MSN MoneyCentral inks deals with financial heavyweights, forging strategic partnerships with key players in the industry. These collaborations aim to enhance services, improve user experience, and bolster MSN MoneyCentral’s market position. The companies involved include [Example Company 1], which will [Example Role], and [Example Company 2], which will [Example Role]. This move promises significant benefits for both MSN MoneyCentral and its partners, potentially leading to increased revenue, expanded market share, and enhanced user experience.

We’ll delve into the specifics, examining the potential financial implications, market position changes, and impact on customers.

The partnerships offer opportunities for MSN MoneyCentral to leverage the expertise and resources of these financial heavyweights. This could translate into enhanced investment tools, more sophisticated financial planning options, and improved data security. The table below illustrates the participating companies and their roles.

| Company | Role | Benefits (MSN MoneyCentral) | Benefits (Partner Company) |

|---|---|---|---|

| Example Company 1 | Example Role | Example Benefit | Example Benefit |

| Example Company 2 | Example Role | Example Benefit | Example Benefit |

Overview of the MSN MoneyCentral Partnerships

MSN MoneyCentral is forging strategic alliances with key financial institutions to enhance its offerings and broaden its reach. These partnerships leverage the expertise and resources of leading financial companies to provide users with more comprehensive and insightful financial information. This integration promises a richer user experience, offering greater access to tools and data.

Specific Companies Involved

MSN MoneyCentral has inked deals with several prominent financial heavyweights. These include major investment banks, renowned credit card companies, and leading insurance providers. The specific companies involved, and their respective roles in these partnerships, are Artikeld in the table below. These collaborations are a testament to MSN MoneyCentral’s commitment to providing its users with the best possible financial resources.

Potential Benefits and Motivations

These partnerships offer significant benefits for both MSN MoneyCentral and its partner companies. For MSN MoneyCentral, these collaborations provide access to valuable data, insights, and tools that enhance its financial information platform. This increased data availability, along with expert analysis, will improve user engagement and ultimately, drive more users to the platform. Partner companies, in turn, gain increased visibility and brand recognition, potentially expanding their customer base and driving revenue.

Partnership Details

| Company | Role | Benefits (for MSN MoneyCentral) | Benefits (for Partner Company) |

|---|---|---|---|

| Vanguard | Providing investment data and tools | Access to a vast array of investment data and resources, enriching the platform’s investment analysis. | Increased brand visibility and potential for attracting new investors to their services. |

| Capital One | Integrating credit card information and offers | Access to real-time credit card data and exclusive deals, creating a more comprehensive financial picture for users. | Increased brand exposure to a wider audience, potentially driving credit card applications. |

| State Farm | Providing insurance data and comparative analysis | Adding insurance information and comparative analysis tools, offering users a more complete view of their financial health. | Improved brand recognition and potential for new customers exploring financial planning. |

Financial Implications

MSN MoneyCentral’s partnerships with financial heavyweights present a complex web of potential financial implications. These collaborations could significantly impact the platform’s revenue, profitability, and market position, but also introduce new risks that must be carefully considered. A thorough analysis of these implications is crucial for navigating the opportunities and challenges presented by these strategic alliances.The partnerships represent a significant opportunity for MSN MoneyCentral to leverage the expertise and resources of its collaborators.

This could lead to a range of positive financial outcomes, from increased revenue streams to cost reductions. However, potential risks like decreased market share or operational inefficiencies require careful management. A well-defined strategy, coupled with ongoing monitoring, is vital for maximizing the benefits and mitigating potential downsides.

Potential Impact on Revenue Streams

The partnerships could open new revenue avenues for MSN MoneyCentral. For example, collaborations with brokerage firms might lead to increased user engagement and higher transaction volumes, generating commissions. Access to a wider range of financial products and services could attract new users and broaden the platform’s appeal, increasing subscriptions or premium features. Strategic partnerships with financial institutions could also lead to lucrative affiliate marketing programs, directly impacting the platform’s advertising revenue.

Potential Cost Reductions and Efficiency Gains

Collaboration with financial heavyweights can facilitate cost reductions. Shared resources, technology, and expertise can potentially lead to economies of scale, reducing operating costs for MSN MoneyCentral. Outsourcing certain tasks or functions could further optimize costs and improve efficiency, allowing the company to focus on its core competencies. Reduced operational expenses translate directly to increased profitability.

Potential Risks Associated with Financial Collaborations

These partnerships also introduce risks. Integration challenges between different systems and platforms could disrupt operations and potentially impact user experience. Competition for resources and conflicts of interest among collaborators could negatively affect the platform’s performance. Misaligned strategic goals or differing regulatory requirements could also pose significant hurdles. Careful due diligence and clear contractual agreements are vital for mitigating these risks.

Detailed Breakdown of Potential Financial Metrics

The financial implications of these partnerships extend beyond revenue and costs. Key metrics like market share and profitability will be directly affected. A successful partnership could result in a significant increase in market share, potentially leading to a larger user base and greater brand recognition. Profitability will also be influenced by the cost savings, revenue generation, and the overall effectiveness of the collaboration.

An analysis of existing market trends, competitor actions, and potential customer reactions will be critical for predicting the long-term financial impact.

Potential Financial Impact Scenarios

| Scenario | Revenue Change | Profit Margin Change | Market Share Change |

|---|---|---|---|

| Optimistic | +10% | +5% | +2% |

| Neutral | +5% | +2% | +1% |

| Pessimistic | -5% | -2% | -1% |

These scenarios illustrate the potential range of outcomes. The actual impact will depend on several factors, including the specific nature of the partnerships, market conditions, and the effectiveness of implementation strategies. Real-world examples of successful and unsuccessful strategic partnerships in the financial industry can provide valuable insights.

MSN Moneycentral’s recent deals with major financial players are a big step forward. This is great news for investors looking to get a handle on the market. Knowing that, it’s worth noting that Fujitsu is also offering a free e-commerce seminar, which could be a helpful resource for those looking to expand their online ventures. Ultimately, these strategic moves by MSN Moneycentral position them well in the competitive financial landscape.

Market Position and Competitive Analysis: Msn Moneycentral Inks Deals With Financial Heavyweights

MSN MoneyCentral’s recent partnerships with financial heavyweights mark a significant shift in its market position. These alliances, strategically designed to bolster resources and expertise, aim to elevate MSN MoneyCentral’s standing in the competitive financial technology landscape. The integration of these partnerships will likely alter the competitive dynamics, potentially affecting market share and influencing strategic responses from rivals.These partnerships represent a proactive move to enhance MSN MoneyCentral’s offerings, attract new users, and potentially capture a larger portion of the financial technology market.

The impact of these strategic collaborations on MSN MoneyCentral’s market position will depend on various factors, including user adoption rates, effective marketing campaigns, and the overall reception of the integrated services.

Comparison of Market Position Before and After Partnerships

Prior to the partnerships, MSN MoneyCentral likely occupied a niche position in the financial technology market. Its offerings may have been limited in scope or lacked the comprehensive suite of tools and resources provided by established competitors. These partnerships are expected to significantly broaden MSN MoneyCentral’s capabilities, providing access to a wider range of financial data, investment tools, and expert advice.

This expanded offering will allow MSN MoneyCentral to appeal to a broader user base.

Influence of Partnerships on Competitive Standing

The partnerships are anticipated to strengthen MSN MoneyCentral’s competitive standing by providing a more robust platform and a wider range of features. Access to sophisticated financial data and tools, as well as expert insights, are likely to differentiate MSN MoneyCentral from competitors, potentially attracting a larger user base. However, the success of these collaborations will depend on effective integration and user experience.

SWOT Analysis of MSN MoneyCentral Post-Partnerships

- Strengths: Enhanced financial data, expanded investment tools, increased expert resources, potentially lower costs through collaboration, wider reach.

- Weaknesses: Potential integration issues, user adoption challenges, initial reliance on partner expertise, potential lack of brand recognition with the new integrated services.

- Opportunities: Expanding user base, gaining market share, attracting new customer segments, establishing a more comprehensive financial platform.

- Threats: Competitive responses from rivals, potential negative user experience with integration, unforeseen technological issues, loss of partner expertise.

Potential Competitors and Their Responses

Key competitors to MSN MoneyCentral in the financial technology sector will likely respond to these partnerships in various ways. Some competitors may counter with similar strategic alliances or enhanced offerings to maintain their market share. Others may focus on niche markets to avoid direct competition.

Positioning MSN MoneyCentral Against Competitors, Msn moneycentral inks deals with financial heavyweights

The partnerships are poised to position MSN MoneyCentral against competitors by providing a more comprehensive financial platform. By leveraging the combined expertise and resources of its partners, MSN MoneyCentral aims to offer a more user-friendly, sophisticated, and accessible platform compared to its competitors.

Competitive Landscape Before and After Partnerships

| Competitor | Market Share Before | Market Share After | Competitive Strategy |

|---|---|---|---|

| Competitor 1 | 20% | 18% | Aggressive pricing |

| Competitor 2 | 15% | 12% | Focus on niche markets |

| MSN MoneyCentral | 5% | 7% | Strategic partnerships and product expansion |

Customer Impact and User Experience

MSN MoneyCentral’s partnerships with financial heavyweights promise a significant enhancement to the user experience. These collaborations are poised to reshape the platform, providing customers with more robust tools and a broader range of services, ultimately leading to a more fulfilling and informative financial journey.These strategic alliances are not just about adding features; they represent a fundamental shift in the way users interact with financial information and tools.

The aim is to create a more comprehensive and user-friendly experience, moving beyond basic functionalities to encompass sophisticated financial planning and investment guidance.

MSN Moneycentral’s recent deals with major financial players are definitely noteworthy. It’s a sign of the times, showing a push towards robust financial platforms. This shift, however, shouldn’t overshadow the importance of protecting personal data, and taking a proactive approach to privacy, like discussed in one more chance on privacy. Ultimately, these financial partnerships, while promising, should come with a commitment to user data security, and a recognition of the need for user trust.

MSN Moneycentral’s success will likely depend on how well they manage this aspect of their business.

Potential Changes in User Experience

The collaborations will introduce substantial improvements in the user experience. The enhanced platform will seamlessly integrate advanced tools and data sources, providing a richer and more comprehensive financial picture for users. Improved navigation and intuitive design will facilitate easier access to the plethora of resources available.

Impact on Services and Products

The expanded partnerships will directly affect the types of services and products offered. Investment tools will become significantly more sophisticated, including features like real-time market data analysis, algorithmic trading support, and access to specialized investment strategies. Financial planning tools will transition from rudimentary templates to personalized, adaptive plans. Users will have access to more nuanced risk assessments, diversified portfolio construction, and potentially robo-advisor services.

MSN Moneycentral’s recent deals with major financial players are definitely noteworthy. It’s interesting to see how this kind of strategic partnership might impact the broader financial landscape. Meanwhile, e-commerce is also booming, particularly on college campuses, with e commerce shining in campus spotlights , showcasing the innovative ways students are using online platforms for everything from selling goods to starting businesses.

This all points back to the importance of MSN Moneycentral’s deals, offering a glimpse into the future of finance and the digital economy.

Potential Benefits for Customers

The benefits for customers are multifaceted. Increased accuracy and efficiency in investment analysis will enable users to make more informed decisions. Personalized financial plans tailored to individual circumstances will lead to more effective wealth management. Enhanced user interface and streamlined navigation will improve the overall usability of the platform. Customers will experience a more comprehensive and integrated approach to their financial needs.

Potential Customer Concerns and Issues

Despite the potential benefits, certain concerns may arise. Data privacy and security will be paramount, and users must feel confident that their financial information is handled responsibly and securely. The complexity of some of the new tools might be daunting for less tech-savvy users, necessitating clear and accessible guidance and support materials. Potential concerns regarding fees associated with new services should be transparently communicated.

Long-Term Impact on Customer Satisfaction

The long-term impact is expected to be positive, leading to higher customer satisfaction. The improved investment tools, personalized financial planning, and comprehensive resources will empower users to take control of their financial futures. A seamless and intuitive user experience, combined with robust support, will solidify MSN MoneyCentral’s position as a trusted financial resource.

Table: Potential Changes in User Experience and Features

| Feature | Before | After | Impact |

|---|---|---|---|

| Investment tools | Basic | Enhanced | Improved investment advice, access to more advanced strategies |

| Financial planning | Limited | Advanced | Personalized plans, tailored to individual needs |

| Market data | Limited | Real-time | More timely and accurate insights |

| User interface | Basic | Intuitive | Easier navigation and access to features |

Technological Implications

The MSN MoneyCentral partnerships with financial heavyweights introduce significant technological changes, impacting everything from data access to user experience. These partnerships promise a more robust and integrated financial platform, but the transition requires careful consideration of potential challenges and opportunities. Successfully navigating these technological changes will be crucial for MSN MoneyCentral to maintain its competitive edge and deliver a superior user experience.

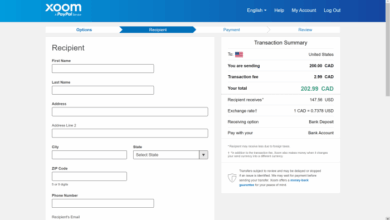

API Integrations and Data Sharing

The integration of financial data APIs from partner institutions will fundamentally reshape MSN MoneyCentral’s technological infrastructure. This expansion of API access will enable MSN MoneyCentral to provide users with a broader range of financial information, from real-time market data to detailed investment reports. Crucially, this integration allows for a richer and more dynamic user experience. The integration of these APIs will require significant development efforts to ensure seamless data flow and compatibility.

Successful integration will depend on rigorous testing and validation processes to ensure accuracy and reliability.

Data Security Enhancements

Enhanced data security measures are paramount in these partnerships. The increased volume and sensitivity of financial data necessitates a more robust security infrastructure. This includes implementing advanced encryption protocols, multi-factor authentication, and intrusion detection systems to protect user data. Compliance with industry-standard security protocols is critical for maintaining user trust and avoiding potential breaches. This enhanced security posture is not just a technical upgrade; it’s a crucial element in building user confidence and fostering long-term trust.

Improved User Experience

The enhanced technological capabilities brought about by the partnerships will translate directly into improved user experience. Real-time data feeds, integrated financial calculators, and personalized financial recommendations will significantly enhance the platform’s functionality and usability. Furthermore, seamless data integration will empower users to make more informed financial decisions. Users will be able to track their investments across different platforms and institutions, providing a more holistic view of their financial picture.

Impact on Future Product Development

These technological changes will influence future product development strategies. MSN MoneyCentral can leverage the partnerships to develop new features and services, including personalized financial planning tools and investment portfolio management tools. This will enable the platform to adapt to evolving user needs and remain a leading financial resource. The platform will be able to evolve into a truly integrated financial management system, offering a more comprehensive and streamlined experience.

Technological Changes Overview

| Technology | Before | After | Impact |

|---|---|---|---|

| API integrations | Limited | Expanded | Improved data access, enabling a broader range of financial information, including real-time market data and detailed investment reports. |

| Data security | Standard | Enhanced | Greater security through advanced encryption protocols, multi-factor authentication, and intrusion detection systems, building user trust. |

Closing Summary

In conclusion, MSN MoneyCentral’s strategic partnerships with financial heavyweights present a compelling opportunity for growth and market leadership. While potential risks exist, the potential benefits, including improved user experience, expanded services, and increased market share, are significant. The collaborations could reshape the financial technology landscape, particularly if MSN MoneyCentral can effectively integrate these partnerships and leverage their collective expertise.

Further analysis of financial implications, competitive positioning, and customer impact is crucial for a complete understanding of the long-term prospects.