Online trading sounds death knell for brokerages, forcing a dramatic reshaping of the industry. Traditional brokerage models are being challenged by the rise of user-friendly online platforms, altering the very landscape of financial services. This shift is driven by technological advancements, evolving customer preferences, and a fiercely competitive market. From the impact on business models to financial implications, we’ll delve into the multifaceted transformation occurring within the brokerage sector.

This article will explore how online trading platforms are disrupting the traditional brokerage business, examining the key factors contributing to this change, and the strategies brokerages are adopting to adapt. We will also analyze customer behavior, technological advancements, and the competitive landscape to understand the full picture.

Impact on Brokerage Business Models

The rise of online trading platforms is fundamentally reshaping the traditional brokerage landscape. This shift is driven by consumer demand for accessibility, cost-effectiveness, and personalized trading experiences, placing immense pressure on established brokerages to adapt or risk obsolescence. Traditional business models are being challenged, requiring a deep understanding of the changing market dynamics and innovative strategies to remain competitive.The traditional brokerage business model, often centered on a full-service approach, is undergoing a significant transformation.

This transformation is driven by the increasing availability and popularity of online trading platforms. These platforms offer lower transaction costs, 24/7 accessibility, and often more advanced charting and analysis tools. As a result, customers are increasingly drawn to the convenience and efficiency of online trading, leading to a decline in demand for traditional, full-service brokerages.

Changing Brokerage Business Models

The shift towards online trading is forcing a significant evolution in brokerage business models. Traditional full-service brokerages, reliant on a network of financial advisors and high-touch customer service, are struggling to compete with the efficiency and lower costs of online-only platforms. Discount brokers, positioned between the two, offer a middle ground, with varying levels of support and technology.

Strategies for Adaptation

Brokerages can adopt several strategies to adapt to the evolving online trading environment. One key strategy involves leveraging technology to enhance the online trading experience. This could include developing more sophisticated trading platforms, integrating advanced data analytics, and implementing robust security measures. Another crucial strategy is to differentiate their offerings by focusing on niche markets or specialized services.

For example, some brokerages are focusing on providing more personalized investment advice, while others are specializing in specific asset classes like options or cryptocurrency. Finally, a cost-effective approach involves streamlining operations and minimizing overhead costs to reduce the cost of services.

Revenue Streams Comparison

Traditional brokerages often generate revenue through a combination of commission fees, advisory fees, and potentially investment banking services. Online-only platforms, conversely, rely heavily on commission-based models, leveraging economies of scale to minimize costs and maximize profits. The shift towards lower commissions and higher trading volumes is crucial for online-only platforms to maintain profitability. A key difference lies in the value proposition; traditional brokerages often focus on holistic financial planning, while online-only platforms emphasize ease of use and cost-effectiveness.

Factors Contributing to the Shift

Several factors are driving the shift towards online trading. These include the increasing availability of information and educational resources, advancements in technology, and a growing preference for self-directed investment. Furthermore, the rise of mobile technology and the accessibility of 24/7 trading platforms have significantly contributed to this trend. The growing awareness and understanding of investment opportunities among retail investors also play a significant role in driving this shift.

Consequences of Non-Adaptation

Brokerages that fail to adapt to the changing online trading landscape face significant consequences. They may lose market share to more agile and cost-effective competitors, experience a decline in profitability, and potentially face complete obsolescence. The ability to attract and retain customers will become increasingly challenging, as online platforms offer greater convenience and potentially lower costs. Ultimately, failing to adapt can lead to a significant decline in business.

Comparison of Brokerage Models

| Feature | Full-Service | Discount | Online-Only |

|---|---|---|---|

| Cost | Higher (includes advisory fees) | Lower than full-service, but higher than online-only | Lowest (primarily commission-based) |

| Customer Service | High-touch, personalized | Moderate | Limited or automated |

| Investment Advice | Comprehensive | Basic or none | Typically none, but potentially robo-advisory integration |

| Technology | Often outdated compared to online platforms | Generally better than full-service, but not as advanced as online-only | Highly advanced and user-friendly |

| Revenue Model | Commission, advisory fees, investment banking | Commission, potentially research services | Commission |

The Role of Technology in Online Trading

The digital revolution has fundamentally reshaped the landscape of financial markets, particularly online trading. Technology has democratized access to investment opportunities, transforming the way individuals and institutions engage in trading activities. This evolution has brought about a significant shift in brokerage business models, challenging traditional approaches and driving a new era of financial interaction.Technological advancements have been instrumental in facilitating the growth of online trading.

The ease of access, coupled with the ability to execute trades 24/7, has empowered investors with unparalleled control over their portfolios. This has led to increased participation and diversification within the financial markets.

Mobile Trading Applications

Mobile trading apps have become indispensable tools for investors, providing instant access to real-time market data and facilitating quick trading decisions. The ubiquity of smartphones and high-speed internet connections has enabled investors to stay connected to the markets regardless of their location. This constant connectivity has significantly increased the frequency of trading activity, and the ability to respond to market fluctuations immediately.

Algorithmic Trading

Sophisticated algorithms have automated many aspects of the trading process, optimizing strategies and reducing human error. These algorithms can analyze vast amounts of market data to identify patterns and execute trades with precision. High-frequency trading (HFT) is a prime example, where algorithms execute millions of trades per second, leveraging milliseconds of advantage to profit from small price fluctuations.

Security Measures in Online Trading Platforms

Robust security measures are critical for online trading platforms to protect user funds and data. These platforms utilize advanced encryption technologies to safeguard sensitive information and employ multi-factor authentication to prevent unauthorized access. Regular security audits and vulnerability assessments are essential to maintaining a secure trading environment. The use of secure payment gateways is also a critical aspect in preventing fraudulent activities.

Cost-Effectiveness of Online Trading Platforms

Online trading platforms typically offer lower transaction costs compared to traditional brokerage methods. Eliminating the need for physical interactions and intermediaries reduces overhead, translating into lower fees for investors. This cost-effectiveness is a key driver in the adoption of online trading by retail investors. The ability to execute trades directly with the platform, without intermediaries, contributes significantly to this cost advantage.

Evolution of Trading Platforms, Online trading sounds death knell for brokerages

| Era | Platform Features | Impact |

|---|---|---|

| Early 2000s | Basic online platforms with limited charting and order types. | Enabled basic online trading, but lacked advanced features. |

| Mid 2000s | Introduction of mobile trading apps, algorithmic trading, and advanced charting tools. | Increased accessibility and speed of trading, empowered investors with more sophisticated tools. |

| Present | AI-powered trading recommendations, social trading features, and integrated wealth management tools. | Personalized investment strategies, enhanced community interaction, and seamless wealth management. |

“The cost-effectiveness of online trading is a key factor in its popularity. Lower transaction costs translate to more capital for investors to work with.”

Customer Behavior and Preferences

Online trading has fundamentally reshaped the landscape of investment, empowering individuals with unprecedented access to financial markets. This accessibility, however, has brought forth a complex interplay of motivations, preferences, and behaviors among online traders. Understanding these dynamics is crucial for brokerages to adapt their strategies and remain competitive in this evolving market.The shift towards online trading has brought a new breed of investor, distinct from traditional investors in their characteristics and approaches.

This difference in investor profiles necessitates a tailored understanding of the motivations driving their decisions. Understanding the key features attracting online traders, alongside the impact of user experience and the rise of robo-advisors, is essential for crafting effective brokerage strategies.

Motivations and Preferences of Online Traders

Online traders are often driven by a desire for greater control and independence in managing their investments. This contrasts with traditional investors who might rely on professional advice and established investment strategies. The accessibility of real-time market data, coupled with the ability to execute trades independently, are key factors in this shift. Furthermore, the lower costs associated with online trading platforms, compared to traditional brokerage services, can also be a significant motivator.

Online trading is definitely making a ripple effect, and it’s sounding like the death knell for some brokerages. Big changes are happening in the industry, and the recent acquisition of Abacus by DoubleClick in a massive $1 billion deal doubleclick to acquire abacus in 1 billion deal is a prime example of how consolidation is happening. This trend of consolidation, combined with the rise of DIY trading platforms, suggests a challenging future for traditional brokerages.

This accessibility often leads to a higher frequency of trades, compared to traditional investors.

Demographic Characteristics of Online Traders vs. Traditional Investors

Online traders often exhibit a younger demographic profile compared to traditional investors. They tend to be more tech-savvy and comfortable with digital tools. While the exact demographics vary by region and platform, online traders are often found to be more active on social media and engage more with financial news and analysis through online resources. Traditional investors, conversely, may be older, with a higher level of investment experience and a preference for in-person or phone-based interaction.

This disparity in demographics underscores the need for brokerages to cater to the specific needs and expectations of each group.

Key Features Attracting Customers to Online Trading Platforms

A user-friendly interface is paramount for attracting customers to online trading platforms. Clear visualizations of market data, intuitive navigation, and simple-to-use order placement tools are highly sought-after features. Real-time market data feeds, along with customizable dashboards and alerts, are crucial for keeping traders informed and responsive to market fluctuations. The availability of educational resources, such as webinars and tutorials, is also a strong motivator for new and less experienced online traders.

Online trading is definitely sounding the death knell for some brokerages, but it’s not all doom and gloom. Think about how companies like GoodHome.com are innovating and adapting, like in their recent venture with AOL Women.com, Goodhome com plays house with aol women com. Ultimately, the companies that can diversify and find new ways to engage customers will likely be the ones who survive this changing market, even if it means online trading takes a significant chunk of their business.

Furthermore, the ability to conduct research and analyze data using in-built tools or third-party integrations enhances the overall platform appeal.

Impact of User Experience on Online Trading Platforms

A positive user experience is essential for online trading platforms. Intuitive navigation, clear visualizations, and responsive design are critical for seamless interaction. Intuitive design, coupled with high-quality customer support, significantly enhances the user experience. This experience is particularly crucial for first-time users and those who may lack extensive trading experience. The platform’s ability to provide consistent performance, even during high-volume trading periods, also contributes to a positive user experience.

In essence, a good user experience creates a positive emotional connection with the platform and fosters long-term loyalty.

Robo-Advisors and Their Role in Online Trading

Robo-advisors have gained significant traction in online trading, offering automated investment strategies and portfolio management. They cater to investors who prioritize simplicity and ease of use over active management. These platforms typically use algorithms to build and maintain diversified portfolios, reducing the need for extensive market research and active trading decisions. Robo-advisors often target individuals with smaller initial investment capital and seek to ease the burden of managing investments.

The rise of robo-advisors highlights the changing preferences of online traders, reflecting a trend towards simpler and more automated investment approaches.

Potential Impact of Customer Expectations on the Future of Brokerages

Brokerages must adapt to evolving customer expectations, recognizing the need for seamless integration across multiple devices and platforms. A personalized experience, incorporating individual investment goals and risk tolerance, is critical for retaining customers. Enhanced security measures, coupled with transparent fee structures, are crucial to build trust and confidence. Customer expectations in the future will likely demand even more advanced features, such as AI-powered investment suggestions and personalized educational resources.

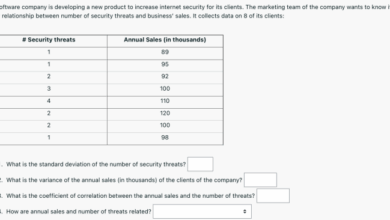

Customer Segments and Preferences in Online Trading

| Customer Segment | Motivations | Preferences | Technology Needs |

|---|---|---|---|

| Beginners | Low-cost entry, educational resources | Simple interfaces, clear instructions, educational materials | Intuitive platform, accessible support channels |

| Active Traders | Real-time market data, high-speed execution | Advanced charting tools, customizable dashboards, multiple order types | High-performance platform, low latency |

| Experienced Investors | Portfolio diversification, personalized strategies | Advanced research tools, personalized portfolio management, tailored investment strategies | Scalable platform, robust security features, advanced analytics |

Competitive Landscape and Market Trends

The online trading landscape is a dynamic arena where established players jostle with newcomers, each vying for a larger slice of the pie. This competitive environment is fueled by technological advancements, evolving customer preferences, and a constant push for innovation. Understanding the pricing strategies, major players, and emerging trends is crucial for anyone seeking to navigate this complex market.The competitive landscape in online trading is characterized by a complex interplay of factors, including the variety of products offered, pricing models, and the technological infrastructure underpinning these platforms.

This creates a multifaceted environment where platforms constantly strive to differentiate themselves through innovative features, competitive pricing, and superior customer service.

Pricing Strategies of Online Trading Platforms

Different online trading platforms employ various pricing strategies to attract and retain customers. These strategies often include commission-based models, tiered pricing structures, or even subscription-based fees. The choice of pricing strategy directly impacts the platform’s profitability and its ability to cater to different segments of the market.

- Commission-Based Models: Many platforms charge a commission on each trade executed. These commissions can vary significantly based on the asset traded, the volume of trades, and the platform’s specific pricing structure. Some platforms offer tiered commission structures, where higher trade volumes result in lower commission rates, incentivizing active trading.

- Zero-Commission Platforms: The zero-commission model has gained significant traction, especially among retail investors. These platforms typically offset their revenue through markups on executed trades or other fees. This strategy aims to attract a broader customer base, especially those seeking low-cost access to the market.

- Subscription-Based Models: Some platforms offer subscription-based access to their platform’s features and tools, allowing customers to pay a recurring fee for premium services. These services might include access to advanced charting tools, research reports, or dedicated customer support.

Overview of the Competitive Landscape

The online trading market is highly competitive, with numerous players vying for market share. This competition necessitates continuous innovation and adaptation to meet the ever-changing demands of investors.

- Direct Competition: Established players face direct competition from newer entrants, who often leverage technology to offer more user-friendly interfaces or more competitive pricing models. This constant churn in the market forces established firms to innovate and stay ahead of the curve.

- Indirect Competition: Online trading platforms also face indirect competition from other investment vehicles, such as robo-advisors or traditional brokerage firms. These competitors offer different investment approaches and may cater to specific investor needs.

Major Players in the Online Trading Industry

The online trading industry boasts several prominent players, each with a unique approach and market positioning. These companies often leverage their brand recognition and technological prowess to secure a strong market share.

- Examples of major players: Some of the leading players include well-known brokerage firms, such as Fidelity Investments, TD Ameritrade, and Schwab, along with newer, digitally-focused platforms. Their market presence and influence vary depending on factors such as geographical reach, product offerings, and regulatory compliance.

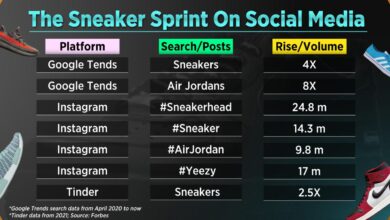

Emerging Trends in Online Trading

Several emerging trends are shaping the future of online trading, significantly impacting the competitive landscape. These trends, such as social trading, are influencing how investors interact with the market.

- Social Trading: Social trading platforms are gaining popularity, allowing investors to learn from and potentially copy the trades of other users. This approach offers potential for faster decision-making and increased exposure to market insights. Examples include platforms where users can follow, copy, and learn from the investment strategies of successful traders.

Innovative Features of Online Trading Platforms

Online trading platforms continually introduce innovative features to enhance the user experience and cater to specific investor needs. These features often involve integrating advanced technologies into their platforms.

- Advanced charting tools: Many platforms offer sophisticated charting tools that enable investors to analyze market trends and identify potential trading opportunities. These tools are often customizable to meet individual needs.

- Algorithmic trading: Some platforms allow for the development and implementation of algorithmic trading strategies, enabling automated trading decisions based on specific parameters. This feature is particularly valuable for investors with sophisticated trading approaches.

Potential Disruptions in the Future

The future of online trading is likely to be shaped by ongoing technological advancements and shifts in investor behavior.

- Increased automation: The increasing use of artificial intelligence and machine learning in trading could lead to greater automation of investment decisions. This could potentially disrupt the traditional role of human traders.

- Enhanced security measures: Cybersecurity threats pose a significant concern for online trading platforms. The future will likely see increased investment in robust security measures to protect user data and funds.

Market Share of Major Online Trading Platforms

The market share of online trading platforms fluctuates based on various factors. A table summarizing the market share of major platforms would reflect these dynamic shifts. Unfortunately, I do not have access to real-time market share data and cannot provide a table.

Financial Implications for Brokerages

The rise of online trading platforms is fundamentally altering the landscape of the brokerage industry. Traditional brick-and-mortar brokerages, reliant on in-person interactions and commissions from trades, face significant financial pressures as online platforms offer lower fees and increased accessibility. This shift necessitates a reevaluation of brokerage business models, prompting adaptation and innovation to remain competitive.The shift to online trading presents both challenges and opportunities for brokerages.

The potential loss of revenue from traditional brokerage activities is substantial, demanding a proactive response in terms of cost-cutting and strategic investment. This necessitates a deep understanding of the financial implications, which will be discussed in detail.

Potential Impact on Financial Performance

Brokerages will likely experience a decline in revenue stemming from reduced commission income, as online platforms attract customers with lower transaction fees. This decline will vary based on the specific brokerage’s customer base and the extent of its online presence. The impact will be more pronounced for brokerages that rely heavily on traditional brokerage models.

Loss of Revenue from Traditional Activities

The move to online trading will undeniably impact the revenue streams traditionally associated with brokerages. Reduced commission income from trades is a direct consequence of the lower fees charged by online platforms. Furthermore, the diminished need for in-person consultations and financial advice will decrease revenue from these services. This loss is not uniformly distributed across all brokerages, with those relying on high-volume trading and high-margin commissions facing the most significant losses.

Successful Adaptations to Online Trading

Several brokerages have successfully adapted to the changing market. Some have embraced online trading by developing user-friendly platforms and offering a wider range of investment products, while others have transitioned to a fee-based or subscription-based model. A notable example is the increasing adoption of robo-advisors, which allows brokerages to automate investment strategies and reduce operational costs. This demonstrates a crucial shift in business models, highlighting the need for brokerages to become more technologically driven and customer-centric.

Cost-Cutting Measures

To mitigate the financial impact, brokerages can implement various cost-cutting measures. These include streamlining operations by reducing staff, optimizing technology, and reducing overhead costs. Efficient use of technology and automation can help to reduce operational expenses and maintain profitability.

Investments in Technology to Maintain Competitiveness

To stay competitive in the evolving online trading landscape, brokerages must invest in cutting-edge technology. This includes developing sophisticated trading platforms, enhancing cybersecurity measures, and integrating with other financial technology providers. Investing in user-friendly mobile apps and AI-driven tools is essential to attract and retain clients in this competitive environment. The future success of many brokerages hinges on their ability to integrate and leverage these technologies effectively.

Implications for Investors

Investors will be impacted by the shift towards online trading as brokerages adjust to the new market realities. Investors might benefit from the lower fees offered by online platforms, but may also face increased competition and a less personalized service. It is crucial for investors to carefully evaluate the offerings of various brokerages and choose the platform that best aligns with their individual needs and investment goals.

Potential Financial Implications for Brokerages (Five-Year Forecast)

| Year | Revenue (Estimated) | Profit Margin (Estimated) | Operational Costs (Estimated) |

|---|---|---|---|

| 2024 | $XXX million | X% | $YYY million |

| 2025 | $YYY million | Y% | $ZZZ million |

| 2026 | $ZZZ million | Z% | $XXX million |

| 2027 | $AAA million | A% | $YYY million |

| 2028 | $BBB million | B% | $ZZZ million |

Note: Values in the table are estimates and will vary based on specific brokerage strategies and market conditions.

Online trading is seemingly sounding the death knell for some brokerages. The changing landscape of finance, coupled with the rise of DIY platforms, is putting immense pressure on traditional firms. Meanwhile, Red Hat’s recent updates to Linux, as seen in this article red hat updates linux , highlight how adapting to technological shifts is crucial for survival in any sector.

This adaptability is exactly what some brokerages are struggling with, leaving them vulnerable in the face of online competition.

Regulatory and Legal Aspects: Online Trading Sounds Death Knell For Brokerages

Online trading, while offering unprecedented access to financial markets, is subject to a complex web of regulations. These regulations are crucial for safeguarding investors, maintaining market integrity, and preventing fraudulent activities. Understanding these frameworks is vital for both brokerage firms and individual investors.

Regulatory Frameworks Governing Online Trading

Various jurisdictions have established regulatory frameworks for online trading activities. These frameworks often address aspects like market manipulation, insider trading, investor protection, and the conduct of financial intermediaries. Different countries have distinct legal structures and regulatory bodies, leading to a diverse landscape of rules and standards. This necessitates a deep understanding of the specific regulatory requirements for each market.

Compliance Measures for Online Trading Platforms

Brokerage firms operating online trading platforms must adhere to stringent compliance measures to ensure investor protection and market integrity. These measures include robust anti-money laundering (AML) procedures, Know Your Customer (KYC) protocols, and controls to prevent market manipulation. They also need to comply with reporting requirements for transactions and customer activity. Failure to meet these requirements can result in severe penalties.

Role of Regulatory Bodies in Shaping the Online Trading Environment

Regulatory bodies play a critical role in shaping the online trading environment. They set standards, enforce regulations, and investigate suspected violations. Their actions influence market practices, investor confidence, and the overall health of the online trading industry. For example, the Securities and Exchange Commission (SEC) in the US, and the Financial Conduct Authority (FCA) in the UK, are instrumental in establishing and enforcing regulations in their respective jurisdictions.

Examples of Legal Issues Related to Online Trading

Several legal issues can arise in online trading. These can range from market manipulation schemes to instances of fraud and negligence. For instance, a brokerage firm failing to implement adequate security measures for customer accounts could lead to significant financial losses for investors. Another example involves the use of sophisticated algorithms for automated trading, which can raise concerns about market manipulation.

Cases of unauthorized trading or misappropriation of customer funds are also potential legal pitfalls.

Future of Regulation in Online Trading

The future of regulation in online trading is likely to involve increasing emphasis on technology-driven solutions. This includes the development of sophisticated surveillance tools to detect fraudulent activities, and adapting regulations to new financial instruments and trading strategies. The evolution of cryptocurrencies and decentralized finance (DeFi) will likely necessitate new regulatory frameworks. Adapting to these changes is crucial for the continued stability and integrity of the online trading industry.

Key Regulatory Requirements for Online Trading Platforms

| Region | Key Regulatory Requirements |

|---|---|

| United States | Compliance with SEC regulations, including registration requirements for broker-dealers, anti-money laundering (AML) compliance, and investor protection measures. |

| European Union | Adherence to MiFID II regulations, encompassing requirements for market transparency, investor protection, and the conduct of financial intermediaries. |

| United Kingdom | Compliance with FCA regulations, including registration requirements, anti-money laundering (AML) measures, and investor protection standards. |

| Japan | Adherence to regulations set by the Financial Services Agency (FSA), covering investor protection, market integrity, and the conduct of financial intermediaries. |

| Australia | Compliance with ASIC regulations, encompassing investor protection, market manipulation, and the conduct of financial institutions. |

Conclusive Thoughts

In conclusion, the rise of online trading is reshaping the brokerage industry. Traditional models face significant challenges, forcing adaptation to survive. The future of brokerages hinges on their ability to embrace technological advancements, understand evolving customer preferences, and compete effectively in the dynamic online trading market. This transformation is not just about adapting to new technologies, but also about understanding the evolving needs of investors and offering competitive services to maintain market share.