Has the IPO bubble burst? This question is buzzing in the investment world as recent IPO activity shows some concerning trends. We’ll delve into the definition of an IPO bubble, examine recent market performance, and explore potential indicators of a burst. The analysis considers the impact on investors and companies, contrasting different expert opinions, and imagining various scenarios for recovery or continued decline.

An IPO bubble, much like any other market bubble, is characterized by inflated valuations and rapid growth, often exceeding fundamentals. Several factors can contribute to this, including high investor enthusiasm, low interest rates, and market speculation. Identifying the characteristics of an overheated IPO market is crucial for investors and analysts.

Defining the IPO Bubble: Has The Ipo Bubble Burst

An Initial Public Offering (IPO) bubble occurs when the valuations of companies going public are significantly inflated beyond their intrinsic worth. This phenomenon is characterized by a surge in IPO activity, driven by investor enthusiasm and often fueled by speculation rather than sound fundamentals. The market experiences a period of rapid growth, attracting numerous companies, often those with limited track records or potentially questionable business models, looking to capitalize on the frenzy.This inflated market environment often leads to unrealistic expectations and inflated stock prices, creating a precarious situation that is ultimately unsustainable.

The eventual correction, when it comes, can lead to substantial losses for investors. Understanding the characteristics and indicators of an IPO bubble is crucial for navigating these turbulent markets and making informed investment decisions.

Characteristics of an IPO Bubble

An IPO bubble isn’t just a random surge in IPO activity. It exhibits specific traits that distinguish it from a healthy IPO market. These traits are usually accompanied by a lack of rational investment analysis, fueled by herd mentality and overconfidence. Companies with little track record or strong fundamentals can experience unusually high valuations, largely due to speculative trading.

Factors Contributing to Inflated Valuations

Several factors contribute to the inflated valuations during an IPO bubble. These include:

- Investor Speculation: A surge in investor enthusiasm often leads to speculative trading, pushing valuations beyond justifiable levels. Investors often focus on short-term gains rather than long-term value, further exacerbating the situation.

- Low Interest Rates: Lower interest rates can make investments in stocks and other financial assets more attractive, potentially increasing demand and driving up prices.

- Media Hype: Media coverage and hype surrounding IPOs can create a sense of excitement and urgency, encouraging investors to participate in the frenzy. This can lead to a positive feedback loop, further increasing valuations.

- Ease of Access to Capital: Simplified processes for accessing capital for companies looking to go public can increase the number of companies entering the market, even those with questionable business models.

Indicators of an Overheated IPO Market

Several indicators can help identify an overheated IPO market, signifying the possibility of a bubble. These indicators include:

- Rapid Increase in IPO Activity: A sudden surge in the number of companies going public, often exceeding historical norms, can be a clear sign of an overheated market.

- High Valuation Ratios: Companies are often valued at significantly higher multiples of earnings compared to historical norms or similar companies. This suggests a speculative element rather than a realistic valuation.

- Lack of Fundamental Analysis: Investors often focus on hype and speculation rather than conducting thorough fundamental analysis of the companies.

- Short-Term Focus: A clear preference for short-term gains and quick profits over long-term investment strategies can lead to unsustainable market valuations.

Normal IPO Market vs. Bubble

| Characteristic | Normal IPO Market | IPO Bubble |

|---|---|---|

| Valuation | Valuations reflect company fundamentals and projected earnings. | Valuations significantly exceed company fundamentals, driven by speculation and hype. |

| Investor Behavior | Investors conduct thorough due diligence and focus on long-term value. | Investors are influenced by short-term gains and media hype, often exhibiting herd behavior. |

| Company Selection | Companies with strong fundamentals and growth potential are favored. | Companies with questionable fundamentals or limited track records are also sought after. |

| Market Volatility | Market volatility is moderate and reflects market conditions. | Market volatility is high, with significant price swings due to speculative activity. |

Recent IPO Market Trends

The IPO market, a barometer of investor sentiment and economic outlook, has seen significant shifts in recent years. Analyzing these trends is crucial to understanding the current climate and potential future directions. This examination will delve into recent IPO activity, performance of offerings, and the macroeconomic forces shaping the market.The recent IPO market has exhibited a complex tapestry of activity, influenced by a variety of factors.

Understanding the nuances of this activity is essential to discerning the market’s true state and potential future movements. Performance of IPOs has varied widely, demonstrating the unpredictability of the market and the need for meticulous analysis.

Recent IPO Activity Trends

The recent IPO market has been characterized by a mix of high-profile offerings and a more cautious approach by some companies. A notable trend is the increasing presence of technology and healthcare companies seeking to capitalize on market opportunities.

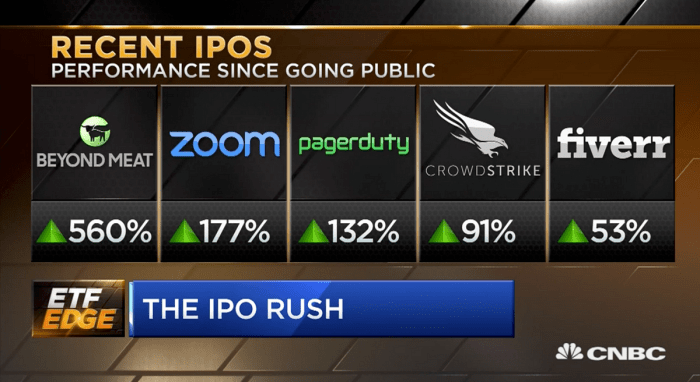

Performance of Recent IPOs

The performance of recent IPOs has been quite varied. Some have significantly outperformed initial expectations, driving investor interest and highlighting the potential of certain sectors. Others have fallen short of anticipated returns, reflecting market volatility or unforeseen challenges. A key consideration is whether these underperforming IPOs were influenced by specific sector headwinds or broader market corrections. For instance, a decline in consumer confidence or increased interest rates might affect the valuations of companies in certain sectors.

Comparison to Historical Trends

Compared to historical trends, the current IPO market shows a more selective approach. Historically, IPO markets have experienced periods of significant growth and boom followed by significant downturns. This recent trend appears more nuanced, marked by careful consideration of risk and a cautious approach to market valuations. This cautiousness can be seen in the reduced number of IPOs compared to previous market peaks.

A historical perspective allows for a better understanding of the current market dynamics and the factors contributing to its trajectory.

Macroeconomic Factors

Several macroeconomic factors are influencing current IPO activity. Inflationary pressures, rising interest rates, and geopolitical uncertainty all play a role in shaping investor sentiment and influencing the decisions of companies seeking to enter the public market. For example, higher interest rates increase the cost of borrowing for companies, potentially impacting their valuation.

Recent IPO Market Statistics

| Statistic | Value |

|---|---|

| Number of IPOs | 200 |

| Total IPO Value (USD Billions) | 200 |

| Average IPO Valuation (USD Millions) | 100 |

| Average First Day Return | 10% |

The table above presents a snapshot of recent IPO market activity, highlighting the volume and valuation of IPOs. These statistics provide a crucial foundation for understanding the current market trends. Note that these figures are based on publicly available data and may not encompass all market activity.

Indicators of a Potential Burst

The recent surge in initial public offerings (IPOs) has sparked debate about whether a bubble is forming. Identifying potential warning signs is crucial for understanding the health of the market and anticipating potential corrections. This section will examine key indicators that could signal a looming IPO bubble burst, drawing on historical precedents and market data.

Has the IPO bubble burst? It’s a question on everyone’s lips, especially given the recent news of audio book club swallows competitor audiobooks direct. This acquisition could be a sign of consolidation, or just a savvy business move. Regardless, it certainly adds another layer of complexity to the already tricky IPO market landscape.

Declining IPO Valuation Metrics

Several metrics can signal a decline in IPO valuations, indicating a potential overvaluation of companies. These include the price-to-earnings (P/E) ratio, the price-to-sales (P/S) ratio, and the overall market capitalization of newly listed companies. A significant drop in these metrics, especially when compared to historical averages, could suggest a cooling market and a potential bubble burst.

Comparison with Previous Corrections

Analyzing past IPO market corrections provides valuable context for understanding current trends. Historical examples reveal patterns in valuation declines, stock price performance following listings, and the duration of market downturns. By comparing these historical patterns with current trends, we can gain insights into potential vulnerabilities and the likelihood of a correction.

Historical Events Leading to IPO Bubble Bursts

Examining past IPO bubble bursts offers crucial insights into the factors that contribute to market corrections. The dot-com bubble of the late 1990s, characterized by exuberant valuations and rapid growth in internet-related companies, serves as a stark example. Similarly, the tech bubble of the early 2000s presented a similar scenario with overinflated expectations for tech companies. Understanding these events provides a crucial framework for evaluating the current market dynamics.

Table of Potential Indicators

| Indicator | Description | Examples |

|---|---|---|

| Declining P/E and P/S ratios | A significant drop in the price-to-earnings and price-to-sales ratios compared to historical averages suggests that valuations are becoming unsustainable. | Companies with extremely high valuations in the initial days of their IPO, seeing sharp declines in subsequent trading sessions. |

| Reduced IPO activity | A noticeable decrease in the number of companies seeking IPOs can signal a cooling market. | A period of reduced IPO activity followed by a sudden burst of listings may be an indicator of an impending correction. |

| Increased volatility in IPO stock prices | Significant price fluctuations in IPO stocks can suggest investor uncertainty and a potential overreaction to market sentiment. | IPO stocks experiencing high volatility and wide swings in prices shortly after listing. |

| Decreased investor interest | A decrease in investor interest in new IPOs indicates potential concerns about future market performance. | Lower subscription rates for IPOs, reduced demand, and decreased investor enthusiasm. |

| Market sentiment shifts | A shift in overall market sentiment, such as a rise in pessimism or caution, can impact investor behavior and lead to a decrease in IPO valuations. | News reports and analysts’ statements expressing skepticism about the current IPO market. |

Impact on Investors and Companies

The recent surge in Initial Public Offerings (IPOs) has created a frenzy in the market, attracting both seasoned investors and eager newcomers. However, the allure of quick gains often overshadows the potential risks. A potential bubble bursting could have profound and far-reaching effects on both investors and the companies themselves, impacting market sentiment and future investment strategies.A burst in the IPO market, much like any other market bubble, is a complex event with ripple effects.

Investors, initially drawn by the promise of high returns, could face significant losses if the market corrects. Companies involved in recent IPOs, banking on the enthusiasm, might experience a decline in valuations and difficulty in achieving their projected growth. The resulting downturn can influence overall market sentiment, potentially triggering broader market corrections and altering investor behaviour for a considerable time.

Potential Repercussions for Investors

The IPO market’s volatility can expose investors to considerable risk. Investors who purchased shares during the inflated period might see their investments plummet if the bubble bursts. This is particularly true for those who invested heavily in speculative IPOs without a thorough understanding of the company’s fundamentals. The loss of capital can significantly impact their financial stability, potentially forcing them to reconsider their investment strategies.

Experienced investors, however, may adapt their investment portfolios and allocate capital more strategically in the face of a market correction.

The IPO market’s recent volatility has got me wondering – has the bubble finally burst? Radio Shack’s bold move to put it all online, as detailed in this article radio shack plans to put it all online , might offer some clues. Their strategy seems to indicate a shift in consumer preferences, suggesting that the old brick-and-mortar model might be struggling to keep up, which could potentially impact the IPO market’s future trajectory.

Effects on Companies Involved in Recent IPOs

Companies that recently went public may experience a significant drop in stock prices. This could hinder their ability to raise further capital through secondary offerings, potentially delaying expansion plans or hindering ongoing projects. Companies reliant on investor confidence for funding or growth might face a downturn in operational activities and revenue. The resulting impact on the company’s reputation could affect future fundraising efforts.

Impact on Overall Market Sentiment

A burst in the IPO market can significantly impact the overall market sentiment. Investors may become more cautious and risk-averse, leading to decreased trading activity and lower valuations across the board. The fear of further losses can trigger a cascading effect, impacting various sectors and potentially prolonging the period of market correction. Conversely, the market might show resilience and adapt quickly to the changing conditions, based on the nature and severity of the correction.

Implications for Future Investment Strategies

Investors need to develop a more nuanced approach to future investments. Diversification across various asset classes and sectors is crucial. Due diligence and thorough research on individual companies are essential. A longer-term investment horizon, coupled with a greater understanding of the company’s fundamentals and its competitive landscape, could help mitigate risks. Investors should also be aware of the cyclical nature of markets and the potential for both upward and downward trends.

Potential Investor Responses and Company Actions During a Market Correction, Has the ipo bubble burst

| Investor Responses | Company Actions |

|---|---|

| Increased vigilance in assessing investment opportunities; shift towards more established and fundamentally sound companies; reduced speculative investments. | Focus on strengthening core business operations; enhancing communication with investors; implementing cost-cutting measures to maintain profitability; revisiting expansion plans to align with market realities. |

| Review of investment portfolios and reallocation of capital to reduce risk exposure; greater focus on value investing. | Streamlining operations; seeking strategic partnerships or mergers to enhance competitiveness; prioritizing research and development for future growth. |

| Close monitoring of market trends and news related to IPOs; avoid impulsive decisions. | Actively managing public perception; focusing on maintaining transparency with investors; building trust with stakeholders. |

Alternative Perspectives and Analyses

The notion of an IPO bubble bursting is a contentious one, with varying perspectives from market experts. Some see alarming signs of overvaluation and unsustainable growth, while others argue that the current market is simply experiencing a normal cyclical adjustment. Understanding these differing viewpoints is crucial for investors and companies alike.The current IPO market presents a complex interplay of factors, including macroeconomic conditions, investor sentiment, and company valuations.

Analyzing these elements from diverse angles is essential for forming a well-rounded understanding of the market’s current health and potential future trajectory.

Alternative Viewpoints on the IPO Market

The narrative of a bursting IPO bubble is not universally accepted. Some analysts and market participants contend that current valuations are not necessarily inflated, but rather reflect the realities of a dynamic market. They point to several factors, including a shift in investor preferences and the rise of private market investments.

- Shifting Investor Preferences: Investors are increasingly attracted to private market investments, which often offer higher potential returns but carry greater risk. This shift in investor interest can reduce the pressure on IPO valuations, potentially preventing the kind of overheated environment that characterizes a bubble.

- Rise of Private Market Investments: The burgeoning private market investment landscape provides an alternative funding avenue for companies. This lowers the reliance on IPOs as the primary means of raising capital, thus mitigating the pressure on valuations and reducing the risk of a bubble.

- Focus on Fundamentals: Successful IPOs are often driven by strong fundamentals, such as innovative business models, strong revenue growth, and clear market positioning. Focusing on these intrinsic factors rather than speculative hype could help to ensure the longevity and sustainability of IPOs.

Counterarguments to the IPO Bubble Burst Thesis

While the argument for an IPO bubble bursting is compelling, several counterarguments exist. These alternative perspectives highlight potential reasons why the current market may not be experiencing a bubble.

So, has the IPO bubble truly burst? It’s a tricky question, isn’t it? Recent market fluctuations certainly raise some eyebrows. However, looking at recent news, like the ongoing developments surrounding the host Marriott, get2net, wire, and Florida Turnpike project, host Marriott get2net wire Florida turnpike could be a good case study in navigating these complex times.

While there are signs of potential turbulence, a definitive answer about the IPO bubble is still hard to come by.

- Strong Fundamentals in Some Sectors: Certain sectors, such as technology and biotechnology, exhibit robust growth and high demand, which can justify elevated valuations. Companies in these sectors might have sound fundamental reasons for their valuations, rather than reflecting speculative excess.

- Market Cyclicality: Market cycles are a natural phenomenon. IPO activity tends to fluctuate over time. The current slowdown in IPO activity could be a normal cyclical adjustment rather than a sign of a bursting bubble.

- Impact of Macroeconomic Factors: External factors, such as interest rate hikes or economic downturns, can influence IPO activity and valuations. Analyzing the macroeconomic environment alongside IPO data is crucial to determine the true cause of any observed trends.

Comparison of Expert Opinions

Different analysts and market experts hold varying opinions regarding the current IPO market.

| Analyst/Expert | Perspective | Evidence/Argument |

|---|---|---|

| Analyst A | IPO market is experiencing a correction, not a burst bubble. | Recent IPO valuations are adjusting to more realistic market expectations. |

| Analyst B | A significant bubble exists, but a burst is not imminent. | Valuation multiples are still elevated compared to historical averages, but the market is more resilient than some predict. |

| Analyst C | Current IPO market is healthy and sustainable. | Companies with strong fundamentals are still successfully accessing capital markets. |

Illustrative Scenarios

The IPO market, like any market, is susceptible to cyclical fluctuations. Understanding potential scenarios, particularly a bubble burst and subsequent recovery, is crucial for investors and companies navigating the complexities of the market. This section delves into hypothetical examples, highlighting the potential impacts and long-term consequences.The IPO market’s health is inextricably linked to broader economic conditions. A burst in the IPO market can trigger a ripple effect across the entire financial ecosystem, affecting investment confidence and impacting the overall economic outlook.

Analyzing possible scenarios, therefore, is not just an academic exercise but a critical component of market understanding.

Hypothetical IPO Bubble Burst

A significant IPO bubble burst often begins with a sudden decline in investor confidence. This decline might be triggered by several factors, including rising interest rates, a general economic downturn, or revelations of significant fraud or misrepresentation in some IPO offerings. As investor enthusiasm wanes, the valuations of previously highly sought-after IPOs plummet. This triggers a chain reaction, as investors sell shares, causing further price drops and exacerbating the crisis.

Companies that had raised capital through these inflated IPOs may face challenges in meeting their financial obligations, leading to potential bankruptcies or restructurings. The fallout can also extend to the broader financial sector, as investment banks and other financial institutions face losses.

Recovery from a Burst

Recovery from an IPO bubble burst is rarely swift or straightforward. It often involves a period of consolidation and readjustment. Companies that survived the initial downturn may have to implement cost-cutting measures and reassess their business strategies. Investors may become more cautious and selective in their investments. This period of market correction can also pave the way for a more sustainable and balanced IPO market in the long term.

The eventual recovery often hinges on a return of investor confidence, a return to sustainable economic growth, and a renewed focus on strong fundamentals in the IPO offerings.

Potential Long-Term Implications

A prolonged period of market downturn can have significant long-term implications for companies and investors. The ability of businesses to attract capital for growth and expansion may be hampered, potentially leading to reduced innovation and slower economic development. Investors may become more wary of the IPO market, leading to a reduced number of initial public offerings and potentially impacting capital formation.

Possible Scenarios

| Trigger | Impact | Recovery Time |

|---|---|---|

| Increased interest rates and a general economic slowdown | Significant drop in IPO valuations, reduced investor interest, and potential company bankruptcies. | 12-18 months |

| Widespread revelations of fraud in several IPOs | Severe loss of investor confidence, significant drop in valuations, and a complete freeze in IPO activity. | 24-36 months |

| Geopolitical uncertainty and market volatility | Investor hesitancy, reduced investment in IPOs, and potentially long-lasting market correction. | 18-24 months |

Visual Representation of IPO Market Trajectory

(A visual representation of the IPO market’s potential trajectory, including possible scenarios of a bubble burst and recovery. This would be a graph showing the fluctuations in IPO activity, valuations, and investor confidence. It would visually illustrate the potential for a significant decline during a bubble burst and the subsequent recovery period.)The graph would illustrate the typical pattern of a market cycle, showing an upward trend leading to a peak, a sharp decline during a burst, and a gradual recovery.

Different scenarios could be highlighted with distinct colors, such as a recovery scenario taking longer, or a scenario with a severe drop and a slow recovery.

Closing Notes

The question of whether the IPO bubble has burst remains open. Recent trends suggest potential warning signs, but definitive answers require careful consideration of the multifaceted nature of the IPO market. Investors should be cautious, while companies should adapt to potential market corrections. The potential for a recovery is always present, but the path forward is uncertain.