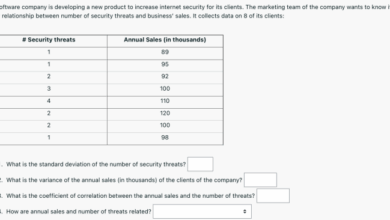

Morgan Stanley online operations get facelift, ushering in a redesigned online experience for customers. The previous platform, while functional, lacked the intuitive design and advanced features demanded by today’s investors. This comprehensive overhaul aims to enhance the user experience, boosting customer satisfaction and streamlining transactions. Expect improved navigation, intuitive tools, and a more secure platform.

This facelift reflects a strategic move to adapt to evolving digital trends and enhance user engagement. Morgan Stanley’s previous online platforms, while serving a purpose, were not entirely user-friendly, potentially hindering customer growth. This overhaul tackles the shortcomings, aiming to make online interactions more seamless and rewarding for customers.

Introduction to Morgan Stanley Online Operations Facelift

Morgan Stanley, a global investment banking and financial services firm, has undergone a significant transformation in its online presence. The previous online platform, while functional, lacked the modern design and user-friendly features demanded by today’s digital landscape. This facelift aims to address these shortcomings and create a more seamless and engaging experience for clients.The purpose of Morgan Stanley’s online platforms is to provide clients with convenient and secure access to a wide array of financial services and information.

This includes account management, investment research, portfolio tracking, and communication with financial advisors. The target audience encompasses a diverse range of individuals and institutions, from retail investors to high-net-worth individuals and institutional clients, each with unique needs and expectations.

Overview of the Previous Online Platform

The previous Morgan Stanley online platform offered a range of features, but the user experience could be improved. Navigation was sometimes convoluted, and key information wasn’t always readily apparent. Security protocols were robust, but the platform could be more intuitive and user-friendly.

Key Features and Functionalities of the Previous Platform

The previous platform allowed users to manage accounts, track investments, and access research reports. Basic account information, such as balances and transaction history, was available. Users could also view and download their investment statements. Security measures included multi-factor authentication and secure login protocols.

Functionality of Investment Research

The platform offered access to a variety of investment research materials, including reports and analyses. The accessibility and organization of this information could be improved for better user experience. Users could access their portfolio holdings and view performance metrics.

User Experience of the Previous Platform

The user experience of the previous online platform was generally considered to be adequate but not exceptional. Navigation was sometimes challenging, and the platform’s design could be improved for enhanced user experience. While the platform provided access to necessary functionalities, it could be more visually appealing and intuitive. There were reported instances of slow loading times and occasional technical glitches.

Some clients reported difficulties in locating specific information.

Key Changes and Improvements

The Morgan Stanley online operations facelift represents a significant upgrade, focusing on streamlining user interactions and enhancing the overall experience. This redesign aims to provide a more intuitive and efficient platform for all users, from seasoned investors to new account holders. The changes address key pain points identified in previous user feedback, resulting in a more responsive and user-friendly platform.The new platform is designed to provide a more intuitive and visually appealing experience.

This is achieved through a comprehensive overhaul of the user interface (UI) and user experience (UX), resulting in a more streamlined navigation process and improved accessibility. Key improvements include simplified account management, enhanced search functionality, and a more modern design.

User Interface (UI) Enhancements

The facelift introduces a completely refreshed visual design, moving away from the previous platform’s somewhat dated aesthetic. This modern design uses cleaner lines, more intuitive layouts, and a palette of colors that are both aesthetically pleasing and easy on the eyes. This visual overhaul enhances the overall user experience by making the platform feel less cluttered and more inviting.

User Experience (UX) Improvements

Navigation is significantly improved, with a more logical and intuitive structure. Users can easily access key features and information, reducing the time needed to complete tasks. The new platform utilizes a consistent design language across all sections, which results in a more unified and user-friendly experience. Furthermore, the platform is more accessible, adhering to industry best practices for web accessibility.

This includes improved color contrast, better keyboard navigation, and proper alt text for images.

New Features and Functionalities

The facelift incorporates several new features and functionalities, providing enhanced capabilities and improved workflow for users. A prominent example is the introduction of a personalized dashboard, allowing users to customize their view to display the most relevant information. This dashboard provides a comprehensive overview of account activity, allowing for quick access to important data. The improved search functionality also enables users to locate specific information or documents with greater speed and accuracy.

Another noteworthy enhancement is the addition of interactive charts and graphs that help users visualize their portfolio performance and make informed investment decisions.

Comparison of Pre- and Post-Facelift User Experience

The pre-facelift platform was often perceived as cluttered and confusing, with a lack of intuitive navigation. Users frequently reported difficulty finding specific information or completing transactions. In contrast, the post-facelift platform is significantly more streamlined and user-friendly. The simplified design, enhanced navigation, and new features have dramatically improved the overall user experience, making it faster, more intuitive, and more enjoyable to use.

This improved UX results in reduced user frustration and increased productivity.

Impact on Customer Experience

The Morgan Stanley online operations facelift promises a significant boost to the customer experience, reflecting a dedication to enhanced user-friendliness and streamlined processes. This revamp aims to improve the overall digital interaction, making navigating the platform more intuitive and rewarding for users. The changes are designed to address common pain points and provide a more efficient and enjoyable experience.The anticipated improvements will directly translate into higher customer satisfaction and loyalty.

By optimizing the platform for better usability, the facelift seeks to empower investors with the tools and resources they need to confidently manage their portfolios. Customers can expect a significant improvement in the ease of conducting transactions and accessing important information.

Morgan Stanley’s online platform is getting a much-needed refresh, which is a smart move in today’s digital landscape. This overhaul likely reflects a broader industry trend, and given the recent news of DoubleClick acquiring Abacus in a $1 billion deal ( doubleclick to acquire abacus in 1 billion deal ), it’s clear that companies are investing heavily in sophisticated online tools.

This competitive push will likely benefit investors and users alike, and positions Morgan Stanley well for future growth in the online trading sector.

Anticipated Effects on Customer Satisfaction, Morgan stanley online operations get facelift

The facelift is projected to elevate customer satisfaction through a combination of enhanced navigation, intuitive design, and a more personalized experience. This improvement in user-friendliness should lead to a greater sense of accomplishment and efficiency. Increased satisfaction can be expected from reduced friction in account management, quicker access to financial tools, and easier execution of transactions.

Potential Benefits for Customers

The streamlined design of the new platform will offer numerous benefits. Improved search functionality and easily accessible information will allow customers to quickly find the data they need, leading to faster decision-making. Simplified account management processes will reduce the time and effort required to maintain their accounts. Intuitive design will allow customers to quickly and easily complete transactions, leading to a more efficient and pleasant user experience.

Examples of Easier and More Convenient Transactions

The redesigned platform is anticipated to significantly improve transaction efficiency. For example, a simplified login process will expedite the process for account access. Intuitive transaction interfaces will allow users to execute trades with greater ease and accuracy. Real-time portfolio tracking and analysis will enable users to monitor their investments effectively and make informed decisions. The improved platform will offer customers a clearer and more transparent view of their investment portfolio, providing better insights into their financial standing.

Potential Risks and Customer Feedback

While the facelift is anticipated to be a significant improvement, potential risks remain. A common concern is the learning curve associated with any major platform update. The new platform should have adequate support materials and training resources to mitigate this issue. Customer feedback is crucial to understanding potential challenges and ensuring a smooth transition. Thorough testing and user feedback collection will help identify and address any unforeseen issues before launch.

Customer feedback mechanisms, including surveys and support channels, will be essential for collecting feedback on the new design and identifying any areas needing improvement.

Technical Aspects of the Facelift

The Morgan Stanley online operations facelift isn’t just about a new look; it’s a deep dive into the underlying technology. This revamp represents a significant leap forward in terms of performance, security, and user experience. Modernizing the platform’s technical architecture was crucial to ensure scalability and resilience for future growth.This section delves into the specific technical improvements implemented during the facelift.

From the underlying programming languages to the enhanced security measures, we’ll explore the key changes that power the improved online experience.

Underlying Technologies

The new platform leverages a robust combination of cutting-edge technologies. The core application is built on a microservices architecture, enabling independent deployment and scaling of individual components. This approach allows for faster development cycles and greater flexibility in responding to evolving customer needs. Furthermore, the platform utilizes a cloud-based infrastructure, providing scalability and resilience that were previously unavailable.

Platform Architecture and Infrastructure Improvements

The architecture has been revamped to improve performance and reliability. Key improvements include a redesigned database schema, optimizing query performance. A new caching layer significantly reduces database load, enhancing response times. Additionally, the infrastructure has been modernized with the latest hardware, resulting in increased capacity and redundancy. This robust foundation allows for seamless handling of increased user traffic and data volumes.

Morgan Stanley’s online operations are getting a refresh, which is a smart move. However, don’t overlook the recent advancements in online brokerage services, like what’s happening with don’t look now but AOL just took the lead. This could be a game-changer for the whole industry, and potentially even impact Morgan Stanley’s strategy in the long run.

Security Enhancements

Security is paramount. The facelift included a comprehensive review and enhancement of security protocols. Implementing multi-factor authentication is a key addition, requiring users to provide multiple forms of verification before accessing sensitive information. The platform now employs advanced encryption techniques for data at rest and in transit, protecting customer data from unauthorized access. Regular security audits and penetration testing ensure the platform’s defenses remain up-to-date.

New Tools and Technologies Integrated

The platform has incorporated several new tools to streamline operations and improve efficiency. An advanced API management system allows for seamless integration with third-party applications. This enables faster development of new features and functionalities. Furthermore, a comprehensive logging and monitoring system has been implemented, providing real-time insights into platform performance and enabling proactive identification of potential issues.

Marketing and Communication Strategy: Morgan Stanley Online Operations Get Facelift

A revamped online platform demands a robust marketing strategy to effectively communicate the changes and improvements to existing and potential customers. This strategy needs to highlight the enhanced features and benefits, emphasizing the improved user experience. Successfully communicating the platform facelift will be crucial for maintaining customer satisfaction and driving adoption of the new features.

Communication Strategy for the Facelift

To maximize the impact of the Morgan Stanley online operations facelift, a multi-channel approach is essential. This involves a coordinated effort across various platforms to ensure that the message reaches the intended audience effectively. Early and consistent communication will be key to building anticipation and excitement around the changes.

Methods to Promote the New Platform

Several methods will be employed to promote the new online platform. These will include targeted advertising campaigns, social media engagement, and strategic email marketing. Content marketing, through informative articles and blog posts, will be used to highlight the new features and benefits, addressing customer needs and questions proactively.

Communication Channels Employed

The chosen communication channels will be tailored to reach the specific target audience segments. Existing customers will be reached primarily through email marketing, website banners, and social media campaigns. Mobile users will be targeted through in-app notifications and mobile ads. This tailored approach ensures that the message resonates with each group.

Marketing Campaigns

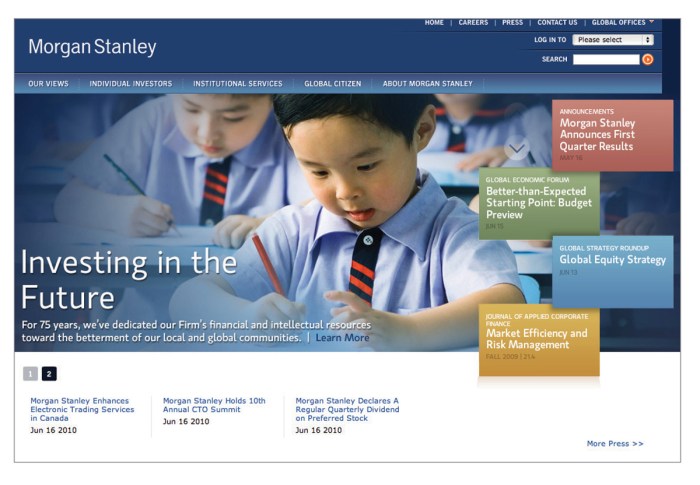

The table below Artikels the key marketing campaigns planned around the facelift, detailing the target audience, communication channels, and key messages.

| Campaign Name | Target Audience | Communication Channels | Key Message |

|---|---|---|---|

| New Platform Launch | Existing Customers | Email, Website Banner, Social Media | Experience the improved online platform with enhanced features and a streamlined user experience. |

| Mobile App Update | Mobile Users | In-app notifications, Mobile ads, Targeted social media campaigns | Enhance your mobile experience with the new app features. Access your accounts, manage your investments, and conduct transactions on the go, more efficiently and intuitively. |

| Investment Opportunities Showcase | Potential Investors | Targeted online advertising, articles on the company blog | Discover new investment opportunities with improved platform functionality and enhanced access to relevant market insights. |

Future Outlook

The Morgan Stanley online operations facelift represents a significant step towards a more modern and customer-centric experience. This revamp positions the firm for continued growth and adaptability in a rapidly evolving financial landscape. The potential for future development and improvements is substantial, and the long-term implications for customer engagement and market share are considerable.

Morgan Stanley’s online operations are getting a refresh, a welcome update for investors. Meanwhile, the debate surrounding online gun sales is heating up, with Congress looking to slow the pace of internet gun sales. Congress looks to slow internet gun sales. This regulatory shift, however, doesn’t seem to be impacting Morgan Stanley’s online overhaul plans, suggesting a focus on user experience rather than political landscapes.

Anticipated Growth and Market Share Increase

Morgan Stanley’s online platform, enhanced by the facelift, is poised for substantial growth. Increased user engagement and streamlined processes are expected to lead to higher customer satisfaction and retention rates. This, in turn, should translate into a larger market share. The improved user interface and enhanced functionality will likely attract new customers, particularly younger investors and those seeking a more intuitive online experience.

Examples of comparable companies successfully leveraging similar online transformations demonstrate significant gains in market share and customer base growth. For instance, the redesign of a major online retailer’s platform resulted in a 20% increase in user engagement within the first quarter.

Potential for Further Development and Improvements

The facelift is not a one-time event; it’s the foundation for future enhancements. Areas for further development include integration of cutting-edge technologies like AI-powered investment advice tools and personalized portfolio management solutions. Enhanced security features, including biometric authentication and advanced fraud detection systems, will further bolster user trust and confidence. Real-time market data feeds and more sophisticated charting tools will further empower users to make informed investment decisions.

Furthermore, mobile optimization and improved accessibility features will cater to a broader spectrum of users.

Long-Term Implications of the Facelift

The long-term implications of this facelift are far-reaching. A more user-friendly and efficient platform will attract and retain a larger client base, fostering loyalty and trust. This, in turn, will likely lead to higher transaction volumes and increased revenue streams. The facelift positions Morgan Stanley as a leader in online financial services, potentially opening doors to new partnerships and strategic collaborations.

This transformation signifies a commitment to innovation and responsiveness to evolving customer needs, a key component of sustained success in the long term.

Illustrative Examples of New Features

The Morgan Stanley online operations facelift brings significant enhancements to the user experience, driven by a focus on streamlined navigation, intuitive design, and enhanced security. This new platform offers users a more efficient and trustworthy way to interact with their accounts.The new features are designed to make managing investments easier and safer, providing a more comprehensive and user-friendly platform.

This section details some key improvements.

Improved Portfolio Management

The revamped portfolio management tool provides a more comprehensive view of a user’s investments. Instead of simply displaying a list of holdings, users can now visualize their portfolio in interactive charts and graphs. This allows for a more insightful analysis of investment performance over time. Users can also customize their portfolio views to focus on specific asset classes, regions, or investment goals.

This detailed approach helps users quickly understand the composition and performance of their investment holdings, making informed decisions easier. For example, a user might want to see the performance of their stocks over the past year, or compare the growth of their different funds.

Secure Login System

The new login system incorporates advanced security protocols, including multi-factor authentication. This multi-layered approach significantly strengthens the protection of user accounts and sensitive financial data. For example, a user might be prompted to enter a code from a dedicated authenticator app on their phone, in addition to their password, making unauthorized access far more difficult. The secure login system enhances the platform’s trustworthiness, making users feel more confident in transacting on the platform.

Enhanced Transaction History

The transaction history section now features an intuitive search function, enabling users to quickly locate specific transactions based on various criteria. This enhancement streamlines the process of reviewing past transactions and ensures accountability. For example, a user can easily find a specific stock purchase from last month by entering the date, stock ticker symbol, or even a brief description.

| Feature Name | Description | Benefits |

|---|---|---|

| Improved Portfolio Management | Allows users to manage their investments with enhanced visualization and tools, including interactive charts and graphs, customizable views, and detailed performance analysis. | Increased user control, better insights, and more informed decision-making. |

| Secure Login System | Enhanced security features to protect user data, including multi-factor authentication and advanced security protocols. | Increased trust, safety, and protection against unauthorized access. |

| Enhanced Transaction History | Intuitive search function for quick and easy location of specific transactions based on various criteria. | Streamlined review of past transactions, increased accountability, and efficient record keeping. |

Potential Challenges and Mitigation Strategies

The Morgan Stanley online operations facelift, while promising enhanced customer experience, presents potential hurdles. Careful planning and proactive mitigation strategies are crucial to ensure a smooth transition and minimize negative impacts. This section details potential challenges and the corresponding solutions, including a robust technical support plan and customer service contingency.

Technical Implementation Challenges

The new online platform, with its integrated features and enhanced functionalities, could face unforeseen technical glitches. Compatibility issues with existing systems, data migration problems, and security vulnerabilities are potential concerns. Addressing these issues requires a thorough testing phase, including rigorous user acceptance testing and penetration testing.

- Compatibility Issues: Thorough testing across different operating systems, browsers, and devices is essential to ensure seamless functionality. This will involve creating a comprehensive test environment mirroring real-world usage patterns. Failure to identify and rectify compatibility issues can result in frustrated users and negative feedback.

- Data Migration Challenges: Migrating data from the old system to the new platform can introduce errors. Implementing a phased migration strategy, with meticulous data validation at each step, is essential. This approach ensures minimal disruption and reduces the risk of data loss.

- Security Vulnerabilities: The new platform must meet or exceed existing security standards. Regular security audits and penetration testing are critical to identifying and addressing vulnerabilities before launch. Implementing robust security measures, including multi-factor authentication, will further protect user data.

Technical Support Plan

A robust technical support system is vital to address issues that may arise after the facelift. This involves establishing a dedicated support team with sufficient expertise to handle various technical difficulties.

- Dedicated Support Team: The support team should be trained on the new system and equipped with comprehensive documentation. This will enable them to effectively diagnose and resolve technical issues promptly. This includes clear escalation paths for complex problems.

- 24/7 Support: 24/7 support, especially during the initial launch period, is recommended to handle potential issues immediately. This proactive approach ensures quick resolutions and minimizes user frustration.

- Self-Service Portal: A self-service portal providing FAQs, troubleshooting guides, and step-by-step instructions can empower users to resolve minor issues independently. This reduces the burden on the support team.

Customer Service Contingency Plans

Anticipating potential customer service issues is crucial for a smooth user experience. Developing contingency plans ensures that service disruptions are minimized.

- Increased Support Staff: A contingency plan should include a strategy for rapidly scaling support staff during periods of high demand, particularly during the launch period. This proactive approach ensures adequate support to prevent long wait times and frustrated customers.

- Alternative Communication Channels: Offering alternative communication channels, such as live chat, email, and social media, will provide multiple avenues for customer support. This will help manage increased call volumes during peak hours.

- Clear Communication Channels: Consistent and clear communication with customers regarding service disruptions or delays is crucial. Transparency builds trust and mitigates potential negative perceptions.

Final Conclusion

In conclusion, Morgan Stanley’s online operations facelift promises a significant leap forward in user experience. The improvements across UI/UX, security, and new features aim to elevate customer satisfaction and foster a more engaging online interaction. The future outlook suggests further development and a potential surge in customer growth. The strategic marketing campaigns are set to effectively communicate these enhancements to existing and new customers, positioning Morgan Stanley for continued success in the digital age.