Ernst Young internet taxation can wait – this statement sparks a debate about the future of digital taxation. It raises crucial questions about the fairness and feasibility of taxing online activities, particularly in a globalized economy. The potential implications for businesses, governments, and individuals are significant, and this analysis explores the various facets of this complex issue.

This in-depth look examines Ernst Young’s perspective on the matter, considering their role as a major player in the tax advisory world. We’ll explore the concept of “internet taxation” itself, including different methods and challenges. Further, we’ll analyze the potential impacts of delaying these taxes, considering revenue streams, market competition, and international relations. Alternative solutions and current trends in global tax policies will also be evaluated.

Understanding the Phrase “Ernst Young Internet Taxation Can Wait”

The phrase “Ernst Young Internet Taxation Can Wait” reflects a stance, likely held by some within the firm, suggesting a delay in addressing the complexities of taxing digital transactions. This position is potentially linked to the challenges and evolving nature of the internet economy, where traditional tax models struggle to adapt. It implies a need for further study and consideration before implementing new tax regulations, which could impact businesses and individuals differently.This delay tactic, if adopted by relevant authorities, could have considerable implications for current economic policies, particularly concerning international trade and digital commerce.

It highlights the ongoing struggle between the pace of technological advancement and the adaptation of existing tax structures. A prolonged wait could hinder the development of a fair and efficient global tax system for digital activities.

Potential Implications for Economic Policies

The phrase suggests a perceived need for a more nuanced approach to taxing digital activities. This may stem from the difficulty in attributing profits or sales to specific jurisdictions, a common issue in the digital realm. This could lead to a period of uncertainty for businesses operating in the global digital marketplace, potentially hindering investment and innovation. The delay might also result in a less-than-ideal global tax landscape, leading to revenue losses for governments and potentially exacerbating existing tax loopholes.

Interpretations by Various Stakeholders

Different stakeholders interpret the phrase in distinct ways. Businesses may view it as a temporary reprieve from the pressure of immediate tax compliance, allowing them time to adapt their strategies. Governments, on the other hand, may see it as a delaying tactic that hinders their ability to collect necessary revenue and maintain fiscal stability. Individuals may interpret it as a lack of governmental concern for the fair and equitable taxation of digital activities.

Historical Context of Similar Discussions

Throughout history, similar debates have arisen whenever new technologies challenged existing tax frameworks. The introduction of e-commerce, for instance, presented similar challenges for traditional tax systems. Historically, tax authorities have adapted to new forms of commerce, often through incremental adjustments and legislative updates. Understanding this history can provide insights into how current challenges can be navigated in a way that balances the needs of all stakeholders.

Impact on Global Trade and International Tax Regulations

The phrase’s implications extend beyond national borders. A prolonged delay in addressing internet taxation could hinder the development of consistent and globally applicable tax regulations. This could lead to trade disputes, inconsistencies in tax treatment across countries, and ultimately, a less efficient and fair global economic system. This potential outcome may have a significant impact on the competitiveness of businesses operating internationally.

The need for clear and uniform rules is paramount for promoting a level playing field in global trade.

Ernst Young’s Role and Perspective

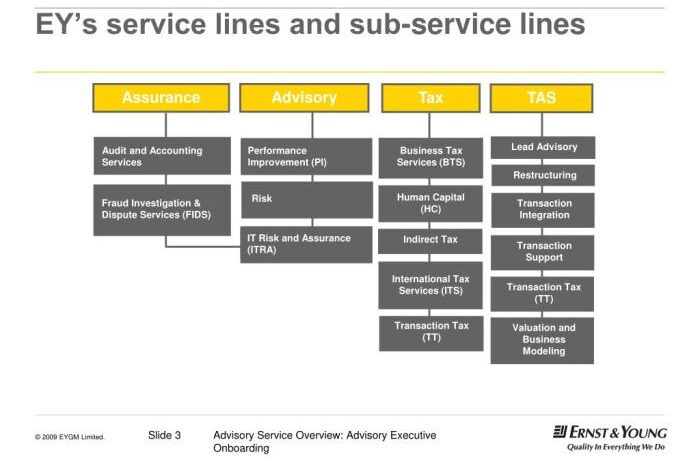

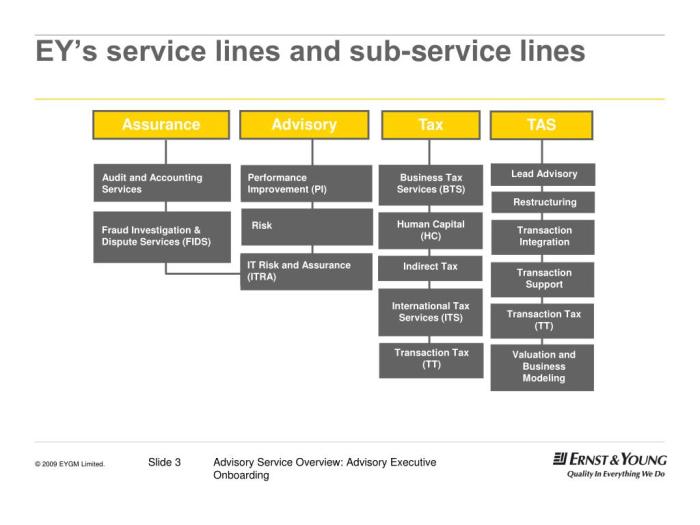

Ernst & Young (EY) is a global professional services network that provides a wide range of services, including auditing, tax, consulting, and advisory. In the context of taxation, EY acts as a consultant, advisor, and often, a representative for businesses and individuals, guiding them through complex tax regulations and helping them comply with tax laws. Their role extends to offering strategic tax planning and optimization, as well as helping navigate the intricacies of international tax laws.EY’s stance on internet taxation, as reported in various news sources and analyses, suggests a cautious approach, advocating for a more nuanced and comprehensive understanding of the challenges before implementing new taxes.

Their perspective is likely influenced by the complexities of the digital economy and the potential impact on global trade and investment. This nuanced view is not always easily categorized as “for” or “against” internet taxation but rather reflects an understanding of the complexities and the need for solutions that are effective and equitable.

Ernst Young’s Role in Taxation

EY provides various services related to taxation, including tax compliance, planning, and advisory. Their expertise encompasses different types of businesses, from small enterprises to multinational corporations. Their global reach enables them to advise on cross-border tax issues, which is crucial in today’s interconnected world.

EY’s Stance on Internet Taxation

EY’s public pronouncements regarding internet taxation often emphasize the need for careful consideration of the potential consequences of new tax regulations. They typically highlight the complexities of taxing digital transactions and the need for international cooperation to develop effective and equitable solutions. The firm’s recommendations generally favor solutions that are sustainable and do not negatively impact global trade and investment.

Potential Motivations for Delayed Internet Taxation

EY’s advocacy for a delayed approach to internet taxation may stem from several motivations. One key motivation is the desire to avoid disrupting the digital economy’s growth. EY may believe that premature implementation of complex internet tax rules could hinder innovation, investment, and trade. Furthermore, EY may be concerned about the potential for double taxation or tax avoidance strategies if the rules are not carefully designed and coordinated globally.

Ernst Young’s internet taxation delay seems like a smart move, especially considering the current economic climate. While the world waits for the next big tax announcement, Starbucks Oxygen Media is reportedly about to unveil a new blend. This new coffee flavor might be the perfect accompaniment to a wait for more concrete details on the internet tax. Ultimately, Ernst Young’s decision to hold off on the internet taxation is a wise one, given the complexities of the situation.

Starbucks Oxygen Media to offer a new blend

Potential Conflicts of Interest

As a major professional services firm, EY works with many businesses and industries. Some of these businesses might be directly affected by internet taxation. This potential for conflicts of interest must be acknowledged. EY has a responsibility to maintain objectivity and impartiality in its advice, even when dealing with clients whose interests might be directly affected by new regulations.

This necessitates rigorous ethical standards and robust procedures to ensure objectivity.

The Concept of “Internet Taxation”

The phrase “Ernst Young internet taxation can wait” highlights a significant debate surrounding the complexities of taxing digital services. This debate isn’t just about how much to tax, but also where and how to tax them. The traditional methods of taxation, often based on physical presence or transactions, don’t always fit the digital world. This makes the issue of internet taxation crucial for governments worldwide.Traditional methods of taxation, which relied heavily on physical presence and tangible goods, are increasingly inadequate in the digital age.

This inadequacy has led to a push for new, more appropriate methods of taxing digital services, creating a global challenge for policymakers.

Methods of Taxing Digital Services

The current landscape of digital services presents a diverse array of possible taxing methods. These range from taxing the revenue generated by digital businesses to taxing specific transactions or activities. The key challenge lies in determining which method best aligns with the nature of digital services and their global reach. This requires a careful balancing act between ensuring fair revenue collection and avoiding creating barriers to innovation.

- Value-added tax (VAT): VAT is a consumption tax levied on the value added at each stage of production. Applying VAT to digital services can be complex, requiring a determination of where the value is added and where the consumer is located. For example, a software company based in one country might sell its software to a customer in another country, complicating the VAT calculation.

- Digital Services Taxes (DSTs): DSTs are a newer type of tax specifically designed for digital businesses. These taxes often target the revenue generated by online advertising, digital marketplaces, and other digital activities. The implementation of DSTs varies significantly across countries, leading to a patchwork of different tax rules globally. For instance, France implemented a DST in 2020, targeting the revenue of large digital companies operating within its borders.

These vary in rates and scope, creating potential complications for businesses operating in multiple jurisdictions.

- Income tax: Income tax is levied on the profits of a company. Applying income tax to digital companies can be tricky, especially when the company’s activities span multiple countries and there’s no single clear source of income.

Challenges in Taxing Digital Activities

The digital economy presents unique challenges for taxation. The lack of physical presence, the global nature of transactions, and the complexity of determining the location of economic activity make traditional tax models difficult to apply. This necessitates a fresh approach to taxation that can effectively capture the revenue generated by digital businesses without hindering their operations.

- Jurisdictional issues: Determining the appropriate jurisdiction for taxing digital services is complex, as businesses often operate across multiple countries. This lack of clarity leads to disagreements about which country has the right to tax the revenue.

- Defining the scope of digital services: The ever-evolving nature of digital services creates challenges in defining which activities should be taxed. This is particularly difficult as new services emerge and existing services transform.

- Data collection and reporting: Collecting and verifying data on digital activities can be difficult and expensive. This is further complicated by the need to ensure the confidentiality and security of the data.

Comparing Models of Internet Taxation Across Countries

Different countries have adopted various approaches to internet taxation. This divergence reflects the ongoing debate about the most effective and equitable method for taxing digital activities. For example, some countries have implemented specific digital services taxes, while others have focused on adapting existing tax laws. This demonstrates the absence of a universally agreed-upon approach.

| Country | Tax Model | Key Features |

|---|---|---|

| France | Digital Services Tax (DST) | Targets revenue of large digital companies operating in France. |

| United States | Various approaches | Focus on adapting existing tax laws to the digital economy. |

| European Union | Ongoing discussions | Exploring potential for harmonized approach to digital taxation. |

Potential Benefits of Taxing Internet Services, Ernst young internet taxation can wait

Taxing internet services could provide significant benefits to governments. These benefits include increased revenue, improved tax collection efficiency, and the ability to fund public services. This could also contribute to a more equitable distribution of tax burdens. The potential for these benefits is significant, especially for governments grappling with economic challenges and a need for increased public funding.

- Increased government revenue: Taxing digital services could provide governments with additional revenue streams to fund public services.

- Fairness and equity: Taxing digital services could help ensure that digital companies contribute fairly to the economies where they operate.

- Economic development: A well-designed digital tax system could encourage investment and innovation in the digital economy.

Current International Agreements Related to Digital Taxation

International discussions and agreements on digital taxation are ongoing. These agreements aim to establish a more coordinated and consistent approach to taxing digital activities. However, there’s currently no single global framework, and ongoing negotiations reflect the difficulty in reaching consensus.

- OECD’s BEPS project: The OECD’s Base Erosion and Profit Shifting (BEPS) project is a key initiative focused on addressing tax avoidance and improving the international tax system. This has influenced discussions about taxing digital services.

- Ongoing negotiations: Negotiations among countries on digital taxation continue, and the ultimate outcome remains uncertain.

Potential Impacts of Delayed Taxation

The decision to delay internet taxation, as advocated by Ernst Young, presents a complex set of potential consequences. This delay, while potentially benefiting certain sectors, could have far-reaching effects on businesses, governments, and the global economy. Understanding these impacts is crucial for assessing the long-term implications of such a policy.

Potential Consequences for Businesses in the Digital Economy

Delayed internet taxation could provide temporary advantages for businesses operating in the digital space. They may experience reduced compliance burdens and potentially lower operational costs in the short term. However, this delay could create uncertainty and instability in the long run. Without clear tax frameworks, businesses might struggle to plan investments, making strategic decisions based on unclear future tax liabilities.

Furthermore, a lack of consistent taxation across countries could hinder the development of a level playing field for businesses competing globally. For instance, companies operating in jurisdictions with different tax regimes may face unequal treatment, potentially impacting their competitiveness.

Potential Impact on Government Revenue Streams

A delay in internet taxation could significantly impact government revenue. This is particularly concerning in jurisdictions where digital commerce is substantial. Prolonged inaction could lead to a decline in tax revenue, requiring governments to seek alternative revenue sources or potentially reduce public spending. The potential for reduced revenue may also discourage investment in infrastructure and public services, impacting the overall economy.

For example, countries heavily reliant on digital transactions, like many in the developed world, could experience a significant loss of tax revenue if a delay is prolonged.

Potential Impact on International Trade and Investment

Delayed internet taxation could create disparities in tax burdens across countries, potentially distorting international trade flows. Businesses may shift operations to jurisdictions with more favorable tax regimes, potentially affecting the competitiveness of nations that maintain more traditional tax structures. This could also lead to decreased foreign investment in countries with delayed or uncertain tax policies. For example, if one country significantly delays or eliminates internet taxes while others maintain them, companies might choose to move operations and investment capital to the more lenient jurisdiction, impacting economic development in the first country.

Comparison of Potential Benefits and Drawbacks of Delayed Internet Taxation

| Feature | Benefit | Drawback |

|---|---|---|

| Revenue Generation | Short-term avoidance of administrative costs associated with implementing new taxes. | Potential long-term loss of substantial tax revenue, particularly in digitally active economies. Difficulty in recouping lost revenue and the need for alternative revenue strategies. |

| Market Competition | Potentially fosters short-term competitive advantage for companies operating in the digital space, particularly those in countries with delayed taxation. | Creates uneven playing field across countries, potentially distorting international competition. Uncertainty can hamper long-term investment decisions by businesses. |

| Tax Compliance | Temporary reduction in the burden of complying with new tax regulations for businesses. | Potential for increased complexity and future compliance issues as a result of delayed and/or inconsistent implementation of tax rules across jurisdictions. Increased complexity in managing global tax liabilities. |

| International Relations | Potential for short-term diplomatic benefits by avoiding potential international friction. | Potential for long-term diplomatic tensions if tax policies diverge significantly across countries, leading to trade disputes and conflicts. |

Alternative Solutions and Strategies

The debate around internet taxation is complex, requiring innovative solutions to address the challenges presented by the digital economy. Traditional tax models often struggle to adapt to the fluidity and global nature of online commerce. This necessitates the exploration of alternative methods, drawing inspiration from successful tax policies in other sectors, and comparing approaches to taxing digital services.

The aim is to find solutions that are equitable, efficient, and capable of fostering sustainable economic growth in the digital age.The current system, with its reliance on physical presence and traditional tax jurisdictions, is ill-equipped to capture the revenue generated by multinational digital corporations. A shift is needed towards a more comprehensive and adaptable approach that recognizes the unique characteristics of the digital economy.

This involves looking at various strategies and their potential impacts on stakeholders, from businesses to governments and consumers.

Alternative Tax Models for Digital Services

Several alternative tax models can be explored, building on existing tax policies in other sectors. One approach involves adapting existing value-added tax (VAT) systems to encompass digital services. This would entail establishing a clear framework for defining the taxable scope of digital transactions and ensuring consistent application across different jurisdictions. Another model centers around a digital services tax (DST), a broad-based tax levied on the provision of digital services.

Ernst Young’s pronouncements on internet taxation seem to be taking a backseat, at least for now. While the intricacies of digital commerce demand attention, maybe some of that energy could be channeled into appreciating the sheer volume of spam we encounter daily. It’s fascinating, really, and a whole new field of study has emerged, like new horizons in spam appreciation , which I highly recommend if you’re looking for a different kind of intellectual stimulation.

Ultimately, though, the need for clear internet tax regulations still remains, a matter that Ernst Young will likely return to soon.

This approach could be designed to address the revenue leakage often associated with digital businesses operating across multiple countries.

Adapting Existing Tax Policies to the Digital Economy

The global nature of the digital economy necessitates a global approach to taxation. Countries can explore the use of a digital sales tax (DST) or a form of a digital transaction tax (DTT) which could be applied to online transactions. The success of VAT models in other sectors demonstrates their potential for adaptation to the digital realm. However, careful consideration must be given to potential double taxation and the complexities of cross-border transactions.

Comparing and Contrasting Approaches

Various approaches to taxing digital services present both advantages and disadvantages. A DST, for instance, offers a straightforward approach to taxing digital services, but may be seen as creating a barrier to global digital trade. A more nuanced approach might involve a tiered system, where different rates are applied based on the value of the digital service or the level of revenue generated.

These approaches must be compared and contrasted, considering the specific impacts on different sectors and stakeholders. For example, a global tax on data transfer could potentially generate substantial revenue, but would also require international cooperation and agreements.

Ernst Young’s stance on delaying internet taxation is interesting, but frankly, it feels a bit out of touch with the fast-paced digital world. Meanwhile, a new health site, health site targets female baby boomers , is cleverly addressing the specific health concerns of this demographic, demonstrating how businesses are adapting to target needs. Ultimately, perhaps a more nuanced approach to internet taxation is needed, one that considers the evolving needs of consumers and businesses alike, like the ones this site is creating.

Impact on Stakeholders

The potential impact of each solution on various stakeholders must be carefully assessed. Businesses will need to adapt to new tax obligations and compliance requirements. Governments may experience increased revenue but also face challenges in administering the new systems. Consumers may experience changes in prices or access to digital services. A comprehensive assessment of the potential impact on each stakeholder group is crucial for designing effective and equitable tax policies.

For example, a DST could increase the cost of digital services for consumers, potentially impacting small businesses and consumers in developing countries.

Current Trends and Developments

The global landscape of taxation, particularly concerning the digital economy, is in constant flux. Governments grapple with the challenge of taxing multinational corporations operating across borders, and the rise of digital platforms has further complicated this issue. Understanding these evolving trends is crucial for businesses and policymakers alike, and the debate over internet taxation is a key component of this ongoing evolution.The digital economy’s inherent complexities are driving nations to re-evaluate traditional tax policies.

New legislative initiatives are emerging, and international cooperation is playing a critical role in shaping the future of digital taxation. This dynamic environment necessitates a nuanced understanding of the arguments surrounding delayed internet taxation.

Global Tax Policies Related to the Digital Economy

Recent years have witnessed a significant shift in global tax policies toward addressing the unique challenges of the digital economy. Nations are increasingly recognizing the need for a more comprehensive and adaptable approach to taxing cross-border digital transactions. This shift reflects a global acknowledgement that traditional tax models are inadequate for the contemporary digital marketplace.

Recent Legislative Changes Concerning Digital Taxation

Numerous countries have implemented or are considering legislation aimed at taxing the digital economy. For example, the OECD’s Base Erosion and Profit Shifting (BEPS) project has spurred international cooperation on tax matters, leading to the development of new rules and frameworks. France’s digital services tax (DST) is a prominent example of a nation-specific measure, prompting global discussion and debate.

The implementation of such measures is not without challenges, however, as the practical application and potential conflicts between different national regulations remain a concern.

Evolving Landscape of International Tax Cooperation

International tax cooperation is evolving to address the intricacies of digital taxation. Organizations like the OECD are playing a crucial role in fostering global standards and guidelines. Multilateral discussions and agreements are becoming more frequent, aiming to establish common ground for taxing digital businesses. The success of these efforts hinges on the willingness of nations to compromise and collaborate on complex international tax issues.

Role of Technological Advancements in Shaping Future Tax Policies

Technological advancements are profoundly impacting tax policies. Cryptocurrencies, blockchain technology, and the increasing automation of financial transactions are examples of emerging technologies that require new approaches to tax collection and enforcement. The ability of tax authorities to keep pace with these advancements will be crucial in maintaining a fair and effective tax system. Predicting the exact impact of these technologies on future tax policies is complex, but understanding their potential influence is crucial for proactive policy-making.

Arguments for and Against Delaying Internet Taxation

The debate surrounding internet taxation often centers on the benefits and drawbacks of delaying implementation. Proponents of delayed taxation argue that implementing such measures too early might hamper the growth of the digital economy. Conversely, opponents of delayed taxation emphasize the need for equitable taxation of all economic activities. They assert that a delay could lead to further tax avoidance and create an uneven playing field for businesses.

Illustrative Scenarios

The debate surrounding internet taxation is complex, encompassing various potential outcomes and impacting numerous stakeholders. Analyzing hypothetical scenarios provides a framework for understanding the potential consequences of different approaches to internet taxation. These scenarios, while simplified, highlight the crucial factors to consider in the decision-making process.

Delayed Internet Taxation

A delay in implementing internet taxation could lead to several consequences. Businesses, particularly those operating internationally, might experience a period of uncertainty and difficulty in planning their financial strategies. Revenue collection from internet services might be postponed, impacting government budgets and potentially leading to funding shortages for essential public services. This delay could also create a competitive disadvantage for some countries, potentially attracting businesses to jurisdictions with established digital tax systems.

- Economic Impact: Delayed taxation might encourage digital businesses to expand in regions without such taxes, potentially stifling economic growth in areas that have already established digital economies. The absence of revenue from digital services could hinder investments in crucial infrastructure, further impacting economic development.

- Investor Confidence: Uncertainty surrounding future tax policies could deter foreign investment, impacting job creation and overall economic growth. Investors may seek opportunities with clearer tax landscapes, potentially hindering the growth of the digital sector.

- Tax Avoidance: A delayed or absent tax system could incentivize tax avoidance, making it more challenging to collect revenue from digital transactions and hindering the fairness of the tax system. This could further exacerbate the revenue gap and potentially lead to a decline in government services.

Immediate Internet Taxation

Implementing immediate internet taxation could have a rapid and significant impact. This could lead to immediate revenue streams for governments, which could be used to fund public services. However, this immediate taxation could also impact consumer spending, business operations, and international trade. Businesses might relocate to countries with less burdensome digital tax policies.

- Economic Impact: Immediate taxation could cause an immediate shift in economic activity, potentially driving businesses to regions with lower tax rates. This shift could impact employment in sectors related to digital services and potentially reduce overall economic growth in the short term.

- Consumer Behavior: Consumers might react to higher prices on internet services by reducing usage or seeking alternative, lower-cost options. This change in consumer behavior could impact the growth of the digital economy.

- International Competition: A country imposing immediate internet taxation might face competition from countries without similar policies. This could lead to a decrease in foreign investment and a decrease in overall economic growth.

Comparison of Scenarios

A delay in internet taxation may result in long-term economic stagnation as businesses avoid investing in regions with unclear or uncertain tax policies. Immediate taxation could cause a short-term economic downturn as businesses adapt and consumers react to increased costs. The long-term economic impact of either scenario is uncertain, with both posing significant challenges for governments and businesses.

Potential Impact on Economic Growth

Both scenarios have the potential to significantly impact economic growth, though in differing ways. Delayed taxation could lead to long-term economic stagnation, as businesses avoid investment and growth in regions with unclear tax policies. Immediate taxation, while potentially generating immediate revenue, could lead to short-term economic contraction as businesses and consumers adjust to the new tax environment. The optimal approach is likely a carefully considered balance between the need for revenue and the need to foster economic growth.

Conclusion: Ernst Young Internet Taxation Can Wait

In conclusion, the debate surrounding Ernst Young’s stance on internet taxation highlights the complexities of taxing digital activities in the 21st century. The potential benefits and drawbacks of delaying taxation are substantial and impact various stakeholders, from businesses to governments. The exploration of alternative solutions and future trends reveals a dynamic landscape requiring careful consideration of economic, social, and political factors.

Ultimately, finding a balanced approach that fairly taxes the digital economy while fostering global economic growth remains a significant challenge.