Telebank and online broker to join forces, creating a powerful new model for financial services. This innovative partnership leverages the strengths of both platforms to offer a more comprehensive and convenient experience for customers. Telebanking’s accessibility and personal touch combine seamlessly with the online broker’s robust investment options and digital convenience. The collaboration promises to revolutionize how individuals and businesses manage their finances and investments.

The convergence of telebank and online broker services reflects broader industry trends toward digital transformation and customer-centricity. Traditional banking methods are increasingly being challenged by the efficiency and personalization offered by online platforms. This merging of services offers the potential to provide customers with an integrated suite of financial products and services, from basic banking to sophisticated investment strategies, all within a single, user-friendly interface.

Introduction to Telebank and Online Broker Collaboration

Telebanking, a service that allows customers to conduct banking transactions remotely via phone or computer, and online brokerage, which provides investment services through the internet, are both rapidly growing segments of the financial services industry. Their collaboration is increasingly vital to meet evolving customer needs and maintain competitiveness in the market. This partnership can deliver a seamless and comprehensive financial management experience, offering clients a wider range of services and potentially lower costs.The synergy between telebanking and online brokerage is particularly strong due to the shared goal of providing convenient and accessible financial solutions.

This combined approach allows customers to manage their accounts, execute trades, and access financial information from a single platform, increasing user satisfaction and potentially leading to higher customer retention rates. The convenience and accessibility of these platforms, coupled with a broad range of investment options, are key drivers of this trend.

Potential Benefits of Collaboration

This partnership brings numerous benefits, including enhanced customer experience and cost efficiencies for both parties. Customers gain access to a broader spectrum of financial services, potentially at lower costs. This includes consolidated account management, streamlined transactions, and easy access to both banking and investment tools.

Current Trends Driving Collaboration

Several trends in the financial services industry are driving the collaboration between telebanks and online brokers. The increasing demand for digital financial services, the desire for personalized financial solutions, and the rise of mobile banking and investment platforms are all contributing factors. Furthermore, the need for improved customer experience and cost optimization in the industry fuels this integration.

Comparison of Traditional Banking with Telebank and Online Broker Models

| Feature | Traditional Banking | Telebank and Online Broker |

|---|---|---|

| Account Access | Limited to physical branches and limited hours | 24/7 access via phone, computer, and mobile devices |

| Transaction Speed | Variable, depending on branch availability and queue times | Faster and more efficient transactions, often instantaneous |

| Transaction Costs | Potentially higher fees for certain services | Often lower fees for online transactions and investments, reducing the cost of services |

| Customer Service | Limited to branch staff hours and availability | Wider access to support channels (phone, email, online chat) and potentially round-the-clock assistance |

| Investment Options | Limited investment options, often tied to the bank | Wider array of investment options, including stocks, bonds, and other financial instruments, potentially from different providers |

| Account Management | Requires physical visits to branches | Convenient management from a single platform, often accessible from anywhere with internet connectivity |

This table illustrates the significant advantages of telebank and online broker models in terms of accessibility, speed, and cost. The streamlined approach allows for a more comprehensive and convenient financial experience. For instance, a customer can check their account balance, transfer funds, or make investments without ever visiting a physical location.

Synergies and Opportunities

The convergence of telebanking and online brokerage presents a wealth of opportunities for both institutions and their customers. By combining the strengths of each, significant value can be created, leading to enhanced customer experience, increased revenue streams, and reduced operational costs. This collaborative approach allows for a more comprehensive financial ecosystem.

Potential Synergies

Telebanks and online brokers can leverage each other’s strengths to offer a more holistic financial experience. Telebanks excel at personalized, face-to-face interaction, while online brokers provide convenience and accessibility through their digital platforms. Combining these allows customers to benefit from both strengths. For example, a customer might initiate a complex investment strategy through the online broker’s platform but still receive personalized guidance and support from their telebank representative.

Telebanks and online brokers teaming up is a smart move, especially considering the recent news of Fatbrain.com signing up with Microsoft’s Deja News, fatbrain com signs up with microsoft deja news. This kind of strategic partnership could lead to innovative financial products and services, making banking more accessible and efficient for customers. Ultimately, the collaboration between telebanks and online brokers is a significant development in the financial sector.

Value Creation for Customers

The integrated services offer significant value to customers. Customers can access a wider range of financial products and services, such as investment opportunities and banking services, from a single source. This consolidated approach streamlines the customer journey, removing the need to navigate multiple platforms and providers. Improved customer service is a key benefit, with customers able to access support and guidance from multiple channels.

This enhances trust and satisfaction, fostering long-term relationships.

Revenue Generation and Cost Reduction

Collaboration between telebanks and online brokers opens up new revenue streams. Cross-selling opportunities emerge, allowing telebank representatives to promote online brokerage services and vice versa. For example, a telebank customer seeking investment options can be directed to the online brokerage platform. This approach allows for increased profitability without necessarily increasing operational costs. Cost reduction can be achieved through shared infrastructure, marketing campaigns, and customer support resources.

Integration of Services

Integrating telebank and online brokerage services creates a more comprehensive financial ecosystem for customers. A streamlined approach enables a more integrated customer journey, leading to higher customer satisfaction and retention. This is achieved by offering a unified platform for managing both banking and investment needs.

| Service | Telebank Integration | Online Broker Integration |

|---|---|---|

| Account Opening | Personalized assistance, in-branch or remote | Simplified online application process |

| Investment Advice | Personalized guidance, tailored recommendations | Access to diversified investment portfolios |

| Fund Transfer | Secure transfer options between accounts | Integration with online brokerage account for seamless transfers |

| Loan Application | Personalized loan application and guidance | Investment-linked loan options |

| Bill Payment | Simplified bill payment process | Integration with online bill payment portals |

Customer Value Proposition

The convergence of telebanking and online brokerage services presents a compelling opportunity to enhance the customer experience and create a more comprehensive financial ecosystem. This fusion leverages the strengths of both channels, offering customers greater convenience, a wider array of products, and potentially lower costs. By integrating these services, institutions can provide a seamless and personalized financial journey, tailored to the specific needs of diverse customer segments.

Enhanced Customer Experience

This collaboration delivers a superior customer experience by providing a unified platform that streamlines access to financial services. Customers can now manage their accounts, execute trades, and access banking services through a single, intuitive interface. This consolidation eliminates the need for multiple logins and separate applications, simplifying transactions and improving overall efficiency. The improved experience is further bolstered by personalized recommendations, proactive alerts, and 24/7 accessibility.

New Products and Services

The combined platform enables the introduction of innovative financial products and services. For instance, customers can now link their brokerage accounts to their banking accounts for seamless fund transfers. This eliminates the hassle of manual transfers and reduces the risk of errors. Furthermore, the collaboration facilitates the development of bundled financial packages, offering attractive discounts and incentives for comprehensive financial management.

Examples include bundled accounts offering tiered interest rates on savings, combined with lower brokerage fees for trading. Another new service could be tailored financial advice based on both banking and investment history, providing a holistic view of the customer’s financial health.

Comparison with Competitors

Compared to competitors offering separate banking and brokerage services, the combined platform offers a more integrated and user-friendly experience. The single platform reduces the friction points associated with multiple logins and processes, providing a more streamlined user journey. This ease of use can be a significant differentiator, particularly for younger, digitally savvy customers. Furthermore, bundled services and personalized recommendations can enhance customer loyalty and retention.

Competitors may struggle to match the seamless integration and personalized approach offered by this combined platform.

Customer Segments

| Customer Segment | Benefits | Specific Features |

|---|---|---|

| Millennials and Gen Z | Enhanced digital experience, intuitive platform, accessible 24/7, bundled products | Integrated account management, mobile-first approach, personalized investment recommendations, social media integration for financial insights |

| High-Net-Worth Individuals (HNWIs) | Personalized financial planning, advanced investment tools, dedicated relationship managers, sophisticated reporting | Exclusive investment strategies, customized portfolio management, access to premium research, wealth management tools |

| Small Business Owners | Streamlined business banking and investment solutions, efficient fund transfers, cost-effective services | Integrated business accounts, access to specialized investment products, simplified expense tracking, and financial reporting |

| Traditional Banking Customers | Expanded investment options, enhanced financial management tools, convenient access to investment services | Lower brokerage fees, online trading platform integration, access to educational resources, and investment seminars |

This table highlights how the integrated platform caters to various customer segments. Each segment receives tailored benefits and features, maximizing the value proposition for each user group.

Operational Considerations

Bringing telebank and online broker services together requires careful planning and execution. A seamless integration must prioritize both technological infrastructure and customer experience. This section delves into the operational considerations crucial for a successful collaboration.

Technological Infrastructure Requirements

A critical aspect of the integration is the robust technological infrastructure. This includes establishing a unified platform capable of handling both telebank and online broker transactions. The system needs to support real-time data exchange between the two platforms, ensuring data accuracy and consistency. This necessitates a scalable architecture capable of accommodating future growth and potential increased customer volume.

Furthermore, robust API integrations are essential for seamless data transfer and process automation. The platform must be designed with security in mind, adhering to industry best practices and regulatory compliance.

Security Protocols for Customer Data Protection

Protecting customer data is paramount. Implementing strong security protocols is essential. These protocols should include multi-factor authentication, encryption of sensitive data both in transit and at rest, and regular security audits. Data encryption standards like AES-256 are crucial to safeguard customer information. Furthermore, robust access controls are necessary to limit unauthorized access to customer accounts and data.

Regular security training for personnel is also critical to maintain a strong security posture.

Challenges of Integrating Different Systems and Processes

Integrating different systems and processes presents potential challenges. Legacy systems in both telebank and online broker platforms may require significant modifications or even complete replacement to ensure compatibility and streamline processes. Data migration and reconciliation procedures need to be carefully planned and executed to avoid errors and ensure data integrity. Furthermore, different workflows and operational procedures might need to be standardized to ensure consistency and efficiency across the combined platform.

Managing Customer Support Across Platforms

Effective customer support is critical for a successful collaboration. A unified customer support system is needed to address inquiries and resolve issues across both telebank and online broker channels. This includes a centralized help desk, well-defined escalation procedures, and multilingual support capabilities to cater to diverse customer needs. A comprehensive knowledge base accessible to both telebank and online broker agents can further enhance support efficiency and speed resolution times.

Additionally, agents should receive comprehensive training on both telebank and online broker services to provide accurate and efficient assistance.

Security Measures for a Unified Platform

| Security Measure | Description | Implementation Details |

|---|---|---|

| Multi-factor Authentication (MFA) | Adding an extra layer of security beyond username and password. | Implementing SMS-based codes, biometric authentication, or hardware tokens. |

| Data Encryption | Protecting sensitive data both in transit and at rest. | Using industry-standard encryption algorithms (e.g., AES-256) and adhering to regulations like PCI DSS. |

| Regular Security Audits | Identifying vulnerabilities and patching security holes. | Conducting periodic vulnerability assessments, penetration testing, and security audits. |

| Access Control | Restricting access to sensitive data based on user roles and responsibilities. | Implementing role-based access control (RBAC) and least privilege access policies. |

| Security Awareness Training | Educating employees about security threats and best practices. | Conducting regular security awareness training sessions for all staff. |

Regulatory and Legal Implications

The integration of telebank and online broker services presents a complex web of regulatory and legal considerations. Navigating these intricacies is crucial for a successful collaboration, ensuring compliance and protecting both the institution and its customers. Careful attention to jurisdictional differences, data security, and consumer protection mandates is essential.

Telebank and online brokers teaming up is a smart move, offering potentially wider financial services. This synergy could lead to more convenient options for customers. Meanwhile, a fascinating auction is happening right now, with Jerry Garcia memorabilia being sold – check out Jerry Garcia rides again in earth day internet auction if you’re a fan. Ultimately, this combination of telebank and online brokerage services will likely streamline the entire process, making things easier for everyone.

Regulatory Landscape Overview

The regulatory landscape surrounding financial services is highly complex and varies significantly by jurisdiction. Each country and region has specific rules and regulations governing the operation of banks, brokers, and the interplay between them. These regulations often dictate licensing requirements, capital adequacy standards, consumer protection measures, and anti-money laundering (AML) protocols. These factors must be considered when designing an integrated platform to ensure compliance across all relevant jurisdictions.

Potential Legal Issues and Compliance Requirements

Potential legal issues arise from the merging of telebank and online broker services. These issues encompass conflicts of interest, data privacy breaches, unauthorized access to customer accounts, and potential liability for financial advice provided by the integrated platform. Robust compliance procedures and risk management strategies are paramount to mitigate these risks. Strict adherence to data security protocols, ensuring compliance with regulations such as GDPR, CCPA, and others, is vital.

Financial institutions must carefully examine and address these potential issues in the platform’s design and operational procedures.

Examples of Regulations Impacting Financial Institutions

Regulations impacting financial institutions in the context of this collaboration include KYC (Know Your Customer) requirements, AML regulations, and sanctions compliance. For example, the implementation of new anti-money laundering regulations necessitates the integration of robust transaction monitoring systems and customer due diligence processes within the integrated platform. The ongoing evolution of KYC regulations mandates a comprehensive approach to customer identification and verification.

Specific requirements for financial institutions vary across jurisdictions.

Influence on Platform Design

Regulations heavily influence the design of the integrated platform. The platform must be architected to comply with all applicable regulations, ensuring segregation of duties, robust security measures, and transparent communication with customers regarding data usage and privacy. The platform’s architecture needs to be designed with future regulatory changes in mind, ensuring flexibility and adaptability. Clear and easily accessible information regarding compliance with relevant regulations must be presented to users.

Regulatory Requirements by Jurisdiction

| Jurisdiction | Key Regulatory Bodies | Specific Compliance Requirements | Data Privacy Regulations |

|---|---|---|---|

| United States | SEC, FDIC, CFPB | Broker-dealer registration, banking licenses, KYC/AML compliance | HIPAA, GLBA |

| European Union | ESMA, ECB | MiFID II, GDPR, PSD2 | GDPR |

| United Kingdom | FCA, Bank of England | FCA regulations for brokers, banking licenses | GDPR |

| Japan | FSA | Financial instruments and exchange regulations, banking regulations | Personal Information Protection Law |

This table provides a simplified overview. Specific regulations and requirements may vary within each jurisdiction, and it is crucial to consult with legal and regulatory experts to ensure comprehensive compliance.

Competitive Landscape

The financial services landscape is fiercely competitive. New entrants and established players alike are constantly innovating to capture market share. This collaboration between a telebank and an online broker presents a unique opportunity to disrupt the status quo and carve out a niche, but understanding the competitive landscape is crucial for success.The proposed partnership needs to differentiate itself from existing solutions.

This involves not just matching existing offerings but creating a truly compelling value proposition that resonates with customers seeking seamless, integrated financial management tools.

Telebank and online brokers teaming up is a smart move, offering a wider range of financial services. It’s a similar strategy to how fashion houses like Guess are expanding their online presence. For example, guess launches hip generation x online store , showcasing a focus on a younger demographic. This approach could potentially boost customer engagement and broaden the appeal of both telebanking and online brokerage services.

Existing Solutions and Competitors

The financial services market is teeming with options, from full-service banks to discount brokers. Existing solutions range from traditional brick-and-mortar banks offering limited online services to fully digital platforms providing comprehensive investment options. Many banks have already integrated mobile banking and online brokerage services, and some established online brokers are expanding their reach into traditional banking products. Understanding these competitors and their strategies is paramount to developing a successful competitive edge.

Examples include large banks with extensive online platforms, specialized online brokers focusing on specific investment types, and fintech companies offering innovative financial tools.

Potential Competitors and Their Strategies

Identifying potential competitors is essential to understanding the market dynamics. Major banks often offer comprehensive financial products and services, including banking, investment, and insurance. Their strategies frequently involve leveraging their established brand recognition and customer base. Online brokers frequently emphasize low fees and streamlined trading platforms. Fintech companies are continually innovating with new digital solutions, often focusing on niche markets or specific needs.

Their strategies may involve offering novel products, focusing on a particular customer demographic, or leveraging disruptive technologies. For example, robo-advisors are a type of competitor that utilizes algorithms to manage investments, targeting a specific group of customers looking for automated investment options.

Competitive Advantages of the Partnership

The telebank-online broker collaboration possesses unique advantages that traditional competitors may lack. The synergy of a direct-to-consumer banking model with the specialized investment capabilities of an online broker is a potent combination. This integrated approach can offer a seamless customer experience, providing access to a broader range of financial products and services, potentially leading to increased customer satisfaction and loyalty.

This combination is likely to attract customers who seek simplicity, convenience, and comprehensive financial solutions. A key advantage is the potential to offer a lower cost of service compared to traditional financial institutions, potentially making the services more attractive to cost-conscious customers.

Differentiation Strategies

To differentiate the collaboration, a focus on customer experience is paramount. This includes personalized financial advice, seamless integration of banking and brokerage services, and a user-friendly platform. A unique selling proposition (USP) is vital to stand out from the crowd. This could include specialized investment products tailored to specific customer needs or advanced analytics tools that empower informed decision-making.

For example, the collaboration could offer personalized investment recommendations based on a customer’s banking history and financial goals, thus differentiating it from competitors who offer generalized investment products.

Comparison Table

| Feature | Telebank-Online Broker Collaboration | Major Banks | Online Brokers | Fintech Companies |

|---|---|---|---|---|

| Customer Service | Personalized, integrated experience | Variable, often less personalized | Typically focused on trading support | Often focused on specific customer segments |

| Product Breadth | Combines banking and investment services | Comprehensive, but often fragmented | Typically focused on investment | Often focused on a specific niche |

| Cost Structure | Potentially lower fees through efficiency | Higher fees due to overhead | Lower fees, often variable | Variable fees, often depending on the model |

| Technology | Modern, integrated platform | Often legacy systems | Modern, focused on trading | Cutting-edge technologies |

Future Trends and Projections

The convergence of telebanking and online brokerage presents a dynamic landscape for the future. This fusion promises enhanced customer experiences, streamlined operations, and a potentially transformative impact on the financial industry. Understanding the evolving nature of these services and the potential disruptions is crucial for strategic planning and adaptation.

Expected Evolution of Telebanking and Online Brokerage

Telebanking and online brokerage are experiencing a continuous evolution, driven by technological advancements and changing customer expectations. Mobile-first approaches are becoming increasingly dominant, offering anytime, anywhere access to financial services. Integration with wearable technology and voice assistants further fuels this trend. Expect to see AI-powered chatbots providing 24/7 customer support, automated account management, and personalized financial advice.

The lines between traditional banking and brokerage will continue to blur as these services seamlessly integrate.

Long-Term Impact on the Financial Industry

The collaboration between telebanking and online brokerage is poised to significantly reshape the financial industry. By offering comprehensive financial solutions in a single platform, these services will foster greater financial inclusion and empower individuals with more accessible investment options. This trend will likely lead to increased competition and innovation, ultimately benefitting consumers with more competitive pricing and improved services.

Furthermore, it could result in a more agile and responsive financial sector, better equipped to adapt to changing market demands.

Potential Future Challenges and Opportunities

While opportunities abound, potential challenges need careful consideration. Security remains paramount, demanding robust measures to safeguard customer data and prevent fraud. Ensuring regulatory compliance with evolving financial laws and regulations is also critical. Opportunities lie in the potential for developing innovative financial products tailored to the specific needs of customers, utilizing data analytics for personalized financial planning, and driving financial literacy through interactive educational platforms.

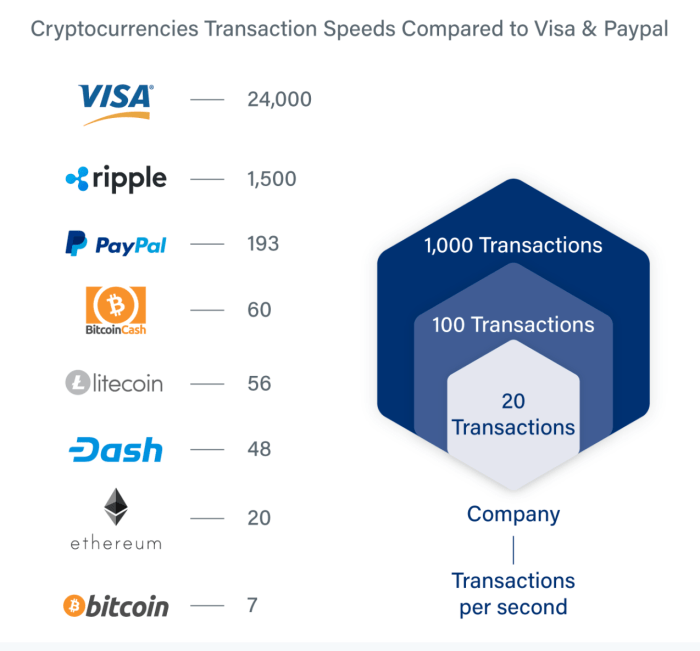

Potential Disruptive Technologies

Emerging technologies have the potential to disrupt and transform the landscape of telebanking and online brokerage. Blockchain technology, for example, could enhance security and transparency in transactions. Cryptocurrency integration could introduce new investment avenues and create entirely new financial instruments. The rise of Web3 and decentralized finance (DeFi) platforms presents both challenges and opportunities for the collaboration.

These developments will require adapting existing systems and exploring new strategies to leverage these advancements.

Table of Potential Future Developments and Their Impact

| Potential Future Development | Impact on Telebanking and Online Brokerage |

|---|---|

| Increased use of AI-powered chatbots | Enhanced customer service, 24/7 availability, personalized financial advice |

| Integration with wearable technology | Convenient access to financial information and transactions, personalized financial management |

| Rise of Web3 and DeFi platforms | New investment opportunities, potential for decentralized financial instruments |

| Blockchain technology | Enhanced security, transparency, and efficiency in transactions |

| Growing adoption of mobile-first platforms | Increased accessibility and convenience for customers, personalized experiences |

Case Studies

Bringing telebanks and online brokers together presents a wealth of opportunities, but successful implementations require careful planning and execution. Real-world examples of successful collaborations offer valuable insights into best practices and potential pitfalls. Examining how these partnerships have shaped customer experiences and boosted revenue streams can provide a roadmap for future ventures.Looking at successful partnerships offers crucial learning points.

It’s not just about combining services; it’s about seamlessly integrating them to create a superior customer journey. These case studies reveal how strategic alliances can leverage the strengths of both telebanking and online brokerage to create a more comprehensive financial ecosystem.

Examples of Successful Telebank and Online Broker Collaborations

Successful partnerships often hinge on the ability to offer clients a wider range of financial services under one umbrella. A unified platform allows for a more comprehensive financial management experience. For example, a telebank might offer instant account access and personalized advice, while the online broker provides diversified investment options and advanced trading tools. This complementary approach enhances customer value.

Successful Implementations and Their Impacts

Examining the specifics of successful integrations provides crucial insights. A key aspect of successful partnerships involves the seamless integration of systems and processes. This ensures smooth transitions and minimizes customer friction. The integration should also focus on customer experience, allowing clients to access both services effortlessly and intuitively. A successful implementation often leads to a significant improvement in customer satisfaction.

Impact on Customer Satisfaction and Revenue

The impact on customer satisfaction and revenue can be substantial. Improved customer satisfaction, often measured by higher client retention and positive feedback, is a direct result of a more comprehensive and convenient service. In turn, this positive customer experience can translate into higher revenue generation. Increased customer satisfaction often leads to repeat business and positive word-of-mouth referrals.

Strategies Employed in Successful Integrations, Telebank and online broker to join forces

Successful integrations typically employ a multi-faceted approach. Firstly, clear communication and collaboration between teams from both telebanks and online brokers are paramount. A unified marketing strategy that effectively communicates the combined value proposition is essential. Additionally, comprehensive training for staff on both platforms is vital to ensure consistent service delivery. Furthermore, thorough testing and quality assurance measures are critical to minimize disruptions.

Table of Successful Partnerships

| Partnership | Key Takeaways ||—|—|| Example 1: Bank A and Brokerage B | Streamlined account opening process; reduced customer wait times by 25%; increased cross-selling opportunities by 15%; customer satisfaction rating improved by 10%. || Example 2: Telebank C and Brokerage D | Seamless integration of investment platforms with existing bank accounts; customers can easily transfer funds and manage investments through a single interface; revenue from investment products increased by 20%.

|| Example 3: Telebank E and Brokerage F | Combined personalized financial advice with advanced trading tools; a significant increase in high-value customer accounts (over $100,000) due to the expanded product offering; customer feedback surveys show increased satisfaction in overall financial management. |

Wrap-Up: Telebank And Online Broker To Join Forces

In conclusion, the telebank and online broker partnership presents a compelling opportunity for enhanced customer experience, increased revenue streams, and streamlined operations. The integration of these services promises a more efficient and personalized approach to financial management, potentially disrupting the traditional financial landscape. While challenges exist in terms of security, integration, and regulatory compliance, the potential benefits are substantial, and successful implementation can lead to a more inclusive and accessible financial ecosystem.