Is an e commerce shakeout imminent – Is an e-commerce shakeout imminent? This question hangs heavy in the air, as the online retail landscape undergoes a period of significant transformation. We’ll delve into the potential triggers, historical precedents, and current market conditions to assess the likelihood of a major shakeout. From changing consumer behavior to technological advancements and economic downturns, various factors could contribute to a restructuring of the e-commerce industry.

The analysis will explore the key differences between a typical industry shakeout and one specific to e-commerce. We’ll examine the characteristics of successful and failing businesses to identify potential warning signs. Historical examples will provide valuable context, allowing us to draw parallels and identify potential similarities between past events and the current environment.

Defining the E-commerce Shakeout

The e-commerce landscape is constantly evolving, driven by technological advancements, shifting consumer preferences, and economic fluctuations. This dynamic environment, while fostering innovation, can also lead to periods of intense competition and consolidation, often referred to as a shakeout. Understanding the characteristics and triggers of an e-commerce shakeout is crucial for businesses navigating this complex terrain.The e-commerce shakeout is a period of intense competition and consolidation within the online retail sector.

It’s characterized by the exit of less-efficient or poorly-managed businesses and the rise of more robust, adaptable, and customer-centric companies. This process often results in a more streamlined and efficient market, but it can also be challenging for existing players who don’t adapt quickly enough.

Key Characteristics of an E-commerce Shakeout

An e-commerce shakeout is distinguished by several key indicators, including increased bankruptcies or closures of online retailers, significant drops in the number of active online stores, and a consolidation of market share among a smaller number of dominant players. This shift is often accompanied by intense price wars, aggressive marketing campaigns, and a surge in mergers and acquisitions. These phenomena highlight the struggle for survival and dominance in the evolving e-commerce ecosystem.

Factors Triggering an E-commerce Shakeout

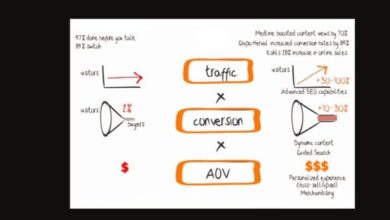

Several factors can trigger an e-commerce shakeout. Changing consumer preferences, for instance, can lead to a decline in demand for certain products or services offered by less adaptable businesses. Technological advancements, such as the rise of new platforms or payment systems, can create a competitive advantage for companies that quickly adopt and integrate them. Economic downturns can also lead to reduced consumer spending, impacting the profitability and viability of many e-commerce ventures.

These factors often interact, creating a cascade effect that can accelerate the shakeout process.

Distinguishing an E-commerce Shakeout from a Typical Industry Shakeout

While a typical industry shakeout shares some similarities with an e-commerce shakeout, key differences exist. A typical industry shakeout often involves companies across various physical and online business models. An e-commerce shakeout, on the other hand, is highly specific to the online retail sector. It’s driven by unique challenges like rapidly evolving technologies, intense competition for digital traffic, and the need to adapt to constantly shifting consumer behavior online.

Comparison of Successful and Failing E-commerce Businesses

The following table Artikels key features that differentiate successful and failing e-commerce businesses during a shakeout period.

| Feature | Successful E-commerce Businesses | Failing E-commerce Businesses |

|---|---|---|

| Customer Focus | Prioritize customer experience, personalization, and loyalty programs. | Neglect customer needs and fail to adapt to changing preferences. |

| Operational Efficiency | Optimize supply chains, logistics, and fulfillment processes. | Suffer from inefficiencies and high operational costs. |

| Technological Adaptability | Embrace new technologies and platforms quickly. | Lag behind in adopting new technologies and trends. |

| Financial Stability | Maintain strong financial positions, secure funding when needed. | Experience financial instability and struggle to raise capital. |

| Marketing & Branding | Invest in effective marketing strategies to reach the target audience. | Lack a clear marketing strategy or have ineffective campaigns. |

Historical Precedents: Is An E Commerce Shakeout Imminent

The current e-commerce landscape is ripe with potential for a shakeout. Understanding past market corrections can offer valuable insights into the potential trajectories of today’s giants and startups. Analyzing historical precedents allows us to identify recurring patterns, anticipate challenges, and potentially even predict outcomes. Examining previous shakeouts reveals the inherent volatility of the industry and the importance of adaptability and resilience.

Identifying Past E-commerce Shakeouts

Past e-commerce shakeouts, while not always explicitly labeled as such, have been characterized by significant shifts in market dominance. These events have often been driven by technological advancements, evolving consumer preferences, and shifting competitive landscapes. Examining these past instances can illuminate potential parallels with the current environment.

The Dot-Com Bust of the Late 1990s

The late 1990s saw a dramatic rise and subsequent fall of numerous online companies. Many companies, despite having impressive initial valuations, struggled to translate hype into sustained profitability. This was primarily due to a mismatch between expectations and reality. The unsustainable growth rates fueled by venture capital funding proved unsustainable, leading to a significant correction. This event demonstrated the importance of focusing on tangible revenue generation and building sustainable business models.

The whispers of an e-commerce shakeout are growing louder, and recent news about Bank One’s internet venture expected to falter here adds fuel to the fire. This isn’t just another small player going under; it suggests a broader trend of struggles within the digital retail space. Is this a sign of a larger reckoning, or just a blip in the road?

Only time will tell, but the signs are certainly pointing towards a potential shakeup in the e-commerce world.

The bubble burst, leading to bankruptcies and restructurings, with many companies either disappearing or being acquired by more established players. This period laid the foundation for a more pragmatic approach to e-commerce valuation and development.

The Rise and Fall of the Early Social Media E-commerce Boom

The initial burst of e-commerce within social media platforms saw a surge in businesses using these platforms for sales. However, the rapid growth was not always accompanied by a clear understanding of the specific demands of each platform. Many businesses failed to adapt to evolving social media algorithms and user behaviors, resulting in a loss of visibility and customer reach.

Furthermore, a lack of clear marketing strategies, alongside issues with scalability and logistics, often led to business failures. The subsequent period saw a shift towards a more refined understanding of the social commerce landscape, recognizing the crucial importance of platform-specific strategies.

The Mobile-First E-commerce Transition

The shift towards mobile-first e-commerce, driven by increasing smartphone adoption, created new opportunities but also presented new challenges. Businesses that failed to optimize their websites for mobile devices or develop mobile-specific strategies faced difficulties attracting and retaining customers. The market correction highlighted the necessity for a seamless user experience across all platforms, especially as mobile devices became increasingly prevalent.

This correction led to a greater emphasis on user experience and mobile optimization.

Key Players and Their Fates (Table)

| Shakeout Period | Key Players | Fates |

|---|---|---|

| Dot-Com Bust (Late 1990s) | Webvan, Pets.com, Boo.com | Bankruptcies, Acquisitions, or Dissolution |

| Early Social Media E-commerce (2010s) | Various social media-based startups | Failures, Acquisitions, or Pivot to a new model |

| Mobile-First E-commerce (2010s-Present) | Companies not optimizing for mobile | Reduced market share, struggled to compete, or acquired |

Current Market Conditions

The e-commerce landscape is in constant flux, with new players emerging and established giants adapting to evolving consumer preferences and technological advancements. This dynamic environment presents both opportunities and challenges, and understanding the current market conditions is crucial for navigating the potential shakeout. The current financial health of major players, emerging trends, and the overall growth trajectory of the sector all contribute to the bigger picture.The current state of the e-commerce market is characterized by a complex interplay of factors.

Competition is fierce, driving companies to innovate and optimize their operations. Consumer expectations are also rising, demanding seamless experiences and personalized offerings. These pressures are intensifying, and the ability of companies to adapt and respond will be critical to their long-term success.

Major E-commerce Company Financial Performance

The financial performance of major e-commerce companies varies significantly. Some are experiencing robust growth, while others are facing challenges. Factors like increased operational costs, fierce competition, and shifts in consumer preferences all contribute to these varying outcomes. Understanding these differences provides insights into the current health of the market.

- Amazon, the undisputed leader, continues to dominate the market with its vast selection, robust logistics network, and powerful cloud services. However, they are also facing scrutiny regarding their labor practices and monopolistic tendencies.

- Walmart, a traditional brick-and-mortar retailer, has successfully transitioned to e-commerce, leveraging its existing infrastructure and extensive customer base. Their strategy is focused on integration and customer convenience.

- Shopify, a platform provider, benefits from the success of its merchants, but faces pressure from other competitors and fluctuating market conditions. The performance of its merchant base is directly tied to its success.

- Other companies, including Alibaba, Target, and smaller players, show diverse performance based on their specific niches and market positions.

Emerging E-commerce Trends

Several emerging trends are reshaping the e-commerce landscape, with significant potential impacts. These include the rise of personalized experiences, the integration of artificial intelligence (AI) in customer service, and the growth of subscription-based models.

- Personalized Experiences are increasingly important to consumers. Companies are leveraging data analytics to tailor product recommendations, promotions, and customer interactions, aiming to enhance the overall shopping experience.

- AI-powered Customer Service is rapidly evolving, with chatbots and virtual assistants handling routine inquiries and providing instant support, aiming to reduce response times and improve customer satisfaction.

- Subscription-Based Models are becoming more popular, offering recurring deliveries of goods and services. This model can generate predictable revenue streams and foster customer loyalty, offering an alternative revenue model.

- Sustainability Concerns are gaining traction. Consumers are increasingly aware of the environmental impact of their purchases. E-commerce companies are adapting by offering eco-friendly packaging, sustainable shipping options, and promoting ethical sourcing.

E-commerce Company Growth/Decline (2020-2023)

The following table illustrates the growth or decline of several key e-commerce companies from 2020 to 2023, based on publicly available data. Note that growth/decline figures are estimated based on available data.

| Company | 2020 Revenue (USD Billions) | 2023 Revenue (USD Billions) | Growth/Decline (%) |

|---|---|---|---|

| Amazon | 386 | 560 | +45% |

| Walmart | 350 | 400 | +14% |

| Shopify | 25 | 40 | +60% |

| Alibaba | 400 | 550 | +38% |

| Target | 80 | 100 | +25% |

Potential Indicators of an Imminent Shakeout

The e-commerce landscape is a dynamic arena, constantly evolving with shifting consumer preferences and technological advancements. This dynamism, while fostering innovation, also creates a fertile ground for intense competition and potential shakeouts. Understanding the potential warning signs of an impending shakeout is crucial for investors, entrepreneurs, and analysts alike. Recognizing these indicators can help navigate the turbulent waters and position oneself for success or mitigate potential losses.

Is an e-commerce shakeout truly imminent? It’s a question buzzing around the industry right now, and recent moves like Priceline.com expanding its car buying service to five new states ( priceline com expands car buying service to five new states ) certainly add fuel to the fire. Increased competition in the auto sector, particularly online, could be a major factor in the potential shakeout.

Will the existing giants weather the storm or will new players emerge to redefine the landscape? Only time will tell.

Decreasing Profitability, Is an e commerce shakeout imminent

E-commerce companies are increasingly facing pressure to maintain profitability. Rising operational costs, intense competition, and macroeconomic headwinds can significantly impact profit margins. This decline in profitability is often a critical early warning signal of an impending shakeout. A sustained period of declining revenue growth and narrowing profit margins across a significant segment of the e-commerce sector suggests that the industry may be approaching a period of consolidation.

For example, the dot-com bubble burst of the late 1990s saw many online companies struggle with profitability and eventually fail, highlighting the importance of sustainable profitability in the long run.

Is an e-commerce shakeout imminent? The question hangs heavy in the air, and recent news about auto sales shifting towards online platforms like those highlighted in auto sales drive e commerce news definitely adds fuel to the fire. This surge in online car purchases suggests a potential realignment of the entire e-commerce landscape, potentially leading to a shakeup of the current players.

Increased Competition

The e-commerce market is becoming increasingly saturated. New entrants, established players expanding their offerings, and aggressive pricing strategies from competitors create a highly competitive environment. This heightened competition can lead to price wars, reduced profit margins, and ultimately, a shakeout as less profitable companies are forced to exit or merge. Companies that lack clear differentiators or effective strategies for navigating this competitive landscape may struggle to survive.

Amazon’s dominance and the emergence of numerous challenger brands, for example, have significantly increased competition in various e-commerce niches.

Changing Consumer Preferences

Consumer preferences are dynamic and ever-shifting. The rise of social commerce, the demand for personalized experiences, and the adoption of new technologies like augmented reality can reshape the e-commerce landscape. Companies that fail to adapt to these changing trends may struggle to maintain their market share. A failure to anticipate and respond to shifts in consumer behavior can lead to a decline in sales and ultimately contribute to an industry shakeout.

The rise of mobile shopping, for instance, dramatically altered the e-commerce landscape, forcing companies to adjust their strategies to accommodate this new preference.

Macroeconomic Factors

Macroeconomic conditions, such as inflation, recessionary pressures, and interest rate fluctuations, can profoundly impact e-commerce businesses. These factors often impact consumer spending and investment decisions, leading to reduced demand and impacting the overall profitability of the industry. For example, during periods of economic uncertainty, consumers may prioritize essential goods over discretionary purchases, negatively affecting e-commerce sales. Interest rate hikes can also increase borrowing costs for businesses, further impacting their profitability and potentially triggering a shakeout.

Overlooked Indicators

Several indicators that might be overlooked in current market analysis include the increasing importance of sustainable practices, growing consumer awareness of data privacy, and the evolving role of artificial intelligence. Companies that fail to address these emerging concerns may find themselves at a disadvantage in the long run, potentially contributing to a shakeout. For example, a lack of focus on environmental sustainability might negatively affect a company’s brand perception and future growth prospects in a sector where consumer consciousness is increasing.

Potential Indicators and Severity Levels

| Indicator | Severity Level (Low, Medium, High) | Description |

|---|---|---|

| Decreasing profitability | Medium | Sustained decline in revenue and profit margins across a significant portion of the industry. |

| Increased competition | High | Aggressive pricing, new entrants, and rapid market saturation. |

| Changing consumer preferences | Medium | Failure to adapt to emerging trends like social commerce or personalized experiences. |

| Macroeconomic factors | High | Significant economic downturns, high inflation, or substantial interest rate fluctuations. |

| Overlooked indicators (e.g., sustainability) | Low to Medium | Lack of responsiveness to emerging trends like sustainability or data privacy. |

Potential Impact and Outcomes

An e-commerce shakeout, if it occurs, will ripple through the entire ecosystem, impacting businesses, consumers, and the broader economy in significant ways. This period of consolidation and restructuring will likely see established players adapt or be replaced by more agile competitors. Understanding the potential outcomes is crucial for anyone involved in the industry, from investors to everyday consumers.

Consequences for Businesses

The shakeout will undoubtedly lead to a significant restructuring of the e-commerce landscape. Companies that fail to adapt to changing market conditions, such as evolving consumer preferences, technological advancements, or intense competition, will face closure or significant downsizing. Successful businesses, on the other hand, will likely acquire struggling competitors or adapt to become more efficient. The implications for established companies range from mergers and acquisitions to significant operational changes to maintain market share.

Consequences for Consumers

Consumers will likely experience both positive and negative effects during a shakeout. A reduced number of major players might lead to fewer choices, especially in niche markets. However, it could also bring about more competitive pricing, enhanced customer service, and tailored product offerings. Consumers might experience price fluctuations, changes in delivery services, and potentially less variety in product choices in the short term.

Scenarios of Shakeout Unfolding

Several scenarios could play out during an e-commerce shakeout. One potential scenario involves large, established players acquiring smaller, struggling competitors, leading to a concentration of market share. Another scenario might see a significant number of smaller companies failing, leading to a more limited selection for consumers. These scenarios can also involve a mix of these factors, potentially with some companies emerging as dominant players, while others are forced to adapt or shut down.

Long-Term Effects on E-commerce Structure

The long-term impact of a shakeout will be profound, reshaping the very structure of the e-commerce industry. Companies that demonstrate resilience and adaptability will likely emerge as the leaders, characterized by innovation, advanced technology, and a strong understanding of consumer needs. Furthermore, the shakeout will likely accelerate the adoption of new technologies, such as artificial intelligence and automation, leading to a more efficient and personalized shopping experience.

Impact on Consumer Spending Patterns

Consumer spending patterns will be influenced by the shakeout, although the extent and direction are uncertain. In some cases, consumers might shift their spending to more established brands, anticipating greater stability and reliability. Conversely, they might be more inclined to try new, smaller companies that offer unique products or competitive pricing, leading to a more diversified spending pattern.

Potential Outcomes Table

| Outcome | Likelihood | Impact |

|---|---|---|

| Increased Competition among Top Players | High | Price wars, innovation, improved customer service |

| Emergence of New Dominant Players | Medium | Shift in market share, new business models |

| Significant Consolidation of Market Share | Medium | Reduced choice for consumers, potential for higher prices |

| Large-Scale Failures of Smaller Players | Medium-High | Reduced product variety, potential for job losses |

Strategies for Navigating a Shakeout

The e-commerce landscape is constantly evolving, and periods of intense competition and consolidation, or shakeouts, are inevitable. Understanding how to navigate these challenging times is crucial for survival and success. Businesses must adapt quickly to shifting market dynamics and customer preferences to remain competitive and thrive.Successfully weathering a shakeout requires a proactive approach, encompassing strategic adjustments across various operational facets.

Adaptability and a deep understanding of market trends are paramount. This includes proactively analyzing customer behaviors, adjusting pricing strategies, and exploring innovative solutions to meet evolving demands.

Adapting to Changing Market Conditions

Adaptability is key to surviving and thriving in a shakeout. Businesses need to continuously monitor market trends, customer preferences, and competitor actions. This involves analyzing data from various sources, such as sales figures, customer feedback, and market research reports. Recognizing emerging trends early enables businesses to adjust their strategies and offerings in a timely manner. For instance, a growing emphasis on sustainability might necessitate adjustments to product sourcing, packaging, and marketing efforts.

Customer-Centric Strategies

Understanding and anticipating customer needs is essential for success. Analyzing customer data and feedback can provide insights into evolving preferences, allowing businesses to tailor products and services accordingly. For example, if customers are demanding more personalized experiences, businesses should focus on building customized solutions. Providing exceptional customer service and building strong relationships with customers are vital in a shakeout, as customer loyalty can become a differentiating factor.

Exceptional customer service, proactive communication, and readily available support channels are critical during a period of intense competition.

Operational Efficiency and Cost Optimization

Operational efficiency and cost optimization are crucial during a shakeout. Businesses need to streamline operations, reduce unnecessary expenses, and find ways to improve their bottom line. This might involve optimizing supply chain management, automating processes, or negotiating better deals with suppliers. Examining current processes for inefficiencies, and leveraging technology to streamline operations can significantly reduce costs. Furthermore, analyzing and eliminating non-essential expenses can boost profitability.

Competitive Analysis and Differentiation

Recognizing and analyzing competitors is vital in a shakeout. Understanding their strategies, strengths, and weaknesses can provide insights into market positioning. This knowledge allows businesses to identify areas where they can differentiate themselves and offer unique value propositions to customers. For example, a company might focus on niche markets, offering specialized products or services to stand out from the competition.

Innovation in product offerings and service delivery are important. Developing new and improved offerings that resonate with customer needs and preferences is essential.

Investment in Innovation and Technology

Investing in innovation and technology is crucial to remain competitive during a shakeout. This can include developing new products or services, implementing new technologies to enhance operations, or improving existing processes. Embracing technological advancements, and leveraging data analytics to gain actionable insights are important. Examples include adopting new technologies like AI for customer service or implementing automation for order fulfillment.

Table: Key Strategies for E-commerce Businesses During a Shakeout

| Strategy | Description | Example |

|---|---|---|

| Adaptability | Continuously monitoring market trends and adjusting strategies | Responding to growing demand for sustainable products by adjusting sourcing and packaging |

| Customer-Centricity | Prioritizing customer needs and preferences | Providing personalized product recommendations and exceptional customer support |

| Operational Efficiency | Streamlining operations and reducing expenses | Automating order fulfillment processes and negotiating better supplier deals |

| Competitive Differentiation | Identifying unique value propositions to stand out from competitors | Focusing on niche markets or offering specialized products |

| Innovation and Technology | Investing in new technologies and processes | Implementing AI-powered chatbots for customer service |

Ending Remarks

In conclusion, the possibility of an e-commerce shakeout warrants careful consideration. The current market conditions, coupled with potential indicators, paint a picture of a dynamic and evolving landscape. Understanding the potential impact on businesses, consumers, and the broader economy is crucial. Navigating this evolving environment requires proactive strategies and adaptability. Ultimately, the question of whether a shakeout is imminent remains open, but the analysis presented here provides a framework for understanding the potential risks and opportunities.