Merrill Lynch joins online trading party, marking a significant shift in the brokerage industry. This move signals a crucial adaptation to the evolving landscape of financial services, where online platforms have become increasingly popular. The traditional model of in-person brokerage is facing challenges from the accessibility and convenience of online trading, and Merrill Lynch’s entry into this arena promises to be a pivotal moment.

This analysis will delve into the potential impact on the brokerage industry, exploring the platform’s features, target audience, and potential competitive advantages and disadvantages.

This new online platform presents a fascinating case study in how a legacy financial institution navigates the digital transformation. Understanding the details of this transition is crucial for both investors and industry professionals, as it will likely set a precedent for future adaptations within the brokerage world.

Introduction to Merrill Lynch’s Online Trading Entry

Merrill Lynch’s foray into online trading signifies a significant shift in the brokerage landscape. This move, while strategically important, also carries implications for the future of traditional brokerage models and the overall competitive dynamics within the industry. The decision signals a recognition of the evolving needs and preferences of investors, who increasingly favor digital platforms for ease of access and transaction execution.This transition reflects a broader trend toward online financial services, as more and more individuals seek investment options and tools that are readily available and convenient.

Merrill Lynch’s entry into the online trading arena will likely reshape the way brokerage services are delivered and perceived, impacting both established players and newer entrants.

Historical Context of Brokerage Models

Traditional brokerage models, characterized by in-person interactions and dedicated financial advisors, have long been the cornerstone of the industry. These models fostered trust and personalized guidance, but they often came with higher fees and less accessibility. The advent of online platforms fundamentally altered this dynamic. Lower transaction costs and 24/7 accessibility became attractive features for a broader investor base, particularly younger generations accustomed to digital interactions.

The rise of discount brokers like Fidelity and Schwab demonstrated the viability and appeal of online investment platforms.

Potential Impact on the Brokerage Industry

Merrill Lynch’s entry into online trading is poised to significantly alter the competitive landscape. The integration of online tools with Merrill Lynch’s existing resources, including its extensive network of financial advisors, could create a powerful combination. This convergence of traditional expertise with digital accessibility could attract a wider range of investors, potentially increasing market share. However, the move also presents a challenge to established online-only brokers, forcing them to innovate and differentiate to maintain their market position.

Competition will likely intensify, leading to more competitive pricing and an increased focus on user experience.

Potential Competitive Advantages and Disadvantages

Merrill Lynch, with its established brand recognition and reputation for financial expertise, has a significant advantage. Its large client base and existing infrastructure can be leveraged to facilitate a smooth online transition. However, the transition to a fully online platform may necessitate significant investments in technology and infrastructure to ensure seamless operation and user experience. The risk of losing clients who prefer the personalized touch of traditional advisors also exists.

Moreover, adapting to the demands of a digitally-native user base will be crucial for maintaining competitiveness.

Merrill Lynch’s Competitive Position

The table below highlights some potential advantages and disadvantages Merrill Lynch might encounter in the competitive online trading space:

| Competitive Advantage | Competitive Disadvantage |

|---|---|

| Established brand recognition and trust | Adapting to the demands of a digitally-native user base |

| Extensive network of financial advisors | Potential loss of clients preferring personalized guidance |

| Large client base and infrastructure | Significant investment required for technology and infrastructure |

| Potential to combine traditional expertise with digital accessibility | Competition from established online-only brokers |

This strategic shift necessitates a careful consideration of customer needs and a commitment to innovation in the online trading space. The successful integration of online trading with Merrill Lynch’s existing services will depend heavily on maintaining trust, enhancing user experience, and offering competitive pricing.

Features and Functionality of the New Platform

Merrill Lynch’s foray into online trading presents a compelling opportunity for investors. This new platform promises a streamlined experience, offering both seasoned traders and newcomers a sophisticated toolkit. The platform’s features are designed to enhance trading efficiency and provide valuable insights, potentially offering a competitive edge in the dynamic market.

Key Platform Features

This section details the core functionalities of the new Merrill Lynch online trading platform. Understanding these features is crucial for assessing its value proposition. The platform leverages modern technology to provide a range of tools and services.

- Enhanced Charting Capabilities: The platform boasts advanced charting tools that go beyond basic line graphs. Interactive charting features allow for a detailed examination of market trends and patterns, providing valuable insight into potential trading opportunities. This is a significant upgrade from competitors who often offer basic charting tools. Users can customize their charts to visualize specific metrics, such as moving averages or volume data, allowing for more in-depth analysis.

- Real-Time Market Data: Access to real-time market data is crucial for timely trading decisions. The platform provides up-to-the-minute information on various financial instruments, ensuring users stay informed about market fluctuations. Competitors’ platforms often lag in providing real-time updates, potentially leading to missed opportunities.

- Portfolio Management Tools: The platform’s portfolio management tools offer a comprehensive view of investment holdings. Users can track their investments across different asset classes, including stocks, bonds, and mutual funds. This feature simplifies portfolio monitoring and helps users stay on top of their investment performance. Competitor platforms often lack the same level of detail and comprehensive tracking.

- Educational Resources: Merrill Lynch integrates educational resources into the platform to assist users in understanding the intricacies of trading. These resources provide tutorials, market analysis, and investment strategies, fostering a deeper understanding of the market. This feature distinguishes Merrill Lynch from competitors who may not offer the same level of educational support.

Comparison with Competitors

A comparative analysis highlights the strengths and weaknesses of Merrill Lynch’s new platform against its rivals. This evaluation will assist in assessing the platform’s competitive advantages.

So, Merrill Lynch is jumping into the online trading fray. This move makes sense, given the current market trends, but it also highlights a larger shift in financial services. Interestingly, this also connects to CBS Sportsline’s recent announcement of a new e-commerce reseller program, CBS Sportsline announces new e-commerce reseller program , which suggests a broader trend of sports and finance intertwining.

This whole online trading thing is clearly evolving rapidly, and Merrill Lynch is certainly trying to stay ahead of the curve.

| Feature | Merrill Lynch | Competitor A | Competitor B |

|---|---|---|---|

| Charting Capabilities | Advanced, interactive, customizable | Basic, limited customization | Intermediate, some customization |

| Real-Time Data | Superior, up-to-the-minute | Delayed, may have lags | Near real-time, but may have some latency |

| Portfolio Management | Comprehensive, multi-asset class tracking | Limited, basic tracking | Good, but lacks some details |

| Educational Resources | Integrated, tutorials, analysis | Limited, basic articles | No integrated resources |

User Experience and Interface Design

The platform’s user experience is critical to its adoption. A user-friendly interface ensures ease of navigation and intuitive functionality. The platform aims to provide a smooth and seamless experience.The platform’s interface design is modern and intuitive. Navigation is straightforward, allowing users to access the various features with ease. The use of clear visuals and concise information presentation enhances the overall experience.

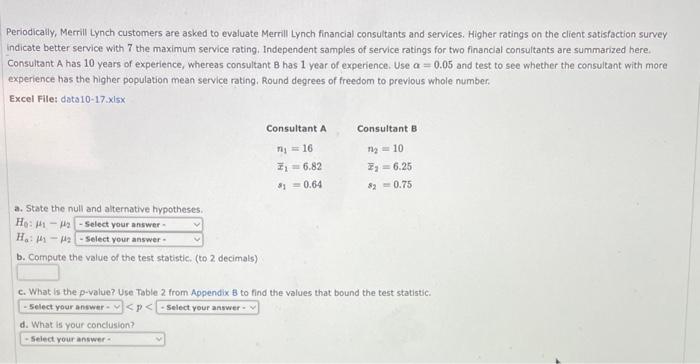

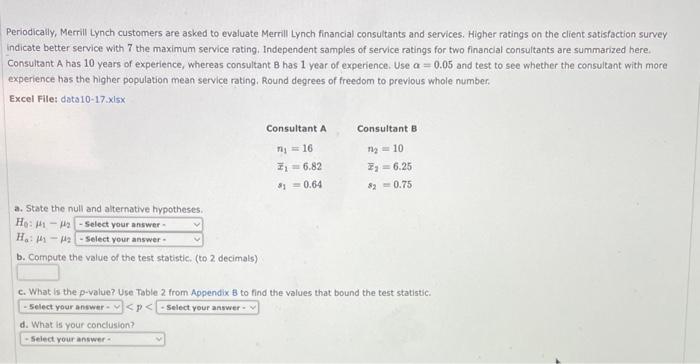

Target Audience and Market Positioning: Merrill Lynch Joins Online Trading Party

Merrill Lynch’s foray into online trading necessitates a precise understanding of its target demographic and a robust market positioning strategy. The platform’s success hinges on attracting the right users while carving out a unique niche within the competitive online brokerage landscape. This involves careful consideration of pricing models and a clear differentiation from existing services.This section delves into the target audience Merrill Lynch is aiming for with its new online offering, examining pricing strategies and their potential impact, analyzing the firm’s market positioning within the online trading sector, comparing and contrasting the platform’s target demographic to other brokerage services, and presenting a table summarizing target demographics for different competitor services.

Target Demographic Analysis

Merrill Lynch’s online trading platform likely targets a broad range of investors, from seasoned professionals to younger, tech-savvy individuals looking for a user-friendly platform. This dual focus is key to capturing a significant market share. The platform’s design should prioritize ease of use and intuitive navigation for less experienced users, while also offering advanced tools and functionalities for those with more complex investment strategies.

The platform should offer a balance of accessibility and sophistication.

Pricing Strategies and Impact

Merrill Lynch’s pricing model will be crucial in attracting and retaining users. A competitive pricing strategy, potentially tiered based on account size or trading volume, is essential. Consideration must be given to the overall cost of maintaining the platform and the value proposition it offers to users. Transparency in pricing is vital to fostering trust. For instance, some platforms offer tiered commission structures based on trade frequency or account value.

Market Positioning within Online Trading

Merrill Lynch, with its established brand and reputation, seeks to capitalize on its existing client base while attracting new investors to the online space. Differentiation from other online brokerage services is key. This could involve offering unique investment tools, tailored financial advice, or superior customer service. For example, a focus on personalized portfolio management could be a differentiator.

Comparison to Other Brokerage Services

Merrill Lynch’s target demographic will likely overlap with other brokerage services, yet there will be subtle differences. The platform’s strengths and weaknesses should be clearly articulated to attract a specific segment of investors. Younger, tech-savvy investors may be drawn to the platform’s intuitive design, while established investors may prioritize the firm’s reputation and financial expertise.

Target Demographics of Different Brokerage Services

| Brokerage Service | Primary Target Demographic | Secondary Target Demographic |

|---|---|---|

| Merrill Lynch | Experienced investors, high-net-worth individuals, and those seeking personalized financial advice. | Tech-savvy individuals and younger investors seeking a user-friendly platform. |

| eTrade | Individual investors, small businesses, and those seeking basic investment tools. | Investors focused on low-cost trading and ease of use. |

| Fidelity | A wide range of investors, from beginners to seasoned traders, with a strong emphasis on mutual funds and retirement accounts. | Individuals and families seeking comprehensive financial planning resources. |

| Schwab | Individuals and small businesses seeking low-cost investment options and extensive research tools. | Investors who prioritize simplicity and efficiency in their trading activities. |

Impact on Existing Customers and Employees

The introduction of Merrill Lynch’s online trading platform represents a significant shift in how the firm interacts with its clients and manages its workforce. This transition presents both opportunities and challenges for both existing customers and employees, requiring careful consideration and proactive management. Understanding these implications is crucial for a smooth and successful implementation.

Potential Implications for Existing Clients

Existing Merrill Lynch clients will experience a broadened range of access to investment products and services. The online platform will likely offer greater flexibility and 24/7 accessibility, enabling clients to execute trades and manage their portfolios at their convenience. This enhanced accessibility is expected to be especially valuable for clients who prioritize self-directed investment strategies. However, the shift also presents a challenge for clients who prefer the personalized service of a dedicated financial advisor.

The platform must effectively bridge the gap between self-service and personalized advice to cater to the diverse needs of existing clients. Merrill Lynch should provide comprehensive training resources and support channels to help clients navigate the new platform.

Impact on Merrill Lynch Brokerage Staff

The introduction of the online platform necessitates a significant adjustment in the roles and responsibilities of Merrill Lynch’s brokerage staff. This shift is expected to affect both junior and senior members of the team. A key aspect of this change involves a re-evaluation of the brokerage staff’s skillsets and the need for training on new technologies and processes.

Challenges and Opportunities for the Workforce

The transition presents several challenges for Merrill Lynch’s brokerage staff. There may be a need for retraining or upskilling to equip employees with the necessary knowledge and technical proficiency to effectively assist clients using the new platform. This transition also creates opportunities for employees to develop new skill sets and potentially transition into roles that leverage their expertise with the new online platform.

Merrill Lynch’s foray into online trading is definitely noteworthy. It signals a shift in how we interact with financial services, but with increased online activity comes a heightened risk of spam. Fortunately, the recent launch of the anti-spam coalition site anti spam coalition site launched offers a crucial resource for users, helping to mitigate these risks and ensure a smoother experience for everyone navigating the evolving online trading landscape.

This development is vital in the context of Merrill Lynch’s new online platform, making it safer for all involved.

Adaptability and a willingness to learn new technologies will be crucial for success in this transition.

Transition Period and Management

A well-structured transition period is essential for a smooth implementation of the new online platform. This period should include comprehensive training programs for employees, providing them with the necessary skills to effectively use and support the platform. Clear communication channels should be established to address client concerns and provide support during the transition. A phased approach, starting with limited access and gradual expansion, can mitigate potential disruptions and ensure a controlled rollout.

Robust client support systems must be in place to address any technical issues or questions that may arise.

Comparison of Potential Employee Roles Before and After Transition

| Role (Before Transition) | Role (After Transition) | Description of Changes |

|---|---|---|

| Junior Broker | Client Relationship Manager (Online) | Junior Brokers will transition to focus on guiding clients through the online platform, handling account management and trade execution through the online platform. |

| Senior Broker | Senior Relationship Manager (Hybrid) | Senior Brokers will continue to manage high-net-worth clients but will also have the opportunity to provide guidance and support on the new platform, leading training programs for junior staff. |

| Financial Advisor | Financial Advisor (Integrated Platform) | Financial advisors will maintain their focus on personalized financial advice, utilizing the online platform as a tool to streamline client interactions, portfolio management, and trade execution. |

Potential for Innovation and Future Development

The launch of Merrill Lynch’s online trading platform marks a significant step towards digital transformation in the financial services industry. Beyond the initial features, the platform’s potential for future development is substantial, offering opportunities for enhanced user experience, broader market reach, and increased profitability. This exploration delves into potential avenues for innovation, including partnerships, integration, and adaptation to future market trends.The future of online trading hinges on continuous innovation.

By anticipating evolving market demands and leveraging emerging technologies, Merrill Lynch can maintain its competitive edge and provide a superior experience for its users. This includes proactively exploring integration with cutting-edge financial instruments and platforms, while also fostering strategic partnerships to expand its reach and offerings.

Potential Partnerships and Collaborations

Strategic partnerships with fintech companies are crucial for expanding the platform’s capabilities and offerings. Collaborations could involve integration of advanced AI-powered tools for algorithmic trading, or partnering with cryptocurrency exchanges to offer diversified investment options. This could potentially involve co-branded services, joint marketing campaigns, or shared technology infrastructure. For instance, a partnership with a leading blockchain technology firm could lead to the development of secure and transparent crypto trading capabilities within the platform.

Integration with Other Financial Products and Services

Expanding the platform to encompass a wider range of financial products and services is a logical step. This could involve seamless integration with Merrill Lynch’s existing investment advisory services, enabling clients to access comprehensive financial planning resources through a unified online platform. Further integration with robo-advisors could provide automated portfolio management options, catering to a broader segment of investors.

For example, integrating a mortgage calculator within the platform could facilitate a more holistic financial management experience for clients.

Adapting to Future Market Trends

The online trading landscape is constantly evolving. To remain competitive, Merrill Lynch’s platform needs to adapt to future market trends, such as the growing popularity of mobile trading and the increasing demand for personalized investment experiences. The platform must be responsive and adaptable to the needs of diverse investor segments, with a focus on enhanced user interfaces and seamless mobile functionality.

This also includes incorporating the latest security measures to protect user data and funds.

Future Integration Scenarios with Other Financial Instruments

The platform’s potential extends beyond traditional securities. Future integration with alternative investment vehicles, such as private equity funds or real estate investment trusts, could broaden the investment options available to clients. The introduction of fractional ownership in assets could further enhance accessibility. This would need careful consideration of regulatory compliance and investor education. For instance, integration with peer-to-peer lending platforms could offer alternative financing options for clients.

Competitive Landscape and Analysis

The online trading landscape is intensely competitive, with established giants and nimble startups vying for market share. Merrill Lynch’s foray into online trading necessitates a deep understanding of the existing players and their strengths and weaknesses. Success hinges on identifying unique selling propositions and understanding the evolving needs of investors.The competition in online brokerage is fierce. Established players like Fidelity, Schwab, and Vanguard have robust platforms with extensive features, attracting a broad spectrum of investors.

New entrants, often with innovative technology and cost-effective models, are also challenging the status quo. Merrill Lynch needs to carve out a distinct space in this crowded market.

Competitive Analysis of Major Players

Merrill Lynch’s new online trading platform must be compared against its key competitors. Understanding their strengths and weaknesses will help determine how to differentiate Merrill Lynch’s offering. Direct comparisons, while helpful, need to be complemented by an understanding of each company’s overall investment strategy and client base.

- Fidelity Investments: Known for its comprehensive research tools, user-friendly interface, and extensive investment options, Fidelity attracts a wide range of investors. Their platform is often praised for its intuitiveness, especially for those new to online trading. However, they may be less appealing to sophisticated investors seeking more tailored services.

- Charles Schwab: Schwab’s platform is a strong contender with a reputation for low fees and excellent customer service. They appeal to investors who prioritize simplicity and cost-effectiveness. Schwab’s platform often excels in its ease of use for both beginner and seasoned investors.

- Vanguard: Vanguard’s focus on low-cost index funds and ETFs has made them a popular choice for investors seeking passive investment strategies. Their online platform, while functional, might not offer the same level of active trading tools as some competitors.

Differentiation Strategies, Merrill lynch joins online trading party

Merrill Lynch needs to highlight unique aspects of its platform to attract and retain clients. Focusing on specific niches or providing exceptional customer service can be effective differentiators.

Merrill Lynch jumping into the online trading scene is a big deal. It’s a sign of the times, really. This move follows a similar trend, like when Hewlett-Packard teamed up to launch Ariba.com , showing how companies are adapting to the changing digital landscape. Ultimately, Merrill Lynch’s move reflects a broader shift in how people are investing and trading, and it’s likely to have a significant impact on the industry.

- Sophisticated Research and Advisory Services: Merrill Lynch’s legacy in financial advising provides an opportunity to offer comprehensive research and advisory services integrated within the online platform. This can differentiate it from purely online brokerage platforms.

- Personalized Investment Strategies: By leveraging its financial advisors’ expertise, Merrill Lynch can provide tailored investment strategies and recommendations within the online platform. This could be a key differentiator for wealth management clients.

- Specialized Investment Products: Offering specialized investment products or access to niche markets can appeal to specific investor groups. This approach would need to be thoroughly researched and tested to ensure it resonates with a targeted market segment.

Potential Threats and Opportunities

The online trading sector is constantly evolving, introducing new technologies and challenges. Merrill Lynch must adapt to remain competitive.

- Technological Disruption: Emerging fintech companies are developing innovative platforms with advanced trading algorithms and user interfaces. This poses a threat to established players but also presents opportunities for Merrill Lynch to explore new technologies to improve their platform.

- Regulatory Changes: Frequent regulatory changes in the financial sector can impact trading platforms. Merrill Lynch must remain vigilant to any updates and ensure compliance across its platforms.

- Shifting Investor Preferences: Investor preferences and needs are constantly evolving. Merrill Lynch must stay informed about these trends and adapt its platform to meet evolving demands.

Competitive Advantages and Disadvantages

Merrill Lynch’s strengths and weaknesses within the online trading landscape will determine its success. A thorough assessment of its competitive positioning is crucial.

- Advantages: Merrill Lynch’s brand recognition and extensive network of financial advisors provide a strong foundation. Leveraging these strengths for personalized investment strategies and specialized products could yield a significant competitive edge. Existing customer base and brand trust can be a strong competitive advantage.

- Disadvantages: The legacy system and culture may present challenges in adopting agile development strategies necessary to compete with innovative startups. Potential challenges in attracting younger, technology-savvy investors who may be more drawn to competitors’ user-friendly platforms and lower costs.

Overall Assessment of the Move

Merrill Lynch’s foray into online trading marks a significant shift in the brokerage landscape. It signals a recognition of the evolving preferences of investors and a response to the increasing dominance of digital platforms in finance. This move promises both opportunities and challenges, requiring a careful evaluation of the potential impact on both the firm and the industry as a whole.This assessment will delve into the potential long-term effects of this transition, considering the associated risks and rewards, and providing a comprehensive overview of the platform’s strengths and weaknesses.

Ultimately, it aims to contextualize Merrill Lynch’s online trading initiative within the broader financial landscape.

Potential Long-Term Impact on the Brokerage Industry

Merrill Lynch’s entry into online trading could trigger a domino effect, compelling other traditional brokerage firms to adapt and embrace digital technologies. This competitive pressure could lead to a wave of innovation, resulting in more user-friendly platforms, improved customer service, and potentially lower fees. However, it also presents a threat to firms who fail to adapt, potentially leading to market share loss.

The success of Merrill Lynch’s online platform will set a precedent for the industry, influencing future strategies and product development.

Risks and Rewards Associated with the Transition

The transition to online trading presents both considerable risks and significant rewards. A key risk is the potential for decreased profitability if Merrill Lynch fails to attract a sufficient number of new online clients to offset the costs of developing and maintaining the platform. Competition from established online brokers and fintech companies also poses a risk. Conversely, the rewards include increased market share, a broader customer base, and potentially a stronger brand image in the digital age.

The ability to attract and retain new clients, and manage customer expectations, will be crucial in maximizing rewards and mitigating risks.

Strengths and Weaknesses of the Platform’s Approach

Merrill Lynch’s online trading platform, while still nascent, likely possesses several strengths. It’s plausible that the platform leverages Merrill Lynch’s existing infrastructure and customer base to gain initial traction. Strong brand recognition and reputation for financial expertise may attract clients. However, the platform may face challenges if it doesn’t address the needs and expectations of today’s digitally savvy investors.

Ease of use, intuitive design, and robust customer support are crucial to long-term success. The platform’s ability to integrate seamlessly with existing Merrill Lynch services, such as wealth management, will be a significant factor.

Overall Impact on the Broader Financial Landscape

Merrill Lynch’s online trading entry could influence the broader financial landscape in several ways. It might lead to a more competitive environment, potentially benefiting retail investors through lower fees and more diverse product offerings. Increased accessibility to online trading could empower a wider range of investors, potentially driving greater participation in the financial markets. The success of this venture will depend on the ability to effectively bridge the gap between traditional brokerage services and the demands of the digital age.

Closing Summary

Merrill Lynch’s foray into online trading is a bold step into the digital age of finance. The company’s approach, while potentially disruptive to the traditional model, also carries significant opportunities. The platform’s success will depend on its ability to effectively target the right audience, offer competitive pricing, and provide a seamless user experience. The long-term impact on the industry remains to be seen, but Merrill Lynch’s decision is a clear indicator of the growing importance of online trading platforms in the financial world.

This shift necessitates a careful consideration of how existing customers and employees will adapt, and what innovative features can distinguish the platform in the competitive landscape.