Online trading business brings windfalls and headaches, presenting a complex landscape of potential riches and significant risks. Navigating this arena requires a deep understanding of the various trading platforms, the strategies for maximizing profits, and the crucial steps for mitigating the inherent dangers. From forex to stocks to crypto, the world of online trading offers a dynamic environment, but it’s not without its challenges.

This exploration dives into the intricacies of online trading, examining the exhilarating possibilities and the potential pitfalls. We’ll delve into the specifics of different trading types, the advantages and disadvantages of various platforms, and the essential strategies for success. Understanding both the windfalls and headaches is paramount to navigating this exciting yet demanding market.

Introduction to Online Trading Businesses

Online trading businesses have revolutionized the financial landscape, offering individuals unprecedented access to global markets. These platforms connect traders with a vast array of investment opportunities, from traditional stocks and bonds to innovative cryptocurrencies and forex markets. However, the allure of potential riches comes with inherent risks, requiring careful consideration and a solid understanding of the market dynamics.These businesses facilitate the buying and selling of various financial instruments online, allowing investors to participate in global markets from anywhere with an internet connection.

The accessibility and liquidity provided by these platforms have opened up investment avenues for a wider range of people. While the potential for substantial gains is undeniable, so too are the inherent risks and the necessity of meticulous research and strategy development.

Defining Online Trading Businesses

Online trading businesses encompass a wide range of platforms that facilitate the buying and selling of financial instruments. These instruments can include stocks, bonds, currencies (forex), commodities, and cryptocurrencies. These platforms provide a digital marketplace where investors can execute trades, manage their portfolios, and access real-time market data. The goal of these businesses is to connect traders with the instruments they seek to buy or sell, facilitating transactions efficiently and transparently.

Types of Online Trading Businesses

Online trading encompasses various asset classes, each with its own set of risks and rewards. The primary types include:

- Forex Trading: Forex, or foreign exchange trading, involves buying and selling currencies. The value of currencies fluctuates constantly, creating opportunities for profit but also significant risk of loss. Traders often utilize leverage, which magnifies both potential gains and losses.

- Stock Trading: This involves buying and selling shares of publicly traded companies. The value of stocks is influenced by factors like company performance, market trends, and investor sentiment. Traders can profit from price appreciation or dividends, but also face potential losses if the value of the stock declines.

- Cryptocurrency Trading: This emerging market involves trading digital currencies like Bitcoin and Ethereum. The volatility of cryptocurrencies is exceptionally high, making it both a lucrative and risky investment area. Traders need to understand the blockchain technology underlying these assets and their inherent price fluctuations.

Activities Involved in Online Trading Businesses

Online trading platforms facilitate a variety of activities crucial to the investment process. These include:

- Market Research: Understanding market trends, news events, and economic indicators is essential for informed trading decisions.

- Order Placement: Traders utilize the platform to execute buy and sell orders for financial instruments.

- Portfolio Management: Traders use the platform to monitor their holdings, track performance, and adjust their positions as needed.

- Risk Management: Developing strategies to mitigate potential losses is critical in online trading. This includes setting stop-loss orders and diversifying investments.

Comparing Online Trading Platforms

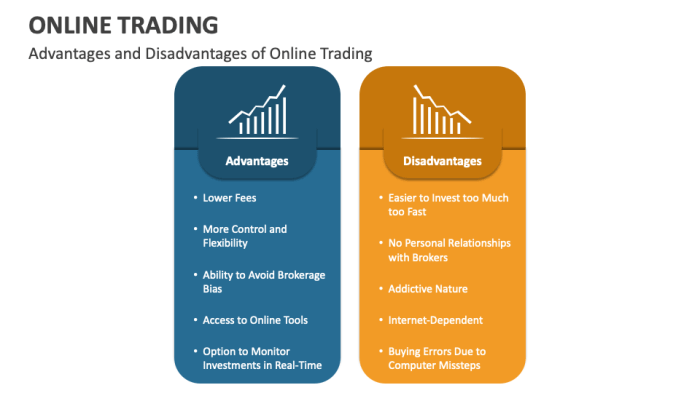

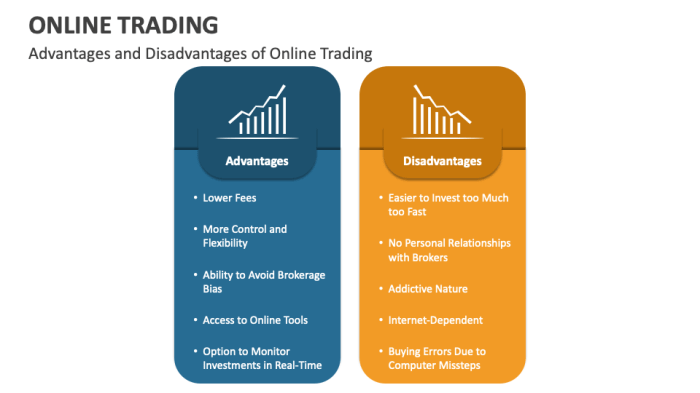

The following table provides a comparison of advantages and disadvantages across various online trading platforms, highlighting factors to consider when selecting a platform:

| Platform Type | Advantages | Disadvantages |

|---|---|---|

| Forex | High liquidity, leverage opportunities, 24/5 market access | High volatility, significant risk of loss due to leverage |

| Stocks | Established market, historical data readily available, diverse investment choices | Lower potential returns compared to forex, can be less volatile |

| Crypto | Potential for high returns, innovative investment opportunity | Extremely volatile, regulatory uncertainty, and price fluctuations |

The Windfalls of Online Trading: Online Trading Business Brings Windfalls And Headaches

Online trading, while presenting inherent risks, offers the potential for substantial financial gains. The ability to leverage market fluctuations, execute trades rapidly, and access a global marketplace can lead to impressive returns for those who understand the intricacies and master the strategies. However, success requires a disciplined approach, meticulous research, and a deep understanding of the financial instruments involved.The allure of online trading lies in the prospect of significant financial rewards.

Successful traders can generate substantial income streams, potentially exceeding traditional employment earnings. This potential for wealth creation, however, is not guaranteed and requires significant effort and knowledge.

Potential Financial Gains

Online trading allows for diverse income generation opportunities. Profit margins can be substantial, particularly for experienced traders who understand market trends and implement effective strategies. These gains can manifest as capital appreciation, dividend payouts, or interest income, depending on the specific investments and trading instruments used. Profit potential is directly linked to risk tolerance and investment strategies employed.

Strategies for Maximizing Profits

Successful online trading hinges on several key strategies. Thorough market analysis is crucial to identify profitable opportunities. Understanding technical indicators and charting patterns allows traders to anticipate market movements. Risk management is paramount, as it mitigates potential losses and protects capital. Position sizing, diversification, and stop-loss orders are crucial risk management tools.

Furthermore, continuous learning and adaptation to changing market conditions are essential for long-term success.

Factors Contributing to Successful Ventures

Several factors contribute to successful online trading ventures. Discipline and emotional control are vital. Impulsive decisions can lead to significant losses, so traders need to stick to their trading plans and avoid emotional reactions to market fluctuations. Thorough research and a deep understanding of the financial instruments and markets are equally crucial. Consistency in applying trading strategies and adhering to risk management practices are key for long-term profitability.

Examples of Successful Traders

Numerous individuals have achieved significant success in online trading. While specific names and details are often not publicly disclosed for privacy reasons, case studies and success stories from reputable financial publications and educational platforms can offer valuable insights. The common thread among successful traders often involves continuous learning, disciplined execution, and a deep understanding of the financial markets.

Online trading can be a wild ride, full of potential profits but also plenty of pitfalls. It’s like navigating a treacherous financial sea, sometimes yielding amazing windfalls, other times leaving you with a sinking feeling. However, it’s fascinating to see how businesses like the expanding ivillage for expectant mothers, ivillage expansion caters to expectant mothers , are carefully designed to support and nurture a different kind of growth, which makes me wonder if there are similar, thoughtful approaches to online trading that could help navigate those financial seas more effectively.

Ultimately, the online trading world is still a rollercoaster, requiring careful consideration and a dash of luck.

Common Trading Strategies and Potential Returns

| Trading Strategy | Potential Return (Annualized) | Risk Level |

|---|---|---|

| Day Trading | 5-20% | High |

| Swing Trading | 10-15% | Medium |

| Long-Term Investing | 7-12% | Low |

| Options Trading | Variable, potentially higher | High |

Note: Potential returns are estimates and can vary significantly based on market conditions, individual skill, and strategy implementation.

The Headaches of Online Trading

While the allure of quick profits in online trading is undeniable, it’s crucial to acknowledge the potential pitfalls. The journey towards financial success in this arena is rarely smooth, and understanding the challenges is as important as grasping the opportunities. This section delves into the common hurdles and risks inherent in online trading, equipping you with knowledge to navigate the market with more informed decisions.Online trading, despite its potential rewards, is fraught with risks that can quickly lead to significant losses.

Unfamiliarity with market dynamics, poor risk management, and emotional decision-making can all contribute to unfortunate outcomes. Navigating these potential pitfalls requires a proactive and disciplined approach, and this section will Artikel strategies to mitigate these risks.

Common Mistakes Made by Online Traders

A crucial aspect of successful online trading is recognizing and avoiding common mistakes. These errors can stem from a lack of experience, poor understanding of market dynamics, or even emotional reactions to market fluctuations.

- Lack of sufficient research and due diligence is a common pitfall. Failing to thoroughly investigate a potential investment, analyze market trends, or understand the financial health of a company can lead to poor investment decisions and financial losses.

- Overtrading is another frequent error. Trading too frequently, often driven by greed or fear, can lead to higher transaction costs and increased chances of losses. A disciplined approach focused on specific trading strategies and pre-determined entry and exit points is crucial.

- Poorly defined trading plans can result in inconsistent strategies and emotional decision-making. Having a solid trading plan, including risk tolerance, entry and exit points, and investment goals, helps traders remain objective and avoid impulsive actions based on fear or greed.

Risk Management in Online Trading

Effective risk management is paramount in online trading. It’s not about eliminating risk entirely, but about controlling and mitigating it to protect capital and ensure long-term success.

Online trading, while offering potential riches, can also be a rollercoaster of ups and downs. It’s a fascinating world, but navigating the complexities of market fluctuations and managing risk is a constant challenge. Just look at how companies like RealNetwork are making moves in the digital music sphere, like their recent acquisition of the MP3 company Xing, realnetwork buys mp3 company xing.

This kind of strategic deal-making highlights the shifting landscape and underscores the ever-present need for careful planning and risk assessment in today’s trading environment. Ultimately, online trading remains a balancing act of opportunities and pitfalls.

“Risk management is not about avoiding risk, but about controlling and mitigating it.”

Proper risk management strategies involve setting stop-loss orders, diversifying investments, and carefully considering the potential for loss. The focus should be on preserving capital, allowing for a greater probability of long-term success.

Regulatory Frameworks Governing Online Trading

Different jurisdictions have established regulatory frameworks to govern online trading activities. These regulations aim to protect investors and maintain market integrity. Understanding the regulations specific to your location is essential for compliance and to avoid potential legal issues.

- Regulations vary significantly by country and region. Understanding the specific regulations for your trading location is crucial to avoid legal issues and maintain compliance.

- Regulatory bodies, such as the Securities and Exchange Commission (SEC) in the US, monitor market activity and enforce rules to protect investors.

- These regulatory frameworks aim to maintain transparency, fairness, and accountability in the online trading market.

Comparison of Risk Management Strategies

This table Artikels various risk management strategies, highlighting their strengths and weaknesses:

| Risk Management Strategy | Strengths | Weaknesses |

|---|---|---|

| Stop-Loss Orders | Limits potential losses on a trade. | May not always prevent all losses, especially in rapidly changing markets. |

| Diversification | Reduces overall portfolio risk by spreading investments across different assets. | May not always generate the highest returns. |

| Position Sizing | Allocates appropriate capital to each trade. | Requires careful consideration and discipline. |

| Hedging | Offsets potential losses in one investment with gains in another. | Can be complex and may not always be effective. |

Comparing Windfalls and Headaches

Online trading, while offering the potential for substantial financial gains, is not without its challenges. The allure of quick profits and the freedom of independent work can be compelling, but the reality often involves navigating complex markets, managing risk, and continuous learning. This section delves into the crucial comparison between the windfalls and headaches associated with this exciting but demanding field.Understanding the intricate balance between potential rewards and inherent risks is paramount for any aspiring online trader.

A thorough evaluation of both sides, coupled with proactive risk management strategies, is essential for achieving sustainable success.

Weighing the Potential Benefits

The allure of online trading stems from its potential for significant financial returns. Successful traders can achieve substantial profits through astute market analysis, skillful execution, and a well-defined trading strategy. Capitalizing on market trends and exploiting arbitrage opportunities are just two examples of the potential avenues for generating substantial income. Furthermore, the flexibility and independence offered by online trading are attractive to many.

The ability to set your own hours and work from anywhere in the world can greatly improve work-life balance.

Recognizing the Potential Drawbacks

The inherent volatility of financial markets is a critical consideration. Unforeseen market fluctuations, sudden economic shifts, and unexpected events can quickly erode capital if not managed effectively. Trading involves substantial risk, and the potential for significant losses is always present. Additionally, the competitive landscape can be challenging. Many traders enter the market with high expectations, only to find themselves struggling against experienced professionals and sophisticated algorithms.

This competitive environment requires consistent effort, discipline, and a commitment to ongoing learning.

Essential Strategies for Risk Mitigation

Developing a robust trading plan is fundamental. This plan should Artikel clear entry and exit strategies, risk tolerance levels, and position sizing guidelines. Understanding your personal risk tolerance is critical; avoid overleveraging your account. Risk management strategies, such as stop-loss orders and position limits, are crucial to safeguarding capital. Thoroughly researching and understanding the financial instruments you are trading is also essential.

The Importance of Continuous Learning

The financial markets are dynamic entities. New trends, technologies, and market insights emerge constantly. Successful traders understand the need for ongoing learning and adaptation. Staying abreast of market news, analyzing trends, and continually refining your trading strategy are crucial. Following reputable financial news sources, attending webinars, and engaging with online communities are effective ways to stay updated.

Common Trading Pitfalls and Solutions

| Pitfall | Solution |

|---|---|

| Ignoring market analysis | Develop a systematic approach to analyzing market trends and news. |

| Failing to define clear trading goals | Establish precise trading objectives, risk tolerance levels, and profit targets. |

| Lack of risk management | Implement stop-loss orders, position limits, and diversification strategies. |

| Emotional trading | Develop emotional control and discipline to avoid impulsive decisions. |

| Overconfidence | Embrace a growth mindset and continuous learning to avoid complacency. |

Building a Sustainable Online Trading Business

Turning a passion for trading into a sustainable business requires careful planning and execution. It’s not a get-rich-quick scheme; it demands dedication, knowledge, and a realistic understanding of the challenges involved. This section delves into the key steps for establishing a profitable and enduring online trading enterprise.

Establishing a Solid Foundation

A successful online trading business hinges on a strong foundation. This encompasses meticulous research, a well-defined business plan, and a deep understanding of the market. Thorough market analysis and competitor research are essential for identifying potential niches and opportunities. Knowing your target audience and their needs will help you tailor your services effectively.

Developing a Robust Online Presence

A strong online presence is crucial for attracting and retaining customers. This involves creating a professional website, utilizing social media platforms, and engaging in search engine optimization () strategies. A user-friendly website with clear information about your services and transparent pricing is vital. Social media can be used to build a community and engage potential clients. helps ensure your website ranks highly in search results, driving organic traffic.

Prioritizing Customer Service and Support

Excellent customer service and support are essential for fostering trust and loyalty. Responsive communication, clear explanations of trading strategies, and readily available resources contribute to a positive customer experience. Providing multiple channels for customer support, such as email, phone, and live chat, enhances accessibility and responsiveness. Addressing customer concerns promptly and professionally builds confidence and encourages repeat business.

Online trading can be a whirlwind of potential profits, but also a rollercoaster of frustrations. It’s a fascinating industry, especially considering how, back in the day, companies like Dell, Microsoft, and the SBA had to grapple with the Y2K problem, as detailed in dell microsoft sba address y2k issues. Navigating those complexities, while seemingly distant from today’s trading challenges, highlights the ever-present need for robust systems and problem-solving in any dynamic business environment.

Still, the allure and potential pitfalls of online trading remain compelling and demanding.

Crafting a Comprehensive Business Plan

A detailed business plan is the roadmap for your online trading business. It should include market analysis, financial projections, operational strategies, and risk management plans. Clear financial goals, detailed marketing strategies, and defined operational procedures are all critical components. Contingency plans for market fluctuations and potential risks are also vital. Consider including specific performance indicators (KPIs) to measure progress against your goals.

Key Metrics for Tracking Performance

Tracking key performance indicators (KPIs) is crucial for assessing the health and progress of your online trading business. Regular monitoring and analysis allow for adjustments to strategies and ensure sustained growth. Consistent monitoring and analysis are essential to identify areas needing improvement and make informed decisions for future growth.

| Metric | Description | Importance |

|---|---|---|

| Customer Acquisition Cost (CAC) | The cost incurred to acquire a new customer. | Helps determine the efficiency of marketing campaigns. |

| Customer Lifetime Value (CLTV) | The predicted revenue a customer will generate throughout their relationship with the business. | Indicates the profitability of customer relationships. |

| Conversion Rate | The percentage of visitors who complete a desired action (e.g., making a trade). | Reflects the effectiveness of your website and marketing strategies. |

| Average Transaction Value (ATV) | The average amount customers spend on each trade. | Helps identify opportunities to increase revenue. |

| Customer Retention Rate | The percentage of customers who remain loyal to the business over a specific period. | Indicates the success of customer service and satisfaction. |

| Return on Investment (ROI) | The profitability of your trading strategies. | Measures the overall success of your online trading business. |

Illustrative Case Studies

Online trading, while brimming with potential for significant windfalls, also presents a landscape fraught with challenges. Understanding how successful traders navigate these waters and how those who encounter setbacks learn from their experiences is crucial for aspiring investors. Real-world examples provide invaluable insights into the complexities of this dynamic market.Successful online trading strategies are not a one-size-fits-all solution.

Factors like market conditions, individual risk tolerance, and the trader’s chosen approach all play a critical role in determining outcomes. Analyzing the approaches of both successful and less successful traders offers valuable lessons, highlighting the nuances of this intricate field.

Successful Trader: The Day Trader

This trader utilizes a highly active approach, employing technical analysis and real-time market data to capitalize on short-term price fluctuations. Their success hinges on a rapid decision-making process and a disciplined adherence to pre-defined trading rules.

- Strategy: Focus on highly liquid stocks, developing trading rules based on price patterns and volume analysis. Utilizing tools like charting software and news feeds for real-time information.

- Windfalls: Capitalizing on short-term trends and executing trades quickly. High-frequency trading allows them to profit from smaller price movements.

- Headaches: The constant pressure of managing risk in volatile markets, the need for extremely fast internet connectivity and specialized software. High trading costs can eat into profits if not carefully managed.

Successful Trader: The Long-Term Investor

This trader’s strategy prioritizes long-term value investing. They meticulously research companies, focusing on fundamental analysis and identifying companies with strong growth potential.

- Strategy: Thorough research on financial statements, industry trends, and management teams to identify undervalued opportunities. A diversified portfolio with a focus on long-term growth.

- Windfalls: The compounding effect of consistent, long-term returns. Profiting from companies with strong fundamentals, regardless of short-term market fluctuations.

- Headaches: The patience required for long-term strategies, potential for market downturns to impact investment returns. Risk management requires a clear understanding of investment timelines.

The Impact of Setbacks, Online trading business brings windfalls and headaches

Learning from setbacks is as critical as recognizing success. Traders who experience losses often find valuable lessons in understanding the reasons behind their failures.

- Reason for Setbacks: Inadequate risk management, insufficient research, emotional trading, and poor trading psychology are common factors behind losses. Ignoring established rules and using leverage inappropriately can exacerbate issues.

- Lessons Learned: Developing a robust trading plan, prioritizing risk management, and understanding the psychology of trading are crucial for mitigating losses. Constant self-assessment and a focus on continuous improvement are key.

Comparison of Trading Approaches

| Trader Type | Strategy | Risk Tolerance | Time Horizon | Key Metrics |

|---|---|---|---|---|

| Day Trader | Technical analysis, short-term trends | High | Short | Speed, execution, real-time data |

| Long-Term Investor | Fundamental analysis, long-term growth | Medium | Long | Company research, diversification, patience |

The Future of Online Trading

The online trading landscape is in constant flux, driven by technological advancements and evolving regulatory frameworks. This dynamic environment presents both significant challenges and exciting opportunities for businesses operating in this sector. From the integration of artificial intelligence to the increasing sophistication of regulatory oversight, understanding these trends is crucial for navigating the future of online trading.The future of online trading hinges on the ability to adapt to these emerging trends.

Businesses that embrace innovation and proactively address regulatory changes will be best positioned to thrive in this ever-evolving market.

Emerging Trends and Technologies

The online trading landscape is being reshaped by a number of emerging trends and technologies. These innovations are impacting everything from the user experience to the underlying infrastructure. Real-time data feeds, advanced charting tools, and sophisticated algorithmic trading are transforming how investors interact with the markets. Furthermore, the integration of blockchain technology is adding a layer of security and transparency to the process.

Artificial Intelligence in Online Trading

Artificial intelligence (AI) is rapidly transforming online trading. AI-powered algorithms are capable of analyzing vast amounts of market data in real-time, identifying patterns, and making predictions. This can lead to more informed investment decisions, potentially increasing returns and reducing risks. For example, AI can help identify potential fraud or manipulation, safeguarding both investors and the trading platform.

Furthermore, AI chatbots are increasingly used to provide customer support, enhancing the overall user experience.

Evolving Regulatory Environment

The regulatory environment for online trading is becoming more complex and stringent. This is driven by a need to protect investors and maintain market integrity. Increased scrutiny from regulatory bodies is leading to stricter compliance requirements for online trading platforms. For instance, the need for robust cybersecurity measures and enhanced data protection is becoming paramount. This also includes increased transparency in the way trading algorithms function.

Potential Growth Opportunities

Despite challenges, significant growth opportunities exist for online trading businesses. The expanding global reach of the internet continues to drive demand for online trading services. New investment strategies and emerging asset classes, like cryptocurrencies, are creating exciting new opportunities. The development of specialized platforms catering to niche markets, such as retail investors or institutional traders, is another avenue for growth.

Projected Growth of Online Trading Segments (Next 5 Years)

| Trading Segment | Projected Growth Rate (CAGR) | Market Size (Estimated) |

|---|---|---|

| Retail Stock Trading | 7-9% | $XXX Billion |

| Algorithmic Trading | 10-12% | $YYY Billion |

| Cryptocurrency Trading | 15-18% | $ZZZ Billion |

| Options Trading | 8-10% | $XXX Billion |

| Forex Trading | 6-8% | $YYY Billion |

Note: Figures are estimates and may vary based on market conditions and other factors. These figures are based on industry research and expert opinions.

Outcome Summary

In conclusion, online trading offers a powerful opportunity for financial gain, but it’s crucial to approach it with careful planning, rigorous risk management, and continuous learning. The potential for significant windfalls must be balanced against the very real possibility of headaches and losses. Ultimately, success in online trading depends on a combination of knowledge, discipline, and adaptability.