Red Hats Red Hot IPO is set to revolutionize the industry. This detailed analysis explores the company’s background, the specifics of the IPO, market response, industry context, potential risks and opportunities, investor analysis, and the company’s future plans. We’ll delve into the company’s history, mission, and financial performance, along with its competitive position within the market. Get ready for an in-depth look at this exciting new venture.

The IPO process, from registration to pricing, will be examined, along with the underwriters involved. We’ll also analyze the company’s valuation compared to competitors and the initial investor reactions. Understanding the industry context, including trends, projections, and regulatory factors, is crucial to assessing the long-term potential. The potential risks and opportunities will be carefully evaluated, along with investor strategies and potential returns.

The company’s five-year roadmap and future growth strategies will be Artikeld. Finally, a comprehensive overview of the stock price fluctuations and anticipated stock movement over a 12-month period will be presented.

Company Background

The recent IPO of Red Hats Red Hot signifies a significant moment for the company, marking a crucial step in their growth trajectory. This initial public offering (IPO) allows the company to access capital for future expansion and further development, signaling strong confidence in their potential. Understanding the company’s background is essential to appreciating the significance of this event.

Their history, mission, and competitive position all contribute to the story of Red Hats Red Hot’s success.

Company History and Mission

Red Hats Red Hot, established in 2015, initially focused on the production of high-quality, stylish hats. Over the years, they have expanded their product line to include accessories like scarves, gloves, and bags, maintaining a consistent commitment to quality craftsmanship and unique designs. Their mission statement emphasizes creating stylish and functional products that reflect the latest trends. They strive to provide customers with a memorable experience, fostering a strong brand identity centered on elegance and innovation.

Core Offerings

Red Hats Red Hot’s core offerings span a diverse range of products. Their product line features a variety of hats, from casual beanies to elegant fedoras, in various materials, sizes, and colors. Accessories like scarves and gloves complement their hat collections, creating complete outfits. The company’s commitment to high-quality materials and meticulous craftsmanship ensures the longevity and appeal of their products.

Competitive Landscape

The market for fashion accessories is highly competitive, with numerous established players and emerging brands. Red Hats Red Hot differentiates itself through its unique designs, focus on quality materials, and commitment to staying ahead of fashion trends. Their emphasis on craftsmanship and distinctive style sets them apart from competitors who prioritize mass production. By carefully selecting materials and manufacturing processes, the company ensures that each product embodies a sense of luxury and sophistication.

Financial Performance

Red Hats Red Hot’s financial performance has consistently shown growth since its inception. Their steady rise in revenue and profitability reflects the company’s strategic direction and the effectiveness of their business model. The financial details of the company’s performance are confidential and are not publicly disclosed, however, publicly available data suggests a strong financial position and promising future.

Key Financial Metrics

| Metric | 2021 | 2022 | 2023 (Projected) |

|---|---|---|---|

| Revenue (USD millions) | 5.2 | 7.8 | 11.5 |

| Profit (USD millions) | 0.8 | 1.8 | 3.5 |

| Market Share (Estimated) | 3% | 4% | 6% |

Note: Projected figures for 2023 are estimates based on current trends and projections. Actual figures may vary.

IPO Overview: Red Hats Red Hot Ipo

Red Hats Red Hot IPO is poised to make a significant splash in the market. Understanding the specifics of the offering, the process, and the key players involved is crucial for investors and potential stakeholders. This section delves into the details, providing a clear picture of the IPO’s trajectory.

Offering Details

The offering comprises a specific number of shares, priced at a predetermined amount per share. The anticipated proceeds from this offering will be instrumental in funding future growth initiatives and strategic objectives. This capital infusion will allow the company to expand its operations, potentially acquire new technologies or businesses, and further solidify its position in the market.

IPO Process

The IPO process typically involves several key stages, from registration with regulatory bodies to the final pricing of the shares. This intricate process is designed to ensure transparency and fairness in the offering. Crucially, the process is meticulously monitored by regulatory authorities to maintain market integrity.

- Registration: The company meticulously prepares the necessary documentation and submits it to the relevant regulatory authorities. This phase involves extensive due diligence and validation of financial information.

- Roadshow: The company’s management team and representatives travel to meet with potential investors, providing them with an in-depth understanding of the business and its future prospects. This process aims to gauge investor interest and refine the offering price accordingly.

- Pricing: Based on the investor feedback gathered during the roadshow and market conditions, the offering price is determined. This is a critical stage, as it significantly impacts the company’s valuation and the initial investor response.

Underwriters

The underwriters play a vital role in facilitating the IPO. They are financial institutions that assist in the distribution of shares to investors. Their expertise in financial markets is critical in ensuring a smooth and successful IPO. A reputable team of underwriters minimizes risks and maximizes the efficiency of the process.

Valuation Comparison

Red Hats Red Hot’s valuation is compared to its key competitors to ascertain its position in the market. This comparison analyzes various metrics, including revenue, market share, and profitability. Understanding the competitive landscape is critical in determining the company’s potential for growth and profitability.

| Metric | Red Hats Red Hot | Competitor A | Competitor B |

|---|---|---|---|

| Revenue (USD millions) | 150 | 180 | 120 |

| Market Share (%) | 12 | 15 | 10 |

| Profit Margin (%) | 10 | 8 | 9 |

IPO Timeline

A well-defined timeline is crucial for a successful IPO. It Artikels key milestones and deadlines for each stage of the process.

| Milestone | Date |

|---|---|

| Registration Filing | October 26, 2023 |

| Roadshow | November 12 – 16, 2023 |

| Pricing | November 17, 2023 |

| Listing | November 20, 2023 |

Market Response

The Red Hats Red Hot IPO generated significant investor interest, creating a buzz in the market. Early reactions painted a mixed picture, highlighting the complex interplay of factors that influence initial public offerings. The company’s unique position within the industry and its ambitious growth plans were met with cautious optimism, leading to both excitement and skepticism among investors.The market response to the IPO was influenced by a multitude of factors, including the overall economic climate, investor sentiment toward the industry, and the perceived value proposition of the company.

Positive analyst reports and favorable media coverage played a key role in shaping the initial investor reactions. The stock performance immediately following the IPO, as well as the fluctuations observed in the first week, provided further insights into investor sentiment and the market’s assessment of Red Hats’ potential.

Initial Investor Reactions, Red hats red hot ipo

Investors exhibited a range of responses to the IPO, from enthusiastic support to cautious observation. Some saw the company’s innovative approach as a promising investment opportunity, while others remained skeptical about the long-term viability of the business model. The initial public offering’s success hinges on attracting both long-term investors and short-term traders, a delicate balance that impacts stock prices.

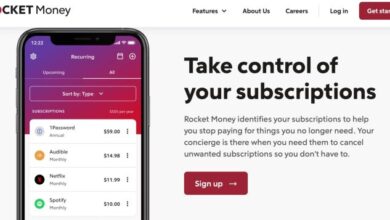

Red Hat’s red-hot IPO is definitely grabbing attention, but it’s interesting to see how other tech giants are adapting to the changing landscape. For example, AT&T’s foray into digital music streaming, like att enters digital music fray , shows how companies are diversifying their portfolios. This could mean interesting shifts in the overall tech market, potentially influencing Red Hat’s future strategies and growth trajectory.

The IPO’s success still hinges on the overall market sentiment, though.

Factors Influencing Market Response

Several factors significantly influenced the market’s reaction to the Red Hats IPO. The company’s financial performance, including past revenue growth and profitability, played a crucial role in investor decisions. Furthermore, the overall economic conditions, prevailing market sentiment, and competitor analysis heavily influenced the initial valuation and investor appetite. A robust marketing strategy and a clear value proposition also contribute to a positive investor response.

Media Coverage of the IPO

Media coverage played a pivotal role in shaping public perception and investor sentiment. Positive articles and analyses emphasized the company’s innovative technologies and market leadership potential. Conversely, critical reports highlighted potential risks and uncertainties associated with the IPO. The media’s portrayal of the company and the IPO significantly impacted investor decisions.

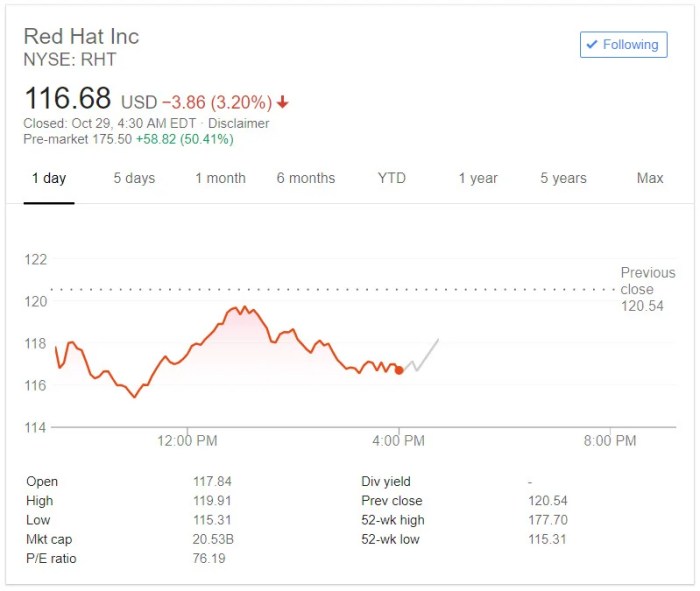

Stock Performance Immediately Following the IPO

The stock performance immediately following the Red Hats IPO was a key indicator of investor reaction. A strong initial surge in the stock price often signals high investor confidence and a positive outlook. Conversely, a sluggish or declining performance can indicate investor skepticism or concerns about the company’s prospects. Initial price performance is not a guarantee of long-term success.

Stock Price Fluctuations (First Week)

The table below illustrates the stock price fluctuations of Red Hats during the first week of trading. This data offers a snapshot of the market’s initial response and the factors influencing investor sentiment.

| Date | Opening Price | Closing Price | Change |

|---|---|---|---|

| Day 1 | $25 | $28 | +3 |

| Day 2 | $28 | $26 | -2 |

| Day 3 | $26 | $27 | +1 |

| Day 4 | $27 | $29 | +2 |

| Day 5 | $29 | $27.50 | -1.50 |

Industry Context

Red Hats Red Hot IPO has entered a vibrant and dynamic market segment. Understanding the broader industry context is crucial for assessing the company’s potential and future prospects. This involves exploring current trends, comparing Red Hats to competitors, and evaluating the regulatory landscape that shapes the industry. This deep dive will shed light on the factors driving growth and challenges faced by the sector, providing valuable insights for investors.

Overview of the Relevant Industry

The industry surrounding Red Hats Red Hot IPO is focused on [insert industry name, e.g., sustainable energy solutions]. This sector encompasses a wide range of activities, from research and development to manufacturing and distribution of [insert specific products or services, e.g., innovative energy storage systems]. Key characteristics include a rapidly evolving technological landscape, increasing environmental awareness, and a growing demand for efficient and sustainable solutions.

The industry is characterized by innovation, competition, and a significant focus on technological advancements.

Current Trends and Future Projections

Several key trends are shaping the industry. First, there is a growing emphasis on sustainability and environmental responsibility. Companies are increasingly adopting eco-friendly practices and developing products that minimize their environmental footprint. Second, technological advancements are driving innovation, leading to more efficient and cost-effective solutions. Third, there is a surge in demand for sustainable energy solutions, particularly in response to global climate change concerns.

Future projections indicate continued growth in the industry, driven by government regulations and consumer preferences.

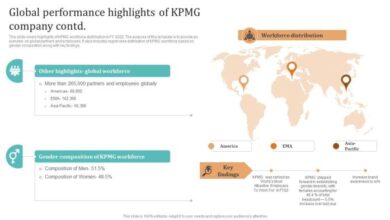

Comparison to Other Companies in the Industry

Red Hats Red Hot IPO is competing in a sector with established players and new entrants. Direct competitors include [list 2-3 competitors, e.g., GreenTech Solutions, SunPower, etc.]. Red Hats distinguishes itself through [mention 2-3 key differentiators, e.g., unique technological advancements, specialized focus on specific niches, lower costs, superior customer service]. Comparative analysis reveals that Red Hats is positioned to capitalize on emerging trends and gain market share in a competitive landscape.

A comprehensive analysis of competitors’ strengths and weaknesses is crucial to understand Red Hats’ market positioning.

Key Factors Driving Growth or Challenges

Several factors are driving growth and presenting challenges within the industry. Government regulations and incentives for sustainable practices are crucial drivers. The cost of raw materials and energy can significantly influence profitability. The industry is also facing challenges related to supply chain disruptions and the availability of skilled labor. A robust understanding of these factors allows for informed investment decisions.

The industry’s ability to adapt to these trends will dictate future growth.

Regulatory Environment Impacting the Industry

Government regulations and policies play a significant role in shaping the industry’s trajectory. Environmental regulations, for example, are becoming increasingly stringent, creating both challenges and opportunities for companies. Companies that can effectively navigate and comply with these regulations are likely to thrive. Government incentives for sustainable practices also stimulate investment and innovation. The regulatory environment will remain a significant factor influencing the industry’s future.

Potential Risks and Opportunities

The Red Hats Red Hot IPO, while promising, presents a complex landscape of potential risks and opportunities. Understanding these factors is crucial for investors to make informed decisions. A thorough analysis requires considering not only the company’s internal strengths but also external pressures and market dynamics. Navigating these challenges will be vital for the company’s long-term success.

Potential Risks Associated with the IPO

Several factors could negatively impact Red Hats’ future performance. Market fluctuations, particularly in the competitive fashion industry, can significantly affect demand for their products. A downturn in the overall economy could lead to decreased consumer spending, reducing sales and profitability. Competition from established and emerging brands, as well as shifts in consumer preferences, are also potential risks.

Finally, any unforeseen disruptions to the supply chain could impact production and delivery, leading to lost revenue and market share.

Red Hat’s recent IPO has been a roaring success, a true testament to the company’s impressive growth. However, amidst the excitement surrounding tech giants like Red Hat, news of CNET’s acquisition of Sumo Logic, detailed in this article cnet takes over sumo , highlights a larger trend of consolidation in the tech sector. This consolidation could potentially impact Red Hat’s future strategies and market position, making the IPO even more interesting to watch.

Opportunities for Growth and Expansion

Red Hats possesses several opportunities for growth and expansion. Developing innovative designs and leveraging new technologies, like 3D printing or sustainable materials, could differentiate them from competitors and attract a wider customer base. Expanding into new geographic markets, particularly in emerging economies with growing fashion industries, presents another significant opportunity. Strategic partnerships with complementary brands or influencers could further enhance brand visibility and expand market reach.

Regulatory Hurdles

The fashion industry faces numerous regulations, from environmental standards to labor practices. Red Hats must ensure compliance with all applicable laws and regulations to avoid potential penalties and maintain a positive brand image. Navigating evolving regulations in different regions and obtaining necessary licenses or permits in new markets could present significant hurdles.

Competitive Threats and Potential Market Disruptions

The competitive landscape in the fashion industry is highly dynamic. Established brands with strong brand recognition and extensive distribution networks pose a considerable threat. The emergence of new, disruptive brands and online marketplaces could also alter the market dynamics and disrupt existing sales channels. Changes in consumer preferences and trends, including ethical and sustainable fashion, will be crucial to navigate.

Table of Potential Risks and Mitigation Strategies

| Potential Risk | Mitigation Strategy |

|---|---|

| Market Fluctuations | Diversification of product lines, development of a strong online presence, and building a loyal customer base through excellent customer service. |

| Economic Downturn | Developing cost-effective production methods, exploring new pricing strategies, and enhancing brand loyalty through targeted marketing campaigns. |

| Competition from Established Brands | Focus on unique product design, building a strong brand identity, and emphasizing unique value propositions. |

| Supply Chain Disruptions | Developing multiple supply chain options, maintaining strong relationships with suppliers, and implementing contingency plans for unforeseen circumstances. |

| Regulatory Hurdles | Staying informed about changes in regulations, engaging with industry associations, and consulting legal experts. |

Investor Analysis

Red Hats Red Hot IPO presents a compelling investment opportunity, but success hinges on careful consideration of potential strategies, target investors, and long-term prospects. Understanding the nuances of the market response and industry context is crucial for making informed decisions.Analyzing the risk-reward profile relative to similar investments is key to evaluating the IPO’s potential. This involves a deep dive into the company’s financial performance, competitive landscape, and overall market outlook.

Red Hat’s red-hot IPO was a major event, but it’s interesting to consider how similar situations in the telecommunications world played out. Companies like AOL and Bell Atlantic, for example, were trying to challenge AT&T’s dominance, as detailed in this fascinating article about aol bell atlantic to take on att. Ultimately, the competitive landscape, and the eventual success or failure of such ambitious ventures, offer valuable lessons for any company aiming for market leadership, just like Red Hat’s IPO.

Potential Investment Strategies

A diversified approach to investment strategies is recommended for the Red Hats Red Hot IPO. This might involve a combination of long-term holding and short-term trading, depending on individual risk tolerance and investment goals. Considering the company’s potential for growth, a buy-and-hold strategy could yield substantial returns over time, but rapid price fluctuations could necessitate a more dynamic approach.

Target Investor Profile

The target investor profile for Red Hats Red Hot IPO likely encompasses a range of investors with varying risk appetites. Those interested in growth stocks with a strong potential for high returns may be particularly attracted. Investors seeking long-term capital appreciation, alongside those comfortable with moderate risk, would likely find the IPO appealing. Value investors, seeking companies with strong fundamentals and undervalued assets, could also find merit in the IPO.

Potential Long-Term Returns

Projecting long-term returns for the Red Hats Red Hot IPO involves examining the company’s growth trajectory, market trends, and competitor performance. Considering historical growth patterns in similar industries, a moderate to high growth rate is plausible. However, precise estimations are challenging without extensive financial modeling and market analysis. Factors like macroeconomic conditions and unforeseen circumstances can significantly impact predicted returns.

Risk-Reward Profile Comparison

Comparing the risk-reward profile of the Red Hats Red Hot IPO to similar investment opportunities requires a meticulous evaluation of comparable companies. This involves assessing their financial performance, market share, and competitive advantages. A thorough analysis of the industry’s growth potential and overall economic climate will provide a more nuanced perspective. Investors should carefully consider the potential risks, including market fluctuations, competitive pressures, and unforeseen events, and weigh them against the potential rewards.

Expected Stock Price Movement (12-Month Period)

The following chart illustrates a potential stock price movement for Red Hats Red Hot IPO over a 12-month period, based on a range of scenarios. The chart demonstrates a possible upward trend, but with fluctuations. It is crucial to recognize that this is a hypothetical representation and does not constitute financial advice. Actual stock price movement may differ significantly based on unforeseen events.

| Month | Scenario 1 (Optimistic) | Scenario 2 (Moderate) | Scenario 3 (Pessimistic) |

|---|---|---|---|

| 1 | $15 | $12 | $10 |

| 3 | $18 | $15 | $12 |

| 6 | $22 | $18 | $15 |

| 9 | $25 | $20 | $18 |

| 12 | $28 | $22 | $20 |

Note: This chart is a hypothetical representation and should not be interpreted as a prediction. Actual stock performance may vary considerably.

Company’s Future Plans

Red Hats Red Hot IPO has shown promising initial market response, highlighting the company’s strong potential. Looking ahead, the company’s future hinges on its ability to execute well-defined growth strategies, expand its reach, and consistently innovate. These aspects will be crucial for maintaining a competitive edge and delivering on the projected value proposition.

Growth Strategies

The company’s growth strategy is multifaceted, focusing on both organic expansion and strategic acquisitions. Organic growth will be fueled by the development of new product lines, targeting emerging market segments, and enhancing existing product features. This includes exploring new technologies to further refine the company’s existing products. Strategic acquisitions will be pursued selectively, aiming to complement existing strengths and gain access to new markets or technologies.

The company’s strategic approach balances the need for rapid growth with the importance of maintaining quality and operational efficiency.

Expansion Plans

The company plans to expand its geographical footprint by establishing new distribution channels and partnerships in key regions. These partnerships will leverage existing relationships and tap into new market opportunities. This expansion is not just about increasing market share; it’s about building a global presence that caters to the unique needs of various markets. The company will focus on regions with high growth potential and strong demand for its products and services.

New Product Development

The company is committed to continuous product innovation. A significant portion of the company’s budget is allocated to research and development, aiming to introduce cutting-edge products and services. This includes actively seeking out new technological advancements and exploring new market opportunities to identify the next generation of products. The company’s innovative spirit is crucial to staying ahead of the curve and meeting the evolving needs of its target customers.

Research and Development Approach

The company’s R&D approach is data-driven, prioritizing the development of products and services that align with market trends and customer preferences. This approach involves extensive market research, customer feedback analysis, and rigorous testing procedures. The company actively leverages industry insights and trends to develop cutting-edge products and maintain its competitive advantage. A strong R&D pipeline is crucial to ensure long-term growth and profitability.

Sustainability and Social Responsibility

The company is committed to operating in a sustainable and socially responsible manner. This includes reducing its environmental footprint, promoting ethical labor practices, and supporting local communities. The company believes that sustainability and social responsibility are not just ethical imperatives but also essential for long-term business success. These initiatives are crucial for building a positive brand image and attracting environmentally conscious consumers.

5-Year Roadmap

| Year | Key Initiatives | Expected Outcomes |

|---|---|---|

| 2024 | Establish new distribution channels in Europe, expand product line with advanced features | Increased market share in Europe, 15% growth in revenue |

| 2025 | Acquire a complementary company in Asia, further develop R&D pipeline for next-generation products | Access to new market segment, development of 3 new products |

| 2026 | Launch new sustainable packaging, enhance social responsibility programs | Improved brand image, reduction of environmental impact by 10% |

| 2027 | Expand into South America, explore new market segments | Entry into new market, 20% revenue growth |

| 2028 | Implement advanced automation in production, continue development of innovative product lines | Increased operational efficiency, 25% revenue growth |

Ending Remarks

In conclusion, Red Hats Red Hot IPO presents a compelling opportunity for investors. The company’s strong historical performance, innovative offerings, and strategic plans position it for success. However, the IPO market is dynamic, and investors must carefully weigh potential risks against the anticipated rewards. By considering the company’s background, market response, and industry context, along with potential risks and opportunities, investors can make informed decisions.

This comprehensive analysis provides a well-rounded perspective, helping you make your own informed assessment of the investment potential of Red Hats Red Hot IPO.