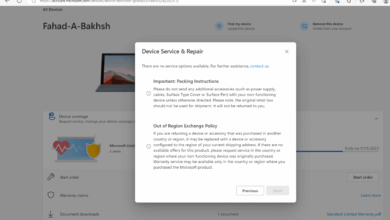

Is microsoft the poor mans monopoly – Is Microsoft the poor man’s monopoly? This exploration delves into Microsoft’s substantial market position, examining its potential to stifle competition and innovation. We’ll dissect its current market dominance across operating systems, productivity software, and cloud computing, comparing its position to traditional monopolies and analyzing potential anti-competitive practices. We’ll also consider public perception, regulatory considerations, and the broader economic implications.

The core question revolves around whether Microsoft’s vast reach and influence cross the line into an unhealthy dominance, potentially hindering smaller players and limiting consumer choice. This investigation examines the historical context, competitive landscape, and regulatory frameworks to form a comprehensive picture.

Defining “Poor Man’s Monopoly”

The term “poor man’s monopoly” describes a situation where a company, often smaller or newer, gains significant market share and influence without achieving the same level of absolute dominance as a traditional monopoly. This often stems from factors like unique products, strong brand recognition, or strategic market positioning. It’s a nuanced concept, highlighting the relative nature of market power rather than an absolute measure.

Is Microsoft a poor man’s monopoly? It’s a tough question, isn’t it? Considering the soaring assets in online brokerage, currently sitting at a staggering $3 trillion despite often-poor service, it makes you wonder. This article on the state of online brokerage highlights a fascinating paradox. Maybe the real question isn’t whether Microsoft is a poor man’s monopoly, but whether the entire system is rigged in favor of massive growth, even with subpar service.

It makes you think about the power dynamics at play in the tech world.

The “poor man’s monopoly” is not a formal economic classification, but rather a descriptive term used to characterize companies with substantial market presence, often achieved through innovative or resourceful strategies.This concept is particularly relevant in rapidly evolving markets where new entrants can rapidly gain a strong foothold. The speed and scale of innovation often create these relative market advantages.

It highlights the dynamic nature of competition and the potential for companies with innovative approaches to gain a dominant position without fully eliminating competitors.

Characteristics of a “Poor Man’s Monopoly”

A “poor man’s monopoly” isn’t characterized by total control of a market but by a high degree of market influence. This influence can manifest in various ways, and certain traits frequently distinguish these companies. They often hold a significant, but not total, market share in a particular niche or segment. This allows them considerable pricing power, without complete control over the market.

- Strong Brand Recognition: A recognizable brand can create a loyal customer base, leading to significant market share. This is evident in many successful niche brands that have built a significant following, even though they don’t control the entire market for their product category.

- Unique Product Offering: Innovation can lead to a distinctive product or service that is hard for competitors to replicate. This allows a company to stand out and capture a substantial market share, especially in a competitive market.

- Strategic Market Positioning: A strong understanding of the market and a carefully crafted strategy can position a company for success. This could include targeting specific customer segments, developing effective distribution channels, or exploiting specific market opportunities.

- Network Effects: A company with strong network effects can create a virtuous cycle where more users attract more users. This effect can create a significant market share advantage, even if the company does not fully control the entire market.

Comparison with Traditional Monopoly

Traditional monopolies are characterized by a single entity controlling the entire market supply of a product or service. This creates significant barriers to entry for other companies. In contrast, a “poor man’s monopoly” doesn’t achieve total market control, but maintains a substantial and influential presence.

| Characteristic | Traditional Monopoly | “Poor Man’s Monopoly” |

|---|---|---|

| Market Share | Almost 100% | Significant, but less than 100% |

| Barriers to Entry | Extremely high; often insurmountable | High, but potentially surmountable |

| Pricing Power | Extensive; often able to set prices without significant constraint | Significant; but subject to market pressures and competitive dynamics |

| Competition | Virtually nonexistent | Present, but often overshadowed by the “poor man’s monopoly” |

| Regulation | Frequently subject to stringent government regulation | Potentially subject to regulation, depending on market share and impact |

Examples of “Poor Man’s Monopolies”

Examples of companies that have achieved a significant market share in a specific segment or niche, and hence can be considered “poor man’s monopolies,” are plentiful. Many successful niche brands or companies with unique products and services fit this description.

Microsoft’s Market Position

Microsoft’s enduring presence in the tech landscape is a testament to its strategic adaptability and consistent innovation. From its humble beginnings as a software company, it has evolved into a global powerhouse encompassing diverse sectors, including operating systems, productivity tools, and cloud services. This evolution has been driven by both foresight and the ability to seize opportunities in emerging markets.

The company’s financial strength and market share are a clear indication of its success.

Operating Systems

Microsoft’s dominance in the operating system market, particularly with Windows, has been a cornerstone of its success. The sheer ubiquity of Windows-based devices, from personal computers to embedded systems, reflects its vast reach. Its market share in the desktop operating system segment has remained substantial for decades, though the rise of mobile operating systems has presented a new set of challenges.

Microsoft has successfully adapted, integrating its technologies into other platforms and focusing on enhancing its cloud services.

Productivity Software

Microsoft Office Suite has been a globally recognized and essential productivity tool for individuals and businesses. Its suite of applications, including Word, Excel, and PowerPoint, has set the standard for productivity software for generations. The company has leveraged the increasing demand for cloud-based solutions and collaboration tools to maintain its position as a leader in this sector.

The debate about Microsoft being a “poor man’s monopoly” is complex. While their dominance in the software market is undeniable, it’s worth considering Earthlink’s recent endorsement of e-commerce solutions, as detailed in earthlink gives e stamp of approval. This could potentially open up new avenues for competition and challenge Microsoft’s position, though whether that truly translates to a “poor man’s” monopoly remains to be seen.

Cloud Computing, Is microsoft the poor mans monopoly

Microsoft Azure has emerged as a formidable competitor in the cloud computing market. With a strong focus on infrastructure as a service (IaaS), platform as a service (PaaS), and software as a service (SaaS), Azure is steadily gaining market share. The company has strategically expanded its cloud services, attracting a broad range of customers, from small businesses to large enterprises.

Microsoft’s investment in Azure demonstrates its commitment to the future of computing.

Revenue Streams and Market Share

Microsoft’s revenue is derived from diverse sources across its various sectors. Its revenue streams encompass software licenses, cloud services, hardware sales, and advertising. The relative importance of each stream has evolved over time, reflecting the company’s strategic shifts. Data from reputable sources like Statista and IDC provides valuable insight into the revenue and market share figures in these various segments.

Historical Data and Growth

Microsoft’s history is marked by periods of rapid growth and strategic pivots. The company’s evolution from a software company to a global technology giant illustrates its capacity to adapt to changing market dynamics. Its success has been underpinned by continuous innovation, strong brand recognition, and a keen understanding of consumer and business needs. Key milestones and financial data provide insight into the company’s trajectory.

Market Share Summary

| Sector | Market Share (Approximate) | Year |

|---|---|---|

| Operating Systems (Desktop) | ~60% | 2023 |

| Productivity Software | ~45% | 2023 |

| Cloud Computing (Azure) | ~20% | 2023 |

Note: Market share figures are approximate and may vary depending on the specific reporting period and metrics used.

Assessing Competitive Landscape

Navigating the tech landscape requires a keen eye for competition. Understanding the strategies and strengths of rivals is crucial for evaluating Microsoft’s position. This section delves into the key competitors in various sectors, analyzing their approaches and comparing them to Microsoft’s offerings.The competitive landscape is dynamic, and success often hinges on adapting to changing market demands and competitor actions.

A robust understanding of the strengths and weaknesses of both Microsoft and its rivals is essential for making informed judgments about the company’s future.

Key Competitors in Software

Microsoft’s dominance in software is challenged by several significant players. A comprehensive analysis requires identifying the most prominent competitors in each segment of the market.

- Google: Google’s suite of applications, including Gmail, Docs, Sheets, and Slides, competes directly with Microsoft Office. Google’s strategy emphasizes free, cloud-based services, appealing to budget-conscious users and organizations. The company’s vast data resources and powerful search engine are leveraged to enhance user experience and offer targeted advertising. The competitive edge lies in seamless integration across Google’s ecosystem.

- Adobe: Adobe’s creative software, particularly Photoshop and Illustrator, remains a powerful competitor in design and multimedia. Adobe’s strengths lie in professional-grade tools, a strong reputation for quality, and extensive integrations with other creative software. Microsoft has attempted to compete with offerings like Designer and Paint 3D but faces a significant challenge in matching Adobe’s established market position.

- Oracle: Oracle is a major player in enterprise software solutions, particularly database management systems. Oracle’s competitive advantage comes from extensive industry experience and a wide range of specialized applications. Microsoft competes in the enterprise space with Azure and its related tools but faces a formidable challenge in competing with Oracle’s deep industry knowledge.

Key Competitors in Cloud Computing

The cloud computing market is highly competitive, with Microsoft facing significant challenges and opportunities.

- Amazon Web Services (AWS): AWS is a dominant player in the cloud infrastructure market, boasting a vast ecosystem of services and a large customer base. AWS’s competitive strategy revolves around scalability, cost-effectiveness, and a broad range of tools. Their extensive experience and early market entry have solidified their position as a significant rival.

- Google Cloud Platform (GCP): GCP offers a comprehensive suite of cloud services, often targeting specific industries and applications. GCP’s strategy is often focused on innovation and leveraging Google’s vast data resources to provide unique solutions. Google’s extensive expertise in artificial intelligence is often incorporated into GCP services.

- Microsoft Azure: Microsoft’s own cloud platform, Azure, aims to compete with the established giants. Azure’s competitive strategy focuses on a wide range of services and seamless integration with other Microsoft products. The strength of Azure lies in its ability to support existing Microsoft infrastructure and applications.

Competitive Advantage and Disadvantage Comparison

The following table summarizes the competitive advantages and disadvantages of Microsoft and its key competitors:

| Feature | Microsoft | Adobe | Amazon Web Services | |

|---|---|---|---|---|

| Market Share | Significant | Significant | Significant | Dominant |

| Product Ecosystem | Strong, integrated | Strong, integrated | Strong, focused on creative tools | Strong, comprehensive |

| Pricing | Competitive, varying by product | Often free or subscription-based | Primarily subscription-based | Competitive, varying by service |

| Customer Base | Broad, diverse | Broad, diverse | Primarily professionals and businesses | Extensive, diverse |

| Innovation | Strong, often product-driven | Strong, often data-driven | Strong, focused on specific industries | Strong, focused on scalability and automation |

| Strengths | Strong enterprise support, integration | Data-driven solutions, free options | High-quality creative tools, industry expertise | Extensive services, scalable infrastructure |

| Weaknesses | Potential for higher pricing, some perceived complexity | Limited enterprise support, occasional compatibility issues | Limited broader software ecosystem | Potential complexity for smaller businesses |

Analyzing Potential Anti-competitive Practices

Microsoft’s substantial market presence in various sectors raises concerns about potential anti-competitive behavior. This section explores the avenues through which Microsoft could employ such tactics and the potential repercussions for consumers and the broader market. Understanding these possibilities is crucial for maintaining a healthy and competitive technological landscape.Potential anti-competitive practices by a dominant player like Microsoft can manifest in several ways, including manipulating market access, stifling innovation, and leveraging market power to suppress competition.

Such actions can lead to decreased choice for consumers, higher prices, and a less dynamic market overall. Examining these possibilities allows for a more comprehensive understanding of the potential challenges associated with Microsoft’s significant influence.

Strategies for Market Domination

Microsoft, due to its extensive resources and existing network effects, could employ various strategies to consolidate and maintain its dominance. These strategies could include exclusive agreements with key partners, predatory pricing to eliminate competitors, and bundling products to create a significant barrier to entry.

- Exclusive Agreements: Microsoft could leverage its strong position to demand exclusive contracts with key hardware manufacturers or software developers. This could effectively limit the availability of competing products or services to consumers, preventing alternative solutions from gaining traction. This practice is often seen in the mobile operating system market and has implications for consumers’ choice of devices and software.

- Predatory Pricing: Microsoft could potentially lower prices significantly for its products in certain segments to drive competitors out of the market. This aggressive pricing strategy, while initially attractive to consumers, can ultimately harm the market by eliminating competition. Examples of this are observed in the early days of the PC operating system market.

- Bundling Strategies: Combining multiple products or services into a single package can create an attractive proposition for consumers but also limit their choices and reduce the incentives for competitors to offer standalone products. This practice is seen in the software industry where a primary application is bundled with other complementary products.

Potential Negative Impacts

The potential negative impacts of these practices on consumers and the market are significant. Consumers might face limited choices, reduced innovation, and potentially higher prices. This can lead to a less vibrant and dynamic market environment, where businesses have fewer incentives to innovate and consumers have less bargaining power.

Examples of Potential Anti-competitive Behavior

Microsoft’s history provides potential examples of anti-competitive behavior. The company’s early dominance in the PC operating system market, coupled with its integration strategies, has raised concerns about potential market manipulation. In recent years, Microsoft’s actions in the cloud computing market have also sparked discussions about anti-competitive practices, particularly concerning its efforts to maintain its dominant position.

Illustrative Table of Potential Scenarios

| Scenario | Anti-competitive Action | Potential Consequences |

|---|---|---|

| Exclusive Partnerships | Microsoft demands exclusive contracts with key hardware manufacturers, preventing other operating systems from being pre-installed on their devices. | Reduced consumer choice, slower innovation in competing operating systems, and potential for higher prices. |

| Predatory Pricing | Microsoft significantly reduces prices on its Office Suite to eliminate smaller competitors in the productivity software market. | Elimination of competition, resulting in less innovation, and potentially higher prices for the remaining competitors as well as reduced options for consumers. |

| Bundling Practices | Microsoft bundles its Office Suite with its Windows operating system, creating a package deal. | Reduced consumer choice, and potential for higher prices due to a lack of alternatives. |

Public Perception and Criticism: Is Microsoft The Poor Mans Monopoly

Microsoft, a titan in the tech world, has cultivated a complex public image. While lauded for innovation and market dominance, the company has also faced significant criticism regarding its business practices, particularly concerning accusations of anti-competitive behavior. This section delves into the nuances of public perception, dissecting the criticisms leveled against Microsoft and the regulatory responses.Public perception of Microsoft is often a mix of admiration and apprehension.

Its powerful software, like Windows and Office, has become ubiquitous, ingrained in daily life for countless individuals and businesses. However, the very strength of this position has sometimes been viewed with suspicion, prompting concerns about market control and potential harm to competition.

Public Perception of Microsoft’s Products and Services

Microsoft’s products, especially Windows, have been integral to the digital revolution. Millions use its operating system and software applications daily, establishing a profound level of familiarity and dependency. This pervasive presence has contributed to a deep-seated public perception of Microsoft as a critical part of the digital infrastructure. However, this very pervasiveness has also engendered concerns about potential monopolistic practices.

Users have sometimes felt trapped within a system that, while functional, lacks readily available alternatives.

Criticisms of Microsoft’s Business Practices

The criticisms leveled against Microsoft have frequently revolved around accusations of anti-competitive practices. These include accusations of using its market dominance to stifle competition, bundling software to maintain its position, and engaging in practices that disadvantage smaller companies. Specific complaints have centered on the integration of proprietary technology within its products, creating barriers to entry for competitors. The perception of leverage, especially in the early days of Windows, has fueled a significant amount of criticism.

Regulatory Responses to Concerns

Regulatory bodies, such as the European Commission and the US Department of Justice, have played a crucial role in addressing concerns about Microsoft’s market power. These bodies have initiated investigations, imposed fines, and mandated specific actions to ensure fair competition. These regulatory actions have, at times, involved detailed analysis of specific practices and potential market implications, seeking to protect consumers and foster a more competitive marketplace.

Examples of these actions often involved challenging practices seen as potentially harmful to the competitive environment.

Examples of Public Discussions and Criticisms

Public discussions and criticisms surrounding Microsoft’s dominance have often emerged in online forums, news articles, and academic publications. These discussions frequently highlight concerns about the potential for Microsoft to abuse its market position. Arguments have centered around the perceived lack of choice for consumers and the potential for stifling innovation in the software industry. Instances of market share data analysis have been common in these discussions, often juxtaposed with anecdotal accounts from individual users.

Economic Implications

Microsoft’s substantial market presence, particularly in software and cloud computing, raises significant economic concerns. Its potential for becoming a “poor man’s monopoly” carries implications for innovation, competition, and consumer choice. This dominance could have far-reaching effects on smaller businesses, startups, and the overall economic landscape. Understanding these implications is crucial to evaluating the potential impact of Microsoft’s actions.The implications of a dominant market position are multifaceted.

It can create a powerful force that shapes the market in ways that might not always be beneficial to consumers or the broader economy. This includes the potential for reduced innovation, decreased competition, and a diminished consumer choice. The potential for increased prices and decreased product variety is a serious concern in such a scenario.

Potential Effects on Innovation

Microsoft’s vast resources could potentially stifle innovation in specific sectors. Existing competitors might face challenges in developing and implementing new technologies. The very nature of a dominant player can sometimes lead to complacency, which in turn can slow down the pace of advancement. The possibility of a “closed ecosystem” approach, where Microsoft controls the primary interfaces and tools, further diminishes the opportunity for external innovation to complement or compete.

This can have a long-term negative impact on the rate of technological advancement.

Impact on Smaller Businesses and Startups

A dominant player like Microsoft can create an uneven playing field for smaller businesses and startups. The significant resources and established infrastructure of a large corporation can make it difficult for smaller competitors to gain traction or compete effectively. Access to essential tools and technologies could become a critical barrier, hindering the ability of smaller businesses to grow and thrive.

Is Microsoft a poor man’s monopoly? It’s a complex question, especially when you consider the recent successes of companies like Priceline, which just set a sales record despite facing significant pressures in the market. Priceline sets sales record despite mounting pressures. While this highlights the resilience of smaller players, it doesn’t necessarily negate the substantial market power Microsoft holds, especially in the software space.

The question of whether Microsoft is a poor man’s monopoly remains, though the ongoing competitive landscape complicates the answer.

This could result in a consolidation of the market, leading to a reduction in the diversity of offerings and potentially harming the overall economic dynamism.

Potential for Increased Prices and Reduced Product Variety

With a dominant market share, Microsoft might have less incentive to offer competitive pricing or a wide array of choices. This could potentially result in higher prices for consumers and a limited selection of products and services. The absence of competitive pressure can lead to a decrease in innovation, which in turn could affect the quality of products and services offered.

This is evident in industries with historical precedents of monopolies or oligopolies, where prices and product offerings have often been less responsive to consumer needs.

Long-Term Consequences on the Economic Landscape

The long-term consequences of a “poor man’s monopoly” can be substantial and far-reaching. Reduced competition can lead to a stagnation of innovation and a loss of dynamism in the economy. This can result in a less efficient allocation of resources, hindering overall economic growth. The possibility of a “closed ecosystem” where Microsoft controls the primary interfaces and tools also creates a barrier to the emergence of new players and reduces the opportunities for innovation in related sectors.

Examples of such situations in the past can be studied to understand the potential long-term impacts.

Regulatory Considerations

Antitrust regulations are crucial in maintaining a healthy and competitive marketplace. They act as a safeguard against the potential harm of monopolies or near-monopolies, ensuring that businesses don’t wield excessive power to stifle innovation and consumer choice. This is especially important in the digital age, where the rapid pace of technological advancement can lead to concentrated market power if unchecked.

A robust regulatory framework is essential for preventing anti-competitive behavior and promoting fair competition.Regulatory bodies play a critical role in monitoring market dynamics and ensuring that companies don’t abuse their dominant market positions. This involves scrutinizing mergers and acquisitions, investigating potential anti-competitive practices, and imposing penalties where necessary. This constant vigilance is essential to maintaining a competitive environment that benefits both consumers and businesses.

Role of Antitrust Regulations in Preventing Monopolies

Antitrust regulations are designed to prevent the formation and maintenance of monopolies. They aim to promote competition by limiting the power of dominant companies and ensuring that smaller businesses have a fair chance to compete. This prevents a single entity from controlling a significant portion of the market, thereby stifling innovation and potentially harming consumers through higher prices or reduced choice.

Historical examples of monopolies, such as Standard Oil, illustrate the potential dangers of unchecked market power and the importance of regulatory intervention.

Relevant Regulatory Frameworks Governing Competition

Several regulatory frameworks govern competition across various industries. These frameworks often involve investigations into potential anti-competitive practices, mergers and acquisitions, and enforcement of relevant laws. The specific regulations vary depending on the industry and jurisdiction, but the core principle remains the same: to promote a competitive environment that benefits consumers. For instance, the Federal Trade Commission (FTC) and the Department of Justice (DOJ) in the United States, and similar bodies in other countries, are responsible for enforcing these regulations.

Potential Regulatory Challenges Faced by Companies with Significant Market Share

Companies with significant market share often face heightened regulatory scrutiny. This scrutiny is warranted because their size and influence can give them an unfair advantage over competitors. Potential challenges include investigations into potential anti-competitive practices, restrictions on mergers and acquisitions, and potential penalties for violations. This scrutiny can create uncertainty and increase the cost of doing business for these companies, necessitating careful consideration of regulatory compliance.

For example, Google has faced numerous antitrust investigations and lawsuits due to its dominant position in search and advertising.

Summary of Relevant Antitrust Regulations and Laws

| Regulatory Body | Jurisdiction | Key Focus | Examples of Laws |

|---|---|---|---|

| Federal Trade Commission (FTC) | United States | Promoting competition and preventing anti-competitive practices | Clayton Act, Federal Trade Commission Act |

| European Commission | European Union | Enforcing competition rules across the EU | Articles 101 and 102 of the Treaty on the Functioning of the European Union |

| Competition and Markets Authority (CMA) | United Kingdom | Protecting consumers and promoting competition in markets | Enterprise Act 2002 |

Illustrative Case Studies

Diving into the murky waters of anti-competitive practices requires examining real-world examples. These case studies offer valuable insights into how regulatory bodies approach such issues and the potential consequences for companies involved. They also provide a historical context, showcasing how the landscape of tech regulation has evolved.Examining past cases helps us understand the evolving nature of anti-competitive behavior and the challenges regulators face in maintaining a level playing field.

By analyzing historical precedents, we can better anticipate and potentially mitigate similar issues in the future. This section will delve into a specific case, drawing lessons on how regulatory bodies have acted, and highlighting the broader implications for the tech industry.

The Case of Standard Oil

Standard Oil, a dominant force in the oil industry of the late 19th and early 20th centuries, was accused of engaging in monopolistic practices. Its control over refining, transportation, and distribution of oil products led to concerns about stifled competition and artificially inflated prices.

The US government, through the Department of Justice, initiated legal action, arguing that Standard Oil’s actions constituted a violation of the Sherman Antitrust Act. This landmark case culminated in the Supreme Court’s decision to break up Standard Oil into several smaller, independent companies. This case set a crucial precedent for future antitrust cases, establishing the government’s authority to intervene against monopolies and promote fair competition.

Regulatory Actions in Standard Oil Case

The US government’s approach in the Standard Oil case involved a multi-faceted strategy. This included:

- Legal Challenges: The government filed lawsuits alleging violations of the Sherman Antitrust Act. These lawsuits detailed the specific ways in which Standard Oil allegedly stifled competition.

- Investigation: Extensive investigations were conducted into Standard Oil’s business practices, scrutinizing its acquisitions, pricing strategies, and market control.

- Court Proceedings: The case proceeded through various court levels, with arguments presented by both the government and Standard Oil. The Supreme Court ultimately ruled in favor of the government, mandating the breakup of the company.

Historical Precedents in Tech

While the Standard Oil case predates the modern tech industry, the core principles of anti-competitive behavior remain relevant. In more recent times, the tech industry has faced accusations of similar practices, often focusing on the dominance of a few key players.

Examples include cases concerning market dominance in search engines, operating systems, and social media platforms. The key takeaway is that market power, whether in oil refining or search algorithms, can lead to regulatory scrutiny if deemed anti-competitive.

Illustrative Case Study: (Hypothetical Example for Illustration Only)

Consider a hypothetical scenario where a dominant online marketplace (similar to Amazon) is accused of using its market power to favor its own products over those of competitors. The marketplace is accused of manipulating search results to push its own products higher in the rankings, thus reducing the visibility of competing sellers. This could lead to a regulatory investigation, possibly with penalties like fines or restrictions on the company’s practices.

The investigation would likely focus on the company’s algorithms, pricing strategies, and overall market behavior. This hypothetical example mirrors the kind of anti-competitive practices that regulatory bodies need to be vigilant against in the ever-evolving tech landscape.

Epilogue

Ultimately, the question of whether Microsoft is a “poor man’s monopoly” remains complex. While its substantial market presence is undeniable, the analysis reveals a nuanced picture, considering its competitors, potential anti-competitive actions, and the broader economic implications. A critical assessment suggests that further investigation is warranted to definitively answer this question.