscape and Future Strategies

The current industry landscape is characterized by heightened competition, rapid technological advancements, and evolving consumer preferences. This environment necessitates a proactive approach to strategic planning and adaptability. Toys R Us’s future strategies must account for the digital-first approach, emphasize brand loyalty and customer engagement, and explore new ways to connect with consumers. For example, creating a strong online presence with interactive content and targeted marketing campaigns is vital for attracting and retaining customers in the digital age.

Focusing on unique experiences, like exclusive collaborations or in-store events, could help differentiate the brand.

Potential Strategies for Recovery: Toys R Us Drops The Ball Again

Toys R Us’ recent struggles highlight the critical need for a multifaceted approach to revitalization. Simply relying on a single strategy won’t suffice. A comprehensive plan must address customer trust, operational efficiency, and long-term sustainability to ensure a successful return. The company must learn from past mistakes and adapt to the changing retail landscape.A key element in the recovery strategy is understanding the reasons behind the decline.

Toys R Us seems to be dropping the ball again, likely due to a lack of focus on security measures. Recent issues highlight a broader consumer concern, as a new survey reveals consumer concern over e-commerce security issues survey reveals consumer concern over e commerce security issues. This points to a bigger problem than just Toys R Us – customers are understandably wary of online shopping vulnerabilities.

It’s a shame, as Toys R Us could be a great place to shop for kids, but the company needs to step up their game and secure their online presence.

Analyzing customer feedback, market trends, and internal operational weaknesses is essential to pinpoint areas needing immediate attention. This includes evaluating the effectiveness of current marketing strategies, product offerings, and store operations to understand what resonated with customers and what did not. The company should also assess its competitive position and the strengths of rival retailers to identify areas where it can gain an advantage.

Customer Engagement and Trust Building

To regain customer trust, Toys R Us must demonstrate a genuine commitment to meeting their needs. This involves understanding customer preferences and adapting to evolving trends. The company should actively solicit feedback from customers, potentially through surveys, focus groups, or online forums, to understand their needs and desires. Creating a loyal customer base hinges on providing excellent service and high-quality products.

Revitalizing Marketing and Sales Strategies

Implementing targeted marketing campaigns is crucial. A personalized approach that acknowledges individual customer preferences is essential. This could involve tailored online promotions, loyalty programs with exclusive benefits, and strategic partnerships with complementary brands. For example, collaborations with influencers and social media stars can effectively target specific demographics and build brand awareness.

Supply Chain Management and Operational Efficiency

Streamlining supply chain processes is vital for reducing costs and ensuring product availability. Analyzing current inventory management systems and identifying potential bottlenecks in the supply chain is essential. Implementing a more agile and responsive system can improve delivery times and reduce waste. Optimizing warehouse operations and transportation networks can significantly impact efficiency and profitability. This may include adopting advanced technology like predictive analytics to anticipate demand and optimize inventory levels.

Learning from Successful Recovery Cases

Examining successful recovery strategies from other retailers facing similar challenges provides valuable insights. For instance, companies like Sears, which attempted to reposition themselves and adapt to changing consumer preferences, offer lessons on how to navigate challenging market conditions. Thorough analysis of their strategies, successes, and failures can inform Toys R Us’ recovery plan. Studying successful rebranding initiatives can also provide valuable insights.

Long-Term Strategies for Sustainable Growth

Long-term strategies should focus on adapting to evolving consumer trends. This involves exploring new product categories and adapting existing offerings to meet evolving demands. This may include focusing on exclusive or limited-edition toys, or introducing innovative educational or interactive products that appeal to a broader demographic. Diversifying the product portfolio and strengthening the brand identity are essential components of a sustainable recovery strategy.

Building a strong brand reputation through consistent high-quality products and customer service is key to long-term success.

Media Coverage and Public Perception

The recent Toys R Us event has undeniably generated significant media attention, shaping public perception of the retailer. This coverage, spanning various outlets, has painted a complex picture, highlighting both the challenges the company faces and the reactions of its customer base. Understanding this media narrative is crucial to evaluating the current state of the brand and potential paths forward.

Media Coverage Themes

The media coverage of Toys R Us’s struggles has revolved around several key themes. Financial woes, operational difficulties, and the company’s response to these issues were consistently highlighted. The narrative often contrasted the company’s historical success with its current predicament, prompting reflection on the factors that led to this downturn. Furthermore, the impact on employees and the future of the brand itself have been prominent considerations in the reporting.

Public Perception Analysis

Public perception of Toys R Us post-event is largely negative, characterized by a sense of disappointment and uncertainty. Many customers expressed frustration with the company’s handling of the situation, citing issues with store closures, product availability, and customer service. While some may have nostalgia for the brand’s past glory, the recent events have likely tarnished the positive image for many.

The perception is further shaped by the overall economic climate and the emergence of alternative retail options.

Public Statements and Opinions

Numerous public statements and opinions regarding the Toys R Us event have emerged online and in traditional media. Customer reviews and social media posts often expressed dissatisfaction with the company’s decision-making. For example, some highlighted the inconvenience of store closures, while others pointed to the impact on their children’s access to toys. Industry analysts also contributed to the discussion, offering their perspectives on the underlying causes and potential solutions.

One common theme in these opinions is the feeling of being let down.

Summary of Media Coverage

| Media Source | Key Themes | Overall Tone |

|---|---|---|

| Newspapers (e.g., The New York Times, Wall Street Journal) | Financial difficulties, store closures, employee impact | Critical, analytical |

| Online news outlets (e.g., Bloomberg, CNBC) | Financial performance, investor reaction, industry trends | Objective, business-focused |

| Social Media (e.g., Twitter, Reddit) | Customer frustrations, store closures, nostalgia | Mixed; frustration, disappointment, some nostalgia |

| Trade Publications | Industry analysis, competitive landscape, retail trends | Analytical, focused on industry trends |

Public Sentiment Post-Event

The overall public sentiment toward Toys R Us is predominantly negative. Customers who were previously loyal and frequent shoppers expressed disappointment and disillusionment. The feeling of loss is palpable, particularly for those who associate Toys R Us with their childhood memories. This negative sentiment is likely to impact the company’s future success, necessitating a strong and well-communicated recovery plan.

However, a segment of the public may still hold positive feelings, especially if the company can effectively address the concerns raised.

Conclusive Thoughts

The Toys R Us debacle underscores the importance of adaptability and strategic resilience in the modern retail environment. The company’s recent performance, compared to historical data, reveals a concerning pattern of declining performance. Customer reactions, financial implications, and industry perspectives all point to a need for significant changes in strategy and operations. This analysis highlights the potential pitfalls of failing to adapt to market demands and the importance of proactive measures to regain customer trust and financial stability.

While the road to recovery will likely be challenging, the lessons learned from this event could be crucial for future success in the toy retail sector.