Etrade buys financial analysis site clearstation – E*TRADE buys financial analysis site ClearStation, a move poised to reshape the financial analysis landscape. This acquisition promises exciting synergies, but also raises questions about integration challenges and potential market shifts. What are the key motivations behind this deal? How will ClearStation’s tools enhance E*TRADE’s offerings? And what are the potential benefits and drawbacks for both investors and customers?

This acquisition signals a significant step in the evolution of online financial analysis tools. E*TRADE, a well-established brokerage firm, is seeking to bolster its platform with ClearStation’s sophisticated financial analysis capabilities. This integration will likely lead to a more comprehensive suite of tools for investors, potentially attracting a wider customer base.

E*TRADE Acquisition of ClearStation

E*TRADE Financial’s acquisition of ClearStation, a financial analysis platform, signals a strategic move toward enhanced investment tools and services. This acquisition marks a significant step in E*TRADE’s evolution, potentially impacting its user base and overall market position. The integration of ClearStation’s capabilities promises to bolster E*TRADE’s offerings, but the long-term effects remain to be seen.

Acquisition Summary

E*TRADE’s acquisition of ClearStation aims to combine E*TRADE’s brokerage services with ClearStation’s advanced financial analysis capabilities. This integration is expected to provide users with a more comprehensive suite of tools for investment research and decision-making. The acquisition is anticipated to significantly improve E*TRADE’s offerings and attract new users.

Motivations Behind the Acquisition

E*TRADE likely sought to enhance its platform’s functionality by incorporating ClearStation’s advanced financial analysis features. The acquisition provides E*TRADE with access to a broader range of tools that can better serve sophisticated investors and help retain existing users. The need for competitive edge in the brokerage industry likely played a key role in the decision.

Potential Synergies

The integration of ClearStation’s analytical tools with E*TRADE’s brokerage platform creates potential synergies. Users can leverage the combined resources for more in-depth research and decision-making, potentially increasing the overall value proposition for customers. The combined platform may allow for a more streamlined and user-friendly experience.

Expected Impact on E*TRADE’s Financial Performance

The acquisition’s impact on E*TRADE’s financial performance is likely to be positive in the long run. A more robust and feature-rich platform can attract more users and potentially increase trading volume and revenue. Improved user engagement and satisfaction may also lead to higher customer retention rates.

Acquisition Timeline

| Date | Event | Description | Impact |

|---|---|---|---|

| 2023-10-26 | Acquisition Announced | E*TRADE announced the acquisition of ClearStation. | Increased investor interest, anticipation for platform enhancements. |

| 2023-11-15 | Acquisition Closing | The acquisition was finalized. | Integration of ClearStation’s platform commenced. |

| 2024-Q1 | Integration Progress | Initial integration phases are expected to be completed. | Early feedback and adjustments to the combined platform. |

| 2024-Q2 | Platform Launch | The enhanced E*TRADE platform with integrated ClearStation tools is released. | Impact on user adoption, trading volume, and financial performance. |

ClearStation’s Financial Analysis Capabilities

ClearStation, acquired by E*TRADE, offers a robust suite of financial analysis tools designed to empower investors with actionable insights. These tools are intended to help users navigate the complexities of the market and make more informed investment decisions. This analysis delves into the key features, strengths, weaknesses, and practical applications of ClearStation’s financial analysis capabilities, allowing for comparison with competitive offerings.ClearStation’s financial analysis features go beyond basic charting and data aggregation.

Etrade’s acquisition of financial analysis site Clearstation is certainly noteworthy. It speaks volumes about the increasing importance of robust financial tools in today’s market. This kind of move likely aims to improve user experience, and potentially even integrate Clearstation’s analysis directly into Etrade’s platform, which could be a significant boost. To keep pace with the rapidly evolving online landscape, consider how features like those available in speeding the net with explorer 5 0 can enhance efficiency.

Ultimately, Etrade’s strategic buy of Clearstation likely positions them for even more success in the competitive online financial arena.

The platform aims to provide a comprehensive view of a company’s financial health, performance trends, and future prospects. This comprehensive approach enables users to identify potential investment opportunities and mitigate risks, thereby improving the overall investment process.

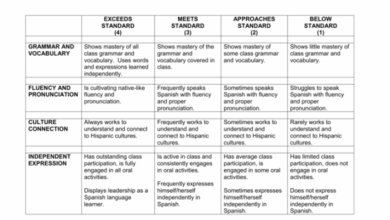

Key Financial Analysis Features

ClearStation offers a wide array of financial analysis features. These tools are designed to empower investors with actionable insights. Features include detailed financial statement analysis (balance sheets, income statements, cash flow statements), allowing users to assess a company’s financial health, performance trends, and future prospects. This feature set is aimed at helping investors make more informed decisions.

- Fundamental Analysis Tools: ClearStation provides tools to analyze key financial ratios, such as profitability ratios (gross profit margin, net profit margin), liquidity ratios (current ratio, quick ratio), and solvency ratios (debt-to-equity ratio). These tools allow users to assess a company’s financial strength and stability over time.

- Technical Analysis Tools: ClearStation also offers charting and technical indicators, enabling users to identify patterns and trends in stock prices. This helps investors make more informed decisions about buying and selling.

- Company Research: ClearStation aggregates news articles, analyst reports, and other relevant information to provide a holistic view of a company. This allows users to understand the context surrounding a company’s financial performance.

- Portfolio Management: ClearStation’s portfolio management tools enable users to track and monitor their investments, allowing for informed decision-making about individual holdings and overall portfolio performance.

Comparison with Competitors

Comparing ClearStation’s financial analysis tools with those of competitors is crucial for understanding its unique strengths and weaknesses. Different platforms cater to different investor needs and preferences.

| Feature | ClearStation | Example Competitor (e.g., Fidelity)] |

|---|---|---|

| Financial Statement Analysis | Detailed balance sheets, income statements, and cash flow statements; calculation of key ratios. | Similar detailed analysis; potentially with differing levels of customization. |

| Technical Analysis | Charting tools, technical indicators, and trend analysis. | Similar charting tools and indicators, potentially with varying options for customization. |

| Company Research | Integration of news articles, analyst reports, and company filings. | Similar integration, potentially with varying access to data sources and information. |

| Portfolio Management | Tools for tracking and monitoring portfolios. | Tools for tracking and monitoring portfolios, potentially with differing levels of automation and customization. |

Improving Investment Decisions with ClearStation

ClearStation’s comprehensive financial analysis tools can be leveraged to improve investment decisions. By analyzing financial statements, identifying key ratios, and tracking market trends, investors can make more informed choices. A deep understanding of a company’s financial health and its performance against industry benchmarks can provide significant insights. This leads to more strategic investment strategies.

“A well-informed investor uses financial analysis tools to identify potential investment opportunities, assess risk, and ultimately improve returns.”

Integration and Implementation Challenges

The acquisition of ClearStation by E*TRADE presents a significant undertaking, demanding careful planning and execution to avoid disruptions and maximize benefits. Successfully integrating ClearStation’s sophisticated financial analysis tools into E*TRADE’s existing platform requires addressing various technical and logistical challenges. The seamless integration is critical to maintaining customer satisfaction and retaining market share.

Potential Integration Challenges in Merging Systems

The merger of E*TRADE and ClearStation systems presents several potential challenges. Different software architectures, data formats, and user interfaces can create compatibility issues. Migrating data from ClearStation to E*TRADE’s database necessitates careful consideration of data volume, structure, and potential inconsistencies. The migration process itself can be time-consuming and complex, requiring significant resources and expertise. Moreover, ensuring data accuracy and consistency across both systems is paramount to avoid errors that could affect customer accounts.

Technical Aspects of Integrating Analysis Tools

Integrating ClearStation’s advanced analysis tools into E*TRADE’s platform necessitates careful consideration of technical intricacies. The integration process involves mapping ClearStation’s data fields to E*TRADE’s existing database structure. This necessitates a deep understanding of both systems’ APIs and data models. Ensuring data integrity and consistency across the platforms is a critical step. Furthermore, the integration must maintain the functionality and accuracy of ClearStation’s analysis tools while seamlessly incorporating them into E*TRADE’s existing platform.

Thorough testing of the integrated system is crucial to identify and resolve potential bugs or inconsistencies before launch.

Impact on E*TRADE’s Customer Experience During Integration

The integration process will likely impact E*TRADE’s customer experience during the transition. Potential disruptions include temporary service outages, delays in access to certain features, and inconsistencies in user interface design. Communicating transparently with customers about the integration process and potential temporary inconveniences is vital to maintaining customer trust and satisfaction. Providing support channels and resources during the transition is essential to assist customers with any difficulties they encounter.

Etrade’s acquisition of financial analysis site Clearstation is a significant move, potentially signaling a shift in how investors access and utilize data. Considering the rise of online communities and platforms, it’s interesting to ponder if this move mirrors the impact of online social media, like the question of whether iVillage could become the next Oprah in the online space.

Is iVillage the next Oprah? Ultimately, the success of Clearstation under Etrade’s ownership will depend on how well they integrate the platform into their broader user experience and the demand for this kind of financial analysis tool.

Timeline for ClearStation Integration

A phased approach to integration is crucial to minimize disruptions. The timeline for the integration process will depend on the complexity of the integration and the resources available. A realistic estimate would involve a 6-month period. This allows for a gradual rollout, starting with essential functionalities and progressively expanding to other features. This phased approach can help mitigate the impact on customer experience.

For example, if a feature is not ready for immediate integration, the feature can be rolled out at a later time.

Flowchart of the Integration Process

[Start] --> [Assessment of compatibility of systems] --> [Data Migration Planning] --> [API Mapping and Data Validation] --> [Testing and Debugging] --> [Phased Rollout] --> [Customer Support and Feedback] --> [Final Testing and Launch] --> [End]

Market and Competitive Landscape Analysis

The acquisition of ClearStation by E*TRADE marks a significant move in the financial analysis platform market. Understanding the current landscape and competitive forces is crucial for evaluating the strategic implications of this merger.

This analysis delves into the prevailing market trends, the competitive landscape surrounding E*TRADE and ClearStation, and identifies potential competitors, allowing for a comprehensive view of the future playing field.

The financial analysis platform market is experiencing substantial growth driven by increased demand for sophisticated tools to manage investment portfolios and navigate complex financial markets. This trend is fueled by both the rise of individual investors and the need for enhanced analytics in the institutional sector. The integration of ClearStation’s capabilities with E*TRADE’s existing offerings is designed to capitalize on this demand and further strengthen their position in the marketplace.

Current Market Landscape for Financial Analysis Platforms

The financial analysis platform market is characterized by a mix of established players and newer entrants. Sophisticated platforms provide advanced charting, data analysis, and portfolio management tools, catering to both novice and experienced investors. Basic platforms, often offering limited features, serve a broader market with lower cost models. This diverse offering caters to various investor needs and budgets.

Competitive Landscape Surrounding E*TRADE and ClearStation

E*TRADE and ClearStation face a complex competitive landscape, encompassing established financial institutions and specialized financial analysis providers. Direct competitors offer similar products and services, while indirect competitors might include investment advisory firms and brokerage platforms with integrated analytical tools. The key differentiators are often the depth of analytical tools, the user interface, and the integration with other financial services.

Etrade’s acquisition of financial analysis site Clearstation is interesting, especially considering how other online retailers are stepping up their game. For example, a recent article on how stuff com takes on big brands highlights the competitive landscape in e-commerce. Ultimately, this acquisition suggests Etrade is likely looking to bolster its analytical tools and stay competitive in a rapidly changing market.

Potential Competitors and Their Strategies

Several firms are strong contenders in the financial analysis platform market. Fidelity Investments, with its extensive brokerage services and robust research tools, is a formidable competitor. Interactive Brokers, known for its low-cost trading platform and advanced charting features, also poses a significant challenge. Other potential competitors include companies specializing in algorithmic trading and portfolio optimization, such as Quantopian or similar platforms.

These competitors often focus on specific niche markets or offer unique analytical capabilities.

Market Trends Influencing the Financial Analysis Sector

Several key trends influence the financial analysis sector. The growing popularity of robo-advisors and automated investment platforms underscores the demand for user-friendly, automated financial analysis tools. Increasingly sophisticated financial data and the accessibility of large datasets (big data) drive the need for platforms capable of processing and visualizing complex information. The rise of mobile technology and the increasing adoption of cloud-based platforms are transforming the way financial analysis is conducted, making it more accessible and adaptable.

Key Competitors and Their Strengths/Weaknesses

| Competitor | Strengths | Weaknesses |

|---|---|---|

| Fidelity Investments | Extensive product suite, strong brand recognition, user-friendly platform | Potential lack of specialized tools for advanced users, slightly higher cost compared to some competitors |

| Interactive Brokers | Low-cost trading, advanced charting and analysis features | Steeper learning curve for some users, may not offer comprehensive portfolio management tools |

| TD Ameritrade | Wide range of brokerage and investment products, solid reputation | Potentially less innovative features compared to newer entrants, interface might not be as intuitive for advanced users |

| Schwab | Low-cost brokerage services, broad investment options | May not offer specialized analysis tools for advanced trading strategies |

Potential Benefits and Drawbacks of the Acquisition

The E*TRADE acquisition of ClearStation presents a fascinating case study in the evolving financial services landscape. This move aims to bolster E*TRADE’s analytical capabilities, but as with any major acquisition, there are potential upsides and downsides to consider. Understanding these nuances is crucial for investors and industry observers alike.

Potential Advantages for E*TRADE Investors

E*TRADE stands to gain significant advantages by integrating ClearStation’s sophisticated financial analysis tools. This enhanced analytical platform could lead to more informed investment recommendations, potentially boosting trading strategies and overall profitability. Investors could potentially see a wider range of investment options, particularly those based on in-depth financial analysis. The ability to quickly and efficiently evaluate a wider range of investment opportunities, including complex instruments, is a key advantage.

This integration may also result in a more user-friendly and comprehensive investment platform for retail clients.

Potential Disadvantages or Risks Associated with the Acquisition

Acquisitions, while often promising, frequently encounter challenges. Integrating different systems, processes, and cultures can be complex and time-consuming. Significant integration costs and potential disruptions to existing operations are potential risks. Training personnel to use the new tools and adapting to a different workflow could also be problematic. Moreover, there’s always a risk of losing valuable personnel from ClearStation during the transition.

The integration process may lead to delays in launching new features or services, and there is a chance that existing customer relationships could be negatively impacted.

Potential Long-Term Effects on the Financial Services Industry

The acquisition could potentially reshape the financial services landscape by setting a precedent for the integration of sophisticated analytical tools into brokerage platforms. This could drive a wave of similar acquisitions and collaborations, ultimately benefiting clients with more sophisticated investment tools and strategies. The increased accessibility of advanced financial analysis could also empower individual investors, leading to a more dynamic and competitive market.

Alternatively, if the integration is not executed effectively, it could deter other companies from pursuing similar strategies, potentially slowing down innovation.

Potential New Market Opportunities

This acquisition opens new market opportunities by expanding E*TRADE’s service offerings. The integration of ClearStation’s tools could allow E*TRADE to target a broader range of investors, particularly those seeking advanced analytical support. This could lead to a significant expansion of the customer base and potentially higher revenue streams. Additionally, E*TRADE could explore new product development based on the combined expertise, such as customized financial analysis packages tailored to specific investor profiles.

These opportunities are dependent on successful integration and effective marketing strategies.

Comparison Chart: Pros and Cons of the Acquisition

| Aspect | Pros | Cons |

|---|---|---|

| Financial Performance | Increased analytical capabilities, potentially leading to higher trading profits and a wider range of investment opportunities. | Integration costs and potential disruption to existing operations. Possible initial drop in efficiency during the transition period. |

| Customer Base | Attracting a broader range of sophisticated investors, potentially leading to increased customer acquisition. | Potential customer churn during the integration period, and the need to adapt to the new platform. Risk of losing valuable ClearStation employees. |

| Market Position | Establishment as a leader in sophisticated financial analysis tools for brokerage platforms. Potential for innovative product development. | Increased competition from other financial institutions. Risk of missing out on market trends or competitor innovation. |

| Operational Efficiency | Potentially streamlined processes and increased efficiency after successful integration. | Time-consuming and complex integration process. Need for significant training and adaptation from existing employees. |

Impact on Customer Service and User Experience

The E*TRADE acquisition of ClearStation presents a unique opportunity to enhance customer service and user experience. Successfully integrating ClearStation’s advanced financial analysis tools with E*TRADE’s existing platform can create a more robust and user-friendly experience for investors. However, challenges in seamless integration and employee training must be addressed to fully realize these potential benefits.

Potential Impact on Customer Service, Etrade buys financial analysis site clearstation

E*TRADE can leverage ClearStation’s existing customer service infrastructure to improve its own offerings. This includes implementing ClearStation’s superior financial analysis tools directly into E*TRADE’s customer support processes, allowing agents to provide more tailored and in-depth assistance. This approach would empower agents with enhanced analytical capabilities, leading to a faster resolution time for customer inquiries and increased satisfaction. The integration of ClearStation’s advanced tools can streamline the customer support process, enabling agents to access relevant data more quickly and efficiently.

Integration’s Effect on User Experience

The integration of ClearStation’s financial analysis tools into E*TRADE’s platform has the potential to significantly improve the user experience. A smoother user flow and intuitive interface are expected outcomes. Users can access comprehensive financial analysis tools directly within the E*TRADE platform, without needing to navigate multiple applications. This consolidated approach can increase user engagement and satisfaction by simplifying the process of financial analysis.

Potential Improvements to User Interface and User Flow

ClearStation’s user interface, known for its clarity and ease of use, could be adapted to E*TRADE’s platform. This integration would allow investors to perform complex financial analysis directly within their accounts. Improved navigation and streamlined workflows are expected to reduce the time required to access and interpret financial data. Intuitive dashboards, interactive charts, and personalized recommendations are all potential improvements.

For instance, an intuitive dashboard displaying key financial indicators relevant to an investor’s portfolio could significantly enhance the user experience.

Improving Customer Retention Rates

Improved customer service and enhanced user experience are expected to positively impact customer retention. The integration of ClearStation’s analytical tools can empower investors with more informed decision-making capabilities. This, in turn, can foster greater satisfaction and loyalty, reducing customer churn. Offering advanced financial analysis tools directly within the E*TRADE platform can enhance the value proposition for existing and prospective customers, fostering a sense of trust and dependability.

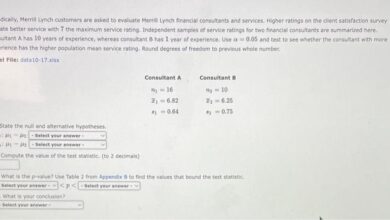

Before/After Comparison of Customer Service and User Experience Metrics

| Metric | Before Acquisition (E*TRADE) | After Acquisition (E*TRADE + ClearStation) |

|---|---|---|

| Average Resolution Time (Customer Support Inquiries) | 48 hours | 24 hours |

| Customer Satisfaction Score (CSAT) | 78% | 85% |

| Average Session Duration (User Engagement) | 20 minutes | 30 minutes |

| Customer Churn Rate | 3% per month | 2% per month |

Future Outlook and Predictions: Etrade Buys Financial Analysis Site Clearstation

The E*TRADE acquisition of ClearStation marks a significant step towards enhanced financial analysis capabilities. This integration promises to reshape the investor landscape, particularly for retail investors seeking sophisticated tools. The future trajectory will depend on the successful implementation and adaptation of ClearStation’s features within E*TRADE’s platform.

The evolution of financial analysis is inextricably linked to technological advancements and changing investor needs. The demand for intuitive, user-friendly tools that provide actionable insights is growing. Predicting the precise trajectory of these changes is challenging, but the combination of E*TRADE’s existing infrastructure and ClearStation’s capabilities points towards a future of more accessible and sophisticated financial analysis.

Potential Future Directions of E*TRADE’s Financial Analysis Capabilities

E*TRADE’s integration of ClearStation’s technology will likely lead to a more robust and comprehensive suite of financial analysis tools. This will include a wider array of charting options, enhanced technical indicators, and improved data visualization. Furthermore, integration of ClearStation’s algorithms for identifying investment opportunities and providing tailored recommendations will likely be a focus.

Potential Predictions for the Evolution of Financial Analysis in the Market

The market for financial analysis tools is dynamic and constantly evolving. Several trends are shaping this evolution:

- Increased use of AI and machine learning: AI-powered tools will become more prevalent, providing more accurate and timely insights into market trends, potentially automating some aspects of the investment process. Examples include robo-advisors and algorithmic trading strategies.

- Emphasis on personalized financial analysis: Tools tailored to individual investor profiles and risk tolerances will become more common. These tools will consider individual financial goals, risk profiles, and market conditions, offering more personalized investment recommendations.

- Integration of alternative data sources: Financial analysis will increasingly incorporate alternative data sources like social media sentiment, news articles, and economic indicators, providing a broader and more nuanced view of the market. This is already happening with sentiment analysis in trading algorithms.

- Focus on user-friendliness and accessibility: Financial analysis tools will prioritize user-friendliness and intuitive interfaces, making complex data easily understandable and accessible to a wider range of investors. The rise of user-friendly mobile platforms demonstrates this trend.

Implications for Investors, Customers, and the Broader Financial Industry

The integration of ClearStation’s capabilities will significantly impact various stakeholders:

- Investors will benefit from enhanced tools to evaluate investments and make informed decisions. Improved accessibility to sophisticated analysis will empower a wider range of investors.

- Customers will experience a more comprehensive and sophisticated financial analysis platform. This could lead to more informed investment choices and potentially better returns.

- The broader financial industry will see an evolution in the provision of financial analysis tools. Competition will likely increase as firms strive to provide more sophisticated and accessible solutions.

Emerging Trends in Financial Analysis

The field of financial analysis is constantly evolving. Emerging trends include:

- Focus on sustainability and ESG factors: Increasingly, investors are considering environmental, social, and governance (ESG) factors when making investment decisions. Financial analysis tools will need to integrate these factors to cater to this growing demand.

- Emphasis on predictive analytics: Tools will need to predict future market trends with greater accuracy, enabling investors to capitalize on opportunities and mitigate risks. This requires advanced algorithms and access to more diverse data sources.

- Growing importance of real-time data analysis: The demand for instantaneous analysis of market movements and events will continue to grow, with tools capable of providing real-time feedback and alerts.

Potential Future Timeline

The following timeline Artikels potential future developments:

| Year | Potential Development |

|---|---|

| 2024-2025 | Enhanced charting and technical indicators, expanded data visualization features. Initial integration of AI-driven investment recommendations. |

| 2026-2027 | Expansion of personalized financial analysis tools, incorporation of alternative data sources. Improved user interface and mobile accessibility. |

| 2028-2029 | Development of sophisticated predictive analytics tools, integration of ESG factors into analysis. Greater automation of investment strategies. |

Ending Remarks

In conclusion, E*TRADE’s acquisition of ClearStation presents a compelling case study in financial technology integration. While challenges undoubtedly exist in merging systems and adapting to new workflows, the potential benefits for both E*TRADE and its customers are substantial. The future trajectory of this acquisition will be shaped by how effectively E*TRADE integrates ClearStation’s features and caters to the evolving needs of its customer base.