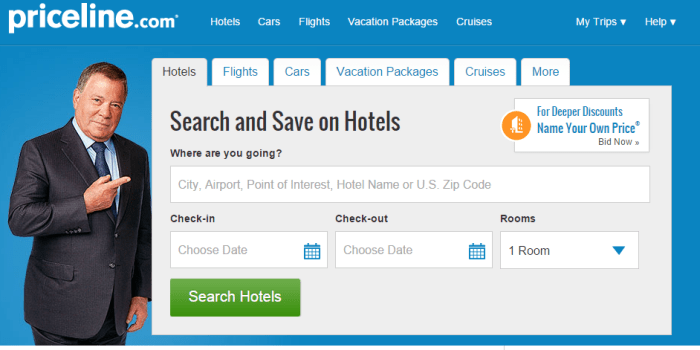

Priceline com tells home buyers name your price – Priceline.com tells home buyers “name your price,” offering a revolutionary approach to home purchasing. This new system allows buyers to submit their desired price for a home, potentially bypassing traditional negotiation tactics. But what are the mechanics behind this innovative model? How does it affect both buyers and sellers? And what are the potential pitfalls and advantages of this new way to buy a home?

This article explores the intricacies of Priceline.com’s “Name Your Price” system, examining the process from a buyer’s perspective, analyzing market trends, and delving into the strategies and challenges for both buyers and sellers. We’ll look at the technology, legal considerations, and the potential impact on the housing market.

Understanding the “Name Your Price” Model: Priceline Com Tells Home Buyers Name Your Price

Priceline.com’s “Name Your Price” feature for homes presents a unique approach to the traditional home-buying process. This model, while offering potential benefits for both buyers and sellers, also comes with inherent challenges. It’s a system designed to foster a more direct and potentially faster transaction, but understanding its mechanics is key to navigating this unconventional market.This system works by allowing buyers to submit a price they’re willing to pay for a home, while sellers have the option to accept or reject the offer.

The key is transparency and flexibility, which can accelerate the process, but also requires careful consideration by all parties.

Mechanics of the “Name Your Price” Feature

The “Name Your Price” system allows buyers to express their desired price range for a home. This differs significantly from traditional offers, which often involve a formal offer contingent on various factors. The system essentially puts the buyer in a more active role in the negotiation process, allowing for a more direct approach to securing a home.

Step-by-Step Procedure for a Buyer

The process typically involves these steps:

- The buyer identifies homes they are interested in through Priceline.com’s listings.

- The buyer carefully researches the home’s comparable properties, local market trends, and the asking price.

- Based on their research and desired budget, the buyer enters a price they are willing to pay for the home, often within a specified range.

- The buyer may be required to provide supporting documentation, such as proof of funds, to strengthen their position.

- The buyer actively monitors the status of their offer, keeping in close contact with the real estate agent representing the seller.

Potential Advantages and Disadvantages

For buyers, the advantage lies in the potential to secure a home at a price they’re comfortable with, potentially avoiding the protracted negotiations often associated with traditional offers. However, the disadvantage is the risk of the seller rejecting the offered price. For sellers, the benefit is the potential for a quicker sale, and the opportunity to potentially receive a price higher than they might through traditional methods.

Conversely, the disadvantage lies in the potential for receiving an offer below their expectations, and the increased pressure of making a quick decision.

Comparison to Traditional Home Buying Processes

The “Name Your Price” model contrasts significantly with traditional home buying. In traditional methods, offers are typically presented with contingencies and are subject to multiple rounds of negotiation. In contrast, “Name Your Price” is more straightforward, emphasizing direct pricing. The buyer is presented with the opportunity to set the initial price, potentially leading to a faster transaction if the seller accepts.

Comparison to Other Online Real Estate Platforms

Compared to other online real estate platforms, Priceline’s “Name Your Price” model stands out for its unique approach to pricing. While other platforms offer similar features, the “Name Your Price” feature emphasizes a more direct pricing exchange between buyer and seller, bypassing many of the standard contingencies and negotiations.

Typical “Name Your Price” Home Purchase Steps

| Step | Buyer Action | Seller Action |

|---|---|---|

| 1 | Identifies desired home and researches comparable properties. | List the property on Priceline.com. |

| 2 | Enters desired price range and provides supporting documents. | Reviews the offer and considers the price. |

| 3 | Monitors the offer status and communicates with the agent. | Accepts or rejects the offer. |

| 4 | Negotiates terms if the offer is accepted. | Negotiates terms if the offer is accepted. |

| 5 | Completes necessary paperwork and closes the transaction. | Completes necessary paperwork and closes the transaction. |

Market Impact and Trends

The “Name Your Price” model, a revolutionary approach to home buying, is rapidly reshaping the housing market. Its impact on traditional practices, pricing strategies, and the overall buying experience is profound and warrants careful consideration. This model introduces a degree of flexibility and control previously unseen in the real estate landscape.The model’s influence extends beyond individual transactions. It’s altering the dynamics of supply and demand, potentially leading to interesting shifts in market equilibrium.

This new approach requires a nuanced understanding of how it affects price volatility, negotiation tactics, sale timelines, and long-term market trends.

Impact on the Overall Housing Market

The “Name Your Price” model directly affects the overall housing market by introducing a dynamic pricing mechanism. Instead of a rigid, competitive bidding process, this model fosters a more personalized and potentially quicker transaction process. This can lead to a more efficient allocation of homes, potentially reducing the time homes remain on the market. However, it also introduces a degree of uncertainty, as the final price is not predetermined.

Potential for Price Volatility

The “Name Your Price” model inherently introduces the potential for price volatility. While it allows sellers to potentially obtain higher prices, it also opens the door to fluctuating final asking prices. Buyer and seller expectations may influence the final price, potentially creating a more unpredictable market compared to traditional sales. Real-world examples demonstrate that market fluctuations and individual circumstances can significantly affect the ultimate sale price, sometimes leading to price increases or decreases depending on market conditions and buyer interest.

Influence on Negotiation Strategies

The “Name Your Price” model necessitates a significant shift in negotiation strategies. Traditional methods of negotiation, based on competitive bidding, are largely rendered obsolete. Instead, sellers must be prepared to adapt their strategy, potentially offering more nuanced discussions regarding the asking price and associated terms. Buyers, conversely, need to be prepared to justify their offer within the context of the market and the property’s features.

Effect on Home Sale Timeframes

The “Name Your Price” model has the potential to shorten the timeframe for home sales. By removing the need for multiple rounds of bidding, the process can be streamlined. However, this efficiency depends on both buyer and seller flexibility and agreement on the final price. The elimination of bidding wars could accelerate the sales process, though potential delays might arise from the negotiation process itself.

Comparison of Average Sale Times

| Method | Average Sale Time | Factors Affecting Time |

|---|---|---|

| Traditional Methods (e.g., bidding wars) | Variable, often exceeding 30-60 days | Competition, market conditions, property characteristics, and buyer/seller negotiations. |

| “Name Your Price” Model | Potentially shorter, ranging from a few days to several weeks | Buyer and seller agreement, market dynamics, and the level of flexibility demonstrated by both parties. |

Potential Trends Over Time

The “Name Your Price” model’s impact on the housing market is likely to evolve over time. Several potential trends may emerge. One possible trend is an increased focus on pre-sale pricing strategies. Another is a more refined understanding of market pricing dynamics and their correlation to “Name Your Price” offers. This could lead to the development of predictive models and tools to help both buyers and sellers navigate the new model.

Additionally, the model may influence the development of new real estate agents’ roles, requiring them to be more consultative and market-aware than in the past.

Consumer Perspective

The “Name Your Price” model on Priceline.com offers a unique dynamic to the travel booking experience. Consumers are empowered to directly interact with sellers, potentially securing a better deal than traditional bidding systems. This model introduces an element of negotiation and self-advocacy that can lead to significant savings. However, it also introduces complexities and potential risks that consumers need to understand.The consumer experience with Priceline’s “Name Your Price” feature is a two-sided coin.

Priceline.com letting homebuyers name their price is a fascinating development. It’s almost like the online marketplace is catching on to the principle of supply and demand. This strategy seems quite similar to how onsale com shifts gears to sell PCs at cost is revolutionizing the tech sector. Ultimately, both models highlight a trend of consumer empowerment and a dynamic approach to pricing in the online marketplace.

Priceline.com’s strategy seems well-positioned to tap into this new wave of consumer-driven pricing.

On one hand, the flexibility and direct negotiation are enticing. Consumers can propose a price that aligns with their desired budget, potentially finding a perfect match for their needs. On the other hand, navigating the system, understanding seller expectations, and managing the potential for a non-successful negotiation is essential for a positive outcome.

Priceline.com’s new “name your price” system for homes is fascinating, right? It’s like a modern-day auction, but for houses! This innovative approach reminds me of the incredible success of an e-commerce star, an e commerce star is bornbaltimore inc , showing how dynamic pricing can disrupt traditional markets. Ultimately, Priceline’s strategy might just revolutionize how we buy and sell homes, much like how online shopping has transformed retail.

Consumer Experience with Name Your Price

The “Name Your Price” feature allows consumers to submit their desired price for a hotel, car rental, or other travel services. This process is often more interactive than a standard booking site, where the consumer is presented with predetermined pricing options. The consumer’s proposed price directly impacts the seller’s response. This interactive element allows for a dynamic negotiation, potentially resulting in significant savings.

However, this also introduces an element of uncertainty as the success of the negotiation depends on the seller’s willingness to accept the proposed price.

Priceline.com’s “name your price” approach for homebuyers is pretty interesting, right? It’s a bold move, but it also hints at a broader shift in how we approach pricing. This reminds me of how iship announces new e-commerce shipping service , which seems to be streamlining the shipping process, creating a more efficient marketplace. Ultimately, Priceline’s strategy might just be a sign of the times, where buyers have more control over the price they pay.

Potential Risks and Rewards, Priceline com tells home buyers name your price

Consumers face potential risks when using the “Name Your Price” feature. A crucial factor is the risk of not securing a booking at all, as the seller may not accept the proposed price. Furthermore, consumers might end up paying more than expected if their initial price is too low. Conversely, there are significant rewards. Consumers have the opportunity to secure attractive deals by precisely targeting their desired price point.

Success Stories and Challenges

A potential success story is a consumer finding a hotel at a price significantly lower than advertised elsewhere. This success is directly related to the consumer’s knowledge of the market and the ability to effectively negotiate. A challenge, however, is when the consumer’s proposed price is too low and the seller refuses the offer. This highlights the importance of understanding the market value of the service and strategically approaching the negotiation process.

Psychological Factors in Pricing

The psychology of pricing plays a significant role in the “Name Your Price” model. Consumers may be influenced by factors such as anchoring bias (being influenced by the first price they see), framing effects (how the price is presented), and their own perceived value of the product. For instance, a higher initial price may influence a consumer to propose a lower price, even if it’s still above the actual value of the service.

Similarly, the presentation of a deal, such as highlighting the price savings, can significantly impact the consumer’s decision.

Comparison of Buyer and Seller Expectations

| Buyer Expectations | Seller Expectations | Potential Mismatches |

|---|---|---|

| To secure a desirable service at a competitive price. | To receive a fair price for the service, considering market value and potential costs. | Buyer may propose a price significantly lower than the seller’s perceived value, leading to a declined offer. |

| To engage in a transparent and efficient negotiation process. | To have the flexibility to accept or decline offers. | Differences in expectations regarding the negotiation process can lead to frustrations on both sides. |

| To feel confident that the proposed price is fair and reasonable. | To perceive the proposed price as reflecting the market value of the service. | Discrepancies in the perception of market value may lead to unsuccessful negotiations. |

Seller Perspective

The “Name Your Price” model, while offering potential benefits for buyers, presents a unique set of considerations for sellers. It shifts the traditional negotiation dynamic, requiring sellers to adapt their pricing strategies and mindset. This section delves into the seller experience, examining the challenges and opportunities inherent in this approach.

Seller Experience with Name Your Price

Sellers using the “Name Your Price” system must be prepared for a different sales process. They are not simply listing a property with a suggested price; they are actively engaging with potential buyers to determine the optimal price. This involves a more involved and nuanced understanding of market value and the motivations of potential buyers. It demands proactive communication and a willingness to consider a wider range of offers.

Adapting to the Name Your Price System

Sellers can adapt to this system by focusing on accurate market research and thorough property preparation. Thorough knowledge of comparable sales in the area is crucial. This includes understanding recent sales, listing prices, and factors influencing the market. Preparing the home for sale—through staging, repairs, and professional photography—can significantly influence buyer perception and potentially justify a higher price.

For instance, sellers might invest in minor upgrades to increase the perceived value of their home, potentially attracting higher offers.

Potential Challenges and Strategies for Sellers

Potential challenges include navigating a potentially lengthy negotiation process, dealing with offers that may be lower than expected, and managing the psychological aspects of pricing. To address these challenges, sellers should develop a clear pricing strategy, which should be based on thorough market research. A strong understanding of their property’s unique features and the current market conditions is vital.

Maintaining a professional and positive demeanor throughout the process is also important. This can help in building trust and ultimately closing a deal at a mutually agreeable price.

Positioning Homes Effectively

Positioning homes effectively in the “Name Your Price” model necessitates a strategic approach that emphasizes the property’s unique value proposition. High-quality photography and detailed property descriptions are crucial to showcase the property’s strengths. Highlighting any recent upgrades, unique features, or desirable location details will be important to potential buyers. A compelling online presence, including virtual tours, can greatly enhance the visibility and attractiveness of the property.

Pros and Cons of “Name Your Price” for Sellers

Pros include the potential to achieve a higher sale price by attracting a broader range of potential buyers. This is possible because the seller is in control of their initial price. Cons include the potential for a longer sales cycle and the need for active participation in the negotiation process. This might lead to uncertainty and a potentially stressful process if the seller isn’t prepared.

Financial Implications for Sellers

Financial implications include the potential for higher sale prices, but also the risk of not achieving the desired price if the property doesn’t resonate with buyers. The longer sales cycle might also mean potential additional holding costs. These factors should be considered when developing a pricing strategy and managing expectations. Potential for a higher sales price is balanced against the possibility of a lower price if the home doesn’t attract suitable offers.

Table: Typical Seller Responses to “Name Your Price” Offers

| Offer Type | Seller Response | Factors Influencing Response |

|---|---|---|

| Competitive Offer (Close to asking price) | Accept offer | Market value, property condition, buyer’s financial position, overall market demand. |

| Lower Offer (Significantly below asking price) | Counter-offer or decline | Market value compared to initial offer, seller’s desired price, potential for future negotiation, overall market conditions. |

| Multiple Offers | Evaluate offers based on terms, conditions, and market comparison | Market analysis, buyer’s financial strength, time frame for closing, potential for future negotiation. |

| No Offers | Re-evaluate pricing strategy, adjust expectations, potentially reduce asking price, consider different marketing strategies. | Market conditions, property features, marketing efforts, seller’s desired price. |

Technological Aspects

The “Name Your Price” model, while conceptually straightforward, relies heavily on sophisticated technology to function smoothly and securely. This technology encompasses everything from the platform’s architecture to the algorithms that drive price determination and user interaction. Understanding these technological underpinnings is crucial to appreciating the model’s complexities and its potential for disruption in the real estate market.The core of the “Name Your Price” platform is a robust online marketplace designed to connect buyers and sellers.

This platform, acting as a central hub, facilitates communication, transaction processing, and the intricate dance of price negotiation. Security is paramount, demanding a strong technological foundation to protect sensitive data and maintain user trust.

Platform Architecture

The platform’s architecture is built upon a scalable cloud-based infrastructure. This allows for handling a large volume of user requests and data efficiently, crucial for a platform that anticipates high traffic during peak periods or market fluctuations. Real-time updates and dynamic displays of available properties are possible due to this design. The platform’s architecture is also designed for flexibility, accommodating potential future expansions and enhancements.

Security Measures

Robust security measures are implemented to safeguard user data. These measures include encryption of sensitive information, multi-factor authentication protocols, and regular security audits to detect and mitigate vulnerabilities. The platform utilizes advanced encryption techniques to protect financial transactions and personal details. Access controls are meticulously managed to limit unauthorized access and maintain the confidentiality of buyer and seller information.

Communication and Transaction Features

The platform facilitates communication and transactions through various features. Secure messaging systems allow for direct communication between buyers and sellers, enabling transparent negotiations and streamlining the process. Built-in tools for document sharing, virtual tours, and scheduling property viewings are included to further streamline the experience. Payment processing is integrated securely, and contracts can be electronically signed and stored for ease of record-keeping.

These tools are designed to improve efficiency and transparency.

Role of Algorithms in Price Determination

Algorithms play a vital role in price determination. Sophisticated algorithms analyze market trends, property characteristics, comparable sales, and other relevant data to provide insights to both buyers and sellers. These insights assist in formulating realistic and competitive price expectations, contributing to smoother and more efficient negotiations. The algorithms constantly adapt to changing market conditions, ensuring price recommendations are relevant and accurate.

For example, if a property’s neighborhood experiences an increase in property values, the algorithm would reflect this in its price estimations.

Examples of Technology Influence

Technology influences the “Name Your Price” model in several ways. Automated valuation models, for instance, provide initial price estimations, accelerating the negotiation process. Real-time market data feeds allow both parties to remain informed about current market conditions, enhancing transparency and potentially leading to faster agreement. Mobile-friendly interfaces allow users to access and engage with the platform from various devices, fostering greater accessibility and flexibility.

Technological Components of the Platform

| Component | Function | Security Considerations |

|---|---|---|

| Cloud Infrastructure | Provides scalability and reliability for handling large volumes of data and transactions. | Data encryption at rest and in transit, access controls, regular security audits. |

| Secure Messaging System | Enables direct communication between buyers and sellers. | End-to-end encryption, access controls, secure message verification. |

| Automated Valuation Models | Provides initial price estimations based on market data. | Regular model validation, data integrity checks, transparency in algorithm methodology. |

| Real-time Market Data Feeds | Provides up-to-date information on market trends and comparable sales. | Data accuracy verification, secure data acquisition, and regular data updates. |

| Payment Processing System | Facilitates secure financial transactions. | PCI DSS compliance, secure payment gateways, transaction logging. |

Legal and Regulatory Considerations

The “Name Your Price” model, while offering potential benefits for both buyers and sellers, introduces a unique set of legal and regulatory complexities. Navigating these complexities is crucial for ensuring a fair and transparent marketplace. Understanding potential pitfalls and establishing clear legal frameworks are essential for the long-term success of this innovative approach.The model’s inherent flexibility necessitates careful consideration of legal implications, particularly concerning contract formation, pricing transparency, and potential liability.

The lack of a predetermined price can lead to ambiguity and disputes if not carefully managed through clear and comprehensive legal documents.

Potential Legal Implications

The “Name Your Price” model introduces several potential legal implications. These implications range from issues concerning contract validity to liability for misrepresentation. This model’s inherent flexibility can create uncertainty if not properly structured and enforced. The absence of a fixed price can make it harder to prove fraudulent intent or misrepresentation.

Relevant Legal Frameworks and Regulations

Various legal frameworks and regulations can influence the operation of a “Name Your Price” model. These include consumer protection laws, real estate regulations, and general contract law principles. Understanding these regulations is essential to mitigate potential risks and ensure compliance.For example, consumer protection laws may mandate specific disclosures or limitations on how sellers can set prices. Real estate regulations may dictate the format and content of contracts.

Understanding and adhering to these regulations is crucial to prevent legal challenges.

Potential Conflicts and Resolution

Disputes are possible in any marketplace, and the “Name Your Price” model is not immune. Disagreements can arise regarding price valuations, contract terms, or the interpretation of agreed-upon conditions.Several strategies can resolve these conflicts, including mediation, arbitration, and litigation. Mediation, an informal process, can facilitate communication and compromise. Arbitration, a more structured process, may be faster than litigation.

Litigation, while time-consuming, can provide a legally binding resolution.

Liability Issues for Buyers and Sellers

Both buyers and sellers face potential liability issues. Sellers may be liable for misrepresenting the property’s condition or value. Buyers may be liable for failing to disclose material information or for breaching contract terms.To mitigate these risks, comprehensive and transparent contracts are crucial. Such contracts should clearly define responsibilities, contingencies, and dispute resolution procedures. Both parties should understand the potential legal ramifications of their actions within the “Name Your Price” framework.

Importance of Transparent Contracts

Clear and transparent contracts are paramount in the “Name Your Price” model. These contracts must explicitly define the pricing process, the conditions under which the price is final, and the dispute resolution mechanisms. This transparency helps prevent misunderstandings and ambiguities that could lead to legal challenges.

Potential Legal Challenges and Resolutions

| Challenge | Potential Resolution | Supporting Laws |

|---|---|---|

| Discrepancy in price valuation | Establish a formal valuation process with certified appraisers. Define a timeframe for acceptance and counter-offers. | Real Estate Appraisal Laws, Consumer Protection Acts |

| Misrepresentation of property condition | Require thorough inspections and disclosure of known issues. Establish a mechanism for handling disputes regarding undisclosed defects. | Real Estate Disclosure Laws, Fraud Statutes |

| Breach of contract | Clearly define contract terms and responsibilities. Include provisions for liquidated damages and remedies for breach. | Contract Law, State Specific Contract Laws |

| Lack of clarity in pricing mechanism | Explicitly define the process for price negotiation and acceptance. Provide clear guidelines on the use of external tools or services. | Contract Law, Consumer Protection Laws |

Final Conclusion

In conclusion, Priceline.com’s “Name Your Price” model presents a compelling alternative to traditional home buying. While it promises efficiency and potentially faster transactions, it also introduces new complexities and risks for both buyers and sellers. Understanding the mechanics, potential market impact, and consumer/seller perspectives is crucial for navigating this evolving landscape. The long-term success of this model remains to be seen, but it undoubtedly reshapes the way we approach homeownership in the digital age.