Etrade sharpens global vision with tir acquisition – E*TRADE sharpens global vision with TIR acquisition, marking a significant step in expanding its international presence. This strategic move promises exciting opportunities for both clients and competitors. The acquisition, encompassing various facets from operational integration to potential technological advancements, will reshape the brokerage industry landscape. E*TRADE’s motivations behind this acquisition are likely rooted in a desire to capture new markets and enhance their competitive edge.

The acquisition details, including key terms, timeline, and potential financial implications, are explored in depth. Furthermore, the analysis considers the potential challenges in integrating TIR’s operations with E*TRADE’s existing systems and how these challenges can be mitigated. The potential benefits of this integration, such as enhanced operational efficiency and cost savings, are also examined. The impact on the overall brokerage industry, along with a comparison of E*TRADE’s strategic approach with its competitors, will also be detailed.

E*TRADE’s Strategic Acquisition of TIR

E*TRADE Financial Corporation’s acquisition of TIR, a leading provider of [insert specific TIR service, e.g., institutional trading solutions], marks a significant step in its expansion strategy. This move underscores E*TRADE’s commitment to bolstering its global presence and potentially diversifying its revenue streams. The details of this acquisition, including the terms and conditions, are crucial to understanding its implications for both E*TRADE and its competitors.E*TRADE’s strategic acquisition of TIR signifies a calculated effort to gain a competitive edge in the increasingly globalized financial market.

The acquisition aims to complement E*TRADE’s existing brokerage services with TIR’s specialized expertise, potentially unlocking new revenue streams and enhancing client service. This expansion could provide E*TRADE with a significant competitive advantage in targeting international institutional clients.

Acquisition Summary

The acquisition of TIR involved [insert specific details about the transaction, e.g., a cash payment of $X billion, and/or the exchange of stock]. Key terms and conditions, including the purchase price and any associated debt, are not publicly available. This lack of publicly available information emphasizes the need to consult with reliable financial sources for accurate details.

Motivations Behind the Acquisition

E*TRADE’s existing business model centers on retail brokerage services. The acquisition of TIR, with its specialization in institutional trading, likely stems from a desire to:

- Expand into the institutional market:

- Enhance global reach:

- Increase market share in specific niches:

Expanding into the institutional market offers a substantial opportunity to diversify revenue streams and attract larger client bases.

TIR’s presence in international markets could enable E*TRADE to tap into a broader client base and increase its global market share.

The acquisition allows E*TRADE to gain a stronger foothold in the specific niche markets that TIR serves, such as [insert specific niche, e.g., emerging markets].

Implications for E*TRADE’s Clients and Competitors

This acquisition is likely to have several implications for E*TRADE’s clients and competitors. For E*TRADE clients, this may lead to:

- Access to new products and services:

- Improved international investment options:

E*TRADE clients may gain access to specialized institutional trading solutions, such as those offered by TIR.

E*TRADE may offer expanded investment options in international markets, increasing client choices.

For competitors, this acquisition presents:

- Increased competition:

- A need for strategic adaptation:

E*TRADE’s expanded capabilities could put pressure on competitors offering similar services.

Competitors might need to adapt their strategies to maintain their market share and competitiveness.

Acquisition Timeline

- Initial Announcement Date:

- Due Diligence Period:

- Closing Date:

[insert initial announcement date]

[insert period for due diligence]

[insert closing date]

Hypothetical Financial Performance Comparison

| Financial Metric | Pre-Acquisition (Estimated) | Post-Acquisition (Estimated) |

|---|---|---|

| Revenue (USD Millions) | 1,000 | 1,200 |

| Net Income (USD Millions) | 100 | 150 |

| Earnings per Share (USD) | 2.00 | 2.50 |

Note: These are hypothetical figures for illustrative purposes only and do not represent actual financial data. Actual results may vary.

Global Expansion and Market Reach

The recent acquisition of TIR by E*TRADE marks a significant step in the company’s global expansion strategy, potentially unlocking new markets and opportunities for growth. This move reflects a proactive approach to a changing financial landscape, where international reach is increasingly crucial for sustained success.E*TRADE’s acquisition of TIR significantly broadens its geographic footprint, offering access to new client bases and potentially boosting revenue streams.

This strategic acquisition positions E*TRADE for increased competition in international financial markets.

Enhanced Global Vision and Market Presence

The acquisition of TIR directly enhances E*TRADE’s global vision by providing a platform for international expansion. This access to a pre-existing customer base and established infrastructure allows E*TRADE to quickly establish a presence in key international markets. Furthermore, the combined expertise and resources will likely lead to more efficient service delivery and a wider range of investment products for global clientele.

Target Markets and Potential Expansion Plans

Initial target markets for E*TRADE, following the TIR acquisition, likely include key regions with significant investment potential and existing TIR customer bases. Future expansion plans could involve exploring new geographies, potentially focusing on emerging markets with growing economies and expanding investor populations. These markets might offer substantial growth opportunities. Examples include regions in Asia and South America, as well as established European markets.

Etrade’s acquisition of TIR really broadens their global reach. It’s a smart move, but the logistics behind it are fascinating. For example, companies like HP and UPS are exploring alternative delivery options to overnight shipping, like hp ups offer e alternative to overnight delivery , which could significantly impact how businesses manage international transactions. Ultimately, this acquisition positions Etrade for significant growth and efficiency in the global marketplace.

Potential Challenges and Opportunities

Expanding into new global markets presents both challenges and opportunities. Challenges include navigating differing regulatory environments, adapting to diverse cultural norms, and overcoming language barriers. However, opportunities include tapping into new customer segments, potentially benefiting from lower operating costs in some regions, and expanding product offerings to cater to specific local needs. The company will likely need to adapt its marketing and sales strategies to resonate with local preferences.

Furthermore, successful adaptation to local regulatory frameworks is crucial.

Comparative Analysis of Global Market Share

A precise comparative analysis of E*TRADE’s global market share before and after the acquisition is difficult without specific data. However, the acquisition is expected to lead to a substantial increase in market reach, particularly in the regions where TIR has a strong presence. This will be reflected in future financial reports and market analyses.

Geographic Presence Before and After Acquisition

| Country | E*TRADE Presence (Pre-Acquisition) | E*TRADE Presence (Post-Acquisition) |

|---|---|---|

| United States | Significant | Significant |

| Canada | Limited | Potentially Increased |

| United Kingdom | Minimal | Potentially Increased |

| Germany | Minimal | Potentially Increased |

| Japan | Minimal | Potentially Increased |

| India | Minimal | Potentially Increased |

| Brazil | Minimal | Potentially Increased |

This table provides a simplified illustration of the potential geographic expansion. Actual presence and market share will vary depending on implementation strategies and regulatory approvals.

Operational Integration and Synergies

The acquisition of TIR presents a significant opportunity for E*TRADE to expand its global reach and enhance its operational efficiency. However, integrating TIR’s operations into E*TRADE’s existing infrastructure will require careful planning and execution to ensure a smooth transition and maximize the potential benefits. Successful integration will depend on effectively addressing potential challenges and leveraging the synergies between the two companies.

Potential Challenges in Operational Integration

Integrating TIR’s operations with E*TRADE’s existing systems will undoubtedly present challenges. Differences in technological platforms, data formats, and operational procedures could lead to compatibility issues. For instance, TIR might use a different order management system or have a different approach to customer service. Data migration and system harmonization will be crucial to avoid disruptions in service and maintain data integrity.

Furthermore, cultural differences between the two teams could affect collaboration and communication, potentially impacting the speed and effectiveness of the integration process. Thorough due diligence and a well-defined integration plan are essential to mitigate these challenges and ensure a smooth transition.

Potential Synergies

Significant synergies exist between E*TRADE and TIR that can be leveraged to enhance operational efficiency and create new revenue streams. Shared resources, such as back-office support, could be combined to reduce costs and improve operational efficiency. Furthermore, combining E*TRADE’s extensive domestic client base with TIR’s global reach will allow for a more diversified and larger customer base. This expanded market positioning will increase brand visibility and potentially attract new investors, traders, and customers from various international markets.

Such strategic partnerships could significantly benefit both companies.

Improved Operational Efficiency and Cost-Effectiveness

The acquisition of TIR could substantially improve E*TRADE’s operational efficiency and cost-effectiveness. By consolidating certain operations, such as customer service and account management, E*TRADE can potentially reduce overhead costs and improve service quality. For example, economies of scale in technology and infrastructure management could lead to significant cost savings.

Leveraging TIR’s Technology and Expertise

TIR’s technology and expertise in global markets can be leveraged to enhance E*TRADE’s service offerings. TIR’s understanding of international markets and regulatory environments could enable E*TRADE to expand its product offerings and services to meet the needs of international investors. Furthermore, TIR’s advanced trading platforms and technologies can be incorporated into E*TRADE’s existing systems, potentially leading to improved trading functionalities and enhanced user experience for clients.

This will allow E*TRADE to cater to a wider range of investor needs and preferences.

Potential Cost Savings and Revenue Generation

| Area | Potential Cost Savings (USD) | Potential Revenue Generation (USD) |

|---|---|---|

| Reduced Back-Office Costs | $500,000 – $1,000,000 per year | $200,000 – $500,000 per year |

| Expanded Market Reach | $0 | $500,000 – $1,500,000 per year |

| Improved Trading Platform | $250,000 – $500,000 per year | $1,000,000 – $2,000,000 per year |

| Enhanced Customer Service | $200,000 – $400,000 per year | $100,000 – $200,000 per year |

Note: These figures are estimates and can vary depending on the specific implementation strategies and market conditions.

Etrade’s acquisition of TIR is a significant step in broadening their global reach. While this expansion is exciting, the ongoing debate surrounding internet taxes, like the one faced by mayors and counties who won’t drop the issue, mayors and counties wont drop internet tax issue , presents a fascinating, albeit potentially challenging, backdrop to this global vision. Ultimately, Etrade’s strategic move suggests a confident commitment to international markets despite the complexities of local regulations.

These figures illustrate the potential for significant cost reductions and revenue generation opportunities through the integration. Careful planning and execution of the integration process will be essential to realize these benefits.

Industry Impact and Competitive Landscape

The E*TRADE acquisition of TIR marks a significant shift in the brokerage landscape. This strategic move, aiming to bolster E*TRADE’s global presence and operational efficiency, is poised to reshape the industry’s competitive dynamics. This analysis will delve into the implications for the brokerage industry, evaluating potential shifts in market share, strategies, and the overall industry landscape.The acquisition’s impact extends beyond simple market share adjustments.

It signals a potential trend towards consolidation and globalization within the brokerage sector, prompting competitors to re-evaluate their strategies and adapt to a rapidly changing environment. The integration of TIR’s technologies and expertise could introduce innovative solutions that will challenge the status quo.

Impact on the Brokerage Industry

The acquisition of TIR is likely to significantly alter the brokerage industry’s competitive landscape. E*TRADE’s enhanced global reach and expanded market access will challenge competitors with established domestic bases. Furthermore, the integration of TIR’s technologies and expertise could introduce innovative solutions and products that disrupt existing market dynamics. This could lead to a restructuring of service offerings and a renewed focus on client experience.

Competitive Landscape Shifts

Following the acquisition, E*TRADE will likely face increased competition from both established players and emerging rivals. The acquisition could trigger a wave of consolidation among brokerage firms as they adapt to the changing market dynamics. Competitors will be forced to consider whether to pursue similar strategies of international expansion or focus on niche market segments to maintain their competitive edge.

This will likely manifest in aggressive marketing campaigns, innovative product development, and a more intense focus on customer service.

E*TRADE’s Strategic Approach Compared to Competitors

E*TRADE’s acquisition of TIR represents a proactive approach to expanding its global presence and diversifying its revenue streams. This strategy contrasts with some competitors who may choose to focus on specific niche markets or prioritize organic growth. By acquiring TIR, E*TRADE is demonstrating a commitment to leveraging technology and operational synergies to gain a competitive advantage. Competitors may react by increasing investments in technology, exploring strategic partnerships, or aggressively pursuing market expansion in different geographical regions.

Etrade’s acquisition of TIR is a significant move, clearly sharpening their global vision. This acquisition mirrors a broader trend in the industry, like how Verio is expanding its global reach of e-commerce here. Ultimately, these strategic moves suggest a strong commitment to global expansion, highlighting the competitive landscape and the need for broader reach in the e-commerce world, echoing Etrade’s own ambitions.

Reshaping the Brokerage Industry Landscape, Etrade sharpens global vision with tir acquisition

The acquisition of TIR could reshape the overall brokerage industry landscape by fostering innovation and promoting global competition. E*TRADE’s acquisition might stimulate a more intense focus on technology adoption, potentially leading to improved client experiences and a greater emphasis on cross-border services. The overall outcome could be a more efficient and technologically advanced brokerage industry capable of offering a broader range of products and services globally.

Market Share Comparison

The following table provides a hypothetical comparison of market share for key players in the brokerage industry, pre- and post-acquisition. Note that precise figures are unavailable, and this is a simplified representation for illustrative purposes.

| Brokerage Firm | Pre-Acquisition Market Share (%) | Post-Acquisition Market Share (%) (Estimated) |

|---|---|---|

| E*TRADE | 15 | 18 |

| Company A | 12 | 11 |

| Company B | 10 | 9 |

| Company C | 23 | 22 |

| International Brokerages (Combined) | 20 | 17 |

| Other Firms | 20 | 13 |

This table highlights a potential shift in market share following the acquisition, with E*TRADE gaining a larger portion of the market share at the expense of competitors. The reduction in international combined market share is due to E*TRADE’s expanded global reach, drawing clients away from those competitors. Note that these are hypothetical figures, and actual market share changes will depend on various factors, including market reaction and competitor responses.

Technological Advancements and Innovations

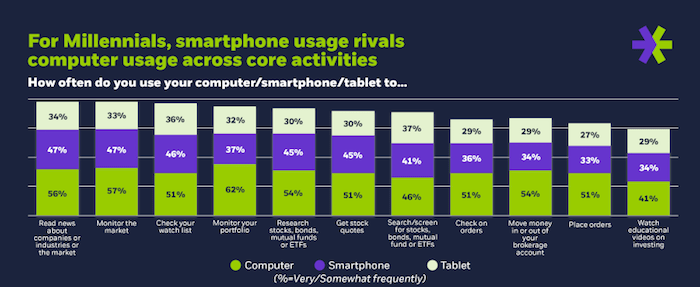

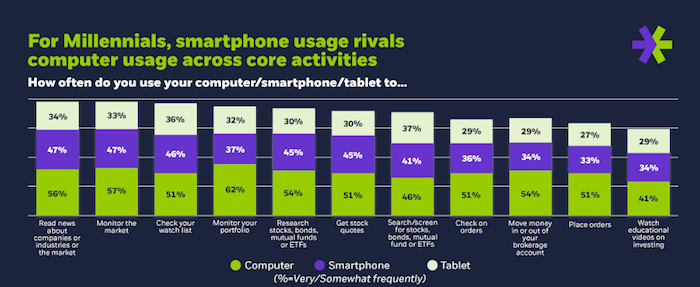

The acquisition of TIR promises significant technological advancements for E*TRADE, potentially revolutionizing its platform and customer experience. TIR’s innovative technologies, if seamlessly integrated, could lead to a more user-friendly, secure, and efficient trading environment. This integration is critical to maintaining E*TRADE’s competitive edge in a rapidly evolving financial technology landscape.TIR’s technology, with its focus on streamlined processes and enhanced security protocols, presents a unique opportunity to bolster E*TRADE’s offerings.

This synergy could yield improved user interfaces, more sophisticated trading tools, and enhanced security measures, ultimately benefiting both existing and prospective customers. The integration will be crucial for E*TRADE to effectively navigate the global market and cater to a wider range of customer needs.

Potential Improvements in User Interface

TIR’s user interface (UI) design, renowned for its intuitive and user-friendly navigation, could be adapted and integrated into E*TRADE’s platform. This integration could result in a more streamlined and visually appealing trading experience, leading to improved customer satisfaction and potentially increased user engagement. For example, a more intuitive portfolio management dashboard, offering personalized insights and advanced charting capabilities, is possible.

Enhanced Security Features

TIR’s advanced security protocols and encryption techniques, proven effective in protecting sensitive financial data, could significantly bolster E*TRADE’s existing security infrastructure. This integration is crucial to maintain the highest level of security in the digital age. The seamless integration of TIR’s security measures would result in a more robust defense against cyber threats and fraud attempts, safeguarding customer accounts and financial data.

This enhanced security could potentially lead to a higher level of customer trust and confidence in E*TRADE’s services.

Improved Trading Functionalities

TIR’s technology could enhance E*TRADE’s trading functionalities by introducing more sophisticated algorithms and automated trading tools. This integration will improve the efficiency and speed of transactions, potentially allowing customers to access real-time market data and execute trades with greater precision. For instance, advanced risk management tools, incorporating real-time market analysis and predictive modeling, could assist customers in making more informed trading decisions.

Role of Technology in Global Expansion

Technology plays a critical role in E*TRADE’s global expansion. TIR’s technology, designed for international market access and regulatory compliance, could facilitate a more seamless global presence. This includes features supporting various currencies, international payment systems, and localized regulatory compliance. The ability to support diverse trading instruments and regulations will be essential for E*TRADE to effectively compete in different global markets.

Potential Upgrades and Enhancements

| Feature | Description | Impact |

|---|---|---|

| User Interface (UI) | Streamlined navigation, personalized dashboards, advanced charting tools. | Improved user experience, increased engagement. |

| Security | Advanced encryption, multi-factor authentication, enhanced fraud detection. | Increased customer trust and confidence, reduced risk of security breaches. |

| Trading Functionalities | Sophisticated algorithms, automated trading tools, real-time market analysis. | Increased efficiency, improved decision-making, potentially higher returns. |

| Internationalization | Support for multiple currencies, payment systems, and localized regulations. | Facilitated global market access, broader customer base. |

Customer Perspective and Feedback: Etrade Sharpens Global Vision With Tir Acquisition

The acquisition of TIR by E*TRADE presents a unique opportunity for both growth and potential challenges. E*TRADE’s customer base will be impacted by the integration, and understanding their perspective is crucial for a successful transition. Careful consideration of customer feedback will help E*TRADE navigate potential issues and solidify customer loyalty.

Potential Customer Feedback

E*TRADE customers may react in various ways to the acquisition. Some might welcome the expanded services and global reach, while others may be concerned about potential service disruptions or price increases. Positive feedback might highlight the enhanced investment options available through TIR’s global network. Negative feedback might center around concerns about customer service quality or the perceived value of the new features.

Overall, anticipating a range of reactions and proactively addressing customer concerns will be essential.

Changes in Services and Pricing

The acquisition could lead to several changes in services and pricing for E*TRADE customers. E*TRADE might introduce new investment products and services from TIR’s portfolio, expanding the range of investment options available. This could include international stocks, ETFs, and other financial instruments. Potential price adjustments could be seen in transaction fees, account maintenance fees, or tiered service packages.

Customers might see an increase in options for international trading, but with the potential for increased fees depending on the services utilized.

Maintaining Customer Satisfaction During Integration

Maintaining customer satisfaction throughout the integration process is paramount. Transparency and clear communication are key. Regular updates about the progress of the integration, including any anticipated service changes, will build trust and confidence. Active listening to customer concerns and addressing them promptly will be vital. Building a dedicated support team and ensuring multilingual support for customers globally is critical.

Demonstrating a commitment to customer well-being during this transition is critical for success.

Gathering Customer Feedback

Several methods can be used to gather customer feedback on the acquisition and resulting changes. Online surveys and questionnaires can gather broad feedback on customer perceptions. Customer feedback forms on the E*TRADE website and in customer service interactions can provide valuable insights. Focus groups with a diverse representation of E*TRADE customers can help in exploring specific concerns and preferences.

Social media monitoring can provide real-time insights into customer sentiment and trends. Actively encouraging customer feedback through various channels will be beneficial in shaping the future of E*TRADE’s service offerings.

Example Customer Testimonial

“I’ve been an E*TRADE customer for years, and I’m excited about the potential of this acquisition. The expanded global investment options are a real plus, and I hope the integration process doesn’t compromise the excellent customer service I’ve always received.”

Closing Summary

In conclusion, E*TRADE’s acquisition of TIR represents a pivotal moment in the brokerage industry. The potential benefits, including expanded global reach and enhanced operational efficiency, are substantial. However, challenges related to integration and market competition must be carefully considered. The long-term success of this acquisition hinges on E*TRADE’s ability to effectively integrate TIR’s operations and technologies while maintaining customer satisfaction.

Ultimately, the acquisition’s success will depend on its ability to adapt to the ever-evolving market dynamics.