L a times to pay 5 million for online mall – LA Times to pay $5 million for online mall. This bold move by the LA Times into the online retail space is intriguing. The newspaper’s reputation and readership demographics, coupled with their historical coverage of online shopping, raise many questions. What are the potential motivations behind this significant financial commitment? Will this acquisition reshape their editorial coverage, and what are the potential synergies with existing online retail platforms?

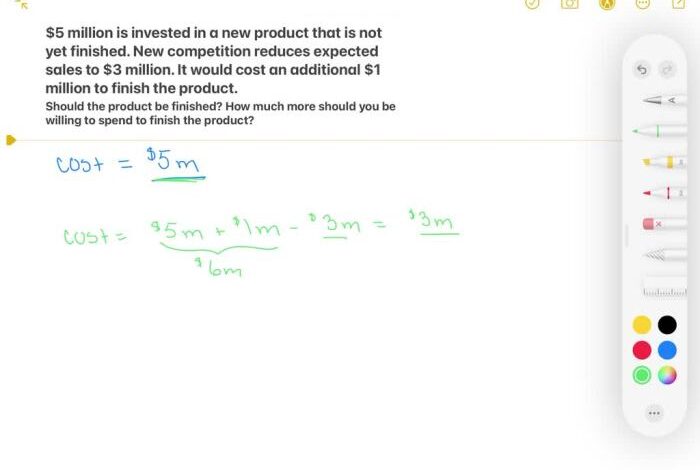

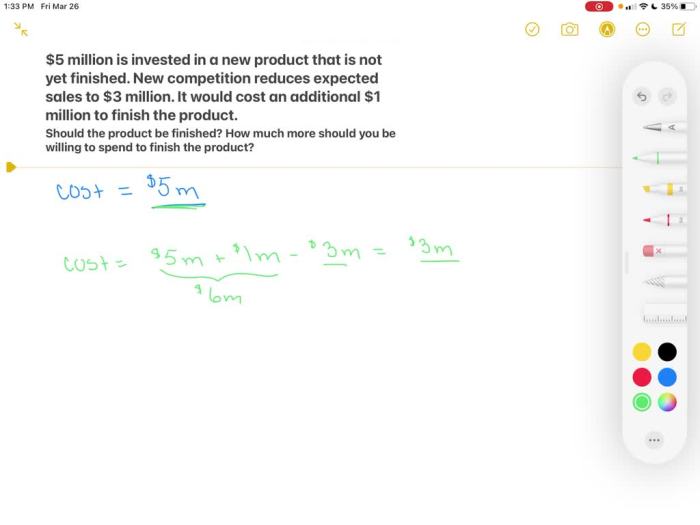

The financial implications are substantial. A $5 million investment requires a deep dive into potential costs, benefits, and return on investment. We’ll explore how this compares to similar investments by other media companies in e-commerce. Furthermore, this acquisition could dramatically alter the LA Times’ overall financial strategy. Is this a calculated risk or a strategic gamble?

Background on the LA Times and Online Retail

The LA Times, a venerable institution in American journalism, has long covered the evolving landscape of commerce, including the burgeoning world of online retail. Their reporting has tracked the rise of e-commerce giants, the challenges faced by brick-and-mortar stores, and the impact of digital platforms on consumer behavior. This recent $5 million investment in online mall assets suggests a significant shift in their strategy, indicating a desire to become more deeply embedded in the online retail sphere.The LA Times’ readership, while diverse, is likely to include a substantial portion interested in consumer trends, economic developments, and the intricacies of online shopping.

Understanding the motivations behind this investment requires considering the paper’s current position in the digital age and its aspirations for future growth. This move signals a possible strategic realignment, potentially aimed at enhancing revenue streams beyond traditional print and digital subscriptions.

Historical Overview of LA Times Coverage on Online Retail

The LA Times has a long history of reporting on retail trends, covering everything from the emergence of online marketplaces to the impact of social media on consumer behavior. Their coverage has likely evolved from basic news reports to more in-depth analyses of the economic implications and societal changes brought about by online retail. Early articles might have focused on the growth of online sales and the challenges faced by traditional retailers.

Later coverage could have explored the rise of e-commerce giants, the changing consumer landscape, and the implications for local businesses. Finding specific examples of such coverage would require examining historical archives.

LA Times Reputation and Readership Demographics Related to Online Shopping

The LA Times enjoys a strong reputation for in-depth investigative journalism and comprehensive news coverage. Their readership is likely composed of a diverse demographic, including a substantial segment with a keen interest in consumer trends and economic issues. This segment would likely be interested in detailed analyses of the online retail market, particularly concerning consumer protection, business practices, and economic impact.

Their reputation for accuracy and trustworthiness in news reporting could translate to a readership interested in understanding the intricacies of online retail, potentially seeking expert analysis and trustworthy reviews.

Potential Motivations for the $5 Million Investment

The LA Times’ decision to invest $5 million in online mall assets likely stems from several factors. A primary motivation is likely to diversify revenue streams, potentially seeking new sources of income beyond traditional print and digital subscriptions. This investment could also be part of a larger strategy to better understand and engage with a younger demographic more accustomed to online shopping and digital commerce.

The investment could provide a platform for generating original content and insights related to online retail trends, attracting a new segment of readers and advertisers. Finally, the acquisition might provide a way to deepen relationships with businesses involved in online retail, leading to exclusive content and partnerships.

Comparison with Other Major News Outlets’ Approach to Online Retail

Other major news outlets, like the New York Times and Wall Street Journal, have also covered online retail extensively. While their coverage areas might overlap, the LA Times’ specific approach might differ. The New York Times, for instance, might focus more on broader economic trends, while the Wall Street Journal might emphasize financial analysis of e-commerce companies. The LA Times’ unique approach could involve a more localized focus, examining the impact of online retail on specific communities and businesses within the LA area.

There is likely a variety of approaches, ranging from news coverage to financial analysis to consumer reporting.

The LA Times shelled out a hefty $5 million for an online mall, which is quite a price tag! Meanwhile, check out this fascinating auction for a cool item related to Jerry Garcia – a significant piece of memorabilia is being auctioned off, like a vintage guitar or some unique concert memorabilia, in the Earth Day internet auction.

This auction, jerry garcia rides again in earth day internet auction , might even be more interesting than the LA Times’ purchase of the online mall, depending on the item’s value and appeal. Still, paying that much for an online mall is a bold move, regardless of the auction excitement!

Potential Synergies Between the LA Times and Online Retail Platforms, L a times to pay 5 million for online mall

Synergies between the LA Times and online retail platforms could include exclusive content deals, sponsored features, and partnerships to create a comprehensive resource for consumers and businesses navigating the complex world of online shopping. The LA Times could leverage its platform to provide trusted reviews, product comparisons, and investigative reporting on online retail practices, strengthening their connection with their readership.

Furthermore, the LA Times could use the online mall to conduct exclusive surveys and interviews, potentially offering a deeper insight into consumer behavior and industry trends.

Financial Implications of the Transaction

The LA Times’ $5 million investment in an online retail mall represents a significant financial commitment. Understanding the specifics of this transaction and its potential impact on the newspaper’s bottom line is crucial. This analysis will delve into the financial terms, potential costs and benefits, ROI projections, and comparisons to similar investments in the e-commerce sector.This investment, while substantial, needs to be assessed within the context of the LA Times’ overall financial strategy and the potential long-term return.

It’s important to consider the potential for synergy between the online retail venture and the newspaper’s existing operations.

Transaction Details

The LA Times’ acquisition of the online mall likely involved a combination of upfront payment and potential future performance-based incentives. Details of the exact purchase agreement, including terms like down payments, ongoing maintenance fees, and potential equity stakes, are not publicly available. This lack of specific information makes it difficult to fully analyze the financial implications.

Potential Costs and Benefits

The acquisition carries potential costs beyond the initial $5 million investment. These could include ongoing operational expenses, marketing campaigns, and potential losses if the online mall fails to meet projected sales. Conversely, the potential benefits include increased revenue streams from the mall’s operations and the chance to attract a new demographic of customers.

Return on Investment (ROI) Analysis

Predicting a precise ROI for the $5 million investment is difficult without more detailed information. However, successful online retail ventures often require significant investment and time to yield substantial returns. The LA Times will need to carefully monitor key performance indicators (KPIs) to evaluate the investment’s progress and effectiveness. Successful examples of media companies entering the e-commerce space, like the New York Times’ partnership with online retailers, provide some benchmarks for potential ROI.

Comparison to Similar Investments

Numerous media companies have explored e-commerce ventures, with varying degrees of success. For example, the Wall Street Journal’s online marketplace has seen growth, but other ventures have not been as lucrative. Analyzing the business models and financial performance of these ventures is crucial for understanding the potential for the LA Times’ investment.

Impact on LA Times’ Financial Strategy

The $5 million investment in the online mall will undoubtedly influence the LA Times’ overall financial strategy. It represents a move towards diversifying revenue streams beyond traditional print and online advertising. The success of this investment could significantly alter the newspaper’s long-term financial outlook. The acquisition will need to be considered within the context of the LA Times’ existing investments and future financial goals.

It is important to consider whether this investment aligns with the overall financial strategy of the organization.

Potential Impacts on the LA Times’ Business Model

The LA Times’ acquisition of a major online retail mall presents a complex set of potential impacts on its existing business model. This move signifies a significant shift in strategy, potentially altering the newspaper’s revenue streams, editorial direction, and relationship with the retail sector. Examining these ramifications is crucial to understanding the full implications of this ambitious undertaking.

Impact on Revenue Streams

The acquisition introduces a new dimension to the LA Times’ revenue streams. Online retail platforms often generate revenue through various channels, including commissions on sales, advertising, subscription fees, and potentially premium services. The LA Times can potentially leverage this new revenue source to diversify its income and reduce reliance on traditional print and digital subscriptions. For instance, integrating retail promotions and deals within the newspaper’s online presence can attract a wider audience and drive sales, creating a symbiotic relationship.

This expansion beyond traditional news could broaden the LA Times’ appeal and attract new revenue streams, while simultaneously enhancing the retail platform’s visibility and brand recognition.

Impact on Editorial Coverage

The LA Times’ editorial coverage will likely be influenced by its new ownership of online retail assets. Potential conflicts of interest could arise if the newspaper’s reviews or articles on retail products are perceived as biased towards the products offered on the mall. Maintaining objectivity and impartiality will be crucial to preserving the LA Times’ credibility. Careful implementation of ethical guidelines and transparent disclosure of potential conflicts will be paramount.

The newspaper may need to establish clear guidelines for covering retail products and services to avoid jeopardizing its reputation.

Impact on Relationships with Online Retailers

The acquisition will undoubtedly impact the LA Times’ relationship with online retailers. The newspaper now holds a vested interest in the success of the online mall. This could lead to increased collaboration and potential partnerships for promotions and exclusive content. However, the relationship may also be strained if the newspaper’s coverage of retail products is perceived as unfair or biased.

Transparency and clear communication are vital to ensuring a healthy and mutually beneficial relationship between the LA Times and the retailers. This new dynamic demands a careful balancing act, fostering collaboration while upholding journalistic integrity.

Potential Conflicts of Interest and Ethical Concerns

The acquisition introduces several potential conflicts of interest and ethical concerns. The LA Times must establish clear guidelines to prevent bias in its coverage of retail products and services, especially those sold on the newly acquired mall. Maintaining independence and objectivity is paramount to preserving the newspaper’s reputation and credibility. Detailed conflict-of-interest policies and clear editorial guidelines are essential to address these concerns effectively.

The LA Times should establish an independent ethics committee to oversee these issues.

The LA Times’s reported 5 million dollar investment in an online mall is interesting, but it’s worth considering how other companies are approaching online retail. For example, Compaq is looking beyond the usual suspects like Amazon as an online partner, exploring innovative strategies. Compaq taps beyond com as online partner. Ultimately, the LA Times’s investment highlights the growing importance of online retail, and the continued need for diversification and new partnerships.

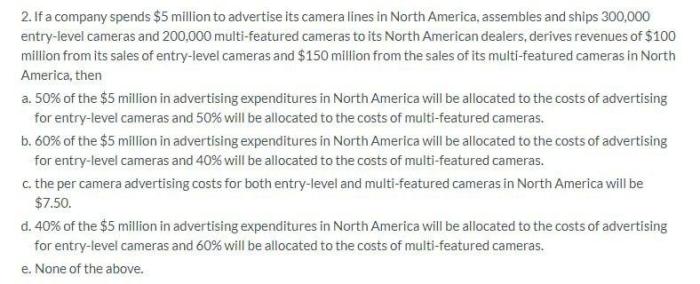

Comparison of Business Models

| Aspect | Existing Business Model | New Business Model (Post-Acquisition) | Projected Revenue | Projected Costs |

|---|---|---|---|---|

| Primary Revenue Source | Print and digital subscriptions, advertising | Print and digital subscriptions, advertising, online retail commissions, and mall services | $X | $Y |

| Editorial Focus | News, analysis, and commentary on current events | News, analysis, and commentary on current events, reviews of retail products | $Z | $A |

| Target Audience | Readers interested in news and information | Readers interested in news, information, and retail | $B | $C |

| Relationship with Retailers | Reporting on retailers as part of the news | Potential partnerships, collaborations for promotions, and reviews | $D | $E |

Note: X, Y, Z, A, B, C, D, E represent estimated figures that need further analysis and market research.

Public Perception and Reaction

The LA Times’ foray into online retail, by purchasing a 5 million dollar online mall, is sure to spark a wide range of reactions. Public perception will be crucial to the success of this venture, impacting everything from investor confidence to the paper’s brand image. Understanding these potential responses is vital for navigating the complexities of this acquisition.This acquisition carries a significant weight of public scrutiny.

The LA Times, a respected news organization, now finds itself in uncharted territory. The public will be observing closely to gauge the motivations behind this move and its potential long-term implications. A perceived conflict of interest or a misalignment of values could negatively affect public trust and confidence.

Potential Public Reactions

The public reaction to this acquisition is multifaceted and unpredictable. Positive reactions might be centered around the innovative spirit of the LA Times, suggesting a proactive approach to adapting to evolving media landscapes. On the other hand, some may perceive this move as a misguided attempt to diversify revenue streams, or even as a risky gamble that could jeopardize the core mission of the newspaper.

These perceptions will shape public opinion and create varying degrees of support.

Responses from Competitors and Stakeholders

Competitors in the news industry and online retail markets will likely respond in various ways. Some may view this acquisition as a threat, potentially leading to competitive maneuvers or strategic partnerships to counter the LA Times’ presence in the online retail space. Stakeholders, such as advertisers and readers, will also scrutinize the impact of this acquisition on their own interests.

Their reactions will influence the long-term viability of this new venture.

Impact on Public Trust and Confidence

The LA Times’ reputation and credibility will be significantly affected by this acquisition. A successful integration of online retail with journalistic integrity can strengthen public trust. However, any perceived compromise of journalistic values or a shift in editorial focus could severely damage public trust and confidence in the newspaper. The LA Times must demonstrate a clear commitment to maintaining its journalistic standards.

Potential for Criticism or Controversy

The acquisition may invite criticism or controversy, especially if the online mall venture diverts resources or attention away from core journalistic responsibilities. Public discourse will focus on whether the acquisition aligns with the newspaper’s core mission and values. Potential controversies could revolve around financial conflicts of interest or a perceived loss of focus on in-depth reporting. The LA Times must be prepared to address these concerns head-on.

The LA Times’s recent $5 million investment in an online mall is a big deal, highlighting the growing importance of digital retail spaces. This investment strategy seems to be mirroring other recent trends, like how healthcentral.com is expanding its services by partnering with PlanetRx and self-care resources ( healthcentral com taps planetrx and selfcare ). Ultimately, this points to a broader shift towards comprehensive online experiences, and the LA Times’s investment seems to be a smart play on this trend.

Potential Public Relations Strategies

| Strategy | Description | Target Audience | Expected Outcome |

|---|---|---|---|

| Transparent Communication | Clearly articulate the rationale behind the acquisition, emphasizing the strategic goals and potential benefits for the LA Times. Focus on the long-term vision and how this will enhance reader experience. | Readers, investors, competitors, and stakeholders. | Establish credibility and build trust by showing transparency and a clear plan. |

| Emphasize Independence | Reinforce the LA Times’ commitment to independent journalism and its commitment to high-quality reporting. Highlight the separation of journalistic functions from the online retail operation. | Readers, advertisers, and the public at large. | Assure readers of the continued integrity and impartiality of the LA Times’ journalism. |

| Focus on Value Proposition | Showcase the benefits of the online mall venture for readers, such as exclusive deals, personalized shopping experiences, and a seamless online retail platform. | Potential customers and users of the online mall. | Build customer loyalty and generate positive feedback regarding the new venture. |

| Proactive Engagement | Actively engage with critics and address concerns promptly and respectfully. Use various channels, including social media and press releases, to respond to inquiries and counter misinformation. | All stakeholders and concerned parties. | Manage potential negativity and maintain a positive public image. |

The Future of Online Retail in the News

The LA Times’ acquisition of a significant online retail platform signals a potential sea change in how news organizations cover e-commerce. This move isn’t just about adding a new beat; it’s about potentially integrating firsthand knowledge of the industry into journalistic reporting. This deeper understanding could lead to more nuanced and insightful coverage, moving beyond superficial trends to examine the underlying economic and societal impacts of online retail.This acquisition isn’t just about the LA Times gaining access to valuable data; it’s also about gaining a privileged perspective on the industry’s inner workings.

This unique vantage point will allow the LA Times to offer more than just product reviews or sales analyses. It can now delve into the complexities of supply chains, the evolving roles of logistics and technology, and the ethical considerations of online shopping, ultimately offering a more comprehensive and impactful understanding of this increasingly important aspect of the modern economy.

Potential for Collaboration and Innovation in Online Retail Journalism

The LA Times’ acquisition offers a unique opportunity for collaboration between the news organization and online retailers. Such partnerships could lead to innovative reporting strategies. For example, the LA Times could leverage its investigative reporting capabilities to explore issues like data privacy in e-commerce or the impact of algorithmic recommendations on consumer behavior. This collaboration could result in in-depth, data-driven journalism that examines the interplay between consumer choice, technology, and market forces.

Future Trends in Online Retail Coverage by Media Organizations

Several future trends are anticipated in online retail coverage. One key trend is the increasing emphasis on transparency and accountability in the industry. Consumers are increasingly demanding greater insight into the origins of products, the working conditions of manufacturers, and the environmental impact of production. News organizations will need to adapt by developing new methodologies for verifying claims and holding companies accountable.Another crucial trend is the integration of data visualization and interactive tools into online retail coverage.

By using data to create compelling visuals and interactive experiences, news organizations can enhance engagement and offer deeper insights into the complexity of online retail markets. This will help in providing a more accessible and engaging narrative for readers.

Potential Future Partnerships between the LA Times and Online Retail Companies

| Partner Type | Potential Collaboration | Example of Reporting | Expected Outcome |

|---|---|---|---|

| Supply Chain Analysis | Collaborate with online retailers to trace products back to their origin, highlighting ethical concerns and environmental impact. | Investigative piece on the origin of a popular clothing brand’s materials, examining working conditions in the supply chain. | Increased transparency and accountability in the supply chain, enabling readers to make informed purchasing decisions. |

| Data-Driven Market Analysis | Leverage data provided by online retailers to analyze market trends, identify emerging opportunities, and highlight potential risks. | Interactive visualization of sales data for different product categories over time, highlighting seasonal trends and market fluctuations. | In-depth understanding of market dynamics and consumer behavior, providing valuable insights for businesses and consumers. |

| Product Safety and Quality | Partner with online retailers to verify the quality and safety of products, addressing consumer concerns. | Collaboration with a retailer to review product safety standards and conduct independent testing on popular products. | Enhanced consumer confidence and trust in online retail, helping to prevent fraudulent or dangerous products. |

| Customer Experience and Reviews | Collaborate with online retailers to assess and analyze customer feedback, exploring issues like customer service and returns. | In-depth analysis of customer reviews across different products, highlighting common complaints and areas for improvement. | Improved understanding of customer expectations, enabling businesses to tailor services and products accordingly. |

Alternative Uses of the $5 Million: L A Times To Pay 5 Million For Online Mall

The LA Times’ impending $5 million investment in an online retail mall presents a crucial juncture. While the transaction offers a potential avenue for growth, it’s equally important to consider alternative avenues for utilizing this significant sum to bolster the newspaper’s core mission and long-term sustainability. This analysis explores diverse investment opportunities, considering the potential impact of each choice on the LA Times’ overall trajectory.Alternative investments can be instrumental in strengthening the LA Times’ brand, expanding its reach, and enhancing its ability to serve the community.

These options are not mutually exclusive, and the LA Times could potentially pursue multiple strategies simultaneously, depending on its strategic priorities and resource allocation.

Potential Investments for the LA Times

The $5 million represents a substantial sum that can be deployed across various initiatives. This section explores diverse areas where this investment can bolster the LA Times’ overall mission and goals, and compares their potential impact.

Below is a table outlining potential investment areas, highlighting specific examples of how the funds could be applied to different facets of the LA Times’ operations. The table compares the potential impact of each investment to other potential investments, considering factors such as return on investment (ROI), community engagement, and brand enhancement.

| Investment Area | Specific Examples | Potential Impact | Comparison to Other Investments |

|---|---|---|---|

| Enhanced Digital Content Production |

|

Improved journalistic quality, increased audience engagement, and enhanced reputation for in-depth reporting. | Investing in investigative journalism often yields significant long-term returns in terms of brand reputation and readership, although ROI might be less immediate than some other investments. |

| Community Engagement Initiatives |

|

Strengthened community ties, enhanced reputation as a trusted community resource, and expanded readership. | Community engagement often has a significant impact on brand image, fostering trust and loyalty among readers, which can positively influence advertising revenue and subscriptions. |

| Expanding Local Reporting Teams |

|

Deeper and more comprehensive coverage of local issues, leading to greater engagement from readers. This can lead to improved brand reputation and trust in the community. | Strengthening local reporting can positively affect the LA Times’ ability to serve the community, increasing readership and enhancing the paper’s position as a valuable community resource. |

| Investing in Technology and Infrastructure |

|

Improved user experience, enhanced operational efficiency, and a better platform for future growth. | Investing in technology ensures the LA Times remains competitive in the digital landscape and allows for more efficient content creation and delivery. |

The potential impact of each investment varies depending on the specific strategy and implementation. Careful consideration of the LA Times’ existing resources, strengths, and long-term goals is critical when evaluating these options.

Last Word

The LA Times’ purchase of online mall assets presents a fascinating case study in media adaptation. From potential impacts on revenue streams and editorial coverage to public perception and the future of online retail news, this transaction has far-reaching consequences. The potential for conflicts of interest and ethical concerns needs careful consideration. Ultimately, this investment raises questions about the evolving relationship between news organizations and the ever-changing landscape of online retail.

The next chapter for the LA Times promises to be an exciting one, and its implications are significant for the industry as a whole.