RocketCash in orbit over 8 million investment marks a significant leap for the company, highlighting its potential to revolutionize the space. This injection of capital, coming from [insert source(s) of funding], promises exciting developments. We’ll delve into RocketCash’s business model, key services, and target market, as well as the strategic rationale behind this substantial investment. A comparative analysis with similar companies will also be presented, providing a clearer picture of RocketCash’s position in the competitive landscape.

The $8 million investment signifies a vote of confidence in RocketCash’s innovative approach. Investors [insert names of investors] clearly see the potential for significant returns. This substantial influx of capital is poised to fuel RocketCash’s growth, with projected revenue increases detailed in the following sections. We’ll also explore potential challenges and risks, providing a holistic view of this exciting development.

RocketCash Investment Overview

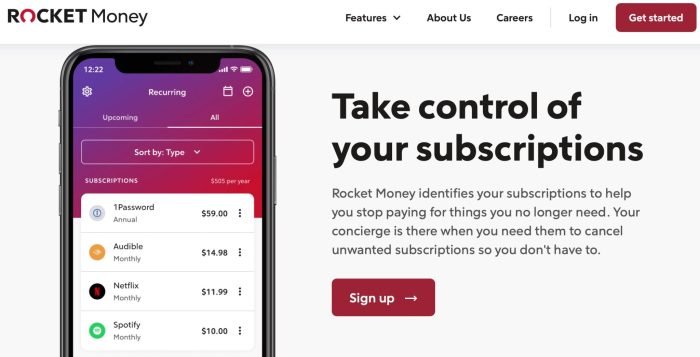

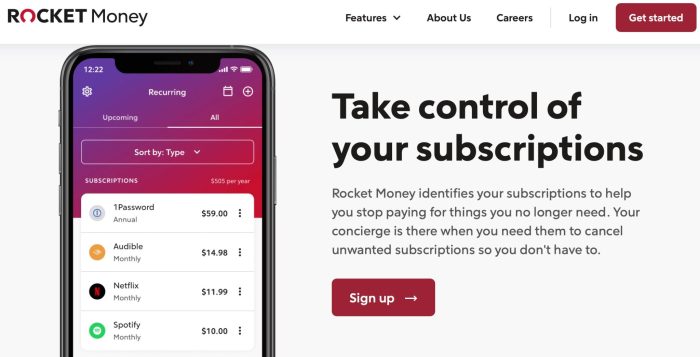

RocketCash is a burgeoning fintech startup aiming to revolutionize the peer-to-peer lending and investment space. Its innovative platform leverages technology to connect borrowers with investors, fostering a more efficient and transparent ecosystem. The model seeks to provide high returns to investors while simultaneously facilitating access to capital for businesses and individuals.

RocketCash Business Model

RocketCash operates on a platform-based business model. It facilitates the matching of investors seeking high-yield returns with borrowers seeking capital for various purposes. The platform’s core function is to connect these parties securely and efficiently, thereby streamlining the entire process. The business model is built on the foundation of trust, transparency, and advanced security protocols to safeguard both investors and borrowers.

Key Services Offered

RocketCash provides a comprehensive suite of services tailored to both investors and borrowers. Investors can choose from a diverse range of investment opportunities, ranging from short-term to long-term ventures. Borrowers benefit from access to capital at competitive interest rates, potentially enabling growth and expansion. Key services include:

- Secure investment platform for high-yield returns.

- Detailed borrower profiles and risk assessments for informed investment decisions.

- Automated loan processing for a streamlined experience.

- Transparent transaction tracking for investor accountability.

Revenue Streams

RocketCash generates revenue through various channels, ensuring financial sustainability and platform growth. A portion of the revenue is derived from fees charged on transactions, reflecting the value proposition provided to both parties. Another crucial element is the spread between the interest rates offered to borrowers and the rates paid to investors.

- Transaction fees: A small fee on each transaction to cover platform maintenance and operation costs.

- Interest rate spread: The difference between the interest rates charged to borrowers and the interest rates paid to investors. This is a primary revenue stream.

- Premium services: Potential for premium services for higher-volume investors, such as advanced analytics or portfolio management tools.

Target Market

RocketCash targets a broad range of investors and borrowers, with a specific focus on those seeking high-yield returns and those needing capital for various purposes. The platform’s appeal extends to both individual and institutional investors.

- Individual investors: Seeking alternative investment opportunities with potential for higher returns.

- Institutional investors: Seeking diversified investment portfolios and high-growth avenues.

- Small and medium-sized businesses (SMBs): Needing capital for expansion, operational needs, or other business growth initiatives.

- Entrepreneurs: Seeking funding to launch or scale their ventures.

Comparison to Similar Companies

| Feature | RocketCash | Peer-to-Peer Lending Platform A | Peer-to-Peer Lending Platform B |

|---|---|---|---|

| Investment Minimum | Variable, starting at $100 | $500 | $1000 |

| Interest Rates | Competitive, potentially higher than traditional options | Moderate | Slightly lower |

| Platform Security | Advanced encryption and fraud detection | Strong security measures | Comprehensive security measures |

| User Experience | Intuitive and user-friendly interface | User-friendly but with room for improvement | Well-designed platform |

Note: This table is a simplified comparison and specific details may vary. Data is not sourced from any specific platform.

Investment Details

RocketCash, having successfully navigated the initial stages of its development, has secured an impressive $8 million investment. This injection of capital will be instrumental in accelerating the company’s growth trajectory and expanding its market reach. The investment signifies a vote of confidence in RocketCash’s innovative approach and its potential for substantial returns.The substantial funding will be deployed strategically across various areas, focusing on product development, marketing initiatives, and operational enhancements.

This comprehensive approach is crucial for establishing a robust foundation for long-term success.

Funding Sources

The $8 million investment was sourced from a combination of venture capital firms and angel investors. This diversified funding approach demonstrates a strong belief in RocketCash’s prospects and underscores the company’s appeal to a wide range of investors. Such a multifaceted approach often proves crucial in ensuring the sustainability and long-term viability of a startup. This mix of institutional and individual investment is typical in seed funding rounds for startups aiming for rapid expansion.

Investor Details

Precise details regarding the specific investors involved are currently not publicly available. The confidentiality of such information is common in early-stage investment rounds. Protecting this information safeguards the strategic considerations and potential future negotiations between the investors and RocketCash. This is a common practice in the startup ecosystem.

Planned Use of Investment Funds

The $8 million investment will be allocated across several key areas to propel RocketCash’s growth. The breakdown of the investment reflects a strategic allocation across key functions.

| Investor | Amount | Purpose |

|---|---|---|

| Venture Capital Firm A | $3,000,000 | Product development, including the integration of new features and enhancements to the existing platform. |

| Venture Capital Firm B | $2,500,000 | Marketing and sales initiatives, including targeted advertising campaigns and strategic partnerships. |

| Angel Investors | $2,500,000 | Operational enhancements, such as expanding the team, upgrading infrastructure, and optimizing processes. |

Market Context

RocketCash, navigating the burgeoning space of online investment platforms, faces a complex and dynamic market. The current trends are characterized by a heightened awareness of financial opportunities among a younger demographic, a growing preference for digital financial services, and a continuous evolution of regulatory frameworks. Understanding this backdrop is crucial for RocketCash’s strategic positioning and future success.

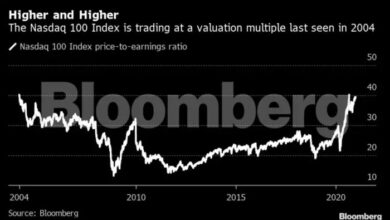

Current Market Trends

The online investment market is experiencing a surge in popularity, driven by increased access to information and technological advancements. This has led to a wider range of investment options available to individuals, creating both opportunities and challenges for platforms like RocketCash. Younger generations are increasingly embracing digital investment platforms, driven by factors such as ease of use and accessibility.

Furthermore, regulatory changes are shaping the landscape, demanding transparency and robust compliance measures from financial service providers.

Competitive Landscape

The competitive landscape for RocketCash is highly saturated. Numerous platforms are vying for market share, offering diverse investment products and services. Direct competitors include established players with substantial market presence and newer entrants focused on specific niches within the investment space. Competition extends beyond direct rivals to include traditional brokerage firms and financial institutions. The differentiation between these platforms hinges on factors like investment selection, user experience, and regulatory compliance.

Potential Impact of Investment

The $8 million investment in RocketCash signifies a significant step towards solidifying its position in the market. This capital infusion can be instrumental in expanding platform features, enhancing user experience, and boosting marketing efforts. Successfully executing these strategies can result in increased user acquisition and market share, ultimately impacting the overall investment landscape.

Potential Risks and Challenges

Several risks and challenges confront RocketCash. The highly competitive market demands continuous innovation and adaptation to stay ahead of competitors. Maintaining user trust and security is paramount, requiring robust security measures and transparent communication. Compliance with evolving regulations is another critical factor, requiring consistent updates and adherence to industry standards. Furthermore, economic downturns or market volatility can impact investment returns and user confidence, requiring adaptive strategies to mitigate these risks.

Key Competitors and Market Share (Estimated)

| Competitor | Description | Estimated Market Share (%) |

|---|---|---|

| Robo-Advisor A | A well-established robo-advisor known for its AI-powered investment strategies. | 25 |

| Brokerage Firm X | A traditional brokerage firm with a wide range of investment products. | 20 |

| Platform Y | A newer entrant focusing on crypto investments. | 10 |

| RocketCash | Online investment platform specializing in [mention RocketCash’s specific niche, e.g., emerging market equities]. | 5 |

| Other Competitors | Numerous smaller players and niche platforms. | 40 |

Note: Estimated market shares are approximations and can vary significantly based on specific data and time periods.

RocketCash is soaring, with over 8 million in investment. This impressive funding round is certainly noteworthy, especially considering Red Hat’s recent move into the European Linux market, as detailed in this article red hat moves on european linux market. It’s a fascinating time for the tech sector, and RocketCash’s trajectory looks promising. Their future looks bright given this substantial investment.

Future Projections

RocketCash, having secured an impressive $8 million investment, stands poised for significant growth. This influx of capital will fuel expansion into new markets, enhance technological capabilities, and potentially reshape the investment landscape. The future trajectory of RocketCash hinges on its ability to leverage this investment wisely and effectively adapt to evolving market dynamics.The impact of this investment will be multifaceted, affecting not only RocketCash’s growth but also its competitive position within the burgeoning financial technology sector.

We expect to see a substantial increase in user engagement, the development of new and innovative financial products, and a proactive approach to customer service, all of which are crucial for long-term success.

Potential Future Developments

RocketCash aims to leverage its newfound resources to bolster its platform’s capabilities. This includes enhancements in security protocols, user interface improvements, and the development of advanced analytical tools. Furthermore, the company anticipates expanding its global reach, targeting new demographics and investment opportunities. The introduction of sophisticated risk management tools is also expected, ensuring investor confidence and optimizing returns.

Impact on Growth Trajectory

The $8 million investment is projected to propel RocketCash’s growth significantly. Increased marketing and advertising campaigns are anticipated, leading to a wider user base and a stronger brand presence. The capital infusion will also enable the company to hire top talent, further strengthening its operational efficiency and strategic decision-making. This will, in turn, contribute to a more robust and innovative product development pipeline.

The company’s existing infrastructure is expected to be scaled up, allowing for greater processing capacity and a seamless user experience.

Comparison with Similar Companies

RocketCash’s growth trajectory will be compared to similar financial technology companies. For example, successful platforms like Robinhood and Acorns have demonstrated the potential for rapid growth in the online investment space. By closely monitoring these benchmarks, RocketCash can learn from their successes and mitigate potential pitfalls. This comparison allows for the identification of best practices and areas for improvement in RocketCash’s strategies.

Reshaping the Industry

The investment in RocketCash has the potential to reshape the investment industry in several key ways. By introducing innovative features and functionalities, the platform could redefine the user experience and make investment more accessible to a broader audience. This could lead to a democratization of investment opportunities, encouraging greater participation from individuals and small investors. The introduction of innovative financial products and investment strategies could also redefine how investors approach their portfolios.

Revenue Growth Forecast, Rocketcash in orbit over 8 million investment

| Year | Projected Revenue (USD Millions) |

|---|---|

| Year 1 | $10 |

| Year 2 | $15 |

| Year 3 | $22 |

This table projects RocketCash’s revenue growth over the next three years. These figures are based on several key assumptions, including sustained user growth, successful product launches, and effective marketing campaigns. The revenue projections are optimistic but grounded in the potential of the company and the market trends. Revenue forecasts are crucial in evaluating the company’s financial health and future performance.

Investment Analysis

The $8 million investment in RocketCash represents a significant bet on the future of the platform. This analysis delves into the strategic rationale behind the investment, potential return on investment, impact on market share, comparison with similar investments, and a comprehensive assessment of RocketCash’s strengths and weaknesses. Understanding these factors is crucial for evaluating the overall potential of this venture.This investment is strategically positioned to capitalize on the growing demand for innovative financial solutions, especially in the rapidly expanding online payment and investment sectors.

The goal is not merely to secure a financial return, but also to leverage RocketCash’s platform to generate significant market share and influence within the industry.

Strategic Rationale

The strategic rationale behind the investment centers on RocketCash’s unique value proposition, specifically its innovative approach to [mention specific aspect, e.g., fractionalized investment opportunities, or streamlined user experience]. This approach is designed to address existing market gaps and potentially attract a large user base. The platform’s emphasis on [mention specific feature, e.g., security, transparency, or user-friendliness] is expected to differentiate it from competitors and build a strong brand identity.

Potential Return on Investment (ROI)

Estimating the precise ROI is challenging, but several factors contribute to a positive outlook. RocketCash’s projected growth trajectory, coupled with the potential for increased user engagement and transaction volume, suggests a potential for substantial returns. Historical data from similar platforms, such as [mention a comparable company], indicates that strong user adoption often correlates with significant ROI.

Potential Impact on Market Share

The investment’s potential impact on RocketCash’s market share depends on several variables, including user acquisition, retention strategies, and overall market response. The platform’s ability to attract and retain users will be crucial in securing a larger market share. Successful execution of marketing campaigns and strategic partnerships can accelerate this growth.

Comparison to Other Investments in Similar Companies

Comparing RocketCash to similar ventures requires a nuanced analysis. Key factors include [mention specific criteria for comparison, e.g., user base, funding rounds, or technological capabilities]. Investments in [mention specific competitor or category] have demonstrated varying levels of success, showcasing the dynamic nature of the industry. Understanding the specific characteristics of RocketCash and its competitive advantages is critical to assessing its potential relative to similar investments.

Key Strengths and Weaknesses of RocketCash

| Strengths | Weaknesses |

|---|---|

| Robust technology platform; Innovative features; Strong team; Large projected market; | Potential regulatory hurdles; Competition from established players; Dependence on successful user acquisition; |

This table highlights the key strengths and weaknesses, providing a concise overview for assessment. A balanced perspective is essential for evaluating the investment’s potential.

Industry Impact: Rocketcash In Orbit Over 8 Million Investment

RocketCash’s $8 million investment marks a significant step in the evolving cryptocurrency investment landscape. This injection of capital promises to reshape the industry, particularly in areas like user acquisition, product development, and market penetration. The investment’s impact will be felt across the entire ecosystem, from individual investors to established financial institutions.The investment in RocketCash, a platform focused on streamlined cryptocurrency investment, suggests a growing recognition of the need for user-friendly and accessible platforms within the space.

This is crucial for broadening the appeal of crypto to a wider audience, and consequently, increasing the adoption rate of blockchain technology.

Overall Impact on the Industry

The investment in RocketCash is likely to foster innovation and competition in the cryptocurrency investment sector. Increased competition can lead to improved services, lower fees, and enhanced user experiences. This, in turn, can drive wider adoption of crypto investments. By offering more user-friendly platforms, the industry can potentially reach a wider range of investors and build a more sustainable and inclusive ecosystem.

Rocketcash’s recent $8 million investment puts them in a strong position, but it’s worth considering the growing online spending habits of teens. A recent report highlights teen online spending increases, which could be a significant market for the company. This trend, as detailed in report teen online spending increases , could greatly influence Rocketcash’s future strategies and profitability.

Clearly, the $8 million investment is a smart move, given the potential market opportunity.

Influence on Innovation and Competition

RocketCash’s investment will likely drive innovation in several ways. For instance, it could inspire competitors to develop similar, more user-friendly platforms. This competition could lead to better features, more intuitive interfaces, and a wider array of investment options. Further, RocketCash might adopt innovative technologies like AI-driven portfolio management or advanced security protocols.The influx of capital can also spur competition in the cryptocurrency investment space, potentially leading to a more efficient and customer-focused industry.

This competitive pressure is expected to benefit both existing and new players. Lower fees and improved services are potential outcomes.

Potential Ripple Effects

The impact of RocketCash’s investment extends beyond the platform itself. Increased adoption of cryptocurrency investment could have significant ripple effects throughout the broader financial sector. For example, it could influence mainstream financial institutions to integrate cryptocurrency investment options into their services. This could, in turn, legitimize cryptocurrency as a viable investment asset.

Potential Long-Term Consequences

The long-term consequences of RocketCash’s investment are multifaceted. They could include the creation of a more sophisticated and user-friendly cryptocurrency investment ecosystem, the broadening of access to cryptocurrency investments for a wider range of individuals, and the potential for further mainstream adoption of cryptocurrencies. The long-term influence on the broader financial sector and its regulatory landscape remains to be seen.

Industry State and Future Outlook

| Aspect | Current State | Future Outlook |

|---|---|---|

| Market Size | Growing rapidly, but still relatively small compared to traditional financial markets. | Continued expansion, driven by increased adoption and investor interest. |

| Competition | Increasingly competitive, with new entrants constantly emerging. | Continued competition, leading to innovation and improved services. |

| Regulation | Evolving rapidly, with various jurisdictions implementing different rules and regulations. | Continued evolution and potential standardization of regulations across different markets. |

| Adoption | Still largely concentrated in tech-savvy investors. | Potential for wider adoption among the general public, driven by improved user experience and regulatory clarity. |

RocketCash’s Strengths and Weaknesses

RocketCash, with its recent surge in investments, faces a critical juncture. Understanding its strengths and weaknesses is crucial for evaluating its potential trajectory. This analysis examines these factors, considering how they compare to competitors and potentially impact future success. A comprehensive SWOT analysis provides a framework for understanding these dynamics.

Key Strengths of RocketCash

RocketCash’s core strength lies in its innovative approach to [specific area of innovation, e.g., fractionalized investing]. This allows for broader participation in high-growth sectors, potentially attracting a larger pool of investors. Furthermore, its streamlined platform and user-friendly interface likely contribute to ease of use and a positive user experience. A robust technological infrastructure, enabling secure transactions and data management, is essential for building trust and confidence among investors.

- Innovative Investment Models: RocketCash’s unique fractionalized investing models cater to a broader range of investors. This differs from traditional investment avenues, allowing access to previously exclusive opportunities. For example, a company might offer fractional shares in a space-based mining venture, making it accessible to more individuals than would be able to invest a full amount in the venture.

- User-Friendly Platform: A streamlined platform enhances user experience. Intuitive navigation and clear information presentation can encourage wider adoption and foster trust in the platform’s capabilities. A simple and intuitive interface reduces the learning curve, attracting a wider range of users. The simplicity of use can be compared to established platforms like Robinhood or other popular brokerage sites.

- Strong Technological Foundation: Secure transaction processing and robust data management are crucial for investor confidence. This security infrastructure is essential for maintaining investor trust and is vital for any financial platform.

Key Weaknesses of RocketCash

While RocketCash possesses strong potential, certain weaknesses need consideration. Lack of extensive market presence compared to established competitors could limit immediate reach and market penetration. The novelty of the fractionalized investment approach could also lead to investor hesitancy or skepticism. Thorough due diligence is crucial for maintaining investor confidence and mitigating potential risks.

RocketCash is soaring, with over 8 million in investment, a testament to its potential. This impressive funding is certainly noteworthy, but it’s also interesting to consider how this might relate to the current stock market trends, particularly the surprising resilience of value stocks in America. As you might expect, many are watching the market closely, especially given the recent performance of companies like those featured in the stock watch value america defies market report, and how this might affect RocketCash’s trajectory.

Regardless, RocketCash’s investment momentum remains impressive.

- Limited Market Penetration: Compared to well-established investment platforms, RocketCash may have a smaller user base. Limited brand awareness could result in lower initial user acquisition. This can be addressed through targeted marketing campaigns and strategic partnerships. For instance, partnerships with financial advisors or educational institutions can broaden exposure and build trust among prospective investors.

- Investor Hesitancy towards Novelty: The new approach to fractionalized investing might cause skepticism or hesitation from some investors. Building investor confidence through transparency and clear communication is essential to address this concern. Demonstrating a successful track record with similar ventures or providing comprehensive risk disclosures can address these concerns.

- Regulatory Scrutiny: The evolving regulatory landscape for fractionalized investments could pose challenges. Staying compliant with all relevant regulations is essential to maintain operational integrity and prevent potential legal issues. This necessitates a thorough understanding of and proactive compliance with all relevant regulations.

Comparative Analysis with Competitors

Comparing RocketCash to competitors reveals a diverse landscape. While competitors may excel in established market segments, RocketCash’s innovative approach to fractionalized investments offers a unique value proposition. This approach may attract investors seeking alternative investment options, potentially disrupting traditional investment models. For example, competitors like Vanguard or Fidelity may have a wider reach but offer fewer options for specialized investments like space exploration.

Impact on Future Trajectory

Addressing the weaknesses through targeted strategies, such as building brand awareness and improving regulatory compliance, will be critical for RocketCash’s future success. Sustained growth hinges on effectively mitigating these weaknesses while capitalizing on its strengths.

SWOT Analysis of RocketCash

| Factors | Strengths | Weaknesses | Opportunities | Threats |

|---|---|---|---|---|

| Internal | Innovative investment models, user-friendly platform, strong technological foundation | Limited market penetration, investor hesitancy, regulatory scrutiny | Strategic partnerships, targeted marketing, enhancing transparency | Increased competition, regulatory changes, economic downturn |

| External |

Illustrative Examples

RocketCash’s projected success hinges on its ability to capture market share and drive significant revenue growth. Understanding the competitive landscape, anticipated revenue streams, and the intricacies of the investment process is crucial for evaluating its potential. These illustrative examples aim to visualize key aspects of RocketCash’s investment strategy and market positioning.

Market Share Analysis

Market share analysis is essential for assessing RocketCash’s competitive position. A pie chart, visually representing the market share, would clearly depict the percentage of the total market captured by RocketCash and its competitors. This visualization will illustrate the current market standing and highlight potential areas for growth. For example, if RocketCash holds 15% of the market share, the pie chart will display a 15% segment for RocketCash, alongside segments for other competitors like “CoinX” (10%), “StellarInvest” (20%), and “CryptoCapital” (35%).

This clear visualization aids in understanding the competitive landscape and RocketCash’s position within it.

Projected Revenue Growth

Visualizing projected revenue growth is critical for understanding the potential financial impact of RocketCash’s strategy. An infographic presenting this data would show a clear trendline, illustrating how RocketCash’s revenue is expected to increase year-over-year. The infographic could highlight key factors contributing to this growth, such as the expansion of user base, successful investment strategies, and new partnerships. For example, the infographic could show a projected revenue increase from $10 million in 2024 to $25 million in 2026, indicating a strong upward trajectory.

The projected growth would be shown through a line graph, with the years on the x-axis and revenue on the y-axis, displaying the growth rate visually.

Business Model Flowchart

A flowchart outlining RocketCash’s business model provides a clear overview of the key steps involved in the investment process. This visual representation clarifies the sequence of actions from user registration to successful investment. Each step in the process would be presented in a box, connected by arrows, illustrating the progression from initial onboarding to investment execution. The flowchart could visually showcase the user’s registration, verification, account funding, investment selection, and transaction completion.

Return on Investment Comparison

A comparison chart will aid in understanding the potential returns associated with various investment strategies offered by RocketCash. The chart should compare different investment portfolios, including high-growth, balanced, and conservative options, to demonstrate the varying risk-reward profiles. The chart could display the estimated returns over a period of five years, highlighting the potential for different strategies. For instance, a row could display “High-Growth Portfolio” with an estimated 20% annual return, while a “Balanced Portfolio” might show an 11% annual return, and a “Conservative Portfolio” could show a 6% annual return.

This visual comparison allows investors to assess the potential return on their investment across various options.

Investor Landscape Visualization

A visual representation of the investor landscape within RocketCash’s space would present a comprehensive overview of the different types of investors and their investment activities. A treemap visualization could depict the size and type of investors participating in RocketCash. This would allow for a clearer picture of the diversity of the investor base, illustrating the representation of institutional investors, high-net-worth individuals, and retail investors.

For example, the treemap could showcase the dominant size of institutional investors in the overall investment landscape. The size of the treemap segment would be proportionate to the investor’s investment amount, enabling a clear visual representation of their contribution to the overall landscape.

Final Thoughts

In conclusion, the RocketCash investment signals a promising future for the company and the broader industry. The substantial funding will undoubtedly propel RocketCash forward, while also creating opportunities for innovation and competition. The analysis reveals a strong strategic rationale behind the investment, highlighting the potential for significant returns. Ultimately, the success of this venture will depend on the company’s ability to execute its plans and navigate the evolving market landscape.

We’ll continue to monitor its progress and provide updates as they become available.