Red Hat moves on european linux market, signaling a significant expansion into the European market. This signals a major shift in strategy for Red Hat, as they look to capitalize on opportunities within the European Linux landscape. Europe’s Linux market is a complex one, filled with established players and emerging trends, making Red Hat’s entry a noteworthy event.

The company will likely face both challenges and opportunities in this new frontier. Their success will depend on their ability to adapt to the regional nuances and competitive landscape.

The Artikel for this piece covers the market overview, Red Hat’s strategic approach, the competitive landscape, potential opportunities and challenges, financial implications, and technological aspects of this move. We’ll explore the historical context, current market share, competitive analysis, and the company’s future projections for success in Europe. A deep dive into the European Linux market and Red Hat’s strategies for thriving in this region is the goal.

Market Overview

Red Hat’s continued presence and growth in the European Linux market are significant indicators of the evolving landscape. The European market, while presenting challenges, offers substantial opportunities for Linux-based solutions. The market’s dynamic nature, driven by technological advancements and shifting business needs, requires careful consideration of both existing and emerging competitors.

European Linux Market Trends

The European Linux market is experiencing a period of both maturation and evolution. Increasing adoption of cloud computing and containerization technologies is driving demand for robust and reliable Linux-based infrastructure solutions. Businesses are increasingly seeking open-source options for cost-effectiveness and flexibility, while maintaining security and compliance. However, regulatory hurdles and concerns about vendor lock-in remain challenges.

Red Hat’s Market Share in Europe

Precise market share figures for Red Hat’s Linux products in Europe are not publicly available. However, Red Hat’s substantial presence in the enterprise sector suggests a significant market share. Their strong focus on enterprise-grade solutions, coupled with extensive support and services, positions them well in the European market.

Red Hat’s expansion into the European Linux market is definitely a big deal. It’s interesting to consider how this move might affect e-commerce security, particularly when weighing server-based versus desktop solutions. For instance, the security implications of a shift to Linux in this sector, especially in the face of increasing cyber threats, are certainly worth exploring. This is further underscored by the recent debates on e commerce security debateserver based vs desktop solutions.

Ultimately, Red Hat’s strategy in Europe could have significant ripple effects on the overall landscape of online retail security.

Red Hat vs. Competitors

Red Hat’s Linux offerings in Europe are compared favorably to those of other providers. Their comprehensive suite of enterprise-grade solutions, including Red Hat Enterprise Linux, and a robust ecosystem of services and support, distinguishes them. While other providers, such as SUSE, offer competing Linux distributions, Red Hat often leads in terms of enterprise adoption.

Historical Context of Red Hat in Europe

Red Hat has a long and established presence in the European market. Their early adoption of Linux technologies and focus on the enterprise segment have positioned them as a key player. The company has invested in local resources and partnerships, which has strengthened its presence in the European market. This historical investment has cultivated a strong network of clients and support infrastructure.

Key Players in the European Linux Market

| Company | Market Share | Focus Areas | Competitive Advantage |

|---|---|---|---|

| Red Hat | (Estimated ~30-40%) | Enterprise-grade Linux distributions, Cloud services, Automation tools | Comprehensive support, strong ecosystem, and established brand recognition. |

| SUSE | (Estimated ~10-20%) | Enterprise-grade Linux distributions, Cloud solutions | Strong focus on open-source and customization options. |

| Canonical (Ubuntu) | (Estimated ~10-20%) | Desktop and server Linux distributions, Cloud solutions | Widely used in the desktop and personal computing environments. |

| Other Linux Distributors | (Varying) | Specific niche markets (e.g., embedded systems, IoT) | Specialization and focus on specific hardware or software needs. |

Note: Market share estimates are approximate and not definitive. Exact figures are often proprietary and not publicly released. The table presents a general overview of market positioning.

Red Hat’s Strategy

Red Hat’s expansion in the European Linux market hinges on a multifaceted strategy that goes beyond simple product distribution. Understanding the nuances of the European market, particularly its diverse customer base and regulatory landscape, is crucial for success. This strategy prioritizes tailoring solutions to specific European needs while leveraging Red Hat’s existing global strengths.Red Hat’s approach involves a blend of localized marketing, strategic partnerships, and a deep understanding of the technological trends shaping the European market.

Red Hat’s expansion into the European Linux market is interesting, especially considering the established partnerships they have. This new push highlights the evolving channel dynamics, as seen in the ongoing evolution of partnerships like the new channel dynamic age old partnership endures. Ultimately, Red Hat’s European strategy seems to be one of adapting to the changing landscape while leveraging existing relationships.

Their success in this new market will depend on their ability to navigate these complexities.

The company aims to solidify its position as a leader in open-source solutions by offering comprehensive support and resources to its European clients.

Red Hat’s Market Targeting Tactics

Red Hat employs a variety of tactics to resonate with European customers. These tactics are not one-size-fits-all, recognizing the distinct needs of different European markets and industries. This approach includes targeted marketing campaigns highlighting the specific benefits of Red Hat’s open-source solutions for industries such as finance, healthcare, and manufacturing.

Red Hat’s Partnerships and Collaborations

Red Hat fosters strong partnerships with key European technology providers and organizations. These collaborations aim to broaden Red Hat’s reach and provide enhanced value propositions to customers. For instance, partnerships with European cloud providers can create synergistic offerings that leverage Red Hat’s expertise in open-source technologies and the cloud providers’ infrastructure capabilities.

Potential Acquisitions and Strategic Alliances

Potential acquisitions or strategic alliances can significantly impact Red Hat’s European expansion. Acquisitions of smaller European open-source companies or those specializing in niche technologies could give Red Hat a competitive edge by broadening its product portfolio and deepening its knowledge of specific industry needs. Strategic alliances with key European distributors or integrators can create a wider distribution network and support base.

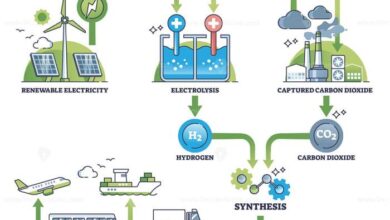

Impact of Cloud Computing on Red Hat’s Strategy

Cloud computing has become a pivotal force in the European market, and Red Hat is positioned to capitalize on this trend. Red Hat’s open-source technologies are well-suited to the needs of cloud environments. This aligns with European companies’ increasing reliance on cloud-based solutions. Red Hat’s OpenShift platform, for example, facilitates the deployment and management of applications on various cloud infrastructures.

This ensures that Red Hat’s offerings can be seamlessly integrated into the evolving cloud ecosystem.

Target Customer Base in Europe

| Customer Segment | Description | Specific Needs |

|---|---|---|

| Large Enterprises | Multinational corporations, large government agencies | Scalability, security, compliance, and robust support for existing infrastructure. |

| Mid-Sized Businesses | Companies with 100-1000 employees | Cost-effectiveness, agility, and ease of integration with existing systems. |

| Startups and SMEs | Fast-growing companies, small and medium-sized enterprises | Affordable solutions, rapid deployment, and flexible scaling options. |

Red Hat targets diverse European customers. The table above provides a simplified view of their target market. Red Hat’s strategy recognizes the varying needs of these groups. This table emphasizes the importance of offering tailored solutions to different segments within the European market.

Competitive Landscape: Red Hat Moves On European Linux Market

Red Hat’s success in the European Linux market hinges on its ability to navigate a complex and competitive landscape. Numerous players vie for market share, each with distinct strengths and weaknesses. Understanding these dynamics is crucial for Red Hat to refine its strategies and maintain its position as a leader. A robust understanding of the competitive pricing and feature sets is critical for success.

Key Competitors

Several companies directly compete with Red Hat in the European Linux market. These include established players with deep industry experience and smaller, more agile startups with niche offerings. Some key competitors include SUSE Linux Enterprise, Canonical (Ubuntu), and smaller specialized providers catering to specific industries. The competitive landscape is dynamic, with new entrants constantly emerging. Understanding the evolving competitive environment is essential for long-term success.

Strengths and Weaknesses of Red Hat

Red Hat possesses a strong reputation for its comprehensive enterprise Linux solutions, extensive support ecosystem, and deep commitment to open-source principles. However, it faces challenges in certain niche markets where specialized expertise or specific features are crucial. For example, SUSE might be better positioned in some specialized server deployments. Red Hat’s strength in enterprise-grade solutions is a considerable advantage, but it needs to address potential gaps in specialized market segments.

Competitive Pricing Strategies

Pricing strategies in the European Linux market are diverse and often depend on the specific features and support levels offered. Red Hat typically employs a tiered pricing model that reflects the varying needs of different organizations. Competitors like SUSE also offer tiered models, but their specific pricing structures might be different, potentially focusing on different support packages. Competitive pricing requires careful consideration of feature sets, support, and the specific needs of European businesses.

Overview of the Competitive Landscape

The European Linux market is characterized by a mix of established players and emerging competitors. The market is highly fragmented, with several niche providers targeting specific industries or vertical markets. This diversity makes it crucial for Red Hat to tailor its offerings to specific customer needs while maintaining its comprehensive enterprise-grade solutions. Understanding the evolving market dynamics and the needs of European businesses is essential for Red Hat’s continued success.

Red Hat’s Open-Source Approach

Red Hat’s commitment to open-source principles can be viewed as both a strength and a potential weakness by competitors. While it fosters collaboration and innovation within the open-source community, some competitors may argue that it doesn’t fully capture the market for commercial solutions. However, the open-source approach fosters innovation and flexibility.

Competitive Offerings Comparison

| Feature | Red Hat | SUSE Linux Enterprise | Canonical (Ubuntu) |

|---|---|---|---|

| Pricing | Tiered, based on features and support | Tiered, often focused on specific support packages | Subscription-based, potentially more flexible for some organizations |

| Features | Comprehensive suite of enterprise-grade tools, extensive support, and automation | Strong focus on enterprise-grade features, particularly for specific server deployments | Focus on flexibility and ease of use, strong developer community |

| Support | Extensive support options | Strong support, particularly for specialized server configurations | Strong support options, particularly in developer-focused areas |

Potential Opportunities and Challenges

Red Hat’s foray into the European Linux market presents a complex interplay of opportunities and hurdles. Navigating the diverse regulatory landscapes, competitive pressures, and evolving technological trends will be crucial for success. Understanding the potential pitfalls and leveraging the available advantages is paramount for Red Hat’s continued growth and market leadership.The European Linux market, while not as monolithic as some might perceive, offers pockets of significant potential for Red Hat.

However, this potential is intertwined with challenges related to regional variations in regulations, business cultures, and the ever-shifting technological landscape. Red Hat must tailor its approach to resonate with the specific needs and preferences of each European market segment.

Potential Opportunities for Red Hat

Red Hat can capitalize on the growing demand for open-source solutions in the European market. Businesses across various sectors are increasingly seeking cost-effective, flexible, and reliable software solutions, making open-source platforms like Linux a compelling choice. Furthermore, Red Hat’s comprehensive portfolio of open-source products and services, including its enterprise-grade Linux distributions, middleware, and cloud solutions, positions it well to cater to a wide spectrum of European businesses.

Obstacles and Challenges for Red Hat in Europe

Several factors could impede Red Hat’s expansion in Europe. Competition from established players and new entrants, including both open-source and proprietary vendors, is fierce. Local competitors with strong market presence and tailored offerings may present a significant challenge. Overcoming these challenges requires a deep understanding of the unique needs and preferences of European businesses and governments. Red Hat must also effectively address concerns about data privacy and security, which are paramount in the European Union.

Impact of Regional Regulations on Red Hat’s Operations

European Union regulations, such as GDPR, significantly impact data privacy and security practices. Red Hat must ensure its services and products comply with these regulations. Additionally, national variations in data protection laws across Europe add complexity to Red Hat’s operational strategies. Understanding and adapting to these regulations is crucial for successful market penetration. The company needs to establish strong compliance frameworks and demonstrate a commitment to protecting user data.

Role of Government Policies and Incentives

Government policies and incentives can significantly influence Red Hat’s market presence. Policies promoting digitalization and open-source adoption can create a favorable environment for Red Hat’s growth. For instance, subsidies or tax breaks for businesses adopting open-source technologies could boost demand for Red Hat’s solutions. Conversely, restrictive policies or regulations could pose a challenge. Monitoring and engaging with government initiatives is essential for strategic decision-making.

Potential Technological Advancements Impacting Red Hat

Technological advancements, such as the increasing adoption of cloud computing, the rise of containerization technologies, and the advancement of artificial intelligence, will affect Red Hat’s market position. Red Hat needs to leverage these advancements and adapt its product portfolio to meet the changing demands of the European market. These technologies will influence the future of enterprise software, and Red Hat must position itself as a leader in this evolution.

Potential Growth Areas in the European Linux Market

- Public Sector: The public sector in Europe is increasingly embracing open-source technologies for efficiency and cost savings. Red Hat’s solutions can address the specific needs of public sector organizations, such as improved digital services, enhanced security, and streamlined IT operations. Opportunities exist in areas like e-government, healthcare, and education.

- Financial Services: The financial services sector is a large and crucial market in Europe. Red Hat’s enterprise-grade solutions can help these institutions manage complex data, improve security, and maintain compliance with evolving regulations. Security and regulatory compliance are paramount here.

- Manufacturing: The manufacturing sector in Europe is undergoing digital transformation, adopting Industry 4.0 technologies. Red Hat’s open-source solutions can help manufacturers optimize their processes, improve efficiency, and enhance product quality.

- Cloud Adoption: The adoption of cloud computing is accelerating in Europe. Red Hat’s cloud-native solutions can support organizations migrating to cloud environments and help them leverage the benefits of cloud technologies. The increasing importance of hybrid and multi-cloud strategies should be considered.

Financial Implications

Red Hat’s foray into the European Linux market presents a compelling opportunity, but its financial implications require careful analysis. Understanding the potential revenue streams, profit margins, and associated risks is crucial for strategic decision-making. This section delves into the financial aspects of Red Hat’s European expansion, providing insights into potential outcomes and the associated challenges.European Linux adoption is steadily growing, and Red Hat, with its strong brand and robust portfolio, is well-positioned to capitalize on this trend.

However, success hinges on accurate financial forecasting and risk mitigation. Competition in the European market is fierce, and Red Hat must effectively allocate resources to maximize its return on investment.

Financial Overview of Red Hat’s European Operations

Red Hat’s existing European operations provide a foundation for understanding the potential market. Historical revenue data, customer demographics, and operational costs in the region will be vital to extrapolate potential future performance. Key metrics include the current market share, average revenue per user, and the cost of acquiring and retaining customers in Europe. Understanding these factors will help determine the feasibility and profitability of future expansion.

Potential Revenue and Profit Projections

Forecasting Red Hat’s European Linux business revenue and profit requires considering various factors, including market size, growth rates, pricing strategies, and competitive dynamics. A thorough market analysis is essential to accurately estimate the potential market share. For example, a realistic growth projection might estimate a 15% increase in revenue over the next 5 years. Further refinement is achieved by considering the penetration rate of Red Hat products in each European country.

Detailed Financial Analysis of Red Hat’s Market Position

Red Hat’s market position in Europe is multifaceted. Its strengths include a robust product portfolio, strong brand recognition, and established partnerships. However, competitors like [mention a competitor] pose a significant challenge. A comprehensive analysis should consider the price sensitivity of the European market and the level of customer loyalty towards existing solutions. This should be compared with Red Hat’s global market performance to understand regional nuances.

Red Hat’s expansion into the European Linux market is definitely interesting. It’s a big move, and considering recent news about how companies like Autobytel are adjusting their strategies, like in the case of autobytel com hitting the road in Japan , it’s clear that adaptability is key in today’s market. This European push by Red Hat suggests they’re aiming to capitalize on growing demand for Linux solutions in the region.

Potential Financial Risks and Opportunities

Expansion into new markets inherently carries risks. Currency fluctuations, economic downturns, and unforeseen regulatory changes can all impact profitability. Red Hat must develop strategies to mitigate these risks, including hedging against currency fluctuations and building resilience into its supply chain. Opportunities, on the other hand, include potential synergies with existing European operations and the chance to gain market share from competitors.

Exploring new revenue streams through strategic partnerships and licensing agreements could also prove beneficial.

Comparison of Red Hat’s Financial Performance in Europe with Global Performance

A critical comparison is needed between Red Hat’s financial performance in Europe and its global performance. This analysis will reveal any regional variations in profitability, growth rates, and customer demographics. This comparison should highlight any potential discrepancies or differences between the European market and other global regions. Understanding these nuances is crucial for tailoring specific strategies to the European market.

Financial Model for Forecasting Red Hat’s European Market Share

A financial model is essential to predict Red Hat’s market share in Europe over the next five years. This model should incorporate key variables such as market size, growth rates, pricing strategies, and competitor actions. A realistic scenario could project Red Hat gaining 10% of the European Linux market share within the next five years, with specific projections for each year.

This model should be dynamic and adaptable to changing market conditions. This will allow for a thorough evaluation of the potential ROI and risks associated with the European expansion.

Example: A financial model using discounted cash flow analysis can project potential returns and highlight potential risks. Key variables to consider include projected revenue, operational costs, and capital expenditures.

Technological Aspects

The European Linux market is a dynamic landscape, shaped by both established players and emerging technologies. Understanding the current state of Linux technologies in Europe is crucial to assessing Red Hat’s strategic positioning and potential for growth. This section will delve into the technological aspects impacting Red Hat’s presence and future in the region.

Current State of Linux Technologies in Europe, Red hat moves on european linux market

Linux adoption in Europe spans various sectors, from enterprise servers to embedded systems. Open-source solutions are increasingly preferred for their flexibility, cost-effectiveness, and community support. Many European companies have already integrated Linux into their infrastructure, recognizing its benefits in terms of efficiency and customization. However, the pace of adoption varies across countries and industries. Government initiatives and industry standards play a significant role in shaping the trajectory of Linux usage.

Emerging Technologies’ Impact on Red Hat

Emerging technologies like containers and serverless computing are profoundly impacting the IT landscape. Containers, enabling the packaging and deployment of applications as isolated units, are transforming application development and deployment strategies. Serverless computing, offering a pay-as-you-go model for computation, is changing how cloud services are consumed. Red Hat’s position in these emerging areas will be critical for its continued success in Europe.

Red Hat’s existing expertise in virtualization and its open-source approach positions it well to adapt to these trends. The adoption of these technologies by European businesses is growing rapidly.

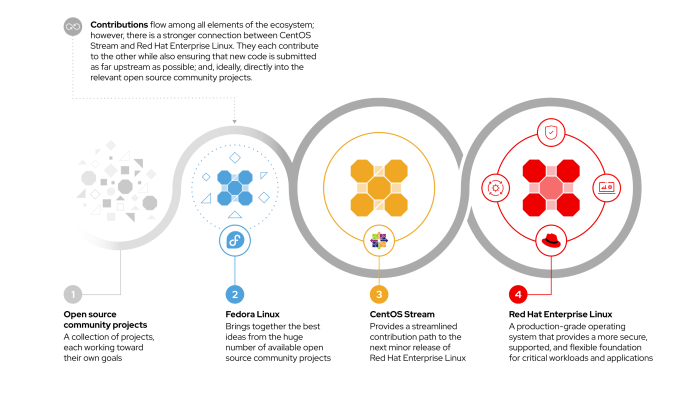

Red Hat’s Role in Open-Source Evolution

Red Hat has a significant role in shaping the evolution of open-source technologies in Europe. Its commitment to community involvement and support fosters collaboration and innovation. By offering commercial support, training, and enterprise-grade solutions, Red Hat empowers organizations to leverage the full potential of open-source technologies. Red Hat’s presence and leadership in open-source communities directly influence the adoption and development of Linux-based solutions in Europe.

Technological Infrastructure for Red Hat’s Offerings

Supporting Red Hat’s Linux offerings in Europe requires robust technological infrastructure. This includes reliable and high-speed network connectivity, secure data centers, and skilled personnel. The European Union’s focus on digital infrastructure development provides a supportive backdrop for Red Hat’s expansion. Addressing potential infrastructure gaps, particularly in specific regions, will be crucial to cater to the diverse needs of European enterprises.

Cloud-based solutions and hybrid approaches are gaining traction, which requires Red Hat to adapt its infrastructure offerings accordingly.

Potential Technological Innovations for Red Hat

Potential technological innovations could further enhance Red Hat’s presence in the European market. Focus on security-enhanced Linux distributions and advanced container orchestration solutions could create a competitive advantage. Furthermore, innovative solutions for edge computing, addressing the growing demand for distributed processing and real-time data analysis, could be a valuable addition to Red Hat’s portfolio. Development of specialized solutions tailored for specific European industries could be a key differentiator.

Comparison of Red Hat’s Linux Distribution and Competitors’ Offerings

| Feature | Red Hat Enterprise Linux | Canonical Ubuntu | SUSE Linux Enterprise Server |

|---|---|---|---|

| Commercial Support | Extensive, including enterprise-grade support packages | Available, varying in scope and cost | Comprehensive, catering to enterprise needs |

| Community Involvement | Active participation in open-source communities | Strong community support and contributions | Significant involvement in the Linux ecosystem |

| Containerization Support | Integrated containerization technologies, leveraging OpenShift | Robust containerization capabilities | Comprehensive support for containerization technologies |

| Serverless Computing | Cloud-native integration and serverless solutions | Cloud-based integration and serverless options | Cloud-based solutions and serverless computing |

| Security | Advanced security features and practices | Strong security features and practices | Robust security measures and tools |

This table highlights key features of Red Hat’s Linux distribution and competitors. These distinctions are crucial for understanding Red Hat’s competitive positioning in the European market. It is important to note that these are not exhaustive comparisons and that other factors might influence a specific company’s choice.

Ending Remarks

In conclusion, Red Hat’s foray into the European Linux market presents both exciting possibilities and considerable hurdles. The company’s strategic approach, competitive positioning, and financial projections will be crucial to their success. The evolving technological landscape and regulatory environment will also play a significant role. This expansion represents a major gamble for Red Hat, but one with the potential to yield substantial rewards if executed effectively.

The future of Red Hat’s presence in Europe is a story yet to be written.