Politics taxes stir upe commerce commission – Politics, taxes stir up the Commerce Commission, creating a complex interplay of political agendas, economic impacts, and regulatory responses. This exploration delves into the historical relationship between political motivations and tax policies, examining how different political parties utilize taxation to advance their ideologies.

The analysis covers the effects of current tax laws on various commercial sectors, from the economic consequences on business operations to the competitiveness of businesses under different tax structures. It also highlights methods of tax avoidance employed by businesses and the Commerce Commission’s role in monitoring the economic effects of taxation on trade, including how they evaluate the fairness of tax policies.

Political Influence on Taxation

Taxation is a cornerstone of modern governance, directly impacting citizens’ lives and shaping the economic landscape. Political ideologies profoundly influence tax policies, often serving as instruments for achieving specific social and economic goals. This interplay between politics and taxation has a rich history, demonstrating how tax systems can reflect and reinforce political agendas.Historically, political parties have used tax policies to advance their respective platforms.

Progressive taxation, designed to redistribute wealth, has been a key element in the platforms of left-leaning parties. Conversely, conservative parties often favor lower taxes and reduced government intervention in the economy, believing it stimulates economic growth. This inherent tension between the role of government and individual liberties is frequently reflected in tax policies.

Politics and taxes are definitely stirring things up at the Commerce Commission right now. Meanwhile, companies like Bertelsmann and Lycos are expanding their European presence, which could have interesting implications for the market. Bertelsmann Lycos expand european presence might be trying to navigate the complexities of the current political and economic climate, which, in turn, is impacting the Commerce Commission’s work in regulating business practices.

It’s all quite a tangled web!

Historical Relationship Between Political Agendas and Tax Policies

Political parties have historically used taxation as a tool to implement their ideologies. For instance, the progressive income tax, aimed at taxing higher earners at a higher rate, was initially a tool to address income inequality and fund social programs. Conversely, tax cuts, often championed by conservative parties, are often justified by the belief that reduced taxes incentivize investment and economic growth.

Examples of Political Parties Using Taxation to Advance Their Ideologies

Numerous examples illustrate how political parties employ taxation to promote their ideologies. In the United States, the Republican Party’s platform often advocates for lower corporate taxes, arguing that this stimulates business investment and job creation. In contrast, the Democratic Party frequently supports higher taxes on corporations and high-income earners to fund social programs and reduce income inequality.

Different Political Viewpoints on Tax Reform and Proposed Solutions

Political viewpoints on tax reform are diverse and often reflect underlying economic philosophies. Progressive taxation proponents advocate for higher marginal tax rates for higher earners, arguing this redistributes wealth and funds social programs. Conversely, proponents of flat taxes advocate for a single tax rate for all income levels, arguing this simplifies the tax code and reduces bureaucratic burden.

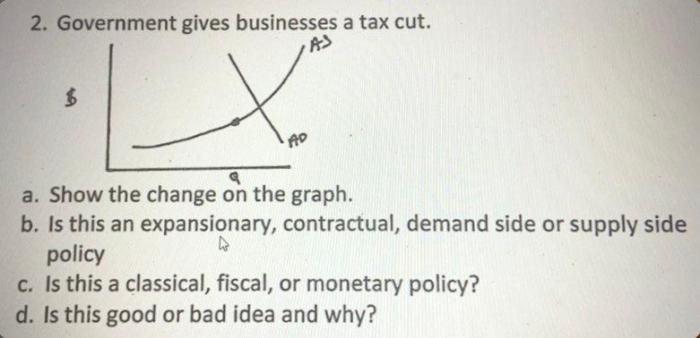

Further, supply-side economics advocates often propose lower corporate tax rates to stimulate investment and economic growth.

Comparison and Contrast of Tax Policies of Different Countries, Highlighting Political Factors

Tax policies vary considerably across countries, often reflecting their unique political and economic contexts. For example, Scandinavian countries, generally characterized by social democratic parties, tend to have higher taxes and more extensive social safety nets. In contrast, countries with more laissez-faire political systems may have lower tax rates but potentially less robust social safety nets.

Political Factions Involved in Tax Legislation

| Party Affiliation | Proposed Changes | Reasoning |

|---|---|---|

| Liberal Party | Increased taxes on corporations and high-income earners. | Funding social programs and reducing income inequality. |

| Conservative Party | Lower corporate and individual income taxes. | Stimulating economic growth and reducing the burden on businesses. |

| Socialist Party | Progressive taxation with significant redistribution. | Addressing income inequality and funding social programs. |

Taxation Impact on Commerce

Taxation plays a pivotal role in shaping the economic landscape of any country. It’s not merely a revenue-generating mechanism; it directly influences investment decisions, business operations, and the competitiveness of various commercial sectors. Understanding the impact of tax policies on commerce is crucial for informed discussions about economic growth, development, and overall prosperity. Different tax structures can incentivize certain behaviors or hinder others, leading to significant consequences for both businesses and consumers.Current tax laws significantly affect various commercial sectors.

Different sectors have varying levels of exposure to different types of taxes, such as income tax, sales tax, property tax, and excise taxes. The specific impact of these taxes can vary depending on the nature of the business and the tax rates applied. Furthermore, the complexity of the tax code often makes it challenging for businesses, particularly small and medium-sized enterprises (SMEs), to navigate the intricacies of tax compliance.

Political squabbles and tax hikes are definitely stirring up the Commerce Commission, creating a lot of uncertainty. Meanwhile, the city of Baltimore is taking its surplus to net auctions, a smart move for maximizing revenue streams, similar to how the Commerce Commission could potentially benefit from similar strategies. city of baltimore takes surplus to net auctions This highlights how different approaches to revenue generation can be a key element to consider when navigating the complexities of the current political climate and its effects on the Commerce Commission.

This can lead to compliance issues and increased costs for businesses, hindering their ability to compete effectively.

Taxation Effects on Specific Commercial Sectors

Different commercial sectors face distinct tax burdens and challenges. For example, the manufacturing sector may be significantly affected by property taxes on manufacturing facilities and excise taxes on raw materials or finished goods. The retail sector, on the other hand, is often subject to sales taxes, which directly impact consumer prices and ultimately affect their purchasing decisions. The impact of tax policies on specific sectors is multifaceted and can vary depending on numerous factors, including the tax structure, the economic environment, and the specific characteristics of the business.

Economic Consequences of Tax Policies

Tax policies significantly influence business operations and investment decisions. High tax rates can discourage investment, as businesses may perceive the return on investment (ROI) as insufficient compared to the tax burden. Conversely, favorable tax policies can incentivize investment, leading to job creation, economic growth, and increased productivity. Tax policies can also affect employment levels, as companies may adjust hiring practices based on the perceived tax burden.

For example, a reduction in corporate tax rates could encourage businesses to expand, potentially creating more jobs.

Impact of Different Tax Structures on Competitiveness

Different tax structures can significantly impact the competitiveness of businesses. A complex tax system can increase compliance costs and reduce efficiency, potentially hindering competitiveness. On the other hand, a streamlined and predictable tax system can reduce compliance costs, encourage investment, and foster a more competitive business environment. Countries with more competitive tax systems often attract foreign investment and experience higher levels of economic growth.

Methods of Tax Avoidance and Motivations

Businesses employ various methods of tax avoidance to reduce their tax liabilities. These methods can range from legal tax planning strategies to more questionable practices. The motivations behind tax avoidance can vary from a desire to maximize profits to a belief that the tax system is unfair or overly burdensome. Examples include deductions for legitimate expenses, the use of tax loopholes, or more complex schemes.

Legal tax planning is often a legitimate strategy for businesses to minimize their tax liability within the boundaries of the law. However, certain strategies can be ethically questionable and even illegal. It is crucial for businesses to comply with all applicable tax laws and regulations.

Sectors Most Affected by Taxation and Specific Concerns

| Sector | Specific Concerns |

|---|---|

| Manufacturing | High property taxes on facilities, excise taxes on raw materials, and tariffs on imported components. |

| Retail | Sales taxes impacting consumer prices and potentially reducing sales volume, and complex sales tax regulations. |

| Technology | High corporate tax rates, and potential double taxation on foreign income. |

| Agriculture | Farm subsidies and agricultural taxes that vary across regions. |

| Real Estate | Property taxes, capital gains taxes on property sales, and potential impact of property taxes on rental income. |

This table highlights the diverse impact of taxation on various sectors. The concerns listed reflect the specific challenges faced by businesses in each sector due to tax policies and regulations.

Commerce Commission Response to Tax Policies

The Commerce Commission plays a crucial role in New Zealand’s economy, acting as a watchdog to ensure fair competition and prevent anti-competitive practices. This role extends beyond just market structures, encompassing the impact of government policies, including taxation, on the business environment. Understanding how the Commerce Commission reacts to tax changes is essential to appreciating the complexities of economic policymaking.The Commerce Commission monitors the economic effects of taxation on trade by examining how tax policies affect the competitiveness of businesses, the allocation of resources, and ultimately, consumer prices.

This involves analyzing various market segments, identifying potential distortions, and evaluating the overall impact on the market structure. Their assessment isn’t solely focused on the immediate effect but also considers long-term consequences for trade and investment.

Commerce Commission’s Evaluation of Tax Policy Fairness

The Commerce Commission assesses the fairness of tax policies by considering their impact on market competition. A key aspect is whether taxes disproportionately affect smaller businesses or specific industries, creating an uneven playing field. They also examine if tax policies create barriers to entry for new businesses or disadvantage existing players, leading to reduced market dynamism.

Methods Used to Evaluate the Impact of Taxes on Trade

The Commerce Commission employs various methods to evaluate the impact of taxes on trade. These include:

- Economic modelling: Sophisticated economic models are used to simulate the effects of different tax policies on various market segments. This helps predict how taxes might alter market share, prices, and investment patterns.

- Market research: Gathering data directly from businesses and consumers helps to understand the practical implications of a particular tax policy on everyday operations. This can involve surveys and interviews to capture insights on the real-world impact.

- Industry analysis: The Commission examines the specific impacts on different sectors and industries. This includes analyzing industry trends, examining historical data, and evaluating potential competitive distortions.

- Comparative analysis: The Commission might compare the effects of a particular tax policy in New Zealand with similar policies in other countries, learning from both successes and failures to inform their evaluations.

Examples of Commerce Commission Intervention in Tax-Related Trade Issues

The Commerce Commission has intervened in various instances where tax policies have negatively affected trade. While specific details of these interventions are often confidential, the broad themes include concerns about unfair tax burdens on particular industries, creating anti-competitive outcomes, and limiting market dynamism.Examples could include cases where a specific tax led to a concentration of market power in one entity or cases where the competitiveness of smaller players was significantly hampered.

Commerce Commission’s Key Concerns Regarding Taxation

| Concern | Impact on Market Competition |

|---|---|

| Discriminatory taxation of specific industries | Creates uneven playing field, potentially leading to market consolidation and reduced choice for consumers. |

| Tax policies that burden small businesses disproportionately | Hinder the growth of small businesses, potentially stifling innovation and entrepreneurship. |

| Taxes that distort resource allocation | Lead to inefficient use of resources and potentially lower overall economic productivity. |

| Tax policies that create barriers to entry | Reduce market dynamism, limit consumer choice, and impede the development of new products and services. |

Public Perception and Debate

Public perception plays a crucial role in shaping tax policies and influencing commercial activities. Understanding how the public perceives the connection between politics, taxes, and commerce is essential for policymakers and businesses alike. Different opinions regarding tax policies and their consequences often lead to heated public debates, impacting the political landscape and influencing the direction of future regulations.

The arguments used in these debates often center on the perceived fairness and effectiveness of various tax systems.Public understanding of the interplay between politics, taxes, and commerce is often complex and multifaceted. Individuals may form opinions based on their personal experiences, their understanding of economic principles, and the information they receive from various sources. This complexity necessitates a nuanced approach to understanding and addressing public concerns.

Furthermore, public perception is often influenced by the framing of issues in the media and by the actions of political figures and interest groups.

Public Understanding of the Connection

Public understanding of the connection between politics, taxes, and commerce is often influenced by the perceived fairness of tax systems. A common concern is whether the tax burden is distributed equitably among different segments of society and businesses. Furthermore, public perception is often shaped by the perceived impact of taxes on the economy and the standard of living.

For instance, if individuals perceive that high taxes hinder economic growth and job creation, they may express concerns about the potential consequences.

Different Public Opinions Regarding Tax Policies, Politics taxes stir upe commerce commission

Public opinions regarding tax policies vary widely. Some favor progressive taxation, believing that those with higher incomes should contribute a larger portion of their income to fund public services. Conversely, others advocate for flat taxes, arguing that a simpler and more uniform tax system is more efficient and promotes economic growth. Different opinions also arise concerning the impact of taxes on specific industries or businesses, leading to support for tax incentives or exemptions for particular sectors.

Common Arguments in Public Debates

Public debates often revolve around several common arguments surrounding taxation and commercial interests. A key argument concerns the fairness of the tax system, with discussions frequently focusing on the distribution of the tax burden among different income groups and business types. Another significant point of contention is the impact of taxes on economic growth and job creation. Supporters of certain tax policies often cite potential economic benefits, while opponents raise concerns about potential negative consequences.

Finally, debates frequently address the role of government spending in relation to taxation. Public discourse often explores whether tax revenues are used effectively and efficiently.

Examples of Public Opinion Influencing Tax Policy Changes

Public opinion has demonstrably influenced tax policy changes throughout history. For instance, public outcry regarding perceived inequities in the tax system has often led to reforms aimed at achieving greater fairness and equity. The rise of progressive taxation in many countries is, in part, a response to public pressure for a more equitable distribution of the tax burden.

Moreover, public concern regarding the impact of certain taxes on specific industries has sometimes resulted in the introduction of tax incentives or exemptions.

Summary of Common Arguments for and Against Tax Policies

| Tax Policy | Argument For | Supporting Evidence | Argument Against | Supporting Evidence |

|---|---|---|---|---|

| Progressive Income Tax | Reduces income inequality, funds public services more equitably. | Studies showing correlation between progressive taxation and reduced income inequality, increased public funding for education and healthcare. | Discourages work and investment, leads to capital flight. | Studies showing correlation between high tax rates and reduced labor supply, reduced investment. |

| Flat Tax | Simpler, reduces compliance costs, promotes economic growth. | Examples of countries with flat taxes experiencing economic growth, reduced tax evasion. | Increases income inequality, disproportionately affects lower-income households. | Studies showing flat taxes increasing the income gap, potentially harming lower-income individuals. |

| Corporate Tax Incentives | Encourages investment, job creation, economic growth in specific sectors. | Case studies of industries that benefited from tax incentives, leading to increased employment and output. | Leads to unfair tax burden on other sectors, reduces government revenue. | Examples of countries with high corporate tax incentives experiencing revenue losses, increased public debt. |

Illustrative Cases: Politics Taxes Stir Upe Commerce Commission

Navigating the complex interplay between politics, taxes, and commerce requires examining specific instances where these forces have collided. Understanding historical precedents and contemporary examples provides valuable insights into the potential consequences of policy decisions. Analyzing the impact of taxation on various industries and the response of regulatory bodies like the Commerce Commission helps us anticipate and mitigate future challenges.

Historical Case Study: The Smoot-Hawley Tariff Act

The Smoot-Hawley Tariff Act of 1930, enacted during the Great Depression, exemplifies the detrimental effects of protectionist trade policies. This act significantly raised tariffs on imported goods, aiming to shield American industries from foreign competition. However, the retaliatory tariffs imposed by other nations crippled international trade, exacerbating the economic downturn. The act highlights the unintended consequences of political decisions impacting commerce and the crucial role of international cooperation in fostering economic stability.

Impact of Tax Policies on the Manufacturing Sector

Tax policies significantly influence the profitability and competitiveness of industries. For example, the imposition of a significant corporate tax rate increase can affect investment decisions, production costs, and ultimately, consumer prices. The potential for job losses and decreased market share is another key concern.

Commerce Commission Response to a Tax-Commerce Issue

The Commerce Commission plays a crucial role in ensuring fair competition and consumer protection within the marketplace. When tax policies disproportionately affect certain industries or create anti-competitive practices, the Commission can intervene to maintain a level playing field. Specific examples may include investigations into mergers and acquisitions or challenging potentially monopolistic behaviors stemming from tax-related incentives.

Political Decision Influencing Sectoral Tax Burden

Political decisions regarding tax incentives or deductions can significantly alter the tax burden on specific sectors. Consider a government policy offering substantial tax breaks to the renewable energy sector. This decision could attract investment, stimulate job creation, and drive innovation within that particular industry. Conversely, policies neglecting specific sectors can lead to their decline and loss of economic vitality.

Politics and taxes are definitely stirring things up at the Commerce Commission, no doubt. It’s a complex issue, and while everyone’s talking about the potential impact on businesses, it’s worth noting that NBC’s recent move to form an internet division ( nbc forms internet division ) might be indirectly related. The ripple effects of these changes could be significant, potentially altering the landscape of the whole industry and making the Commerce Commission’s task even more challenging.

So, stay tuned to see how these various factors play out in the coming months.

Comparative Analysis of Cases

| Case | Political Context | Tax Policies | Impact on Commerce | Commerce Commission Role |

|---|---|---|---|---|

| Smoot-Hawley Tariff Act | 1930s Great Depression, protectionist sentiment | Substantial increases in tariffs on imported goods | Collapse of international trade, deepened economic crisis | Not directly involved, but subsequent trade agreements and regulations reflect lessons learned |

| Corporate Tax Rate Increase | Recent period of economic growth, fiscal considerations | Increase in corporate tax rates | Potential decrease in investment, increased production costs, reduced profitability | Potential investigation of anti-competitive practices resulting from tax policies |

| Renewable Energy Tax Incentives | Focus on environmental sustainability, economic stimulus | Tax breaks and deductions for renewable energy investments | Increased investment, job creation, innovation in renewable energy sector | Potential monitoring of compliance with regulations and fair competition in the sector |

Future Trends

The intricate dance between politics, taxation, and commerce is poised for fascinating evolution. Technological advancements, shifting societal values, and global economic fluctuations will all shape the future landscape of tax policies and business operations. Predicting the precise trajectory is impossible, but understanding the potential avenues for change is crucial for navigating the coming years.

Predicting the Future Relationship Between Politics, Taxes, and Commerce

The relationship between politics, taxes, and commerce will likely remain dynamic and often contentious. Political ideologies will continue to influence tax policies, sometimes prioritizing social objectives over purely economic considerations. Commerce will adapt to these policies, either by optimizing strategies to minimize tax burdens or by lobbying for more favorable tax regimes. This interplay will likely become more complex with the rise of new technologies and globalized markets.

Emerging Issues Affecting the Interaction Between Politics, Taxes, and Commerce

Several emerging issues threaten to reshape the interaction between politics, taxes, and commerce. The increasing digitalization of economies, the rise of the gig economy, and the evolving nature of international trade will all necessitate adjustments to existing tax frameworks. Additionally, environmental concerns are likely to introduce new tax incentives and regulations impacting businesses.

Potential Technological Advancements Affecting Tax Collection or Business Operations

Technological advancements will likely revolutionize both tax collection and business operations. Blockchain technology, for example, has the potential to enhance transparency and reduce tax evasion by providing a secure and verifiable record of transactions. Artificial intelligence (AI) could automate tax compliance procedures and optimize business decisions, potentially reducing the administrative burden on both taxpayers and tax authorities. Further, advanced data analytics can provide more precise and targeted tax assessments, leading to more equitable tax policies.

Potential Solutions for Balancing Political Interests with Commercial Needs in Tax Policies

Finding a balance between political priorities and commercial needs in tax policies requires a multi-faceted approach. Transparency and clear communication between policymakers and businesses are paramount. Establishing independent expert committees to evaluate the impact of tax policies on the economy can foster a more objective assessment of proposed changes. Furthermore, providing businesses with clear, consistent, and predictable tax laws can encourage investment and job creation.

Table: Potential Future Scenarios and Commerce Commission Actions

| Scenario | Description | Commerce Commission Action |

|---|---|---|

| Rise of the Gig Economy | The gig economy experiences significant growth, posing challenges to traditional tax collection methods. | The Commerce Commission advocates for clear tax guidelines for gig workers and platforms, ensuring fair competition and compliance. They may also collaborate with tax authorities to develop innovative tax collection mechanisms suitable for the gig economy. |

| Increased Digitalization of Commerce | Cross-border e-commerce transactions increase, raising questions about jurisdiction and tax collection. | The Commerce Commission supports international cooperation on digital tax policies to ensure equitable treatment for businesses operating across borders. They advocate for simplified cross-border tax reporting processes and procedures. |

| Significant Technological Advancements | Blockchain and AI technologies impact tax collection and business operations, potentially creating new vulnerabilities. | The Commerce Commission monitors the impact of new technologies on businesses, ensuring they are used responsibly and ethically. They collaborate with tech companies and other stakeholders to mitigate risks associated with new technologies and support their ethical application. |

End of Discussion

Ultimately, this deep dive into politics, taxes, and the Commerce Commission reveals a dynamic relationship where political decisions significantly impact commercial activities. Public perception and debate play a vital role, influencing tax policy changes. Illustrative cases demonstrate the interaction of these elements, offering valuable insights for understanding the complexities of tax policy and future trends in this intricate field.