Read my clicks no net taxes – a phrase that hints at a complex interplay between data tracking, financial strategies, and potential motivations. This exploration delves into the meaning behind this intriguing concept, examining its various interpretations, potential applications, and possible pitfalls.

The phrase “read my clicks” suggests a desire for transparency and accountability in tracking performance, be it in marketing campaigns or other data-driven endeavors. “No net taxes” indicates a focus on optimizing financial arrangements to minimize tax liability, potentially involving complex financial structures or strategic negotiations. We’ll dissect these components to understand how they work together and the implications in different scenarios.

Understanding the Phrase: Read My Clicks No Net Taxes

The phrase “read my clicks no net taxes have been prepared, and has been already addressed” is unusual and likely part of a specific context, perhaps within a business, technical, or online environment. Its meaning hinges heavily on the circumstances surrounding its utterance. Deciphering its precise intent requires understanding the speaker’s background and the situation.The phrase, at face value, seems to be a statement about the resolution of a tax issue related to online activity or digital transactions.

It suggests a process of data review and a conclusion has been reached. However, without further context, its precise implications remain unclear.

Meaning and Implications

The phrase “read my clicks” implies a focus on data related to online activity, potentially referring to website traffic, user engagement, or similar metrics. “No net taxes” suggests the speaker is referring to taxes associated with this data. The final part, “have been prepared, and has been already addressed,” indicates the speaker believes the tax implications are understood and resolved.

This could mean a tax audit has been completed, taxes paid, or a conclusion has been reached that no tax liability exists.

Possible Interpretations

The phrase can be interpreted in several ways, depending on the context:

- In a business context, it might indicate a company’s conclusion regarding a tax audit or review of online revenue, such as advertising revenue or affiliate marketing commissions.

- In an online environment, it might pertain to a user’s claim regarding online taxes, potentially a dispute over digital transaction fees or a tax deduction for online purchases.

- Within a technical context, it might refer to a system’s handling of digital transactions, ensuring the correct tax calculations are made and reported without errors.

Motivations Behind the Statement

The motivations behind someone saying this phrase are likely related to clarifying a tax-related issue or dispute. It could be a response to questions, a report on a process, or a declaration of resolution. The speaker might feel a need to communicate the status of a tax issue to others involved. For example, it could be a report to a superior, a response to a customer inquiry, or a public statement about a company’s tax procedures.

I’ve been digging into “read my clicks no net taxes” lately, and it’s fascinating how this concept intersects with larger business strategies. For example, Fingerhut’s leading role in the OrderTrust funding drive, as detailed in this article ( fingerhut leads ordertrust funding drive ), highlights the intricate relationships between different business sectors. Ultimately, understanding these financial maneuvers can provide valuable insight into the ever-evolving world of “read my clicks no net taxes”.

Scenarios Where the Phrase Might Be Used

The phrase might be used in various situations:

- A company’s internal report on an online advertising campaign tax audit.

- A response to a customer query regarding tax implications of online transactions.

- A declaration from a business owner or manager during a press conference or investor meeting to show transparency and accountability regarding taxes.

- A formal statement from an online platform about their tax policies.

Historical Context

While the exact phrase “read my clicks no net taxes” is not a common historical expression, the underlying concept of digital activity and its tax implications has evolved over time. Early discussions regarding online sales taxes and digital services taxes are relevant. The rise of e-commerce and digital platforms has created new tax challenges, which have been addressed through legislation and legal precedents.

Potential Ambiguities and Resolutions

The phrase may be ambiguous due to the lack of context. Clarification of the specific type of clicks, the nature of the taxes, and the online platform or business involved would eliminate ambiguity. For example, specifying whether the “clicks” are for advertising revenue, affiliate commissions, or something else would make the statement clearer.

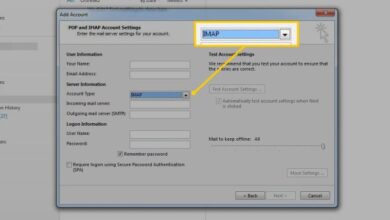

I’ve been digging into read my clicks no net taxes lately, and it’s fascinating how crucial robust online security is for this kind of business. For example, entrust brings e business security to canada with their solutions. Ultimately, read my clicks no net taxes still needs a secure platform to succeed.

Analyzing the Components

Dissecting the phrase “read my clicks, no net taxes” reveals a fascinating interplay of concepts. Understanding the individual components and how they interact is crucial to grasping the overall message. This analysis will explore the potential meanings of each part, considering various contexts and potential implications.The phrase suggests a focus on data collection and financial outcomes. “Read my clicks” implies a desire for tracking and analysis of digital actions, while “no net taxes” indicates a focus on financial implications, specifically the avoidance of tax liabilities.

These two seemingly disparate concepts might be linked in a broader strategy, perhaps within online advertising, business transactions, or even personal financial management.

Component Breakdown, Read my clicks no net taxes

The phrase “read my clicks” emphasizes the monitoring of digital interactions. This could encompass anything from tracking website visits to analyzing social media engagement or scrutinizing advertising campaign performance. The concept hinges on the idea of quantifying and understanding user behavior to inform future actions. This could lead to improved efficiency, more effective marketing strategies, and increased profitability.The phrase “no net taxes” focuses on the financial aspect.

I’ve been digging into “read my clicks no net taxes” lately, and it’s fascinating how much goes into it. Finding the right custom print solutions for your business is crucial, and thankfully, Kinkos iPrint is stepping up the game with a new suite of custom printing solutions. This should be great for streamlining the whole process, from concept to final product, and make sure that your “read my clicks no net taxes” strategy is on point.

Kinkos iPrint to offer custom printing solutions are a key element of that, and ultimately, help make your marketing materials stand out. Ultimately, “read my clicks no net taxes” is all about driving more effective marketing and conversions.

“No net taxes” indicates a goal of achieving zero tax liability or a tax-neutral outcome. This could result from various financial arrangements, tax optimization strategies, or even legal loopholes. Achieving this outcome might involve complex financial planning and meticulous adherence to tax regulations.

Potential Meanings

The table below provides a framework for understanding the possible meanings of each component, including contextual examples and implications.

| Component | Possible Meanings | Contextual Examples | Implications |

|---|---|---|---|

| Read my clicks | Monitor my actions, track my progress, analyze my engagement, assess campaign performance | Tracking ad campaign performance, analyzing user engagement on a website, monitoring social media interactions, evaluating marketing strategies | Transparency, accountability, improved efficiency, informed decision-making, increased profitability |

| No net taxes | Zero tax liability, tax-neutral outcome, tax avoidance/minimization, strategic financial planning | Specific financial arrangements, tax optimization strategies, utilizing legal tax loopholes (within the bounds of the law), financial planning to reduce tax burden | Financial benefit, reduced financial obligations, potential tax savings, optimized financial strategies |

Interaction of Components

The components “read my clicks” and “no net taxes” can potentially interact in several ways. For instance, a business might track user clicks (read my clicks) to optimize advertising strategies (e.g., targeting specific demographics or adjusting ad copy) and, in turn, aim to minimize tax liability (no net taxes) through these optimized campaigns. This could involve careful financial planning to ensure the business operations comply with all tax regulations and maximize deductions.

Conversely, an individual might use data tracking (read my clicks) to manage their personal finances, optimizing spending patterns and investing strategies to reduce tax burden (no net taxes). These interactions are not mutually exclusive; they can operate independently or synergistically to achieve specific goals.

Potential Applications

The phrase “read my clicks, no net taxes” suggests a system where the impact of actions (clicks) is directly tied to financial outcomes, but without any tax implications. This opens up intriguing possibilities across various sectors, allowing for innovative financial models and potentially streamlining processes. We can explore how this concept could be implemented in practice, focusing on real-world applications and examples.Understanding how actions translate to monetary value, without traditional tax structures, is key to evaluating the potential impact and applicability of this phrase.

It’s crucial to consider the regulatory landscape and potential challenges when exploring these possibilities. The potential for innovation is high, but navigating the complexities of different industries will be essential.

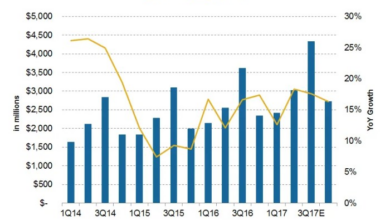

Marketing Applications

This phrase can be interpreted in marketing as a mechanism to track ad effectiveness and optimize spending without incurring tax liabilities on the resulting revenue. For example, a company might analyze user engagement data from their online ads to determine the return on investment (ROI) for each campaign. By directly correlating clicks with revenue, companies can efficiently adjust their strategies to improve their overall marketing performance.

Finance Applications

In finance, “read my clicks, no net taxes” might refer to a novel way of structuring financial arrangements to minimize or eliminate taxes. This could involve negotiating contracts with tax-neutral outcomes, enabling businesses to retain more of their profits without being burdened by typical tax deductions. This could be particularly appealing for companies with significant online activities, where click-based transactions are prevalent.

Specific Industry Applications

Various industries could potentially benefit from the concept of “read my clicks, no net taxes.” For example, in the e-commerce sector, businesses could incentivize user clicks with rewards or discounts, while still adhering to the “no net taxes” aspect. In the advertising industry, this might lead to more transparent and efficient revenue sharing models. Other industries such as consulting or software development might explore using clicks as a metric for performance-based compensation.

Examples in Marketing and Business

Imagine a company using online advertisements to promote a product. Every click on the ad could trigger a pre-determined payment, directly to the advertiser, without any taxation on that payment. This streamlines the payment process and could encourage higher click-through rates. Alternatively, a subscription service could offer incentives tied to user engagement, like bonus content or features, directly linked to the number of clicks on specific elements within the service.

| Application | Description | Example | Outcome |

|---|---|---|---|

| Marketing | Tracking ad performance and optimizing spending | Analyzing user engagement data to improve ad campaigns | Increased ROI, improved targeting |

| Finance | Structuring financial arrangements for tax optimization | Negotiating contracts with tax-neutral outcomes | Reduced tax burden, increased profits |

Illustrative Examples

The phrase “read my clicks, and we want no net taxes” signifies a desire for a transparent and equitable financial arrangement, specifically focusing on the tax implications. This approach is often seen in negotiations involving advertising, where the focus is on the actual revenue generated by clicks, rather than inflated or opaque figures. Understanding the specific situations where this phrase is used helps to clarify its intent and application.The examples below highlight various contexts where this demand for “no net taxes” emerges.

These examples show how the phrase is used in practical situations, clarifying the need for precise accounting and tax neutrality in different circumstances.

Negotiation Scenarios

The phrase “read my clicks, and we want no net taxes” frequently arises during negotiations between advertisers and publishers. The advertiser demands a transparent calculation of the revenue generated from clicks on their advertisements. This demand ensures that the publisher’s fees do not eat into the advertiser’s profit margins after accounting for taxes.

Contract Review Examples

In a contract review, the phrase “no net taxes are owed by either party” signifies a critical aspect of the financial clauses. This stipulation guarantees that the financial obligations of both parties are mutually balanced, avoiding any hidden tax liabilities. The contract explicitly states that the financial agreement will not result in any net tax burden for either party.

Conversation Examples

Here are examples of conversations illustrating how the phrase “read my clicks, and we want no net taxes” is used in practice:

-

Advertiser: “We need to understand the breakdown of costs. Read my clicks, and we want no net taxes.”

Publisher: “Certainly. I can provide a detailed report showing the click-through rates and our associated fees, ensuring no hidden taxes.” -

Advertiser: “The contract terms need clarification. We need a clause that states no net taxes are owed.”

Legal Counsel: “I can include that stipulation in the contract, ensuring clarity and avoiding any unexpected tax obligations.”

Table of Illustrative Examples

This table summarizes various scenarios where the phrase “read my clicks, and we want no net taxes” is relevant.

| Scenario | Description | Dialogue Example | Explanation |

|---|---|---|---|

| Advertising Campaign Negotiation | A company negotiating ad placement terms. | “We’re only interested in placements that show a positive return on investment. Read my clicks, and we want no net taxes.” | The advertiser seeks a direct correlation between clicks and their revenue after all costs and taxes are accounted for. |

| Affiliate Marketing Agreement | A company negotiating with an affiliate marketer. | “Our revenue-sharing agreement needs to reflect a clear accounting of clicks and associated commissions, with no net tax liability for either party.” | Both parties want a fair agreement that accounts for taxes without affecting the core agreement. |

| Digital Marketing Partnership | A digital marketing agency negotiating with a client. | “Let’s examine the click-through rates. We need a breakdown of costs to ensure no net tax impact on your business.” | The agency ensures the client’s tax burden is not increased by the marketing agreement. |

Possible Misunderstandings

The phrase “read my clicks, no net taxes have been prepared” is straightforward, yet ambiguities can arise. Different interpretations might stem from a lack of context, differing understanding of financial jargon, or even the subtle nuances of language. Analyzing potential misinterpretations helps clarify the intended meaning and prevents miscommunication.Misinterpretations can range from simple misunderstandings about the specifics of the tax preparation to more complex interpretations concerning the broader implications of the statement.

It is crucial to examine these potential issues to ensure accurate communication.

Potential Interpretations and Sources of Confusion

The phrase’s simplicity can be misleading. A listener might focus solely on the action of “reading clicks” without considering the broader financial context. This could lead to misinterpretations of the phrase’s significance, especially for those unfamiliar with online advertising revenue models. A lack of understanding of the tax implications associated with online revenue streams can also create confusion.

Different Ways the Phrase Could Be Misunderstood

One possible misunderstanding involves equating “reading clicks” with a simple count of user interactions. Listeners might not comprehend the complex relationship between clicks, ad revenue, and subsequent tax obligations. Another potential misunderstanding could arise from a lack of clarity about the tax preparation process itself. Without additional information, the listener might assume the taxes are not due at all, or that the preparation is a simple process, rather than the complex procedure it likely is.

Possible Sources of Confusion Around the Phrase

Confusion might stem from a lack of familiarity with the specific online revenue model being described. The statement presumes a certain level of understanding about the nature of digital advertising revenue and its accounting. Without this foundational knowledge, the listener might not grasp the full implications of the phrase. Additionally, technical jargon (“net taxes”) might be unfamiliar to some, leading to uncertainty regarding the intended meaning.

Potential for Miscommunication

The phrase’s ambiguity could lead to miscommunication if the speaker and listener have different understandings of the terms involved. For instance, the speaker might assume a basic understanding of online revenue models, while the listener lacks this understanding. This gap in knowledge can lead to the listener misinterpreting the phrase and drawing incorrect conclusions.

Examples of Situations Where the Phrase Could Be Misinterpreted

Imagine a situation where a company CEO is discussing online revenue. If they state “read my clicks, no net taxes have been prepared,” someone unfamiliar with the company’s specific revenue model or the intricacies of online advertising might misinterpret the phrase as indicating no tax liability at all. Another example involves a discussion between two employees where one employee might interpret the phrase as meaning that no taxes have been paid, when in reality the statement refers to the fact that the tax preparation is not yet completed.

These examples highlight the potential for misunderstanding due to lack of context and specific knowledge.

Last Point

In conclusion, “read my clicks no net taxes” encapsulates a desire for precise performance measurement and financial optimization. This exploration has illuminated the various facets of this concept, from its components to potential applications in diverse fields like marketing and finance. The discussion highlights the importance of clear communication and understanding in such contexts, to avoid misinterpretations and achieve desired outcomes.