Report traditional financial services must adapt or perish – Report: Traditional financial services must adapt or perish. The financial world is rapidly evolving, and traditional institutions face a critical juncture. Disruptive technologies like fintech, AI, and blockchain are reshaping the landscape, challenging established models and customer expectations. This report examines the crucial adjustments needed for survival, from embracing digital transformation to optimizing operational efficiency and forging strategic partnerships.

The future of finance depends on these institutions’ ability to adapt quickly and decisively.

The report delves into the key areas of concern for traditional financial institutions, including the evolving needs of modern consumers, technological advancements, and the importance of maintaining operational efficiency and regulatory compliance. It presents a detailed analysis of how these institutions can compete effectively in the new financial ecosystem. The report also offers a glimpse into the future of finance and the role of traditional institutions in society.

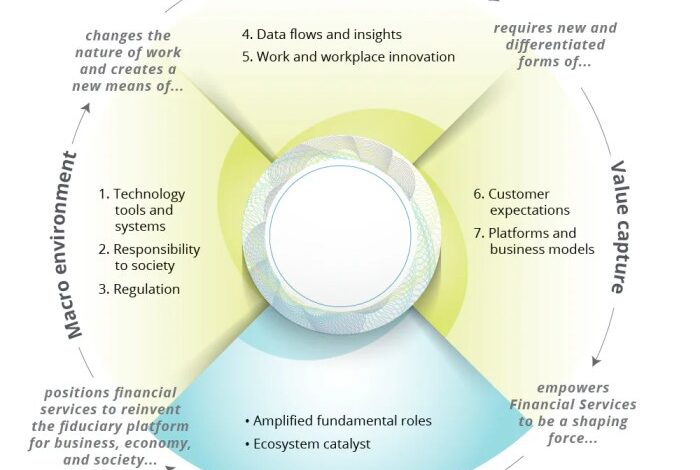

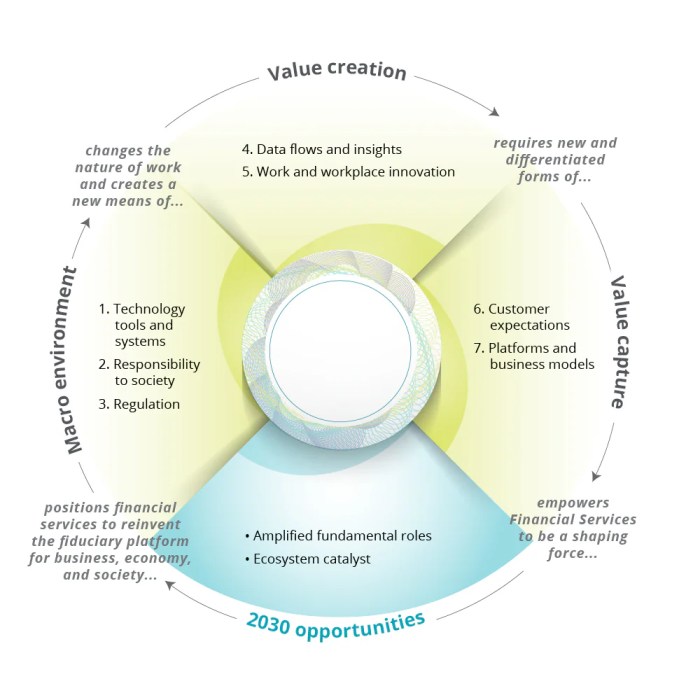

The Evolving Landscape of Financial Services

The traditional financial services industry, built on decades of established processes and regulations, is undergoing a seismic shift. This transformation is driven by rapid technological advancements, changing customer expectations, and the emergence of innovative financial technology (fintech) companies. Navigating this evolving landscape requires a strategic approach to adaptation for existing institutions to remain competitive and relevant.The current state of traditional financial services is characterized by a growing demand for digital channels and personalized experiences.

Customers increasingly expect seamless online interactions, mobile banking, and customized financial advice. However, this demand is often met with legacy systems and processes that are slow to adapt, creating a gap between customer expectations and service delivery. This gap presents a significant challenge for traditional institutions, requiring them to embrace new technologies and approaches.

Key Trends and Challenges in Traditional Financial Services

Traditional financial institutions face numerous challenges in the evolving landscape. These challenges include the need to enhance customer experience, manage cybersecurity risks, comply with evolving regulations, and compete with agile fintech companies. Furthermore, maintaining profitability in a competitive market while fostering responsible growth is paramount.

- Increased Customer Expectations: Customers now expect instant access to information, personalized financial advice, and seamless integration across various financial products. Traditional institutions must invest in modern technology and customer service strategies to meet these expectations.

- Cybersecurity Threats: The digitalization of financial services has exposed the industry to heightened cybersecurity risks. Data breaches and fraudulent activities can result in significant financial losses and reputational damage. Traditional institutions need robust cybersecurity measures to safeguard customer data and maintain trust.

- Regulatory Compliance: Financial regulations are constantly evolving to address new risks and challenges. Traditional institutions must adapt to these changes and ensure compliance to avoid penalties and maintain operational stability.

- Competition from Fintech: Fintech companies are disrupting traditional financial services by offering innovative products and services at lower costs. This competition requires traditional institutions to embrace innovation and efficiency to maintain market share.

Disruptive Technologies and Innovations

Several disruptive technologies are reshaping the financial services industry. These include fintech, artificial intelligence (AI), and blockchain technology. These technologies are offering opportunities for increased efficiency, personalized services, and enhanced security.

- Fintech: Fintech companies are leveraging technology to create new financial products and services, often with lower costs and improved accessibility. Examples include peer-to-peer lending platforms and mobile payment systems. This disruptive force necessitates a strategic response from traditional institutions.

- Artificial Intelligence (AI): AI is being used to automate tasks, personalize customer experiences, and detect fraudulent activities. AI-powered chatbots and risk assessment tools are transforming customer service and operational efficiency within financial institutions.

- Blockchain: Blockchain technology is being explored for its potential to improve transparency, security, and efficiency in financial transactions. Its application in areas like cross-border payments and secure asset management is gaining traction.

Successful Adaptations by Existing Financial Institutions

Many traditional financial institutions are successfully adapting to the changing landscape. These institutions are embracing digital transformation, investing in fintech companies, and developing innovative solutions to meet evolving customer needs.

- Digital Transformation Initiatives: Many banks are investing heavily in digital platforms and mobile applications to enhance customer experience and offer more convenient access to financial services.

- Strategic Partnerships with Fintech Companies: Some financial institutions are partnering with fintech companies to access new technologies and expertise. This collaboration can help bridge the gap between traditional approaches and innovative solutions.

- Developing Innovative Financial Products: Some institutions are creating new financial products tailored to specific customer segments and needs. This responsiveness is key to staying relevant in a rapidly changing market.

Potential Consequences of Inaction

Failing to adapt to the evolving financial services landscape can have severe consequences for traditional institutions. These institutions risk losing market share, becoming irrelevant to customers, and ultimately facing financial distress.

- Loss of Market Share: If traditional institutions fail to adapt to the changing market dynamics, they risk losing market share to agile fintech companies that are more responsive to customer needs.

- Decreased Customer Engagement: Traditional institutions that are slow to adopt new technologies and services may experience a decline in customer engagement, as customers increasingly prefer more convenient and innovative solutions.

- Financial Distress: The inability to adapt can lead to significant financial losses and even financial distress for institutions that fail to embrace change.

Comparison of Traditional Financial Institutions and Emerging Fintech Companies

| Feature | Traditional Financial Institutions | Emerging Fintech Companies |

|---|---|---|

| Technology | Legacy systems, often slow to adapt | Agile, innovative technologies |

| Customer Experience | Often impersonal, limited digital channels | Personalized, highly digitalized |

| Cost Structure | High overhead, complex operations | Often lower operational costs |

| Regulation | Subject to stringent regulations | Navigating regulatory landscapes |

| Scalability | Potentially slower scaling | Often rapid scalability |

Adapting to Customer Expectations

The financial services industry is undergoing a dramatic transformation, driven by the evolving needs and preferences of modern consumers. Traditional institutions, if they hope to thrive in this new landscape, must embrace innovation and adapt to the changing expectations of their customers. This requires a fundamental shift in how financial services are delivered, focusing on accessibility, personalization, and seamless digital experiences.Financial institutions need to recognize that customers are increasingly tech-savvy and expect a level of convenience and control that was unimaginable just a few years ago.

This necessitates a significant investment in digital transformation, moving beyond basic online banking to encompass sophisticated mobile applications, AI-powered tools, and personalized financial advice. The future of finance is intertwined with the future of technology, and institutions that fail to adapt will likely struggle to retain customers.

Changing Needs and Preferences of Modern Consumers

Modern consumers are demanding more than just basic financial products. They seek transparency, simplicity, and a high degree of personalization in their interactions with financial institutions. They are increasingly comfortable using technology to manage their finances, and expect seamless integration across different platforms. Speed and efficiency are key, as is a user-friendly interface. The ability to access information and manage accounts 24/7 is becoming the norm.

Consumers are also showing a growing interest in ethical and sustainable financial practices.

Importance of Digital Transformation

Digital transformation is no longer a luxury but a necessity for financial institutions. It involves not just migrating existing services online, but fundamentally reimagining how financial products and services are delivered. This includes developing intuitive mobile apps, implementing robust cybersecurity measures, and leveraging artificial intelligence for personalized financial advice and fraud detection. Digital platforms allow institutions to reach a wider customer base, reduce operational costs, and improve customer satisfaction.

Reports are flooding in that traditional financial services need a serious overhaul, or they’ll be left behind. This need for adaptation extends beyond just the sector itself; consider how espanol com joins a crowded Spanish language field —it highlights the ever-evolving digital landscape and the importance of reaching diverse audiences. Ultimately, traditional finance needs to embrace innovation and change to stay relevant in a rapidly transforming world.

Examples of successful digital transformation in the financial sector include the rise of robo-advisors and the increasing use of fintech solutions.

Need for Personalized Financial Services and Products

Consumers are increasingly seeking personalized financial services tailored to their specific needs and circumstances. This goes beyond simply offering different product packages. It involves understanding individual financial goals, risk tolerances, and aspirations. Financial institutions need to leverage data analytics and machine learning to provide truly personalized advice and product recommendations. This can range from automated investment portfolios adjusted to individual risk profiles to personalized budgeting tools.

The use of AI-powered chatbots and virtual assistants can provide quick, accessible support to customers.

Innovative Customer Service Models

To meet evolving customer expectations, financial institutions need to move beyond traditional customer service models. Innovative approaches include:

- 24/7 accessibility: Providing online and mobile access to accounts and services, ensuring customers can manage their finances at any time.

- Proactive customer support: Using technology to anticipate customer needs and proactively address potential issues.

- Personalized financial advice: Offering tailored financial advice and support based on individual circumstances.

- Emphasis on user experience (UX): Designing intuitive and user-friendly interfaces for all digital channels.

Customer Segmentation and Evolving Expectations

Understanding different customer segments and their evolving expectations is critical for tailoring financial products and services. A robust segmentation strategy allows institutions to tailor marketing campaigns, service offerings, and product development.

| Customer Segment | Evolving Expectations |

|---|---|

| Millennials | Simplicity, speed, and transparency in financial services, strong online presence, personalized advice. |

| Gen Z | Focus on sustainability, ethical investments, ease of use, strong social media presence, gamified experiences. |

| Baby Boomers | Trustworthy advice, personalized service, familiar interactions, intuitive technology that does not overwhelm. |

| High-net-worth individuals | Sophisticated investment strategies, personalized wealth management, tailored advice, seamless global access. |

Technological Advancements and Integration: Report Traditional Financial Services Must Adapt Or Perish

The financial services industry is undergoing a rapid transformation, driven largely by technological advancements. From online banking and mobile payments to sophisticated AI algorithms, technology is reshaping how financial institutions operate and interact with customers. This evolution necessitates a strategic approach to integration and adaptation to maintain competitiveness and relevance. The key is to understand not just the

- what* of these technologies, but also the

- how* and

- why* they are impacting the sector.

The future of finance is intricately linked to the effective utilization of technology. Financial institutions must embrace technological innovation not just as a means to an end, but as a core component of their business strategy. This involves a holistic approach that encompasses not only the implementation of specific technologies, but also the development of a culture of continuous learning and adaptation within the organization.

Role of Technology in Transforming Financial Services

Technology is fundamentally altering the financial landscape. From automating routine tasks to providing personalized financial advice, technology is streamlining operations, reducing costs, and enhancing customer experience. Digital platforms have become the primary point of contact for many consumers, demanding a seamless and user-friendly experience. This shift necessitates a focus on developing robust digital infrastructure and providing reliable access to financial services.

AI and Machine Learning in Enhancing Financial Processes

AI and machine learning are revolutionizing financial processes. AI-powered systems can analyze vast amounts of data to identify patterns and predict future trends, leading to more accurate risk assessments, personalized financial advice, and fraud detection. For example, algorithms can assess creditworthiness more efficiently, allowing for faster loan approvals and reducing the risk of default. Machine learning can also optimize investment strategies and personalize financial products to meet individual needs.

These advancements are creating more efficient and accurate financial processes.

Blockchain Technology for Security and Efficiency

Blockchain technology offers a secure and transparent platform for financial transactions. Its decentralized nature ensures data integrity and immutability, significantly reducing the risk of fraud and errors. This can be particularly beneficial for cross-border payments and supply chain finance, where the secure and transparent tracking of assets and transactions is critical. Blockchain is already being implemented in various areas of finance, demonstrating its potential to revolutionize financial operations.

Integration of Various Technologies within a Single Financial Platform

The integration of various technologies into a single financial platform is crucial for creating a cohesive and efficient customer experience. This involves combining online banking, mobile payments, AI-powered risk assessment tools, and blockchain-based security features into a unified platform. A seamless and intuitive interface is essential to ensure user adoption and streamline operations. For example, a financial institution could integrate AI-driven fraud detection with blockchain-based transaction verification to significantly enhance security.

Advantages and Disadvantages of Adopting Different Technologies

| Technology | Advantages | Disadvantages |

|---|---|---|

| AI/Machine Learning | Improved risk assessment, personalized services, fraud detection, optimized investment strategies | Data dependency, potential for bias in algorithms, high implementation costs |

| Blockchain | Enhanced security, transparency, immutability of records, reduced fraud | Scalability issues, complexity in implementation, regulatory uncertainty |

| Cloud Computing | Scalability, cost-effectiveness, accessibility, flexibility | Security concerns, vendor lock-in, potential for downtime |

Operational Efficiency and Cost Reduction

Traditional financial institutions face immense pressure to adapt to the changing market landscape. Staying competitive requires a laser focus on operational efficiency and cost reduction, enabling them to invest in innovation, enhance customer experiences, and maintain profitability. This necessitates a proactive approach to streamlining processes, embracing automation, and leveraging data-driven insights.Operational excellence is no longer a luxury; it’s a necessity for survival in the modern financial services arena.

Financial institutions must not only maintain their current market share but also proactively seek ways to lower costs and increase their bottom line. This is achieved through a comprehensive strategy that encompasses process optimization, automation, and a robust data-driven decision-making framework.

Strategies for Optimizing Operational Processes

Streamlining processes is crucial for achieving operational efficiency. This involves analyzing current workflows, identifying bottlenecks, and implementing solutions to eliminate redundancies. Detailed process mapping can reveal areas for improvement and suggest innovative approaches to complete tasks. Implementing lean principles can help optimize workflows and reduce waste, while digital transformation initiatives can further streamline operations and create more efficient processes.

Opportunities for Automation and Streamlining Operations

Automation presents a significant opportunity for cost reduction and improved efficiency. Robotic Process Automation (RPA) can automate repetitive tasks, freeing up human capital for higher-value activities. Implementing AI-powered tools can automate tasks such as fraud detection, customer service interactions, and loan processing. Furthermore, leveraging cloud-based solutions can offer scalable and cost-effective infrastructure.

Importance of Cost-Effective Solutions for Maintaining Competitiveness

Cost-effective solutions are vital for maintaining a competitive edge. Financial institutions need to evaluate and select technologies that offer the best value for the investment. Cloud computing, for instance, provides scalable and cost-effective infrastructure, eliminating the need for expensive on-premises data centers. Open-source software and tools can provide cost-effective solutions without sacrificing quality or functionality.

Need for a Data-Driven Approach to Decision-Making

Data analysis is critical for making informed decisions about process optimization and cost reduction. Analyzing transaction data, customer behavior, and market trends can reveal patterns and insights that can inform strategic choices. Data-driven insights can help identify areas for process improvement, anticipate future challenges, and optimize resource allocation.

Potential Cost Savings Through Process Optimization

| Process Area | Potential Cost Savings (USD) | Description |

|---|---|---|

| Loan Processing | $50,000 – $100,000 per month | Automating loan applications, documentation, and approvals can reduce processing time and errors. |

| Customer Service | $25,000 – $50,000 per month | Chatbots and AI-powered customer service tools can handle routine inquiries, freeing up human agents for more complex issues. |

| Fraud Detection | $10,000 – $20,000 per month | AI-powered fraud detection systems can identify suspicious activities more quickly and accurately, preventing financial losses. |

| Compliance | $15,000 – $30,000 per month | Automated compliance monitoring tools can reduce the time and resources needed for regulatory reporting and compliance checks. |

“A well-designed and implemented process optimization strategy can lead to substantial cost savings and improved efficiency for traditional financial institutions.”

Regulatory Compliance and Risk Management

The financial services industry is facing an increasingly complex regulatory environment. Navigating this landscape requires a proactive approach to compliance and robust risk management strategies. Failure to adapt can lead to significant penalties and reputational damage, highlighting the critical need for financial institutions to stay ahead of the curve.

Reports are flooding in that traditional financial services need a serious overhaul or face extinction. It’s a pretty grim outlook, but maybe a little competition from innovative platforms like Yahoo’s new auction program for merchants, yahoo launches new auction program for merchants , could spark some much-needed change. Ultimately, the industry needs to adapt or risk becoming irrelevant in the modern financial landscape.

Evolving Regulatory Landscape

The regulatory landscape for financial institutions is constantly evolving. New regulations often emerge in response to market developments, technological advancements, and societal concerns. These changes can encompass areas such as data privacy, anti-money laundering (AML), know-your-customer (KYC), and cybersecurity. Understanding and anticipating these changes is crucial for staying compliant and maintaining investor confidence. For example, the implementation of GDPR across Europe has had a profound impact on data handling practices within the financial sector, requiring significant adjustments in data collection and storage policies.

Importance of Robust Risk Management Strategies

Robust risk management strategies are essential for financial institutions to mitigate potential losses and maintain financial stability. Effective risk management involves identifying, assessing, and mitigating various risks, including market risk, credit risk, operational risk, and reputational risk. A well-defined risk framework enables proactive measures to prevent and address potential issues. Failure to manage risks effectively can lead to substantial financial losses, impacting both the institution and its stakeholders.

Challenges of Maintaining Compliance in a Rapidly Changing Environment

Maintaining compliance in a dynamic regulatory environment presents significant challenges. The sheer volume of regulations, their complexity, and the need for constant adaptation can strain resources and require significant investments in training and technology. Staying current with evolving legal and regulatory requirements is critical. Keeping abreast of changes in international and national legislation is essential for compliance.

Examples of Successful Risk Management Frameworks

Several financial institutions have implemented successful risk management frameworks. These frameworks typically incorporate elements such as risk appetite statements, comprehensive risk assessments, and well-defined escalation procedures. A strong internal control system and ongoing monitoring are essential components. For example, some institutions have established dedicated compliance departments with clear lines of authority and responsibility, ensuring that compliance efforts are properly integrated into the organization’s overall operations.

Reports are flooding in that traditional financial services need a serious overhaul, or they’ll be left in the dust. Think about how Dell, Microsoft, and the SBA had to scramble to fix Y2K issues; dell microsoft sba address y2k issues highlight the need for adaptability in the face of rapid technological change. This underscores the urgency for the financial industry to embrace innovation or risk becoming irrelevant.

They need to move with the times, or face the same fate as the dinosaurs.

Compliance Requirements for Various Financial Products

| Financial Product | Key Compliance Requirements |

|---|---|

| Investment Funds | Regulation of fund structures, investor protection, reporting requirements, and AML/KYC measures. |

| Mortgages | Compliance with lending regulations, underwriting standards, and consumer protection laws. |

| Trading Activities | Compliance with market regulations, including insider trading restrictions, fair pricing, and market manipulation rules. |

| Payment Services | Compliance with payment regulations, anti-money laundering rules, and consumer protection regulations. |

The table above illustrates a simplified overview of compliance requirements. Each product type has its unique set of rules and guidelines that must be strictly adhered to. Failure to meet these requirements can result in substantial penalties and legal repercussions.

Competitive Strategies for Survival

The financial services industry is undergoing a dramatic transformation. Traditional institutions face intense pressure from nimble fintech companies and changing customer expectations. To thrive in this new landscape, these established players must adopt innovative competitive strategies that address both immediate needs and long-term sustainability. These strategies must balance cost-cutting with a focus on customer experience and the adoption of emerging technologies.Adapting to this evolving environment requires a multifaceted approach that prioritizes operational efficiency, product innovation, and strategic partnerships.

Simply maintaining the status quo is no longer an option; proactive measures are essential for survival and growth.

Competitive Strategies

Different competitive strategies are employed by financial institutions, each with its own strengths and weaknesses. Cost leadership, differentiation, and focus strategies are common approaches. Cost leadership focuses on achieving the lowest operational costs to offer the most competitive pricing. Differentiation strategies seek to create unique products or services that set the institution apart from competitors. A focus strategy concentrates on serving a niche market effectively, tailoring products and services to specific customer segments.

Strategic Partnerships

Strategic partnerships are becoming increasingly vital for traditional financial institutions. Collaborations with fintech companies, technology providers, and other financial institutions can bring together specialized expertise, resources, and market reach. This collaborative approach can accelerate innovation, improve service offerings, and expand market share.

Innovation in Product Offerings

Innovation in product offerings is critical for attracting and retaining customers in the modern financial landscape. Traditional financial institutions must embrace digital channels, personalized services, and new financial products to address evolving customer needs. For example, offering mobile-first banking experiences, integrating AI-powered tools for customer service, and developing new investment products that cater to specific demographics are all examples of this proactive approach.

This necessitates a willingness to experiment with new technologies and approaches, while maintaining a strong foundation of security and regulatory compliance.

Potential Strategic Partnerships

| Traditional Financial Institution | Potential Partner | Potential Benefits |

|---|---|---|

| Large Bank (e.g., Bank of America) | Cloud Computing Provider (e.g., Amazon Web Services) | Enhanced security and scalability of online banking services; access to cutting-edge technology. |

| Regional Credit Union | Fintech Company specializing in small business lending | Access to a wider pool of small business customers and expertise in digital lending. |

| Investment Bank | Cybersecurity Firm | Enhanced protection against cyber threats and improved regulatory compliance; increased trust and confidence from investors. |

| Insurance Company | Data Analytics Firm | Better understanding of customer risk profiles and improved pricing models. |

The Future of Traditional Financial Services

Traditional financial institutions face a complex and rapidly evolving landscape. They must adapt to maintain relevance and profitability in a world increasingly driven by technology and changing customer expectations. The future of these institutions hinges on their ability to embrace innovation, prioritize customer experience, and foster strong community ties. This necessitates a strategic shift from traditional operating models to a more agile and customer-centric approach.

A Vision for Future Financial Institutions, Report traditional financial services must adapt or perish

The future of traditional financial institutions involves a shift towards a more holistic and integrated approach to financial management. This means moving beyond transactional services to encompass advisory roles and personalized financial solutions. This vision includes providing comprehensive financial planning, investment management, and wealth management services. The integration of technology will play a pivotal role in streamlining operations, enhancing customer experience, and expanding reach.

The Role of Financial Institutions in Society

Financial institutions play a crucial role in fostering economic growth and stability. They act as vital intermediaries, channeling funds from savers to borrowers and facilitating economic activity. In the future, their role will expand to encompass social responsibility, supporting initiatives that promote financial inclusion, community development, and environmental sustainability. Examples include microfinance programs, community investment funds, and partnerships with non-profit organizations.

The Importance of Community Engagement

Strong community engagement is essential for the long-term success of financial institutions. This includes actively participating in local initiatives, supporting local businesses, and fostering trust and relationships within the community. By becoming an integral part of the community, financial institutions can build loyalty, enhance their reputation, and contribute positively to the overall well-being of the region. For instance, local branches can partner with local schools and organizations to promote financial literacy programs.

Potential for New Business Models and Revenue Streams

Innovative business models and revenue streams are crucial for financial institutions to remain competitive. This includes leveraging technology to offer new products and services, such as digital banking platforms, robo-advisors, and personalized financial management tools. Further, partnerships with fintech companies and the exploration of alternative investment avenues can diversify revenue sources. Examples include offering subscription-based financial planning services or introducing fractional ownership of investments.

Key Components of a Future-Proof Financial Institution

| Component | Description |

|---|---|

| Customer-Centric Approach | Prioritizing customer needs and preferences, providing personalized financial solutions, and enhancing customer experience through seamless digital channels. |

| Technological Integration | Implementing cutting-edge technologies, such as AI and machine learning, to streamline operations, improve decision-making, and enhance security. |

| Operational Efficiency and Cost Reduction | Optimizing internal processes, reducing operational costs, and leveraging automation to enhance productivity. |

| Community Engagement | Actively participating in local initiatives, supporting local businesses, and fostering relationships within the community. |

| Risk Management and Compliance | Implementing robust risk management frameworks, adhering to regulatory standards, and proactively addressing emerging financial risks. |

| Adaptability and Innovation | Embracing change, fostering a culture of innovation, and exploring new business models to stay ahead of the competition. |

| Financial Inclusion | Supporting initiatives that promote financial inclusion, particularly for underserved populations, through tailored products and services. |

Closure

In conclusion, the report highlights the urgent need for traditional financial services to adapt or face obsolescence. The evolving landscape necessitates a multifaceted approach, encompassing digital transformation, strategic partnerships, and innovative product offerings. Embracing technological advancements, understanding customer expectations, and optimizing operational efficiency are crucial for survival. This report serves as a roadmap for financial institutions to navigate the challenges and seize the opportunities in the ever-changing financial world.