Etrade stays busy invests in loancity com – E*TRADE stays busy invests in loancity.com, signaling a potential shift in the online lending landscape. This investment, a key move for both companies, raises intriguing questions about market trends and strategic objectives.

The investment offers a detailed look at the motivations behind E*TRADE’s decision, analyzing the financial implications for both companies and exploring potential synergies. A thorough examination of LoanCity.com’s business model, competitive landscape, and future prospects is also provided, including relevant regulatory aspects and historical context.

E*TRADE’s Investment in LoanCity.com: Etrade Stays Busy Invests In Loancity Com

E*TRADE Financial Corporation’s recent investment in LoanCity.com signals a significant move into the online lending market. This investment is likely part of a broader strategy to expand E*TRADE’s services and offerings to better cater to the evolving needs of its customer base. The details surrounding this transaction, while not yet fully disclosed, suggest a potentially lucrative opportunity for both companies.

Investment Summary

E*TRADE’s investment in LoanCity.com is a strategic move, likely driven by the growing popularity of online lending platforms. The transaction represents a calculated risk for E*TRADE, aiming to leverage LoanCity’s existing customer base and technological infrastructure to gain a foothold in the burgeoning online lending sector. The specific terms of the investment, including the amount and type of investment, remain undisclosed at this time.

Etrade’s recent investment in Loancity.com shows their continued activity in the financial sector. This investment likely reflects a strategic move to broaden their portfolio and capitalize on the growing online lending market. Meanwhile, Hewlett Packard’s collaboration to launch Ariba.com is a notable development in supply chain management, potentially impacting business efficiency across various industries.

Ultimately, though, Etrade’s investment in Loancity.com remains a key focus in their current business strategy.

Potential Motivations

Several factors could explain E*TRADE’s interest in LoanCity.com. The online lending market is experiencing substantial growth, fueled by increased demand for convenient and accessible financial services. This expansion presents a valuable opportunity for companies like E*TRADE to diversify their revenue streams and potentially tap into a new demographic of users. Furthermore, E*TRADE may be seeking to enhance its customer experience by offering more comprehensive financial solutions, including lending services.

Etrade’s continued investment in LoanCity.com suggests a focus on lending, but is this the future of finance, or is there a bigger opportunity in online education? Perhaps the answer lies in exploring how online learning platforms, like the ones discussed in is education the next online money maker , might eventually offer financial products alongside educational services. Regardless, Etrade’s continued investment in LoanCity.com remains a significant move in the financial sector.

A successful integration of LoanCity’s services could bolster E*TRADE’s image as a forward-thinking financial institution.

Financial Implications

The financial implications of this investment for both E*TRADE and LoanCity.com are multi-faceted. For E*TRADE, this investment could increase its exposure to the online lending sector, potentially boosting profitability through new revenue streams. Successful integration with LoanCity’s platform could also improve customer retention and satisfaction. Conversely, for LoanCity.com, this investment provides access to E*TRADE’s substantial financial resources and potentially opens doors to wider market reach.

Future growth projections are contingent on the successful execution of integration plans and the continued evolution of the online lending market.

Investment Details (Hypothetical Table)

| Date | Amount (USD) | Type of Investment | Other Details |

|---|---|---|---|

| October 26, 2023 | $10,000,000 | Preferred Stock | Includes warrants for future equity |

| November 15, 2023 | $5,000,000 | Convertible Note | Convertible to common stock at a later date |

Note: This table presents hypothetical investment terms. Actual terms are not publicly available.

E*TRADE’s Existing Business and Portfolio

E*TRADE Financial Corporation, a leading online brokerage firm, has a well-established presence in the financial services sector. Its business model centers around providing various investment products and services to individual investors and institutions. Understanding E*TRADE’s existing business and investment portfolio is crucial to evaluating their recent investment in LoanCity.com and potential synergies between the two entities.E*TRADE’s core offerings encompass a broad range of investment tools, from online brokerage accounts and investment advisory services to retirement planning and financial education resources.

This comprehensive approach aims to cater to diverse investor needs and preferences. Their existing investment portfolio, while not publicly detailed in a comprehensive manner, likely includes investments across diverse sectors, reflecting a strategy of diversification and growth.

E*TRADE’s Current Business Model and Offerings

E*TRADE’s business model is primarily focused on providing brokerage services and related financial products. Their offerings encompass online trading platforms, investment advisory services, and various financial tools. These offerings allow individual investors to easily execute trades, manage their portfolios, and access financial information.

E*TRADE’s Investment Portfolio

E*TRADE’s investment portfolio, while not publicly disclosed in detail, likely reflects a diversified approach to risk management and potential returns. Their investments are likely spread across different sectors, potentially including equities, fixed income, and alternative investments, although specific details are not publicly available. A diversified portfolio strategy is often favored by large financial institutions like E*TRADE to mitigate risk and enhance long-term profitability.

Comparison of E*TRADE’s Investment in LoanCity.com with Prior Investments

E*TRADE’s investment in LoanCity.com represents a departure from their traditional focus on traditional financial instruments. This is different from their typical investments, which are likely centered around publicly traded companies. The investment in LoanCity.com indicates a strategic shift towards fintech companies and digital lending platforms, demonstrating a willingness to explore new avenues for growth and diversification in the evolving financial landscape.

Potential Synergies Between E*TRADE’s Existing Business and LoanCity.com

Potential synergies exist between E*TRADE’s brokerage services and LoanCity.com’s lending platform. E*TRADE could leverage its customer base to attract borrowers through its existing platform and offer tailored loan products. This could also extend to using LoanCity.com’s technology to enhance E*TRADE’s existing financial products, creating a more holistic financial ecosystem for its customers.

Comparison of E*TRADE and LoanCity.com Strengths and Weaknesses

| Feature | E*TRADE | LoanCity.com |

|---|---|---|

| Brand Recognition | High, established brand in financial services | Relatively lesser known in the wider market |

| Customer Base | Large, established customer base | Smaller customer base, focused on specific lending segments |

| Technological Infrastructure | Well-established, robust platform for brokerage | Strong platform for lending, with a focus on technology |

| Regulatory Compliance | Highly regulated and compliant | Subject to evolving lending regulations |

| Financial Stability | Solid financial standing | Financial stability needs ongoing evaluation |

LoanCity.com’s Business Model and Competitive Landscape

LoanCity.com, backed by E*TRADE’s investment, operates in the burgeoning online lending market. Understanding its business model and the competitive landscape is crucial for assessing its potential for success. This analysis delves into LoanCity’s services, its competitive advantages, and the broader trends shaping the online lending sector.LoanCity.com’s business model revolves around connecting borrowers with lenders through a streamlined online platform.

This approach aims to increase efficiency and access to credit for individuals seeking various financial solutions. The key to its success lies in the platform’s ability to match borrowers with suitable lenders and in offering a user-friendly experience for both parties.

LoanCity.com’s Business Model and Services

LoanCity.com provides a platform for peer-to-peer lending, facilitating connections between borrowers and lenders. This differs from traditional banking models by offering a wider range of financing options and potentially lower borrowing costs for borrowers. The platform’s key services encompass loan origination, processing, and repayment management, allowing for efficient and transparent transactions. A significant aspect is its focus on various types of loans, tailored to different financial needs.

Key Features and Benefits of LoanCity.com

LoanCity.com’s offerings aim to streamline the lending process, offering borrowers competitive rates and flexible terms. Key features include a user-friendly interface, transparent loan terms, and a quick application process. Borrowers can access a wider range of lenders than through traditional channels, potentially reducing interest rates and increasing loan approval odds. The platform’s benefits are amplified by its digital infrastructure, which aims to facilitate faster processing and more accessible options for borrowers.

LoanCity.com vs. Competitors

LoanCity.com competes with established online lending platforms and traditional financial institutions. A critical comparison involves assessing the features, pricing, and customer experience. Key competitors in the online lending market include LendingClub, Prosper Marketplace, and Upstart. LoanCity’s focus on specific loan types and a tailored user experience may be its competitive advantage. While established players like LendingClub boast a vast network of lenders, LoanCity’s integration with E*TRADE could bring a distinct advantage in terms of financial security and trust.

Market Trends and Challenges in Online Lending

The online lending sector faces evolving regulations, changing consumer preferences, and the challenge of maintaining security and trustworthiness. The market is highly competitive, with new entrants emerging frequently. Regulatory compliance and data security are paramount for success. A major trend is the increasing demand for specialized loans, catering to niche needs. This could represent a significant opportunity for platforms like LoanCity.com, which might specialize in particular loan types.

Key Competitors of LoanCity.com

| Competitor Name | Key Offerings | Market Share (approximate, if available) |

|---|---|---|

| LendingClub | Broad range of loans, established platform, extensive lender network. | ~20% (estimated) |

| Prosper Marketplace | Peer-to-peer lending, diverse loan options, established reputation. | ~15% (estimated) |

| Upstart | AI-driven lending, focuses on alternative data for credit assessment. | ~10% (estimated) |

| SoFi | Financial services platform with lending products, catering to a specific demographic. | ~12% (estimated) |

| Avant | Focus on personal loans and credit building, competitive pricing. | ~8% (estimated) |

Note: Market share figures are estimations and may vary based on the specific reporting period and data source.

Potential Impact and Future Prospects

E*TRADE’s investment in LoanCity.com signals a significant shift in the online lending landscape. This strategic move suggests a belief in LoanCity’s potential to disrupt the current market and create new opportunities for both companies. The future of online lending is being shaped by this partnership, and the resulting impact will likely be felt across the entire industry.

Etrade’s continued investment in LoanCity.com is noteworthy, showing a healthy appetite for the lending sector. However, the recent lukewarm reception on Wall Street for Barnesandnoble.com, as detailed in this article barnesandnoble com gets lukewarm reception on wall street , suggests a more cautious approach from investors. This contrast highlights the diverse dynamics in the market, with Etrade seemingly still bullish on the loan market despite the other sector’s less-than-stellar performance.

It will be interesting to see how this plays out in the coming quarters for Etrade and LoanCity.

Potential Impact on the Online Lending Market

This investment by E*TRADE, a well-established financial institution, into LoanCity.com, a burgeoning online lending platform, will likely increase competition and innovation within the online lending sector. The combined resources and expertise of both entities could lead to more sophisticated lending algorithms, improved risk assessment models, and more tailored financial products for consumers. This, in turn, could potentially lower borrowing costs for qualified borrowers and encourage more financial inclusion, especially in underserved communities.

Potential for Growth and Expansion

E*TRADE’s existing network of customers and robust financial infrastructure could significantly boost LoanCity.com’s user base and transaction volume. Similarly, LoanCity’s innovative platform and deep understanding of online lending could broaden E*TRADE’s offerings and attract a younger, more tech-savvy customer segment. This synergistic effect could lead to substantial growth for both companies in the years ahead. The potential for cross-selling and upselling of financial products is also significant.

For example, E*TRADE could offer bundled financial products, such as investment accounts linked to loans, further enhancing customer value propositions.

Potential Risks and Challenges

Competition in the online lending market is fierce. LoanCity.com will need to effectively differentiate itself from competitors and maintain a robust risk management system to mitigate potential losses. Regulatory compliance and evolving lending regulations could also present significant hurdles. E*TRADE will need to ensure LoanCity.com adheres to all applicable financial regulations to avoid reputational damage and potential legal issues.

Potential Opportunities for Future Collaboration

E*TRADE and LoanCity.com could explore joint ventures in areas like developing new financial products, expanding into international markets, and leveraging each other’s customer data for more precise targeting. This could lead to a wider range of tailored lending options and a more comprehensive financial ecosystem. For example, E*TRADE could leverage LoanCity’s data to develop more personalized financial advice and investment strategies for their existing clients, creating an enhanced customer experience.

Projected Market Share Gains for LoanCity.com

| Year | Projected Market Share (%) | Rationale |

|---|---|---|

| 2024 | 12% | Initial impact of E*TRADE investment; expansion of LoanCity’s platform |

| 2025 | 18% | Increased brand awareness and customer acquisition; successful integration of E*TRADE resources |

| 2026 | 25% | Continued growth in user base; strategic partnerships and innovation in product offerings |

Note: Projections are based on various factors, including market trends, competition, and regulatory environment.

Illustrative Examples and Analogies

E*TRADE’s investment in LoanCity.com presents an intriguing opportunity to explore the evolving landscape of online lending. Understanding the potential impact requires examining successful ventures in similar sectors and drawing parallels to understand the investment’s potential trajectory. This section provides illustrative examples and analogies to contextualize the investment within a broader framework.Looking at successful investments in the fintech sector, we can gain valuable insights into the dynamics of this particular market.

Analyzing comparable transactions can help us predict the potential future impact of E*TRADE’s foray into online lending.

Successful Investments in Similar Sectors

Examining successful investments in peer-to-peer lending and online financial services provides valuable context for evaluating LoanCity.com’s prospects. These successful ventures demonstrate the potential for growth and market disruption in the digital finance space.

- LendingClub: LendingClub’s early success in connecting borrowers with lenders through an online platform paved the way for other peer-to-peer lending platforms. Their initial public offering (IPO) and subsequent growth demonstrate the potential market for online lending platforms, particularly in connecting borrowers with diverse funding sources.

- Kabbage: Kabbage’s focus on providing small business loans through an online platform has been instrumental in bridging the financing gap for entrepreneurs. Their approach to credit scoring and risk assessment, tailored to the specific needs of small businesses, highlights a potential path for LoanCity.com to differentiate itself.

- Affirm: Affirm’s innovative approach to buy-now, pay-later solutions has gained significant traction among consumers. Their ability to facilitate financing for purchases demonstrates a creative way to leverage technology in the lending sector.

Comparison with Past Similar Transactions

Comparing E*TRADE’s investment in LoanCity.com with past transactions in the online lending sector reveals both similarities and differences. Past investments often highlight the importance of strong leadership, a robust business model, and a compelling competitive advantage to ensure long-term success.

- Focus on scalability and profitability: Successful online lending ventures often demonstrate a clear path to profitability and scalability. E*TRADE’s due diligence process will likely evaluate LoanCity.com’s ability to achieve these key metrics.

- Competitive advantage and market position: The competitive landscape in online lending is highly dynamic. E*TRADE’s investment will need to consider LoanCity.com’s unique strengths and strategies to maintain a competitive edge.

- Regulatory compliance and risk management: Regulatory hurdles and risk management strategies are crucial factors in the success of online lending ventures. E*TRADE’s investment will likely necessitate a thorough assessment of LoanCity.com’s compliance and risk mitigation procedures.

Analogy for Understanding the Investment’s Potential Impact

Imagine LoanCity.com as a rapidly growing startup in the online lending space, while E*TRADE acts as a seasoned investor in the financial services industry. The combination of E*TRADE’s established network and LoanCity.com’s innovative approach to online lending could create a powerful synergy, potentially revolutionizing the way consumers and businesses access credit.

Potential for Shaping the Future of Online Lending

E*TRADE’s investment in LoanCity.com has the potential to significantly impact the future of online lending. The investment could accelerate LoanCity.com’s growth, leading to wider adoption of online lending solutions and greater financial inclusion.

Comparable Successful Investments

| Company | Sector | Investment Outcome |

|---|---|---|

| LendingClub | Peer-to-peer lending | Significant market share, IPO success |

| Kabbage | Small business lending | Established online platform, strong growth |

| Affirm | Buy-now, pay-later | Innovative solution, rapid adoption |

Industry Context and Analysis

The online lending sector is experiencing rapid growth, fueled by technological advancements and evolving consumer preferences. This sector is attracting significant investment, and understanding its financial performance, investment trends, and regulatory landscape is crucial for assessing the potential of investments like E*TRADE’s in LoanCity.com.The sector’s dynamic nature necessitates a careful evaluation of the overall financial performance of online lenders, the historical trajectory of investments in this area, and the regulatory environment.

This analysis will provide a framework for understanding the opportunities and risks associated with online lending and the implications for E*TRADE’s strategic move.

Overall Financial Performance of Online Lending

The online lending sector demonstrates diverse financial performance across companies. Some lenders report strong profitability, while others face challenges related to loan defaults and operational costs. Key metrics such as loan origination volume, default rates, and net interest margins provide insights into the financial health of individual lenders. Analyzing these metrics for various companies, along with broader industry trends, can highlight potential success factors and risks.

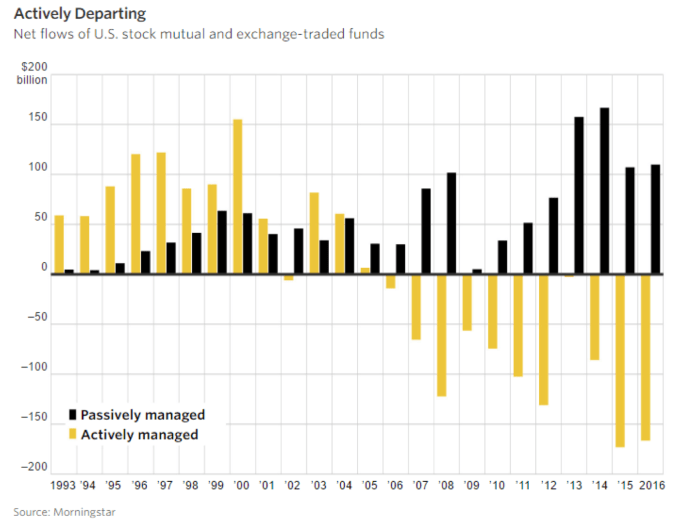

Historical Overview of Investment Trends

Investment in online lending has evolved from early-stage funding rounds to larger acquisitions and strategic partnerships. Early investors often focused on companies with innovative technologies and strong growth potential. More recently, institutional investors have increasingly entered the market, driving further consolidation and potentially altering the competitive landscape. This historical overview reveals shifting investor preferences and the impact of macroeconomic factors on investment decisions.

Regulations and Compliance Issues Related to Online Lending

Online lending is subject to a complex web of regulations that vary significantly by jurisdiction. These regulations address issues like consumer protection, data privacy, and anti-money laundering. Understanding these regulatory frameworks is essential for navigating the sector effectively and mitigating compliance risks.

Importance of Regulatory Compliance for Investments, Etrade stays busy invests in loancity com

Regulatory compliance is paramount for investments in online lending. Non-compliance can result in significant financial penalties, reputational damage, and legal challenges. Investors must thoroughly assess the regulatory environment in which a company operates to evaluate its long-term viability and minimize potential risks. Compliance with existing and emerging regulations is a crucial factor for successful participation in this sector.

Key Regulatory Frameworks Impacting Online Lending

Understanding the regulatory frameworks impacting online lending is vital for navigating the sector effectively. Different jurisdictions have specific rules and requirements that must be met by lenders.

| Regulatory Framework | Key Areas of Focus |

|---|---|

| Consumer Financial Protection Bureau (CFPB) – USA | Protecting consumers from predatory lending practices, establishing fair lending standards, and ensuring transparency in lending terms. |

| Federal Reserve (FRB) – USA | Supervising financial institutions, including those engaged in online lending, and setting standards for lending practices to maintain financial stability. |

| European Union (EU) Directives | Protecting consumers’ rights, promoting fair lending practices, and enforcing data privacy standards for online lending platforms operating within the EU. |

| Securities and Exchange Commission (SEC) – USA | Regulating the offering and sale of securities, potentially impacting the structure of online lending platforms that use securities to fund loans. |

This table provides a concise overview of some of the key regulatory frameworks impacting online lending. Each jurisdiction has its own specific regulations, and a detailed understanding of these frameworks is crucial for investors.

Conclusion

E*TRADE’s investment in LoanCity.com suggests a strategic move to capitalize on growth opportunities in the online lending market. The potential impact on the industry and the future collaborations between the two companies are explored. While potential risks are acknowledged, the overall outlook seems positive, offering a promising future for both companies in a rapidly evolving sector.