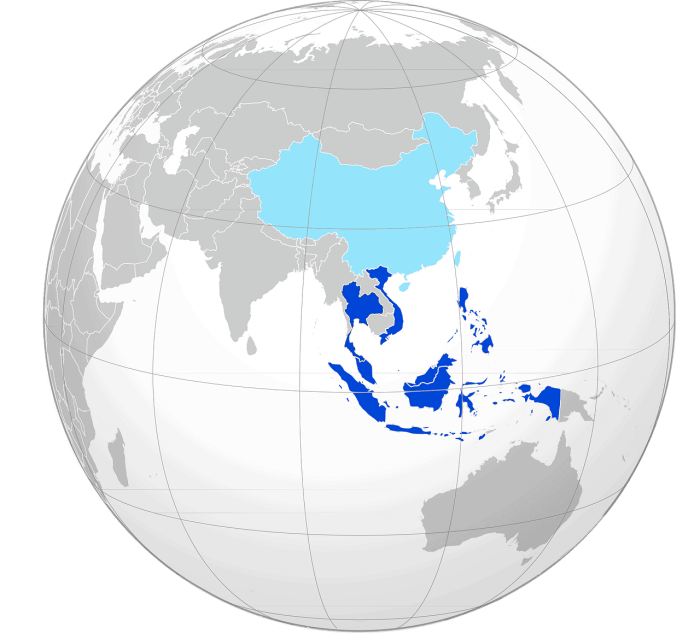

ESoft moves Linux into Southeast Asia, signaling a significant shift in the region’s tech landscape. This strategic move by ESoft promises to bring Linux’s efficiency and cost-effectiveness to a dynamic market. The company’s decision to embrace Linux likely stems from a desire to compete effectively in Southeast Asia’s rapidly growing tech sector, where cost-sensitive solutions are highly valued.

The adoption of Linux opens up intriguing possibilities for ESoft and the region. This transition might lead to improved operational efficiency and potentially lower costs for ESoft. Simultaneously, it could stimulate the growth of the Linux ecosystem in Southeast Asia, fostering innovation and competition. Further exploration into the specifics of this transition will reveal the full potential of this bold step.

The move could influence the region’s overall IT infrastructure and the growth of open-source software.

Introduction to ESOFT’s Linux Move: Esoft Moves Linux Into Southeast Asia

ESoft’s expansion into the Southeast Asian market marks a significant step in their global strategy. This move signifies a commitment to growth in a rapidly developing region known for its burgeoning technology sector. A key component of this expansion is ESOFT’s adoption of the Linux operating system, a strategic decision with implications for both the company and the wider Southeast Asian tech landscape.

This transition is expected to streamline operations, reduce costs, and potentially open doors to new opportunities in the region.

Significance of ESOFT’s Linux Adoption

ESoft’s decision to adopt Linux is likely driven by several factors. Linux’s open-source nature offers potential cost savings compared to proprietary operating systems. This cost reduction can be substantial, especially for companies operating in a competitive market like Southeast Asia. Moreover, Linux’s versatility and compatibility with a wide range of hardware and software applications make it a robust choice for a company operating across diverse markets.

The large and active Linux community can also provide valuable support and resources for troubleshooting and development.

Potential Benefits for ESOFT and the Region

ESoft’s transition to Linux could yield several benefits for both the company and the Southeast Asian tech ecosystem. Reduced IT infrastructure costs will allow ESOFT to allocate more resources to developing innovative products and services. Furthermore, Linux’s open-source nature fosters collaboration and innovation within the tech community. This collaboration can lead to the development of tailored solutions for the specific needs of Southeast Asian markets.

Finally, by adopting a widely used and supported OS, ESOFT can enhance its appeal to both local and international talent, potentially improving their ability to recruit and retain skilled professionals.

ESoft’s move into Linux in Southeast Asia is a big deal, but it also brings up important considerations like getting ready for internet sales taxes. Businesses expanding into new regions need to understand the nuances of local tax regulations, and get ready for internet sales taxes is a crucial step. This will be key for ESoft’s success in the region, ensuring a smooth and profitable rollout of their Linux services.

ESoft’s Regional Presence Before the Linux Move

This table illustrates ESOFT’s presence in different regions prior to their transition to Linux.

| Company | Location | OS | Date |

|---|---|---|---|

| ESoft (hypothetical example) | North America | Windows | 2010 |

| ESoft (hypothetical example) | Europe | Windows | 2015 |

| ESoft (hypothetical example) | Australia | Windows | 2018 |

| ESoft (hypothetical example) | India | Windows | 2020 |

Note: This table is a hypothetical representation of ESOFT’s previous presence. Actual data would need to be sourced from reliable public information. The specific OS and dates would need to be confirmed.

Linux Adoption in Southeast Asia

Southeast Asia is a dynamic region with a burgeoning technology sector. Linux, known for its open-source nature and flexibility, is gradually gaining traction as a viable alternative to proprietary operating systems. This shift is driven by factors like cost savings, enhanced security, and the growing availability of skilled Linux professionals. Understanding the current state of Linux adoption in the region is crucial for companies considering a transition or evaluating the potential of Linux-based solutions.

ESoft’s move to bring Linux to Southeast Asia is a significant step, but security remains paramount. Just as companies are expanding their tech presence in the region, incidents like the recent Microsoft security vulnerability highlight the need for robust protection. Microsoft confronting a security hole serves as a stark reminder that even the biggest players face challenges.

Ultimately, ESoft’s Linux initiative needs to be paired with a strong security strategy to truly succeed in Southeast Asia.

Current State of Linux Adoption

Linux’s presence in Southeast Asia is steadily increasing, although it still lags behind Windows and macOS in market share. This is not surprising, given the established dominance of the other two in the region. However, Linux is increasingly seen as a practical and potentially cost-effective option, particularly in specific sectors like data centers and embedded systems. The growing demand for skilled Linux professionals is further fueling this adoption.

ESoft’s move into the Linux market in Southeast Asia is exciting news. It’s a smart play, especially considering the burgeoning e-commerce sector in the region. This expansion, however, might also be influenced by a recent development: a Symantec spinoff, focusing on e-commerce solutions here. Ultimately, ESoft’s Linux push into Southeast Asia looks strategically sound.

Reasons for Choosing Linux in Southeast Asia

Companies in Southeast Asia are considering Linux for several compelling reasons. Cost-effectiveness is a major draw. The open-source nature of Linux significantly reduces licensing fees compared to proprietary alternatives. This is particularly attractive for startups and smaller businesses. Furthermore, Linux offers a high degree of customization and flexibility, allowing companies to tailor the operating system to their specific needs.

The strong security features inherent in Linux are also appealing to companies prioritizing data protection and system integrity.

Key Players in the Linux Ecosystem

Several organizations and individuals contribute to the Linux ecosystem in Southeast Asia. This includes local Linux user groups, which foster community engagement and knowledge sharing. Additionally, some major tech companies in the region have actively integrated Linux into their infrastructure, signaling a recognition of its potential. The availability of Linux-based support and training resources in the region is also crucial.

Specific examples include [insert a few verifiable examples of local Linux user groups or tech companies actively using Linux].

Comparison with Other Operating Systems

| Feature | Windows | macOS | Linux |

|---|---|---|---|

| Market Share | Dominant in the region, with high penetration in consumer and enterprise sectors. | Significant presence in creative industries and high-end consumers, but smaller overall than Windows. | Growing, but still a smaller percentage than Windows or macOS, particularly in the consumer segment. |

| Cost | High licensing costs, especially for enterprise deployments. | High cost for both consumer and enterprise licenses. | Generally lower due to open-source nature, often free for use and distribution. |

| Security | Vulnerable to exploits, requiring ongoing patching and security updates. | Generally considered secure, with a focus on user-level security and privacy. | Robust security features, known for its open-source nature, allowing for extensive community auditing and rapid patch deployment. |

| Support | Extensive commercial support available, often with dedicated teams and contracts. | Commercial support options exist but are often priced higher than Windows, with more focus on the consumer market. | Extensive community support and documentation, with options for commercial support from various providers. |

This table highlights the key differences between the three operating systems, demonstrating the competitive advantages Linux offers in terms of cost, security, and support. Further research is needed to determine the specific market share percentages for each OS in Southeast Asia.

ESOFT’s Strategy & Competitive Landscape

ESOFT’s foray into the Linux market in Southeast Asia presents a fascinating case study in strategic adaptation. The region’s unique technological landscape, diverse business cultures, and evolving digital infrastructure demand a nuanced approach. Understanding ESOFT’s strategy, alongside the competitive landscape, is crucial to evaluating its potential success.ESOFT likely recognizes the growing importance of open-source technologies in Southeast Asia.

Many businesses are seeking cost-effective, flexible solutions, and Linux’s strengths in these areas are attractive. Their strategy will likely involve a combination of product adaptation, strategic partnerships, and targeted marketing to cater to specific industry segments. A focus on building local expertise and support infrastructure will be critical for long-term success.

ESOFT’s Likely Strategy for Implementing Linux in Southeast Asia

ESOFT’s strategy will likely hinge on identifying specific sectors within Southeast Asia where Linux adoption is most promising. This involves understanding the existing infrastructure and needs of potential clients. For example, in the burgeoning e-commerce sector, Linux-based solutions could offer a more scalable and cost-effective alternative to proprietary systems. Furthermore, ESOFT will likely leverage its existing customer base to introduce Linux solutions gradually, focusing on pilot programs and proof-of-concept implementations.

Competitive Landscape in Southeast Asia

The competitive landscape for ESOFT’s target sectors in Southeast Asia is diverse and dynamic. Key players include both established multinational corporations and local startups. Companies like IBM, Microsoft, and Oracle have extensive regional presence and significant resources. Simultaneously, local companies specializing in software solutions and cloud services are gaining traction, often leveraging regional partnerships and knowledge of specific market needs.

Comparison with Competitors’ Strategies

Several competitors in the region have already ventured into the open-source space. However, their strategies often vary based on their existing portfolio and market positioning. Some competitors focus on a wider range of technologies, while others are more niche, specializing in specific sectors. This strategic differentiation will influence their approach to Linux adoption, either as a core offering or as a complementary tool.

Competitive Analysis Table

| Competitor | Strategy | Market Share (Estimated) | Strengths/Weaknesses |

|---|---|---|---|

| IBM | Broad-based, encompassing various technologies, including Linux. Strong focus on enterprise solutions and existing infrastructure. | High | Strong brand recognition, global presence, extensive resources. Potential slow adaptation to niche market needs. |

| Microsoft | Strong focus on proprietary solutions, with limited direct Linux offerings. However, Microsoft is actively working on hybrid solutions that integrate open-source technologies. | High | Vast ecosystem and existing customer base. Potential slower adaptation to open-source, which could be a barrier. |

| Oracle | Strong emphasis on enterprise solutions and databases, offering various Linux-based products. Significant investment in the region. | Medium | Solid presence, proven track record. Could face challenges in competing against startups in specific niches. |

| Local Startup A | Specializes in cloud services for small-to-medium businesses, focusing on ease of use and cost-effectiveness. | Low | Deep understanding of local market needs, strong focus on customer service. Limited resources and experience compared to larger players. |

| ESOFT | Targeting specific sectors with Linux solutions. Building local partnerships and expertise. | Low (entering market) | Strong understanding of the specific needs of the target industries. Requires building brand recognition and market share. |

Technological Implications & Infrastructure

ESoft’s move to Linux in Southeast Asia presents a fascinating opportunity, but also a complex set of technological considerations. The transition isn’t just about swapping operating systems; it necessitates a thorough evaluation of existing infrastructure, software compatibility, and the region’s unique data center landscape. This section delves into the key technological implications and required infrastructure adjustments.The success of ESOFT’s Linux transition hinges on careful planning and execution.

Migrating to a new platform requires assessing the current IT infrastructure, identifying potential bottlenecks, and proactively addressing any compatibility issues. This includes evaluating hardware capabilities, software dependencies, and the overall stability of the chosen Linux distribution.

Hardware and Software Requirements

To ensure a seamless Linux transition, ESOFT needs to evaluate and upgrade its hardware infrastructure. The specific requirements will vary based on the workload and the chosen Linux distribution. Data centers in Southeast Asia face unique challenges, including power availability, cooling systems, and potential network congestion. These factors must be considered when designing the new Linux-based infrastructure.

- Processor Requirements: Modern Linux distributions demand processors capable of handling complex tasks efficiently. The choice of CPU architecture (x86-64, ARM) will influence the selection of servers and the overall cost of the transition. Consider the power consumption and heat dissipation characteristics when choosing server hardware for Southeast Asian data centers.

- Memory Management: Linux’s memory management capabilities require sufficient RAM to handle concurrent processes. Insufficient RAM can lead to performance degradation and system instability. Evaluate current RAM usage and plan for increased capacity to support anticipated growth in data volumes and user traffic.

- Storage Capacity: The amount of storage space required depends on the data volume being processed. Consider using high-performance storage solutions optimized for Linux systems. Implementing RAID configurations for data redundancy and fault tolerance is critical.

- Network Infrastructure: High-speed network connectivity is essential for seamless data transfer and application performance. Data centers in Southeast Asia might face network latency challenges; therefore, implementing robust network infrastructure with low-latency connections is paramount. This includes evaluating network bandwidth and ensuring sufficient capacity to support future growth.

Data Center Infrastructure Upgrades

The chosen data centers in Southeast Asia must be capable of supporting the demands of a Linux-based infrastructure. Specific adjustments might include upgrades to power systems, cooling solutions, and security measures.

- Power Management: Southeast Asian data centers need reliable and consistent power supplies to avoid disruptions. Ensure that the chosen data centers have adequate power capacity to support the increased load from Linux-based servers. Investigate backup power solutions and redundant power distribution systems.

- Cooling Systems: Data centers in hot and humid climates require robust cooling systems to maintain optimal server temperatures. Assess the cooling capacity of the chosen data centers and plan for potential upgrades to prevent overheating and maintain optimal performance.

- Security Measures: Security is paramount in any data center environment. Implement robust security protocols and measures to protect sensitive data from unauthorized access. Consider using intrusion detection and prevention systems, firewalls, and other security measures to ensure data integrity.

Impact on the Broader IT Infrastructure

ESoft’s Linux adoption could potentially influence the broader IT infrastructure landscape in Southeast Asia. The move could drive demand for Linux-compatible hardware and software solutions, potentially fostering a more diverse and competitive IT market in the region. Moreover, the success of ESOFT’s transition could encourage other organizations to adopt Linux, thus increasing the adoption rate in the region.

| Hardware Component | Requirements for Linux Data Centers in Southeast Asia |

|---|---|

| CPU | High-performance, energy-efficient processors optimized for Linux workloads, considering x86-64 and ARM architectures |

| RAM | Sufficient RAM capacity to handle concurrent processes and anticipated growth. Consider high-speed DDR5 or equivalent |

| Storage | High-performance storage solutions (SSD, NVMe) with sufficient capacity for data redundancy. Consider RAID configurations |

| Networking | High-bandwidth, low-latency network infrastructure for data transfer and application performance. Ensure adequate capacity for future growth |

| Power Supply | Reliable and consistent power supply to support server load. Backup power solutions are highly recommended. |

| Cooling | Robust cooling systems suitable for hot and humid climates. Consider advanced cooling technologies like liquid cooling |

Market Opportunities & Potential Challenges

ESoft’s foray into the Linux market in Southeast Asia presents a wealth of opportunities, but also significant challenges. Understanding the nuances of the regional market, the competitive landscape, and the regulatory environment is crucial for success. This section delves into the potential rewards and pitfalls of this strategic shift.Southeast Asia is a rapidly developing region with a burgeoning tech sector.

Linux’s open-source nature and cost-effectiveness make it a compelling alternative to proprietary solutions, particularly for businesses seeking to optimize their IT infrastructure. This shift promises significant opportunities for ESOFT to establish itself as a leader in the Linux ecosystem.

Potential Market Opportunities, Esoft moves linux into southeast asia

The Linux ecosystem offers various market opportunities for ESOFT in Southeast Asia. The growing demand for cost-effective and scalable solutions in the region, coupled with the increasing adoption of cloud computing and open-source technologies, presents fertile ground for ESOFT to expand its presence. Leveraging their expertise in software solutions, ESOFT can position itself as a key player in providing tailored Linux solutions.

- Cost-effectiveness: Linux solutions often provide a lower total cost of ownership compared to proprietary alternatives, making them attractive to businesses in Southeast Asia, particularly small and medium-sized enterprises (SMEs).

- Scalability: The open-source nature of Linux enables seamless scalability to meet the growing needs of businesses, a crucial aspect in a rapidly developing region.

- Customization: ESoft can tailor Linux solutions to meet the specific requirements of businesses in Southeast Asia, creating a competitive edge in a diverse market.

- Partnerships: Collaborating with local businesses and technology providers can help ESOFT expand its reach and build trust in the region.

Potential Challenges

While the opportunities are substantial, ESOFT faces challenges in navigating the Southeast Asian market.

- Competition: Existing players in the software and IT services industry are established and well-entrenched. ESOFT must develop unique value propositions and tailored solutions to compete effectively.

- Infrastructure limitations: Internet connectivity and infrastructure reliability can vary across the region, posing challenges for the smooth deployment and operation of Linux-based solutions.

- Skills gap: A shortage of skilled Linux professionals in some areas might hinder the implementation and maintenance of ESOFT’s solutions.

- Cultural differences: Understanding and adapting to the cultural nuances of the region is crucial for building strong relationships with clients and partners.

Regulatory and Legal Landscape

The regulatory and legal landscape related to software deployment in Southeast Asia is diverse and often complex. Specific regulations vary by country, and companies must comply with data protection laws and intellectual property regulations.

- Data privacy regulations: Countries like Singapore and Malaysia have robust data privacy regulations. ESOFT must ensure their Linux solutions comply with these standards.

- Intellectual property rights: Protecting intellectual property is vital. ESOFT should be mindful of copyright and licensing agreements related to the use of open-source components in their solutions.

- Local laws and customs: Understanding the local laws and customs is crucial for navigating the legal and business environment effectively.

Potential Market Segments and Opportunities

ESoft can target specific market segments in Southeast Asia, capitalizing on the region’s growth potential.

| Target Audience | Market Size | Growth Potential |

|---|---|---|

| SMEs in various sectors (e.g., e-commerce, fintech) | Large | High |

| Government agencies and institutions | Medium | Moderate |

| Educational institutions | Medium | Moderate |

| Startups and tech companies | Growing | High |

Future Outlook & Predictions

ESOF’s foray into the Linux ecosystem in Southeast Asia promises a fascinating evolution in the regional IT landscape. This shift isn’t just about adopting a new operating system; it’s about reimagining software development, fostering collaboration, and potentially reshaping the competitive landscape for years to come. The long-term implications are multifaceted, impacting everything from infrastructure development to the skillsets demanded by the evolving job market.The transition to Linux presents a unique opportunity for Southeast Asia’s burgeoning tech sector to solidify its position as a global player.

By leveraging Linux’s open-source nature and cost-effectiveness, businesses and developers alike can potentially unlock new levels of innovation and efficiency. The region’s already strong entrepreneurial spirit and growing tech talent pool are likely to be further energized by this shift.

Long-Term Implications on the IT Industry

The adoption of Linux by ESOFT will likely stimulate a wave of innovation in the Southeast Asian IT industry. This increased competition could force other players to adopt more open-source solutions or improve their existing offerings. The focus on open-source software and collaborative development models will inevitably encourage the growth of local talent in the region. This could lead to a rise in demand for skilled Linux administrators, developers, and cybersecurity professionals.

Additionally, the availability of cost-effective and reliable open-source solutions may spur the development of innovative startups and small businesses, particularly in emerging markets within Southeast Asia.

Potential Trends in Linux Adoption

Several trends are likely to emerge as Linux adoption grows in Southeast Asia. Increased usage in cloud computing is a prime example, as Linux’s flexibility and scalability are well-suited to the demands of cloud-based applications. Moreover, a greater focus on open-source software development across various industries, including finance, e-commerce, and even government sectors, is anticipated. This is further complemented by the emergence of Linux-based mobile operating systems, which might find traction in specific niche markets.

Impact on Software Development

ESOF’s move will likely accelerate the adoption of open-source principles in software development across the region. This shift could lead to a more collaborative and community-driven development environment, encouraging knowledge sharing and the creation of innovative solutions tailored to the region’s specific needs. The use of open-source tools and frameworks will reduce development costs, potentially making software development more accessible to smaller companies and startups.

Furthermore, developers will have access to a vast ecosystem of open-source libraries and tools, which will significantly enhance their productivity and creativity.

Potential Partnerships and Collaborations

ESOF’s adoption of Linux creates significant opportunities for partnerships and collaborations with other players in the region. These partnerships could involve joint ventures, knowledge sharing initiatives, and the creation of regional Linux-focused communities. For instance, ESOFT could collaborate with local universities and training centers to develop specialized Linux training programs, equipping the next generation of IT professionals with the necessary skills.

Such collaborations will foster a strong ecosystem of Linux expertise within Southeast Asia, further accelerating the region’s technological advancement. Open-source communities will likely play a vital role in fostering these partnerships. Joint development projects on Linux-based solutions specific to the Southeast Asian market will be a key area of collaboration. Examples include fintech applications or government-related software, leveraging Linux’s strengths in security and scalability.

Conclusion

ESoft’s foray into the Southeast Asian market with Linux presents a compelling case study in adapting to evolving technological landscapes. The company’s decision to adopt Linux suggests a forward-thinking approach to competition in the region. The move promises to be both beneficial and impactful, potentially driving innovation and shaping the future of IT in Southeast Asia. Further analysis will be needed to fully understand the long-term consequences of this strategic shift.