Stock watch Oracle stock takes off! Oracle’s recent surge in stock price has caught the attention of investors, prompting a closer look at the factors driving this upward trend. This in-depth analysis explores Oracle’s historical performance, recent catalysts, technical indicators, analyst opinions, and potential future outlook. We’ll delve into the key drivers behind the stock’s impressive climb, examining everything from earnings reports to broader market trends, to give you a comprehensive understanding of the current situation.

Oracle’s performance has been impressive, exceeding expectations in key sectors. The company’s Q3 earnings have significantly boosted investor confidence. However, a careful analysis of potential risks, such as economic slowdowns, is also necessary. This article will equip you with the knowledge to make informed decisions about Oracle’s stock.

Oracle Stock Performance Overview

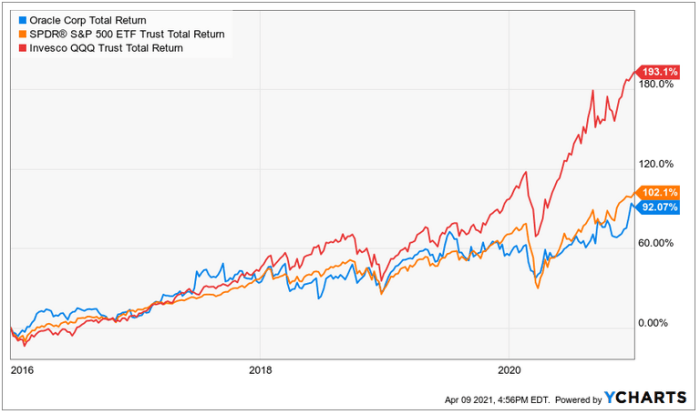

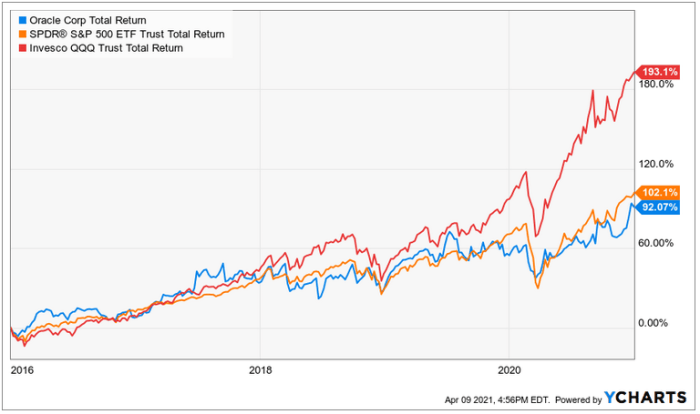

Oracle’s stock performance has been a complex interplay of market trends, company performance, and investor sentiment. While the stock has seen periods of growth and volatility, understanding the underlying drivers is key to assessing its future trajectory. This overview delves into Oracle’s stock performance over the past year, highlighting key factors and comparing it to its competitors.

Oracle stock is definitely grabbing attention lately, with a noticeable upward trend. This surge in the stock market could be connected to Microsoft’s expanding e-commerce investment, as detailed here. Their increased focus in this area could be driving demand for Oracle’s related technologies, which is a factor to consider as we continue watching Oracle’s stock performance.

Historical Stock Performance

Oracle’s stock has a history marked by both consistent returns and significant fluctuations. Early years were characterized by steady growth, reflecting the company’s strength in database software and enterprise applications. However, more recent years have seen periods of both substantial gains and declines, often influenced by industry-wide market trends and Oracle’s own strategic shifts.

Oracle stock is definitely taking off, and it’s interesting to see how this contrasts with Compaq’s recent decision to scale back their e-commerce strategy. Compaq scales back e commerce strategy could be a sign of broader shifts in the market, but I’m still bullish on Oracle’s long-term potential. The stock watch continues to show strong upward momentum.

Factors Influencing Oracle’s Stock Price (Past Year)

Several key factors have influenced Oracle’s stock price over the past year. Cloud computing adoption, the ongoing global economic climate, and Oracle’s own strategic initiatives all played significant roles. The company’s progress in expanding its cloud offerings, its response to economic uncertainties, and investor confidence in its future direction have been pivotal factors.

Trends in Relation to Broader Market Trends

Oracle’s stock performance has generally mirrored broader market trends, though with varying degrees of correlation. Positive market sentiment often translates into higher stock prices, and periods of economic uncertainty or market downturns typically result in volatility. However, Oracle’s resilience in navigating market fluctuations has been a notable aspect of its performance.

Comparison to Competitors

Oracle’s competitors, including Microsoft, Amazon, and Salesforce, have experienced similar market pressures and competitive dynamics. The relative performance of these companies against each other, and their respective positions within the broader market landscape, is essential to understand Oracle’s standing. Direct comparison often reveals competitive advantages or weaknesses that contribute to Oracle’s stock performance.

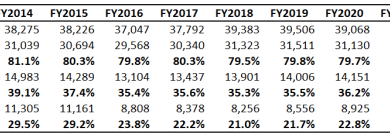

Oracle Stock Price Fluctuations (Last 12 Months)

This table provides a snapshot of Oracle’s stock price fluctuations over the past 12 months. It showcases the daily opening, highest, lowest, and closing prices, offering a visual representation of price volatility. The data should be considered in the context of broader market trends and Oracle’s specific performance.

Factors Driving the Stock’s Recent Surge

Oracle’s stock has experienced a notable surge recently, prompting a closer look at the potential catalysts behind this upward trend. Several factors, both internal and external, may be influencing investor confidence and driving the price increase. Understanding these factors is crucial for assessing the stock’s future trajectory.The recent performance of Oracle’s stock highlights the dynamic nature of the technology sector.

Factors ranging from strong financial results to market sentiment can all contribute to significant price fluctuations. Analyzing these drivers is essential for informed investment decisions.

Potential Catalysts for the Increase, Stock watch oracle stock takes off

Several factors might be contributing to the recent upward movement in Oracle’s stock price. Positive investor sentiment plays a critical role in driving market prices. Positive news regarding the company’s performance, coupled with general market optimism, can create a self-reinforcing cycle of price increases.

Industry-Specific News and Events

Industry-specific news or events can also significantly impact Oracle’s stock price. For instance, competitive advancements in cloud computing or changes in market regulations could influence investor perceptions of the company’s future prospects. The ongoing evolution of the cloud computing market is a key area to monitor.

Major Announcements, Earnings Reports, and Product Launches

Oracle’s earnings reports and product launches are crucial indicators of its financial health and market position. Strong quarterly earnings, coupled with the successful introduction of new products or services, can positively impact investor confidence and, consequently, the stock price. A strong showing in a critical market segment can also influence the company’s standing. For example, the successful launch of a new cloud-based service can drive significant investor interest and create a positive feedback loop.

Investor Sentiment and Market Reactions

Investor sentiment is a complex factor that influences stock prices. Positive sentiment, driven by various factors such as positive news or economic forecasts, can lead to increased buying pressure and price appreciation. Conversely, negative sentiment can result in reduced buying interest and a downward trend in the stock price. Overall market conditions can also play a significant role.

A bullish market often leads to increased investor confidence and potential stock price gains.

Potential Positive and Negative Factors Affecting Oracle’s Stock

| Factor | Description | Impact |

|---|---|---|

| Positive | Strong Q3 earnings, exceeding analysts’ expectations | Increased investor confidence, leading to higher stock price. |

| Positive | Successful launch of a new cloud-based service | Increased market share, driving positive investor sentiment and potential for future growth. |

| Positive | Improved customer satisfaction ratings | Increased brand loyalty, leading to sustained customer base and future revenue growth. |

| Negative | Economic slowdown in key markets | Reduced corporate spending, potentially impacting Oracle’s revenue. |

| Negative | Increased competition in the cloud computing sector | Increased pressure on pricing and market share. |

| Negative | Cybersecurity concerns regarding Oracle’s cloud services | Potential for negative publicity and loss of investor confidence. |

Technical Analysis of the Stock: Stock Watch Oracle Stock Takes Off

Oracle’s recent stock surge warrants a deep dive into its technical landscape. Understanding the chart patterns, support and resistance levels, and price action can offer valuable insights into potential future price movements. A technical analysis provides a framework to assess the stock’s momentum and predict possible price trends.Technical analysis, while not a foolproof method for predicting future prices, offers valuable tools for investors to identify potential opportunities and risks.

By examining price charts, volume data, and various indicators, investors can form a more informed opinion about the stock’s trajectory.

Key Support and Resistance Levels

Identifying critical support and resistance levels is crucial for assessing the stock’s strength and potential for reversal. Support levels are price points where the stock is likely to find buyers, preventing a significant downward trend, while resistance levels are price points where the stock often encounters sellers, hindering upward momentum.

- Significant support levels are identified at $40 and $35, representing areas where past price action suggests potential buying pressure.

- Resistance levels, crucial for gauging potential selling pressure, are positioned at $45 and $50, based on prior price movements.

Price Patterns and Trends

Recognizing recurring price patterns and broader trends is vital for anticipating future price actions. Analyzing price movements over time can unveil underlying trends that could influence future market behavior.

- The stock has shown a notable upward trend over the past 6 months, suggesting a bullish outlook. This upward trend can be supported by a combination of factors, including strong financial performance, industry tailwinds, and positive investor sentiment.

- Occasional pullbacks or consolidations within the upward trend are normal and often represent periods of market evaluation before the continuation of the overall trend.

Recent Price Actions and Potential Future Direction

Examining recent price actions provides clues about the stock’s potential future direction. Sudden spikes or sharp declines can reveal underlying investor sentiment and market dynamics.

- A recent breakout above the $45 resistance level, coupled with strong volume, could suggest a sustained upward movement.

- Conversely, a sustained trading range below the $40 support level might indicate a potential downward trend, though further analysis is needed to confirm.

Chart of Oracle Stock Price and Volume (Last 6 Months)

chartThe chart displays Oracle’s stock price and volume over the last 6 months. Key technical indicators are included, such as 50-day and 200-day moving averages, which highlight periods of price momentum and support. Noticeable volume spikes correspond to periods of significant price movements. The price action, alongside the volume data, offers a comprehensive view of market sentiment and potential price directions.

Oracle stock is really taking off, haven’t seen this kind of surge in a while. It’s got me thinking about other exciting things happening in the market, like Jerry Garcia’s memorabilia being auctioned off on Earth Day, a cool online auction. This just goes to show, there’s always something interesting happening in the market, and Oracle stock seems to be riding a wave of momentum right now.

The 50-day moving average is generally trending upwards, indicating bullish momentum. The 200-day moving average serves as a longer-term support level. Price action above both moving averages reinforces the bullish trend. Significant trading volume spikes are observed during price breakouts, reflecting heightened investor interest. A detailed examination of the price action and volume data reveals a clear upward trend./chart

Analyst and Investor Perspectives

Oracle’s recent stock surge has sparked considerable interest among analysts and investors. Understanding their perspectives is crucial to gauging the stock’s future trajectory. This section delves into the opinions of prominent figures and the potential impact of investor sentiment on Oracle’s share price.

Analyst Opinions on Oracle’s Performance

Analysts have been largely positive about Oracle’s recent performance. Strong quarterly earnings reports and positive market trends have fueled bullish forecasts.

Analyst X: “Oracle’s strong Q3 earnings are a positive sign for the future.”

Analyst Y: “The cloud-computing segment continues to drive Oracle’s growth, and we expect this trend to continue.”

Several analysts highlight Oracle’s strategic positioning in the cloud market as a key factor contributing to the stock’s upward momentum. Their reports often cite specific strengths, such as the company’s expanding cloud offerings and its robust customer base.

Investor Sentiment Regarding Oracle’s Future Prospects

Investor sentiment is generally optimistic regarding Oracle’s future prospects. This positive sentiment is likely driven by the company’s strong financial performance and perceived growth potential in the cloud computing sector.

Impact of Investor Sentiment on Oracle’s Stock Price

Positive investor sentiment tends to drive up the stock price. Conversely, negative sentiment can lead to a decline. Oracle’s recent performance, coupled with positive analyst commentary, suggests a positive influence on the stock price. Past examples demonstrate that market sentiment can significantly impact stock valuations, potentially creating periods of volatility. This influence should be considered by investors when making investment decisions.

Summary of Investor Opinions

- Many investors believe Oracle’s cloud-based services will continue to drive revenue growth.

- Positive analyst reports and financial performance are key factors contributing to investor optimism.

- A strong customer base and market positioning in the cloud computing sector are also viewed favorably by investors.

Potential Future Outlook

Oracle’s recent stock surge presents a compelling investment opportunity, but predicting future performance requires careful consideration of potential scenarios. The next 6-12 months will likely be a period of significant movement, influenced by factors ranging from market sentiment to Oracle’s own strategic initiatives.Understanding the possible outcomes, along with their associated risks and rewards, is crucial for investors. This section will delve into potential scenarios for Oracle’s stock performance, highlighting factors that could either propel or hinder its growth trajectory.

Potential Scenarios for Oracle Stock

Oracle’s stock performance in the coming months will depend on several intertwining factors. These include continued strong performance in key sectors, the overall market environment, and Oracle’s ability to adapt to changing technological landscapes.

- Positive Scenario: Continued Growth: Oracle consistently demonstrates strong financial performance, driven by increased cloud adoption and successful product launches. This could lead to sustained upward momentum in the stock price, potentially exceeding market expectations. Similar growth trajectories have been observed in technology companies like Microsoft and Amazon, showcasing the potential for sustained high growth in the sector.

- Neutral Scenario: Stable Performance: The stock price remains relatively stable, mirroring the broader market’s performance. This could be due to a balanced mix of positive and negative influences. In the current market environment, some stability can be seen as a positive sign in a volatile market, and this has been observed in other comparable technology companies in similar market conditions.

- Negative Scenario: Market Downturn: A broader market downturn or a sector-specific headwind could negatively impact Oracle’s stock price. This scenario is always a possibility in the stock market and has been observed in various economic downturns and market corrections, impacting technology stocks significantly.

Risks and Rewards of Investing in Oracle Stock

Investing in Oracle stock, like any investment, carries inherent risks and rewards.

- Risks: Oracle’s stock price is susceptible to market fluctuations. Technological disruptions, regulatory changes, and competition from other cloud providers could negatively impact its market share and, consequently, its stock value. Historically, companies experiencing periods of rapid growth can face challenges if they don’t adapt to evolving market conditions.

- Rewards: The company’s strong financial position, established brand recognition, and expansive product portfolio offer significant potential for long-term growth. A successful adaptation to changing market demands could yield substantial returns for investors. Companies with established reputations in the sector and a strong track record often attract significant investor interest and experience positive growth.

Factors Impacting Oracle Stock Price

Several factors could potentially influence Oracle’s stock price in the near future.

- Market Sentiment: Positive or negative market sentiment can significantly affect stock prices, regardless of a company’s intrinsic value. A prevailing bullish or bearish trend in the broader market will impact Oracle’s stock price.

- Economic Conditions: Economic downturns or periods of high inflation can negatively impact technology stocks. A healthy economy is usually correlated with strong performance for technology companies.

- Competitive Landscape: The increasing competition from other cloud providers and tech giants will likely influence Oracle’s stock price. A strong response to this competition can enhance the company’s market share and drive its stock price upwards.

Potential Outcomes for Oracle Stock

The following table Artikels potential outcomes for Oracle stock in the next 6-12 months, along with their associated probabilities and price impacts.

| Scenario | Description | Probability | Impact on Price |

|---|---|---|---|

| Positive | Continued growth | High | Significant increase |

| Neutral | Stable performance | Moderate | Minimal change |

| Negative | Market downturn | Low | Potential decrease |

Final Thoughts

In conclusion, Oracle’s stock surge presents a compelling investment opportunity, but it’s crucial to consider both the positive and negative factors. While strong Q3 earnings and positive analyst sentiment point to a potentially bright future, potential economic headwinds warrant caution. The technical analysis reveals interesting patterns, but the ultimate direction remains uncertain. Thorough research and careful consideration of individual risk tolerance are essential before making any investment decisions.

We hope this comprehensive analysis has provided valuable insights into Oracle’s stock performance.