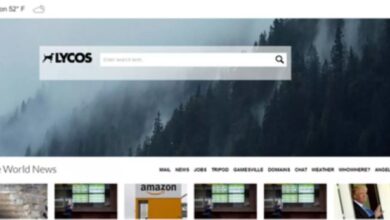

Lycos backs bank of the future, promising a revolutionary approach to banking. This new model aims to reshape the financial landscape, leveraging technology and innovation to create a more accessible and customer-centric experience. Lycos’s vision encompasses a holistic strategy, considering everything from digital banking to financial products and societal impact. From its historical roots to its future plans, this deep dive into Lycos’s vision will explore how this ambitious project might redefine the future of finance.

The proposed bank model will focus on user experience, employing cutting-edge technology to provide seamless digital interactions. Lycos intends to leverage AI and machine learning for personalized services, while maintaining robust security measures. Furthermore, the bank plans to address potential ethical concerns and promote financial inclusion. Lycos aims to stand apart from existing banks through innovation, creating a competitive edge in the market.

Lycos’s Vision for the Future of Banking: Lycos Backs Bank Of The Future

Lycos, a name synonymous with early internet search, is now venturing into a new frontier: the future of banking. This isn’t a simple rebranding exercise; it’s a fundamental shift in how financial services are delivered, aiming to leverage technology to create a more accessible and efficient system for all. Lycos’s vision is not merely to compete but to redefine the industry.Lycos is positioning itself as a disruptive force in the banking sector, recognizing the limitations of traditional models and the growing demand for digital-first solutions.

This approach emphasizes customer-centricity, leveraging data analytics, and integrating cutting-edge technologies to create a more personalized and streamlined experience.

Historical Overview of Lycos

Lycos, founded in 1996, was one of the first major internet search engines. It played a pivotal role in the early days of online information access. While its search engine dominance waned over time, Lycos’s core strength – understanding user needs and adapting to evolving technology – remains a guiding principle in its foray into banking. This historical focus on user-centricity provides a solid foundation for its current ambition in the financial sector.

Lycos’s Aims and Aspirations for the Future of Finance

Lycos aims to revolutionize banking by integrating advanced technologies such as artificial intelligence (AI), blockchain, and biometrics. This approach is intended to offer streamlined account management, secure transactions, and personalized financial advice. The company envisions a future where banking is accessible to all, regardless of their financial background or location. Lycos wants to become the financial partner for the digitally native generation.

Potential Impact on the Existing Banking Landscape

Lycos’s entry into banking will likely create a ripple effect across the existing landscape. Traditional banks, accustomed to established processes, will face pressure to adapt to the rapidly changing digital environment. This pressure will push them to either integrate similar technologies or risk becoming less competitive. The potential for disintermediation, where customers bypass traditional institutions for direct digital solutions, is also a significant possibility.

Potential Competitive Advantages

Lycos’s competitive advantage lies in its understanding of online user behavior and its established digital infrastructure. Its ability to leverage user data for personalized financial solutions and its familiarity with online security protocols gives it a head start over newcomers. Further, the company’s commitment to accessibility could be a strong differentiator.

Target Market for Banking Services

Lycos’s target market is primarily the digitally native generation. This demographic is comfortable with online interactions and expects seamless digital experiences. They are also more open to adopting new technologies, making them ideal candidates for Lycos’s innovative banking approach.

Customer Profile for Lycos’s Bank of the Future

A potential customer profile for Lycos’s bank of the future is a young professional, between the ages of 25 and 40, with a high level of online activity. This individual is tech-savvy, values convenience, and seeks financial solutions that are both accessible and secure. They are likely to have a significant portion of their finances managed through digital platforms and appreciate the use of AI-powered tools for financial planning and investment decisions.

Comparison Between Lycos’s Proposed Banking Model and Existing Models

| Feature | Lycos’s Model | Existing Models |

|---|---|---|

| Accessibility | Highly accessible through mobile and online platforms | Varying levels of accessibility, often limited by physical branches |

| Security | Advanced security measures, including biometrics and AI-powered fraud detection | Varying security protocols, with some lagging behind modern threats |

| Personalization | Personalized financial advice and services based on data analytics | Limited personalization, often relying on standardized offerings |

| Transaction Speed | Rapid and efficient transactions through digital channels | Varying transaction speeds, with some processes taking days or weeks |

Existing banking models often rely on traditional methods, creating a disparity between the expectations of the digital-native generation and the reality of banking. Lycos’s proposed model aims to bridge this gap by providing a streamlined, secure, and personalized experience.

Lycos’s Approach to Digital Banking

Lycos is poised to revolutionize the banking landscape with its innovative digital strategy. This approach prioritizes user experience, leveraging cutting-edge technologies to offer seamless and secure financial services. The core of Lycos’s vision is to transform banking from a complex, often intimidating process into an intuitive and empowering experience for every customer.Lycos’s digital banking platform will be designed to adapt to the evolving needs of modern customers.

The platform will offer a comprehensive suite of features, including account management, mobile payments, and personalized financial advice. This focus on user-centric design and seamless integration will differentiate Lycos from traditional banks and competitors.

Lycos’s Potential Digital Banking Strategy

Lycos aims to create a highly personalized and user-friendly digital banking experience. This involves integrating various technologies, including AI-powered chatbots for instant support and personalized financial advice. The platform will offer secure mobile banking, enabling customers to manage their accounts, make payments, and access financial information from anywhere, anytime. Furthermore, Lycos intends to leverage biometric authentication for enhanced security.

Technological Enhancements for Customer Experience

Lycos intends to significantly enhance the customer experience through the seamless integration of innovative technologies. This includes real-time transaction monitoring, providing customers with immediate insights into their financial activity. Additionally, personalized financial recommendations, powered by machine learning algorithms, will offer tailored advice to improve financial well-being. The platform will be accessible across multiple devices, ensuring consistent functionality and user experience regardless of the platform used.

Potential Technological Hurdles

Lycos recognizes that deploying a robust digital banking platform involves potential challenges. Security breaches, data breaches, and maintaining compliance with evolving regulations are key concerns. Ensuring seamless integration across various devices and operating systems, while maintaining high performance, also poses a significant hurdle. Finally, the need for robust infrastructure to handle increasing volumes of transactions is crucial.

Cybersecurity and Fraud Prevention

Lycos prioritizes the security of customer data and transactions. A multi-layered security approach will be implemented, incorporating robust encryption protocols, regular security audits, and advanced fraud detection systems. Furthermore, continuous monitoring and analysis of transaction patterns will help identify and mitigate potential fraud attempts. Regular security awareness training for employees will also be crucial in preventing internal threats.

AI and Machine Learning in Banking Operations

Lycos will leverage AI and machine learning to enhance several aspects of its banking operations. AI-powered chatbots will provide instant customer support, resolving common queries and guiding users through the platform. Machine learning algorithms will analyze transaction patterns to identify potential fraudulent activities and personalize financial advice for each customer. The integration of AI and machine learning is designed to improve efficiency, reduce operational costs, and provide a more personalized banking experience.

Comparison with Competitors

| Feature | Lycos | Traditional Banks | Fintech Competitors |

|---|---|---|---|

| Personalization | High, AI-driven | Limited | High, data-driven |

| Security | Multi-layered, advanced fraud detection | Varying, often reactive | Strong, often specialized |

| Accessibility | Multi-device, seamless | Often limited to physical branches | Often mobile-first |

| Cost | Potentially lower for customers | Potentially higher due to infrastructure | Often competitive, depending on service |

Fostering Customer Trust and Loyalty

Lycos understands that building customer trust and loyalty is paramount. Transparency in data usage, clear and concise terms and conditions, and readily available customer support channels are crucial elements. Furthermore, a commitment to responsible financial practices, ethical decision-making, and ongoing customer feedback will be key in building long-term customer relationships.

Lycos’s Financial Model and Products

Lycos aims to disrupt the traditional banking model by leveraging innovative technologies and a customer-centric approach. This will involve a comprehensive financial structure, carefully curated product offerings, and a robust risk management strategy. Lycos anticipates a significant market share by focusing on competitive pricing and a user-friendly digital experience.

Financial Structure

Lycos will likely adopt a hybrid financial structure combining elements of a traditional bank with innovative fintech features. This approach will allow for the efficient utilization of capital while enabling the rapid development of new products and services. It will likely include a mix of deposit-taking and lending activities, alongside investment banking operations and potentially even venture capital arms for supporting fintech startups.

The precise mix will depend on regulatory approvals and market conditions.

Product Offerings

Lycos will offer a suite of digital banking products designed for seamless user experience. These products will cater to diverse customer needs, from everyday banking transactions to sophisticated investment strategies.

Lycos backing the Bank of the Future is pretty cool, right? It’s like a futuristic financial institution, but how will it be marketed? Maybe they’ll use the “as seen on TV” approach, like those infomercials promising miracle weight loss solutions. as seen on tv products often rely on flashy visuals and exaggerated claims. Regardless of the marketing strategy, Lycos’s backing of the Bank of the Future is still an intriguing concept.

- Core Banking Services: Current accounts, savings accounts, and payment solutions integrated with popular digital wallets and payment systems. This would include features like real-time account access, secure mobile banking, and automated bill payments.

- Investment Products: Robo-advisors and fractional ownership investment tools will be offered to provide diversified investment options. Lycos may also partner with established investment firms to provide access to a wider range of financial instruments, including mutual funds and ETFs.

- Specialized Financial Products: Lycos might consider tailored financial products for specific segments, like small business loans, or financial planning tools for millennials and Gen Z. These will be designed to address specific needs, and to be scalable and cost-effective.

Risk Management

Lycos’s risk management strategy will be crucial for maintaining financial stability and building customer trust. It will incorporate sophisticated models to assess credit risk, market risk, and operational risk. A comprehensive risk framework will be in place to ensure compliance with regulatory requirements and minimize potential losses.

- Credit Risk Management: A robust credit scoring system and credit monitoring tools will be utilized to assess borrower creditworthiness, enabling appropriate risk assessments. Advanced analytics will identify trends and predict potential risks effectively.

- Market Risk Management: Hedging strategies and diversification of investment portfolios will be implemented to mitigate market fluctuations. Regular monitoring and stress testing will be employed to identify potential risks.

- Operational Risk Management: Strict security protocols and redundancy measures will be implemented to safeguard sensitive customer data. Regular audits and independent security assessments will be conducted to maintain a robust security posture.

Comparison to Competitors

Lycos will differentiate itself from competitors by focusing on a seamless digital experience, innovative product offerings, and competitive pricing. It will leverage technology to offer personalized financial services, a key differentiator in a crowded market.

Revenue Streams

Lycos will generate revenue through a combination of interest income from loans and deposits, transaction fees from payment processing, and potentially fees from investment management services.

- Interest Income: Interest income from loans and deposits will be a core revenue stream. The precise interest rates will depend on market conditions and the risk profile of the loans. Interest rates are constantly adjusted based on the overall economy.

- Transaction Fees: Fees for payment processing and other financial transactions will provide an additional source of income. The fees will be competitively priced and designed to maximize efficiency and convenience.

- Investment Management Fees: Lycos may generate revenue from investment management services, charging fees based on assets under management (AUM). This approach is similar to established investment firms and is a standard practice in the industry.

Pricing Strategy

Lycos’s pricing strategy will be competitive, focusing on value and ease of use. It will aim to offer transparent and affordable financial services that cater to diverse customer segments. Pricing will be analyzed and adjusted frequently to meet market demands and customer expectations.

Potential Partnerships

Strategic partnerships with fintech companies, payment processors, and other financial institutions will be explored to expand product offerings and reach. These partnerships will bring in new technologies, customer bases, and expertise, allowing Lycos to expand rapidly and more efficiently.

- Fintech Partnerships: Collaborations with fintech companies specializing in payments, investment technology, or AI-powered financial tools will enhance Lycos’s technological capabilities and customer offerings.

- Payment Processors: Partnerships with established payment processors will ensure smooth and secure transactions, reducing processing costs and enhancing efficiency.

- Financial Institutions: Collaborations with established financial institutions can provide access to a wider range of financial products and services, allowing Lycos to serve a larger customer base.

Societal Impact of Lycos’s Bank

Lycos’s vision for a digital bank extends beyond mere financial transactions. It aims to redefine the banking experience, offering innovative solutions and services while fostering a positive impact on society. This section explores the potential benefits and challenges associated with Lycos’s bank, focusing on its role in economic growth, financial inclusion, and ethical considerations.

Potential Positive Societal Impact

Lycos’s bank can foster economic growth by facilitating access to financial services for underserved communities. By offering low-cost, accessible digital solutions, Lycos can empower individuals and small businesses, particularly in developing regions, to participate more actively in the economy. This increased economic activity can lead to job creation and a higher overall standard of living. Furthermore, Lycos’s commitment to sustainable practices, such as environmentally conscious investments, can contribute to a more sustainable future.

Contribution to Economic Growth

Lycos’s bank can contribute to economic growth through several mechanisms. Lowering the barrier to entry for financial services, particularly for small businesses, is crucial. Digital banking eliminates the need for physical branches, reducing operational costs and allowing for more competitive pricing. This can incentivize entrepreneurship and stimulate economic activity. Additionally, Lycos’s focus on providing financial education and tools for managing personal finances empowers individuals to make informed financial decisions, ultimately contributing to greater economic stability.

Potential Negative Societal Impacts

While Lycos’s bank promises numerous benefits, potential downsides exist. Security concerns related to digital transactions and data breaches are significant considerations. Lycos will need robust security measures to mitigate these risks. Another potential challenge lies in the potential for digital banking to exacerbate existing inequalities if access to technology and digital literacy are not addressed. Lycos must proactively ensure equitable access to its services and provide training and support to underserved communities.

Addressing Ethical Concerns

Lycos is committed to upholding the highest ethical standards in its operations. The bank will implement robust compliance measures to prevent fraud, money laundering, and other illicit activities. Transparency in operations and clear communication with customers are crucial components of ethical banking. Lycos will adhere to stringent regulatory requirements and engage with regulatory bodies to ensure its practices align with ethical and legal frameworks.

Commitment to Social Responsibility

Lycos’s commitment to social responsibility is demonstrated in several key areas. For instance, the bank plans to partner with non-profit organizations to support initiatives related to education, healthcare, and environmental protection. Lycos aims to use its platform to promote financial literacy, enabling individuals to make informed financial choices. Furthermore, the bank’s sustainability initiatives will focus on environmentally friendly investments and practices.

Lycos backing the bank of the future is a pretty big deal, right? It’s all about making banking easier and more accessible, which is crucial in this digital age. This aligns perfectly with Netscape boosting e-commerce security features, netscape boosts e commerce security features , a move that will likely pave the way for more trust and confidence in online transactions.

Ultimately, Lycos’s support for the future of banking is a smart move, anticipating the seamless integration of technology into everyday finance.

Comparison of Societal Goals to Competitors

| Aspect | Lycos | Competitor A | Competitor B |

|---|---|---|---|

| Financial Inclusion | Prioritizes access for underserved communities through affordable digital solutions and financial literacy programs. | Focuses on attracting high-net-worth individuals. | Aims for broad market penetration with various product offerings. |

| Sustainability | Integrates environmental considerations into investment strategies and operations. | Limited emphasis on sustainability, with a focus on profitability. | Actively pursuing sustainability initiatives to meet growing demand. |

| Ethical Practices | Adheres to stringent regulatory compliance and promotes transparency. | Focuses on regulatory compliance but with limited emphasis on ethical considerations. | Prioritizes ethical practices to build trust and reputation. |

Impact on Financial Inclusion

Lycos’s bank aims to revolutionize financial inclusion by creating an accessible and affordable platform for all. The bank will target underserved communities by providing user-friendly interfaces and support systems in local languages. This initiative will help bridge the financial gap and empower individuals and communities to participate in the economy.

Lycos’s Competitive Landscape

Lycos’s entry into the banking sector necessitates a thorough understanding of the existing competitive landscape. This section examines key players, their strengths and weaknesses, and Lycos’s strategic approach to differentiation and market penetration. A crucial aspect of this analysis involves identifying and mitigating potential barriers to market entry.

Key Competitors

The financial services industry is highly competitive, with established players like traditional banks, fintech companies, and specialized credit unions. Major competitors include established national banks, digital-first banking platforms, and niche lenders focusing on specific customer segments. Understanding their strengths and weaknesses is paramount for Lycos’s success.

Lycos backing the bank of the future is a pretty big deal. It signals a shift towards digital financial solutions, and with that shift comes the exciting prospect of cash rewards going online. This trend aligns perfectly with the future Lycos envisions, where seamless online transactions and lucrative rewards are the norm, like those found at cash rewards go online.

Ultimately, Lycos’s vision for the bank of the future is one built on innovation and user-friendly technology.

Strengths and Weaknesses of Competitors

- Traditional Banks: Strengths lie in extensive branch networks, established customer relationships, and robust regulatory compliance. Weaknesses include slower adaptation to digital technologies, higher operational costs, and potentially less innovative product offerings. Examples include Chase, Bank of America, and Wells Fargo.

- Fintech Companies: Strengths include innovative digital platforms, personalized customer experiences, and potentially lower operational costs. Weaknesses may include concerns regarding security and regulatory compliance, limited brand recognition, and reliance on technology that can be vulnerable to disruptions.

- Specialized Credit Unions: Strengths are often found in strong community ties, personalized service, and potentially lower interest rates for members. Weaknesses might be limited reach and less extensive product portfolios.

Lycos’s Differentiation Strategy

Lycos’s approach to digital banking, with its emphasis on user-centric design and seamless integration, aims to differentiate it from competitors. Lycos’s unique vision for the future of banking, emphasizing a focus on community and sustainable financial solutions, will be a key factor in establishing a distinct brand identity.

Market Penetration Strategies

Lycos will focus on targeted marketing campaigns emphasizing its innovative approach to financial services. Early adopters, tech-savvy millennials and Gen Z, will be primary targets. Strategic partnerships with complementary businesses, like renewable energy providers or sustainable investment platforms, can amplify brand recognition.

Marketing and Branding Strategies

Lycos will leverage digital marketing channels like social media and online advertising to create a strong brand presence. Transparency and a focus on building trust with customers will be key elements. Visual identity will highlight Lycos’s commitment to sustainable practices and community involvement. Example marketing campaigns might focus on the environmental impact of the financial decisions customers make.

Competitive Analysis Table

| Feature | Lycos | Traditional Banks | Fintech Companies | Specialized Credit Unions |

|---|---|---|---|---|

| Digital Platform | Highly advanced, user-centric | Developing, but often lagging | Highly developed, innovative | Limited, often basic |

| Customer Service | Personalized, proactive | Often impersonal, reactive | Personalized, but potentially less human touch | Personalized, often community-focused |

| Financial Model | Sustainable, community-focused | Profit-driven, traditional | Often focused on efficiency, innovation | Community-driven, often with cooperative principles |

| Cost Structure | Potential for lower operational costs | Higher operational costs, branch maintenance | Potentially lower, but reliance on tech | Often lower than large banks |

Overcoming Market Barriers

Lycos will actively engage with regulatory bodies to address compliance concerns and build trust among potential customers. Strong cybersecurity measures will be essential to ensure the protection of sensitive financial data. Building a robust network of financial advisors and community partners will help establish credibility and create a network effect.

Lycos’s Technological Infrastructure

Lycos Bank’s success hinges on a robust and adaptable technological foundation. This infrastructure will not only support our core banking functions but also facilitate innovation and growth in the digital age. Our approach prioritizes security, scalability, and future-proofing, ensuring seamless customer experiences and operational efficiency.

Core Technologies

Lycos Bank will leverage a suite of cutting-edge technologies to deliver a superior banking experience. This includes a cloud-based architecture for scalability and resilience, utilizing industry-leading cloud providers. A modern API-driven platform will enable seamless integration with third-party services and future applications. This platform will also facilitate the development of innovative financial products and services. Furthermore, Lycos will implement a robust data analytics platform to gain insights from customer behavior and market trends, driving informed decision-making and personalized experiences.

Infrastructure Requirements

The necessary infrastructure for Lycos Bank will be designed for high availability and redundancy. This includes geographically dispersed data centers to mitigate risks associated with single points of failure. Advanced network infrastructure, employing high-speed fiber optic connections and robust firewalls, will ensure secure and reliable data transmission. Moreover, the infrastructure will incorporate disaster recovery protocols to ensure business continuity in unforeseen circumstances.

We will employ leading edge cybersecurity measures, such as multi-factor authentication and advanced threat detection systems, to protect sensitive customer data.

Security Protocols, Lycos backs bank of the future

Lycos Bank’s security protocols will adhere to the highest industry standards. These include implementing encryption for all data transmission, employing advanced threat detection systems, and rigorous access controls. We will also conduct regular security audits and penetration testing to identify and address vulnerabilities proactively. Employee training programs will emphasize security awareness and best practices to prevent internal threats.

Maintenance and Support Plan

Lycos Bank will establish a comprehensive maintenance and support plan for its technological infrastructure. This includes a dedicated team of skilled IT professionals to handle system maintenance, security updates, and incident response. A robust help desk system will provide prompt and efficient support to users. Regular system backups and disaster recovery drills will ensure business continuity.

Scalability Considerations

Lycos Bank’s technological infrastructure will be designed for future growth. We anticipate an increase in customer base and transaction volume, which will necessitate a scalable architecture. The system will be modular and designed to handle increased demands without significant performance degradation. The use of cloud-based infrastructure allows for easy scaling up or down as needed, reducing capital expenditure and operational complexity.

Future Technological Advancements

Lycos Bank will remain ahead of the curve by embracing emerging technologies. This includes staying abreast of advancements in artificial intelligence and machine learning to enhance customer service and automate processes. The integration of blockchain technology will enhance security and transparency in financial transactions. We will actively explore and implement new technologies to provide innovative and cutting-edge banking solutions.

Technical Specifications and Capabilities

| Category | Specification |

|---|---|

| Operating System | Linux, Windows Server |

| Database | PostgreSQL, MySQL |

| Cloud Platform | AWS, Azure, GCP |

| Security | Multi-factor Authentication, Intrusion Detection System, Data Encryption |

| Scalability | Modular design, cloud-based architecture |

Final Summary

Lycos’s vision for the bank of the future presents a compelling blend of technological advancements and societal responsibility. By analyzing Lycos’s proposed strategies across various aspects, from its digital approach to its financial model and competitive landscape, we gain insight into the potential impact on the future of banking. Lycos’s journey to disrupt the existing financial infrastructure is certainly one to watch.

The question remains: will Lycos succeed in creating a truly innovative and impactful bank for the future?