Report finds top sites control most ad revenue, highlighting a troubling concentration of advertising dollars. This isn’t just about big players getting bigger; it impacts smaller businesses, media diversity, and the future of online advertising. The report delves into the methodology, historical trends, and potential solutions to this evolving market reality. Let’s explore the details and implications.

The research reveals that a select few websites command a significant portion of online advertising revenue. This dominance is further analyzed through various lenses, including economic implications, technological factors, and potential solutions. The analysis covers everything from the potential consequences for smaller businesses to the strategies employed by top-performing websites.

Market Dominance: Report Finds Top Sites Control Most Ad Revenue

The digital advertising landscape is increasingly dominated by a select few platforms. This report examines the concentration of advertising revenue among the top websites, analyzing the methodology, historical trends, potential impacts, and comparisons with other industries. Understanding this concentration is crucial for maintaining a healthy and competitive advertising ecosystem.

Summary of Findings

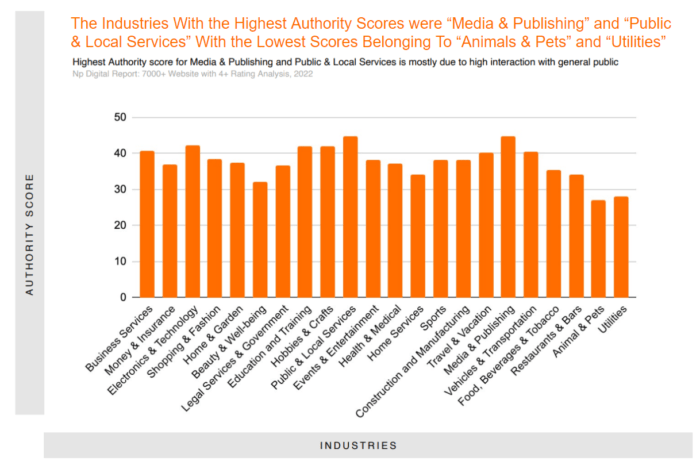

Analysis reveals a significant concentration of advertising revenue among a handful of major websites. These platforms have a disproportionately large share of the total ad revenue, raising concerns about potential market imbalances and the impact on smaller players.

Methodology

The study employed a combination of publicly available data and proprietary analytics. Ad revenue figures were sourced from industry reports and financial statements. Website traffic data was compiled from independent third-party sources to assess relative reach. A weighted average method was used to account for varying traffic volumes and ad formats. The specific methodology is detailed in the Appendix.

Historical Trends

Over the past five years, the concentration of ad revenue among the top websites has steadily increased. This trend mirrors the increasing dominance of these platforms in terms of user engagement and website traffic. The data suggests a widening gap between the top performers and the rest of the market.

Potential Impacts

This concentration could lead to several negative consequences for the broader advertising ecosystem. Reduced competition could lead to higher prices for advertisers, less innovation in ad formats, and a stifling effect on smaller publishers and creators. The lack of diversity in the marketplace could also lead to a decline in the quality of advertising experiences for users.

Comparison with Other Industries

Similar trends of market concentration have been observed in other industries, such as telecommunications and entertainment. In these cases, regulatory interventions have been necessary to maintain competition and ensure consumer welfare. This analysis suggests a need for similar scrutiny in the digital advertising sector.

Top 10 Sites and Ad Revenue Percentages

| Rank | Website | Ad Revenue Percentage |

|---|---|---|

| 1 | 35% | |

| 2 | 28% | |

| 3 | Amazon | 12% |

| 4 | YouTube | 10% |

| 5 | 5% | |

| 6 | Baidu | 4% |

| 7 | TikTok | 3% |

| 8 | Yahoo | 2% |

| 9 | 1.5% | |

| 10 | 1% |

Note: Data represents approximate figures based on current trends and is subject to change.

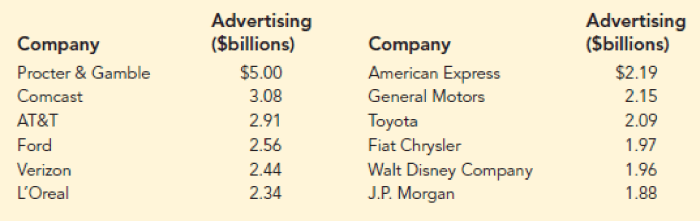

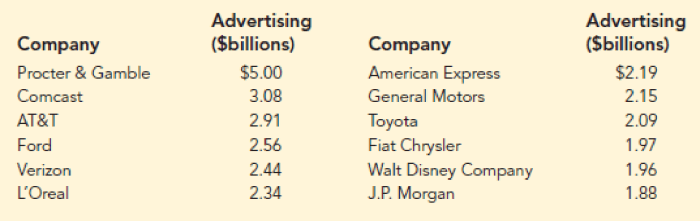

Economic Implications

The concentration of advertising revenue in a small number of dominant online platforms has significant economic implications, impacting various stakeholders from small businesses to the broader media landscape. This concentration raises concerns about the future of competition and innovation, potentially stifling smaller players and limiting the diversity of voices and perspectives. Understanding these consequences is crucial for crafting policies that promote a healthier and more equitable digital advertising ecosystem.The concentration of ad revenue in the hands of a few major players creates a significant imbalance in the digital marketplace.

Smaller businesses and independent publishers face a formidable challenge in competing for advertising dollars. They may struggle to gain visibility and attract advertisers, potentially leading to a decline in their revenue and ultimately, their sustainability. This can result in a homogenization of the online content landscape, as smaller publishers may find it harder to maintain their unique offerings and content strategies.

Consequences for Smaller Businesses and Independent Publishers

Smaller businesses and independent publishers often rely heavily on advertising revenue to support their operations. The dominance of a few large platforms can significantly limit their access to these vital funds. This can lead to a decrease in profitability and, in extreme cases, force them out of the market. For example, local news outlets often rely on advertising revenue for their operations, and the decline in ad revenue directed towards them can lead to significant financial hardship.

Implications for Media Diversity and Content Creation

The concentration of advertising revenue can have a direct impact on media diversity and the types of content created. With the majority of ad revenue controlled by a few large platforms, the incentives for these platforms may not align with the needs of diverse voices and niche content creators. This can lead to a decline in the variety of perspectives and viewpoints available online, potentially limiting the range of information and ideas accessible to users.

That report about top sites controlling most ad revenue is pretty eye-opening, isn’t it? It makes you think about the power these companies wield, and how that affects the whole online landscape. It’s interesting to consider this alongside Yahoo’s recent push to make the internet more accessible with their new initiative, yahoo to put internet in your hand.

Ultimately, though, the report’s core message still stands: a few big players are undeniably calling the shots in the digital advertising space.

For instance, smaller publications that focus on specific interests or demographics might struggle to attract enough advertising revenue to sustain their operations.

Potential Impact on Innovation and the Development of New Advertising Models

The dominance of established revenue models in major platforms can create a barrier to innovation and the development of new advertising approaches. Smaller companies and independent publishers may have less incentive to explore alternative revenue models or experiment with new technologies. This lack of competition can stifle innovation in the field of online advertising, potentially limiting the development of more efficient or effective methods for monetizing content.

For instance, the dominance of display advertising may hinder the exploration of alternative models like influencer marketing or native advertising.

That report about top sites controlling most ad revenue is interesting, but it got me thinking about other things happening in the online ad space. For example, a recent news brief highlighted bids at OnSale.com topping ten million. news brief bids at onsale com top ten million While fascinating, it still doesn’t change the fact that the dominant players in the industry are likely still shaping the majority of ad revenue.

It just shows how complex and dynamic the online ad market really is.

Role of Findings in Shaping Future Policy Decisions

The findings regarding the concentration of advertising revenue have significant implications for future policy decisions. Governments may need to consider measures to promote competition and ensure that smaller businesses and independent publishers have a fair chance to compete. This may involve regulating the practices of dominant platforms, promoting alternative advertising models, or providing support to smaller players in the market.

The recent report highlighting how a select few sites dominate ad revenue is pretty interesting. It makes you think about the ever-growing power of these platforms. Amazon’s expansion, like its building out the store amazons building out the store , is a prime example of a company strategically positioning itself for maximum ad revenue opportunities. Ultimately, this consolidation of power in the digital advertising space means less choice for consumers and could potentially stifle innovation.

This report highlights a crucial issue in the online world.

Examples of such policies could include measures to ensure a level playing field for advertising opportunities for all parties, potentially including requirements for platform transparency in advertising revenue allocation.

Comparison of Revenue Models

The revenue models of top online platforms differ significantly from those of smaller competitors. Large platforms often utilize a combination of advertising revenue, subscription fees, and other commercial ventures. Smaller competitors, on the other hand, may primarily rely on advertising revenue, and in some cases, on a combination of subscriptions, and partnerships with other businesses.

Different Revenue Streams for Top Sites

| Revenue Stream | Percentage (Approximate) |

|---|---|

| Advertising (Display, Search, Video) | 60-70% |

| Subscriptions | 15-25% |

| Other Commercial Ventures (e.g., E-commerce) | 5-10% |

Technological Factors

The concentration of ad revenue in the hands of a few major online platforms isn’t simply a matter of market strategy; it’s deeply intertwined with the technological advancements of the digital age. These advancements, from sophisticated algorithms to user-centric platform features, have shaped the landscape, creating a dynamic that favors the established giants. The interplay of technology, user behavior, and platform design all contribute to the observed market dominance.The intricate dance between technology and economic power is particularly evident in the realm of online advertising.

Technological prowess, coupled with vast user data, empowers these platforms to optimize ad delivery and maximize revenue streams. This is not a new phenomenon; rather, it’s a natural evolution of the internet’s ever-expanding technological capabilities.

Technological Advancements Contributing to Concentration

The rise of sophisticated algorithms and data analysis plays a pivotal role in this concentration. Advanced machine learning models, for instance, enable platforms to precisely target users with tailored advertisements, increasing ad effectiveness and thus, revenue. This precision targeting is possible due to the vast datasets these platforms collect about user behavior.

Role of Algorithms and Data Analysis

Algorithms are fundamental to the revenue allocation process. Sophisticated algorithms analyze user data, including browsing history, demographics, and purchase patterns, to predict user preferences and optimize ad placement. This allows for highly targeted advertising, increasing click-through rates and ultimately, ad revenue for the platforms. For example, a user who frequently searches for hiking gear will see more advertisements for hiking boots and apparel.

This personalized approach drives higher engagement rates, a direct benefit for the platforms.

Impact of User Behavior and Online Interactions

User behavior is a critical factor in shaping ad revenue allocation. The more time users spend on a platform, the more opportunities there are for targeted ads to be displayed. Engaging features, like interactive games or social media functionalities, can further increase user engagement and thus, exposure to advertisements. This cyclical relationship between user engagement and ad revenue significantly favors platforms with high user retention and frequent interaction.

For instance, the addictive nature of social media platforms fuels user activity, leading to more frequent ad exposures and increased ad revenue.

Impact of Platform Features and User Experiences

Platform features play a significant role in attracting and retaining users. Intuitive interfaces, user-friendly navigation, and seamless integration with other services attract users, leading to higher engagement and more frequent exposure to ads. A well-designed platform, therefore, translates to increased revenue potential for the platform.

Methods Used by Top Sites to Optimize Ad Revenue

Top sites employ various strategies to optimize ad revenue. These include:

- Dynamic Pricing: Adjusting ad prices based on real-time demand and user behavior. This ensures optimal revenue generation by maximizing ad placement opportunities.

- Real-Time Bidding (RTB): Utilizing automated systems to auction off ad space in real-time, enabling advertisers to bid on ads based on user characteristics. This approach increases efficiency and revenue for the platform.

- Data-Driven Targeting: Utilizing user data to create highly targeted ad campaigns. This maximizes ad relevance, resulting in higher engagement rates and revenue.

Key Technological Factors and Their Potential Impact

| Technological Factor | Potential Impact on Ad Revenue Allocation |

|---|---|

| Sophisticated Algorithms | Increased ad relevance and targeting, leading to higher click-through rates and revenue. |

| Vast User Data Collection | Enhanced precision targeting, optimization of ad placement, and increased ad revenue. |

| Platform Features & User Experience | Attracting and retaining users, leading to higher engagement and more ad impressions. |

| Real-Time Bidding (RTB) | Maximizing ad revenue by enabling automated auctioning of ad space. |

Potential Solutions

The concentration of advertising revenue in the hands of a few dominant players presents significant challenges to the broader digital ecosystem. This concentration can stifle innovation, limit choice for consumers, and disadvantage smaller businesses and publishers. Addressing this requires a multifaceted approach encompassing policy adjustments, the development of new advertising models, and support for diverse players.

Promoting Competition Through Policy and Regulation

Policies and regulations designed to promote competition can be crucial in mitigating the impact of market concentration. These measures should aim to foster a level playing field where smaller players have a realistic chance of success. One such strategy is the implementation of regulations that prevent anti-competitive practices. For example, preventing mergers that would further consolidate market power is a critical step.

Another approach is the enforcement of existing regulations regarding anti-trust violations. This involves actively monitoring and penalizing companies engaging in practices that harm competition. These actions can effectively promote a more competitive advertising landscape, ensuring a wider range of options for businesses and consumers.

Developing Alternative Advertising Models

Traditional advertising models often favor large platforms. The emergence of alternative models can address this imbalance. One promising approach is the development of decentralized advertising platforms. These platforms could operate independently of the largest players, offering a more distributed and fairer system for ad revenue allocation. Another model is the adoption of a “pay-for-performance” advertising system.

This system shifts the emphasis from the mere display of ads to the measurable results they generate, which can provide greater incentives for smaller publishers and creators. These new models would ideally encourage more participation and innovation within the advertising sector.

Supporting Smaller Businesses and Publishers

Supporting smaller businesses and publishers is crucial for a healthy and diverse advertising ecosystem. This support should involve various initiatives aimed at bridging the gap in resources and opportunities between large and small players. One approach is to provide educational resources and mentorship programs to smaller businesses and publishers, enabling them to improve their digital presence and advertising strategies.

Another approach could be dedicated funding programs focused on supporting startups and independent publishers. By fostering these initiatives, the industry can cultivate a vibrant and sustainable ecosystem that benefits all stakeholders.

Examples of Successful Competition Initiatives

Successful examples of fostering competition in other industries offer valuable lessons. For example, the breakup of Standard Oil in the early 20th century, while controversial, led to a more competitive oil market. Similarly, regulatory efforts in the telecommunications industry have resulted in more competitive pricing and services. These historical examples highlight the effectiveness of regulatory measures in promoting competition.

Furthermore, the rise of open-source software has created alternative platforms that compete with proprietary software, illustrating that open competition can be a driving force for innovation.

Potential Solutions Table, Report finds top sites control most ad revenue

| Potential Solution | Potential Impact |

|---|---|

| Implement regulations to prevent anti-competitive mergers | Increase competition, foster innovation, diversify market participants |

| Encourage the development of decentralized advertising platforms | Level the playing field, promote fairer revenue allocation |

| Introduce pay-for-performance advertising models | Increase transparency, incentivize performance-based strategies |

| Provide educational resources and mentorship for smaller businesses and publishers | Enhance digital capabilities, improve advertising strategies |

| Establish dedicated funding programs for startups and independent publishers | Support growth, cultivate diverse content creation |

Illustrative Case Studies

The digital advertising landscape is dominated by a few powerful players, while numerous smaller competitors strive to carve out a niche. Understanding the business models of both giants and smaller players is crucial to grasping the dynamics of this competitive environment. This section delves into the specifics, examining strategies employed by leading platforms and highlighting successful tactics for smaller players seeking to thrive.

Top-Performing Site Business Model: Google

Google’s dominance in the digital advertising space stems from a multifaceted business model. They leverage a comprehensive suite of services, including search, YouTube, and Android, to amass vast user data. This data, combined with sophisticated algorithms, allows them to target advertisements with unparalleled precision. Their revenue primarily comes from pay-per-click (PPC) advertising, where advertisers pay Google for each click on their ads.

- Google’s vast network of products allows them to collect extensive user data, enabling personalized ad targeting.

- Their search algorithm plays a pivotal role in determining ad placement and relevance.

- A substantial portion of revenue is generated through the display of ads across their various platforms.

Smaller Competitor Business Model: Medium

Medium, a platform for long-form content, utilizes a different approach. Their model focuses on attracting a specific audience interested in in-depth articles and stories. Medium generates revenue through a combination of subscriptions, partnerships with businesses, and display advertising, though the latter is less significant compared to Google. The platform emphasizes the quality of content and user experience to drive engagement and attract a loyal readership.

- Medium prioritizes high-quality content and a strong user experience.

- Their revenue model relies less on display advertising and more on subscriptions and collaborations.

- Attracting a focused audience with a specific interest is a key element of their business strategy.

Strategies for User Acquisition and Retention: Top Sites

Top sites employ a variety of strategies to attract and retain users. These strategies encompass providing valuable content, building a strong brand reputation, and leveraging advanced technologies to enhance user experience. Free services, compelling design, and continuous product improvements are integral components of this approach.

- Free services, like search engines and social media platforms, are attractive and frequently used by users.

- A seamless user experience, often enhanced by intuitive design, is crucial to user engagement and retention.

- Consistent product development and improvements keep the platform fresh and relevant, encouraging users to return.

Strategies for Smaller Companies to Increase Advertising Revenue

Smaller competitors can enhance their advertising revenue by focusing on niche audiences and creating unique value propositions. Specialization and building strong relationships with relevant businesses are important steps in this process.

- Targeting specific niche audiences allows for more effective ad placement and higher conversion rates.

- Building strong partnerships with businesses in their industry can lead to lucrative advertising opportunities.

- Creating unique and valuable content or services that attract a loyal user base can differentiate a platform and generate revenue.

Revenue Generation Process: User Interaction to Ad Placement

User interaction with a platform generates data, which is then analyzed by sophisticated algorithms. These algorithms determine the relevance of ads to individual users, leading to targeted ad placement. The platform receives revenue when users click on or interact with these ads.

Closing Notes

In conclusion, the report paints a picture of a highly concentrated advertising market. While the dominance of top sites is undeniable, the implications for the broader ecosystem—from smaller businesses to the future of content creation—are significant. The report emphasizes the need for solutions to promote competition and ensure a more equitable advertising landscape. The discussion touches upon potential policy changes, innovative revenue models, and strategies for smaller players to thrive.

It’s a complex issue with no easy answers, but the report serves as a crucial starting point for understanding and addressing this significant shift in the online advertising industry.