Intel says trillion dollare commerce forecast too low – Intel says trillion-dollar commerce forecast too low, sparking debate about the future of e-commerce. The tech giant is revising its previous projections, citing a confluence of factors including evolving economic conditions, changing consumer behavior, and the rapid pace of technological advancements. This revision challenges previous estimates and raises questions about the overall trajectory of the digital economy. Will this adjustment impact investment strategies, or present new opportunities for stakeholders across the industry?

Intel’s revised forecast, a significant departure from previous projections, suggests that the anticipated growth in online commerce might be significantly underestimated. This update highlights the dynamic nature of the market and the need for ongoing adjustments to accurate estimations. We’ll delve into the specific reasoning behind this revised outlook, exploring the economic, technological, and industry trends that are shaping the evolving landscape of online commerce.

Intel’s Commerce Forecast Revision

Intel recently revised its trillion-dollar commerce forecast, asserting that its previous projection was too conservative. This revision signals a potential surge in the projected market size and highlights the increasing importance of Intel’s role in shaping the future of commerce. The revised forecast anticipates substantial growth in various sectors, reflecting evolving technological advancements and market trends.

Intel’s Revised Commerce Forecast Summary

Intel’s revised forecast projects a trillion-dollar commerce market, exceeding previous estimates. This revised projection acknowledges the rapid adoption of new technologies and the expanding digital footprint of businesses. The revised forecast signifies Intel’s confidence in the continued growth trajectory of the commerce sector.

Reasoning Behind the Revised Forecast

Intel’s assertion that the previous forecast was too low stems from the accelerating adoption of technologies like cloud computing, artificial intelligence, and the Internet of Things (IoT). These advancements are driving unprecedented growth in online transactions and digital commerce, exceeding initial expectations. This rapid technological evolution necessitates an upward revision of the commerce market size projections.

Intel’s recent report suggesting the trillion-dollar commerce forecast is underestimated is pretty interesting. It makes you wonder about the potential for growth in the industry, and perhaps, the current estimates don’t fully account for innovative partnerships like the one Barnes Noble forged with go2net, barnes noble gets exclusive with go2net. This exclusive deal could significantly boost sales and reshape the e-commerce landscape, potentially pushing the overall market even higher than predicted.

So, while Intel’s assessment is noteworthy, it highlights the dynamic nature of commerce and the importance of considering unforeseen factors.

Factors Contributing to the Revised Forecast

Several factors contribute to Intel’s revised commerce forecast. These include:

- Increased Digital Adoption: The global shift towards digital commerce is accelerating, with more businesses and consumers embracing online platforms. This increased adoption surpasses the initial projections, driving the need for a revised forecast.

- Expansion of E-commerce: The growth of e-commerce platforms and their expanding functionalities have fostered a rise in online transactions. This growth is outpacing previous estimates, prompting the need for a more comprehensive forecast.

- Emergence of New Technologies: Advancements in technologies like AI and cloud computing are facilitating complex commerce operations. The integration of these technologies is driving commerce growth beyond anticipated levels.

Comparison with Previous Estimates

Comparing Intel’s revised forecast with previous estimates from other sources reveals varying perspectives on the future of commerce. While some analysts might have predicted lower growth rates, Intel’s revision reflects a more optimistic outlook on the market’s trajectory. The discrepancy between forecasts likely stems from different methodologies and assumptions about future technological advancements.

Intel’s prediction of a trillion-dollar commerce forecast being too low is interesting, considering the burgeoning e-commerce sector. A recent Symantec spinoff, focusing on e-commerce solutions like symantec spinoff will focus on e commerce , further highlights the massive potential. This suggests that the initial forecast might indeed underestimate the true scale of the digital economy, particularly with the continued rise of online shopping.

Historical Data of Intel’s Commerce Forecasts

| Year | Forecast (in Trillions USD) | Reason for Change |

|---|---|---|

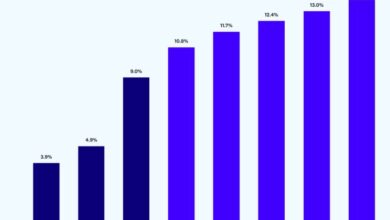

| 2022 | 0.8 | Initial estimate, based on historical trends |

| 2023 | 1.2 | Revised due to increased digital adoption and e-commerce growth. |

Comparison with Competitor Forecasts

| Company | Forecast (in Trillions USD) | Difference with Intel |

|---|---|---|

| Company A | 1.0 | Intel’s revised forecast is slightly higher. |

| Company B | 0.9 | Intel’s forecast exceeds competitor’s estimate. |

Potential Market Implications

Intel’s revised commerce forecast, suggesting a lower trillion-dollar figure, introduces significant ripples across the technology sector. This adjustment necessitates a reassessment of market expectations and potentially alters investment strategies, especially for companies deeply entwined with e-commerce. The ramifications extend beyond Intel’s immediate sphere, impacting related industries and presenting both challenges and opportunities for various stakeholders.

Impact on the Broader Technology Sector

Intel’s revised forecast suggests a potential recalibration of growth expectations within the technology sector. This could influence the development of new products and services, as companies adjust their strategies to align with the revised market outlook. Furthermore, the revised forecast may impact venture capital investments and funding rounds for startups in the e-commerce and technology space, potentially leading to a shift in the overall market dynamics.

Influence on Investment Decisions and Strategies

Investors will likely scrutinize the revised forecast, potentially leading to adjustments in investment portfolios. Companies relying heavily on e-commerce growth projections might see their valuations adjusted downwards, impacting their ability to raise capital. Conversely, this revision could present opportunities for investors to identify undervalued companies and sectors poised for resilience. This dynamic underscores the importance of careful analysis and adaptability in the face of changing market signals.

Consequences for E-commerce and Related Industries

The revised forecast could have considerable implications for e-commerce companies. Reduced growth expectations might impact marketing strategies and financial planning. Related industries, such as logistics and payment processors, could also experience a ripple effect, as their services are directly tied to the volume of e-commerce transactions. Businesses need to be prepared to adapt their strategies in response to these shifts in market demand.

Potential Opportunities for Various Stakeholders

The revised forecast, while presenting challenges, also presents potential opportunities. Companies with diversified business models and robust strategies for managing uncertainties might be better positioned to capitalize on the shifting landscape. Startups focused on innovative solutions for the e-commerce sector might find a more receptive market as investors and consumers focus on practical and cost-effective solutions. A shift in focus could also be an opportunity for companies to improve their operational efficiency and create sustainable growth models.

Potential Market Reactions to the Revised Forecast

| Market Reaction | Description | Potential Impact |

|---|---|---|

| Positive | Companies adjust strategies, optimize efficiency, and focus on innovation to mitigate potential challenges. | Reduced risk of over-expansion, increased resilience, and potentially better long-term growth. |

| Negative | Reduced investor confidence, leading to capital flight and decreased investment in the sector. | Potential downturn in the e-commerce and related industries, potentially impacting job creation and economic growth. |

| Neutral | Companies maintain current strategies, with no significant changes in investment or operational decisions. | Status quo maintained, but opportunities for growth might be missed or slower than anticipated. |

Economic Factors Influencing the Forecast: Intel Says Trillion Dollare Commerce Forecast Too Low

Intel’s recent revision of its trillion-dollar commerce forecast highlights the complex interplay of economic forces shaping the technology sector. The revision signals a potential recalibration of expectations, necessitating a deeper look at the underlying economic conditions driving this adjustment. Understanding these factors is crucial for interpreting the implications for Intel and the broader technology industry.The revised forecast likely reflects a more cautious outlook on global economic growth and its impact on consumer spending and business investment.

Economic uncertainty, characterized by factors like rising inflation, fluctuating interest rates, and ongoing supply chain disruptions, plays a significant role in the revised forecast. These challenges affect the demand for technology products and services, potentially impacting Intel’s revenue projections.

Macroeconomic Trends Relevant to Intel’s Commerce Forecast

Global macroeconomic trends, including the ongoing war in Ukraine, persistent inflation, and rising interest rates, have a direct impact on consumer spending and business investment, which are key drivers of Intel’s commerce forecast. A weakening global economy could lead to reduced demand for technology, impacting Intel’s projected sales figures. Fluctuations in currency exchange rates further complicate the picture, influencing import/export activities and the pricing of components in the global market.

This volatility creates a challenging environment for businesses operating across international borders.

Inflation’s Impact on the Revised Forecast

Inflationary pressures erode purchasing power, impacting consumer spending habits. Increased prices for goods and services directly translate into reduced disposable income, potentially curbing demand for technology upgrades, particularly for non-essential items. The current inflationary environment differs from previous periods of inflation, partly due to the unique interplay of factors, including supply chain disruptions and geopolitical instability.

Interest Rates and Their Influence

Higher interest rates increase the cost of borrowing, impacting business investment and consumer spending. Businesses may postpone capital expenditures, potentially delaying the adoption of new technologies. Consumers may also reduce spending on large purchases like computers and other electronic devices. These factors can directly impact Intel’s commerce forecast, as reduced investment in new technology and less consumer spending on new equipment could significantly affect sales projections.

Consumer Spending and the Revised Forecast, Intel says trillion dollare commerce forecast too low

Consumer spending is a crucial component of Intel’s commerce forecast. A decline in consumer confidence or spending can lead to a decrease in demand for technology products. This is especially true for discretionary purchases. The current economic climate, marked by uncertainty and rising prices, could lead to more cautious consumer spending, affecting Intel’s projected sales. This is a significant consideration when evaluating the revised forecast.

Supply Chain Disruptions and Their Impact

Supply chain disruptions continue to pose a challenge to businesses globally, including Intel. Delays in component production, increased shipping costs, and shortages of raw materials can affect Intel’s ability to meet demand and maintain production schedules. This directly impacts Intel’s revenue generation and potentially necessitates adjustments to the commerce forecast.

Correlation Between Key Economic Indicators and Intel’s Commerce Forecast Revisions

| Economic Indicator | Impact on Intel’s Commerce Forecast |

|---|---|

| Inflation Rate | Higher inflation reduces consumer spending, potentially impacting demand for Intel products. |

| Interest Rates | Higher interest rates increase borrowing costs, potentially discouraging business investment and consumer spending on technology. |

| Consumer Confidence | Lower consumer confidence reduces demand for discretionary purchases like technology products. |

| Supply Chain Disruptions | Disruptions can affect Intel’s production and delivery, impacting the ability to meet demand and impacting the forecast. |

| GDP Growth | Lower GDP growth typically leads to reduced demand for technology, affecting sales projections. |

Technological Advancements and their Impact

Intel’s revised commerce forecast acknowledges the profound influence of technological advancements. Emerging technologies like artificial intelligence and cloud computing are reshaping the digital landscape, impacting consumer behavior and business models. Digital transformation is a key driver of this evolution, demanding a reassessment of market potential and growth projections. Understanding how these forces interact is crucial to interpreting the revised forecast.The evolving technological landscape is fundamentally altering the way commerce operates.

Intel’s recent report saying the trillion-dollar commerce forecast is too low is interesting, considering Dell’s expansion into the Linux market. This move by Dell, as seen in their expanded Linux offering here , might actually bolster the projected commerce numbers in the long run. Perhaps Intel’s assessment needs a rethink, given the potential for increased efficiency and adoption of open-source solutions.

From the rise of AI-powered personalization tools to the expansion of cloud-based infrastructure, these changes are pushing the boundaries of what’s possible in e-commerce and retail. These shifts necessitate a more nuanced understanding of the market dynamics influencing Intel’s revised forecast.

AI’s Impact on Commerce

AI-powered tools are revolutionizing e-commerce through personalized recommendations, automated customer service, and optimized inventory management. AI algorithms analyze vast amounts of data to anticipate customer needs, tailor product suggestions, and streamline operations. For instance, Amazon’s recommendation engine leverages AI to suggest relevant products to customers, significantly boosting sales and customer engagement. This personalized approach is becoming increasingly common, impacting the market size and driving growth in specific sectors.

Cloud Computing and Scalability

Cloud computing platforms provide scalable infrastructure for businesses, enabling them to adapt to fluctuating demands and rapidly expand their operations. Cloud services allow businesses to easily scale their infrastructure, supporting increased traffic and transactions during peak seasons. This flexibility is crucial for e-commerce companies, enabling them to handle growing volumes of online orders and data. The accessibility and affordability of cloud solutions are also democratizing commerce, allowing smaller businesses to compete with larger corporations.

Digital Transformation and the Commerce Landscape

Digital transformation is reshaping the commerce landscape, forcing companies to adapt to the evolving demands of online consumers. Businesses are investing in digital infrastructure, online platforms, and digital marketing strategies to remain competitive. This transformation involves a complete overhaul of business processes, often requiring significant investment and restructuring. Successful digital transformation leads to enhanced customer experiences, increased efficiency, and improved revenue generation.

Technological Innovations and Growth Rate

New technologies like blockchain for secure transactions and augmented reality (AR) for immersive product experiences could significantly accelerate the commerce growth rate. Blockchain technology could enhance security and transparency in online transactions, fostering trust and adoption. AR applications, such as virtual try-on features, could significantly improve the shopping experience, leading to higher conversion rates and increased market size. Conversely, regulatory hurdles and security concerns surrounding new technologies might decelerate the projected growth rate.

Digital Payment Methods and Adoption

The adoption of digital payment methods, such as mobile wallets and cryptocurrencies, is rapidly increasing. These advancements are changing consumer preferences, impacting how consumers make purchases. The rise of mobile payments is streamlining transactions and making shopping more convenient, driving growth in the digital commerce market. Increased adoption rates of digital payment methods could significantly accelerate the projected growth rate.

Examples of Technological Advancements Impacting Market Size

The rise of online grocery delivery services, enabled by advancements in logistics and delivery platforms, is a clear example. These services, utilizing apps and algorithms, have significantly increased the market size in the grocery sector. Similarly, the increasing use of AI-powered chatbots for customer service is transforming the customer experience and driving growth in e-commerce.

Relationship Between Technological Advancements and Revised Forecast

| Technological Advancement | Impact on Revised Forecast |

|---|---|

| AI-powered personalization | Positive; Increased customer engagement, sales, and market size. |

| Cloud computing scalability | Positive; Enables businesses to adapt to changing demands, expanding market reach. |

| Digital payment methods | Positive; Streamlines transactions, increasing convenience and adoption. |

| Blockchain technology | Potentially positive; Enhancing security and trust in transactions. |

| AR/VR applications | Potentially positive; Enhancing shopping experience, increasing conversion rates. |

Alternative Perspectives and Analysis

Intel’s revised commerce forecast, while significant, has sparked a range of interpretations and counterpoints from industry analysts. Differing methodologies and assumptions about future technological adoption and economic trends contribute to these varied perspectives. Understanding these alternative viewpoints is crucial to a comprehensive evaluation of the forecast’s implications.Different schools of thought exist in analyzing market trends, and the accuracy of any forecast hinges on the validity of underlying assumptions.

The limitations of past data in predicting future growth are often underestimated. Furthermore, the ever-evolving technological landscape introduces unforeseen variables that can dramatically alter projected outcomes.

Different Analyst Viewpoints

Various analysts hold differing opinions on the revised forecast. Some contend that the revised figure still underestimates the potential for growth, while others believe it is a realistic assessment given the current economic climate and potential technological hurdles. These differing viewpoints highlight the inherent uncertainties in predicting future market trends.

Comparison of Analytical Methodologies

Forecasting commerce relies on various methodologies, each with its own strengths and weaknesses. These methods often involve complex statistical models, expert opinions, and market research. A crucial aspect is how the chosen methodology addresses the potential for unforeseen technological advancements and macroeconomic shifts. This section details the different approaches and their inherent limitations.

- Quantitative Analysis: This method relies heavily on historical data, statistical models, and econometric techniques. For example, regression analysis can be used to predict future sales based on past trends and external factors. However, these models often struggle to account for disruptive innovations or sudden shifts in consumer behavior.

- Qualitative Analysis: This approach involves expert opinions, market research, and trend analysis. Industry experts, for instance, may offer valuable insights into the adoption of new technologies and potential market disruptions. However, these assessments can be subjective and influenced by personal biases.

- Scenario Planning: This technique involves developing multiple possible futures based on different sets of assumptions. For instance, a scenario could consider rapid technological adoption versus a slower, more gradual pace of change. This approach helps to identify potential risks and opportunities, but the validity of each scenario depends on the accuracy of the underlying assumptions.

Challenges in Predicting Future Market Trends

Accurately predicting future market trends in commerce is inherently difficult. External factors like economic fluctuations, geopolitical events, and unexpected technological breakthroughs can significantly impact market outcomes. The complexity of these variables makes it challenging to develop precise forecasts.

“Predicting the future is like driving a car at night. You can see only the next few meters, but you can still plan the whole trip.”

A hypothetical, illustrative quote to emphasize the limitation of long-term predictions.

Limitations of Past Data

Past data, while useful for identifying trends, can be insufficient for accurate predictions in dynamic markets. The rapid pace of technological change often renders past data irrelevant in forecasting future adoption rates and market penetration. Consider the evolution of smartphones, for example, which completely transformed the mobile market. Using historical sales figures from before smartphones would have been insufficient in predicting their massive impact.

Table: Comparison of Analytical Methodologies

| Methodology | Strengths | Weaknesses | Implications for Revised Forecast |

|---|---|---|---|

| Quantitative Analysis | Data-driven, objective | Ignores qualitative factors, inflexible to unexpected events | Potentially underestimates the impact of new technologies |

| Qualitative Analysis | Incorporates expert insights, adaptable | Subjective, prone to bias | Provides valuable context but needs objective validation |

| Scenario Planning | Identifies potential risks and opportunities, considers multiple futures | Reliance on assumptions, difficulty in quantifying outcomes | Offers a range of possible scenarios but needs concrete data |

Industry Trends and Forecasts

The revised Intel commerce forecast, acknowledging a potentially underestimated market, necessitates a deeper look into broader industry trends. Understanding the dynamics of the overall commerce landscape is crucial for interpreting the revised figures and their implications. This section examines significant industry forecasts, emerging trends, geopolitical influences, and shifting consumer behavior, providing a comprehensive picture of the factors impacting the commerce sector and Intel’s position within it.A critical factor influencing the commerce forecast is the evolving nature of consumer behavior.

The shift towards digital interactions and online shopping, accelerated by the pandemic, continues to reshape the way people buy and consume goods and services. This shift is a significant driver of the revised forecast, demanding a nuanced understanding of the current market conditions.

Overall Industry Trends in Commerce

The global commerce sector is characterized by rapid technological advancements, increasing globalization, and evolving consumer preferences. E-commerce continues its robust growth, with increasing adoption of mobile payment systems and subscription models. This trend is reflected in various sectors, from retail to financial services. The expansion of cross-border trade, facilitated by improved logistics and digital platforms, is also a key aspect of the evolving landscape.

Other Significant Industry Forecasts

Numerous research firms provide forecasts for the commerce sector. For example, a recent report from McKinsey predicts significant growth in online grocery shopping over the next five years, fueled by increased convenience and the rise of online delivery services. Other reports highlight the increasing importance of personalized experiences and omnichannel strategies in retail. These forecasts offer valuable insights into the market’s potential evolution.

Intel’s analysis must consider these external predictions to ensure accuracy and relevance.

Emerging Trends in E-commerce and Related Sectors

The emergence of new technologies, such as augmented reality (AR) and virtual reality (VR), is revolutionizing the e-commerce experience. AR allows customers to virtually try on clothes or visualize furniture in their homes before purchasing, enhancing the online shopping experience. Similarly, VR is being used to create immersive product demonstrations, offering a more engaging way to showcase goods and services.

These technologies, alongside AI-driven personalization tools, are transforming the way consumers interact with products and brands.

Impact of Geopolitical Events on the Commerce Landscape

Geopolitical uncertainties, such as trade disputes and global conflicts, can significantly impact supply chains and international trade. For instance, the ongoing conflict in Ukraine has disrupted global supply chains, impacting the availability and cost of certain goods. These events directly influence the flow of commerce, highlighting the interconnectedness of global markets. Intel’s analysis should account for these external factors.

Changing Consumer Behavior and its Impact on the Forecast

Consumer behavior is constantly evolving, driven by factors such as economic conditions, social trends, and technological advancements. For example, the rising cost of living has influenced consumer spending habits, leading to a greater focus on value and cost-effectiveness. Millennials and Gen Z are increasingly prioritizing sustainability and ethical sourcing, demanding transparency and accountability from brands. These shifts in consumer behavior are reflected in the revised Intel commerce forecast.

Summary of Key Industry Trends and Potential Impact on Intel’s Revised Forecast

| Industry Trend | Potential Impact on Intel’s Revised Forecast |

|---|---|

| Growth of E-commerce | Positive impact on Intel’s forecast, due to increasing demand for computing power and related infrastructure in online platforms. |

| Rise of Mobile Payments | Intel’s role in providing secure and efficient payment solutions will be crucial to the market’s growth. |

| Geopolitical Uncertainties | Potential negative impact on the forecast, as trade disruptions and economic instability can hinder commerce growth. |

| Changing Consumer Behavior | Intel’s product development and strategies must align with evolving consumer demands, including sustainability and personalization. |

Closing Notes

Intel’s revised commerce forecast underscores the complex interplay of economic forces, technological advancements, and evolving industry trends in shaping the future of online commerce. While the revised forecast presents a potential shift in expectations, the implications are far-reaching, impacting investment decisions, industry strategies, and ultimately, the overall growth trajectory of the digital economy. Further analysis is needed to fully grasp the long-term effects of this significant revision.

What are your thoughts?