Establishing a merchant account for your web business is crucial for smoothly processing online payments. This guide dives deep into the essential steps, from understanding different account types to choosing the right provider, integrating with your online store, and managing your account securely. We’ll explore everything you need to know to confidently accept payments and grow your online business.

We’ll cover various aspects, including payment processing options, costs and fees, security measures, and essential documentation. Understanding the intricacies of merchant accounts is key to building a robust and successful online presence.

Introduction to Merchant Accounts

A merchant account is a financial service specifically designed for online businesses to process payments from customers. It’s the backbone of accepting online transactions, enabling businesses to receive payments securely and efficiently. Think of it as a dedicated payment processing account that’s linked to your business and payment gateway.Merchant accounts handle the technical aspects of accepting various payment methods, such as credit cards, debit cards, and digital wallets.

This frees up your business to focus on other essential operations. Understanding merchant accounts is crucial for any online business looking to grow and scale their operations.

Functions of a Merchant Account in Online Payment Processing

Merchant accounts act as intermediaries between your business and payment networks. They facilitate the smooth flow of funds from customers to your business. This involves several key functions:

- Authorization and Capture: The account authorizes transactions, ensuring the customer has sufficient funds and the transaction meets the requirements of the payment network. Once authorized, the funds are captured from the customer’s account and transferred to your business account.

- Fraud Prevention: Merchant accounts often incorporate advanced fraud detection systems to reduce the risk of fraudulent transactions. These systems analyze various data points to identify potential risks and help prevent losses.

- Settlement and Reconciliation: The account processes the settlement of transactions, transferring funds from the payment network to your business account. Reconciliation ensures that all transactions are accurately recorded and matched with corresponding records.

Types of Merchant Accounts

Different merchant account types cater to various business needs and transaction volumes.

- Traditional Merchant Accounts: This is the most common type. It’s suitable for businesses of all sizes, providing comprehensive payment processing capabilities. These accounts typically have higher transaction fees compared to other types but offer greater flexibility and features. A traditional merchant account is often the best option for businesses with established operations.

- Virtual Terminal Merchant Accounts: These accounts offer greater flexibility in accepting payments. Businesses can use a virtual terminal to process transactions over the phone, via email, or through other channels. Virtual terminals are especially useful for businesses that conduct sales outside of a dedicated online storefront.

- Recurring Billing Merchant Accounts: Designed for businesses that handle subscription-based or recurring transactions, these accounts simplify the process of collecting regular payments from customers.

- International Merchant Accounts: Specifically designed for businesses conducting transactions across international borders, these accounts support various currencies and payment methods used in different countries. These accounts facilitate global expansion.

Benefits of Having a Merchant Account for Online Businesses

Merchant accounts offer significant advantages for online businesses:

- Enhanced Security: Merchant accounts provide robust security measures to protect sensitive customer data and prevent fraud. This helps build customer trust and maintain a secure online environment.

- Streamlined Payment Processing: Merchant accounts handle the complex technical aspects of accepting payments, allowing businesses to focus on their core operations.

- Improved Customer Experience: The ability to accept various payment methods enhances the customer experience, attracting a wider range of customers.

- Scalability: Merchant accounts can be tailored to the evolving needs of a growing business, allowing for easy adjustments to accommodate increased transaction volumes.

Payment Gateways vs. Merchant Accounts

While both payment gateways and merchant accounts facilitate online payments, they differ significantly in their functionalities.

- Payment Gateways: A payment gateway is a software application that processes credit card transactions. It acts as an intermediary between the merchant’s website and the payment network. Gateways are generally easier to integrate with online stores. Think of it as the interface for the transaction, while the merchant account handles the financial side.

- Merchant Accounts: Merchant accounts are financial accounts that process and settle transactions. They are a complete payment processing solution, often including fraud protection, settlement, and reconciliation. The merchant account holds the funds from transactions, acting as the primary financial link to the business.

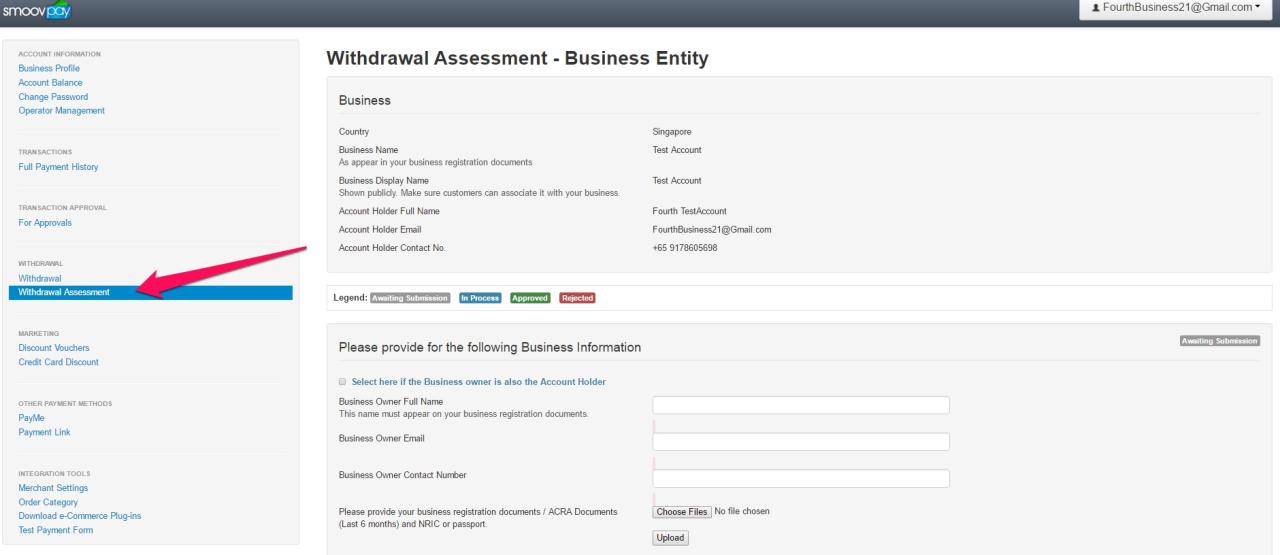

Setting Up a Merchant Account

Getting your online business up and running requires a merchant account, the crucial link that allows you to accept payments from customers. This process involves navigating several steps and understanding the documentation needed to ensure a smooth approval. Choosing the right provider is also essential for a positive transaction experience and to optimize your business’s growth.Setting up a merchant account is a vital step for any online business, acting as the bridge between your customers and your revenue.

The process involves careful planning, meticulous documentation, and a smart selection of a merchant account provider. Understanding the process ensures your business can accept payments seamlessly and securely.

Application Process Steps

The application process for a merchant account usually involves several steps, from initial inquiries to final approval. A common approach includes submitting an application, providing necessary documentation, and undergoing a thorough review. Successful applicants typically demonstrate a stable business model and a commitment to secure transactions.

- Application Submission: Complete the application form accurately, providing details about your business, including its legal structure, location, and projected sales volume. Transparency and completeness are key to a smooth process.

- Documentation Requirements: The necessary documents vary by provider but often include legal documents like articles of incorporation, business licenses, and tax information. Thorough record-keeping is vital during this phase.

- Review and Approval: Expect a review period from a few days to several weeks. Providers assess your business’s financial stability, risk profile, and compliance with regulations. The thoroughness of this review ensures a safe and sustainable transaction process.

Required Documentation

Accurate and complete documentation is crucial for a swift and successful application. This ensures compliance and builds trust with the merchant account provider.

- Business Information: Provide details such as your business name, address, legal structure (sole proprietorship, partnership, LLC, corporation), and EIN (Employer Identification Number). Ensure the information aligns with your legal registration.

- Financial Records: Demonstrate your business’s financial stability through bank statements, profit and loss statements, and balance sheets. The clarity and accuracy of these documents are vital.

- Legal Documents: Submit articles of incorporation, partnership agreements, or other relevant legal documents that demonstrate your business’s legal existence and structure. These are essential for verification purposes.

- Tax Information: Provide tax identification numbers (TINs) and any relevant tax documents. Accurate tax information demonstrates your commitment to compliance.

Factors Influencing Approval

Several factors influence the approval of a merchant account application. The stability of your business, the projected sales volume, and the provider’s risk assessment are crucial. Maintaining a strong business profile and a clear understanding of the factors involved will enhance your chances of approval.

- Business History: A well-established business with a history of consistent revenue and operational efficiency is more likely to be approved. The duration of operation and stability of sales trends are crucial.

- Sales Projections: Demonstrating realistic and credible sales projections is vital. Providers assess your anticipated transaction volume to ensure the account’s suitability.

- Risk Assessment: Providers evaluate your business’s risk profile. A low-risk profile is generally associated with higher approval rates. Factors such as business type, industry, and customer base are taken into consideration.

- Compliance: Maintaining compliance with relevant financial regulations is crucial for approval. Understanding and adhering to these regulations ensures trust and safety for transactions.

Merchant Account Providers Comparison

Different providers offer varying features, fees, and support levels. Consider factors like transaction fees, monthly fees, and customer support when comparing providers. Researching and comparing various providers can help you select the best option for your specific needs.

| Provider | Transaction Fees | Monthly Fees | Support |

|---|---|---|---|

| Provider A | 1.5% + $0.30/transaction | $25/month | 24/7 phone support |

| Provider B | 2% + $0.25/transaction | $50/month | Online FAQs and email support |

Connecting Your Merchant Account

Connecting your merchant account to your online store involves configuring payment gateways and ensuring seamless integration. This process varies based on your store’s platform and the chosen payment gateway. Careful attention to detail and adherence to the provider’s instructions are crucial.

- Gateway Integration: Integrate the chosen payment gateway with your e-commerce platform. This typically involves obtaining API keys and configuring payment processing settings.

- Testing and Verification: Thoroughly test the integration to ensure smooth transaction processing. Test various payment methods and scenarios to catch potential issues.

- Customer Support: Utilize the merchant account provider’s support resources for any issues or questions that arise during the integration process. Addressing problems promptly ensures a positive customer experience.

Choosing the Right Merchant Account

Selecting the ideal merchant account is crucial for a smooth and secure online payment experience. It’s not just about accepting payments; it’s about choosing a partner that understands your business needs and can scale with you. This involves evaluating various factors, from transaction fees to security protocols, to ensure your business operates efficiently and profitably.Careful consideration of your business’s specific needs and future growth trajectory is paramount when selecting a merchant account.

A poorly chosen account can lead to hidden fees, complicated processing, and ultimately, lost revenue.

Key Criteria for Selecting a Merchant Account

Choosing a merchant account requires a thorough evaluation of key criteria. These factors impact not only immediate costs but also long-term financial health. Understanding these elements will help you make an informed decision.

Setting up a merchant account is crucial for any online business. It’s the backbone of accepting payments, and as e-commerce reaches out for Y2K profits, this is more important than ever. You need a secure and reliable way to handle transactions, so taking the time to choose the right merchant account provider is worth the effort.

A good merchant account will help your online business thrive in the long run.

- Transaction volume and type: Your anticipated sales volume and the types of transactions (credit cards, debit cards, mobile payments) will directly influence the account’s suitability. A high-volume business may require a different structure than a small business with sporadic sales.

- Processing fees and rates: Understand the fees associated with each transaction type, as well as any monthly or setup fees. Compare these against other providers to ensure you’re getting the most competitive rates. Thorough analysis is crucial for long-term cost management.

- Payment processing options: Evaluate the various payment methods you need to support. A business catering to a diverse customer base should consider offering multiple options like credit cards, debit cards, and potentially mobile wallets, such as Apple Pay or Google Pay.

- Security measures: Look for a provider with robust security measures to protect your business and customer data. PCI DSS compliance is a strong indicator of secure handling of sensitive financial information. A secure platform builds customer trust and protects your business from fraud.

- Customer support: Reliable and responsive customer support is critical. A merchant account provider should offer various support channels to address any issues promptly. Smooth problem resolution ensures business continuity.

Assessing Transaction Fees and Processing Rates

Transaction fees and processing rates are often complex and can vary significantly between providers. Carefully evaluating these aspects is essential to avoid hidden costs. A simple comparison table can help.

| Feature | Provider A | Provider B |

|---|---|---|

| Credit Card Processing Fee (per transaction) | 2.5% + $0.30 | 2.9% + $0.35 |

| Monthly Fee | $50 | $75 |

| Setup Fee | $250 | Free |

Transaction fees often consist of a percentage of the transaction amount plus a fixed dollar amount. These rates can be influenced by factors like the type of card used, the method of payment, and the specific business’s needs.

Different Payment Processing Options

The range of payment processing options is continuously expanding. A modern merchant account should accommodate various methods to enhance customer convenience and cater to different market segments.

- Credit cards: Visa, Mastercard, American Express, and Discover are still widely used and essential for most businesses.

- Debit cards: Debit card processing offers an alternative for customers who prefer this method.

- Mobile payments: Apple Pay, Google Pay, and other mobile payment platforms are becoming increasingly popular, especially among younger generations. Offering mobile payment options is becoming a crucial differentiator.

Comparing Merchant Account Providers

Comparing different merchant account providers is essential to find the best fit for your business. A comprehensive evaluation requires comparing not only pricing but also features. Features like reporting tools, fraud prevention, and customer support should be evaluated.

- Features: Look for features that align with your business needs, such as reporting tools, fraud prevention systems, and customer support channels.

- Pricing: Compare pricing structures to identify the most cost-effective option for your volume and transaction type.

- Reputation: Research online reviews and testimonials to gain insights into the provider’s reliability and customer service.

Importance of Security Measures in a Merchant Account

Security is paramount in a merchant account. Protecting sensitive customer data is not just good practice; it’s essential for compliance and maintaining customer trust.

- PCI DSS compliance: Ensure the provider adheres to Payment Card Industry Data Security Standard (PCI DSS) requirements to protect customer financial data.

- Fraud prevention: Look for fraud prevention tools and mechanisms to minimize risks and safeguard your business from fraudulent activities.

- Data encryption: Verify that the provider uses robust encryption methods to safeguard sensitive information during transactions.

Managing a Merchant Account

Maintaining a smooth operation with your merchant account requires proactive management. This involves more than just accepting payments; it’s about understanding your financial flow, identifying potential issues, and ensuring compliance with regulations. Effective management safeguards your business’s financial health and prevents costly errors.

Transaction Records and Reports

Thorough record-keeping is crucial for understanding your business’s financial performance and for troubleshooting any issues that may arise. Accurate records are essential for tracking sales, expenses, and revenue, enabling informed business decisions. Detailed transaction records provide a historical context for analyzing trends and identifying areas for improvement.

Maintaining accurate and organized transaction records is vital for:

- Identifying patterns in sales and revenue, enabling forecasting and strategic planning.

- Tracking expenses associated with processing transactions, such as transaction fees.

- Reconciling bank statements with transaction records for accurate financial reporting.

- Providing documentation in case of disputes or audits.

Monitoring Account Activity

Regular monitoring of your merchant account activity is critical for preventing fraud and maintaining a healthy financial status. Proactive monitoring allows you to identify unusual activity promptly, reducing potential losses. Using the available reporting tools provided by your payment processor is key to this process.

Best practices for monitoring account activity include:

- Regularly reviewing transaction reports: Look for any unusual patterns or transactions that do not align with your typical sales activity. This may signal potential fraudulent activity or errors.

- Setting up alerts: Configure alerts for specific thresholds, such as transaction amounts or transaction types, to proactively notify you of significant changes in your account activity.

- Using reporting dashboards: Payment processors often provide dashboards or reporting tools that allow you to visualize key metrics, such as transaction volume, revenue, and fees.

- Reviewing statements: Compare your merchant account statements with your own records to ensure accuracy and identify discrepancies.

Resolving Disputes and Troubleshooting

Addressing disputes and troubleshooting issues promptly is crucial for maintaining positive relationships with customers and avoiding financial losses. A clear and efficient dispute resolution process minimizes negative impacts on your business reputation.

Steps to resolve disputes effectively:

- Understand your processor’s dispute resolution policy: Familiarize yourself with the specific procedures for handling disputes and addressing customer complaints Artikeld by your payment processor.

- Document all communication: Keep detailed records of all interactions with customers and your payment processor during the dispute resolution process. This includes emails, phone calls, and any correspondence.

- Communicate promptly and professionally: Address customer concerns promptly and professionally. Respond to inquiries in a timely manner and provide helpful and accurate information.

- Collaborate with your processor: Work with your payment processor to find a resolution that is satisfactory for both parties involved.

Reporting and Analyzing Payment Data

Analyzing payment data helps businesses understand their sales performance and make informed decisions. This data is invaluable for identifying trends, optimizing strategies, and understanding customer preferences.

Reporting and analysis should include:

- Sales trends: Tracking sales volume and revenue over time helps identify seasonal patterns and sales fluctuations.

- Customer demographics: Analyzing customer data can help understand your target market better, enabling targeted marketing efforts.

- Geographic data: Understanding the location of your customers helps in targeting marketing campaigns more effectively.

- Transaction type analysis: Examining different transaction types can highlight areas of growth or potential problems.

Business Owner Responsibilities

The business owner plays a vital role in managing the merchant account. Their responsibilities include oversight of financial records, adherence to regulations, and maintaining a secure payment system.

Setting up a merchant account for your online store can be a real headache, especially when you’re juggling other aspects of your business. It’s like trying to assemble IKEA furniture while simultaneously dealing with a week of e-commerce snafus, like the ones detailed in a week of e commerce snafus. But remember, a smooth merchant account process is crucial for the long-term success of your web business.

You’ll need to carefully weigh your options and ensure your chosen provider is reliable and supportive.

Business owner responsibilities include:

- Staying informed about regulations: Payment processing regulations can change, and staying updated is crucial to avoid penalties.

- Implementing security measures: Protecting sensitive customer data is a top priority.

- Regularly reviewing account statements: Ensuring that statements are accurate and match your records is essential for detecting errors or fraudulent activity.

- Maintaining communication with the payment processor: This includes inquiries about issues or changes in policies.

Security and Compliance

Building a secure online presence is paramount for any e-commerce business. A robust security framework protects customer data, builds trust, and ultimately contributes to long-term success. Ignoring security measures can lead to significant financial losses, reputational damage, and even legal repercussions.Maintaining compliance with industry standards and regulations is crucial for processing online payments. PCI DSS (Payment Card Industry Data Security Standard) is a key example, outlining stringent security measures for handling sensitive credit card information.

Adhering to these regulations demonstrates your commitment to protecting customer data, building trust, and avoiding costly penalties.

Importance of Security Measures for Online Transactions

Robust security measures are essential to protect sensitive customer data. These measures prevent unauthorized access, data breaches, and fraud, ultimately safeguarding both your business and your customers. A secure system instills trust in customers, fostering loyalty and encouraging repeat business. The psychological impact of a secure online experience directly correlates with customer satisfaction and confidence in your brand.

Security Protocols Required by PCI DSS

PCI DSS mandates specific security protocols to protect cardholder data. These protocols encompass various aspects of your payment processing system, including network security, access controls, and regular security assessments. Complying with these regulations not only avoids hefty fines but also demonstrates your commitment to responsible payment processing. Failure to meet PCI DSS standards can result in significant financial penalties, impacting profitability.

- Strong passwords and access controls are vital for restricting access to sensitive information.

- Regular security audits and vulnerability assessments are essential to identify and mitigate potential risks.

- Data encryption protects cardholder data during transmission and storage.

Legal and Compliance Aspects of Processing Online Payments, Establishing a merchant account for your web business

Understanding and adhering to legal and compliance regulations surrounding online payments is critical. These regulations, including but not limited to the Payment Card Industry Data Security Standard (PCI DSS), ensure responsible handling of financial data. Non-compliance can lead to severe legal consequences and financial penalties, jeopardizing your business.

- Understanding the specific regulations in your jurisdiction is paramount for successful compliance.

- Maintaining accurate records of transactions and customer data is essential for audit purposes and legal compliance.

- Staying informed about changes in payment processing regulations and standards is vital for ongoing compliance.

Checklist for Security Measures Related to Merchant Accounts

Implementing a comprehensive security checklist ensures a secure payment processing system. This checklist helps in identifying vulnerabilities and implementing corrective actions. A proactive approach to security is essential for safeguarding sensitive data and maintaining customer trust.

- Regular Security Audits: Regular security audits are critical for identifying vulnerabilities in your system.

- Data Encryption: Data encryption is essential to protect cardholder data during transmission and storage.

- Strong Access Controls: Restrict access to sensitive information to authorized personnel only.

- Security Awareness Training: Training staff on security best practices is essential to prevent human error.

- Incident Response Plan: A comprehensive incident response plan is crucial for handling security breaches effectively.

Impact of Non-Compliance on Online Businesses

Non-compliance with payment processing regulations can have a detrimental impact on online businesses. This includes significant financial penalties, legal repercussions, and reputational damage. Maintaining compliance is not just a legal requirement; it’s a critical aspect of building trust and long-term success.

“Non-compliance can result in hefty fines, legal battles, and potentially irreparable damage to your business’s reputation.”

Payment Processing Options: Establishing A Merchant Account For Your Web Business

Choosing the right payment processing method is crucial for a successful online business. It directly impacts customer experience, transaction security, and ultimately, your bottom line. Different payment options cater to various customer preferences and business needs, making careful consideration essential.Payment processing methods are not one-size-fits-all. Factors like your target audience, business model, and existing infrastructure will influence the optimal choice.

Understanding the advantages and disadvantages of each method, along with the costs involved, will empower you to select the most effective solution for your online store.

Comparing Payment Processing Methods

Different payment options offer distinct benefits and drawbacks. The most common include credit cards, debit cards, PayPal, and other digital wallets. Selecting the right method requires careful evaluation of your specific business requirements.

| Method | Advantages | Disadvantages | Cost |

|---|---|---|---|

| Credit Cards | Widely accepted, high transaction volume potential, typically higher average transaction value. | Higher processing fees, potential for fraud, security concerns, and compliance requirements. | Variable, typically a percentage of the transaction plus a fixed fee per transaction. |

| Debit Cards | Lower processing fees compared to credit cards, often a faster processing time, customer familiarity. | Lower transaction value, may not be as widely accepted as credit cards, transaction volume might be lower. | Variable, typically a percentage of the transaction plus a fixed fee per transaction. |

| PayPal | Ease of use for customers, reduced risk of chargebacks, often faster processing time, global reach. | Transaction fees are usually higher, potentially lower average transaction values compared to credit cards, less control over customer data. | Variable, typically a percentage of the transaction plus a fixed fee per transaction, may have monthly subscription fees. |

| Other Digital Wallets (e.g., Apple Pay, Google Pay) | Convenience for customers, streamlined checkout experience, enhanced security measures. | Limited acceptance in some regions, potential for security breaches, may not be as widely accepted as credit cards. | Variable, typically a percentage of the transaction plus a fixed fee per transaction. |

Popular Payment Gateways and Their Features

Payment gateways act as intermediaries between your business and payment processors. Choosing the right gateway can significantly impact your transaction efficiency and security.Popular gateways include Stripe, Square, and PayPal. Each offers a unique set of features and benefits, including advanced security measures, comprehensive reporting tools, and potentially integration with other business applications. Stripe, for instance, often excels in its flexibility and API-driven approach, making it ideal for complex business models.

Square is a strong contender for brick-and-mortar businesses transitioning online, offering comprehensive point-of-sale capabilities. PayPal, while primarily known for its digital wallet service, also provides robust gateway functionality, suitable for businesses with global reach.

Choosing the Best Payment Processing Method

The optimal payment processing method hinges on various factors. Consider your target market’s preferences, your business model, and anticipated transaction volume. For instance, if you anticipate high transaction volume and international transactions, a gateway like Stripe might be a more appropriate choice. If you primarily cater to a local market, Square could offer a more tailored solution.

If a simplified checkout experience is paramount, PayPal could be a suitable option.

Thorough research and comparison of different payment gateways are crucial to making an informed decision.

Setting up a merchant account is crucial for any online business. It’s like giving your web store the financial backbone it needs to accept payments, and it’s a necessary step to avoid headaches down the road. Thinking about how companies like 3com, entering the handheld market race, 3com enters handheld race , must have navigated similar financial infrastructure hurdles is a good example.

Ultimately, a solid merchant account streamlines transactions and keeps your business on track.

Costs and Fees Associated

Setting up and maintaining a merchant account involves various costs beyond the initial setup fees. Understanding these transaction fees and how they’re calculated is crucial for accurate budgeting and ensuring profitability. Different payment types and transaction volumes impact the overall cost, making careful analysis essential.

Transaction Fee Types

Merchant account fees fall into several categories. Processing fees, typically a percentage of each transaction, are the most common. Monthly fees are recurring charges for maintaining the account, and other fees can include setup, cancellation, or interchange fees. These various charges can significantly impact the overall cost of processing payments.

Calculating Transaction Fees

Transaction fees are calculated in various ways, often dependent on the payment processor and payment method. The most common method is a percentage-based fee on the transaction amount. For example, a 2.9% + $0.30 fee on a $100 transaction would be $2.90 + $0.30 = $3.20. Some processors also include per-transaction fees or tiered pricing, which varies based on the volume of transactions.

The calculation may also consider the type of transaction (e.g., credit card, debit card, or mobile payment). Moreover, certain high-risk merchants might face higher fees.

Impact of Volume on Transaction Fees

Transaction volume significantly influences the overall cost. Processors often offer tiered pricing models where higher transaction volumes result in lower per-transaction fees. This is a common incentive for businesses expecting significant transaction growth. Negotiating with a processor to find a suitable plan is often beneficial for high-volume businesses.

Common Transaction Fees

The cost of processing different payment types varies. This table Artikels common transaction fees for various payment methods, providing a general overview.

| Type | Processing Fee | Monthly Fee | Other Fees |

|---|---|---|---|

| Credit Cards | 2.9% + $0.30 per transaction | $25-$50 per month | Interchange fees, potentially high-risk fees |

| Debit Cards | 2.5% + $0.25 per transaction | $15-$35 per month | Interchange fees, potentially high-risk fees |

| Mobile Payments (e.g., Apple Pay, Google Pay) | 2.7% + $0.25 per transaction | $15-$40 per month | Interchange fees, potentially high-risk fees |

| ACH/Direct Debit | $0.25-$0.50 per transaction | $10-$25 per month | None |

Evaluating Total Cost

Evaluating the total cost of a merchant account requires a comprehensive approach. Consider not just the transaction fees but also the monthly fees, potentially high-risk fees, and any other associated costs. A thorough review of the contract terms, including all fees and potential hidden charges, is essential before signing. This process involves scrutinizing the payment processor’s fee structure and comparing it with other options to find the most cost-effective solution.

A crucial aspect of this evaluation is to consider future growth potential and project transaction volume to ensure the chosen plan aligns with expected business expansion.

Integrating with Your Online Store

Connecting your merchant account to your online store is a critical step for smooth and secure transactions. This integration process ensures seamless payment processing, allowing customers to complete purchases directly through your website. Understanding the different integration methods and the technical aspects is vital for a robust and reliable online store.

Different Integration Methods

Integrating a merchant account with your online store involves choosing the right method based on your platform and technical expertise. Direct integrations often provide more control and customization but require more technical knowledge. Third-party payment gateways offer a simpler approach but might have limitations in customization. A thorough evaluation of your needs and resources is crucial before selecting a method.

Technical Aspects of Integration

The technical aspects of integration typically involve configuring your store’s payment processing system with the merchant account details. This often involves using Application Programming Interfaces (APIs) to exchange data between your store and the payment processor. APIs define the rules and protocols for communication, enabling secure and reliable data transfer. Properly configuring these APIs and handling security protocols is essential to prevent fraud and maintain customer trust.

APIs and Integrations with Popular E-commerce Platforms

Many popular e-commerce platforms, such as Shopify, WooCommerce, and Magento, offer pre-built integrations with various payment gateways. These integrations often utilize APIs to communicate with the merchant account and process transactions. These platforms typically offer detailed documentation and support to guide merchants through the integration process.

Integration Scenarios

Different e-commerce platforms use various integration methods, each with its own strengths and weaknesses.

| Platform | Method | Steps | Benefits |

|---|---|---|---|

| Shopify | Shopify Payments | Connect your Shopify account to your merchant account through the Shopify dashboard. Configure payment settings. | Simple setup, robust security features, often integrated directly into Shopify’s interface. |

| WooCommerce | WooCommerce Payment Gateways | Install and configure a payment gateway plugin compatible with WooCommerce. Configure the plugin with your merchant account details. | Flexibility in choosing payment gateways, wide range of options. |

| Magento | Magento Payment Gateway Integration | Install and configure a payment gateway extension for Magento. Configure the extension with your merchant account details. | Advanced customization options for handling complex transactions, compatibility with various payment processors. |

Step-by-Step Integration Guide

A general guide for integrating your merchant account with your online store follows a common pattern:

- Choose a payment gateway: Research and select a payment gateway compatible with your e-commerce platform. Consider factors such as transaction fees, security measures, and available features.

- Account setup: Create an account with the chosen payment gateway. Provide necessary information to complete the merchant account setup.

- API configuration: Obtain API credentials and configure the API keys within your e-commerce platform’s settings.

- Testing: Test the integration thoroughly by processing sample transactions. This helps identify and resolve any potential issues before going live.

- Go live: Once all tests are successful, enable the integration for live transactions. Monitor transaction activity and address any discrepancies.

Final Thoughts

In conclusion, establishing a merchant account is a significant step for any online business aiming for financial success. This guide provided a comprehensive overview of the process, equipping you with the knowledge to navigate the complexities of online payment processing. Remember to carefully evaluate your needs, compare providers, and prioritize security to ensure a smooth and profitable online transaction experience.