Intuit moving to expand online payment offerings is a significant move, potentially reshaping the financial landscape. This expansion hints at a strategic shift for Intuit, likely driven by financial incentives and a desire to solidify its market position. Intuit’s existing product portfolio and the competitive landscape will play a crucial role in determining the success of this initiative.

This article explores the motivations behind this expansion, its potential impact on customers, market opportunities, and the technical, regulatory, and marketing considerations involved.

Intuit’s current online payment offerings are being analyzed, along with potential financial gains and strategic goals. The competitive landscape is being compared to Intuit’s current market position, and potential synergies between existing products and expanded online payment offerings are explored. We will also examine the potential impact on existing customers, considering potential benefits, challenges, and the diverse responses of various customer segments.

This expansion could open new avenues for Intuit, including identifying and targeting new customer segments, and integrating new payment features and technologies, potentially including AI-driven payment recommendations and customer service support.

Intuit’s Motivations for Expansion

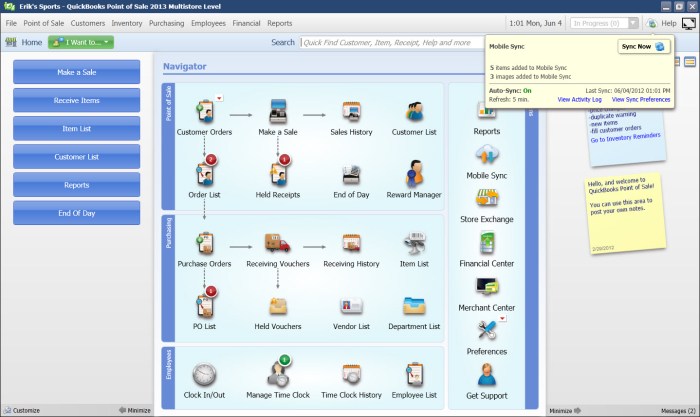

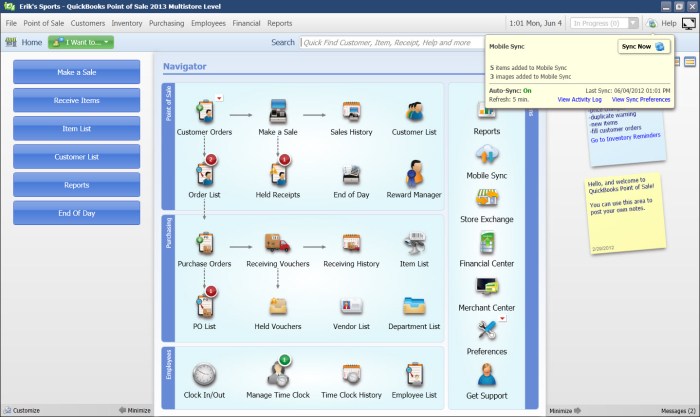

Intuit, a leading provider of financial software and services, has a rich history of innovation in the personal finance sector. Their current product suite includes popular offerings like TurboTax for tax preparation, QuickBooks for accounting, and Mint for personal finance management. Expanding into online payment processing could be a strategic move to further solidify their position in the financial ecosystem and potentially tap into new revenue streams.Intuit’s current online payment offerings likely encompass basic functionalities like online bill pay, potentially integrated with their existing accounting and personal finance tools.

However, expanding these offerings could unlock significant growth opportunities.

Intuit’s Current Online Payment Offerings

Intuit’s current online payment offerings are likely focused on supporting existing users. This might include functionalities like online bill pay and possibly some limited merchant services. Their primary strength lies in their existing user base and familiarity with financial data, which could be leveraged in expanded online payment offerings.

Potential Financial Incentives for Expansion

Expanding into online payment services could create significant financial incentives for Intuit. A larger user base and increased transaction volume could translate into substantial revenue generation. Further, fees associated with payment processing, particularly from merchant services, can yield substantial income. Considerably higher transaction volumes often equate to larger profit margins. For example, companies like Stripe and PayPal have demonstrated substantial revenue generation through online payment processing.

Strategic Goals Pursued Through Online Payment Expansion

Intuit could pursue several strategic goals by expanding into online payments. One key objective might be to enhance the overall value proposition of their existing products by integrating payment processing directly into their platforms. This would make financial management more streamlined for users. Another strategic goal could be to capture a larger market share in the online payment sector, competing with established players like Stripe, PayPal, and Square.

Intuit’s move to expand online payment options is a smart strategy, but it’s crucial to remember that e-commerce security is paramount. With the recent emergence of hacking tools like e commerce security alert bo2k hacking tool , businesses need to prioritize robust security measures. This means staying vigilant and proactively updating systems to protect customer data, which is crucial for Intuit’s continued success in the online payment space.

This would require a significant marketing effort.

Intuit’s move to expand online payment options is definitely interesting, but it’s also worth considering how other companies are adapting. For example, Victoria’s Secret, with its recent invitation to investors to “get intimate” ( victorias secret invites investors to get intimate ), is showing a different kind of financial expansion. Ultimately, both of these strategies highlight the ongoing evolution of online financial services and consumer engagement.

Competitive Landscape for Online Payment Services

The online payment sector is highly competitive, with established players like Stripe, PayPal, and Square holding significant market share. Intuit would need to differentiate its offering to gain a foothold in this competitive environment. This could involve emphasizing features like seamless integration with existing Intuit products, superior customer service, or potentially lower fees for certain user segments.

Comparison of Intuit’s Current Market Position to Competitors

Intuit’s strength lies in its vast user base, particularly in the small business and personal finance sectors. However, established online payment processors like Stripe and PayPal possess a broader reach and more extensive transaction processing infrastructure. Direct comparisons would require data on transaction volume, market share, and customer base size for each company. Intuit would need to demonstrate a clear competitive advantage to attract users and merchants.

Potential Synergies Between Intuit’s Existing Products and Expanded Online Payment Offerings

There are significant synergy opportunities. Intuit’s existing QuickBooks platform, for example, could benefit from seamless integration with online payment processing. This would simplify accounting and financial management for small businesses. Similarly, Mint could provide comprehensive financial insights by incorporating transaction data from online payments. This would improve user understanding of spending patterns and financial health.

Potential Impact on Existing Customers

Intuit’s expansion into online payment services presents both exciting opportunities and potential challenges for its existing customer base. Understanding the nuances of this shift is crucial for existing users to adapt and maximize the benefits while mitigating potential drawbacks. This expansion could significantly impact how Intuit users manage their finances and businesses.The introduction of expanded online payment options by Intuit could offer significant advantages to existing users.

These benefits could range from increased convenience and efficiency to new revenue streams and cost savings. However, careful consideration of potential drawbacks, such as security concerns and user interface compatibility, is also essential.

Potential Benefits for Existing Customers

Intuit’s existing customer base, which spans a broad spectrum of users from small business owners to individual taxpayers, will likely experience several benefits from enhanced online payment services. These improvements could streamline workflows, reduce costs, and create new opportunities.

Intuit’s move to broaden their online payment options is pretty significant. It shows a proactive approach to the evolving digital landscape. Interestingly, this expansion strategy mirrors a similar trend in the tech sector, like how esoft moves Linux into Southeast Asia , highlighting the increasing need for adaptable solutions in diverse markets. Ultimately, this kind of forward-thinking approach from Intuit will likely be crucial for their continued success in the competitive online payment space.

- Enhanced Convenience and Efficiency: Integrating online payment options directly into Intuit’s existing platforms could significantly streamline financial processes for users. Imagine seamlessly processing payments for invoices or handling client deposits without leaving the familiar Intuit interface. This integration will reduce the need for multiple logins and platforms, ultimately saving time and effort.

- Reduced Transaction Costs: Intuit might offer lower transaction fees or more competitive pricing compared to third-party payment processors, potentially saving customers money on every transaction.

- Increased Revenue Streams for Businesses: For business customers, expanded payment options could lead to new revenue opportunities. Integrating payment processing capabilities could enable the creation of new sales channels and increase the accessibility of their products and services.

Potential Challenges or Drawbacks for Existing Customers

While the potential benefits are substantial, existing Intuit customers might also face some challenges as the company expands its online payment offerings. These challenges could range from security concerns to potential disruptions in existing workflows.

- Security Concerns: Increased reliance on online payment systems raises security concerns. Robust security measures, including encryption and fraud prevention mechanisms, will be crucial to maintain customer trust and prevent financial losses.

- User Interface Compatibility: Integrating new payment functionalities into existing Intuit platforms might require a significant adjustment for some users. A smooth and intuitive user experience is essential to avoid user frustration and ensure the seamless adoption of new features.

- Potential for Disruption to Existing Workflows: The transition to a new payment system could disrupt existing workflows, requiring users to adapt their financial processes. Thorough training and support materials will be crucial to ease this transition.

Customer Segment Responses to Expansion

The impact of Intuit’s expanded online payment offerings will vary across different customer segments. Understanding these potential responses will help Intuit tailor its approach and address the specific needs of each group.

| Customer Segment | Potential Response | Example |

|---|---|---|

| Small Business Owners | Likely to be highly receptive to streamlined payment processing options. | A small business owner using QuickBooks could benefit greatly from seamless integration with online payment options, reducing manual data entry and increasing efficiency. |

| Individual Taxpayers | May be less immediately impacted, but still appreciate the convenience of having payment options integrated into their tax preparation software. | An individual taxpayer using TurboTax might find added convenience with payment integration for taxes, particularly for those who prefer digital transactions. |

| Large Businesses | Likely to focus on robust security measures and customized payment solutions tailored to their specific needs. | A large corporation using Intuit’s enterprise solutions might demand a sophisticated payment system with advanced fraud detection and customizable reporting capabilities. |

Market Analysis and Opportunities

Intuit’s expansion into online payment services presents a wealth of opportunities to tap into new customer segments and enhance existing offerings. Understanding the potential market, identifying target demographics, and evaluating innovative payment features are crucial for successful expansion. This analysis delves into the untapped potential and innovative approaches Intuit can leverage to solidify its position in the evolving financial technology landscape.Intuit’s existing customer base, primarily small businesses and self-employed individuals, already demonstrates a high degree of trust and reliance on the company’s products.

Expanding into online payment services can offer these customers seamless integration and further value. Furthermore, identifying and catering to new customer segments will broaden Intuit’s reach and revenue streams. This involves understanding the unique needs and preferences of these emerging customer groups and adapting payment offerings to address those specific requirements.

Potential New Customer Segments

Intuit can effectively target new customer segments by focusing on specific needs and pain points. For example, freelancers and gig workers, often operating outside traditional business structures, frequently require simplified invoicing and payment processing solutions. This segment, characterized by its high growth potential, presents an attractive target for Intuit’s expanded online payment offerings. Furthermore, young entrepreneurs and startups, with limited resources and often complex needs for financial management, are another promising customer segment.

Their specific requirements for flexible payment options, coupled with seamless integration with existing accounting tools, can make them ideal targets.

Size and Potential Growth of Targeted Segments

The freelancer and gig worker market is experiencing substantial growth, fueled by the increasing prevalence of remote work and independent contracting. Estimates show that this sector is rapidly expanding, presenting significant potential for Intuit to capture a substantial market share. Similarly, the startup and young entrepreneur market is also experiencing exponential growth, driven by technological advancements and the ease of launching new businesses.

These segments represent a significant opportunity for Intuit, given their potential to generate substantial revenue and contribute to sustained growth.

New Payment Features and Technologies

Intuit can leverage innovative payment technologies to further enhance its offerings. Mobile-first payment solutions are essential, enabling users to manage finances on the go. Furthermore, offering real-time transaction monitoring and reporting features can provide greater transparency and control over financial activities. Integration with emerging technologies like blockchain for enhanced security and efficiency in transactions could further differentiate Intuit’s offerings.

AI-Driven Payment Recommendations and Customer Service

Integrating AI into payment recommendations and customer service can significantly improve user experience. Personalized payment recommendations tailored to individual customer needs can streamline the payment process and increase user satisfaction. Furthermore, AI-powered customer service can provide quick and accurate responses to customer inquiries, resolving issues promptly and effectively.

Potential New Payment Methods

| Payment Method | Description | Potential Benefits |

|---|---|---|

| Peer-to-peer (P2P) Payments | Facilitating direct payments between individuals or businesses. | Enhanced convenience and speed for transactions, potentially lower fees. |

| Recurring Billing | Automated recurring payments for subscriptions and services. | Increased efficiency and reduced administrative burden for both businesses and customers. |

| International Payments | Enabling global transactions and payments across borders. | Expand reach into international markets for businesses. |

| Cryptocurrency Integration | Supporting the use of cryptocurrencies as payment methods. | Embrace a growing market and provide an advanced feature. |

Technological Considerations: Intuit Moving To Expand Online Payment Offerings

Intuit’s expansion into online payment processing necessitates a robust and scalable technological foundation. This involves not only the infrastructure to handle transactions but also the security protocols to protect sensitive financial data. Moreover, seamless integration with existing Intuit platforms is crucial for a smooth user experience and to avoid creating fragmented systems. Careful consideration of potential scalability challenges and the use of open banking or other APIs are essential for future growth and adaptability.

Technical Infrastructure

Intuit’s new payment processing system requires a highly available and secure infrastructure capable of handling fluctuating transaction volumes. This includes a robust payment gateway, secure servers, and reliable network connectivity. High availability is critical to minimize downtime and ensure uninterrupted service to customers. The system must be designed with redundancy in mind to withstand potential outages and maintain operational continuity.

Real-time transaction processing and low latency are also crucial for providing a seamless customer experience.

Security Protocols

Implementing stringent security protocols is paramount for protecting customer financial data. This includes employing encryption technologies like TLS/SSL to secure data transmission between the user’s device and Intuit’s servers. Multi-factor authentication (MFA) should be a mandatory security measure to prevent unauthorized access. Regular security audits and penetration testing are essential to identify and address potential vulnerabilities. Compliance with relevant financial regulations, such as PCI DSS, is also a critical consideration.

The security measures must be regularly updated to address evolving threats and maintain a high level of protection.

Scalability Challenges

Expanding online payment systems presents significant scalability challenges. Intuit needs to anticipate future transaction growth and ensure the system can handle increased load without compromising performance or security. This might involve cloud-based infrastructure to dynamically adjust resources based on demand. Careful load balancing and efficient database design are essential to manage peak transaction volumes. The system architecture should be designed with scalability in mind from the outset to avoid costly and time-consuming upgrades later on.

Integration with Existing Platforms

Seamless integration with Intuit’s existing tax preparation, financial management, and accounting platforms is crucial for a cohesive user experience. This requires careful API design and development to ensure data consistency and avoid data silos. Data transfer between platforms must be secure, reliable, and efficient to minimize errors and maximize user productivity. This integration can streamline workflows, provide users with a unified view of their financial data, and improve overall user satisfaction.

Leveraging Open Banking or APIs

Open banking APIs and other third-party integrations can significantly expand Intuit’s reach and functionality. By leveraging these APIs, Intuit can access a wider range of financial data from different institutions, enabling new services and features. This can improve the accuracy and completeness of financial reports, enabling more personalized financial advice and insights. Careful consideration of regulatory compliance and data security is paramount when integrating with third-party systems.

This integration can also enhance user experience and streamline processes by offering more comprehensive financial information.

Payment Processing Platform Comparison

| Platform | Pros | Cons | Suitability for Intuit |

|---|---|---|---|

| Stripe | Wide range of features, robust security, established infrastructure | Can be expensive for high-volume transactions | High suitability due to comprehensive features and security |

| PayPal | Large user base, established brand recognition | Limited customization options, potential integration complexities | Moderate suitability, but requires careful consideration of integration |

| Square | Ease of use, user-friendly interface | Limited advanced features, potentially higher transaction fees | Low suitability for complex needs, but potentially suitable for certain Intuit products |

| Adyen | Global reach, advanced payment methods, excellent scalability | Complex setup and high upfront costs | High suitability for Intuit’s global expansion ambitions |

Marketing and Communication Strategy

Intuit’s expansion into online payment offerings requires a comprehensive marketing strategy to effectively communicate the value proposition to existing and potential customers. This strategy needs to clearly articulate the benefits and ease of use, emphasizing how these new services enhance the overall Intuit experience. A well-defined approach will build customer trust and drive adoption.

Communicating the Expansion to Customers

A multi-faceted approach is crucial for communicating the expansion. This includes targeted messaging across various channels, highlighting the benefits of expanded services for different customer segments. Transparency and clear communication about pricing and features are vital to building customer trust. Regular updates and customer support are essential for maintaining positive relationships.

Marketing Channels for Target Customer Segments

Intuit should leverage a mix of online and offline channels to reach its target customer segments. For example, targeted advertising campaigns on social media platforms, search engines, and relevant industry publications can reach potential customers. Collaborations with complementary businesses or partners can introduce Intuit’s services to new audiences. Direct mail campaigns and in-person events can also be effective for reaching specific customer segments.

- Social Media Marketing: Targeted advertising campaigns on platforms like Facebook, Instagram, and LinkedIn can reach specific customer demographics. Influencer marketing campaigns can build credibility and awareness among specific customer segments.

- Search Engine Optimization (): Optimizing website content and online materials for relevant s will improve visibility and attract customers actively searching for online payment services.

- Email Marketing: Personalized email campaigns can inform existing customers about new features and highlight benefits tailored to their specific needs.

- Content Marketing: Creating valuable content, such as blog posts, articles, and webinars, positions Intuit as a thought leader in the online payment space and attracts potential customers seeking information.

Messaging Strategies to Highlight Benefits

The messaging should emphasize the key benefits of expanded online payment services. These benefits should be tailored to the specific needs of each customer segment, and clearly communicated. Examples include increased convenience, faster transactions, reduced costs, and enhanced security.

- Focus on Ease of Use: Highlight the intuitive interface and user-friendly experience of the new payment platform, emphasizing how it streamlines payment processes and saves time.

- Security and Reliability: Emphasize robust security measures and reliable transaction processing to build customer trust and confidence.

- Cost Savings: Clearly articulate the cost advantages of the new payment options, emphasizing reduced transaction fees and increased efficiency.

- Convenience and Speed: Highlight the speed and convenience of online payments, emphasizing how they eliminate the need for physical transactions and accelerate business processes.

Potential Pricing Models for New Online Payment Services

Intuit should consider various pricing models to attract different customer segments. A tiered pricing structure, offering varying levels of service and fees, can cater to diverse needs and budgets. Transaction-based fees, subscription models, and fixed monthly fees are possible options.

- Tiered Pricing: Offer different levels of service with varying fees, catering to small business owners, medium-sized enterprises, and large corporations with different payment volumes and needs.

- Transaction-Based Fees: Charge a fee per transaction, which can be attractive for businesses with high transaction volumes.

- Subscription Models: Offer a monthly or annual subscription fee for access to specific features and functionalities, suitable for businesses with predictable payment needs.

- Fixed Monthly Fees: Provide a flat monthly fee for a specific level of service, simplifying pricing for customers with consistent payment needs.

Potential Marketing Campaigns for Different Customer Segments

| Customer Segment | Marketing Campaign Focus | Key Messaging | Marketing Channels |

|---|---|---|---|

| Small Businesses | Highlight ease of use and affordability | Streamline payments, reduce costs, save time | Social media ads, targeted email campaigns, local events |

| Medium-Sized Businesses | Emphasize scalability and reliability | Efficient payment processing, secure transactions, increased efficiency | Industry publications, webinars, business-to-business (B2B) networking |

| Large Corporations | Showcase advanced features and customization options | Robust payment infrastructure, seamless integration, tailored solutions | Executive briefings, personalized consultations, strategic partnerships |

Regulatory and Compliance Considerations

Navigating the online payment landscape requires a meticulous understanding of regulatory frameworks. Intuit’s expansion into online payment processing necessitates a comprehensive approach to compliance, encompassing data security, privacy, and payment processing regulations. This section Artikels the key considerations and steps to ensure seamless integration with existing and future regulations.

Potential Regulatory Hurdles

Expanding online payment offerings brings a range of potential regulatory challenges. These hurdles can vary significantly based on geographical location and specific payment types. Jurisdictions with stringent consumer protection laws might impose additional compliance requirements. For instance, regulations regarding customer dispute resolution and chargebacks need careful consideration. Additionally, evolving standards for anti-money laundering (AML) and know-your-customer (KYC) protocols require ongoing vigilance.

Data Security and Privacy Regulations

Data security and privacy are paramount. Intuit must adhere to stringent regulations such as the General Data Protection Regulation (GDPR) in Europe and similar laws in other regions. These regulations dictate how personal data is collected, stored, and used. Compliance necessitates robust encryption protocols, secure data storage systems, and transparent data handling policies. Failure to comply can result in substantial penalties and reputational damage.

Payment Processing Regulations

Payment processing regulations vary across countries. Understanding and complying with these regulations is critical for seamless operation. Regulations governing transaction authorization, fraud prevention, and reporting requirements need to be meticulously evaluated. For instance, the Payment Card Industry Data Security Standard (PCI DSS) is crucial for protecting credit card information. Non-compliance with PCI DSS can lead to significant financial penalties and card network restrictions.

Compliance Steps, Intuit moving to expand online payment offerings

A comprehensive compliance strategy requires a multi-faceted approach. First, a thorough review of all applicable regulations is essential. Secondly, establishing a robust compliance framework encompassing policies, procedures, and training programs is critical. Thirdly, implementing and maintaining secure systems is crucial. Finally, conducting regular audits and risk assessments is vital to ensure ongoing compliance.

Internal audits and external audits must be considered.

Key Regulatory Considerations for Online Payments

| Regulatory Area | Key Considerations | Example |

|---|---|---|

| Data Security | Encryption, secure storage, access controls, incident response plans. | Implementing AES-256 encryption for sensitive data. |

| Privacy | GDPR, CCPA, and other regional privacy laws. Transparency and consent are critical. | Clearly outlining data collection and usage practices in privacy policies. |

| Payment Processing | PCI DSS, AML/KYC, transaction authorization, fraud prevention, and reporting requirements. | Meeting PCI DSS requirements for credit card processing. |

| Consumer Protection | Dispute resolution mechanisms, chargeback policies, and consumer rights. | Establishing a clear process for handling customer disputes. |

Potential Future Developments

Intuit’s expansion into online payment offerings presents exciting opportunities for future innovation. Beyond immediate improvements, the company can explore integrated services and leverage emerging technologies to create a comprehensive and user-friendly platform for its customers. This will not only enhance their existing services but also position Intuit as a leader in the evolving financial technology landscape.The future of online payments is dynamic and full of potential.

Intuit can capitalize on this by incorporating innovative features and focusing on long-term strategic goals, which will allow the company to adapt to the evolving needs of its customers.

Potential Integrated Features

Intuit can enhance its payment offerings by integrating additional financial tools and services directly within its platform. This could include features like automated savings accounts, linked budgeting tools, or personalized financial advice. This holistic approach would foster stronger customer relationships and generate more revenue streams for the company. For instance, integrating a budgeting tool directly into QuickBooks could significantly improve the user experience and encourage users to manage their finances more effectively.

This could also include payment protection services and dispute resolution systems, which are vital to fostering trust and customer satisfaction in the digital payment ecosystem.

Long-Term Goals for Online Payments

Intuit’s long-term goals for online payments should align with its overall strategy of empowering small businesses and individuals with financial tools. This could involve creating a seamless, integrated platform that streamlines all financial transactions. One such example could be a platform that allows users to easily transfer funds between different Intuit products or services, or even connect to other financial institutions for a comprehensive financial overview.

Intuit could strive to create a one-stop shop for all financial needs, from managing accounts to receiving payments and making transactions.

Emerging Payment Trends

Intuit should proactively analyze emerging payment trends and explore how to integrate them into its platform. One key trend is the increasing use of mobile wallets and contactless payments. Intuit can leverage this trend by developing mobile payment solutions that are seamlessly integrated with its existing services. Another notable trend is the growth of alternative payment methods, like cryptocurrencies.

Intuit could explore integrating cryptocurrency options into its platform, keeping in mind regulatory considerations and the need to maintain user trust. Intuit could also investigate incorporating peer-to-peer payment options, fostering increased flexibility and ease of use for its customers.

Leveraging Blockchain and Emerging Technologies

Blockchain technology presents exciting opportunities for enhancing security and transparency in online payments. Intuit can explore how blockchain can be used to create more secure payment processing systems. This might include exploring the use of blockchain for verifying transactions, reducing fraud, and improving the speed and efficiency of payment processing. Other emerging technologies like AI and machine learning could be utilized to provide personalized financial recommendations and identify potential fraud more accurately.

For instance, Intuit could leverage AI to identify and flag potentially fraudulent transactions in real-time, enhancing security for all users.

Final Summary

Intuit’s expansion into online payments presents a multifaceted opportunity. The move promises to significantly alter the company’s offerings, creating new avenues for revenue and potentially enhancing customer experiences. However, careful consideration of the competitive landscape, customer needs, and regulatory hurdles is crucial. Intuit’s strategic approach to this expansion will be key to its success, and the long-term impact on both Intuit and its customers remains to be seen.

The company will need to effectively address the technological, marketing, and regulatory considerations to ensure a smooth transition and maintain a strong competitive edge.