Molpay to combat consumer fears with swipe device aims to revolutionize how we think about digital payments. It tackles the common anxieties surrounding new payment methods by focusing on security, privacy, and ease of use. From understanding the specific fears of various demographics to exploring the intuitive user experience of the swipe device, this analysis dives deep into the potential of Molpay to reshape the payment landscape.

This exploration delves into Molpay’s security measures, comparing them to existing methods. It Artikels the potential market impact and discusses strategies to address consumer concerns and build trust. The narrative also includes potential marketing strategies and examines similar payment innovations that successfully gained consumer confidence.

Understanding Consumer Fears Regarding Molpay

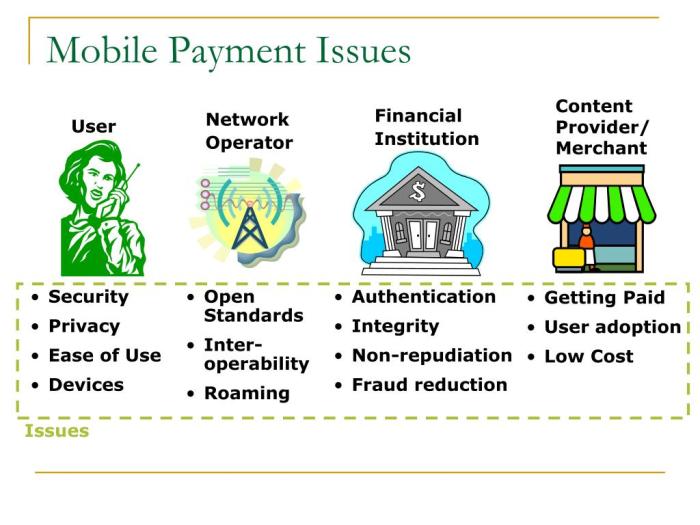

Molpay, a new digital payment system, presents exciting opportunities for streamlined transactions. However, any new financial technology faces potential hurdles in consumer adoption, often stemming from inherent anxieties. This analysis delves into common consumer fears surrounding Molpay, particularly regarding security, privacy, and reliability. Understanding these concerns is crucial for Molpay to build trust and foster widespread acceptance.Consumer apprehension towards new financial products is a well-documented phenomenon.

Factors such as the perceived risk of fraud, the lack of familiarity with the technology, and concerns about data breaches play a significant role in shaping consumer decisions. Molpay must proactively address these concerns to ensure a positive user experience and encourage adoption.

Common Consumer Anxieties

Consumer anxieties regarding financial transactions are multifaceted and can vary significantly depending on individual circumstances. This section explores the core concerns related to Molpay, encompassing security, privacy, and reliability.

| Fear Category | Description | Potential Demographic Impact |

|---|---|---|

| Security | Concerns about the security of personal financial data, including the risk of unauthorized access, hacking, and fraudulent transactions. Users may question the robustness of Molpay’s security measures and the encryption protocols employed. | Younger demographics and those with limited financial literacy might be more susceptible to these concerns, while older generations may be more hesitant to embrace new technologies due to perceived security risks. Lower-income individuals may prioritize security more due to a greater vulnerability to financial loss. |

| Privacy | Concerns about the collection and use of personal data by Molpay. Users may worry about how their transaction data is stored, shared, and potentially used for targeted advertising or other purposes. They may be hesitant to share sensitive information through a new system. | Individuals concerned about data privacy and online security might express greater hesitation. This concern is particularly important in regions with varying data privacy regulations. Concerns may be greater among those in locations with a history of data breaches or those with a low level of trust in financial institutions. |

| Reliability | Concerns about the reliability of the payment system, including issues with transaction processing speed, payment failures, or technical glitches. Users might be hesitant to rely on Molpay if they are unsure about its operational stability and support mechanisms. | Individuals who rely heavily on financial services for daily transactions might be more cautious about adopting Molpay if they perceive any potential disruptions to their regular financial routines. Older generations might be more apprehensive if they perceive the system as potentially unreliable compared to traditional methods. |

Demographic Variations in Fear

Consumer anxieties surrounding Molpay can vary based on demographic factors. This section explores how concerns related to security, privacy, and reliability might differ across age, income, and location.

- Age: Younger generations, accustomed to digital technologies, might have fewer concerns than older generations, who may be more hesitant to adopt new financial methods. Younger users might be more focused on security and privacy issues, while older users may be more concerned with reliability and ease of use.

- Income: Individuals with lower incomes may be more susceptible to financial losses due to fraud, potentially emphasizing their concerns about security and reliability. They may also be less familiar with digital technologies and thus more apprehensive about adopting new payment methods. Conversely, high-income individuals may have more options and less concern about reliability.

- Location: Concerns about Molpay’s reliability and security might vary across different locations based on factors such as local regulations and financial infrastructure. Regions with high rates of financial fraud or a history of cyberattacks might have higher levels of apprehension.

Molpay’s Potential to Address Consumer Concerns

Molpay aims to revolutionize mobile payments, offering a streamlined and secure alternative to traditional methods. Consumers often express concerns about data security and the ease of use of new payment systems. Molpay addresses these concerns by focusing on robust security measures and a user-friendly interface. This approach seeks to build trust and foster widespread adoption.Molpay’s security infrastructure is designed to mitigate risks associated with data breaches and fraud.

By implementing advanced encryption technologies and multi-factor authentication, Molpay significantly reduces the possibility of unauthorized access to sensitive information. This commitment to security is a crucial element in building consumer confidence in a new payment system.

Molpay’s Security Measures

Molpay employs a layered security approach to protect user data. This multi-layered protection incorporates encryption protocols that scramble financial information during transmission, making it indecipherable to unauthorized parties. Moreover, Molpay utilizes advanced fraud detection algorithms to identify and prevent suspicious transactions in real-time. These algorithms analyze transaction patterns, locations, and other factors to flag potentially fraudulent activities.

Molpay also incorporates two-factor authentication, requiring users to verify their identity through multiple channels, adding an extra layer of security.

Benefits of Using a Molpay Swipe Device

Molpay’s swipe device offers a seamless payment experience. Its intuitive design and quick transaction processing contribute to significant time savings. The convenience of a swipe device allows users to make payments effortlessly and rapidly. The system is designed to be quick and easy to use, reducing friction in the payment process. This speed and ease of use are significant advantages over traditional methods.

Comparison to Existing Payment Methods

Molpay distinguishes itself by combining the convenience of a swipe device with robust security protocols. While other payment systems may offer aspects of either security or ease, Molpay strives to integrate both effectively. Molpay’s focus on speed, convenience, and enhanced security provides a compelling alternative to existing methods.

Molpay is trying to ease consumer anxieties about online transactions with their innovative swipe device. While online digital music still faces major obstacles like trust and security concerns , Molpay’s focus on tangible interactions with the swipe device offers a reassuring alternative to entirely digital payments. This approach could be key to broader consumer adoption of online services.

Molpay vs. Other Payment Systems

| Feature | Molpay | Credit Card | Debit Card | Digital Wallet |

|---|---|---|---|---|

| Security | Advanced encryption, multi-factor authentication, real-time fraud detection | Varying levels of security; susceptible to fraud | Generally secure but may have vulnerabilities | Security depends on the specific wallet provider |

| Speed | Fast transaction processing; optimized for swipe devices | Moderate speed; depends on transaction processing times | Moderate speed; transaction times can vary | Speed depends on the network connection and wallet app |

| User Experience | Intuitive swipe device; streamlined payment process | Often involves multiple steps and potential errors | Simple but may lack the ease of other systems | Relies on app interface; user experience varies |

This table illustrates a comparison of Molpay with other common payment systems, highlighting the potential advantages of Molpay in terms of security, speed, and user experience. The table clearly demonstrates Molpay’s potential to provide a superior payment experience compared to existing methods.

Molpay and the Swipe Device

Molpay aims to revolutionize payment processing, and a key component is the swipe device. This device, designed for ease of use, is crucial to achieving a seamless customer experience. Understanding how this device functions and how to troubleshoot potential issues is paramount to building customer confidence and reducing anxieties.The Molpay swipe device is intended to be an intuitive tool, simplifying the payment process for both merchants and customers.

A user-friendly design, combined with clear instructions, will enhance the overall experience.

User Experience: Intuitiveness and Ease of Operation, Molpay to combat consumer fears with swipe device

The Molpay swipe device prioritizes a straightforward design for a smooth user experience. Its intuitive layout minimizes the learning curve, enabling users to quickly master the process. Large buttons and clear instructions are crucial for effortless operation, ensuring that both merchants and customers can easily navigate the payment process. The device is designed to be user-friendly for a variety of user demographics.

Potential for User Error and Mitigation Strategies

While designed for simplicity, human error is always a possibility. To minimize user error, the Molpay swipe device incorporates several safeguards. Clear visual and auditory cues guide the user through each step, preventing common mistakes. Moreover, the device includes an error-detection system that identifies and alerts users to potential issues. This real-time feedback reduces the chance of incorrect entries and ensures the transaction is processed accurately.

Making a Payment with a Molpay Swipe Device: A Step-by-Step Guide

This guide Artikels the process for making a payment using the Molpay swipe device.

- Insert Card: The customer inserts their credit or debit card into the device’s card reader.

- Swipe or Tap: The customer swipes the card through the reader (or taps if the device supports tap-and-go transactions), following the on-screen instructions.

- Confirmation Screen: The device displays a confirmation screen confirming the transaction amount and the card details. The customer reviews the information and confirms the payment.

- Receipt Generation: The device generates a receipt for the customer, confirming the transaction.

- Transaction Completion: Once the transaction is confirmed and processed successfully, the customer’s card details are securely stored and the payment is completed.

Troubleshooting Potential Issues

A table outlining potential issues during a payment transaction and their solutions:

| Potential Issue | Solution |

|---|---|

| Card not recognized | Verify card insertion, ensure card is properly swiped/tapped, and check for any physical obstructions in the card reader. |

| Incorrect transaction amount | Review the amount displayed on the device, and ensure the correct amount is selected. Contact the merchant if the issue persists. |

| Transaction declined | Verify the card’s validity, ensure sufficient funds are available, and check for any temporary network issues. Contact the card issuer for further assistance. |

| Device malfunction | Contact Molpay support for assistance or troubleshooting, and try to restart the device. |

| Receipt not printed | Ensure the printer is connected and operational, and try to restart the printer and the device. Contact Molpay support for assistance if necessary. |

Molpay’s Impact on the Payment Landscape

Molpay’s emergence as a new payment solution promises a significant shift in how consumers interact with their finances. Its innovative approach, coupled with a focus on addressing consumer concerns surrounding swipe devices, positions it to potentially disrupt the existing payment landscape. The company’s success hinges on its ability to capture market share, navigate competition, and adapt to evolving consumer needs.

Potential Market Share Capture

Molpay’s ability to secure a significant market share hinges on its user-friendly interface, robust security measures, and competitive pricing. The company needs to effectively target specific demographics and sectors to achieve widespread adoption. Early adopter strategies and attractive promotional offers will be crucial for rapid initial growth. Success in capturing market share will depend on Molpay’s ability to demonstrate clear value propositions compared to existing payment systems.

Examples of successful new payment systems often highlight a compelling need for simplification, enhanced security, or more convenient payment options, all of which can be potential drivers for Molpay’s adoption.

Impact on Existing Payment Processors

The introduction of Molpay could significantly impact existing payment processors. Competition for market share will likely intensify, forcing established players to innovate and adapt to maintain their customer base. This could lead to price wars, improved services, and potentially the development of new, complementary products to compete with Molpay’s offerings. For example, existing processors might focus on enhancing security features or introducing new payment methods to maintain relevance.

The impact will vary depending on the specific processor and their ability to respond effectively to the new market conditions.

Potential Competition

Molpay faces competition from a wide array of established and emerging payment processors. Direct competitors might include established players like PayPal, Stripe, and Square, who already have substantial market penetration. Furthermore, niche players focused on specific segments of the market, such as mobile-only payment solutions, will also pose a competitive threat. The nature of competition will vary based on the geographical region and target customer demographics.

Successful strategies for competing in this market often involve targeted marketing campaigns, product differentiation, and strategic partnerships to build brand awareness and customer loyalty.

Timeline for Growth and Adoption

Anticipated growth and adoption of Molpay will depend on various factors, including market reception, marketing efforts, and ongoing technological improvements. A detailed timeline is difficult to predict, but the initial phase will likely focus on gaining traction within a specific target market. Challenges include building trust with consumers, overcoming regulatory hurdles, and maintaining security protocols as the user base grows.

Real-world examples of successful new payment systems show that initial adoption is often gradual, with rapid growth occurring after overcoming initial hurdles. For example, Apple Pay experienced an initial period of slow adoption before gaining significant momentum.

Molpay is cleverly tackling consumer anxieties about online transactions with their innovative swipe device. This approach is particularly relevant in the current climate, given the recent keynote addresses that have highlighted the challenges facing mega sites like Amazon and Walmart in adapting to modern payment methods. Keynote puts mega sites under scrutiny, demonstrating the need for secure and user-friendly solutions.

Ultimately, Molpay’s focus on a tangible swipe device offers a reassuring alternative to complex online processes, potentially boosting consumer confidence.

- Phase 1 (Year 1-2): Initial product launch and focused beta testing, targeting specific demographics and sectors. Key challenges include building a secure platform and addressing early user concerns. Examples of companies succeeding in this phase often demonstrate a focus on building trust and addressing user feedback proactively.

- Phase 2 (Year 3-5): Expansion into new markets and partnerships with merchants. Key challenges include scaling infrastructure to handle increased transaction volume and maintaining data security. Examples of successful expansion often include strategic partnerships with complementary businesses.

- Phase 3 (Year 6-8): Continued market penetration and diversification of services, potentially exploring international markets. Key challenges include navigating regulatory environments and maintaining competitive pricing. Examples of companies successfully expanding into international markets often involve a thorough understanding of local regulations and cultural nuances.

Marketing Strategies for Molpay

Molpay’s success hinges on building consumer trust and overcoming potential anxieties surrounding its innovative swipe device. A well-crafted marketing strategy is crucial to position Molpay as a secure and user-friendly payment solution. This requires understanding the concerns of specific demographics and tailoring messaging to address them effectively.Addressing consumer fears requires a multifaceted approach that goes beyond simply showcasing the device’s features.

It needs to emphasize the benefits and alleviate any perceived risks associated with using a new payment method. This proactive approach will establish Molpay as a reliable and trustworthy choice for the future of payments.

Alleviating Consumer Fears

Consumer concerns about new payment technologies often revolve around security, privacy, and ease of use. Addressing these concerns directly and proactively can significantly enhance user confidence. Molpay’s marketing materials should clearly explain the robust security measures implemented to protect user data, such as encryption protocols and fraud detection systems. Transparency about how data is handled and stored is essential to building trust.

Molpay’s new swipe device aims to ease consumer anxieties about online transactions, a smart move considering the current economic climate. While Priceline, for example, is setting sales records despite pressures like rising inflation and potential recession priceline sets sales record despite mounting pressures , it’s crucial for smaller businesses to adapt and offer seamless, trusted payment methods.

Molpay’s focus on user-friendliness is a positive step towards building consumer confidence and fostering a more secure digital economy.

Emphasizing the simplicity of the swipe device, demonstrating its intuitive operation through clear and concise instructions, and showcasing how it integrates seamlessly with existing payment routines, can effectively address concerns about ease of use.

Marketing Campaign Design

A targeted marketing campaign is vital for reaching the most apprehensive demographics. Focus should be placed on building trust and showcasing the advantages of the Molpay swipe device. The campaign should emphasize the security features implemented, emphasizing the protection of sensitive information. Highlighting successful pilot programs or testimonials from early adopters can create a sense of community and build social proof.

Targeting specific demographics with tailored messaging, for instance, through social media campaigns, is a crucial aspect of building trust and confidence.

Visual Aids

Visual aids play a crucial role in conveying complex information effectively. Images depicting the swipe device in various use cases, such as a customer using it at a store checkout or a person making a contactless payment, can clearly illustrate the device’s usability. Visual representations of security protocols, such as encrypted data symbols or secure transaction icons, can instill confidence and demonstrate the robust safeguards in place.

Infographics demonstrating the ease of use of the device, visually outlining the steps involved in a transaction, can further enhance understanding and alleviate concerns. Illustrations showcasing the smooth integration of Molpay with existing payment systems, highlighting how it simplifies transactions, can further reinforce the user-friendly nature of the system.

Compelling Campaign Description

Molpay’s marketing campaign will focus on a powerful narrative emphasizing security and ease of use. The campaign will showcase the sleek design of the Molpay swipe device, juxtaposing it with images of seamless transactions taking place in various settings. Testimonials from satisfied customers will be featured prominently, emphasizing the confidence they now feel in their financial transactions. The campaign will emphasize the device’s robust security features through visual aids, such as an image of a locked vault or a stylized graphic representing encrypted data.

It will demonstrate how the Molpay swipe device simplifies payment procedures, showing customers easily completing transactions at stores, restaurants, and online. These images should evoke a sense of trust, convenience, and modernity. A clear and concise message emphasizing the simplicity and security of the swipe device should be conveyed throughout the campaign, addressing concerns and promoting confidence.

Case Studies of Similar Payment Innovations

Navigating the complexities of consumer trust is crucial for any payment innovation. Examining how similar innovations have addressed consumer concerns provides valuable insights into strategies for success. Understanding the tactics employed by successful predecessors can help Molpay avoid pitfalls and build consumer confidence. Learning from their experiences can streamline Molpay’s path to market acceptance.Similar payment innovations often face skepticism, especially when introducing new technology.

This section details case studies of successful payment systems that addressed consumer concerns, highlighting the strategies used and the lessons learned. Analyzing these successes can provide a roadmap for Molpay’s success in gaining consumer trust and acceptance.

Successful Strategies for Gaining Consumer Trust

Building consumer trust in new payment methods requires careful consideration of perceived security, ease of use, and value proposition. Successful companies have addressed these concerns through various strategies, often combining multiple approaches.

- Transparency and Education: Clear communication about the technology, its security features, and how it works is paramount. Companies like Apple Pay, for example, proactively educated consumers about the security measures behind their systems, emphasizing encryption and two-factor authentication. Detailed explanations and readily available FAQs helped build trust and alleviate concerns.

- Security Focus: Emphasizing security measures is critical. Mastercard and Visa have long invested in robust security protocols, ensuring data protection. Their commitment to security, backed by rigorous standards and certifications, builds confidence in the payment system’s ability to protect consumer data.

- Ease of Use and Integration: User-friendly interfaces and seamless integration with existing systems are vital. PayPal, for instance, prioritized intuitive design and user experience. This focus on simplicity made transactions effortless, encouraging adoption.

- Partnerships and Integrations: Collaborating with established businesses and merchants creates trust and increases accessibility. Google Pay’s integration with numerous retailers and mobile carriers made it easily accessible, further boosting consumer trust.

Lessons Learned from Successful Cases

Several key lessons emerge from these successful payment innovations. Understanding these lessons can inform Molpay’s approach to market penetration and consumer engagement.

- Proactive Communication: Addressing concerns directly and transparently builds trust. Anticipating questions and providing clear explanations fosters confidence in the new technology.

- Demonstrating Security: Providing verifiable security measures and certifications is crucial. Consumers need assurance that their data is protected. Public demonstrations of security protocols and audits can strengthen consumer confidence.

- User-Centric Design: Prioritizing user experience, including ease of use and intuitive interfaces, is critical. Simplifying the process and making it effortless contributes to broader adoption.

- Strategic Partnerships: Collaborating with established businesses and merchants helps expand the reach and legitimacy of the payment system. This approach creates broader access and trust.

Ultimate Conclusion: Molpay To Combat Consumer Fears With Swipe Device

In conclusion, Molpay’s innovative swipe device presents a compelling solution to the challenges of consumer trust in new payment systems. By addressing security concerns, emphasizing ease of use, and employing strategic marketing, Molpay has the potential to redefine the future of digital transactions. The analysis highlights the crucial role of user experience and marketing in fostering trust and acceptance within the market.