Fidelity pumps up e commerce offerings – Fidelity pumps up e-commerce offerings, unveiling exciting new features and enhancements to its online platform. This comprehensive look dives into Fidelity’s existing e-commerce presence, analyzing its strengths and weaknesses, and examining recent developments. We’ll also explore successful strategies from competitors and compare Fidelity’s approach to other financial institutions.

The article delves into specific improvements, such as new functionalities, enhanced user experience, and potential additions to product selection. It also considers the impact on customer interactions, acquisition, and retention, along with the potential market response. Technical and operational considerations, including security measures and scalability, are also examined. Finally, the article projects future trends, potential threats and opportunities, and possible scenarios for Fidelity’s evolving e-commerce presence.

Fidelity’s E-commerce Strategy

Fidelity Investments, a cornerstone of the financial services industry, has been steadily expanding its online presence. This evolution reflects a broader trend in the financial sector, with consumers increasingly seeking convenient and accessible digital options for managing their investments. Understanding Fidelity’s approach to e-commerce is crucial for evaluating its position in the market and anticipating future developments.Fidelity’s e-commerce platform serves as a vital channel for interacting with customers, offering various services from account management to investment tools.

This platform is crucial for maintaining competitiveness in a rapidly changing financial landscape.

Fidelity’s Existing E-commerce Presence

Fidelity’s online platform provides a comprehensive suite of tools and services for managing investments. This includes account access, research tools, and investment management capabilities. The platform is accessible 24/7, allowing clients to manage their accounts at their convenience. Their website is a primary source of information for customers, offering detailed explanations of investment products and strategies. Accessibility features are often included, enabling users with disabilities to effectively utilize the platform.

Fidelity’s Strengths in Online Sales

Fidelity’s strengths lie in its extensive range of investment products and services, coupled with a user-friendly interface. The platform’s robust research tools, including detailed market analysis and investment insights, are significant advantages. Fidelity’s strong brand recognition and established reputation within the financial services sector also contribute to its e-commerce success. The platform is widely trusted and well-regarded.

Fidelity’s Weaknesses in Online Sales

Despite its strengths, Fidelity faces challenges in its e-commerce approach. Competition from newer, more agile fintech companies presents a constant threat. A lack of innovative features compared to some competitors may limit its appeal to younger investors seeking cutting-edge technology. Maintaining the trust and security of sensitive financial data is paramount, and this is a constant concern for any financial institution.

Maintaining a robust security posture is critical for preserving client confidence and preventing fraudulent activity.

Recent Developments in Fidelity’s Online Platform

Fidelity has been actively updating its platform to improve user experience and incorporate new technologies. This includes enhancements to account management features, providing clients with more control over their investments. They have also expanded their educational resources, offering more tools to help clients make informed investment decisions. Integration with other financial platforms or services is an area that is likely to be developed in the future.

Examples of Successful E-commerce Strategies Employed by Competitors

Vanguard, a major competitor, excels in its user-friendly platform and straightforward investment options. Schwab, another prominent competitor, emphasizes low-cost investment options, making them attractive to budget-conscious investors. These companies highlight different strategies that have resonated with distinct investor segments. These successful strategies often emphasize ease of use, transparency, and cost-effectiveness.

Comparison and Contrast of Fidelity’s Approach to Other Financial Institutions

Fidelity’s approach to e-commerce is generally comprehensive, offering a wide array of tools and services. This contrasts with some newer fintech platforms that focus on specific niches or target particular investor demographics. Fidelity’s platform typically caters to a broader range of investors. While some fintechs emphasize innovative technology, Fidelity’s approach leans more toward established and trusted functionality.

Fidelity’s strengths lie in their deep market penetration and robust investment product selection.

Pumping Up Offerings

Fidelity’s e-commerce platform is undergoing a significant upgrade, focusing on enhancing user experience, expanding product selection, and introducing innovative features. This transformation aims to make online interactions more intuitive and engaging, ultimately boosting customer satisfaction and driving sales. The changes reflect a commitment to staying ahead in the competitive online marketplace.The core philosophy behind these improvements is to streamline the entire customer journey, from browsing products to completing purchases.

Fidelity’s recent boost to its e-commerce offerings is a smart move, definitely. It’s interesting to see how this ties into platforms like theglobe com lets users sell intellectual property online , which is changing how we think about online marketplaces. Ultimately, Fidelity’s enhanced platform will likely lead to more convenient and accessible financial services for everyone.

This includes everything from intuitive search capabilities to seamless checkout processes. Ultimately, the goal is to provide a frictionless experience that encourages repeat customers and fosters brand loyalty.

Key Areas of Enhancement

Fidelity is focusing on several key areas to improve its e-commerce platform. These areas include enhanced search functionality, expanded product filtering options, and streamlined checkout processes. These upgrades are designed to improve efficiency and provide a more satisfying experience for users.

Enhanced Search Functionality

The new search engine utilizes natural language processing (NLP) to provide more accurate and relevant search results. Users can now search using more conversational language, leading to improved results and faster product discovery. For instance, a user searching for “blue running shoes for men’s size 10” will receive a more targeted list of products compared to a previous -based search.

Expanded Product Filtering Options

Fidelity has introduced a wider array of filters to refine product searches. Customers can now filter by more specific criteria, including material, color, size, and price range, enabling them to narrow down their choices more effectively. This detailed filtering ensures that users find products that precisely match their requirements, reducing the time spent browsing.

Streamlined Checkout Processes

The checkout process has been streamlined to minimize friction and enhance the overall user experience. This includes implementing a faster payment gateway integration, offering multiple payment options, and providing clear order summaries. The new checkout experience reduces the risk of abandoned carts and promotes a more positive perception of the purchase process.

Improved User Experience

Fidelity is actively working to improve the overall user experience on its e-commerce platform. The redesigned platform incorporates a cleaner layout, a more intuitive navigation structure, and improved responsiveness across various devices. This improvement contributes to a more enjoyable and efficient online shopping experience for all customers.

Potential New Products and Services

Fidelity is exploring new product offerings that can expand its reach and cater to a broader customer base. These include:

- Subscription Boxes: Curated boxes tailored to specific interests, such as fitness, gardening, or home decor, could be offered to provide regular deliveries of products.

- Personalized Recommendations: Utilizing advanced algorithms, Fidelity could provide personalized recommendations based on individual customer preferences, ensuring relevant product suggestions.

- Financial Planning Tools: Integrating financial planning tools directly into the e-commerce platform could help customers manage their finances and purchases more effectively.

These new products and services would further enhance Fidelity’s position as a comprehensive financial and retail partner.

Impact on Customers and the Market

Fidelity’s enhanced e-commerce offerings represent a significant step toward modernizing its customer experience. This evolution will impact not only how customers interact with Fidelity but also the broader financial services market. The changes promise a more seamless and intuitive online platform, ultimately influencing customer acquisition, retention, and market share.

Customer Interaction Enhancement

Fidelity’s improved e-commerce platform is designed to streamline the customer journey. This includes enhanced search functionality, intuitive navigation, and personalized recommendations. Customers will find it easier to locate investment products, compare options, and complete transactions. This streamlined process fosters a more positive and efficient customer interaction.

Impact on Customer Acquisition and Retention

The upgraded e-commerce platform will directly impact customer acquisition and retention. A more user-friendly interface will attract new investors, particularly younger demographics who are increasingly comfortable with online financial services. Improved tools for portfolio management and personalized insights will encourage existing customers to stay with Fidelity. Customer retention will likely improve through the provision of tailored solutions and a more engaging online experience.

Potential for Increased Market Share

Fidelity’s competitive advantage in the financial sector stems from offering a comprehensive suite of financial products and services. The improved e-commerce platform enhances this position by making these offerings readily accessible and easy to use. If Fidelity successfully targets key demographic segments, and the new features resonate with the target audience, increased market share is plausible. This could lead to a more significant presence within the financial services landscape.

Competitive analysis reveals that companies who prioritize digital customer experiences often see growth in market share.

Potential Impact on Customer Service Interactions

The enhanced e-commerce platform is designed to provide customers with more self-service options. This shift will likely reduce the need for customer service interactions regarding basic inquiries and transactions. Consequently, Fidelity’s customer service representatives can focus on complex issues and more personalized support. This shift toward self-service options, common in many successful online businesses, frees up resources and potentially reduces costs.

Fidelity’s recent boost to its e-commerce offerings is certainly exciting. It’s a smart move, especially given the current market trends. Interestingly, there are whispers of a potential partnership between AOL and eBay, which could potentially reshape the digital landscape, as detailed in this article: aol and ebay reportedly discuss partnership. This could add even more competition to the e-commerce arena, making Fidelity’s upgrades even more crucial for staying ahead of the game.

It also allows for a quicker response time to more complex issues, ultimately enhancing customer satisfaction.

Comparison with Competitors’ Enhancements

Several competitors have implemented similar e-commerce enhancements, often with varying degrees of success. The success of these efforts hinges on the overall user experience, the depth of personalization, and the alignment with customer needs. For instance, successful implementations have resulted in increased website traffic and conversions. Conversely, poorly executed changes can lead to confusion and decreased customer engagement.

Fidelity’s strategy needs to carefully consider the current market trends and competitor actions to ensure that their enhancements are effective and meet the needs of their target market.

Technical and Operational Considerations

Pumping up e-commerce offerings demands a robust technical infrastructure and well-defined operational processes. This section delves into the essential technical and operational aspects required to support the enhanced e-commerce capabilities, including security measures and scalability.The increased demand from customers necessitates a review and enhancement of existing infrastructure to handle peak traffic and transaction volumes. This includes upgrades to server capacity, network bandwidth, and database systems.

Proper planning and proactive measures are crucial to avoid performance bottlenecks and ensure a seamless customer experience.

Technical Infrastructure Requirements

The enhanced e-commerce platform necessitates a robust technical infrastructure capable of handling increased traffic and transactions. This includes upgrading existing servers, databases, and network infrastructure. The upgrades must anticipate future growth and support the anticipated surge in traffic and order volumes. Scalable cloud-based solutions are particularly beneficial in accommodating fluctuations in demand.

Operational Challenges and Solutions

Increased e-commerce activity presents several operational challenges. Efficient order fulfillment and inventory management are critical. Implementing a streamlined order processing system, including automated order fulfillment and real-time inventory tracking, will reduce potential delays and errors. Utilizing advanced warehousing and logistics solutions will enhance the speed and efficiency of order delivery. Effective communication channels for customers and internal teams are also essential to address issues quickly and maintain transparency.

Security Measures for Customer Data Protection

Protecting customer data is paramount. Robust security measures must be implemented across the entire e-commerce platform. These measures include encryption of data in transit and at rest, employing multi-factor authentication for user accounts, and regular security audits to identify and address vulnerabilities. Compliance with industry security standards, like PCI DSS, is essential to maintain customer trust and protect sensitive information.

Best Practices in E-commerce Security

Implementing strong security measures is critical to protect customer data. Regular security assessments and penetration testing are recommended to identify and address vulnerabilities before they can be exploited. Regular updates and patching of software systems are vital to ensure the latest security protections are in place. Employee training on security protocols is equally important to maintain a strong security culture within the organization.

Scalability of the E-commerce Platform

The platform must be designed for future growth and increased demand. Modular design allows for scalability and the addition of new features without impacting existing functionalities. Cloud-based infrastructure provides an adaptable solution to easily increase or decrease resources based on fluctuating demand. Regular performance monitoring and capacity planning are essential to anticipate future growth and scale the platform effectively.

Future Trends and Projections

Fidelity’s enhanced e-commerce platform is poised to navigate the dynamic landscape of financial services. Understanding future trends in online financial services is crucial for optimizing strategies and staying ahead of the curve. This section delves into potential future trends, associated risks, and how Fidelity can leverage these changes to its advantage.The financial services industry is experiencing rapid digital transformation, driven by evolving customer expectations and technological advancements.

Customers are increasingly demanding seamless, personalized, and secure online experiences. This shift requires financial institutions to adapt quickly and effectively.

Potential Future Trends in E-commerce for Financial Services

The future of e-commerce in financial services will be characterized by several key trends. Increased personalization, driven by AI and machine learning, will be a key aspect. Customers will expect tailored investment recommendations, personalized financial planning tools, and customized product offerings. Furthermore, integration with other digital platforms, such as social media and mobile apps, will become increasingly common.

This allows for a more comprehensive and accessible user experience. Finally, the focus on security and trust will remain paramount. As online interactions become more complex, robust security measures and transparent communication are vital for maintaining customer confidence.

Potential Threats and Opportunities for Fidelity

The evolving e-commerce landscape presents both threats and opportunities for Fidelity. A key threat is the emergence of new, agile fintech competitors. These companies often leverage innovative technology and aggressive marketing strategies to attract customers. This competitive pressure necessitates Fidelity’s ongoing commitment to innovation and efficiency. An opportunity lies in expanding into new markets and product segments.

This includes offering new investment products, financial planning services, and international investment opportunities. Fidelity can also leverage its extensive customer base and robust brand reputation to capture market share.

Long-Term Impact on Fidelity’s Market Position

The long-term impact of these enhancements will significantly influence Fidelity’s market position. Successful implementation of the e-commerce strategy will likely lead to increased customer engagement and loyalty. Improved accessibility and efficiency will attract new customers, potentially expanding its market share. Conversely, a failure to adapt to evolving trends could result in a loss of market share to competitors.

This underscores the importance of continuous innovation and a customer-centric approach.

Fidelity’s recent boost to their e-commerce offerings is pretty impressive. It’s clear they’re aiming for a more streamlined shopping experience, which is crucial in today’s market. This focus on efficiency dovetails nicely with the current trend of “slimming down e style” – focusing on the essentials and minimizing clutter in online presentation, as detailed in slimming down e style.

Ultimately, these improvements should lead to a better user experience, making Fidelity’s platform even more competitive in the e-commerce space.

Hypothetical Future Scenario for Fidelity’s E-commerce

Imagine a future where Fidelity’s e-commerce platform seamlessly integrates with other financial tools. Users can access their accounts, manage investments, and conduct financial planning through a single, intuitive interface. AI-powered tools provide personalized investment recommendations and financial planning advice, proactively identifying opportunities and mitigating risks. The platform incorporates biometric security measures for enhanced protection of sensitive financial information.

Potential Future Improvements

This table Artikels potential future improvements to Fidelity’s e-commerce platform.

| Feature | Description | Benefits | Timeline |

|---|---|---|---|

| AI-Powered Investment Recommendations | Advanced algorithms analyze market trends and user data to provide personalized investment recommendations. | Improved investment outcomes, enhanced user experience, and reduced decision fatigue. | 2025-2027 |

| Enhanced Security Measures | Implementation of advanced encryption, biometric authentication, and multi-factor authentication for enhanced security. | Increased customer trust and protection against fraud and cyber threats. | 2024-2026 |

| Integrated Financial Planning Tools | Seamless integration of financial planning tools into the e-commerce platform, allowing users to create and manage budgets, track expenses, and plan for the future. | Improved financial literacy, proactive financial planning, and increased customer engagement. | 2026-2028 |

| Personalized Educational Resources | Tailored educational materials and resources based on user’s investment goals and risk tolerance. | Improved financial literacy, increased customer satisfaction, and enhanced understanding of investment strategies. | 2025-2027 |

Illustrative Examples

Fidelity’s enhanced e-commerce platform aims to revolutionize the customer experience, making investment products easily accessible and understandable. This section delves into specific scenarios, illustrating how the platform works and highlighting the enhanced security measures. From finding the perfect investment to completing a secure transaction, this journey will showcase the power of Fidelity’s new platform.This section will demonstrate the streamlined customer journey, showcasing the ease of finding and purchasing investment products, while also detailing the robust security measures implemented to protect user data and financial transactions.

It will conclude with a comparative analysis of Fidelity’s new features against those of key competitors, providing a clear picture of the platform’s strengths and position in the market.

Hypothetical Customer Journey

The customer journey begins with a user navigating the intuitive interface. Search functionality is greatly improved, allowing users to quickly locate specific investment products, whether by type, sector, or even by s. Advanced filters refine search results, ensuring that users quickly identify the appropriate options.

Finding and Purchasing an Investment Product

A user searching for a specific ETF, say “Vanguard Total Stock Market ETF,” can utilize the platform’s advanced search function. The platform displays detailed information about the ETF, including historical performance, expense ratio, holdings, and recent news. This information is presented in a clear and concise format, enabling informed decision-making. The user can easily add the chosen product to their portfolio and proceed to the secure checkout page.

The checkout process is simplified, with multiple payment options available, including various bank accounts and debit/credit cards. The user reviews their order details and confirms the purchase, ultimately receiving a confirmation email.

Security Measures in Online Transactions

Fidelity’s enhanced e-commerce platform prioritizes security. The platform utilizes industry-standard encryption protocols (e.g., TLS 1.3) to protect sensitive data during transmission. Multi-factor authentication (MFA) is employed for added security, requiring users to verify their identity through multiple methods. Regular security audits and penetration testing are conducted to proactively identify and address potential vulnerabilities. Real-time fraud detection systems monitor transactions for suspicious activity.

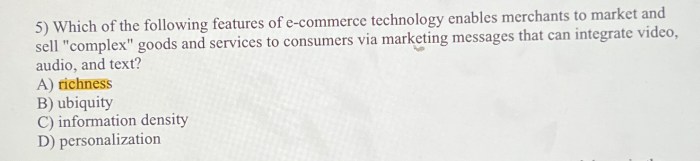

Comparison of Fidelity’s Features with Competitors, Fidelity pumps up e commerce offerings

| Feature | Fidelity | Competitor 1 | Competitor 2 |

|---|---|---|---|

| Investment Product Search | Advanced filters, real-time data updates, intuitive interface | Basic search, limited filtering options | Basic search, limited filtering options, some real-time data |

| Security | Industry-standard encryption, multi-factor authentication, regular security audits | Basic encryption, limited authentication methods | Basic encryption, limited authentication methods, less frequent security audits |

| User Interface | Modern, intuitive design, mobile-responsive | Outdated design, limited mobile responsiveness | Slightly better design than Competitor 1, but still behind Fidelity |

| Customer Support | 24/7 customer support via various channels (phone, chat, email) | Limited customer support hours | Limited customer support channels |

Visual Representation of the Customer Experience

Imagine a user, Sarah, logging into her Fidelity account. The platform’s homepage presents a personalized dashboard, showcasing her current portfolio holdings and investment performance. A prominent search bar allows her to quickly find the “Schwab Total Stock Market ETF.” Detailed information about the ETF is presented in an easy-to-understand format. Visual representations of performance and holdings make complex information accessible.

The checkout process is seamless and secure, leading to a confirmation email upon completion. The entire process is intuitive and user-friendly, designed for ease of use.

Ending Remarks: Fidelity Pumps Up E Commerce Offerings

Fidelity’s commitment to bolstering its e-commerce platform is clear. The company’s efforts to enhance user experience, expand product offerings, and address security concerns position it well for growth in the competitive financial services market. The future looks bright for Fidelity’s online presence, and the impact on customers and the market should be significant. However, ongoing vigilance and adaptation to future market trends will be crucial for long-term success.