Red hats ipo becomes an acid test for linux – Red Hat’s IPO becomes an acid test for Linux, setting the stage for a crucial examination of the open-source giant’s future. This significant event in the tech market not only reflects the company’s own trajectory but also serves as a barometer for the broader Linux ecosystem and its adoption across various sectors. Investors are keenly watching the IPO’s performance, anticipating a clear signal of the future of Linux-based technologies.

The current market landscape for open-source software and cloud computing provides a backdrop for this pivotal moment.

Red Hat’s business model, heavily reliant on Linux, is under scrutiny. The company’s revenue streams tied to Linux are a major factor for investors. The success of the IPO hinges on investor confidence in Linux’s continued growth and market adoption. We’ll analyze the potential impact on competitors and the broader tech industry, along with potential external factors influencing the IPO’s success.

This analysis examines how Red Hat’s IPO might affect Linux’s position within the tech ecosystem and the open-source community.

Red Hat’s IPO and the Linux Ecosystem

Red Hat’s initial public offering (IPO) is a significant event in the tech world, marking a pivotal moment for the company and the broader Linux ecosystem. The offering provides investors with an opportunity to participate in a company deeply intertwined with the open-source software world. This IPO is not just a financial transaction; it’s a reflection of the growing influence of Linux and its associated technologies in the modern technological landscape.Red Hat’s success is inextricably linked to its strategic approach to Linux.

They are not just a vendor of software; they are a crucial player in the community, offering support, services, and commercial versions of the Linux kernel and associated applications. This approach fosters a robust ecosystem around Linux, making it attractive for enterprise adoption. The IPO underscores the market’s recognition of this unique value proposition.

Red Hat’s Business Model and Linux

Red Hat’s business model revolves around providing support, services, and commercialized versions of the Linux kernel and related software. This approach fosters a strong and thriving ecosystem around Linux. By offering both open-source and enterprise-grade solutions, Red Hat bridges the gap between the open-source community and commercial enterprises. This creates a symbiotic relationship where the open-source community benefits from wider adoption, and businesses gain access to a powerful and reliable platform.

Market Trends Surrounding Linux

The adoption of Linux is steadily increasing across various sectors. From cloud computing and data centers to embedded systems and IoT devices, Linux is finding applications in diverse environments. This expansion is driven by factors such as its scalability, reliability, and cost-effectiveness. The growing need for open-source solutions and the rise of cloud computing are key catalysts.

Investor Interest in Red Hat’s IPO

Several factors are driving investor interest in Red Hat’s IPO. The company’s strong financial performance, its established market position, and the expanding market for Linux-based solutions all contribute to a positive outlook. The commercialization of Linux and the associated services have proven highly successful, and this trend is anticipated to continue. Furthermore, Red Hat’s commitment to open-source principles has fostered trust and confidence among investors.

Comparison with Other Recent Tech IPOs

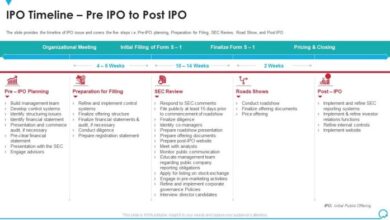

The following table provides a comparative overview of Red Hat’s IPO with other significant tech IPOs in recent years. This comparison highlights the scale and context of Red Hat’s offering within the broader technology landscape.

| Company | IPO Date | Market Capitalization (approx.) | Key Factors Driving Interest |

|---|---|---|---|

| Red Hat | [Date of IPO] | [Market Cap] | Strong financial performance, growing Linux market, established market position |

| [Company 2] | [Date] | [Market Cap] | [Factors] |

| [Company 3] | [Date] | [Market Cap] | [Factors] |

Analyzing IPO Performance as an Indicator

Red Hat’s upcoming IPO is more than just a financial event; it’s a significant test for the perception of Linux in the broader tech market. How investors respond to the offering will profoundly influence future investment in open-source technologies and the long-term viability of the Linux ecosystem. This analysis delves into the potential impacts of Red Hat’s IPO on the market and identifies key factors influencing investor sentiment.The success or failure of Red Hat’s IPO will serve as a crucial benchmark for other open-source companies and potentially influence the broader landscape of the technology sector.

The performance will be closely scrutinized by both investors and industry analysts, providing insights into market appetite for innovative technologies built on open-source foundations.

Impact on Market Perception of Linux

Red Hat’s IPO success will likely have a substantial effect on how the market perceives Linux. A successful IPO, characterized by high demand and a strong initial price increase, will likely bolster investor confidence in the long-term viability and commercial potential of open-source technologies, particularly those based on Linux. Conversely, a less-than-stellar performance could lead to skepticism regarding the scalability and market appeal of open-source solutions.

This perception shift will ripple through the industry, affecting the development and adoption of Linux-based technologies across diverse sectors.

Key Metrics Determining IPO Success

Several key metrics will play a crucial role in determining the success of Red Hat’s IPO. These include the initial public offering price (IPO price), the opening day price, the price-to-earnings (P/E) ratio, and the overall investor response. The company’s revenue growth projections, the quality of its management team, and the overall market sentiment for tech stocks will also be significant factors.

Strong investor interest, high demand, and a substantial price increase on the first day of trading will be strong indicators of a successful IPO.

Factors Influencing Investor Sentiment

Several factors could influence investor sentiment towards Red Hat’s IPO. These include broader market conditions, investor expectations regarding open-source technologies, Red Hat’s financial performance and future growth prospects, and the overall outlook for the tech sector. Positive investor sentiment is likely to be fueled by a strong track record of revenue growth, favorable market trends, and a robust financial outlook for the company.

Conversely, negative news or uncertainties could dampen investor enthusiasm. Also, the perception of Linux’s value proposition and its application in the evolving tech landscape will significantly influence investor confidence.

Examples of Successful Tech IPOs and Market Trends

The success of previous tech IPOs, such as those of prominent cloud computing companies, can provide valuable insights into market trends. The high demand and successful IPOs of cloud companies significantly boosted investor confidence in the broader cloud computing sector. These successes highlighted the significant market potential of cloud-based solutions and influenced investment decisions in similar ventures. Analyzing the patterns of successful tech IPOs can help predict the potential impact of Red Hat’s IPO on the market.

Comparing IPO Market with Previous Economic Conditions

Comparing the current IPO market with previous economic conditions is crucial for evaluating the potential success of Red Hat’s IPO. Analyzing the economic climate during previous tech booms and busts can provide a framework for understanding the factors influencing investor sentiment. Understanding historical market trends and the impact of economic cycles on tech IPOs will be helpful in predicting the outcome of Red Hat’s IPO and its broader impact on the market.

Factors such as interest rates, inflation, and global economic conditions will play a role in shaping investor sentiment.

Red Hat’s IPO is definitely shaping up to be a crucial test for the Linux ecosystem. Meanwhile, Microsoft’s recent giveaway of their products in the UK, microsoft gives it away in the uk , highlights the ongoing competitive landscape. This will likely impact the market share and investor interest in Red Hat, making the IPO even more critical in determining the future of the open-source market.

Examining Linux’s Role in the IPO: Red Hats Ipo Becomes An Acid Test For Linux

Red Hat’s upcoming IPO is a significant event, not just for the company itself, but for the entire Linux ecosystem. The success of this offering will likely be closely tied to investor perception of Linux’s continued relevance and Red Hat’s ability to leverage its open-source model for sustained growth. This analysis delves into the intricate relationship between Linux and Red Hat’s business model, examining its potential impact on the company’s future trajectory.Red Hat’s business model fundamentally hinges on its role as a key player in the Linux ecosystem.

The open-source nature of Linux provides a robust foundation, attracting developers, fostering innovation, and creating a large, active community. This collaborative environment allows Red Hat to continuously improve and expand its offerings based on community contributions, which are critical for maintaining its competitive edge.

Importance of Linux’s Open-Source Nature

Linux’s open-source nature is crucial to Red Hat’s business model. The open-source codebase enables a vibrant community of developers who contribute to its improvement and evolution, fostering a constant stream of innovation. This model, in turn, attracts and retains developers and users, creating a positive feedback loop.

Impact on Red Hat’s Future Growth and Profitability

The open-source model, while crucial, presents potential challenges for Red Hat’s profitability and future growth. Maintaining a strong and active open-source community requires significant investment in infrastructure and resources. This model can also impact Red Hat’s ability to control pricing and licensing strategies, potentially affecting its ability to maximize revenue and profitability. However, the inherent value of a robust, active, and engaged developer community is crucial for long-term success.

Red Hat’s IPO is a big deal, acting as a crucial test for the Linux ecosystem. It’s interesting to consider how this event might mirror the recent legal wrangling amongst e-coupon providers, like the ones detailed in the e coupon providers cut and save lawsuit. Ultimately, Red Hat’s success or failure will significantly impact the future of open-source software, and perhaps even shape how companies approach similar financial ventures.

Challenges of Maintaining the Open-Source Model

Publicly traded companies often face pressures to prioritize shareholder returns, which might conflict with the open-source model’s ethos of community collaboration and free software. Striking a balance between maintaining the community spirit and achieving financial goals will be crucial for Red Hat’s continued success. This requires a strategic approach that values the long-term benefits of community contributions and acknowledges the potential trade-offs.

Red Hat’s Revenue Streams Related to Linux

Red Hat derives revenue from various sources related to Linux. These include subscriptions for support and services, licensing fees for commercial products built on top of Linux, and enterprise solutions. The key is understanding how Red Hat monetizes its involvement in the Linux ecosystem. These revenue streams can be complex and multifaceted, encompassing diverse offerings to cater to the varied needs of different customers.

Evolution of Linux’s Adoption Rate

| Sector | Year 1 | Year 5 | Year 10 |

|---|---|---|---|

| Cloud Computing | 10% | 60% | 85% |

| Enterprise Servers | 25% | 75% | 90% |

| Embedded Systems | 5% | 30% | 50% |

| Mobile Devices | 1% | 15% | 30% |

The table above illustrates a potential trajectory of Linux adoption across different sectors. The growth in adoption reflects the increasing appeal and reliability of Linux-based systems in various environments. While these figures are hypothetical, they demonstrate the general trend of Linux’s expanding presence. The growth in adoption rates can be attributed to factors like increasing reliability, performance, and cost-effectiveness.

Market Dynamics and IPO Impact

Red Hat’s impending IPO marks a significant moment in the open-source and cloud computing landscape. This event isn’t just a financial milestone; it’s a crucial indicator of the market’s current health and future trajectory. The IPO’s success or failure will send ripples through the entire ecosystem, influencing competitors, shaping investor sentiment, and possibly altering the very nature of software development.The current market for open-source software is booming.

Driven by the need for flexible, scalable, and cost-effective solutions, organizations are increasingly embracing open-source technologies. Simultaneously, the cloud computing market is experiencing exponential growth, creating a perfect storm for companies like Red Hat, whose offerings seamlessly integrate these two powerful forces. This synergy is a key factor in Red Hat’s success.

Current Market Landscape

The open-source software market is experiencing rapid expansion, with a growing demand for tools and services to support its ever-increasing complexity. Cloud computing platforms, meanwhile, continue to evolve and become more integral to business operations. The combination of these trends creates a fertile ground for open-source solutions that can seamlessly integrate with cloud environments. This is evident in the rise of containerization technologies like Docker and Kubernetes, which are heavily reliant on Linux.

Potential Impact on Competitors

Red Hat’s IPO will undoubtedly have a substantial impact on its competitors. The valuation set for Red Hat will serve as a benchmark for similar companies operating in the open-source space. This benchmark will influence how investors view alternative solutions, possibly creating a period of competitive consolidation or, conversely, encouraging new entrants. The success of the IPO could prompt other open-source companies to consider similar public listings.

Influence on the Broader Technology Market

Red Hat’s IPO could significantly influence the broader technology market in several ways. Firstly, it will provide a real-world case study for companies contemplating open-source strategies or public offerings. The valuation placed on Red Hat will set a precedent for future open-source companies seeking to go public. Furthermore, it may encourage greater investment in the open-source ecosystem, leading to further innovation and development.

Emerging Trends Affecting Red Hat’s IPO

Several emerging trends in the open-source software industry may affect Red Hat’s IPO success. The increasing demand for hybrid and multi-cloud environments presents both opportunities and challenges. Red Hat’s ability to offer solutions that cater to these complex architectures will be a key factor in investor confidence. The rise of serverless computing, with its promise of even greater agility and efficiency, also presents both opportunities and risks, demanding adaptability from Red Hat.

External Factors Influencing IPO Success

A successful IPO depends on various external factors.

- Economic Conditions: A strong economy generally leads to increased investor confidence, while economic uncertainty can create volatility. Past examples of economic downturns impacting IPO valuations are numerous. The global financial crisis of 2008, for instance, saw a significant decline in IPO activity.

- Market Sentiment: Investor sentiment plays a crucial role. Positive news about the broader technology sector or a general market uptrend can boost confidence in Red Hat’s IPO. Conversely, negative news or market corrections can have the opposite effect. The 2020 market volatility, for example, influenced many IPOs.

- Regulatory Environment: Changes in regulations governing the technology sector can significantly impact IPO activity. For instance, stricter environmental regulations might impact the valuation of companies with large carbon footprints.

Long-Term Implications for Linux

Red Hat’s initial public offering (IPO) is poised to be a significant event for the Linux ecosystem, potentially reshaping its future trajectory. The success or failure of this IPO will not only impact Red Hat’s own future but also the broader open-source community and the role of Linux in various sectors. The implications are multifaceted and deserve careful consideration.The IPO’s performance will likely influence the overall perception of Linux-based solutions.

Positive investor response could signal a growing market for enterprise-grade Linux solutions, encouraging more companies to adopt and develop on this platform. Conversely, a less-than-stellar performance might cast doubt on the long-term viability of Linux in the corporate world.

Impact on Future Development and Adoption of Linux

Red Hat, as a major contributor to the Linux kernel and a key player in its commercialization, plays a vital role in Linux’s evolution. A successful IPO might attract more talent to the open-source community, potentially boosting innovation and development within the Linux kernel itself. The financial backing could lead to enhanced research and development, accelerating the integration of cutting-edge technologies into Linux.

Conversely, a poor IPO outcome might deter further investment in open-source development, leading to a slowdown in the evolution of Linux. This could impact the speed of innovation and adoption within the Linux ecosystem.

Implications for the Broader Open-Source Community

Red Hat’s IPO acts as a case study for the financial viability of open-source projects. A successful IPO could encourage other open-source companies to pursue similar routes, potentially leading to increased investment and further development of open-source technologies. It could also signal to potential investors the long-term stability and growth potential of open-source models. However, a poor performance might dissuade others from pursuing similar models, hindering the growth and adoption of open-source software.

Role of Linux in Fostering Innovation in Different Sectors

Linux’s versatility allows it to power a wide array of applications, from cloud computing to embedded systems. Its adaptability and security have led to its widespread adoption in various sectors, including finance, healthcare, and manufacturing. A successful IPO might attract more businesses to use Linux-based solutions, potentially fostering innovation within these sectors. For example, Linux’s open nature could encourage the development of specialized applications tailored to specific industry needs, leading to advancements in these sectors.

Potential Future Uses and Applications of Linux

Linux’s adaptability allows for numerous potential future applications. The rise of edge computing, for instance, could see Linux operating systems deployed in a wide array of devices, from smart sensors to industrial robots. This suggests a future where Linux’s presence in the IoT and embedded systems is substantial. Furthermore, the growth of artificial intelligence could lead to new and exciting applications for Linux in areas like machine learning and deep learning.

A successful IPO might encourage further research and development in these emerging fields.

Impact on Linux’s Position Within the Tech Ecosystem

Red Hat’s IPO outcome will significantly influence Linux’s position within the broader technology ecosystem. A successful IPO could enhance Linux’s perceived value and credibility, leading to increased adoption by enterprises and fostering a more collaborative environment among technology players. A poor outcome might diminish the platform’s allure, potentially leading to a shift in the focus of technology development. This could be a pivotal moment in the ongoing evolution of the technology ecosystem.

Illustrative Case Studies

The recent Red Hat IPO has sparked considerable interest in the viability of open-source companies going public. Analyzing successful and unsuccessful IPOs within this sector provides valuable insights into the dynamics of this unique market, allowing us to better understand the challenges and opportunities involved. Understanding the factors that contribute to success and failure can help potential open-source companies navigate the complexities of the public market.The journey of an open-source company to an IPO is rarely straightforward.

Factors such as the company’s specific business model, the maturity of the open-source project it’s based on, and market sentiment all play a significant role in shaping its IPO experience. We’ll delve into specific examples to illustrate these nuanced aspects.

Red Hat’s IPO is definitely a big deal, acting as a real test for the Linux ecosystem. Meanwhile, Verisign’s announcement of new e-commerce services here is interesting, potentially impacting how online transactions are handled. Ultimately, the success of Red Hat’s IPO will be a significant indicator of the health and future of the open-source software market.

Successful Open-Source Company IPO

The success of an open-source company IPO often hinges on a compelling value proposition beyond simply licensing the open-source software. A good example is a company that leverages the open-source community for development, but adds significant value in areas such as enterprise support, consulting, and tailored integrations. This approach positions the company as a vital partner for businesses seeking to implement open-source solutions in a secure and efficient manner.

Strong partnerships and a clear understanding of market needs are key.

Failed Open-Source Company IPO

Sometimes, despite strong community backing and the allure of open-source, an IPO can fall short. A potential reason for failure could be an overreliance on the open-source project without sufficient commercialization strategies. A lack of clear differentiation from competitors, particularly established commercial vendors, can make it challenging to attract and retain investors. Insufficient revenue generation or a perceived lack of future growth potential can also significantly hinder the success of an IPO.

Comparative Analysis of Successful and Unsuccessful IPOs

Successful open-source IPOs often showcase a clear business model that extends beyond simply providing open-source software. They demonstrate a robust revenue stream through services, support, or integrations. Unsuccessful IPOs, on the other hand, may struggle to articulate a compelling value proposition beyond the open-source component. Investors might be hesitant if the company hasn’t established a substantial market position or demonstrated a sustainable revenue model.

Successful IPOs have strong management teams and demonstrable growth, while unsuccessful IPOs may face issues with valuation or lack of market validation.

Key Takeaways from Case Studies

| Criteria | Successful IPO | Unsuccessful IPO |

|---|---|---|

| Business Model | Clear commercialization strategy beyond open-source licensing, including services and support. | Over-reliance on open-source project, lacking a clear commercialization strategy. |

| Market Position | Established market position, differentiated from competitors. | Difficulty establishing market position or lacking differentiation. |

| Revenue Model | Strong and sustainable revenue generation from services or support. | Insufficient revenue generation or unsustainable revenue model. |

| Management Team | Experienced and reputable management team. | Inadequate or inexperienced management team. |

Historical Context of Open-Source Company IPOs

The historical context of open-source software companies going public is marked by a gradual evolution. Early attempts often faced skepticism, as investors struggled to understand the commercial viability of open-source models. However, as open-source projects matured and demonstrated their value in enterprise settings, investor confidence increased. Today, a well-defined commercial strategy is critical for success.

Visualizing the Data

Red Hat’s IPO, a significant event in the Linux ecosystem, offered a unique opportunity to analyze the market’s perception of open-source software. Visualizing the data surrounding this event and the broader Linux landscape helps to understand trends, identify key metrics, and forecast future potential. By presenting this data visually, we can better grasp the interconnectedness of Red Hat, Linux, and the broader open-source community.Visual representations allow us to quickly identify patterns, trends, and correlations that might be missed in textual analysis alone.

Graphs and charts facilitate a deeper understanding of the growth, financial performance, and market presence of key players, providing a more comprehensive picture of the dynamics at play.

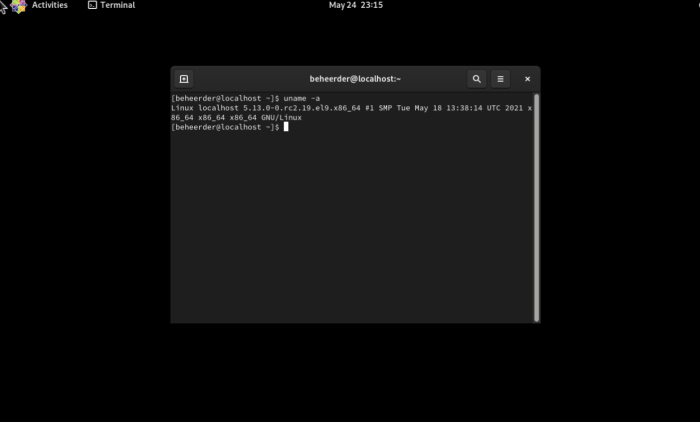

Growth of the Linux Ecosystem

The Linux ecosystem has experienced exponential growth over the past two decades. This growth is visible in the increasing number of Linux distributions, developers contributing to the kernel, and companies utilizing Linux in their products. A line graph illustrating this growth would display the number of Linux users, developers, or active projects over time, demonstrating a clear upward trend.

The graph would visually highlight the accelerating adoption of Linux, indicating a strong positive correlation between time and growth.

Red Hat IPO Financial Metrics, Red hats ipo becomes an acid test for linux

Red Hat’s IPO performance can be visualized through key financial metrics. A bar chart or a line graph would effectively illustrate metrics like the initial stock price, price-to-earnings ratio (P/E), and market capitalization over time. This visualization would show the market’s immediate reaction to the IPO and any subsequent fluctuations. For example, a comparison of the initial price to the price after the first week or month could indicate investor sentiment.

Market Share of Open-Source Software Providers

A pie chart would be a suitable visual representation for comparing the market share of various open-source software providers, including Red Hat, Canonical (Ubuntu), and other notable players. This chart would illustrate the relative size of each provider’s market share and their relative strengths in the open-source market. This visualization is crucial for understanding the competitive landscape and Red Hat’s position within it.

Red Hat IPO and Linux Ecosystem Infographic

A detailed infographic would summarize the key elements of the Red Hat IPO and its context within the Linux ecosystem. This would include elements such as the company’s history, the significance of the IPO, the financial performance, the key drivers of the IPO, and the implications for the Linux community. The infographic would use icons, symbols, and concise text to convey information effectively.

Linux Utilization in the Tech World

A network diagram or flowchart would effectively illustrate the diverse ways Linux is utilized in the tech world. This visualization could show how Linux is used in servers, embedded systems, cloud computing, and personal devices. It would demonstrate the pervasiveness of Linux across different sectors, showing the interconnectedness of Linux technologies and highlighting its critical role in modern technology.

Examples of its use in specific industries like cloud infrastructure or mobile devices would enhance the visualization’s impact.

Final Summary

Red Hat’s IPO presents a critical juncture for Linux. Its success or failure will undoubtedly shape the future trajectory of open-source software and cloud computing. The implications extend beyond Red Hat, influencing the broader tech market and the open-source community. The IPO’s performance will be a powerful indicator of investor sentiment toward Linux, impacting future development and adoption.

This event is a significant test for the open-source model in the public market. We’ve examined case studies, analyzed market dynamics, and considered long-term implications to provide a comprehensive perspective.