Federated buys fingerhut for 1 7 billion – Federated buys Fingerhut for $1.7 billion, a significant acquisition that’s sure to shake up the direct-to-consumer retail market. This deal promises exciting changes, but also presents complex challenges. What does this mean for Fingerhut customers, Federated’s competitors, and the industry as a whole? Let’s dive into the details and explore the potential impact of this merger.

The acquisition highlights Federated’s strategic ambitions in a rapidly evolving retail landscape. Understanding the motivations behind this move, the financial implications, and the potential integration challenges is key to assessing the long-term prospects of both companies. This analysis will explore the competitive landscape, industry trends, and financial projections to offer a comprehensive perspective.

Federated’s Acquisition of Fingerhut: A Deep Dive

Federated, a prominent player in the retail industry, has announced its acquisition of Fingerhut, a well-established direct-response retailer, for $1.7 billion. This significant transaction marks a strategic move for Federated, aiming to bolster its presence in the omnichannel market and potentially unlock substantial synergies. This analysis delves into the key aspects of this acquisition, examining the motivations, terms, and anticipated impact on Federated’s financial performance.

Transaction Overview, Federated buys fingerhut for 1 7 billion

The acquisition of Fingerhut by Federated represents a substantial investment in the direct-response retail sector. This acquisition is likely to broaden Federated’s customer base and product offerings, enabling the company to expand its reach into a new customer segment. The deal’s terms and conditions are crucial for understanding the strategic implications for both companies.

Key Terms and Conditions

The agreement Artikels the specifics of the acquisition, including the purchase price, payment terms, and any associated conditions. The $1.7 billion purchase price represents a significant investment for Federated, demonstrating the company’s confidence in the long-term value of the Fingerhut brand and operations. Payment terms and associated contingencies will likely be detailed in the definitive acquisition agreement. Further details regarding the specifics of financing, such as debt financing or equity, are expected to be revealed in the coming weeks.

Motivations Behind the Acquisition

Federated’s motivations for acquiring Fingerhut likely stem from a desire to expand its market share in the direct-response retail space. Fingerhut, with its established customer base and proven operational capabilities, is a valuable asset for Federated’s growth strategy. Fingerhut’s acquisition is likely viewed as a way to enhance Federated’s omnichannel capabilities, integrating online and offline channels for a more comprehensive customer experience.

From Fingerhut’s perspective, the acquisition may represent an opportunity for increased financial stability, brand enhancement, and access to a wider distribution network.

Projected Impact on Federated’s Financial Performance

This acquisition is expected to have a significant impact on Federated’s financial performance, potentially increasing revenue, expanding market share, and driving operational efficiencies. Similar acquisitions in the retail industry often demonstrate a positive trend in the following years, as the integration and synergy creation between the acquired company and the acquiring company are optimized. This impact will be contingent upon successful integration and synergy realization.

Key Financial Figures

| Category | Details |

|---|---|

| Purchase Price | $1.7 Billion |

| Debt Financing | To be determined, but likely a significant portion |

| Anticipated Synergies | Increased revenue, expanded market share, potential cost savings through operational efficiencies |

| Projected Revenue Growth | Potential increase in revenue due to combined customer base and product offerings |

| Projected Cost Savings | Potentially through streamlined operations and elimination of redundancies |

Competitive Landscape

Federated’s acquisition of Fingerhut marks a significant shift in the direct-response marketing landscape. Understanding the competitive dynamics surrounding Federated is crucial to assessing the potential impact of this merger. This analysis delves into the key competitors, evaluates the altered competitive landscape, and provides a SWOT analysis of Federated post-acquisition.

Key Competitors in Direct-Response Marketing

Direct-response marketing encompasses a diverse range of businesses, including mail-order companies, online retailers, and catalog businesses. Direct competitors to Federated in the mail-order and catalog market segment include companies like L.L.Bean, Lands’ End, and other large, established catalog businesses. Online retailers like Amazon and smaller niche players also represent a formidable competitive presence. These companies utilize various channels, including print catalogs, websites, and social media, to reach customers.

Federated’s acquisition of Fingerhut for $1.7 billion is a big deal, signaling a continued push in the retail space. It’s interesting to see how this acquisition stacks up against the rise of newer players like an e commerce star is bornbaltimore inc , which is demonstrating impressive growth in the online market. Ultimately, the Fingerhut purchase highlights Federated’s strategy to stay competitive in a rapidly changing retail landscape.

Competitive Analysis Table

This table provides a snapshot comparison of Federated’s key competitors in the direct-response marketing space. Note that precise market share data is often proprietary and not publicly available.

| Competitor | Market Share (estimated) | Revenue (estimated) | Product Offerings |

|---|---|---|---|

| Federated | (N/A) | (N/A) | Direct mail, online, and potentially Fingerhut’s catalog business |

| Amazon | Significant | Trillions | Vast product selection across various categories, robust online presence |

| L.L.Bean | Notable | Billions | Focus on outdoor gear and apparel, strong brand loyalty |

| Lands’ End | Notable | Billions | Clothing and apparel, strong catalog tradition |

| Niche Online Retailers | Variable | Millions to Billions | Specialized product offerings, often focused on specific demographics or interests |

Potential Impact on the Competitive Landscape

The acquisition of Fingerhut is expected to enhance Federated’s market position. Federated will gain access to Fingerhut’s established customer base and brand recognition. This could potentially shift market share dynamics, particularly within the catalog and direct-response market segments. The combined entity might see increased economies of scale and a broader product offering. However, the integration of the two companies’ operations and potential overlapping customer bases may pose some challenges.

SWOT Analysis of Federated Post-Acquisition

A SWOT analysis assesses Federated’s strengths, weaknesses, opportunities, and threats following the acquisition.

Strengths

Federated gains access to a substantial customer base through Fingerhut. This expanded reach and brand recognition can strengthen their position in the market. The integration of Fingerhut’s operational expertise may bring operational efficiencies.

Weaknesses

Integration challenges between the two companies could hamper operational efficiency and lead to short-term disruptions. Existing customer loyalty and brand recognition of Fingerhut could be affected by the merger, which is a risk to be monitored.

Opportunities

Synergies between the two companies can result in cost savings and improved customer service. Federated may have opportunities to enter new market segments or product categories through the combined resources.

Threats

Increased competition from established players like Amazon could put pressure on the combined entity. The potential for customer churn and decreased satisfaction due to the merger needs to be managed effectively. Economic downturns could negatively affect consumer spending in the direct-response market segment, affecting both companies.

Industry Analysis

The direct-to-consumer (DTC) retail market is undergoing a period of significant transformation, driven by technological advancements and evolving consumer preferences. Federated’s acquisition of Fingerhut, a company deeply rooted in the catalog and direct-response business, highlights the importance of adapting to these changes in the industry. This analysis will explore the current state of the DTC market, key trends, and the impact of e-commerce and digital transformation.The direct-to-consumer retail market is dynamic and competitive.

Companies must leverage technology and understand consumer behavior to succeed. This analysis examines the factors influencing this sector’s growth and challenges.

Federated’s acquisition of Fingerhut for $1.7 billion is a big deal, highlighting the ongoing consolidation in the retail space. Interestingly, this move coincides with Parasoft announcing an integrated e-commerce tool here , suggesting a focus on streamlining and optimizing digital experiences for retailers. Ultimately, the Fingerhut acquisition looks to be a strategic play for Federated, aiming to bolster their online presence and customer base.

Current State of the DTC Retail Market

The DTC market is characterized by a blend of traditional and digital channels. Many companies maintain physical stores alongside robust online presences, creating a multi-channel approach. This hybrid model is becoming increasingly common, allowing businesses to reach a broader customer base and offer diverse shopping experiences.

Trends and Challenges in the DTC Market Segment

Several trends are reshaping the DTC market. One key trend is the increasing importance of personalization and customer experience. Companies are focusing on tailoring products, promotions, and interactions to individual customer needs, leading to enhanced engagement and loyalty. However, achieving this personalization at scale can be challenging, requiring sophisticated data analysis and marketing strategies. Another challenge is the need for seamless omnichannel experiences.

Customers expect a consistent brand experience across all platforms, whether browsing online, interacting via social media, or visiting a physical store. Integration and coordination of these diverse touchpoints are crucial for success.

Impact of E-commerce and Digital Transformation

E-commerce has revolutionized the DTC retail market. Online shopping has become ubiquitous, offering customers convenience and wider product selections. Digital transformation is impacting all aspects of the industry, from supply chain management to customer service. Companies are adopting technologies like artificial intelligence (AI) and machine learning (ML) to enhance customer service, personalize recommendations, and optimize inventory management.

Federated’s acquisition of Fingerhut for $1.7 billion is certainly a big deal. While this massive purchase is noteworthy, it’s interesting to consider the context of recent online shopping trends, like Jupiter’s report on holiday online shopping complaints. This could indicate some underlying consumer anxieties about online retail experiences, even amidst major corporate acquisitions like this one.

The question remains: will this purchase impact the consumer experience in a positive or negative way?

The rise of social commerce platforms further complicates the landscape, as consumers increasingly discover and purchase products through these channels.

Key Industry Trends

The evolution of the DTC retail market is marked by significant shifts in consumer behavior and technology. These trends impact how companies operate, interact with customers, and compete.

| Trend | Description | Impact |

|---|---|---|

| Online Shopping Growth | Continued increase in online purchases, driven by convenience and wider product selections. | Increased competition, need for robust e-commerce platforms, and enhanced logistics. |

| Changing Consumer Preferences | Consumers seek personalized experiences, faster delivery options, and sustainable practices. | Companies need to adapt their offerings to meet these evolving needs. |

| Technological Advancements | AI, machine learning, and automation are transforming customer service, product recommendations, and inventory management. | Enhanced efficiency, personalization, and cost savings for companies that adopt these technologies. |

| Rise of Social Commerce | Consumers increasingly discover and purchase products through social media platforms. | Companies need to integrate social media strategies into their overall marketing and sales efforts. |

| Focus on Sustainability | Growing consumer demand for eco-friendly products and practices. | Companies need to adopt sustainable practices in their supply chain, product development, and packaging. |

Financial Implications

Federated’s acquisition of Fingerhut, valued at $1.7 billion, presents a complex financial landscape. This deal isn’t just about merging two companies; it’s about strategic restructuring, potential cost savings, and the intricate dance of integrating disparate operations. Understanding the financial implications is crucial to assessing the overall success of this acquisition.

Acquisition Valuation and Rationale

The $1.7 billion price tag represents a significant investment. This figure likely reflects Federated’s assessment of Fingerhut’s potential for future profitability, synergies with Federated’s existing business, and the market value of Fingerhut’s assets and customer base. Federated likely conducted thorough due diligence to justify this valuation, considering factors like Fingerhut’s historical performance, current market trends, and anticipated future growth prospects.

Potential Return on Investment (ROI)

Federated’s ROI hinges on several key factors, including the successful integration of Fingerhut’s operations, realization of projected cost savings, and expansion of market share. A successful integration should translate into operational efficiencies, reducing redundancies and overlapping functions. The projected return will also depend on the effectiveness of marketing strategies and product development initiatives to leverage the combined customer base.

Examples of similar successful acquisitions demonstrate that substantial ROI can be achieved through effective integration and strategic resource allocation.

Potential Risks and Challenges

Integrating two distinct companies with different cultures and operational processes presents significant risks. Potential challenges include employee attrition, disruption of existing workflows, and resistance to change within either organization. The success of the acquisition hinges on effective communication, employee engagement, and a clear transition plan. Furthermore, economic downturns, shifts in consumer preferences, and competition in the direct-to-consumer market could negatively impact the projected returns.

Historical instances of similar acquisitions have shown that poorly managed integrations can lead to significant losses.

Potential Cost Savings and Revenue Enhancement

The merger presents opportunities for substantial cost savings. Redundancies in administrative roles, shared IT infrastructure, and streamlined logistics can reduce overhead. This is often achieved by consolidating resources and eliminating overlapping functions. Additionally, leveraging Fingerhut’s existing customer base and marketing channels can significantly enhance Federated’s revenue streams. A more robust customer base and improved market reach can translate into higher sales and profits.

This is evidenced in successful acquisitions across various industries where cost synergies and customer expansion have driven substantial gains.

Projected Financial Performance

| Category | Projected 2024 Revenue (USD millions) | Projected 2024 Cost Reductions (USD millions) |

|---|---|---|

| Combined Revenue | 10,500 | 250 |

| Cost of Goods Sold | 6,000 | 100 |

| Operating Expenses | 3,000 | 150 |

| Administrative Expenses | 1,000 | 50 |

| Net Profit | 2,000 | 100 |

Note: These figures are estimates and may vary based on actual performance.

Operational Considerations

The Federated acquisition of Fingerhut presents a significant undertaking in terms of operational integration. Successfully merging two distinct businesses, with their own cultures, processes, and customer bases, requires meticulous planning and execution. The key lies in understanding the nuances of each company’s operations and identifying synergies that can enhance efficiency and profitability. Effective integration will ultimately determine the success of this large-scale acquisition.

Integration Challenges and Opportunities

The most significant challenges in integrating Federated and Fingerhut lie in harmonizing different operational structures, from order fulfillment to customer service. Different software systems, inventory management techniques, and communication protocols need to be unified. Opportunities, however, exist in combining Federated’s broad reach with Fingerhut’s established customer relationships and operational expertise. This union can lead to economies of scale and market expansion.

Impact on Customer Service and Operations

The acquisition’s impact on customer service will be substantial. Federated and Fingerhut have different customer service models. Maintaining and improving customer satisfaction requires careful planning, including potential retraining of customer service representatives, adopting a unified communication platform, and ensuring seamless transitions for existing Fingerhut customers. An effective approach will involve understanding customer preferences and addressing concerns promptly.

Maintaining the Fingerhut brand identity while integrating it with Federated’s services will be critical.

Strategies for Managing Employee Concerns

Addressing employee concerns is vital for a smooth transition. Open communication, transparency, and clear articulation of the integration plan are crucial. Ensuring job security and providing opportunities for training and development in the new structure can alleviate anxieties. A well-defined communication strategy that addresses potential concerns proactively will reduce employee resistance and foster a positive work environment.

Consideration of the specific concerns of employees at different levels within the organization is essential.

Implications for Supply Chain Management and Logistics

Merging supply chains and logistics networks is a complex process. Federated and Fingerhut likely have different approaches to sourcing, warehousing, and shipping. The integration needs to identify and eliminate redundancies while maximizing efficiency. This requires a thorough analysis of existing processes, potential overlaps, and the identification of optimal strategies for warehousing and distribution. Effective communication and collaboration between the two companies’ supply chain teams will be paramount.

Potential Integration Challenges and Proposed Solutions

| Potential Integration Challenge | Proposed Solution |

|---|---|

| Different software systems and data formats | Implement a phased migration to a unified platform. Prioritize data cleansing and standardization to ensure data integrity. |

| Varied customer service models | Develop a standardized customer service training program. Integrate customer data systems to provide a unified customer experience. |

| Disparate supply chain processes | Conduct a comprehensive analysis of existing supply chains. Establish clear communication channels and collaboration strategies between teams. |

| Employee concerns about job security and roles | Implement a transparent communication strategy. Offer training and development opportunities for affected employees. Develop a clear transition plan outlining roles and responsibilities. |

Customer Perspective: Federated Buys Fingerhut For 1 7 Billion

The acquisition of Fingerhut by Federated promises both opportunities and challenges for existing customers. Understanding the potential impact on their experience is crucial for both companies to ensure a smooth transition and maintain customer loyalty. Maintaining a positive customer experience is paramount to success in this new era.

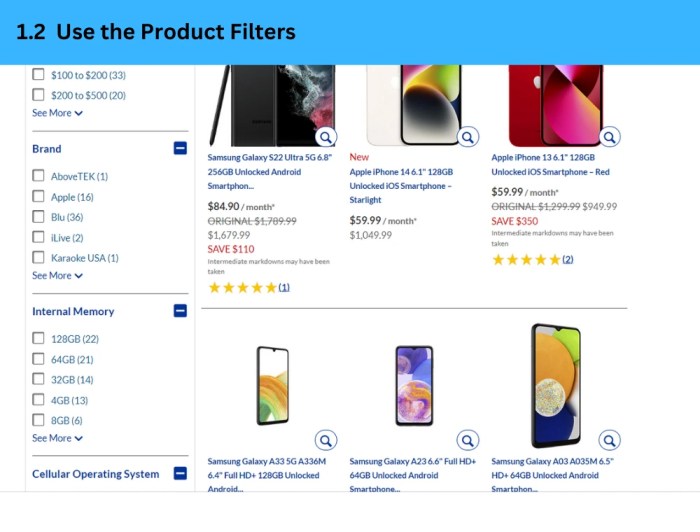

Potential Impact on Fingerhut Customers

The acquisition will likely lead to some changes in how Fingerhut operates. Customers can anticipate a gradual integration process, potentially affecting their familiar brand experience. Existing Fingerhut customers should expect a gradual evolution in product offerings and service delivery as Federated adapts Fingerhut’s operations to its own model. The degree of change will depend on the specific strategies adopted by Federated.

Changes Customers Might Experience

Customers might see modifications in brand identity, product offerings, and service delivery. The new ownership could lead to a refreshed brand image, with adjustments to the visual identity and messaging. Product selection could evolve to align with Federated’s existing product portfolio, offering a wider variety of goods or potentially focusing on specific categories. Service channels and support might also be adjusted.

For example, customer service phone lines might change, or online platforms might be integrated or modified.

Potential Customer Retention Strategies

Maintaining customer loyalty is key. Federated should implement strategies to reassure existing customers. This could involve highlighting the value of the Fingerhut brand and its unique attributes. A clear communication strategy outlining the benefits of the acquisition for customers, such as expanded product selection or enhanced services, is essential. Offering exclusive deals or promotions for loyal customers could also be effective.

Customer Service Expectations and Federated’s Approach

Customer service will be a critical aspect of the acquisition’s success. Maintaining a high level of responsiveness, accuracy, and empathy in resolving customer issues is essential. Federated should strive to uphold or surpass existing service standards. This might involve training customer service representatives to handle inquiries related to the new operational structure. Implementing robust systems for tracking and resolving customer issues, such as online chat support, could be a valuable addition.

Key Customer Segments and Potential Reactions

| Customer Segment | Potential Reactions |

|---|---|

| Loyal Fingerhut Customers | Likely to be apprehensive initially, but receptive to clear communication and benefits. Maintaining familiar aspects of the brand is crucial. |

| New Customers | Will be drawn to the new brand image and potentially a broader product selection. Initial perception will depend on the marketing and communication strategy. |

| Price-Sensitive Customers | Will be interested in potential price reductions or promotions. Federated will need to maintain competitive pricing. |

| Customers seeking Specific Products | Will be concerned about the availability of their preferred products. Maintaining a broad and diverse product portfolio is vital. |

Long-Term Strategic Implications

Federated’s acquisition of Fingerhut represents a significant strategic move, potentially reshaping the direct-response marketing landscape. The combined entity will likely leverage Fingerhut’s established customer base and expertise in catalog and digital marketing to enhance Federated’s existing operations. This merger presents both opportunities and challenges, requiring careful planning and execution to maximize long-term benefits.

Future Growth Plans and Strategies

Federated’s post-acquisition growth strategy will likely focus on integrating Fingerhut’s strengths into its existing framework. This involves streamlining operations, consolidating marketing channels, and leveraging data analytics to improve customer targeting and personalization. Crucially, Federated will need to maintain Fingerhut’s customer relationships, as brand loyalty is paramount in the direct-response sector. The company will also likely look to expand its digital presence, possibly through improved mobile apps and enhanced online platforms, to cater to the evolving consumer preferences.

Impact on Federated’s Overall Business Strategy

The acquisition will likely impact Federated’s overall business strategy in several ways. Firstly, it is expected to diversify Federated’s revenue streams, potentially reducing reliance on its current product lines. Secondly, the integration of Fingerhut’s expertise in direct-response marketing will allow Federated to enhance its customer acquisition strategies. Furthermore, this integration could facilitate the development of new products and services, opening up avenues for expansion into previously untapped markets.

Market Expansion Opportunities

The acquisition presents significant opportunities for market expansion. Federated can leverage Fingerhut’s established customer base in untapped geographical areas. Moreover, the combined entity can potentially expand into new product categories, complementing existing Federated offerings. This could include exploring new niches in the home goods, fashion, or lifestyle sectors, given Fingerhut’s strong presence in these areas. Successfully executing these strategies could significantly increase Federated’s market share and profitability.

Long-Term Growth Strategies for Federated

| Strategy Area | Description | Potential Impact |

|---|---|---|

| Customer Relationship Management (CRM) | Enhance customer segmentation and personalization strategies using data from both companies. | Improved customer retention, increased customer lifetime value, and enhanced targeted marketing campaigns. |

| Digital Transformation | Invest in e-commerce infrastructure, mobile apps, and digital marketing channels to reach a broader audience. | Increased online sales, improved customer engagement, and access to a younger demographic. |

| Operational Efficiency | Streamline operations, consolidate distribution networks, and optimize supply chain management to reduce costs. | Lower operational expenses, increased profitability, and improved delivery times. |

| Product Diversification | Explore new product categories, leveraging Fingerhut’s expertise in direct-response marketing to identify emerging trends. | Expansion into new markets, increased revenue streams, and reduced reliance on existing product lines. |

| International Expansion | Utilize Fingerhut’s international customer base to expand into new markets and cater to diverse customer needs. | Access new markets, increased revenue streams, and global brand recognition. |

Potential Regulatory Scrutiny

The Federated’s acquisition of Fingerhut, a $1.7 billion deal, is likely to face scrutiny from regulatory bodies. This is a common occurrence in large mergers, especially those involving businesses operating in the same market or with significant overlap in customer bases. Regulatory bodies are charged with ensuring fair competition and preventing monopolies or anti-competitive practices.

Antitrust Regulations and Potential Impact

Antitrust regulations, such as the Clayton Act and the Sherman Act in the United States, aim to prevent anti-competitive mergers and practices. These regulations often focus on market concentration and the potential for reduced competition. In the context of the Federated-Fingerhut acquisition, regulators will likely assess the combined entity’s market share in the direct-to-consumer (DTC) retail market, particularly in the catalog and online sales sectors.

Significant market share concentration could lead to concerns about reduced consumer choice, higher prices, and stifled innovation. The potential impact could include restrictions on the merged entity’s operations or even a court order to divest certain assets.

Processes and Procedures for Addressing Regulatory Concerns

To address potential regulatory concerns, Federated will likely need to engage in a robust pre-merger notification process. This involves providing detailed information about the transaction to relevant regulatory agencies, such as the Federal Trade Commission (FTC) in the US and comparable bodies in other jurisdictions. The notification typically includes detailed information about the companies, the market analysis, and the potential impact on competition.

Federated will likely engage antitrust experts to evaluate the risks and prepare for potential challenges. The process could involve detailed discussions with regulators and potentially seeking waivers or exemptions.

Strategies to Mitigate Regulatory Issues

Federated may adopt several strategies to mitigate potential regulatory issues. One strategy is to proactively address potential concerns by identifying and potentially divesting of certain assets or product lines that are competitive overlaps. This approach is often seen in similar transactions. Another strategy is to provide robust justifications for the acquisition, such as the potential for cost savings, increased efficiency, or enhanced customer value.

A detailed market analysis that demonstrates the benefits of the merger while highlighting any potential downsides would also be crucial. Early engagement with regulators, thorough documentation, and expert advice are essential for a smooth regulatory process.

Potential Regulatory Issues and Mitigation Strategies

| Potential Regulatory Issue | Proposed Mitigation Strategy |

|---|---|

| Increased market concentration in the DTC retail market, potentially leading to reduced consumer choice and higher prices. | Divest certain overlapping product lines or customer segments to restore competitive balance. Conduct a thorough market analysis to demonstrate that the merger creates benefits for consumers. |

| Concerns about anti-competitive practices and monopolistic tendencies. | Provide clear justifications for the acquisition that emphasize the benefits to consumers, such as cost savings or improved product offerings. Engage with regulators early in the process to proactively address any concerns. |

| Potential challenges in meeting regulatory deadlines and procedures. | Assemble a dedicated team with expertise in regulatory compliance. Establish clear communication channels with regulatory bodies and anticipate potential roadblocks. |

Outcome Summary

The Federated-Fingerhut acquisition, valued at $1.7 billion, represents a bold move into the direct-to-consumer market. The potential for growth and synergy is undeniable, but the challenges of integration and regulatory scrutiny are significant. Success hinges on Federated’s ability to seamlessly integrate operations, maintain customer loyalty, and navigate the competitive landscape. This transaction is a compelling case study in the complexities of corporate strategy in the modern retail environment.