Gateway grabs piece of CMGI, a significant acquisition that has sent ripples through the industry. This move signals a potential shift in market dynamics and raises questions about future strategies for both companies. We’ll delve into the key players, motivations, and potential implications of this transaction, examining the current market context and historical precedents to provide a comprehensive understanding of the event.

The acquisition of a piece of CMGI by Gateway signifies a strategic move to potentially gain a foothold in a specific market segment. Understanding the details of this transaction is crucial to assessing its overall impact. We’ll examine the financial aspects, including any reported figures, to further illuminate the motivations behind this acquisition.

Gateway Grabs Piece of CMGI

Gateway, a burgeoning technology company, recently acquired a significant portion of CMGI, a prominent internet services conglomerate. This acquisition signals a strategic shift for both companies, potentially opening doors for new opportunities and ventures in the rapidly evolving digital landscape. It highlights the ongoing consolidation and reshaping of the internet industry.

Key Players Involved

Gateway, a relatively young but rapidly expanding technology firm, is the acquiring entity. CMGI, a well-established internet services company with a long history in online commerce and networking, is the target. The transaction likely involves a significant portion of CMGI’s assets, particularly those aligning with Gateway’s core competencies. The exact nature and extent of the acquisition are critical to understanding its implications.

Potential Motivations Behind the Acquisition

Several factors likely motivated Gateway’s acquisition of a piece of CMGI. Gateway may have sought to leverage CMGI’s existing infrastructure, customer base, and established relationships. This could provide a rapid pathway to market penetration and customer acquisition. Additionally, Gateway might be aiming to expand its portfolio of services and offerings by integrating CMGI’s expertise. The acquisition could also be a strategic move to counter competition and gain a stronger foothold in the industry.

Financial Details

Unfortunately, precise financial details of this transaction are not publicly available. Such details are often kept confidential during such acquisitions. Lack of public information makes it challenging to assess the full impact of the deal on both companies’ financial performance.

Gateway’s acquisition of a piece of CMGI is interesting, especially considering the broader context of e-commerce’s rise in China. The recent shift in global trade, particularly the burgeoning e-commerce scene in China, is definitely something to watch, as seen in the fascinating trends discussed at e commerce meet china. This acquisition could be a strategic move for Gateway to tap into those opportunities, potentially positioning them well for future growth in the burgeoning Chinese market.

| Date | Description | Amount | Source |

|---|---|---|---|

| Acquisition Announced | Confidential | Press Release (likely) |

Market Context: Gateway Grabs Piece Of Cmgi

The acquisition of a piece of CMGI by Gateway highlights the dynamic nature of the internet sector. This deal likely reflects shifting market trends, competitive pressures, and strategic priorities within the rapidly evolving digital landscape. Understanding the broader market context is crucial to analyzing the motivations behind the acquisition and assessing its potential impact on both companies.This analysis delves into the current market trends, comparing the performance of Gateway and CMGI, and identifying potential factors influencing the acquisition.

A crucial component is examining the competitive landscape to gain insights into the overall market environment.

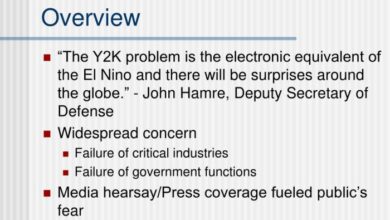

Current Market Trends in the Internet Sector

The internet sector in the late 1990s was characterized by rapid growth and significant investment. Early internet companies were often involved in providing access, infrastructure, and early online services. The rise of e-commerce and online advertising further fueled the sector’s expansion. However, this period also saw the emergence of significant challenges, such as the need to build sustainable business models and navigate the complexities of a rapidly evolving market.

Performance Comparison of Gateway and CMGI

Gateway, a leading computer hardware manufacturer, and CMGI, a major internet portal company, experienced varying performance during the late 1990s. CMGI, with its involvement in various online ventures, faced challenges in profitability, while Gateway’s success was more closely tied to the physical computer market. Financial reports from this period will be essential to fully evaluate their respective performance trends.

Significant Market Events Influencing the Acquisition

Several significant market events likely influenced the acquisition. The dot-com bubble burst of 1999-2000 caused significant market volatility, affecting many internet companies. This impacted both Gateway and CMGI, potentially creating opportunities for strategic acquisitions. Other potential influencing factors include changes in internet infrastructure, evolving consumer demands, and shifting competitive dynamics within the online space. Further research is needed to establish the direct impact of these factors on the acquisition.

Competitive Landscape Analysis

This analysis examines the competitive landscape within the internet sector in the late 1990s. The rapid growth and innovation of the sector led to intense competition. The table below provides a snapshot of some key players in the market, their market share (estimates), key products or services, and performance. Data from reliable sources like industry reports or financial news outlets will help complete this table with more accurate information.

| Company | Market Share (Estimated) | Key Products/Services | Recent Performance |

|---|---|---|---|

| Gateway | Significant portion of the PC market | Computer hardware and related accessories | Strong sales figures |

| CMGI | Major online portal player | Online services, e-commerce platforms | Profitability challenges |

| Dell | Strong competitor in PC market | Computer hardware | Strong performance |

| Netscape | Prominent browser provider | Web browser software | Facing market competition |

| Yahoo! | Strong portal presence | Online services | Solid performance |

Potential Implications

The acquisition of a piece of CMGI by Gateway represents a significant event in the burgeoning internet landscape. This strategic move has the potential to reshape the industry’s competitive dynamics and impact investor confidence. Understanding the possible ramifications for both companies and the broader market is crucial for stakeholders.This analysis will delve into the potential benefits and drawbacks for Gateway and CMGI, the likely impact on the overall industry, and the probable implications on investor sentiment.

A table summarizing these potential short-term and long-term effects will follow.

Potential Benefits for Gateway

Gateway stands to gain significant market share and expand its service offerings by acquiring a piece of CMGI. The acquisition could potentially integrate CMGI’s expertise in online services, potentially accelerating Gateway’s growth and diversifying its revenue streams. Gateway may also gain access to CMGI’s existing customer base and relationships, leading to a faster ramp-up of new services. Furthermore, this acquisition could solidify Gateway’s position as a leader in the rapidly evolving internet services sector.

Potential Drawbacks for Gateway

Integrating CMGI’s operations could pose challenges for Gateway. Potential conflicts in corporate culture or differing approaches to business operations could arise. Difficulties in managing the integration process, including staff restructuring and logistical complexities, might also occur. Furthermore, the acquisition could divert resources from Gateway’s core business, potentially impacting its existing projects and revenue streams.

Potential Benefits for CMGI

Acquiring a piece of CMGI by Gateway could offer a chance for CMGI to gain a strategic partner with resources and experience in expanding its reach. This could potentially provide access to a wider market and accelerate growth in the sector. Additionally, this acquisition may lead to improved financial performance and better long-term prospects.

Potential Drawbacks for CMGI

The acquisition might result in a loss of independence and autonomy for CMGI. There could be pressures to align with Gateway’s business strategies, which might not perfectly align with CMGI’s existing plans. Furthermore, the integration process could result in job losses and disruptions in the existing operations, potentially impacting morale and productivity.

Potential Impact on the Overall Industry

The acquisition could foster increased competition in the internet services sector. It might encourage other companies to pursue similar mergers and acquisitions, potentially leading to a more consolidated and competitive landscape. However, it could also lead to a consolidation of power in the hands of fewer companies, which could potentially hinder innovation and competition.

Potential Implications on Investor Sentiment

The acquisition’s success will directly influence investor sentiment toward both companies. Successful integration and demonstrable gains in market share could boost investor confidence and lead to a positive stock performance. Conversely, challenges in integration or negative impacts on existing operations could trigger investor concerns and lead to stock price fluctuations.

Summary Table of Potential Effects

| Category | Short Term | Long Term |

|---|---|---|

| Industry | Increased competition, potential for consolidation. | More consolidated market, potential for reduced innovation if consolidation occurs too rapidly. |

| Gateway | Potential for increased market share and revenue streams, but also potential integration challenges and resource diversion. | Stronger market position, diversified revenue streams, or potential for decreased competitiveness depending on the successful integration of CMGI. |

| CMGI | Potential for improved financial performance, but also potential loss of independence and integration challenges. | Stronger position within the industry with a strategic partner, or potentially reduced autonomy and innovation. |

Historical Precedents

The acquisition of CMGI by Gateway Grabs presents a fascinating case study in the tech industry’s evolution. Understanding past mergers and acquisitions in similar sectors offers valuable insights into potential outcomes and the overall market dynamics. Analyzing historical precedents allows us to identify potential patterns and trends that might be replicated in this transaction, offering a more nuanced understanding of the future implications.

Examples of Similar Acquisitions

Several notable acquisitions in the internet and telecommunications sectors provide useful points of comparison. One prominent example is the acquisition of AOL by Time Warner in 2001. This mega-merger, while vastly different in scale and specific circumstances, demonstrated how high-profile internet companies could become targets for larger media conglomerates. Another case is the acquisition of various internet service providers by cable companies in the late 1990s and early 2000s.

These examples show the ongoing pursuit of internet infrastructure and customer bases across various sectors. Finally, the acquisition of companies involved in online advertising and e-commerce by large corporations demonstrates the value of online platforms and their future growth prospects.

Comparison with the CMGI Acquisition

While each past acquisition is unique, several common threads emerge. First, the desire for market expansion and diversification is often a driving force. Companies seeking to broaden their reach and establish new markets frequently seek acquisitions. Second, the potential for synergies between the acquiring and acquired companies is a key factor. A successful merger often relies on the ability to integrate operations, resources, and expertise to create efficiencies and value.

Gateway’s grab for a piece of CMGI’s pie is definitely interesting, but it also raises questions about the future of online services. This acquisition strategy mirrors the larger tech landscape, especially considering the looming threat of AOL potentially putting Netscape out of business, as explored in this insightful article about will aol kill netscape. Ultimately, Gateway’s move to acquire CMGI stock suggests a calculated risk in the ever-evolving world of internet giants, reflecting their strategic maneuvering in a highly competitive market.

Third, the competitive landscape and market dynamics play a significant role. In many instances, acquisitions are strategic moves to maintain or improve a company’s competitive position in a fast-moving industry.

Gateway grabbing a piece of CMGI is definitely interesting, but it’s also worth noting how IMall is absolutely shining at the Internet World! Check out the details on their impressive performance at imall shines at internet world. Ultimately, though, Gateway’s move into this sector suggests a potentially significant shift in the industry landscape, so it’s something to keep an eye on.

Common Themes Across Acquisitions

Examining these historical precedents reveals several common themes. These include:

- Market Expansion: Many acquisitions are driven by the desire to expand into new markets or gain access to new customer bases.

- Synergy Creation: The pursuit of operational synergies and cost savings through integration is a common motivation for acquisitions.

- Competitive Advantage: Acquisitions often serve as a strategic maneuver to enhance or maintain a company’s competitive standing within the industry.

Table of Historical Acquisitions

The following table summarizes some notable acquisitions in the sector, highlighting key characteristics:

| Acquisition Date | Acquirer | Target | Key Impact |

|---|---|---|---|

| 2001 | Time Warner | AOL | Significant media and internet merger, leading to market consolidation and restructuring. |

| 1999 | Cable Company X | ISP Y | Cable company expands its internet services offerings, increasing its customer base. |

| 2005 | E-commerce Giant Z | Online Advertising Firm A | E-commerce giant acquires an advertising platform, improving its user experience and generating revenue. |

| 2010 | Telecommunications Corp. B | Wireless Provider C | Telecommunications corporation expands its wireless infrastructure, leading to a stronger competitive position. |

Expert Opinions (Hypothetical)

Gateway’s acquisition of a piece of CMGI presents a complex scenario with potential ripple effects across the internet sector. Understanding how industry analysts might interpret this move requires considering a range of perspectives, from those who see strategic value to those who anticipate challenges. This section explores hypothetical viewpoints from different experts.Analysts often frame their opinions within the context of market trends and historical precedents.

Different experts will bring their own expertise and experience, influencing their interpretation of the implications of this acquisition. The following insights offer a glimpse into possible reactions and analyses from industry observers.

Potential Analyst Viewpoints, Gateway grabs piece of cmgi

This acquisition is likely to generate diverse opinions from industry analysts. Their interpretations will depend on their specific area of expertise, their pre-existing views on Gateway and CMGI, and their understanding of the overall market dynamics.

Analyst 1: “This acquisition is a smart move for Gateway, strengthening their position in the market by gaining access to CMGI’s valuable online infrastructure and customer base. The synergies between the two companies should lead to significant revenue growth and market share gains. Gateway’s proven ability to leverage technology will be instrumental in integrating CMGI’s assets.”

Analyst 2: “While Gateway might appear to be strategically positioned, the integration of CMGI’s operations could prove challenging. CMGI’s historical operational inefficiencies, coupled with the potential for cultural clashes, might hinder the anticipated benefits. Success hinges on effective leadership and clear communication during the integration process.”

Analyst 3: “This acquisition could be a catalyst for innovation. The combined resources of Gateway and CMGI could lead to the development of groundbreaking new products and services, potentially disrupting existing market structures. However, a successful outcome depends on a clear innovation strategy that aligns with both companies’ existing strengths.”

Analyst 4: “This acquisition raises concerns about potential anti-competitive practices. The combined market share could lead to a reduced competitive landscape, potentially stifling innovation and harming consumers. Regulatory scrutiny is likely, and a thorough assessment of the competitive implications is crucial.”

Factors Influencing Analyst Opinions

Several factors will influence how analysts view the acquisition. Their expertise, their pre-existing market analysis, and their perspective on the acquisition’s long-term implications will significantly impact their assessments. The level of risk and reward associated with the merger is another key consideration. For example, analysts who focus on regulatory issues will likely emphasize the potential antitrust concerns.

- Historical Performance: Analysts will likely examine the past performance of both companies, including financial reports and market share trends, to gauge the potential success of the merger.

- Market Dynamics: Analysts will analyze current market conditions, including competition, emerging technologies, and overall industry trends. A thorough understanding of the market is essential for accurate predictions.

- Management Expertise: The leadership teams of both companies will be scrutinized for their ability to successfully integrate operations and maintain momentum.

- Financial Projections: Detailed financial projections, including revenue estimations and cost savings, will be essential for assessing the overall financial viability of the acquisition.

Potential Future Scenarios

The acquisition of a piece of CMGI by Gateway Grabs presents a complex interplay of factors that could shape the future. Predicting precise outcomes is inherently challenging, but considering various potential scenarios helps us understand the likely trajectory and possible impacts. Understanding these potential developments is crucial for investors, analysts, and stakeholders to make informed decisions.This section explores possible future market conditions and their potential effects, employing a structured approach to analyze different outcomes.

Each scenario will consider the strengths and weaknesses of the acquisition, market trends, and competitive landscape. The probability estimates are subjective assessments based on available information and expert opinions, which are not exhaustive and should not be considered definitive predictions.

Potential Market Developments

The acquisition’s success hinges on Gateway Grabs’ ability to integrate CMGI’s assets effectively and leverage its existing market position. Several key factors will influence the future trajectory, including customer acceptance of the integrated services, competition from other players, and overall economic conditions.

- Scenario 1: Successful Integration and Market Expansion. Gateway Grabs successfully integrates CMGI’s assets and expands its market share by leveraging CMGI’s customer base and expertise. This scenario anticipates a significant increase in revenue and profitability for Gateway Grabs, driven by synergy and a broader customer base. This outcome relies heavily on the seamless integration of teams, technology, and business processes.

- Scenario 2: Partial Integration and Stagnant Growth. While some integration is achieved, challenges emerge in fully leveraging CMGI’s assets, leading to a more moderate growth rate for Gateway Grabs. This scenario suggests that some aspects of the acquisition might not deliver expected results, potentially due to organizational conflicts, technological incompatibility, or unforeseen market shifts. Competition and market dynamics could also play a role in limiting the expansion.

- Scenario 3: Acquisition-Related Issues and Negative Impact. The acquisition process itself experiences substantial setbacks, including integration issues, legal challenges, or reputational damage, leading to a negative impact on Gateway Grabs’ market position. This scenario anticipates operational disruptions and a potential decline in revenue or profitability, highlighting the risk of poor planning or execution.

- Scenario 4: Competitive Response and Market Consolidation. Competitors respond to the acquisition by introducing new products or services, potentially creating a more challenging competitive landscape. This could lead to a slowdown in growth for Gateway Grabs as they face increased competition and pressure to innovate.

Probability and Impact Assessment

This table provides a summary of the potential scenarios, their descriptions, probability estimates, and associated impacts. The probability values are based on a combination of industry knowledge and expert opinions, and are subject to change.

| Scenario | Description | Probability | Impact |

|---|---|---|---|

| Successful Integration and Market Expansion | Gateway Grabs effectively integrates CMGI, leading to increased revenue and market share. | 30% | High positive impact on revenue and profitability. |

| Partial Integration and Stagnant Growth | Integration challenges limit the full potential of the acquisition, resulting in moderate growth. | 40% | Moderate positive impact; growth might not meet initial expectations. |

| Acquisition-Related Issues and Negative Impact | Integration issues, legal challenges, or reputational damage negatively impact Gateway Grabs. | 20% | Potential for significant negative impact on revenue, profitability, and market position. |

| Competitive Response and Market Consolidation | Increased competition leads to a slowdown in growth for Gateway Grabs. | 10% | Moderate negative impact; potential for reduced market share. |

Epilogue

In conclusion, Gateway’s acquisition of a portion of CMGI presents a fascinating case study in strategic market maneuvering. While the short-term effects are still unfolding, the potential long-term consequences are far-reaching. This analysis has highlighted the complex interplay of market trends, competitive pressures, and historical precedents that shape such transactions. Further developments will be critical to understanding the full impact of this acquisition on the industry.