IMall goes vertical with pure payments, a bold move that promises a significant shift in the e-commerce landscape. This strategic integration of a pure payments platform signals a major evolution for IMall, likely driven by the desire to enhance customer experience and gain a competitive edge. Expect a deeper dive into the rationale behind this decision, analyzing the potential impacts on IMall’s existing infrastructure, competitive position, and customer base.

The integration will fundamentally alter IMall’s payment processing, affecting everything from partner relationships to customer service. The change promises faster, more secure, and more convenient transactions. We’ll explore the specifics of “pure payments” and how it contrasts with traditional methods, providing a clear picture of the expected changes for IMall’s users.

Overview of IMall’s Vertical Integration

IMall’s recent foray into vertical integration, specifically with pure payments, signals a significant shift in its business strategy. This move aims to enhance operational control and potentially unlock new revenue streams, but also introduces inherent risks. Understanding the motivations, anticipated benefits, and potential challenges is crucial for assessing the long-term impact of this integration.

Key Motivations Behind the Shift

IMall’s decision to vertically integrate its payment processing is driven by a desire to gain greater control over its payment infrastructure. This includes streamlining operations, reducing reliance on third-party providers, and potentially leveraging data to improve customer experience. Improved operational efficiency and potentially lower transaction costs are significant incentives. By controlling the entire payment process, IMall hopes to optimize its overall financial performance and reduce its exposure to external factors.

Potential Benefits Anticipated by IMall

This integration is expected to bring several advantages. Firstly, enhanced operational control allows IMall to tailor the payment process to its specific needs, enabling more agile responses to market changes. Secondly, improved cost management through internalization of payment processing could translate into lower transaction fees, leading to higher profit margins. Lastly, the direct access to customer payment data will enable IMall to personalize offerings and create more targeted marketing campaigns, potentially boosting customer loyalty and sales.

Potential Risks and Challenges Associated with the Transition

The transition to vertical integration, however, presents potential risks. One key challenge is the significant investment required in new technology and infrastructure. The complexity of managing and maintaining a full-fledged payment processing system is considerable, demanding specialized expertise and potentially higher operational costs in the short term. Furthermore, competition in the payment processing industry is fierce, requiring IMall to maintain a high level of innovation and customer service to stay ahead.

A potential misstep in the new system could lead to significant financial losses and damage the customer experience. Finally, regulatory compliance requirements in the payment processing sector are extensive and could add to the complexities of this transition. Careful planning and execution are crucial to mitigate these risks.

Detailed Analysis of Potential Risks

- Increased Capital Expenditure: Vertical integration demands substantial investments in new infrastructure, technology, and staff training. This initial investment might strain IMall’s resources and impact its ability to fund other crucial projects.

- Complexity of Management: Managing a full-fledged payment system introduces complex operational challenges, requiring specialized expertise and potentially higher operational costs. This increased complexity may lead to inefficiencies and errors if not carefully managed.

- Regulatory Compliance Burden: The payment processing sector is highly regulated, with strict compliance requirements. Failure to meet these standards can lead to significant penalties and reputational damage.

- Maintaining Competitive Edge: The competitive landscape in payment processing is intense. IMall must continuously innovate and adapt to stay ahead of the competition and retain market share. Failing to do so could lead to loss of market share and reduced profitability.

Impact on Existing Payment Infrastructure

IMall’s vertical integration with Pure Payments promises a significant overhaul of its payment infrastructure, affecting everything from transaction processing to customer experience. This integration is poised to streamline operations, enhance security, and potentially unlock new revenue streams. The changes will impact not only IMall’s internal systems but also its relationships with existing partners and the overall user experience.

Impact on Existing Payment Infrastructure

The integration of Pure Payments will fundamentally alter IMall’s current payment processing systems. IMall’s existing infrastructure will be replaced or significantly modified to incorporate Pure Payments’ technology. This means existing payment gateways, transaction processors, and potentially even the payment platform’s user interface will be updated. The shift is designed to provide a more robust and secure payment ecosystem, enabling faster transaction speeds and improved fraud detection.

Potential Impact on Partner Relationships and Agreements

The integration with Pure Payments will likely necessitate adjustments to existing partner agreements. Some partnerships may become redundant or require renegotiation to align with the new system’s capabilities. Partners currently handling specific payment tasks might need to adapt to the new integrated platform, and IMall will likely need to re-evaluate its relationships to ensure compatibility and optimal functionality within the new architecture.

New agreements focused on the combined system may be needed to manage transactions efficiently.

Expected Changes in IMall Payment Platform Functionality and Features

The integrated system will introduce several key changes to the IMall payment platform. These improvements include enhanced security protocols, a more streamlined user experience, and potentially expanded payment options. Faster transaction processing and reduced transaction fees are also expected. Customer support processes may be reconfigured to accommodate the new payment platform’s capabilities. Furthermore, the integrated platform may offer enhanced data analytics and reporting capabilities, providing valuable insights into customer payment behavior.

Comparison of Current and Integrated Payment Systems

| Feature | Current System | Integrated System |

|---|---|---|

| Transaction Processing Speed | Variable, dependent on gateway and network congestion | Faster, utilizing Pure Payments’ optimized infrastructure |

| Security Protocols | Existing, potentially outdated | Enhanced, incorporating Pure Payments’ advanced security features |

| Payment Options | Limited to existing partner agreements | Potentially expanded, with greater flexibility and choice |

| Transaction Fees | Varying, based on partner agreements | Potentially reduced, leveraging Pure Payments’ economies of scale |

| Customer Support | Current support channels | Potential integration of Pure Payments’ support resources |

| Data Analytics | Limited data availability | Enhanced data analysis capabilities for deeper insights into payment patterns |

Competitive Landscape Analysis

IMall’s vertical integration into the payment ecosystem presents a fascinating case study in the retail landscape. Understanding how competitors react and adapt is crucial to evaluating IMall’s potential for success and the broader implications for the market. This analysis delves into the competitive strategies of key players, identifies IMall’s unique selling propositions, and assesses the likely responses from rivals.Analyzing competitors’ strategies is paramount to comprehending the impact of IMall’s vertical integration.

The ability to control the entire payment flow from customer interaction to settlement significantly alters the competitive dynamics. This shift forces rivals to re-evaluate their existing infrastructure and consider strategic adjustments to maintain market share.

Competitive Strategies of Key Players

The retail landscape is populated by diverse players with varying degrees of integration. Some retailers rely heavily on third-party payment processors, while others have developed limited in-house payment systems. This spectrum of integration approaches reveals the diverse strategies competitors employ. Understanding these variations allows for a more nuanced assessment of IMall’s position within the market.

IMall’s Differentiators

IMall’s vertical integration strategy offers several key differentiators compared to its competitors. These include a streamlined payment processing system, enhanced customer data capture for personalized promotions, and direct control over transaction costs.

Competitive Advantages and Disadvantages

IMall’s vertical integration approach presents both advantages and potential disadvantages. A streamlined payment flow, optimized for customer experience, can lead to higher customer satisfaction and potentially lower transaction costs. However, significant upfront investments in infrastructure and the potential for integration complexities need careful consideration.

Potential Competitor Responses

IMall’s actions are likely to trigger various responses from key competitors. Some might opt for partnerships with alternative payment providers to address IMall’s integration efforts. Others might accelerate their own vertical integration initiatives to maintain market share. A third category might focus on enhancing their existing payment infrastructure, bolstering customer loyalty programs, and exploring innovative payment methods to mitigate the impact of IMall’s strategy.

Case Studies of Vertical Integration Success

Several companies in other industries have successfully implemented vertical integration strategies, demonstrating the potential benefits. For instance, Amazon’s control over its logistics and delivery network significantly impacts its competitive position. Such examples highlight the potential for IMall to gain a considerable competitive edge by controlling the payment flow within its ecosystem.

Impact on Market Share and Profitability

The impact on market share and profitability depends on IMall’s ability to leverage its integrated payment system. Reduced transaction costs and improved customer experience could lead to increased market share. However, the initial investment and potential integration challenges could temporarily impact profitability.

Potential Customer Benefits: Imall Goes Vertical With Pure Payments

IMall’s vertical integration with Pure Payments promises a significant enhancement in the customer experience. This integration isn’t just about streamlining payments; it’s about creating a more seamless, secure, and convenient shopping environment for all users. This transformation will redefine how customers interact with IMall, leading to increased satisfaction and loyalty.

Enhanced Payment Speed

The integration of Pure Payments’ infrastructure with IMall’s platform will drastically reduce payment processing times. By eliminating the need for multiple third-party integrations and utilizing a single, optimized system, customers will experience faster checkout times. This is particularly beneficial during peak shopping periods and for high-volume transactions. Imagine the convenience of completing a purchase in seconds, without lengthy loading screens or frustrating delays.

This improvement directly impacts customer satisfaction, allowing them to complete their shopping journeys more efficiently.

Improved Payment Security

Security is paramount in e-commerce. IMall’s integration with Pure Payments will leverage cutting-edge security protocols, ensuring that customer financial information is protected from unauthorized access. This includes advanced encryption, fraud detection systems, and multi-factor authentication. This comprehensive approach will build customer trust, fostering a more secure and reliable shopping experience. A secure environment reduces customer anxieties and encourages repeat business.

Increased Convenience and New Services

This integration will pave the way for new and innovative services. Customers may anticipate features such as real-time order tracking integrated with their payment method, personalized payment recommendations based on past purchase history, and potentially, even the ability to make payments directly using biometric authentication. This is not just about making payments easier; it’s about creating a truly personalized and intuitive shopping experience.

Table of Benefits for Different Customer Segments

| Customer Segment | Improved Payment Feature | Benefit |

|---|---|---|

| Frequent Shoppers | Faster checkout times, personalized payment recommendations | Reduced shopping time, optimized experience, potentially tailored deals and discounts |

| New Customers | User-friendly interface, secure payment options | Increased trust and confidence, seamless onboarding process, less friction in the first purchase |

| High-Volume Buyers | Optimized payment processing, real-time order tracking | Enhanced efficiency in managing multiple orders, improved visibility and control over transactions |

| International Customers | Support for diverse payment methods, secure cross-border transactions | Access to broader payment options, simplified international purchases, reduced financial risks |

Future Implications and Predictions

IMall’s vertical integration into payments promises a fascinating future, but its impact on the broader e-commerce landscape and IMall’s own business model is complex. This shift isn’t just about a new payment method; it’s about reshaping the entire customer experience and potentially disrupting existing market dynamics. Understanding the potential implications is crucial for assessing the long-term viability and success of this strategy.This transformation demands a forward-looking perspective, examining potential opportunities and threats, and forecasting how IMall’s payment platform might evolve.

The integration will undoubtedly affect IMall’s competitors and customers, creating a ripple effect that warrants careful consideration.

Potential Long-Term Implications for IMall’s Business Model

IMall’s integration of payments is more than a simple addition of a feature; it’s a fundamental restructuring of its core business model. The ability to control the entire payment flow from purchase to settlement will directly impact IMall’s revenue streams and cost structure. It could lead to significant cost savings through reduced transaction fees and increased control over the customer journey.

Additionally, IMall can potentially leverage its payment platform to offer value-added services, such as tailored financing options or exclusive rewards programs, enhancing customer loyalty and driving revenue.

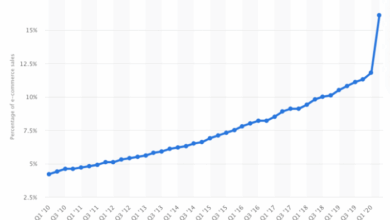

Influence on the Broader E-commerce Landscape

The integration of payments by IMall will likely ripple through the broader e-commerce landscape. Other retailers may be prompted to consider similar vertical integration strategies to gain competitive advantages. The reduction in third-party transaction fees could lead to a decrease in overall transaction costs for consumers. This, in turn, could stimulate e-commerce growth as consumers benefit from lower prices.

A notable example of a company disrupting the landscape through a similar strategy is Apple with its integrated Apple Pay system, which transformed mobile payments.

Emerging Opportunities and Threats

This integration presents a variety of emerging opportunities and threats for IMall. One key opportunity is the potential for increased customer loyalty and data insights. By controlling the payment process, IMall gains a richer understanding of customer behavior, preferences, and spending habits, which can be leveraged to enhance product recommendations, personalize marketing campaigns, and offer more targeted promotions.However, this increased control also presents potential threats.

IMall may face increased scrutiny from regulatory bodies as it gains more control over the payment infrastructure. Additionally, competitors may respond with aggressive countermeasures, creating a more competitive and dynamic market environment.

I’m buzzing about iMall going vertical with pure payments! It’s a significant move, and it looks like a smart strategy for growth. This aligns perfectly with the recent news that MGM has added real-time e-commerce support, mgm adds real time e commerce support , further strengthening the digital landscape. Overall, iMall’s vertical approach with pure payments seems poised to capitalize on this emerging trend.

Potential Future Development Path of IMall’s Payment Platform

The future development of IMall’s payment platform will likely involve a gradual evolution, incorporating new features and functionalities over time. One potential direction is the expansion of payment options to include alternative payment methods, such as cryptocurrencies or mobile wallets, to cater to a wider range of customer preferences.

| Feature | Potential Development |

|---|---|

| Payment Security | Continuous enhancement of security protocols and fraud detection systems to address evolving cyber threats. |

| International Expansion | Development of a robust international payment infrastructure to support global e-commerce transactions. |

| Customer Service | Integration of 24/7 customer support channels specifically designed for payment-related issues. |

This structured approach to payment platform development demonstrates a commitment to innovation and customer satisfaction, positioning IMall for continued success in the evolving e-commerce landscape.

Illustrative Examples of Vertical Integration Success

Vertical integration in e-commerce, especially when coupled with innovative payment systems, can significantly enhance efficiency and profitability. Companies that successfully integrate various stages of the value chain often achieve a competitive edge by streamlining operations, reducing costs, and gaining a deeper understanding of customer needs. This section will delve into real-world examples, highlighting the strategies employed and the outcomes achieved, ultimately providing valuable insights for companies considering similar integration approaches.

Amazon’s Fulfillment Network

Amazon’s extensive fulfillment network stands as a prime example of successful vertical integration in e-commerce. By owning and operating warehouses, delivery services, and logistics networks, Amazon significantly controls the entire order fulfillment process. This allows for faster delivery times, greater control over inventory management, and economies of scale in transportation. The outcome is a seamless customer experience, leading to increased customer loyalty and market dominance.

I’m buzzing about iMall going vertical with pure payments! It’s a major move, and it’s really interesting to see how this integrates with the broader e-commerce landscape. For example, Parasoft recently announced an integrated e-commerce tool parasoft announces integrated e commerce tool that could potentially be a great fit for iMall’s new approach. Ultimately, iMall’s vertical strategy with pure payments is likely to shake things up in the industry.

Key to their success is the meticulous data collection and analysis that informs their logistical decisions, enabling highly efficient delivery routes and optimized inventory placement.

Shopify’s Platform and Ecosystem

Shopify, a leading e-commerce platform provider, exemplifies vertical integration through its ecosystem approach. While not owning every stage of the customer journey, Shopify integrates various tools and services, like payment processing, shipping integrations, and marketing tools, within its platform. This integrated approach simplifies the setup and management of online stores, thereby lowering barriers to entry for new businesses and fostering a robust, interconnected ecosystem.

IMall’s vertical move into pure payments is pretty interesting. It’s a smart strategy, but given recent news, like AOL announcing record earnings and a stock split ( aol announces record earnings and stock split ), it’s clear the online retail landscape is experiencing some significant shifts. Still, IMall’s focus on streamlined payments could be a key differentiator in this evolving market.

The outcome is a higher conversion rate for businesses using their platform and a greater degree of customer satisfaction through a unified experience. Their strength lies in providing a cohesive, one-stop shop for all aspects of running an online store.

Zara’s Supply Chain Management

Zara’s success is significantly attributed to its highly responsive and efficient supply chain management. They integrate design, manufacturing, and distribution to quickly adapt to fashion trends. This agility enables them to offer new collections frequently and maintain a constant flow of fresh inventory. The outcome is a strong brand image, high demand, and increased customer satisfaction. Their vertically integrated model fosters rapid response times, keeping their fashion collections up-to-date and aligned with evolving trends.

This also allows for greater control over costs and product quality.

Comparison of Successful Vertical Integration Cases

| Company | Integration Strategy | Outcome |

|---|---|---|

| Amazon | Owning and operating warehouses, delivery services, and logistics networks | Faster delivery times, greater control over inventory, and economies of scale in transportation. |

| Shopify | Integrating various tools and services, like payment processing, shipping integrations, and marketing tools, within its platform. | Simplified online store setup, a robust ecosystem, higher conversion rates for businesses using their platform, and greater customer satisfaction. |

| Zara | Integrating design, manufacturing, and distribution to quickly adapt to fashion trends. | Strong brand image, high demand, and increased customer satisfaction through rapid response times and fresh inventory. |

Detailed Explanation of Pure Payments

Pure payments are revolutionizing the e-commerce landscape, offering a streamlined and secure approach to online transactions. This new model departs from traditional payment systems, focusing entirely on processing payments, leaving the rest of the e-commerce infrastructure to other specialized platforms. Understanding this shift is crucial to appreciating the potential of vertical integration in e-commerce.The essence of pure payments lies in their dedicated focus.

Unlike traditional payment gateways that are integrated into broader platforms, pure payment systems exist solely to facilitate secure and efficient payment processing. This specialization allows for a deep understanding of payment nuances, leading to enhanced security and a faster user experience.

Defining Pure Payments in E-commerce

Pure payments, in the context of e-commerce, refer to payment processing platforms that are independent from other e-commerce functionalities. These platforms are designed solely to handle transactions, from initial authorization to final settlement, and don’t involve the broader responsibilities of inventory management, product display, or order fulfillment. This separation allows for maximum focus on the payment process itself, fostering innovation and specialization in transaction security and speed.

Characteristics of a Pure Payments Platform

A pure payments platform possesses several key characteristics:

- Specialized Infrastructure: The platform is built and optimized exclusively for payment processing, leveraging advanced technologies like encryption and fraud detection. This specialization often leads to more efficient and secure transactions.

- Focus on Speed and Security: Pure payments platforms prioritize transaction speed and security, enabling faster processing times and mitigating risks associated with online fraud.

- Scalability and Flexibility: These platforms are designed to scale with increasing transaction volumes, adapting to the demands of a growing e-commerce market. They are flexible enough to accommodate various payment methods and international transactions.

- Independent Integration: The platform can be integrated with multiple e-commerce platforms and applications. This modularity offers flexibility to businesses.

Advantages of a Pure Payments Platform, Imall goes vertical with pure payments

The advantages of a pure payments platform extend to both businesses and consumers.

- Enhanced Security: A dedicated focus on security measures, such as advanced fraud detection and encryption, leads to a more secure payment experience for customers.

- Improved Transaction Speed: Optimized payment processing systems reduce transaction times, leading to a more seamless and satisfying customer experience. A pure payment system is focused on just the transaction, so it can be designed to be faster.

- Reduced Costs: Specialized platforms can optimize processing costs by streamlining operations and avoiding the overhead associated with broader e-commerce functionalities.

- Greater Innovation: The focus on payment processing allows for continuous innovation and development of new payment methods and features.

Comparison with Traditional Payment Methods

Traditional payment methods, often integrated into broader e-commerce platforms, lack the specialized focus of pure payment systems. Traditional payment gateways often handle other e-commerce tasks, which can impact speed and security. Pure payments platforms, in contrast, concentrate entirely on the transaction itself, offering potential advantages in speed and security.

How Pure Payments Enhance the E-commerce Experience

Pure payments contribute to a better e-commerce experience by focusing on the transaction itself. This specialization translates into faster processing times, a more secure environment, and a more seamless experience for customers. The dedicated focus on the payment process can enhance the overall e-commerce experience for both businesses and consumers.

Visual Representation of the Integration Process

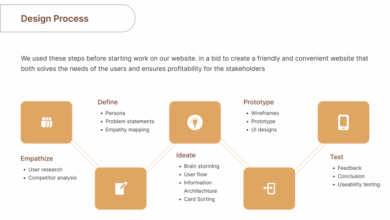

IMall’s vertical integration with Pure Payments represents a significant leap forward in its payment infrastructure. This transformation isn’t just about adding a new payment option; it’s about streamlining the entire process, from customer checkout to transaction processing, and ultimately enhancing the overall IMall experience. This section details the step-by-step integration process, highlighting key milestones and deadlines.

Step-by-Step Integration Process

The integration process unfolds in distinct phases, each crucial for a seamless transition. This structured approach ensures minimal disruption to existing operations while maximizing the benefits of Pure Payments.

- Phase 1: System Assessment & Planning (Q3 2024). This phase involves a thorough analysis of IMall’s existing payment system and the specific functionalities required for integration with Pure Payments. Key stakeholders from both IMall and Pure Payments collaborate to define the scope of work, identifying areas for optimization and potential challenges. A detailed project plan, including timelines and resource allocation, is developed during this crucial preparatory stage.

- Phase 2: Data Migration & Validation (Q4 2024). This phase focuses on transferring existing customer data and transaction history to the new Pure Payments platform. Rigorous validation procedures are implemented to ensure data integrity and accuracy. The data migration process is carefully managed to minimize potential errors and downtime. This ensures the continuity of operations and the accuracy of the integrated system.

- Phase 3: API Integration & Testing (Q1 2025). The crucial API integration between IMall’s core systems and the Pure Payments platform is undertaken. This step involves meticulous testing to ensure compatibility and functionality. Comprehensive testing scenarios, including various transaction types and user roles, are employed to identify and address any potential issues. This phase is critical for ensuring the smooth functioning of the integrated platform.

- Phase 4: User Training & Launch (Q2 2025). This phase involves training IMall’s customer service representatives and internal teams on the new payment platform. This step is essential for ensuring efficient and effective customer support. A phased rollout approach is planned to minimize disruption to IMall’s operations during the launch of the new platform.

Visual Representation: Integration Flowchart

The integration process can be visualized as a flowchart. This flowchart illustrates the key stages and dependencies.

+-----------------+

| System Assessment |---> Data Migration & Validation

+-----------------+ +--------------------------+

| | API Integration & Testing |

| +--------------------------+

|---> User Training & Launch

+-----------------+

|

v

IMall Payment Platform Evolution

Key Milestones and Deadlines

A timeline outlining key milestones and deadlines is crucial for tracking progress.

This provides a clear roadmap for the integration process.

| Phase | Milestone | Deadline |

|---|---|---|

| System Assessment & Planning | Project Plan Completion | September 30, 2024 |

| Data Migration & Validation | Data Migration Completion | December 31, 2024 |

| API Integration & Testing | Integration Testing Completion | March 31, 2025 |

| User Training & Launch | Platform Launch | June 30, 2025 |

Summary

IMall’s vertical integration with pure payments marks a pivotal moment in its evolution. This comprehensive analysis explores the strategic motivations, potential impacts, and future implications of this transformation. From enhanced customer experiences to a strengthened competitive position, the future of IMall looks promising. We’ve examined the potential challenges and risks, but ultimately, the move positions IMall for a strong and competitive future in the evolving e-commerce market.

The specifics of how this new system works will be laid out in detail, with a particular focus on what this means for customers and the company’s future.