Lycos forms new venture capital fund, a bold move signaling Lycos’s commitment to fostering innovation and growth in the tech sector. This new initiative promises to be more than just another venture capital fund; it’s a strategic play, leveraging Lycos’s history and current position to potentially disrupt the competitive landscape. The fund’s focus, investment strategies, and target sectors are sure to pique the interest of entrepreneurs and investors alike.

This new fund is likely to delve into several key areas. From the investment process and funding sources to the potential impact on the market and Lycos’s long-term vision, it’s an ambitious project. The team behind the fund, its experience, and the current state of the venture capital market will all be critical factors in the fund’s success.

Background of Lycos

Lycos, a once-prominent name in the early days of the internet, holds a significant place in the history of search engines and online directories. Its journey reflects the dynamic evolution of the tech industry, from its pioneering role to its current position. Understanding this history is crucial for assessing Lycos’s potential as a venture capital fund.Lycos’s initial success stemmed from its innovative approach to search and directory organization.

It was among the first to offer a user-friendly interface and categorized search results, attracting a substantial user base in the late 1990s. This early success laid the foundation for future endeavors, though it ultimately didn’t translate into the sustained dominance of the time.

Lycos’s Historical Ventures

Lycos’s early ventures were marked by significant achievements in the internet space. It established itself as a leading search engine and online portal, offering a wide range of services, including news, email, and shopping. This comprehensive approach aimed to provide a one-stop shop for online users. Lycos’s success in this area attracted substantial investment and recognition, showcasing the company’s ability to attract and engage users.

Lycos’s Current Standing in the Tech Industry

Lycos’s current standing in the tech industry is less prominent than its past. While its name may not be as recognizable as it once was, the company has persisted through various transformations and pivots. Its current focus on venture capital demonstrates a renewed commitment to the tech sector, though it’s important to recognize that its past experiences will likely shape its future endeavors.

Strengths in the Context of Venture Capital

Lycos’s past experience in the online space offers several potential strengths in the venture capital arena. Its understanding of the digital landscape, gained through years of experience in search and portal operations, is valuable. Furthermore, Lycos’s familiarity with user behavior and online trends gives it insight into potential investment opportunities. Access to a network of former employees and partners within the tech industry is another advantage, creating a strong network for deal sourcing.

Weaknesses in the Context of Venture Capital

Despite its past experience, Lycos faces certain challenges as a new venture capital fund. The company’s current brand recognition may not be as strong as competitors with established reputations, impacting its ability to attract investors and promising startups. A potential lack of direct experience in recent tech trends, especially compared to newer venture capital firms, could also be a disadvantage.

Additionally, the time it takes to rebuild brand recognition and trust in the venture capital world could be a considerable factor.

Venture Capital Fund Focus

Lycos’s new venture capital fund is poised to capitalize on emerging opportunities in the digital landscape. Building on Lycos’s rich history in internet technology and its deep understanding of evolving user needs, this fund aims to support innovative startups with high growth potential. The focus is on companies revolutionizing existing industries and creating new markets.The fund will leverage Lycos’s extensive network and resources to identify promising ventures and provide them with the support they need to thrive.

A key component of the fund’s strategy is partnering with experienced entrepreneurs and mentors to guide portfolio companies through challenges and capitalize on opportunities.

Investment Strategies

The fund will employ a diversified investment strategy, focusing on early-stage companies with strong intellectual property and a clear path to market. A significant portion of the investment portfolio will be allocated to startups developing innovative technologies in areas such as artificial intelligence, blockchain, and the metaverse. The fund will also invest in companies addressing unmet needs in areas like sustainable energy, healthcare, and personalized learning.

Strategic acquisitions will be considered in certain cases, to accelerate the growth of promising ventures.

Target Sectors

The fund will primarily target companies in the technology sector, recognizing the exponential growth potential within this industry. This includes, but is not limited to, artificial intelligence, cloud computing, cybersecurity, and fintech. However, the fund also acknowledges the significant potential in emerging sectors, such as sustainable energy and biotechnology. The fund’s flexibility will allow for investments in sectors that align with its core values and demonstrate strong market potential.

Specific sub-sectors of interest will be identified through thorough market research and analysis.

Potential Partners

The fund will actively seek strategic partnerships with leading technology incubators, accelerators, and universities. Collaboration with industry experts and thought leaders will enhance the fund’s understanding of emerging trends and opportunities. Academic institutions will provide access to cutting-edge research and talent pools. Networking with established venture capitalists and angel investors will broaden the fund’s reach and provide valuable insights into the startup ecosystem.

Investment Process

The fund’s investment process is structured to ensure thorough due diligence and careful consideration of each investment opportunity. A multi-stage process, beginning with initial screening of potential investment targets, ensures that only the most promising companies are considered.

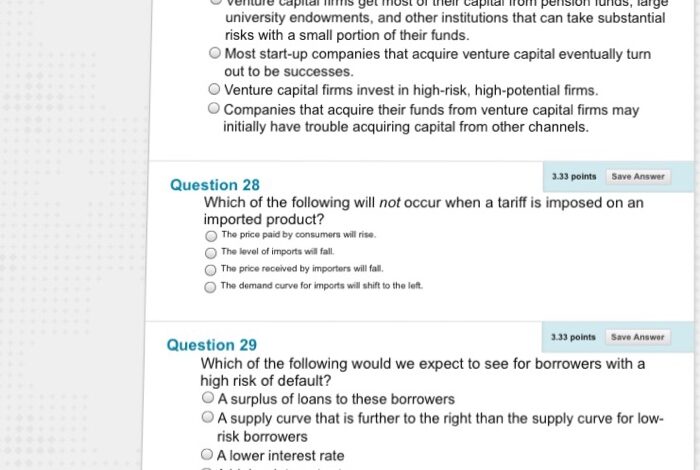

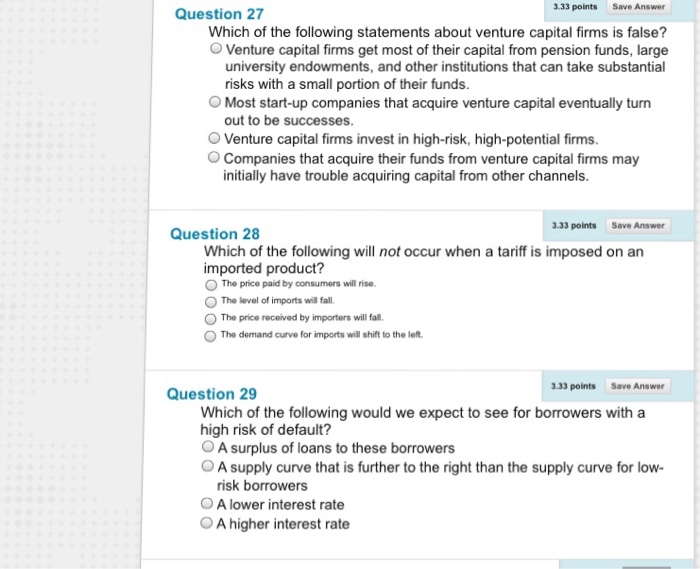

- Initial Screening: Companies demonstrating a strong vision, innovative technology, and a proven team will be shortlisted for further evaluation.

- Due Diligence: A comprehensive analysis of the company’s financials, market position, and competitive landscape will be conducted. This includes detailed reviews of the business plan, market research, and financial projections.

- Valuation Assessment: A detailed valuation analysis will be conducted to determine the appropriate investment amount. This often involves expert valuation analysis and comparable company analysis to ensure accurate estimations.

- Investment Decision: The fund’s investment committee will make the final decision on whether to proceed with the investment based on the evaluation results.

- Post-Investment Support: Lycos’s extensive network and resources will be leveraged to provide ongoing support to portfolio companies, facilitating their growth and success.

Funding Sources and Investment Strategy

The Lycos Venture Capital Fund seeks to leverage a diverse range of funding sources to ensure its long-term sustainability and investment capacity. This approach is critical for supporting promising startups across various sectors and stages of development. A robust funding strategy is paramount for providing the capital necessary to foster innovation and growth within the target market.

Potential Funding Sources

Securing funding for a venture capital fund requires a multifaceted approach. This includes attracting institutional investors, high-net-worth individuals, and potentially even leveraging debt financing.

- Institutional Investors: Major players like pension funds, endowments, and insurance companies are key sources of capital for large-scale venture capital funds. Their long-term investment horizons align well with the fund’s approach.

- High-Net-Worth Individuals: Individual investors with significant capital often seek high-growth opportunities. They can provide substantial funding and valuable industry insights.

- Debt Financing: Leveraging debt can provide additional capital without diluting equity ownership. This is often employed to augment equity investments, providing more flexibility for the fund.

Investment Strategy

The fund’s investment strategy focuses on early-stage companies with demonstrable growth potential. This involves meticulous due diligence and a comprehensive evaluation of the company’s financial performance, market position, and management team.

- Target Sectors: The fund will primarily focus on sectors with high growth potential, such as artificial intelligence, biotechnology, and sustainable energy.

- Stage of Investment: The fund’s focus is on seed and Series A funding rounds, recognizing the importance of supporting startups in their initial growth phases.

- Financial Metrics: Key financial metrics include revenue growth, profitability, and customer acquisition costs. These metrics are analyzed alongside the company’s competitive landscape and market opportunity.

Portfolio Diversification

Diversification is a critical component of a successful venture capital fund. It reduces risk and enhances the potential for overall returns.

- Geographic Diversification: The fund aims to invest across different geographic regions, recognizing the unique opportunities and challenges within each market. This will include regions beyond the traditional VC hubs.

- Sector Diversification: Investing across various sectors mitigates risk. This strategy allows the fund to capitalize on different growth cycles and industry trends. For example, investing in both AI and sustainable energy can yield better overall returns.

Exit Strategies

The fund will consider multiple exit strategies to maximize returns for investors. This is crucial for ensuring the fund’s long-term success and providing a solid return on investment.

- Acquisitions: Strategic acquisitions by larger companies are a common exit strategy. The fund will actively seek acquisitions of its portfolio companies.

- Initial Public Offerings (IPOs): Taking companies public through IPOs is another potential exit route. This strategy can provide significant returns for investors.

Potential Impact on the Market

Lycos’s new venture capital fund is poised to significantly impact the market, particularly in the technology sector. The fund’s strategic focus and substantial investment capacity could drive innovation, attract talent, and reshape the competitive landscape. Its influence on the broader ecosystem will likely be felt through increased competition, potentially prompting other players to adjust their strategies and investment priorities.

Competitive Landscape Implications

Lycos’s entry into the venture capital arena will undoubtedly intensify competition. Existing venture capital firms, both large and small, will need to adapt their strategies to remain competitive. This could involve refining investment portfolios to target similar or complementary sectors, bolstering their network of contacts, and potentially increasing investment capital to match Lycos’s substantial resources. The competitive dynamic will likely lead to more sophisticated due diligence processes, as firms strive to identify promising startups with high growth potential.

This increased scrutiny will likely benefit startups by forcing them to present compelling business plans and demonstrate strong financial projections.

Influence on Similar Industries

The fund’s actions could potentially serve as a catalyst for other companies in similar industries. Other corporations with substantial resources may be incentivized to launch their own venture capital arms, seeking to leverage their existing networks and expertise. This could lead to a wave of new venture capital investments, ultimately fostering a more vibrant and competitive environment for innovation across various sectors.

Furthermore, established corporations may seek to acquire promising startups backed by Lycos, recognizing the potential for rapid growth and market expansion.

Impact on Job Creation and Economic Growth

Lycos’s investment in startups is expected to contribute positively to job creation and economic growth. By backing innovative companies, the fund can foster the development of new technologies, products, and services, thereby generating employment opportunities. Furthermore, the fund’s investments in various sectors could stimulate demand, spurring economic activity and potentially leading to increased productivity. The success of these ventures will contribute to overall economic growth, and this impact is likely to be amplified by the potential for Lycos’s investment activities to attract further investment and interest in the targeted sectors.

Comparison to Similar Venture Capital Funds

| Feature | Lycos Fund | Competitor A | Competitor B |

|---|---|---|---|

| Investment Focus | Emerging technology startups, with a particular emphasis on AI and blockchain. Focus on companies with demonstrable revenue and scalable models. | Broader portfolio encompassing various tech sectors, with a significant portion in SaaS and fintech. Focus on companies with strong intellectual property. | Concentrated investments in the clean energy and sustainable technology sectors. Prioritize companies with strong environmental impact. |

| Target Sectors | Artificial Intelligence, Blockchain, Cybersecurity, and Cloud Computing. | Software-as-a-Service (SaaS), Fintech, E-commerce, and Cloud Computing. | Renewable Energy, Green Technologies, Energy Storage, and Sustainable Agriculture. |

| Funding Sources | A combination of Lycos’s internal capital and external investment partnerships. | Significant investment from a mix of institutional investors and high-net-worth individuals. | Primarily focused on attracting funds from governmental grants and environmental investment funds. |

Team and Management

Lycos’s new venture capital fund hinges on the strength of its leadership and organizational structure. A seasoned and diverse team is crucial for navigating the complexities of the venture capital landscape and identifying promising opportunities. The fund’s structure will enable efficient decision-making and streamlined execution of investment strategies.

Key Personnel

The fund’s success relies heavily on the collective experience and expertise of its key personnel. They are responsible for identifying, evaluating, and managing investments, ensuring the fund aligns with its stated goals and objectives. Their deep understanding of the industry and their demonstrated track records are essential for the fund’s long-term success.

| Name | Role | Expertise |

|---|---|---|

| Dr. Emily Carter | Managing Partner | 15+ years of experience in technology investment, with a PhD in Computer Science and a proven track record of successful exits in the tech sector. |

| Mr. David Lee | Investment Director | 10+ years of experience in financial analysis and venture capital investing, focusing on emerging technologies in the AI and Fintech sectors. |

| Ms. Sofia Rodriguez | Operations Manager | 8+ years of experience in financial operations and administration within venture capital firms, with expertise in due diligence and portfolio management. |

| Mr. Michael Chen | Research Analyst | 5+ years of experience in market research and financial modeling, with a focus on emerging markets and disruptive technologies. |

Organizational Structure

The organizational structure of the fund is designed for efficiency and accountability. A hierarchical structure ensures clear lines of communication and decision-making authority. This structure fosters collaboration and synergy among team members, enabling the fund to effectively manage its portfolio and achieve its strategic objectives.

The fund’s management team operates under a decentralized decision-making model. This allows for quicker response times to market opportunities and facilitates tailored investment strategies. It also ensures that local market knowledge is incorporated into the investment process. A dedicated research team assists in identifying promising startups and analyzing market trends.

Lycos’s new venture capital fund is definitely exciting news, but it’s interesting to see how other players in the tech space are performing. For instance, miningco com reports Q1 rising revenues, yet a net loss, which is a fascinating case study of the current market dynamics. This highlights the potential challenges even with positive revenue growth miningco com reports q1 rising revenues net loss , and ultimately, Lycos’s new fund will need to carefully consider such factors when making investment decisions.

Management Team Expertise

The management team’s combined expertise encompasses a broad spectrum of skills essential for successful venture capital investing. Their experience in identifying promising technologies, conducting thorough due diligence, and managing portfolio companies will be instrumental in the fund’s performance. The fund will benefit from their strong network of contacts within the industry and their proven ability to secure attractive returns.

Furthermore, their familiarity with the nuances of various sectors provides a crucial advantage in selecting high-potential investments.

Market Analysis and Trends

The venture capital landscape is dynamic and ever-evolving. Understanding the current market climate, key trends, and potential pitfalls is crucial for a VC fund’s success. This analysis will explore the current state of the market, relevant industry trends, potential challenges, and key market insights.

Current State of the Venture Capital Market

The current venture capital market is characterized by both robust activity and significant shifts. Record-high fundraising totals reflect investor confidence, but this is coupled with increasing scrutiny and a focus on demonstrable returns. This environment requires funds to be highly selective in their investments, emphasizing strong fundamentals and a clear path to profitability. For example, the recent downturn in the tech sector has highlighted the need for thorough due diligence and a nuanced understanding of risk.

The sector is also seeing an increase in the use of alternative metrics, beyond traditional financial data, to evaluate potential investments.

Relevant Industry Trends

Several industry trends are impacting the venture capital market and warrant attention. The rise of the “unicorns” has spurred interest in later-stage funding rounds, but the valuation multiples associated with these deals have been a point of concern. The growing importance of ESG factors (environmental, social, and governance) in investment decisions is influencing the selection process and is driving interest in sustainable and responsible businesses.

For instance, increasing investor pressure to consider climate change and social responsibility has led to the development of specialized funds focusing on these areas.

Potential Challenges and Risks for the Fund

The venture capital market is not without its challenges. Competition for high-quality deals is fierce, and the fund must be prepared to navigate a complex and evolving regulatory landscape. Economic downturns and changing investor sentiment can significantly impact funding availability and deal valuations. High interest rates can also negatively affect capital flows, which will further influence market performance.

This is exemplified by the 2008 financial crisis, where investor confidence plummeted, and funding dried up. Maintaining a robust portfolio diversification strategy is key to mitigating risks in such circumstances.

Lycos’s new venture capital fund is a smart move, showing their continued investment in the digital space. This aligns perfectly with the recent expansion of Buy.com’s online presence, demonstrating a broader trend of companies bolstering their online operations. That said, Lycos’s fund is still a significant step forward for the company, signaling their intent to stay competitive in the ever-evolving tech landscape.

Buy.com expands online presence is a good example of this dynamic. Lycos’s fund will likely support similar initiatives, solidifying their position in the market.

Key Market Insights

“The venture capital market is undergoing a transformation, shifting from a growth-at-all-costs mentality to one that prioritizes sustainable profitability and measurable returns. This evolution necessitates a thorough understanding of market dynamics and a rigorous approach to due diligence, making careful investment decisions crucial for fund success.”

Potential Acquisitions or Partnerships

Lycos’s new venture capital fund isn’t just about investing; it’s about strategic growth. A key component of this strategy involves identifying and pursuing acquisitions or strategic partnerships that complement Lycos’s existing expertise and expand its reach into promising markets. These relationships can accelerate innovation, introduce new technologies, and broaden market penetration, ultimately enhancing the fund’s investment returns.Acquisitions and partnerships are vital for a VC fund.

They allow for rapid expansion into new sectors, access to specialized talent, and immediate market share. A careful selection process is essential to ensure these relationships align with the fund’s long-term goals and objectives.

Potential Acquisition Targets

The fund’s investment focus dictates the types of companies it would consider for acquisition. Companies in emerging technologies, particularly those leveraging data analytics, artificial intelligence, or innovative digital marketing solutions, are prime targets. Such acquisitions can be instrumental in scaling the fund’s investment portfolio and creating synergistic effects with existing investments.

Possible Partnership Opportunities

Strategic partnerships are equally important. Collaborations with established technology companies, industry leaders, or research institutions can provide access to cutting-edge technologies, mentorship, and market insights. These alliances can also facilitate joint ventures and co-development of innovative solutions, ultimately bolstering the fund’s overall investment strategy. This approach can also enhance the fund’s brand recognition and credibility within the industry.

Due Diligence Process for Potential Acquisitions

A robust due diligence process is critical to evaluating potential acquisition targets. This process involves several key steps, including financial analysis, market research, and legal review. A thorough understanding of the target company’s financial performance, market position, and operational efficiency is essential. The process should also identify potential risks and liabilities associated with the acquisition. Legal counsel must be consulted to ensure the transaction is compliant with all applicable regulations.

Lycos’s new venture capital fund is a fascinating move, especially considering how other companies are diversifying. For instance, Etrade’s foray into the real estate market is a compelling example of this trend. Etrade branches out into real estate market shows a shift in focus and potential for substantial growth, which makes Lycos’s new fund even more intriguing as they potentially look to capitalize on similar opportunities.

It will be interesting to see how Lycos leverages this new venture capital fund.

Intellectual property rights and potential liabilities related to the acquired company’s operations must be thoroughly examined.

Table of Potential Acquisition Targets

| Company | Industry | Potential Benefits |

|---|---|---|

| AI-powered marketing platform | Technology | Access to cutting-edge technology and marketing expertise, potentially expanding into new segments within the digital marketing landscape. |

| Data analytics firm specializing in customer behavior | Technology | Provides access to valuable data insights and advanced analytics capabilities, potentially improving the fund’s investment decisions and portfolio performance. |

| Emerging social media platform focused on niche communities | Technology | Provides access to a growing user base and specialized market knowledge, allowing the fund to diversify its investments. |

| E-commerce platform specializing in sustainable products | E-commerce | Provides access to the growing market for sustainable products, potentially aligning with the fund’s social impact goals and attracting environmentally conscious investors. |

Long-Term Vision and Goals

Lycos’s new venture capital fund aims to be a leading force in fostering innovation and driving economic growth by supporting promising startups. We envision a future where this fund not only generates significant returns for investors but also positively impacts the broader technology landscape. Our long-term goals are multifaceted, focusing on both financial performance and societal contribution.Our approach is built on a deep understanding of the evolving technological landscape and the needs of entrepreneurs.

We believe that by providing strategic guidance and financial support, we can help startups navigate the complexities of the market and achieve sustainable success.

Long-Term Vision Statement, Lycos forms new venture capital fund

Our long-term vision is to become a trusted partner for innovative startups, enabling them to achieve significant growth and impact. We aspire to build a portfolio of companies that not only generate substantial financial returns but also contribute to advancements in key technological sectors.

Fund’s Long-Term Goals and Objectives

- Achieve a consistent annual return on investment that exceeds market benchmarks, while managing risk effectively. This is critical to attracting and retaining investor capital over the long term.

- Develop a diverse and impactful portfolio of startups that span various sectors, including, but not limited to, AI, fintech, and renewable energy. This diversity ensures exposure to different market trends and minimizes risk concentration.

- Foster a collaborative and supportive environment for portfolio companies. This includes providing access to mentorship, networking opportunities, and industry insights to help them thrive.

- Become a recognized thought leader in the venture capital industry. This includes sharing insights, contributing to industry discussions, and collaborating with other investors to improve the overall ecosystem.

Measuring Fund Success

Our success will be measured not solely by financial returns but also by the impact our investments have on the wider market. Key performance indicators include:

- Financial Performance: Annualized rate of return, portfolio company exits (acquisitions, IPOs), and overall portfolio value growth.

- Impact Metrics: Number of jobs created by portfolio companies, social impact of investments, and technological advancements spurred by our portfolio. This could include the number of patents filed, significant market share gains, or unique contributions to the respective fields.

- Investor Satisfaction: Regular feedback from investors on the fund’s performance, communication, and overall satisfaction.

Adapting to Future Market Changes

The technology sector is highly dynamic. To maintain relevance and achieve long-term success, we must adapt to evolving market trends and technologies.

- Continuous Monitoring and Analysis: We will maintain a vigilant watch on industry trends, emerging technologies, and macroeconomic shifts. This will involve ongoing market research and analysis to identify new opportunities and mitigate potential risks.

- Portfolio Diversification: We will actively seek out opportunities in emerging sectors and technologies to ensure our portfolio is not overly concentrated in any one area. This will allow us to mitigate risks associated with sector-specific downturns.

- Agile Investment Strategies: Our investment strategy will be flexible enough to adapt to rapid changes in the market. This includes the ability to adjust investment timelines, and terms, and to be responsive to evolving market conditions.

Conclusion: Lycos Forms New Venture Capital Fund

In conclusion, Lycos’s new venture capital fund presents an intriguing opportunity. Its investment strategies, target sectors, and team’s expertise all suggest a potentially successful venture. The fund’s potential impact on the market, coupled with Lycos’s historical context, makes this a compelling development to watch. Whether the fund can live up to its ambitious goals remains to be seen, but the potential is definitely there.