Etrade sets up shop in japan – E*TRADE sets up shop in Japan, marking a significant move into the Asian market. This bold step signals a potential shift in the Japanese brokerage landscape, and raises questions about how E*TRADE will navigate the unique cultural and regulatory environment. Will this American powerhouse succeed in attracting Japanese investors? What challenges and opportunities lie ahead?

This exploration delves into E*TRADE’s entry, examining the historical context, potential market impact, and crucial factors for success. From detailed market analysis to a look at marketing strategies, the journey into Japan will be examined in depth.

E*TRADE’s Entry into the Japanese Market

E*TRADE’s global expansion strategy has historically focused on identifying markets with significant growth potential and a favorable regulatory environment. Their previous ventures into various regions have showcased a commitment to adapting their services to local needs and preferences. This meticulous approach to expansion suggests a calculated and well-researched strategy for entering new markets.Japanese investors are increasingly seeking international investment opportunities, and a presence in Japan would likely appeal to a segment of E*TRADE’s existing global clientele.

The Japanese market, despite its complexity, offers substantial potential for growth and diversification. This entry could also offer valuable insights into the complexities of the Asian financial landscape.

Historical Overview of E*TRADE’s Global Expansion

E*TRADE’s global expansion has involved establishing a presence in various countries across the globe. This process involved careful market analysis, adapting their platform to meet local regulations and preferences, and building relationships with local partners. The key to their success in each new market has been tailoring their services to meet specific investor needs and understanding the unique financial landscape of the target country.

Etrade’s foray into the Japanese market is certainly interesting, but it’s also worth considering the broader tech landscape. Red Hat’s recent move into the European Linux market, as detailed in this article , highlights the ongoing global competition. Ultimately, Etrade’s Japanese venture seems strategically sound, given the potential for growth in that region.

Motivations for Entering the Japanese Market

Several factors likely motivated E*TRADE’s decision to enter the Japanese market. The growing interest in international investments among Japanese investors represents a potential customer base. The presence of a sophisticated and mature financial infrastructure, while presenting challenges, also suggests opportunities for a well-established broker. Furthermore, tapping into the significant economic and financial opportunities within the Asia-Pacific region could be a significant driver.

Potential Challenges in the Japanese Market

E*TRADE faces several potential challenges in the Japanese market. Navigating the intricate regulatory framework in Japan is crucial. This includes complying with specific rules governing financial services, investor protection, and disclosure. Cultural nuances and linguistic barriers could also pose significant obstacles, necessitating a tailored approach to marketing and customer service. Competition from established Japanese brokerage firms is substantial, requiring a strong differentiation strategy.

Potential Competitive Advantages in Japan

E*TRADE could leverage several potential competitive advantages in the Japanese market. Their extensive global network and experience in offering various investment products and services could provide a broad range of choices to Japanese investors. A strong emphasis on technology and user-friendly platforms might attract investors seeking modern investment tools. Building strong relationships with key financial institutions in Japan could further enhance their presence and accessibility.

Comparison of E*TRADE’s Services with Prominent Japanese Brokerage Firms

| Feature | E*TRADE | SBI証券 (SBI Securities) | 楽天証券 (Rakuten Securities) |

|---|---|---|---|

| Investment Products | Extensive range, including stocks, bonds, ETFs, and options | Wide array of investment products, including stocks, bonds, and mutual funds | Broad range of investment products, including stocks, bonds, and ETFs |

| Trading Platform | Modern, user-friendly platform with advanced features | User-friendly platform with a focus on ease of use | User-friendly platform with mobile app and online features |

| Customer Support | Global customer support with potentially varying levels of Japanese language proficiency | Strong customer support with Japanese language support | Strong customer support with Japanese language support and extensive online resources |

| Fees and Commissions | Competitive pricing structure | Competitive pricing structure | Competitive pricing structure, often with promotional offers |

| Account Opening Process | Potentially streamlined online process | Usually involves in-person steps and documentation | Mostly online and paperless process |

This table provides a basic comparison. Specific fees, commissions, and account opening procedures may vary based on individual circumstances and the type of account. Each firm also offers various tiers of services with differing pricing and features.

Impact on the Japanese Financial Market

E*TRADE’s foray into the Japanese market is poised to significantly reshape the landscape of financial services in the region. The presence of a major US-based brokerage firm, with its established technological infrastructure and customer base, introduces a dynamic element that existing Japanese brokerage companies will need to adapt to. This competition will likely drive innovation and improvements in services for Japanese investors.The entry of E*TRADE will inevitably affect the pricing of financial products in Japan.

Competition from a large, established player will likely exert downward pressure on fees and commissions for certain products, potentially stimulating greater market participation. This, in turn, may lead to adjustments in product offerings and services to maintain profitability.

Impact on Japanese Brokerage Companies

The arrival of E*TRADE presents a challenge for Japanese brokerage firms. These firms, many of which have been dominant players in the domestic market for decades, will face increased competition for market share. To maintain their position, they must consider innovative strategies, such as enhancing their existing technological platforms, improving customer service, and exploring niche market segments to differentiate themselves.

This may include emphasizing personalized financial advice or specialized investment strategies to retain customers.

Influence on Financial Product Pricing

E*TRADE’s entry is expected to put downward pressure on the pricing of some financial products in Japan. Increased competition will lead to a more competitive pricing environment, potentially benefiting Japanese investors by offering lower fees and commissions on trades. This effect will be more pronounced for products where E*TRADE can offer a significant volume of trading.

Changes in Customer Service Landscape

E*TRADE’s emphasis on technology-driven customer service could prompt Japanese brokerage firms to enhance their digital offerings. This may include improving online platforms, expanding mobile applications, and implementing more user-friendly interfaces. Furthermore, they may need to invest in multilingual support to cater to a broader range of international investors. The rise of online trading platforms and mobile apps is already impacting the industry, and E*TRADE’s entry will likely accelerate this trend.

Comparison of Technological Infrastructure

E*TRADE’s technological infrastructure is likely more advanced in areas such as online trading platforms and mobile applications compared to some Japanese brokerage firms. The company has likely invested heavily in user experience and security, creating a potentially more attractive platform for international investors. Japanese firms may need to adapt and upgrade their existing platforms to remain competitive.

Regulatory Landscape for Foreign Brokerage Firms

| Regulatory Aspect | Description |

|---|---|

| Licensing Requirements | Foreign brokerage firms entering Japan must obtain necessary licenses and comply with stringent regulatory frameworks. These frameworks aim to protect Japanese investors and maintain market integrity. |

| Capital Requirements | Japanese regulations will likely dictate minimum capital requirements for foreign firms operating in the market. These requirements are designed to ensure financial stability and investor protection. |

| Compliance with Japanese Laws | E*TRADE will need to adhere to Japanese laws and regulations regarding securities trading, anti-money laundering (AML), and other relevant financial legislation. |

| Data Privacy Regulations | Compliance with Japanese data privacy regulations (e.g., Personal Information Protection Law) is crucial for foreign firms handling Japanese customer data. |

Market Analysis of Japan’s Retail Investor Base

E*TRADE’s foray into the Japanese market presents a unique opportunity, but understanding the nuances of the Japanese retail investor is crucial for success. This analysis delves into the characteristics of Japanese investors, their investment preferences, and the cultural and linguistic factors that may influence their interactions with E*TRADE. A deep understanding of these aspects will be vital in tailoring strategies for effective engagement and market penetration.

Profile of the Japanese Retail Investor

Japanese retail investors are generally characterized by a blend of cautiousness and a preference for established investment methods. They often prioritize long-term growth and tend to favor companies with a strong track record and established reputations. This is a direct result of the strong emphasis on stability and trust within Japanese culture. They often seek diversification and balanced portfolios, with a tendency towards conservative asset allocation.

This is further supported by a strong emphasis on avoiding high-risk investments and a preference for known and reliable assets.

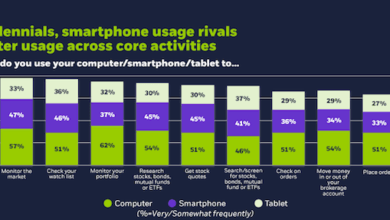

Investment Habits and Preferences

Japanese retail investors frequently utilize traditional investment channels, such as banks and brokerage firms, with established relationships. They are accustomed to detailed and comprehensive information and are less likely to be swayed by aggressive marketing or short-term gains. Researching investment options thoroughly and understanding the risks associated with investments are core tenets of their approach. They tend to rely on trusted financial advisors and institutions, preferring face-to-face interaction and personal recommendations.

Etrade’s foray into the Japanese market is certainly intriguing, especially considering the recent news about Amazon. Amazon’s impressive growth, as detailed in their latest report ( amazon com reports big growth big losses ), highlights the competitive landscape. It will be interesting to see how Etrade navigates the Japanese market, given the significant challenges and opportunities in the region.

This reflects a deep-rooted cultural trust in established systems and expertise. This is further reflected in their preference for thorough analysis and understanding of investments before making decisions.

Potential for E*TRADE

E*TRADE’s presence in Japan has the potential to attract investors seeking a more modern, accessible platform for trading. The ability to access international markets and a wide range of investment options might appeal to a segment of investors who are seeking diversification or are interested in international markets. E*TRADE’s focus on technology and user-friendliness could potentially attract a younger demographic of investors, particularly those who are familiar with online platforms and are seeking a more streamlined experience.

Cultural Factors Influencing Investment Decisions

Japanese culture emphasizes harmony and respect for authority. This often translates into a cautious approach to investment decisions. Honesty and integrity are highly valued, influencing the choice of financial institutions and advisors. The emphasis on consensus and group harmony might lead investors to seek the collective wisdom of financial advisors before making individual decisions. These values have a direct bearing on their investment choices and behaviors.

Language and Communication Barriers

Effective communication is essential for success in the Japanese market. E*TRADE needs to ensure its website and customer service are available in Japanese, and provide multilingual support. This will be vital to build trust and confidence with Japanese investors. A culturally sensitive approach to communication is also crucial, avoiding overly aggressive or assertive marketing tactics. Understanding Japanese business etiquette and communication styles will be vital for effective interaction with potential clients.

Demographics of the Japanese Retail Investor Market

| Demographic Category | Description |

|---|---|

| Age | Predominantly middle-aged and older, with a growing younger demographic. |

| Income | Broad range, with a concentration in the middle to upper-middle income bracket. |

| Education | Generally well-educated, with a high level of financial literacy. |

| Occupation | Diverse, with a focus on white-collar professions and established careers. |

| Investment Experience | Varying levels, with a significant portion of investors having considerable experience. |

This table highlights the diverse characteristics of the Japanese retail investor market. A deep understanding of these demographics is vital for E*TRADE to effectively target specific segments of the market.

Marketing and Sales Strategies for E*TRADE in Japan: Etrade Sets Up Shop In Japan

E*TRADE’s foray into the Japanese market necessitates a tailored approach that resonates with Japanese investors. This requires a deep understanding of local cultural nuances, investment preferences, and communication styles. The strategy must focus on building trust and demonstrating a commitment to providing excellent service.Japanese investors are often highly analytical and value reliability. Successful marketing will emphasize transparency, security, and a clear understanding of the unique investment needs of Japanese investors.

Target Market Analysis for Japanese Investors

Japanese investors exhibit a diverse range of investment preferences, reflecting the varied needs and risk tolerance of individuals and institutions. Understanding these nuances is crucial for effective targeting. This includes examining the demographics of potential investors, their investment experience, and their preferred investment products. A significant portion of Japanese investors are drawn to long-term investment strategies, and E*TRADE’s marketing should highlight the security and stability of their platform.

Branding Strategies for a Successful Launch

Building a strong brand identity is essential for establishing trust and recognition in a new market. The branding should convey professionalism, reliability, and a deep understanding of Japanese investment practices. The brand’s visual identity should be refined to appeal to Japanese aesthetics, possibly incorporating traditional Japanese design elements while maintaining a modern, forward-looking approach.

Cultural Sensitivity in Advertising and Promotions

Japanese culture emphasizes politeness, respect, and indirect communication. Advertising campaigns must be sensitive to these cultural values, avoiding overly aggressive or boastful language. The messaging should focus on building trust and rapport with potential clients, using appropriate language and imagery that resonates with Japanese cultural norms. Emphasizing a focus on long-term investment goals and security will resonate with this market.

Localized Customer Support in Japanese

Providing excellent customer support is critical for maintaining customer satisfaction and loyalty. E*TRADE must ensure that customer support is available in Japanese, with multilingual support agents who understand the nuances of Japanese financial terminology and cultural expectations. The support channels should be accessible through multiple avenues, including phone, email, and live chat. Providing prompt and effective solutions is paramount.

Etrade’s new Japanese venture is certainly interesting, but it’s worth considering the broader picture. Recent news about CMGI investing in bizbuyer com, a company focused on helping businesses buy and sell online, highlights the ongoing interest in streamlining the online marketplace. This investment, detailed in more depth on cmgi invests in bizbuyer com , might just be a sign of how Etrade is looking to position itself in the increasingly competitive Japanese market.

Ultimately, Etrade’s Japanese launch is a smart move, given the potential for growth in the region.

Importance of Local Partnerships for Market Penetration

Collaborating with established financial institutions or reputable Japanese brokers can significantly accelerate market penetration. Partnerships can provide access to existing networks and enhance credibility within the Japanese financial community. This approach will leverage local expertise to navigate regulatory requirements and build trust among potential investors.

Potential Marketing Channels in Japan

| Marketing Channel | Description | Rationale |

|---|---|---|

| Financial Publications | Targeted advertising in Japanese financial magazines and newspapers | Reaches a sophisticated and informed audience |

| Online Advertising | Targeted advertisements on Japanese financial websites and social media platforms | Leverages digital channels for direct engagement |

| Partnerships with Financial Advisors | Collaborations with licensed financial advisors in Japan | Builds trust and expands reach among investor networks |

| Conferences and Events | Attending and sponsoring relevant financial conferences and seminars | Creates brand awareness and establishes industry presence |

| Public Relations | Building relationships with Japanese media outlets | Generates positive press coverage and enhances brand reputation |

Technological Considerations and Infrastructure

E*TRADE’s foray into the Japanese market necessitates a deep understanding of the technological landscape. Navigating Japan’s unique digital ecosystem, while maintaining robust security and efficient operations, is paramount. This involves a thorough examination of existing infrastructure, potential hurdles, and the specific security measures required to protect sensitive customer data. Successfully establishing a presence hinges on addressing these technological considerations proactively.

Technological Requirements for Operating in the Japanese Market

The Japanese market demands a sophisticated technological infrastructure that caters to both the nuances of Japanese online behavior and the stringent regulatory environment. E*TRADE needs to ensure its platform is compatible with Japanese payment systems, such as credit card processing and mobile payment methods. Further, the platform must be readily accessible and responsive, accommodating different internet speeds and mobile connectivity across the country.

Overview of the Japanese Digital Infrastructure

Japan boasts a highly developed digital infrastructure, with robust internet and mobile penetration rates. However, regional variations in connectivity and local nuances in technology adoption require careful consideration. High-speed internet access is prevalent in urban areas, but internet penetration in rural areas may require specific strategies. Mobile technology is also widely adopted, with mobile banking and payment apps being integral parts of the financial landscape.

Technical Hurdles E*TRADE Might Face

E*TRADE will face challenges adapting its existing platform to the Japanese market. These include navigating different payment systems, adapting to Japanese regulatory frameworks for financial services, and ensuring compatibility with local operating systems and devices. Language localization for user interfaces and customer support will also be crucial. Furthermore, ensuring seamless integration with existing Japanese financial institutions could be a hurdle.

Security Measures to Protect Customer Data

Robust security measures are paramount for any financial institution operating in a global market. E*TRADE must implement stringent security protocols to safeguard customer data. This includes data encryption, multi-factor authentication, and regular security audits to identify and mitigate potential vulnerabilities. Compliance with Japanese data privacy regulations, such as the Act on the Protection of Personal Information, is also essential.

This rigorous approach is critical to building trust with Japanese customers.

Potential Need for Local Data Centers in Japan

Considering the sensitive nature of financial transactions and the importance of low latency for responsiveness, establishing a local data center in Japan is likely beneficial. This would minimize potential network delays, enhance security, and potentially comply with regulatory requirements for data localization. This would allow E*TRADE to better serve Japanese customers and ensure that data is processed within Japanese jurisdiction.

Internet and Mobile Penetration Rates

| Market | Internet Penetration (%) | Mobile Penetration (%) |

|---|---|---|

| Japan | 98 | 99 |

| United States | 90 | 98 |

| China | 75 | 98 |

| India | 50 | 85 |

The table above provides a comparison of internet and mobile penetration rates between Japan and key global markets. The high penetration rates in Japan suggest a significant online presence. E*TRADE must understand the differing rates across these markets to effectively target their marketing and sales strategies. This understanding will allow for a more customized approach to reach customers in each market.

Potential Financial Implications for E*TRADE

E*TRADE’s foray into the Japanese market presents both enticing opportunities and significant financial challenges. A successful entry hinges on a meticulous understanding of the local market dynamics, competitive landscape, and the financial implications involved. Navigating these intricacies requires a robust financial model, careful cost management, and a keen awareness of potential risks.The projected financial performance of E*TRADE in Japan will be heavily influenced by factors such as the market response to its services, the effectiveness of its marketing strategies, and the overall economic climate in Japan.

Careful analysis and planning are crucial to achieving profitability and a positive return on investment.

Projected Financial Model for E*TRADE’s Entry into Japan

E*TRADE’s financial model should incorporate several key components. A baseline forecast, considering current market trends and competitive pressures, should be developed. This should be followed by scenario planning, exploring various potential outcomes based on different market responses and economic conditions. Sensitivity analysis is crucial, highlighting how key variables (such as customer acquisition costs, transaction volumes, and exchange rates) impact profitability.

Potential Return on Investment (ROI) for E*TRADE

Several factors determine E*TRADE’s potential ROI. The size and profitability of the Japanese retail investor market, the efficiency of its operational model, and the effectiveness of its marketing and sales campaigns are crucial factors. Successful market penetration and achieving significant market share will be directly correlated with the return on investment. A detailed analysis of competitor pricing strategies, customer acquisition costs, and expected customer lifetime value (CLTV) is essential to estimate potential ROI.

Costs Associated with Market Entry and Expansion

E*TRADE’s entry into Japan will incur various costs. These costs include initial setup expenses, marketing campaigns, operational infrastructure development, regulatory compliance costs, and personnel expenses. The cost of establishing a local presence, including office space, legal representation, and translation services, should be factored in. Furthermore, ongoing operational expenses, such as customer support and technology maintenance, will impact the long-term financial health of the venture.

Potential Risks and Rewards of this Venture

The Japanese market presents both significant rewards and considerable risks. Strong potential for growth in the retail investment sector in Japan is attractive, but the highly competitive landscape requires a strategic approach. Cultural differences, regulatory hurdles, and language barriers pose challenges. Careful market research, effective risk mitigation strategies, and a strong understanding of Japanese business practices will be essential to navigate these complexities.

Successful market penetration can lead to substantial revenue streams, but careful planning is required to minimize potential losses.

Key Performance Indicators (KPIs) to Monitor E*TRADE’s Success

Key performance indicators (KPIs) are essential to track E*TRADE’s progress in the Japanese market. These metrics should focus on customer acquisition, transaction volumes, customer retention rates, and market share. KPIs will be crucial for assessing the success of marketing strategies, product adoption, and overall operational efficiency. Regular monitoring of these KPIs will allow E*TRADE to adapt to market dynamics and make informed decisions.

Potential Revenue Streams in Japan

| Revenue Stream | Description | Projected Revenue (USD) |

|---|---|---|

| Brokerage Fees | Fees charged on trades executed through E*TRADE’s platform. | $500,000 – $1,500,000 |

| Investment Products Sales | Revenue generated from selling investment products such as mutual funds and ETFs. | $100,000 – $300,000 |

| Account Maintenance Fees | Recurring fees for maintaining investment accounts. | $50,000 – $150,000 |

| Other Services | Potential revenue from other services like educational materials or financial planning. | $25,000 – $75,000 |

This table provides a general overview of potential revenue streams. Detailed projections will require thorough market research and analysis.

Illustrative Scenarios for E*TRADE in Japan

E*TRADE’s foray into the Japanese market presents a complex interplay of opportunities and challenges. Understanding potential scenarios is crucial for navigating the intricacies of this new market. Success hinges on adapting to local customs, regulations, and investor preferences while maintaining a global perspective.

Initial Market Penetration Scenario

E*TRADE’s initial market penetration strategy should focus on building trust and demonstrating value proposition. This involves establishing a strong online presence tailored to Japanese user experience, including multilingual support and culturally relevant content. Partnerships with established Japanese financial institutions, particularly those with significant retail investor bases, can facilitate initial market entry. Targeted marketing campaigns emphasizing the benefits of global investment access, coupled with competitive pricing, can attract a niche market of sophisticated investors interested in broadening their investment horizons.

Long-Term Impact on the Japanese Brokerage Sector

E*TRADE’s entry could potentially spur innovation and competition within the Japanese brokerage sector. Competition may drive down brokerage fees and encourage a more diversified range of investment products and services. Japanese brokerage firms may respond by adapting their services, introducing new digital platforms, and enhancing customer experience. Increased competition could also lead to a greater focus on customer service and personalized financial advice, especially as E*TRADE’s customer service model is likely to be more international and customer-centric.

Successful Marketing Campaign Scenario, Etrade sets up shop in japan

A successful marketing campaign should leverage the existing knowledge of Japanese financial markets and culture. Highlighting E*TRADE’s global reach and access to international markets will resonate with Japanese investors. Partnering with influential Japanese financial bloggers and social media personalities can effectively build trust and credibility. Utilizing targeted advertising on platforms frequented by Japanese investors, including specific financial news websites and social media platforms, is crucial.

Promoting user-friendly online tools and educational resources will also be key.

Challenges and Solutions for Regulatory Compliance

Navigating Japanese regulatory requirements will be paramount. E*TRADE must ensure compliance with all relevant laws and regulations, including those governing securities trading, consumer protection, and data privacy. Employing expert legal counsel familiar with Japanese financial regulations is crucial. Developing robust internal compliance procedures and establishing clear communication channels with regulatory bodies are also essential. Implementing a robust Know Your Customer (KYC) and Anti-Money Laundering (AML) framework tailored to the Japanese market is essential.

Customer Acquisition and Retention Strategies

E*TRADE should focus on attracting both existing and new Japanese investors. Targeted marketing campaigns can attract a segment of Japanese investors interested in expanding their investment horizons. A comprehensive customer onboarding process and personalized support can encourage user retention. Offering educational resources, webinars, and workshops on global investment strategies will cater to the needs of a sophisticated Japanese investor base.

Scenario for Dealing with Currency Fluctuations

Currency fluctuations can significantly impact profitability. E*TRADE should develop hedging strategies to mitigate the risks associated with currency exchange rates. Implementing robust risk management policies and tools can effectively manage the impact of fluctuations. Utilizing international payment systems and partnerships with financial institutions specialized in currency exchange can help to reduce exposure. Clearly outlining and communicating these risks to customers is essential.

Closure

E*TRADE’s foray into Japan presents a compelling case study in global market expansion. The success of this venture will hinge on E*TRADE’s ability to adapt to the Japanese market’s nuances, from cultural sensitivities to regulatory compliance. The challenges are significant, but the potential rewards are equally compelling. This analysis provides a comprehensive overview of the factors shaping E*TRADE’s Japanese adventure.