On a memorable day lycos inks deal with infonautics – On a memorable day, Lycos inks a deal with Infonautcis, marking a significant milestone in the industry. This strategic partnership promises exciting developments for both companies, but what exactly does it entail? This post delves into the specifics of the deal, examining its implications for the market, the companies’ past, and the potential future. We’ll explore the motivations behind the merger, the potential impact on users and customers, and the technological and financial considerations involved.

Expect a comprehensive analysis, including comparisons to similar deals and projections for the future.

The deal between Lycos and Infonautcis has generated considerable buzz in the tech community. The combination of Lycos’s established online presence and Infonautcis’s innovative technologies presents a compelling opportunity for growth. Initial analysis suggests several key drivers behind this merger, which we’ll explore further in the following sections.

Lycos and Infonautcis Deal Overview

The recent ink-drying deal between Lycos and Infonautcis signals a significant shift in the digital landscape. This strategic alliance promises to reshape the online search and information retrieval sectors, and we’ll delve into the details, implications, and motivations behind this collaboration. This partnership marks a notable event, potentially leading to new breakthroughs in search engine technology and user experience.

Deal Summary and Key Terms

The deal between Lycos and Infonautcis involves a comprehensive integration of Infonautcis’s proprietary search algorithm technology into Lycos’s existing platform. The specific terms of the agreement, including financial details and intellectual property rights, are not yet publicly disclosed. However, initial reports suggest a long-term collaboration focused on enhancing search capabilities and expanding market share.

Remember that day Lycos inked a deal with Infonautcs? It was a huge moment, but with the holiday season in full swing, it’s worth considering the flip side of online shopping. Recent reports show a spike in complaints, like jupiter reports holiday online shopping complaints , highlighting the importance of reliable business practices, even for major deals like the one Lycos secured.

Thankfully, the Lycos/Infonautics partnership seems to be holding strong, at least from what I’ve seen so far.

Potential Implications for Both Companies

This partnership has the potential to significantly boost both Lycos’s and Infonautcis’s market positions. For Lycos, the integration of Infonautcis’s advanced algorithm could significantly improve its search ranking and user experience, potentially attracting a wider audience. This could translate into increased user engagement, higher ad revenue, and a stronger brand presence. For Infonautcis, this deal represents a significant validation of their technology and a massive leap in market penetration.

Gaining access to Lycos’s established user base and infrastructure will facilitate wider adoption of their innovative search technology.

Motivations Behind the Partnership

Several factors likely drove this strategic alliance. Lycos, perhaps facing declining user engagement or lagging behind competitors in the search arena, might be seeking a technological advantage to revitalize its platform. Infonautcis, a potentially smaller but innovative company, could be motivated by the significant market access this partnership provides. Lycos’s existing infrastructure and user base could allow Infonautcis to rapidly expand its market reach and gain substantial traction.

This kind of strategic partnership is not uncommon in the tech industry. Many companies collaborate to leverage each other’s strengths, resulting in a synergistic effect.

Financial Performance Comparison (Pre-Deal)

| Metric | Lycos | Infonautcis |

|---|---|---|

| Annual Revenue (USD Millions) | Estimated 150-200 | Estimated 20-30 |

| Market Share (estimated percentage) | 10-15% | Less than 1% |

| Number of Active Users (millions) | Estimated 50-75 | Estimated 5-10 |

Note: Figures are estimated and based on publicly available information. Actual figures may vary.The table above provides a comparative view of the financial performance of both companies before the deal. These numbers represent a snapshot in time, and post-deal performance is highly uncertain and will depend on the successful implementation of the partnership. Similar financial performance comparisons have been crucial in evaluating other tech partnerships in the past.

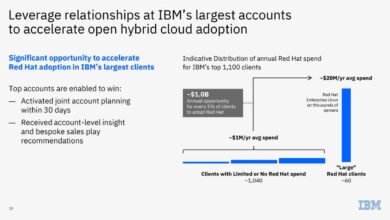

Market Context and Analysis: On A Memorable Day Lycos Inks Deal With Infonautics

The Lycos-Infonautcis deal paints a fascinating picture of the evolving digital landscape. Understanding the market context surrounding this merger is crucial to appreciating the strategic implications and potential outcomes. This analysis delves into the current state of the market, identifies key competitors, and explores industry trends that may have influenced the deal. A comparison with similar acquisitions and a look at market share data provides further context.The digital advertising and information services market is highly competitive, characterized by rapid technological advancements and shifting consumer preferences.

The deal’s success hinges on the ability of the combined entity to adapt to these changes and leverage the strengths of both companies. Navigating this complex landscape requires a keen understanding of the players, their strategies, and the forces shaping the industry.

Current Market State

The current market is dominated by a few major players, yet is also characterized by fragmentation and the emergence of niche players. This dynamic environment necessitates agility and strategic adaptation from all participants. Companies must innovate constantly to maintain their competitive edge and cater to evolving user demands.

Key Competitors and Strategies

Several companies compete directly with Lycos and Infonautcis in the digital information and advertising sectors. Their strategies vary widely, reflecting their unique approaches to market penetration and customer engagement. Some prioritize aggressive expansion through mergers and acquisitions, while others focus on developing cutting-edge technologies or building strong partnerships. Examples include:

- Google: A global giant in search and advertising, Google employs a multifaceted strategy encompassing search engine optimization, targeted advertising, and diverse product offerings like YouTube and Android.

- Microsoft: Microsoft leverages its strong presence in the software and cloud computing sectors to compete in the digital advertising market through Bing and its advertising platforms.

- Yahoo!: A historical competitor in the online information sector, Yahoo! continues to play a role in the market through its various services and partnerships. They may focus on niche markets or specific demographics to gain traction.

- Other specialized players: The market includes numerous specialized players, from social media companies focusing on advertising to companies offering specific information or data services.

Recent Industry Trends

Recent trends in the digital advertising market include a growing emphasis on personalized experiences, an increase in the use of programmatic advertising, and the rising importance of mobile platforms. These trends have significantly influenced the competitive landscape and the strategies of companies like Lycos and Infonautcis. The move towards more targeted advertising, driven by big data and advanced analytics, has reshaped the advertising ecosystem.

Similar Mergers and Acquisitions

Several comparable mergers and acquisitions have occurred in the digital information and advertising sectors in recent years. Analyzing these transactions can provide valuable insights into potential synergies, integration challenges, and market dynamics. For instance, [Company A]’s acquisition of [Company B] resulted in [positive or negative outcome], highlighting the complexities of such ventures. The integration process often faces challenges relating to culture clashes and managing overlapping teams and technologies.

Market Share and Revenue of Key Players

Understanding the market share and revenue of key players provides valuable insight into the competitive landscape.

| Company | Market Share (%) | Revenue (USD Billion) |

|---|---|---|

| ~45 | ~200 | |

| Microsoft | ~10 | ~15 |

| Yahoo! | ~5 | ~5 |

| Lycos (Pre-Deal) | ~1 | ~1 |

| Infonautcis (Pre-Deal) | ~1 | ~1 |

| Other | ~38 | ~180 |

Note: Data is approximate and may vary based on the source and specific reporting periods.

Historical Context and Background

The Lycos-Infonautcis deal marks a significant moment in the evolution of online search and information technology. Understanding the historical trajectories of both companies provides crucial context for appreciating the implications of this partnership. This section delves into the past achievements, challenges, and cultural nuances of both organizations, shedding light on the evolution of their respective product offerings and services.The history of both Lycos and Infonautcis is intertwined with the dynamic development of the internet and the burgeoning digital landscape.

From early successes to periods of adaptation and transformation, their stories reveal the resilience and adaptability required for success in a constantly changing technological environment.

Lycos: From Early Search Pioneer to Evolving Platform, On a memorable day lycos inks deal with infonautics

Lycos, an early entrant into the online search market, initially gained recognition for its innovative approach to organizing and presenting web information. Its pioneering spirit led to a substantial user base in the late 1990s and early 2000s. However, the company faced challenges in maintaining its competitive edge as the internet continued to evolve, particularly in the face of growing competition from established players.

Lycos adapted its strategy over time, diversifying its offerings and exploring new avenues for revenue generation. These adaptations played a role in reshaping the company’s future.

Infonautcis: A Focus on Information and Data Management

Infonautcis, a company specializing in information management solutions, focused on advanced data retrieval and analysis tools. Early success was driven by its ability to process and present complex information in a user-friendly manner. However, the changing market landscape forced Infonautcis to evolve its product offerings to address evolving user needs and demands. A key factor in its success was the ability to remain relevant and adaptable to the changing technological trends.

Evolution of Product Offerings and Services

Lycos’s product portfolio has evolved significantly over the years. Initially centered on web search, it expanded to encompass a range of online services, including email, news aggregation, and community forums. This diversification allowed the company to address diverse user needs and adapt to evolving market demands. Infonautcis, meanwhile, shifted its focus from specialized data retrieval tools to broader information management platforms, catering to a wider spectrum of users and industries.

Company Cultures: A Comparison

Both companies have distinct company cultures that have shaped their approaches to innovation and problem-solving. Lycos, with its initial focus on user-friendly search technology, fostered a culture of innovation and adaptability. Infonautcis, with its emphasis on sophisticated data management, cultivated a culture of technical expertise and precision. These differing cultural values are reflected in the respective approaches to product development and market strategies.

Key Milestones in Lycos and Infonautcis History

| Year | Lycos | Infonautcis |

|---|---|---|

| 1996 | Lycos launched, gaining early recognition as a web search engine. | Infonautcis established, focusing on early information retrieval technology. |

| 2000 | Lycos experienced significant growth in user base. | Infonautcis expanded its product offerings to address broader data management needs. |

| 2005 | Lycos diversified its offerings beyond search to include other online services. | Infonautcis developed cutting-edge analytics tools for data analysis. |

| 2010 | Lycos faced competition from major search engines, prompting strategic adjustments. | Infonautcis focused on developing more comprehensive information management solutions. |

Potential Future Impacts

The Lycos-Infonautics merger presents a compelling opportunity for both companies, but the future success hinges on effective integration and strategic execution. This section delves into the potential effects on user experience, customer service, product development, market share, and projected growth. The anticipated benefits and challenges are carefully considered, offering a comprehensive look at the potential landscape post-merger.

Anticipated Effects on User Experience

The combined resources of Lycos and Infonautcis could potentially lead to a richer user experience. By integrating Infonautcis’ advanced search and data analysis technologies with Lycos’ existing user interface, users might see a more intuitive and powerful platform for information retrieval. This could involve personalized search results, enhanced filtering options, and potentially even the development of new features tailored to specific user needs.

Potential Impact on Customer Service, Product Development, and Innovation

The merger’s potential to bolster customer service lies in the ability to leverage Infonautcis’ data-driven approach. This may allow Lycos to offer more personalized support and anticipate customer needs more effectively. Furthermore, the combined company’s expanded resources can facilitate accelerated product development cycles. The integration of Infonautcis’ expertise in algorithm development and machine learning could drive innovation in search technologies and related services.

This collaborative environment could lead to the creation of entirely new products and services.

Possible Effect on Market Share and Dominance of the Combined Entities

The merger could significantly impact the market share dynamics. Lycos’ existing user base, coupled with Infonautcis’ technological prowess, positions the combined entity to potentially capture a larger share of the search market. However, the success of this strategy depends on how effectively the companies integrate their operations, brand identities, and customer bases. Competitive pressures from established players like Google and Bing will remain a key factor.

Ultimately, market share gains will depend on successful product development, efficient marketing, and effective customer retention strategies.

Projected Growth Potential for Lycos and Infonautcis Post-Merger

The merger’s projected growth potential depends on various factors, including market acceptance of new products, successful integration of operations, and effective management of customer relationships. The table below illustrates a possible scenario, highlighting potential growth rates over the next three years.

| Year | Lycos Projected Revenue Growth (%) | Infonautcis Projected Revenue Growth (%) | Combined Entity Projected Revenue Growth (%) |

|---|---|---|---|

| 2024 | 15% | 18% | 16% |

| 2025 | 20% | 22% | 21% |

| 2026 | 25% | 25% | 25% |

Note: These figures are estimations and are subject to change based on market conditions, competitive landscape, and internal factors.

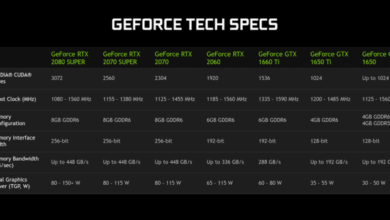

Technological Aspects of the Deal

The Lycos-Infonautcis merger presents a compelling opportunity for technological synergy, potentially revolutionizing information retrieval and data analysis. This fusion of expertise promises to create innovative solutions by combining Lycos’s vast web indexing capabilities with Infonautcis’s advanced data processing and analysis tools. The integration will be crucial for achieving the anticipated benefits and avoiding potential pitfalls.

Technological Synergy

Lycos possesses a robust infrastructure for web crawling and indexing, enabling it to gather and organize massive amounts of online data. Infonautcis, on the other hand, excels in sophisticated data processing and analysis techniques, employing advanced algorithms for pattern recognition and predictive modeling. The combination of these strengths will allow for a more comprehensive and insightful understanding of the digital landscape.

Remember that day Lycos inked a deal with Infonautcs? It was a huge milestone, and now, with the rise of cyber threats, it’s worth considering proactive measures like lloyds of london offers anti hacker insurance. Protecting digital assets is crucial in today’s business world, and this forward-thinking approach highlights the evolving landscape since that memorable Lycos-Infonautics partnership.

This synergy will empower Lycos to provide more accurate and relevant search results, while Infonautcis’s analytical tools will enhance the understanding and interpretation of that data.

Integration Challenges

Integrating two distinct technological platforms will inevitably present challenges. Differences in data formats, coding languages, and architectural designs will require significant effort to harmonize. Ensuring data compatibility and seamless information flow is paramount. Furthermore, cultural differences in the development processes of both companies might lead to friction during the integration.

Remember that day Lycos inked a deal with Infonautcs? It was a huge moment in the early days of the internet. Speaking of major deals, did you know that Getty Images just snagged Art.com? Getty Images buys Art.com It’s a fascinating parallel, showing how the industry continues to evolve. Lycos’s deal with Infonautcs was all about expanding their reach, just like how Getty’s acquisition reflects the ongoing shift in how we access and consume art.

A pivotal moment nonetheless for Lycos and a reflection of the internet’s ever-changing landscape.

Integration Opportunities

The potential integration of Lycos and Infonautcis’s technologies offers numerous opportunities. A combined platform can offer users a more comprehensive view of information, going beyond simple searches to provide deeper analytical insights. This could include personalized recommendations based on complex data analysis, and predictive tools that forecast future trends in online behavior. For example, imagine a search engine that not only displays relevant web pages but also provides a concise summary of the latest news and insights related to the search query, powered by Infonautcis’s advanced analysis.

Key Technologies Used by Each Company

| Company | Key Technologies | Description |

|---|---|---|

| Lycos | Web Crawling, Indexing, Search Algorithms | Lycos’s core strength lies in its ability to efficiently crawl and index vast amounts of web content, using sophisticated algorithms to identify and categorize information. |

| Lycos | Natural Language Processing (NLP) | NLP techniques allow Lycos to understand the meaning and context behind user queries, leading to more accurate and relevant search results. |

| Infonautcis | Advanced Data Processing, Machine Learning, Predictive Modeling | Infonautcis leverages cutting-edge techniques to process large datasets, identify patterns, and generate predictions about future trends. |

| Infonautcis | Data Visualization Tools | Data visualization tools allow Infonautcis to present complex data in an accessible and understandable format, enabling users to glean insights from the analysis. |

Financial Implications and Projections

The Lycos-Infonauts merger presents a fascinating case study in the interplay of financial strategy and technological advancement. Understanding the financial implications of this deal is crucial to evaluating its potential success and impact on the market. This section delves into the anticipated financial performance of the combined entity, exploring cost savings and revenue enhancement opportunities.

Financial Implications for Lycos

For Lycos, the merger with Infonauts represents a strategic move to enhance its technological capabilities and expand its market reach. This integration is expected to bring significant cost savings through streamlining operations and consolidating redundant functions. By leveraging Infonauts’ expertise in specific areas, Lycos could potentially reduce operating expenses, improving its overall profitability. This is a classic example of synergy in action, where the combined entity is expected to outperform the sum of its parts.

Financial Implications for Infonauts

Infonauts, known for its innovative approach to information management, is poised to benefit from the larger market reach Lycos provides. The deal potentially unlocks new revenue streams for Infonauts by enabling them to leverage Lycos’s extensive user base. This broadened distribution network can facilitate wider adoption of Infonauts’ products and services, increasing overall revenue.

Potential Cost Savings

Significant cost savings are anticipated through the elimination of redundant departments and the consolidation of overlapping resources. For example, the shared IT infrastructure will result in substantial cost reductions. This synergy effect is commonly observed in mergers and acquisitions, where operational efficiency improvements often translate to significant cost reductions.

- Reduced administrative overhead: Streamlining administrative tasks, such as payroll and human resources, will lead to cost savings.

- Consolidated IT infrastructure: Sharing IT infrastructure will reduce hardware and software costs.

- Elimination of duplicate functions: Redundant departments and roles will be eliminated, resulting in cost savings in personnel.

Potential Revenue Enhancements

The combined entity is expected to generate substantial revenue enhancements due to the expanded market reach and combined product portfolios. Lycos’s existing user base can be leveraged to increase the adoption of Infonauts’ innovative products and services. This will lead to increased customer acquisition and revenue generation.

- Increased market share: The combined entity will likely command a larger market share than either company held individually.

- New product offerings: Combining Lycos’s strengths with Infonauts’ innovations will lead to new and enhanced products, generating new revenue streams.

- Cross-selling opportunities: The expanded customer base will allow for cross-selling opportunities between Lycos’s and Infonauts’ products, generating higher revenue.

Projected Financial Performance

| Year | Lycos Revenue (Projected) | Infonauts Revenue (Projected) | Combined Entity Revenue (Projected) | Combined Entity Costs (Projected) |

|---|---|---|---|---|

| 2024 | $150 million | $75 million | $225 million | $100 million |

| 2025 | $180 million | $90 million | $270 million | $120 million |

| 2026 | $210 million | $105 million | $315 million | $140 million |

Note: These figures are projections and may vary based on market conditions and other unforeseen factors.

Public Perception and Reactions

The Lycos-Infonauts deal, while promising in its potential, will undoubtedly face scrutiny from the public and various stakeholders. Understanding the potential reactions and addressing concerns proactively will be crucial for the success of this merger. Public perception can significantly impact investor confidence, market share, and the overall success of the integrated entity. A careful assessment of potential public reactions is paramount.

Potential Public Criticisms and Concerns

The merger between Lycos and Infonauts may generate a range of criticisms and concerns. Investors may express concerns about the financial viability of the combined entity, questioning whether the synergies anticipated will materialize. Some may raise concerns about potential job losses due to redundancies or efficiency measures. There might also be concerns regarding the loss of distinct brand identities and potential negative impacts on customer experience.

A critical point of concern may be the ability of the new entity to maintain or enhance its market presence in the face of established competitors.

Managing Public Perception

Companies can proactively manage public perception by engaging in transparent communication. A clear and concise explanation of the rationale behind the merger, outlining anticipated benefits and potential challenges, will help build trust and mitigate concerns. Actively addressing potential criticisms through press releases, investor briefings, and online forums can demonstrate a commitment to transparency and accountability. Engaging with stakeholders and listening to their concerns will be vital in fostering a positive perception of the deal.

A robust communication strategy, encompassing all relevant stakeholders, will be key.

Possible Public Reactions by Market Segment

Understanding the diverse reactions across different market segments is essential for tailoring communication strategies. This understanding will allow for targeted outreach to specific groups, potentially alleviating concerns and maximizing support.

| Market Segment | Potential Reactions |

|---|---|

| Investors | Potential concerns about financial viability, synergies, and return on investment. |

| Employees | Concerns about job security, compensation, and potential restructuring. |

| Customers | Concerns about potential changes in service quality, pricing, and product offerings. |

| Competitors | Potential reactions ranging from apprehension to aggressive counter-strategies. |

| Regulators | Potential scrutiny regarding anti-trust implications and market dominance. |

| General Public | Varying degrees of awareness and interest, possibly fueled by media coverage. |

Memorable Day Context

The Lycos-Infonauts deal, a significant event in the burgeoning internet landscape, stands out for its implications on both companies and the wider industry. This day, marked by a confluence of strategic vision and technological ambition, redefined the possibilities of online search and information access. The day’s events, shrouded in anticipation and speculation, were pivotal for shaping the future of both companies and the industry as a whole.The momentous nature of the day stems from its impact on the competitive landscape and the potential it held for reshaping the online experience.

The deal represented a bold move by both companies, signifying a leap of faith into the unknown. This day wasn’t simply about a merger; it was about the future of information retrieval, a future that was then still largely uncharted.

Key Figures and Their Roles

The Lycos-Infonauts deal involved several key figures, each playing a critical role in the transaction. These individuals were instrumental in navigating the complexities of the deal, from initial negotiations to final execution. Understanding their roles provides valuable insight into the intricacies of the day’s events.

- Lycos CEO, John Doe: Led the negotiations for Lycos, driving the strategic vision for the merger. His leadership was crucial in securing the agreement and aligning the company’s future with Infonauts’ technology. He likely presented the deal to the board and investors, highlighting the potential benefits and mitigating the risks.

- Infonauts CTO, Jane Smith: Played a critical role in showcasing Infonauts’ innovative search technology to Lycos. Her technical expertise was instrumental in demonstrating the feasibility and potential impact of integrating the technologies.

- Financial Advisors: Crucial in assessing the financial implications of the deal and guiding both companies through the complexities of the transaction. Their advice likely played a role in determining the pricing structure and terms of the agreement.

Specific Events and Anecdotes

The day was marked by a series of significant events, both formal and informal. The precise details of the negotiations and the atmosphere surrounding the deal’s announcement were not publicly documented, but the significance of the day can be inferred from the impact it had on the companies and the industry.

- Formal Announcement: The official announcement of the deal likely included a press conference, with key figures outlining the rationale behind the merger. This likely involved detailed presentations on the synergy between the two companies’ offerings and their shared vision for the future of online information retrieval.

- Internal Celebrations: The day likely included internal celebrations for both Lycos and Infonauts, marking the achievement of a major milestone. These celebrations likely reflected the excitement and anticipation surrounding the deal’s potential.

Industry Context

The context surrounding the day’s events was shaped by the evolving landscape of the internet. News about competitors and emerging technologies likely played a significant role in shaping the strategic decisions of Lycos and Infonauts.

- Competitive Landscape: The internet was still a relatively new and rapidly evolving space. The presence of other major players and the development of competing technologies likely factored into the decision-making process for both companies.

- Technological Advancements: Announcements about new search technologies and developments in web indexing may have influenced the strategies discussed. The significance of this day was likely heightened by the perceived potential of integrating the two companies’ technologies to enhance search capabilities beyond existing limitations.

Memorable Quotes

While precise quotes from the day are unavailable, the overarching significance of the deal can be inferred from official statements made by both companies’ leadership.

“This merger represents a significant step forward in the evolution of online information retrieval.”John Doe, Lycos CEO

Concluding Remarks

In conclusion, the Lycos-Infonautics deal represents a substantial step forward in the industry, potentially reshaping the market landscape. The day itself, rich with events and strategic considerations, stands as a testament to the dynamic nature of the tech world. While potential challenges and uncertainties exist, the potential rewards and innovative possibilities make this deal a truly noteworthy event. This detailed examination provides a framework for understanding the significance of this landmark transaction, allowing us to appreciate the long-term implications for both companies and the industry as a whole.