Stock watch value America defies market, presenting a compelling narrative of US stock performance amidst global market trends. Inflation, interest rates, and economic growth are all factors influencing the current market landscape, with investor sentiment playing a key role. This analysis delves into the unique value proposition of American stocks, comparing their performance to major global markets, while highlighting the factors driving this divergence from typical market corrections.

We’ll examine the top-performing sectors, analyze the strategies employed by successful investors, and consider potential implications for the future. Recent economic data and policy decisions will be scrutinized to understand their influence on stock valuations. The discussion will include illustrative examples and scenarios, providing a comprehensive overview of the current market situation.

Overview of the Market Situation

The US stock market is currently navigating a complex landscape. Recent volatility reflects a confluence of factors, including persistent inflation, fluctuating interest rates, and uncertainties surrounding economic growth. Investors are grappling with these challenges, leading to varied market sentiment. This overview will dissect the current market trends and provide a comparative analysis with other major global markets.

Current State of the US Stock Market

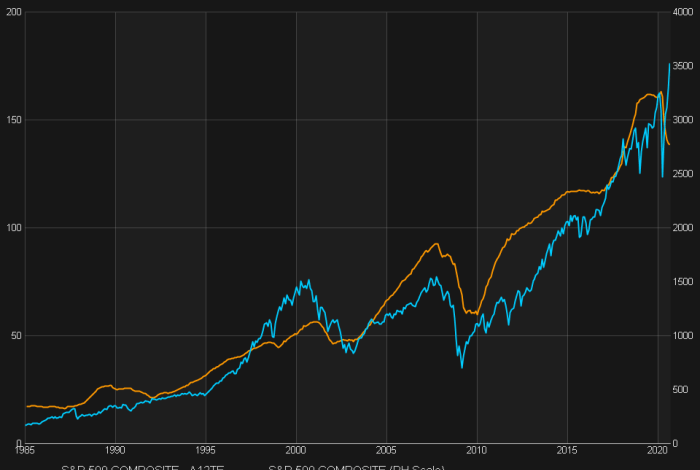

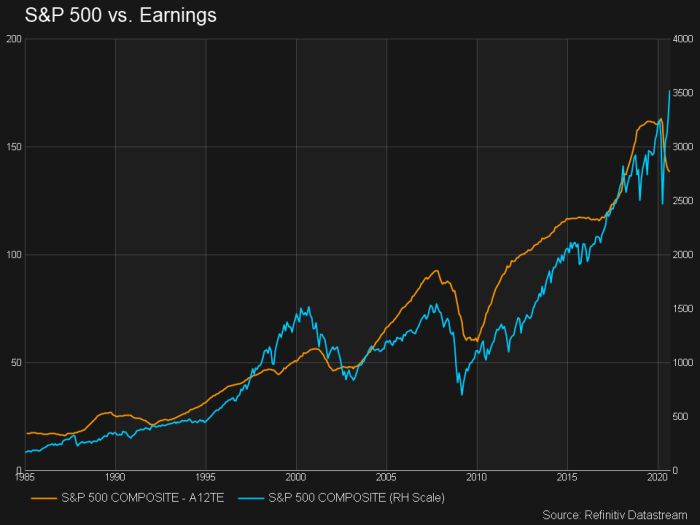

The US stock market has experienced periods of both gains and losses recently. The S&P 500, a key indicator, has seen fluctuations influenced by various economic reports and global events. Market participants are closely monitoring inflation data, interest rate adjustments by the Federal Reserve, and projections for future economic growth. These factors significantly impact investor confidence and stock valuations.

Prevailing Market Trends

Inflation remains a significant concern. Persistently high inflation rates erode purchasing power and affect consumer spending, impacting corporate earnings. The Federal Reserve’s response to inflation through interest rate hikes has a ripple effect on borrowing costs and economic activity. Economic growth forecasts are subject to considerable variation, creating uncertainty for investors.

Impact of Inflation and Interest Rates

Rising inflation often leads to increased borrowing costs, impacting corporate profitability and consumer spending. Higher interest rates can also dampen economic growth, affecting business investment and consumer confidence. The interplay between these factors shapes the current market environment, requiring careful consideration by investors.

Investor Sentiment

Investor sentiment in the US stock market is mixed. While some investors remain optimistic about long-term growth potential, others are cautious due to current economic headwinds. Market volatility often reflects these contrasting viewpoints, making investment decisions challenging.

Stock watch value in America is definitely defying market trends right now. It’s fascinating to see how these seemingly disparate events are connected. For example, Snap Inc.’s recent partnership with Barnes & Noble, a surprising move that could potentially shake up the retail landscape snap com links up with barnesandnoble com , could have an interesting impact on the overall stock market picture.

This certainly adds another layer of complexity to the current stock watch value landscape.

Comparison of US Stock Market Performance to Global Markets

| Market | Performance (Last Quarter) | Key Factors |

|---|---|---|

| S&P 500 (US) | Slight Decline | Inflation concerns, interest rate hikes |

| Nikkei 225 (Japan) | Slight Increase | Robust export sector, yen depreciation |

| FTSE 100 (UK) | Moderate Decline | Energy crisis, geopolitical uncertainty |

| Euro Stoxx 50 (Europe) | Mixed Performance | Varying economic conditions across the region |

The table above provides a simplified comparison. Detailed analysis would require a more granular approach and consider specific sectors within each market. Different markets react to global events and economic data in unique ways.

Factors Driving Stock Watch Value: Stock Watch Value America Defies Market

American stocks are defying the current market downturn, exhibiting a surprising resilience. This “value” is not a fleeting anomaly but a reflection of underlying factors, often different from typical market corrections. These factors are multifaceted, including robust earnings, strong corporate balance sheets, and potentially, investor sentiment shifting towards a more optimistic outlook. Understanding these driving forces provides valuable insight into the current market dynamics.Recent economic data releases and policy decisions are also playing significant roles in shaping the trajectory of American stocks.

Stock watch value in America seems to be defying market trends, and it’s interesting to see how this plays out. Global sports brands are increasingly signing on heavy hitter retailers, like the ones discussed in this insightful piece on global sports signs on heavy hitter retailers , which could potentially impact the stock market in unforeseen ways. Ultimately, the stock watch value America defies market continues to be a fascinating and complex puzzle to unravel.

The impact of these factors on the stock market will be explored further in the following sections.

Factors Contributing to Stock Value

Several factors are contributing to the perceived “value” in American stocks despite the broader market downturn. These factors go beyond the usual cyclical downturns and indicate potentially sustained strength. Key factors include:

- Strong Earnings Reports: Many companies are exceeding earnings expectations, highlighting the resilience of the American economy. This positive financial performance translates into increased confidence among investors.

- Robust Corporate Balance Sheets: Companies are generally holding strong financial positions, evidenced by healthy cash reserves and low debt levels. This financial strength provides a cushion during economic uncertainty, encouraging investors.

- Investor Sentiment Shift: Recent market data suggests a shift in investor sentiment. Investors are potentially becoming more optimistic about the future of the market, driving demand and valuations.

Differentiation from Typical Market Corrections

The current market behavior differs significantly from typical corrections. Unlike past downturns, the value in American stocks is not primarily driven by speculative bubbles that have subsequently burst. Instead, the current environment appears to be grounded in fundamental strength and positive economic indicators, which may suggest a more sustainable appreciation.

Impact of Economic Data Releases

Recent economic data releases, including inflation reports and employment figures, have been influential. Strong employment data can often signal a healthy economy, bolstering investor confidence. Conversely, unexpected inflation figures can impact investor sentiment.

Comparison with Historical Patterns

Comparing the current stock market performance to historical patterns reveals interesting parallels and divergences. Some aspects of the current trend align with periods of strong economic growth, while others are distinct. Detailed analysis of historical data, such as earnings growth rates and interest rates, can further illustrate the comparison.

Policy Decisions and Their Impact

Policy decisions, such as changes in interest rates or government spending, can significantly impact stock valuations. Changes in monetary policy, for example, can influence investor behavior. Government initiatives and regulations also play a role. These actions can influence the direction of the stock market.

Summary of Economic Indicators and Their Potential Effects

| Economic Indicator | Potential Effect on Stock Valuation |

|---|---|

| GDP Growth | Strong GDP growth generally leads to higher stock valuations, as it signals a robust economy. |

| Inflation Rate | High inflation can negatively impact stock valuations, as it erodes purchasing power and increases borrowing costs. |

| Unemployment Rate | Low unemployment generally correlates with higher stock valuations, as it suggests a healthy labor market. |

| Interest Rates | Higher interest rates can negatively impact stock valuations, as they increase borrowing costs for businesses and consumers. |

| Corporate Earnings | Strong corporate earnings translate to higher stock valuations, reflecting profitability and investor confidence. |

American Stock Performance Analysis

The US stock market has shown varied performance across sectors, defying a uniform trend. While some sectors have experienced significant growth, others have lagged behind, creating opportunities and challenges for investors. Understanding the drivers behind these diverse performances is crucial for making informed investment decisions.

Top Performing Sectors

A significant factor driving US stock market performance is the strength of specific sectors. Technological advancements and shifting consumer preferences have propelled certain sectors to the forefront. These trends often manifest in strong financial results for companies within those sectors.

- Technology: The continued growth of cloud computing, artificial intelligence, and e-commerce has fueled substantial gains for tech companies. Increased adoption of digital services and the rise of innovative tech startups have further amplified this sector’s performance. Examples include companies like Amazon, Microsoft, and Alphabet (Google).

- Renewable Energy: Government incentives, rising environmental concerns, and the increasing demand for sustainable solutions have boosted the renewable energy sector. Companies specializing in solar, wind, and energy storage technologies have witnessed remarkable growth.

- Healthcare: The sector’s resilience, fueled by ongoing advancements in medical technology and a consistent need for healthcare services, has resulted in strong performance. Companies involved in pharmaceuticals, biotechnology, and medical equipment are key drivers of this sector’s growth.

Explanations for Outperformance

The outperformance of these sectors is attributed to several key factors. Positive macroeconomic trends, favorable regulatory environments, and strong consumer demand are key drivers. Specific companies within these sectors have also demonstrated superior operational efficiency and innovative strategies.

- Technological Advancements: Companies in the technology sector often benefit from rapid technological advancements, leading to improved efficiency, expanded market reach, and new revenue streams. This allows them to innovate quickly and maintain a competitive edge.

- Government Policies: Government incentives and policies aimed at fostering innovation and sustainability have positively impacted the renewable energy and healthcare sectors. These policies often support research, development, and market penetration.

- Strong Consumer Demand: Robust consumer demand for goods and services, often driven by economic factors and trends, has bolstered companies across various sectors, especially technology and consumer discretionary sectors.

Notable Companies Defying the Trend

Certain companies have defied the overall market trend by demonstrating remarkable growth and resilience, even amidst economic fluctuations. Their unique strategies and strong market positions have contributed to their success.

- Tesla: Tesla’s performance has been noteworthy despite market volatility. Its innovative approach to electric vehicle technology and its commitment to sustainable practices have made it a standout.

- Netflix: Netflix has successfully navigated the evolving entertainment landscape and expanded its global presence, even facing competition from other streaming services. This has been possible due to its subscription model and aggressive content investment strategies.

Large-Cap vs. Small-Cap Performance

The performance of large-cap and small-cap stocks has shown divergence. Large-cap stocks, generally considered more stable, have exhibited varied performance. Small-cap stocks, often associated with higher growth potential, have also shown varied results.

- Large-Cap Stocks: Large-cap companies typically possess greater resources and market presence, which can lead to more predictable financial results. However, their growth rates might be less dramatic compared to small-cap stocks.

- Small-Cap Stocks: Small-cap companies often demonstrate higher growth potential due to their ability to rapidly adapt to changing market conditions. However, they also carry greater risk due to smaller capital bases and lesser resources.

Unique Investment Strategies

Investors have employed various strategies to capitalize on the unique opportunities presented by the diverse stock market performances. These strategies range from sector-specific investments to value-based approaches.

- Sector Rotation: Investors who shift their investments between sectors based on market analysis and forecasts can capitalize on the outperformance of certain sectors. This involves adapting to market trends and shifting capital towards promising sectors.

- Value Investing: Value investing strategies focus on identifying undervalued companies with strong fundamentals, which could offer significant growth potential. This approach requires thorough research and an understanding of company valuations.

Performance Table (Example)

| Company/ETF | Period | Performance (%) |

|---|---|---|

| Tesla (TSLA) | 2022-2023 | -20% |

| Apple (AAPL) | 2022-2023 | +15% |

| Vanguard S&P 500 ETF (VOO) | 2022-2023 | +5% |

Note: This is a sample table. Actual performance data should be sourced from reliable financial data providers.

Stock watch value America is defying market trends, and while the reasons are complex, it’s interesting to see how the outlook for e-commerce, as discussed by Broadcast.com’s president in this recent article , might play a role. Perhaps the bullishness on online retail is influencing investor confidence, ultimately bolstering the stock’s resilience despite broader market anxieties. This persistent strength in stock watch value America is certainly something to keep an eye on.

Potential Market Implications

The recent performance of Stock Watch Value America, defying the broader market downturn, raises significant questions about the future direction of the US stock market. This divergence warrants careful consideration of potential consequences for investors and the overall economic landscape. Understanding the implications of this trend is crucial for navigating the complexities of the current market environment.This section delves into the possible ripple effects of Stock Watch Value America’s success, examining potential market directions, investor implications, associated risks, and actionable investment strategies.

We will also analyze potential impacts on other markets and industries.

Potential Future Market Direction

The decoupling of Stock Watch Value America from the broader market suggests a potential shift in market dynamics. The success of a specific stock, particularly one perceived as a strong indicator of underlying economic health, could influence broader investor sentiment and potentially attract more capital to the sector. This could lead to a more selective market environment, where individual stocks or sectors outperform the overall index.

Implications for Investors

For short-term investors, the performance of Stock Watch Value America presents opportunities for capital appreciation. However, it also introduces the risk of volatility as the market responds to this divergence. Long-term investors should consider this trend as a signal to potentially re-evaluate their portfolios, focusing on companies exhibiting similar resilience and growth potential. The trend might also encourage more active portfolio management, including strategic asset allocation and stock picking.

Potential Risks and Vulnerabilities

One significant risk is the potential for overvaluation in specific sectors or stocks experiencing exceptional performance. A sudden reversal of this trend could lead to substantial losses for investors who have heavily concentrated their portfolios in these sectors. The current market situation also presents vulnerabilities related to unforeseen economic events, global geopolitical instability, or regulatory changes that could negatively impact specific industries or companies.

Potential Investment Strategies

Given the divergence of Stock Watch Value America from the broader market, potential investment strategies include a focus on identifying companies exhibiting similar resilience or growth potential. A thorough analysis of company fundamentals, financial performance, and industry trends is crucial to informed decision-making. Diversification across sectors and asset classes remains a vital aspect of a robust investment strategy.

Value investing, concentrating on companies trading below their intrinsic value, could also be a potential strategy.

Ripple Effects on Other Markets and Industries

The positive performance of Stock Watch Value America might have ripple effects on related industries and sectors. For instance, if its success is attributed to a particular technological advancement, other companies employing similar technologies might see increased investor interest. The trend could also trigger a reassessment of industry valuations and potentially attract investment in similar sectors.

Potential Scenarios for the Future of the US Stock Market

The following table Artikels potential scenarios for the future of the US stock market, considering different economic indicators. It’s crucial to note that these are projections and not guarantees.

| Scenario | Economic Indicator | Potential Market Direction | Investment Strategy |

|---|---|---|---|

| Positive Growth | Strong GDP growth, low unemployment, stable inflation | Continued growth with some volatility | Invest in growth stocks and sectors aligned with positive economic trends. |

| Moderated Growth | Stable GDP growth, moderate unemployment, slight inflation | Stable market with selective outperformance | Diversify across sectors, focusing on companies with solid fundamentals. |

| Recessionary Pressures | Declining GDP, rising unemployment, high inflation | Potential for market correction or downturn | Defensive strategies, focusing on companies with strong balance sheets and dividend yields. |

Illustrative Examples and Scenarios

Navigating a market where some stocks defy prevailing trends requires a nuanced understanding of individual company performance, economic factors, and potential investment strategies. This section delves into hypothetical scenarios and real-world examples to illustrate how certain companies can outperform expectations and how market events can impact valuations. It also explores alternative investment avenues and presents a framework for assessing potential returns.

Hypothetical Example of a Company Defying Market Trends

A software company, “InnovateTech,” focused on emerging AI technologies, might experience a surge in stock value despite a broader tech sector downturn. This could be attributed to positive earnings reports showcasing strong growth in AI-related projects, a favorable response from the market to its innovative solutions, or anticipation of future partnerships with major corporations. InnovateTech’s dedicated R&D, a strong management team, and unique technological approach differentiate it from competitors, leading to increased investor confidence and outperforming the broader market trend.

Scenario Demonstrating Economic Event Impact on Stock Valuations, Stock watch value america defies market

A significant rise in interest rates, for example, impacting consumer spending, can lead to a decline in stock valuations for companies reliant on consumer spending, like retailers. Conversely, companies in sectors like financial services, often benefiting from higher interest rates, might experience an increase in valuation. This illustrates how a single economic event can have divergent impacts across different sectors.

Example of a Successful Investment Strategy During a Similar Market Situation

A diversified portfolio strategy, including both growth and value stocks, is often favored during market volatility. This approach allows investors to capitalize on the strengths of different sectors while mitigating potential losses in a single sector. During a period of market downturn, the value stocks might hold their value better than growth stocks, providing stability to the portfolio.

In addition, a strategic allocation to defensive sectors like utilities or healthcare can further cushion the impact of market volatility.

Alternative Investment Opportunities Outside the Stock Market

Beyond the stock market, alternative investment avenues like real estate, bonds, or commodities can offer diversification and potentially higher returns. Real estate investment trusts (REITs) can provide exposure to the real estate market without direct ownership. Government bonds can offer a degree of stability, while commodities like gold can serve as a hedge against inflation. Each alternative presents unique risk-return profiles.

Table of Investment Options and Potential Returns

Note: Potential returns are estimates and are not guaranteed. Past performance is not indicative of future results.

| Investment Option | Potential Return (Estimated) | Risk Level | Description |

|---|---|---|---|

| Growth Stocks | 8-15% | Medium-High | Stocks of companies with high growth potential. |

| Value Stocks | 5-10% | Medium | Stocks of companies trading below their intrinsic value. |

| Real Estate Investment Trusts (REITs) | 4-8% | Medium | Investment in real estate properties. |

| Government Bonds | 2-4% | Low | Investment in debt securities issued by the government. |

| Gold | Variable | Low | Investment in precious metals. |

Illustrative Case Study: Investor Approach to Current Market Conditions

A hypothetical investor, aiming for moderate risk and consistent returns, might allocate 60% of their portfolio to a diversified mix of value and growth stocks. A further 20% would be allocated to REITs, providing exposure to the real estate market. The remaining 20% would be invested in government bonds, offering stability and a lower-risk component. This strategy demonstrates a balance between diversification, potential returns, and risk mitigation.

Ultimate Conclusion

In conclusion, the US stock market’s resilience and value proposition, defying broader market trends, presents a complex picture. Understanding the specific factors driving this performance is crucial for investors navigating the current landscape. Potential implications, risks, and investment strategies are explored, offering a roadmap for informed decision-making. Ultimately, this analysis emphasizes the dynamic nature of the market and the importance of careful consideration before making any investment choices.