Online trading firms under fire are facing intense scrutiny from regulators, sparking concern among investors. This investigation delves into the reasons behind the regulatory actions, customer complaints, potential financial risks, market misconduct, cybersecurity vulnerabilities, and the overall impact on investor confidence. The fallout from these issues is potentially significant, raising questions about the future of online trading.

Recent regulatory actions against online trading firms reveal a complex web of issues. From forex to stocks to crypto, various types of firms are experiencing different regulatory challenges. This scrutiny highlights the need for greater transparency and accountability in the industry. The resulting customer complaints and disputes, often stemming from misleading marketing or inadequate risk disclosures, further underscore the importance of robust consumer protection measures.

Regulatory Scrutiny of Online Trading Firms

The online trading industry has experienced a surge in regulatory scrutiny in recent years, driven by a desire to protect investors and maintain market integrity. This heightened attention is largely due to the complexities of online platforms, the potential for sophisticated fraud, and the global nature of the markets they operate in. The aim is to ensure fair trading practices and prevent abuse by firms.

Recent Regulatory Actions Against Online Trading Firms, Online trading firms under fire

Recent regulatory actions have targeted various aspects of online trading firm operations. These actions often involve violations of existing regulations concerning transparency, investor protection, and fair dealing. The consequences for violations can range from hefty fines to complete platform suspensions, highlighting the seriousness with which regulators view these breaches.

Specific Regulations Violated by Online Trading Firms

Online trading firms often violate regulations related to disclosure, financial reporting, and customer protection. Lack of transparency regarding fees, hidden commissions, and manipulative trading practices are common violations. Failure to adequately protect customer funds, especially in instances of platform failures or unauthorized withdrawals, is another significant area of concern. Regulators also scrutinize the suitability of products offered to clients, ensuring that they are appropriate for the clients’ investment profiles and risk tolerance.

Examples of Enforcement Actions

Enforcement actions taken against online trading firms include substantial financial penalties. For example, a prominent forex broker was recently fined millions of dollars for misleading advertising and failing to adequately disclose trading risks to clients. In another instance, a cryptocurrency platform was suspended for violating KYC (Know Your Customer) regulations, potentially allowing illicit activities. These actions serve as deterrents and demonstrate the regulators’ commitment to enforcing compliance.

Comparison of Regulatory Issues Across Different Online Trading Firm Types

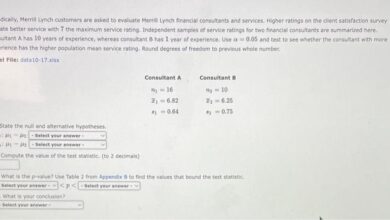

| Type of Firm | Primary Regulatory Issues | Examples of Violations | Typical Enforcement Actions |

|---|---|---|---|

| Forex | Transparency of trading fees, suitability of products to clients, and anti-money laundering (AML) compliance. | Hidden commissions, misleading advertisements, failure to disclose risk factors. | Fines, restrictions on operations, and in severe cases, complete platform shutdowns. |

| Stocks | Fair dealing, market manipulation, and financial reporting. | Insider trading, pump-and-dump schemes, inaccurate financial statements. | Fines, suspension of trading privileges, and potential criminal charges. |

| Cryptocurrency | Lack of transparency, KYC/AML compliance, and security of customer funds. | Failure to comply with anti-money laundering (AML) and Know Your Customer (KYC) procedures, inadequate security measures leading to hacking or theft of funds. | Fines, suspensions of operations, and in extreme cases, asset seizures. |

The table above highlights the common regulatory issues faced by different types of online trading firms. Each type of firm faces unique challenges, necessitating tailored regulatory approaches. Consistent enforcement is critical to maintaining investor confidence and ensuring a fair and transparent market.

Online trading firms are facing a lot of scrutiny lately, with accusations of questionable practices flying around. It’s interesting to see how this relates to the recent news about Cisco and Goldman Sachs backing Agillion, a company specializing in a new trading technology. cisco goldman sachs back agillion This investment might signal a shift in the industry, but it also raises questions about potential conflicts of interest and the overall safety of online trading platforms.

The spotlight is definitely back on these firms, and the need for more transparency is clearer than ever.

Customer Complaints and Disputes

Online trading firms, while offering potentially lucrative opportunities, are also susceptible to customer complaints and disputes. These issues often stem from complex financial instruments, opaque trading platforms, and the inherent risks involved in investment. Understanding the nature of these complaints and the mechanisms for resolving them is crucial for both investors and the firms themselves.

Types of Customer Complaints

Customer complaints against online trading firms often revolve around several key themes. Investors frequently express dissatisfaction with misleading marketing practices, inadequate risk disclosure, and poor customer service. Furthermore, issues concerning trading platform malfunctions, delayed payouts, and unauthorized account access are also common grievances.

Common Themes in Customer Complaints

The following table Artikels the common themes observed in customer complaints lodged against online trading firms:

| Complaint Theme | Description |

|---|---|

| Misleading Marketing | Promotional materials that exaggerate returns or downplay risks, leading customers to make ill-advised investment decisions. |

| Inadequate Risk Disclosure | Insufficient or unclear explanations of the inherent risks associated with specific trading instruments or strategies. |

| Poor Customer Service | Inability to effectively resolve customer inquiries or address concerns in a timely and professional manner. |

| Trading Platform Issues | Malfunctions, bugs, or glitches in the trading platform, leading to lost trades or incorrect transactions. |

| Delayed Payouts | Unjustified delays in transferring funds from trading accounts to customer accounts. |

| Unauthorized Account Access | Unauthorized access to or manipulation of customer accounts, potentially leading to significant financial losses. |

Examples of Customer Disputes Leading to Legal Action

Several high-profile cases illustrate the potential for legal disputes arising from customer complaints. For example, a case against a firm alleging misleading marketing regarding high-yield investment programs resulted in a significant settlement. Another case involved a customer claiming unauthorized access to their account, leading to a lawsuit and subsequent financial compensation. These examples highlight the seriousness with which legal action can be pursued in response to customer grievances.

Mechanisms for Resolving Customer Disputes

Several mechanisms exist to resolve customer disputes, promoting fairness and accountability. These mechanisms include:

- Arbitration: A neutral third party reviews the evidence and makes a binding decision, often chosen by mutual agreement between the parties.

- Mediation: A neutral third party facilitates communication and negotiation between the parties to reach a mutually acceptable resolution. This is often a less formal and potentially faster process than arbitration.

These dispute resolution methods provide structured pathways for addressing grievances and preventing escalated conflicts, thereby fostering trust and confidence in the online trading industry.

Online trading firms are facing a lot of heat lately, with accusations of shady practices flying around. It’s a bit reminiscent of the recent shift in the defense industry, with the Defense Department going commercial, as seen in defense department goese commercial , which could potentially create new avenues for financial manipulation by these same firms. All this points to a need for stricter regulations and greater transparency in the online trading sector.

Financial Risks and Potential Fraud: Online Trading Firms Under Fire

The online trading landscape, while offering accessibility and potential for high returns, presents unique financial risks. These risks, coupled with the anonymity of the internet, create fertile ground for fraudulent activities. Understanding these risks and the measures taken to combat them is crucial for anyone considering online trading.

Key Financial Risks

Online trading firms, despite their sophistication, are not immune to a range of financial risks. These risks stem from the volatile nature of the market, the potential for poor risk management, and the inherent complexity of financial instruments. Common risks include:

- Market volatility: Sudden and significant market shifts can lead to substantial losses for traders, particularly those who are not well-versed in managing risk.

- Insufficient capital: Trading with inadequate capital can lead to margin calls and potentially devastating losses if market conditions deteriorate. Traders often underestimate the necessary capital required for successful trading.

- Poor risk management practices: Lack of proper risk management strategies, including stop-loss orders and position sizing, can result in substantial financial losses. Inconsistent risk management can be a common pitfall for inexperienced traders.

- Inadequate due diligence: Failure to thoroughly research and understand the legitimacy of an online trading firm or the nature of the financial instruments being traded can lead to significant financial losses.

Potential for Fraud and Scams

The online trading environment presents a significant opportunity for fraud and scams. Fraudulent activities can take many forms, including:

- Ponzi schemes: These schemes promise high returns with little or no risk, but operate by paying returns to early investors with funds from new investors, ultimately collapsing when new investors cease to enter the scheme.

- Fake trading platforms: These platforms may appear legitimate but are actually designed to defraud traders. They may manipulate prices, or simply vanish with investor funds.

- Investment fraud: Scammers may pose as financial experts or offer lucrative investment opportunities that are, in reality, designed to deceive and defraud investors. Examples include fake cryptocurrencies or high-yield investment programs.

- Fake testimonials and endorsements: These scams attempt to build trust by creating false testimonials and endorsements from purportedly successful traders. These are often designed to lure investors into participating in a fraudulent scheme.

Regulatory Measures to Prevent Fraud

Regulatory bodies worldwide implement various measures to prevent fraudulent activities in the online trading market. These include:

- Strict licensing and registration requirements: Regulatory bodies often mandate strict licensing and registration requirements for online trading firms. These requirements ensure that firms are properly vetted and adhere to established standards.

- Monitoring of trading activities: Continuous monitoring of trading activities helps to identify suspicious patterns that may indicate fraudulent activity. This can include monitoring unusual trading volumes, price fluctuations, and large-scale transactions.

- Education and awareness campaigns: Regulatory bodies often launch education and awareness campaigns to educate investors about common fraud schemes and how to spot red flags. This includes providing clear information about the risks involved in online trading.

- Investigations and prosecutions: Regulatory bodies investigate suspected fraudulent activities and pursue prosecutions against those who engage in such activities. These actions send a clear message that fraudulent behavior will not be tolerated.

Consequences for Victims of Fraud

Falling victim to fraud in the online trading market can have devastating consequences, including:

- Financial loss: The most immediate and significant consequence is the loss of invested capital. This can lead to significant financial hardship, especially for those who have relied on these funds for their livelihood.

- Emotional distress: Experiencing financial fraud can cause significant emotional distress, including anxiety, frustration, and even depression. The loss of trust can be particularly damaging.

- Damage to reputation: In some cases, victims of fraud may experience reputational damage, especially if the fraud is public. This can make it difficult to rebuild trust and financial standing.

- Legal repercussions: In some cases, victims of fraud may be able to pursue legal action against the perpetrators, but this process can be lengthy and costly.

Market Practices and Misconduct

Online trading firms, while offering convenient access to financial markets, are sometimes embroiled in questionable practices. This scrutiny often centers around deviations from established best practices, potentially harming both investors and the integrity of the market. Understanding these practices, their comparisons to best standards, and the resulting misconduct is crucial for evaluating the trustworthiness of these firms.

Common Market Practices Under Scrutiny

Online trading firms often employ various practices to attract and retain clients. These range from aggressive marketing strategies to offering complex trading instruments. However, some practices fall outside accepted norms and can lead to issues. These practices may involve enticing promotions, potentially misleading clients about the risks involved, or employing tactics to boost trading volume artificially.

Comparison with Best-Practice Standards

Best-practice standards for online trading firms prioritize client protection and transparency. These standards emphasize clear disclosures of fees, risks, and potential conflicts of interest. A critical aspect of best practices involves providing clients with accessible and understandable educational resources about trading strategies. These standards also stress maintaining fair and equitable trading environments. The comparison reveals a discrepancy between the practices employed by some firms and the established best practices.

Examples of Misconduct

Manipulative trading activities, such as spoofing or wash trading, are serious violations of market integrity. Spoofing involves placing orders with the intention of canceling them, creating false market signals. Wash trading involves making trades with no intention of profit, artificially inflating trading volume. Furthermore, conflicts of interest, where a firm’s incentives conflict with its clients’ interests, can arise from hidden commissions or biased recommendations.

Investigation and Addressing Allegations of Misconduct

Regulatory bodies employ various methods to investigate allegations of misconduct. These methods typically involve examining trading records, reviewing client statements, and potentially interviewing company representatives. The process often includes scrutiny of marketing materials, identifying patterns in trading activities, and comparing these patterns with industry standards. The regulatory bodies are responsible for implementing appropriate measures to address misconduct, potentially ranging from fines to suspension of trading privileges.

Categories of Market Misconduct

| Category | Description | Examples |

|---|---|---|

| Manipulative Trading | Actions designed to artificially inflate or deflate prices, or create false impressions of market activity. | Spoofing, wash trading, layering, quote manipulation |

| Conflicts of Interest | Situations where a firm’s interests or incentives conflict with the interests of its clients. | Hidden commissions, biased recommendations, recommending products with higher commissions for the firm |

| Misleading Marketing | Marketing practices that omit or misrepresent crucial information, or employ deceptive strategies to attract clients. | Inflated promises of returns, exaggerated claims about the ease of trading, concealing risks |

| Unfair Trading Practices | Actions that discriminate against or disadvantage certain clients, or violate rules of fair trading. | Discriminatory pricing, unfair order execution, prioritizing certain clients |

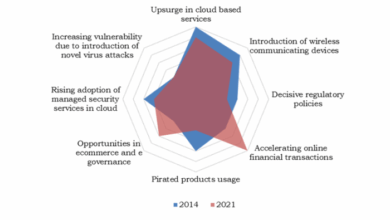

Technological Vulnerabilities and Cybersecurity

Online trading platforms, while offering convenient access to financial markets, face significant cybersecurity challenges. These platforms handle sensitive customer data, including financial information and personal details, making them prime targets for malicious actors. A robust security framework is crucial to protect customers and maintain the integrity of the trading environment.

Potential Cybersecurity Risks

Online trading platforms are susceptible to various cybersecurity threats. These include malware infections, phishing attacks, denial-of-service (DoS) assaults, and sophisticated social engineering tactics. Malicious actors can exploit vulnerabilities in the platform’s software or infrastructure to gain unauthorized access to customer accounts and financial assets. The sheer volume of transactions and the interconnected nature of the systems further amplify the risks.

Vulnerabilities Exposing Customer Data and Funds

Several vulnerabilities can expose customer data and funds. Weak authentication protocols, inadequate encryption of sensitive data, and insufficient security measures for remote access points can be exploited by hackers. Outdated software, lacking proper patching, creates entry points for malicious code. Insufficient monitoring of network traffic and user activity can also hinder the timely detection of suspicious activities.

A lack of multi-factor authentication (MFA) further increases the risk of unauthorized access.

Importance of Robust Security Measures

Robust security measures are essential for online trading platforms. These measures should include strong encryption for data at rest and in transit, multi-factor authentication for all user accounts, regular security audits, and continuous monitoring of network traffic for anomalies. Employing advanced threat detection systems, regular software updates, and employee training programs to address phishing and social engineering tactics are crucial.

Physical security measures, especially for data centers, are equally vital.

Examples of Data Breaches

Several high-profile data breaches have impacted online trading firms. In one instance, a well-known broker experienced a significant breach, exposing customer account information and financial details. The breach resulted in significant financial losses for some customers and reputational damage for the firm. Another example involved a platform experiencing a denial-of-service attack that temporarily disrupted trading operations and caused considerable inconvenience for users.

These incidents highlight the importance of robust cybersecurity practices.

Table Illustrating Security Breaches

| Type of Breach | Description | Impact on Customers |

|---|---|---|

| Phishing Attacks | Deceptive emails or messages aiming to trick users into revealing sensitive information. | Loss of personal and financial data, potential fraudulent activity on accounts. |

| Malware Infections | Malicious software installed on customer devices or the platform itself. | Data theft, unauthorized access to accounts, potential financial losses. |

| Denial-of-Service (DoS) Attacks | Overwhelming the platform with traffic, disrupting service and trading activities. | Inability to access accounts, missed trading opportunities, financial losses. |

| SQL Injection Attacks | Exploiting vulnerabilities in database queries to gain unauthorized access. | Compromised database containing customer data, potential financial losses. |

Impact on Investor Confidence

The recent scrutiny of online trading firms has cast a shadow over the entire industry, raising concerns about investor confidence and potentially impacting the market’s overall health. Negative press, customer complaints, and regulatory investigations can quickly erode trust in these platforms, leading to decreased investment activity and a potentially chilling effect on future growth. Investors are understandably cautious when faced with uncertainty and perceived risk.The online trading market relies heavily on investor confidence.

Online trading firms are facing a lot of scrutiny lately, with accusations of shady practices and questionable security measures. Meanwhile, IBM and Symantec are collaborating on a new front in cybersecurity, like their work to combat the Melissa virus, as detailed in this article ibm symantec team up to battle melissa. This innovative approach to tackling digital threats highlights the importance of robust security measures in the face of increasing cyberattacks, which are directly relevant to the current issues plaguing online trading firms.

When investors lose faith in the integrity and security of these platforms, the market can experience significant downturns. This loss of trust is not simply a matter of investor psychology; it translates directly into decreased trading volumes, potentially harming the profitability of firms and impacting the broader financial ecosystem. The domino effect of such a decline can reverberate through related industries and markets.

Potential Effects on Investor Confidence

Regulatory scrutiny, customer complaints, and publicized financial risks create a climate of uncertainty, directly affecting investor confidence. Investors, especially those new to online trading, may be particularly vulnerable to these anxieties. The perception of risk and potential fraud can lead to a reluctance to engage in online trading, thereby reducing market activity. The loss of confidence could even deter experienced investors, creating a wider impact across the market.

Overall Impact on the Online Trading Market

The negative impact on investor confidence can lead to a contraction in the online trading market. Decreased trading volume can affect the revenue of online trading firms, potentially leading to job losses and market instability. Reduced investor activity also slows innovation and development within the sector. The market becomes less attractive for new entrants and existing players face challenges in attracting and retaining customers.

Historical examples of regulatory crises in other financial markets illustrate the potential for prolonged periods of decreased trading activity and market volatility.

Measures to Rebuild Trust

For online trading firms to rebuild investor trust, transparency and accountability are paramount. Open communication with customers, prompt resolution of complaints, and proactive disclosure of risks are crucial. Demonstrating robust cybersecurity measures, compliance with regulations, and ethical trading practices will instill confidence. Implementing clear and accessible dispute resolution mechanisms and actively addressing concerns through industry initiatives will reassure investors.

Relationship Between Regulatory Actions and Investor Sentiment

Regulatory actions, such as increased oversight and stricter enforcement, are directly correlated with investor sentiment. Investors tend to view increased regulation positively when it signifies a commitment to market integrity and investor protection. However, overly stringent or unpredictable regulatory actions can be perceived as detrimental, creating a sense of instability and impacting investor confidence. A balanced approach that promotes transparency and security without stifling innovation is crucial.

The specific reactions of investors to regulatory changes will vary based on their individual risk tolerance, experience, and understanding of the regulatory landscape. Transparency and proactive communication by online trading firms can mitigate negative perceptions and demonstrate a commitment to investor well-being.

Future Trends and Implications

The recent scrutiny of online trading firms highlights critical shifts in the industry. Increased regulatory oversight, coupled with customer complaints and financial risks, necessitates a proactive approach to future developments. Understanding these trends and implications is crucial for navigating the evolving landscape of online trading.The online trading market is poised for significant changes, driven by technological advancements, evolving investor expectations, and heightened regulatory pressures.

This transformation requires firms to adapt their strategies and operational models to meet the demands of a more complex and scrutinized environment.

Expected Future Trends in Online Trading

The industry will likely witness a continued push towards greater transparency and security. Investors are increasingly demanding more detailed information regarding trading platforms, risk assessments, and dispute resolution processes. This shift in investor expectations will necessitate enhanced educational resources and intuitive platforms that empower informed decision-making.

Implications of Current Events for the Future of Online Trading

The current regulatory scrutiny and public discourse will undoubtedly impact the future of online trading. Increased oversight is likely to lead to more stringent regulations, potentially impacting fees, platform functionalities, and access to certain markets. Firms that prioritize compliance and build robust security measures will be better positioned to thrive in this new environment.

Potential Regulatory Changes or Reforms

Regulatory bodies are expected to implement stricter guidelines concerning platform security, customer protection, and market manipulation. Specific measures may include enhanced KYC (Know Your Customer) procedures, more stringent reporting requirements for trading activity, and potentially higher capital requirements for online trading firms. The implementation of these reforms will necessitate a thorough understanding and adherence to the new regulatory framework for firms.

Elaboration on Possible Long-Term Effects of the Current Scrutiny

The long-term effects of the current scrutiny will likely manifest in a more robust and regulated online trading ecosystem. This may lead to a decrease in fraudulent activities and a greater sense of trust among investors. However, increased regulatory burden could potentially lead to higher operating costs for some firms, potentially impacting the accessibility of online trading for some users.

Firms will need to evaluate their strategies to adapt to these evolving market conditions.

Final Wrap-Up

The investigation into online trading firms under fire paints a concerning picture of potential risks and vulnerabilities. From regulatory scrutiny to customer complaints, financial risks, and market misconduct, the issues are multifaceted and far-reaching. The future of online trading hinges on the industry’s ability to address these concerns and restore investor confidence. Stronger regulations, improved security measures, and transparent business practices are critical to rebuilding trust and ensuring a sustainable future for the online trading market.