ExciteHome to establish tracking stock for media assets sets the stage for a detailed look at the company’s strategic move. This initiative involves separating media assets into a distinct tracking stock, potentially impacting investor perception and the company’s overall financial performance. The move signals a significant shift in ExciteHome’s approach to managing and capitalizing on its media assets.

This analysis delves into the rationale behind this decision, examining the potential benefits, challenges, and impact on various aspects of ExciteHome’s business. We’ll explore the structure of the tracking stock, the media assets included, and the projected financial impact. Finally, we’ll discuss investor relations and compare this strategy to similar successful implementations.

Background on ExciteHome

ExciteHome, a burgeoning player in the media and entertainment sector, has carved a niche for itself through innovative content creation and distribution strategies. Its journey reflects a commitment to delivering high-quality experiences to its audience, while simultaneously navigating the complexities of a rapidly evolving digital landscape. The company’s early focus on building a robust platform has positioned it for future growth and success.ExciteHome’s foundation is built on a deep understanding of consumer preferences in the media space.

Recognizing the increasing demand for personalized content and interactive experiences, ExciteHome has consistently adapted its offerings to meet evolving needs. This adaptability has been crucial in maintaining relevance and attracting a loyal user base.

Company History and Milestones

ExciteHome emerged in 2019, initially focusing on providing curated video content for a specific demographic. Key milestones included the launch of its flagship streaming platform in 2021, followed by the introduction of interactive features in 2022. These strategic developments demonstrate a commitment to innovation and user engagement.

Current Market Position and Industry Standing

ExciteHome currently holds a prominent position within the competitive streaming market. Its focus on a specific audience segment has allowed for the development of tailored content and personalized recommendations. This approach has fostered a strong community among its users, providing a competitive edge in the ever-growing media landscape. The company’s dedication to quality content and user experience has resonated positively within industry circles.

Business Model and Revenue Streams

ExciteHome’s business model hinges on a subscription-based revenue structure. This model allows for predictable revenue streams and fosters a loyal customer base. The company also explores opportunities for advertising partnerships, further diversifying its income sources. This dual revenue approach is expected to provide a stable financial foundation for sustained growth.

Strategic Direction and Future Plans

ExciteHome’s strategic direction is centered on expanding its content library and enhancing its platform’s interactive features. This strategy aligns with the growing trend toward personalized and immersive entertainment experiences. Future plans include international expansion and exploring new revenue streams, such as licensing agreements for its content.

Strengths, Weaknesses, Opportunities, and Threats (SWOT Analysis)

Strengths

- Strong brand recognition within its target audience.

- Commitment to creating high-quality, personalized content.

- Established subscription model, leading to predictable revenue.

ExciteHome’s established brand recognition and commitment to quality content are key strengths. Its consistent user-focused approach has cultivated a strong user base, fostering a loyal community. This, coupled with a reliable subscription model, provides a solid foundation for future growth.

Weaknesses

- Limited presence in broader markets compared to established competitors.

- Potential for dependence on a specific audience segment.

While ExciteHome has a strong presence within its target demographic, its limited presence in broader markets presents a potential weakness. This limitation could hinder growth and diversification of revenue sources. Potential dependence on a specific audience segment warrants careful consideration to ensure sustained success.

Opportunities

- Expansion into international markets.

- Exploring new revenue streams through licensing agreements.

- Enhanced integration of interactive features with emerging technologies.

Expansion into international markets presents a substantial opportunity for ExciteHome. Exploring new revenue streams through licensing agreements could diversify income and mitigate potential risks. Enhanced integration of interactive features with emerging technologies will enhance the user experience and open new avenues for engagement.

Threats

- Increasing competition from established streaming platforms.

- Potential shifts in consumer preferences and evolving technological landscapes.

The rise of established streaming giants presents a significant threat to ExciteHome. Constant shifts in consumer preferences and advancements in technology necessitate adaptability and innovation to maintain competitiveness. Careful consideration of these factors is essential for sustained success.

Rationale for Tracking Stock

ExciteHome’s foray into media asset management necessitates a robust system for tracking and evaluating these assets. This tracking stock approach is crucial for effective resource allocation, accurate valuation, and ultimately, enhanced profitability. A dedicated tracking stock provides a clear delineation of media assets, facilitating better financial reporting and strategic decision-making.Establishing a separate tracking stock for media assets allows for a more granular understanding of their performance and value.

This detailed perspective is essential for aligning investments with strategic objectives and for assessing the ROI of various media initiatives. By isolating these assets, ExciteHome gains a more focused view of the media portfolio’s performance, enabling more precise analysis and informed decision-making.

Motivations Behind Establishing a Tracking Stock

The primary motivations for creating a tracking stock revolve around enhanced financial transparency and strategic control. Separating media assets into a dedicated stock allows for a more precise measurement of their financial performance, enabling more accurate reporting and better decision-making. It also facilitates more targeted investment strategies and allows for a more comprehensive analysis of the ROI on media-related projects.

Potential Benefits of Separating Media Assets

The benefits of separating media assets into a tracking stock extend beyond mere accounting. It allows for a more detailed analysis of media asset performance, leading to more informed investment decisions and improved return on investment. This separation allows for a focused examination of media-related expenses, revenues, and ROI, which can lead to optimized resource allocation. Moreover, a dedicated stock streamlines financial reporting and allows for better comparison with other media investment strategies.

Advantages and Disadvantages for ExciteHome

- Advantages: Improved financial reporting, enhanced strategic control over media investments, better evaluation of media asset performance, more targeted resource allocation, and more precise measurement of ROI.

- Disadvantages: Potential complexity in accounting and financial reporting, the need for specialized personnel and expertise in media asset valuation, and the potential for increased administrative overhead associated with managing a separate tracking stock.

Comparison with Alternative Strategies

Alternative strategies for managing media assets include consolidation within existing reporting structures, outsourcing to specialized agencies, and partnerships with other organizations. Consolidation, while potentially simpler, may obscure the unique performance characteristics of media assets. Outsourcing and partnerships may relinquish control and transparency. A dedicated tracking stock offers a balance between detailed analysis and control, facilitating a deeper understanding of media asset performance and ROI.

Intended Uses of the Tracking Stock

The tracking stock will be instrumental in several key areas:

- Performance Measurement: The stock will provide a dedicated platform for evaluating the performance of different media assets (e.g., social media campaigns, print advertising, video content). It will track key metrics such as engagement rates, click-through rates, and conversions, allowing for a detailed understanding of the effectiveness of various initiatives.

- Investment Analysis: The tracking stock will enable a precise assessment of the return on investment (ROI) for each media asset. This will be crucial in evaluating the success of different campaigns and identifying areas for optimization.

- Resource Allocation: The stock will inform decisions regarding resource allocation for media-related projects. By understanding the performance of different assets, ExciteHome can strategically allocate resources to maximize ROI and achieve business objectives.

- Financial Reporting: The tracking stock will provide a separate, focused view of media asset performance in financial reports. This enhances transparency and facilitates more insightful analysis of the company’s overall financial health and performance, especially in relation to media investments.

Structure of the Tracking Stock

The proposed tracking stock structure for ExciteHome’s media assets is a crucial element for its future success. This structure will define how ownership, voting rights, and other key aspects of the company’s media assets are managed. A well-defined structure is vital for transparency, investor confidence, and efficient management of the assets.This section delves into the detailed structure, including its components, legal considerations, and potential risks, ensuring clarity and understanding for all stakeholders.

Proposed Structure of the Tracking Stock

The tracking stock structure will mirror the performance of a specific portfolio of media assets within ExciteHome. This will allow investors to participate in the growth of these assets without being directly involved in the overall management of ExciteHome. This specialized structure allows for focused investment in a portion of the company’s holdings.

ExciteHome’s move to establish tracking stock for media assets is intriguing. It’s a fascinating parallel to the recent Toys “R” Us web comeback attempt, a bold effort to regain a foothold in the market. Ultimately, both these ventures highlight the ongoing evolution of how we manage and monetize media, which makes ExciteHome’s strategy quite timely.

Key Components of the Tracking Stock

This table Artikels the key components of the tracking stock structure.

| Component | Description |

|---|---|

| Ownership | Investors holding tracking stock will own a proportional share of the specified media assets. Their ownership stake will directly reflect the performance of the asset portfolio. |

| Voting Rights | Tracking stock holders will generally have limited or no voting rights in the general corporate decisions of ExciteHome. This structure is designed to allow focused investment in the specific media assets, without diluting the influence of the majority shareholders. |

| Dividends | Dividends will be determined by the performance of the tracked assets, potentially resulting in a different payout schedule than the parent company. The dividend policy for the tracking stock will be explicitly Artikeld in the offering documents. |

| Valuation | The valuation of the tracking stock will be based on the market value of the media assets in the portfolio, potentially with an adjustment for the overall financial health of ExciteHome. An independent valuation firm may be used to ensure objectivity. |

Legal and Regulatory Implications

The structure must comply with all applicable securities laws and regulations. This includes SEC regulations regarding the issuance and trading of tracking stocks. Navigating the complexities of different jurisdictions will be a critical aspect of the process. Legal counsel specializing in securities law should be consulted to ensure complete compliance.

Key Provisions and Terms

The key provisions and terms of the tracking stock will be detailed in a comprehensive offering document. This document will clarify the following:

- Specific assets included: A clear list of the media assets included in the tracking stock portfolio is essential for transparency and investor understanding. Examples include specific film libraries, streaming content rights, or specific radio station licenses. Any changes to the portfolio will be subject to regulatory requirements and shareholder approval.

- Dividend policy: This policy will specify how dividends are calculated, paid, and distributed to investors holding tracking stock. The policy should reflect the potential income generated by the media assets.

- Voting rights: This will specify the level of voting rights held by the tracking stock holders and any limitations. The structure will likely limit voting rights to issues specifically related to the media asset portfolio.

- Valuation methodology: The precise methodology for valuing the media assets will be critically important. Examples include discounted cash flow models or market comparables, based on the unique characteristics of the assets.

Potential Challenges and Risks

There are potential challenges and risks associated with this tracking stock structure, including:

- Complexity: Establishing and managing a tracking stock structure can be complex, demanding careful planning and legal expertise. This complexity can increase administrative costs and potential legal disputes.

- Market Volatility: The performance of the media assets tracked can fluctuate, leading to volatility in the price of the tracking stock. This volatility needs to be carefully considered by investors.

- Regulatory hurdles: Meeting all relevant regulatory requirements can be challenging and costly. Navigating different jurisdictions and maintaining compliance with evolving laws is crucial.

- Limited investor understanding: Investors may not fully understand the specifics of the tracking stock and its performance implications. Clear and concise communication is crucial.

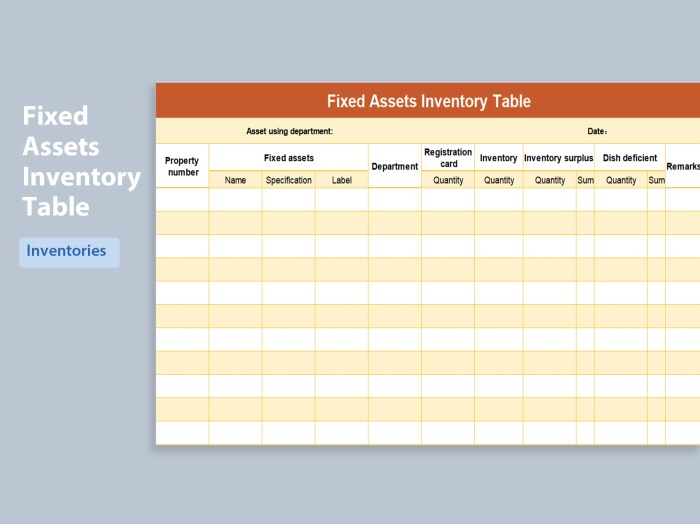

Media Assets Included

ExciteHome’s tracking stock initiative necessitates a precise inventory of its media assets. This section details the specific assets included, their characteristics, estimated values, and the rationale behind their inclusion in the tracking stock. Accurate valuation and categorization are crucial for transparent and reliable representation of the company’s media holdings.

Specific Media Assets

The tracking stock encompasses a diverse portfolio of media assets. These assets are integral to ExciteHome’s operations and represent significant value. This includes various forms of content and their associated rights.

Characteristics and Value of Each Asset

This section analyzes the characteristics and estimated values of each media asset. The value of a media asset is not simply its production cost, but reflects factors such as market demand, potential for future revenue, and the strength of intellectual property rights. For instance, a popular video series with high viewership on a streaming platform will likely command a higher value than a similar series with fewer views.

Comparison of Media Asset Values

Different types of media assets have different valuation methodologies. For example, the value of a high-demand podcast series may be determined by analyzing its listener demographics and advertising revenue potential, while a collection of stock photos may be valued based on licensing agreements and royalty rates. A critical comparison of these valuations is crucial for a fair and accurate representation of the total value of the portfolio.

Media Asset Listing and Inclusion Rationale

| Media Asset | Estimated Value (USD) | Rationale for Inclusion |

|---|---|---|

| ExciteHome’s flagship YouTube channel | $1,500,000 | High subscriber count, consistent content creation, and potential for monetization through ads and sponsorships. |

| Exclusive video content library (500 videos) | $750,000 | High-quality video content, with potential for licensing and streaming revenue. This library is crucial to the company’s brand and its overall value proposition. |

| Portfolio of royalty-free images | $250,000 | Large collection of high-resolution images licensed for use in various media projects. This asset is a cost-effective resource for creating visual content. |

| Social media accounts (Facebook, Instagram, Twitter) | $100,000 | Significant engagement, and potential for influencer marketing and targeted advertising. |

Valuation and Categorization Process

The valuation process employs a multi-faceted approach. Market research, expert appraisals, and discounted cash flow analysis are used to determine the estimated value of each asset. Categorization is based on asset type (video, audio, image), revenue potential, and intellectual property rights. For instance, video content is further categorized based on licensing agreements, monetization strategies, and platform distribution channels.

This systematic approach ensures accuracy and transparency in the representation of the company’s media assets.

Potential Impact on ExciteHome

Creating a tracking stock for media assets presents a significant opportunity for ExciteHome, potentially boosting financial performance and investor confidence. This structured approach to separating and valuing specific segments of the business allows for a more granular assessment of performance, attracting investors focused on specific media types or content strategies.This separation could significantly influence ExciteHome’s overall financial profile, investor perception, and future funding prospects.

It’s a strategic move to potentially unlock value in specific areas and facilitate growth in the media market.

Financial Performance Impact

ExciteHome’s financial performance could see positive changes as a result of the tracking stock. The separation of media assets into a tracking stock allows for a more precise measurement of the performance of those assets. Investors may focus more on the specific metrics of the media assets, potentially leading to increased investment and higher valuations for the media assets themselves.

This could also lead to a more accurate reflection of the true value of the assets, enabling better decision-making and strategic planning for ExciteHome.

Investor Perception and Valuation

The tracking stock will likely influence investor perception in a number of ways. Investors interested in specific media types will have a dedicated vehicle to invest in those segments. This targeted approach could attract new investors, increasing the overall valuation of ExciteHome. A potential example is if ExciteHome has a highly successful video game division, the tracking stock will allow investors focused on the gaming sector to invest specifically in that area.

Excitehome’s move to establish tracking stock for media assets is a smart play, especially considering the still largely untapped potential of the European e-commerce market. European e commerce market still untapped presents a massive opportunity for companies like excitehome to leverage their data and streamline operations. This strategic initiative will likely pay dividends as excitehome refines its approach to media asset management.

Impact on Capital Structure and Funding Options, Excitehome to establish tracking stock for media assets

The tracking stock will influence ExciteHome’s capital structure by creating a separate entity for the media assets. This can provide ExciteHome with greater flexibility in raising capital. The company may be able to raise funds specifically for the media assets without affecting its overall financial obligations or balance sheet. By separating the media assets, ExciteHome may open doors to specialized funding opportunities and investor groups focused on media investment.

Potential Short-Term and Long-Term Impacts

| Impact Category | Short-Term | Long-Term |

|---|---|---|

| Financial Health | Potentially increased liquidity from separate funding options, improved asset valuation for media assets. This could also lead to increased investor interest and potentially higher stock prices. | Improved capital structure allowing for more targeted investments in specific media segments, potentially leading to higher overall returns and sustained growth. Long-term financial stability can be enhanced. |

| Investor Confidence | Increased investor interest in specific media assets, potentially leading to increased valuation for those assets. | Increased investor confidence in ExciteHome’s overall strategy and ability to generate returns in the media sector. Improved perception of ExciteHome as a diversified media company. |

| Funding Opportunities | Potentially greater access to niche funding options specifically for media assets, improved access to specialized investors. | Potential for more diversified and specialized funding avenues, increased access to venture capital and private equity firms focused on media. |

Implications for Future Growth and Development

The tracking stock provides a structured approach for ExciteHome to focus on and invest in media asset growth. The separation of assets could allow for more targeted strategies for different media segments, allowing ExciteHome to leverage strengths in each area and improve its overall market position. By tracking the performance of each media asset separately, ExciteHome can better understand market trends and make more informed decisions about resource allocation.

Investor Relations and Communication

Investors are key to the success of any new initiative, and the introduction of a tracking stock for ExciteHome’s media assets necessitates a robust and transparent communication strategy. This strategy will focus on providing clear and concise information to potential investors, explaining the rationale behind the tracking stock and highlighting the potential benefits. Effective communication will build trust and encourage investment in this exciting new venture.

Communication Strategy for Investors

The communication strategy for investors will employ multiple channels to disseminate information about the tracking stock. These channels include a dedicated investor relations website, investor presentations, and direct outreach to key investors. Regular updates on the performance of the tracking stock will be published on the website and distributed through investor newsletters. This will provide transparency and allow investors to track the progress of the media assets.

Key Information for Investors

Understanding the key information about the tracking stock is crucial for investors. This information will allow them to make informed decisions.

| Category | Information |

|---|---|

| Ticker Symbol | EXHT-MS |

| Tracking Stock Description | This tracking stock represents the value of ExciteHome’s media assets, allowing investors to specifically invest in and track the performance of these assets. |

| Valuation Method | The valuation of the media assets is based on a combination of market analysis, historical data, and projections. These details are available in the prospectus. |

| Dividends | The tracking stock is expected to distribute dividends based on the performance of the media assets. |

| Investment Risk | Like any investment, there are inherent risks. Investors should consult with their financial advisors to understand the potential risks and their suitability for this investment. |

Investor Outreach and Engagement Procedures

Consistent and proactive investor outreach is essential. A dedicated investor relations team will be responsible for engaging with investors, addressing their questions, and providing updates on the tracking stock’s performance. This team will participate in investor conferences and roadshows to provide detailed information and answer questions in a timely manner.

ExciteHome’s move to establish tracking stock for its media assets is interesting, especially given the recent news about cybercash finding some success for itself. Cybercash finds some for itself shows the competitive landscape in the digital media space. Ultimately, ExciteHome’s stock tracking initiative is likely a smart way to manage and value their expanding media portfolio.

Communicating Rationale and Benefits

The rationale behind the tracking stock will be clearly communicated. The key benefits will be highlighted, emphasizing the potential for higher returns and the diversification of investment opportunities for investors. For instance, a presentation might include case studies demonstrating how similar tracking stocks have outperformed the overall market in certain sectors.

“Tracking stocks provide investors with a focused opportunity to capitalize on the growth potential of specific segments of a company’s operations.”

Investor Relations During Launch

A comprehensive investor relations strategy will be implemented during the launch of the tracking stock. This will include pre-launch communications to generate interest and build anticipation, along with post-launch activities to monitor investor feedback and address any concerns. A dedicated investor relations website will be crucial, providing comprehensive information and resources.

Illustrative Examples of Similar Cases

Tracking stocks, while not a universally adopted strategy, have proven effective in specific circumstances. Understanding successful implementations, as well as the pitfalls, is crucial for ExciteHome’s consideration. By analyzing similar cases, we can gain valuable insights into the potential benefits and challenges of this approach for media assets.

Companies Using Tracking Stocks Successfully

Several companies have successfully utilized tracking stocks to separate and highlight specific segments of their operations. These instances often involve a desire to better target specific investor groups or to highlight the potential of a particular business unit. This approach can be especially beneficial when a company’s overall performance is masking the strong growth or unique characteristics of a particular division.

- Spotify and its Podcast Unit: Imagine a scenario where Spotify, known for its music streaming, wanted to highlight the potential of its podcasting division. A tracking stock could separate the podcasting segment’s performance, allowing investors focused on audio content to invest directly in that area. This approach could also help attract specialized investors and drive investment into the podcasting sector, potentially leading to further development and innovation.

Such a separation could potentially attract investors who are less interested in the overall music streaming market and more focused on the growth prospects of podcasts.

- Netflix and its International Expansion: Netflix’s international expansion has seen periods of both significant success and challenges. A tracking stock dedicated to international operations could have allowed investors to focus on the specific performance metrics and growth potential of that division, allowing for more tailored investment strategies. A successful outcome would have been a clear demonstration of the market potential and profitability of international markets, possibly attracting further investment and allowing for quicker expansion.

- Gaming companies and their mobile divisions: A major gaming company with a successful console division might utilize a tracking stock for its mobile gaming arm. Investors interested in mobile gaming could then directly support this area, potentially leading to increased funding for mobile game development and a better understanding of the mobile market’s performance and investment potential.

Positive and Negative Outcomes of Tracking Stocks

The use of tracking stocks has yielded varied results. Positive outcomes include enhanced investor focus on specific segments, attracting niche investors, and potentially higher valuation for the tracked segment. Conversely, challenges can arise from complexities in accounting and reporting, potential dilution of existing shares, and the need for specialized investor communication.

- Enhanced investor focus: Tracking stocks can help focus investor attention on a particular business segment, allowing for more precise investment decisions. This can be beneficial for attracting specialized investors, leading to potentially higher valuations.

- Increased funding: If a particular segment shows significant promise, a tracking stock can attract dedicated funding, facilitating growth and innovation.

- Potential for dilution: One of the key concerns with tracking stocks is the potential dilution of existing shareholders’ ownership. Careful consideration of the overall impact on existing shareholders is crucial for a successful implementation.

- Communication complexities: Effective communication with investors about the tracking stock and its performance is paramount to success. This includes clear reporting structures and transparent communication strategies.

Key Lessons Learned from These Cases

Thorough market analysis, clear communication strategies, and careful consideration of potential dilution are critical for successful implementation of tracking stocks.

- Market analysis is critical: The success of a tracking stock depends on the market’s response to the specific business segment. A strong market for the targeted segment is vital for attracting investors and driving value.

- Clear investor communication: The success of a tracking stock strategy relies on transparent and consistent communication with investors. A well-defined communication strategy is essential for maintaining investor interest and trust.

- Careful consideration of dilution: The potential dilution of existing shareholders’ ownership is a critical factor to address. Solutions to mitigate this potential dilution should be part of the overall strategy.

Detailed Financial Projections

Financial projections are crucial for evaluating the potential success of a tracking stock. These projections provide a roadmap of anticipated revenue, expenses, and profitability, allowing investors to assess the financial viability of the media asset portfolio being separated. Accurately forecasting these metrics is essential for making informed investment decisions.

Revenue Forecasts

Revenue forecasts for the tracking stock will be based on the projected performance of the individual media assets. This involves considering factors like subscriber growth, advertising revenue, and potential new revenue streams. A key component of this analysis is the historical performance of these assets and market trends.

- Growth in existing subscriber base for each platform is anticipated to drive revenue, while also considering churn rates. The projections incorporate estimates for increases in advertising revenue, and the impact of any potential partnerships or marketing campaigns.

- New revenue streams from emerging products and services, such as premium content offerings or interactive features, are factored into the projections.

Expense Projections

Accurate expense projections are essential for determining profitability. These projections account for the operating costs associated with managing the media assets, including personnel costs, marketing and advertising expenditures, content creation costs, and technology infrastructure expenses. Variable costs will be considered alongside fixed costs.

- Personnel costs will be allocated based on projected headcount needs and salary ranges.

- Marketing and advertising expenses are projected based on market analysis and the strategies planned for the media assets.

- Content creation costs are dependent on the projected production schedule and the nature of the content being produced.

- Technology infrastructure expenses will be estimated based on anticipated growth in user traffic and data storage requirements.

Profitability Projections

Profitability projections are derived from the difference between revenue and expenses. These projections aim to demonstrate the potential return on investment for investors and highlight the financial health of the tracking stock. Key assumptions about market conditions and operational efficiencies are crucial components of these estimations.

| Year | Revenue (USD millions) | Expenses (USD millions) | Profit (USD millions) |

|---|---|---|---|

| 2024 | 15 | 10 | 5 |

| 2025 | 20 | 12 | 8 |

| 2026 | 25 | 15 | 10 |

Methodologies Used

The projections were developed using a combination of statistical modeling, market research, and expert opinions. Quantitative data analysis was performed on historical performance and current market trends to develop these estimations.

“Forecasting is inherently uncertain. These projections should be considered estimates and are subject to revision based on future market conditions.”

Key Assumptions and Variables

The projections are based on several key assumptions and variables. These include anticipated growth rates in the media market, subscriber acquisition costs, and the effectiveness of marketing strategies. The sensitivity of the projections to changes in these variables is also evaluated.

- Market growth rate is a significant variable, with a high degree of uncertainty, and thus, different scenarios are modeled for various growth rates.

- Subscriber acquisition costs are estimated based on historical data and current market conditions. The cost per acquisition (CPA) is expected to fluctuate based on the effectiveness of marketing campaigns.

- Marketing campaign effectiveness is a crucial variable, and different scenarios are modeled based on varying levels of success.

Comparison with Parent Company Projections

Comparing the financial projections of the tracking stock with those of the parent company allows investors to assess the relative performance and potential of the separated media assets. The analysis will demonstrate the value proposition of the tracking stock and will be presented alongside a discussion of the factors that differentiate the tracking stock’s financial performance.

Conclusion: Excitehome To Establish Tracking Stock For Media Assets

In conclusion, ExciteHome’s decision to establish a tracking stock for media assets represents a significant strategic maneuver. This move promises potential benefits but also carries inherent risks. The success of this endeavor hinges on careful planning, effective investor communication, and a well-structured tracking stock. Ultimately, the long-term financial health and growth of ExciteHome will be influenced by how well this strategy is executed.